Upper Extremity Market Report

Published Date: 31 January 2026 | Report Code: upper-extremity

Upper Extremity Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights and forecasts for the Upper Extremity market from 2023 to 2033, including market size, industry analysis, regional insights, and technology trends.

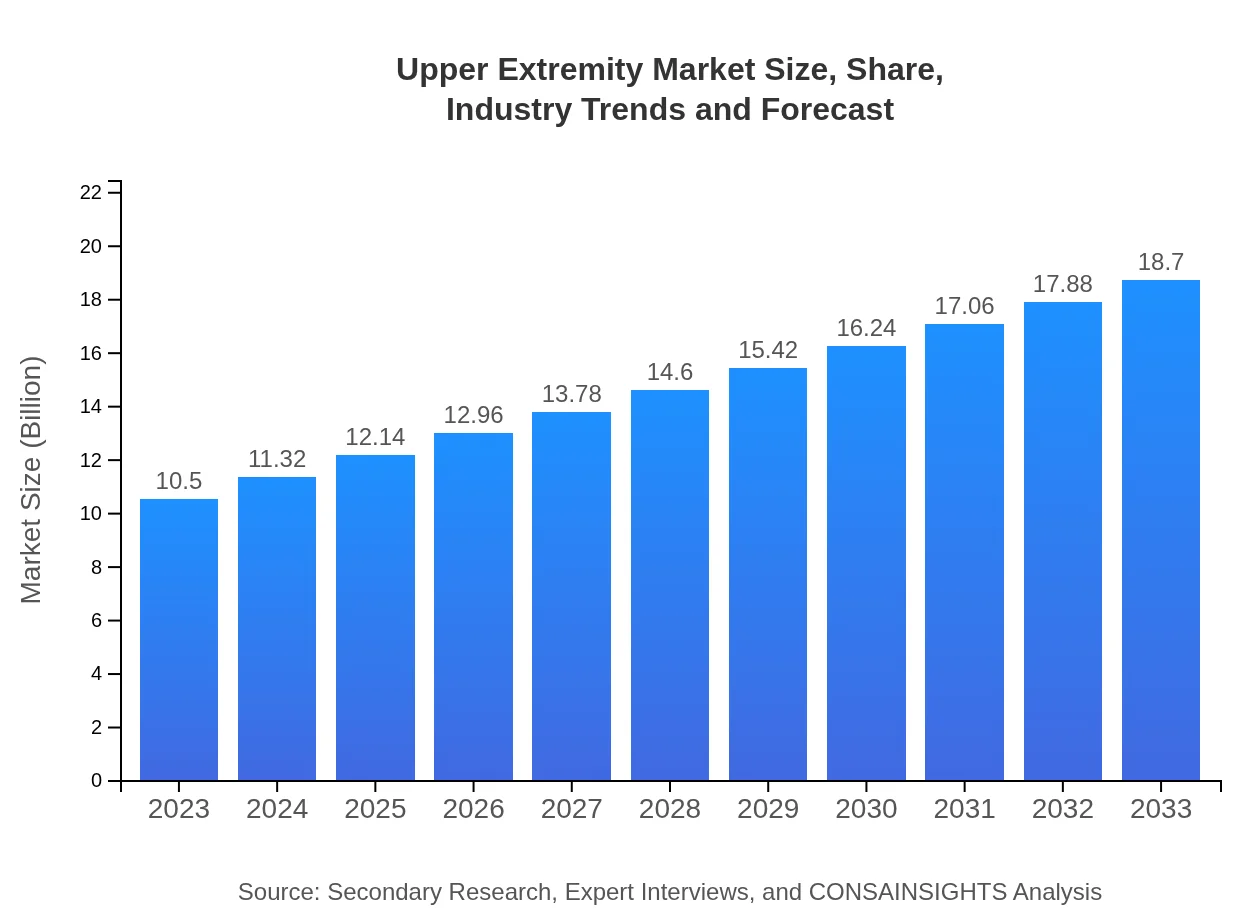

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Stryker Corporation, DePuy Synthes, Medtronic , Zimmer Biomet, Boston Scientific |

| Last Modified Date | 31 January 2026 |

Upper Extremity Market Overview

Customize Upper Extremity Market Report market research report

- ✔ Get in-depth analysis of Upper Extremity market size, growth, and forecasts.

