Upstream Bioprocessing Market Report

Published Date: 31 January 2026 | Report Code: upstream-bioprocessing

Upstream Bioprocessing Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Upstream Bioprocessing market, including an analysis of current trends, market dynamics, growth forecasts from 2023 to 2033, and detailed regional and segment-wise insights.