- ✔ Understand Upper Extremity's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Upper Extremity

What is the Market Size & CAGR of Upper Extremity market in 2023?

Upper Extremity Industry Analysis

Upper Extremity Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Upper Extremity Market Analysis Report by Region

Europe Upper Extremity Market Report:

Europe's Upper Extremity market is expected to see substantial growth from $2.67 billion in 2023 to $4.76 billion by 2033. Improvements in healthcare regulations and increased emphasis on rehabilitation following surgeries drive this growth. The presence of leading healthcare institutions further enhances market potential.Asia Pacific Upper Extremity Market Report:

In the Asia Pacific region, the Upper Extremity market was valued at $2.15 billion in 2023 and is projected to reach $3.84 billion by 2033. The growth is driven by rising healthcare expenditure and a growing awareness for advanced treatment options. Countries like China and India are rapidly improving healthcare infrastructure, thus creating a more conducive environment for the market.North America Upper Extremity Market Report:

North America holds a significant portion of the market, with estimates of $3.75 billion in 2023 projected to grow to $6.67 billion by 2033. The region benefits from advanced healthcare infrastructure, a high prevalence of upper-extremity conditions, and significant investments in research and development, contributing to its prominent position in the market.South America Upper Extremity Market Report:

South America’s Upper Extremity market is anticipated to rise from $0.58 billion in 2023 to $1.02 billion by 2033. Increased prevalence of lifestyle diseases and advancements in medical technologies are vital drivers. Emerging economies in the region are expanding their healthcare capabilities, paving the way for future growth.Middle East & Africa Upper Extremity Market Report:

The Upper Extremity market in the Middle East and Africa is projected to increase from $1.35 billion in 2023 to $2.41 billion by 2033. Factors such as increasing disposable incomes, improved healthcare access, and awareness about upper extremity injuries are contributing to this growth.Tell us your focus area and get a customized research report.

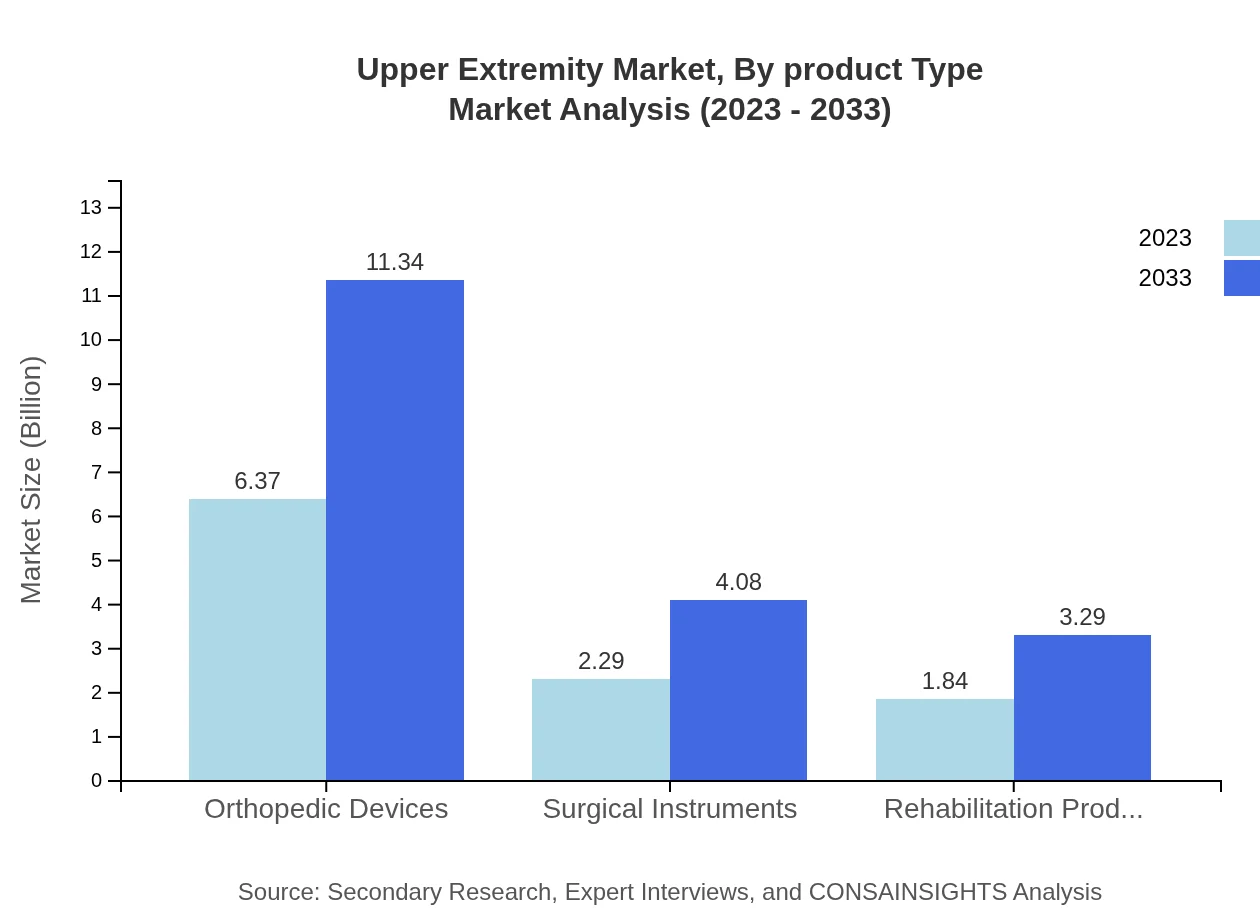

Upper Extremity Market Analysis By Product Type

The market analysis by product type indicates that hospitals account for the largest market share, with a size of $6.37 billion in 2023, expected to grow to $11.34 billion by 2033. Clinics and home care settings also represent significant segments, with sizes of $2.29 billion and $1.84 billion in 2023, escalating to $4.08 billion and $3.29 billion respectively by 2033.

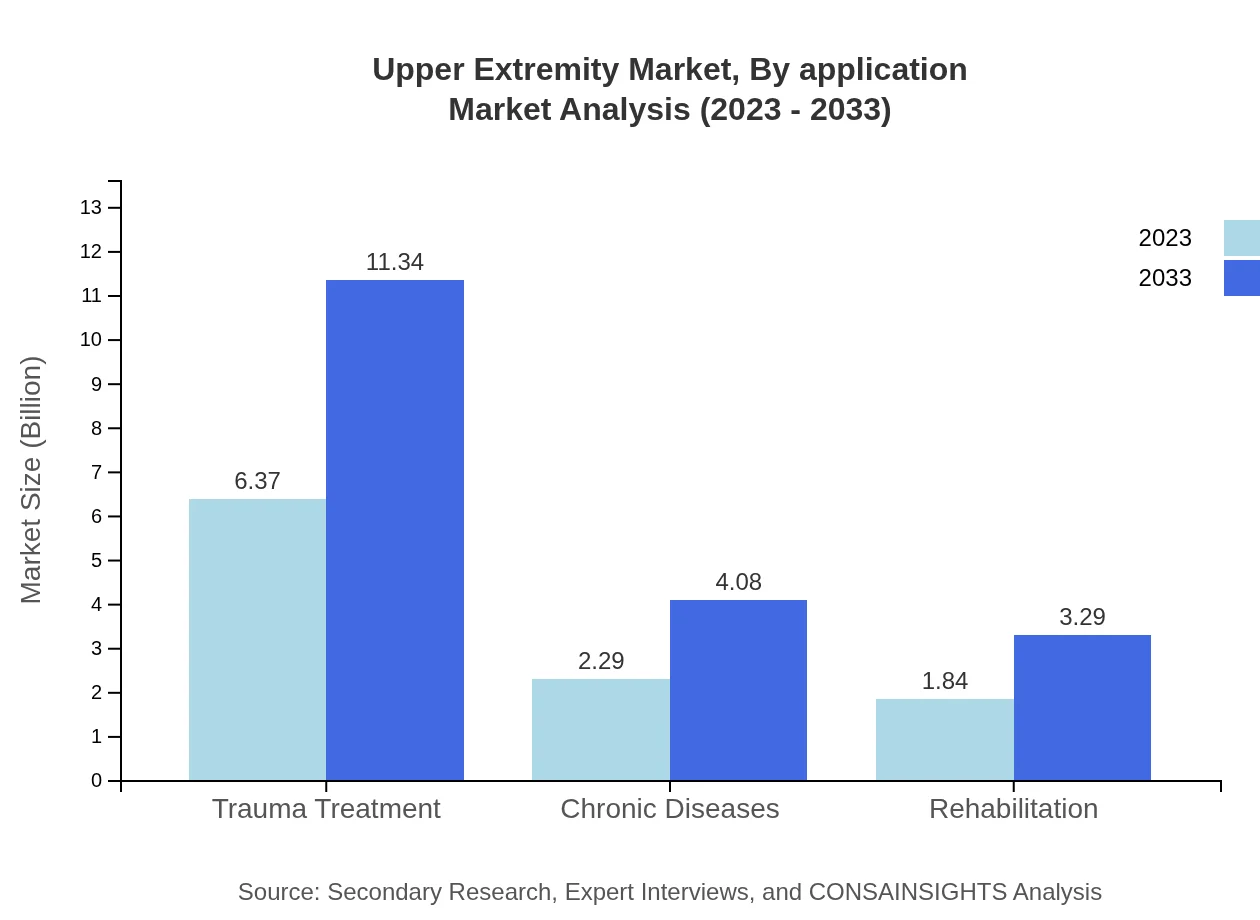

Upper Extremity Market Analysis By Application

The application segment shows trauma treatment dominating the market at $6.37 billion in 2023, forecast to reach $11.34 billion by 2033. Chronic diseases and rehabilitation are also noteworthy, each estimated at $2.29 billion and $1.84 billion in 2023, both projecting double-digit growth over the forecast period.

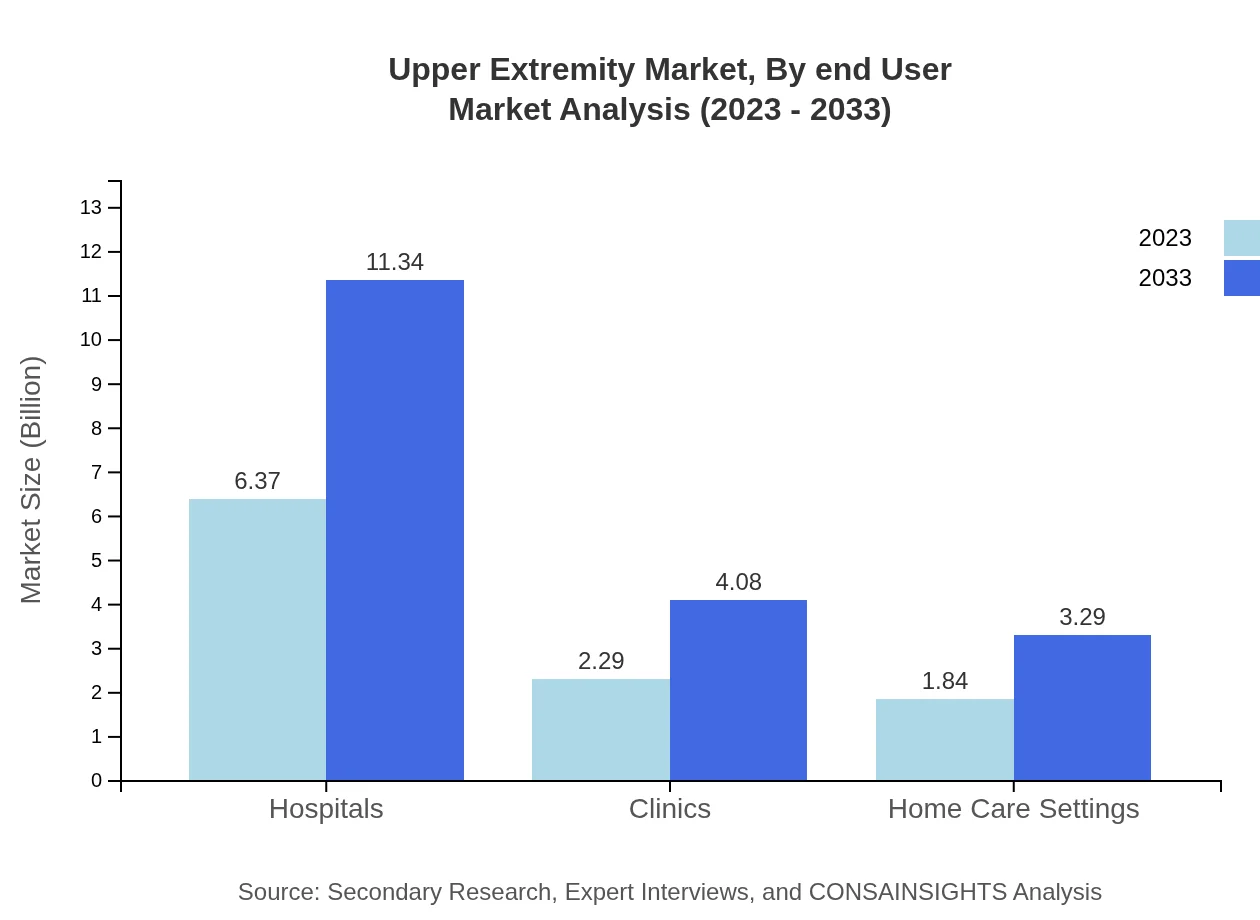

Upper Extremity Market Analysis By End User

Hospitals remain the predominant end-user in the Upper Extremity market, sustaining a significant share of 60.64% in 2023. Clinics and home care settings comprise 21.79% and 17.57% of the market share respectively, indicating a balanced distribution among end-user categories, with all expected to maintain stable growth.

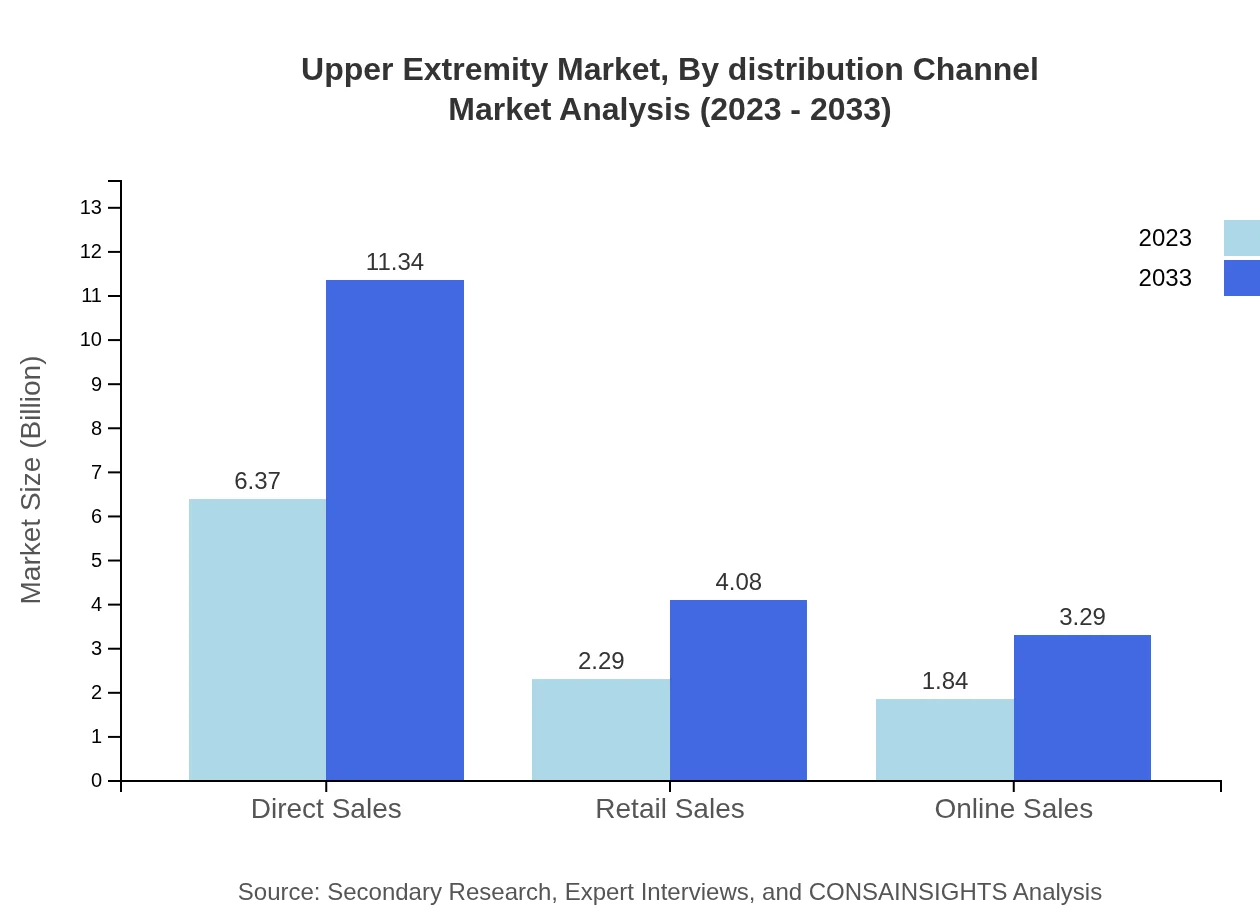

Upper Extremity Market Analysis By Distribution Channel

Distribution channels for the Upper Extremity market include direct sales, retail, and online sales. Direct sales are projected to dominate, achieving a size of $6.37 billion in 2023. Retail and online sales, currently at $2.29 billion and $1.84 billion, are set to increase, indicating a shift towards diversifying sales strategies.

Upper Extremity Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Upper Extremity Industry

Stryker Corporation:

A leading medical technology company specializing in innovative orthopedic and surgical products, Stryker is pivotal in advancing upper extremity treatment solutions.DePuy Synthes:

Part of Johnson & Johnson Medical Devices, DePuy Synthes focuses on orthopedic solutions and has a strong portfolio in upper extremity surgery and rehabilitation.Medtronic :

Medtronic is recognized for its comprehensive range of medical devices and therapies including those that support upper extremity health and recovery.Zimmer Biomet:

Zimmer Biomet is a global leader in musculoskeletal healthcare, providing innovative solutions for joint reconstruction and spinal conditions.Boston Scientific:

Boston Scientific develops and manufactures a wide range of medical devices used in various medical specialties, including surgeries addressing upper extremity conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of upper Extremity?

The market size of the upper-extremity market is projected to reach approximately 10.5 billion USD by 2033, growing at a CAGR of 5.8% from its current value.

What are the key market players or companies in this upper Extremity industry?

Key players in the upper-extremity market include major orthopedic device manufacturers, rehabilitation providers, and innovative surgical instrument developers focusing on advanced technologies and patient care solutions.

What are the primary factors driving the growth in the upper Extremity industry?

Growth is driven by an aging population, increasing incidence of chronic diseases, advancements in orthopedic devices, and the rising demand for effective rehabilitation solutions post-operations.

Which region is the fastest Growing in the upper Extremity?

The fastest-growing region in the upper-extremity market is North America, where the market is expected to increase from 3.75 billion USD in 2023 to 6.67 billion USD by 2033.

Does ConsaInsights provide customized market report data for the upper Extremity industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the upper-extremity industry, ensuring relevant insights and analysis.

What deliverables can I expect from this upper Extremity market research project?

Deliverables include comprehensive market analysis reports, data insights on trends and forecasts, industry player assessments, and tailored recommendations for strategy development.

What are the market trends of upper Extremity?

Current market trends include the growth of minimally invasive surgical techniques, increasing use of telehealth for rehabilitation, and a surge in demand for orthopedic devices and home care settings.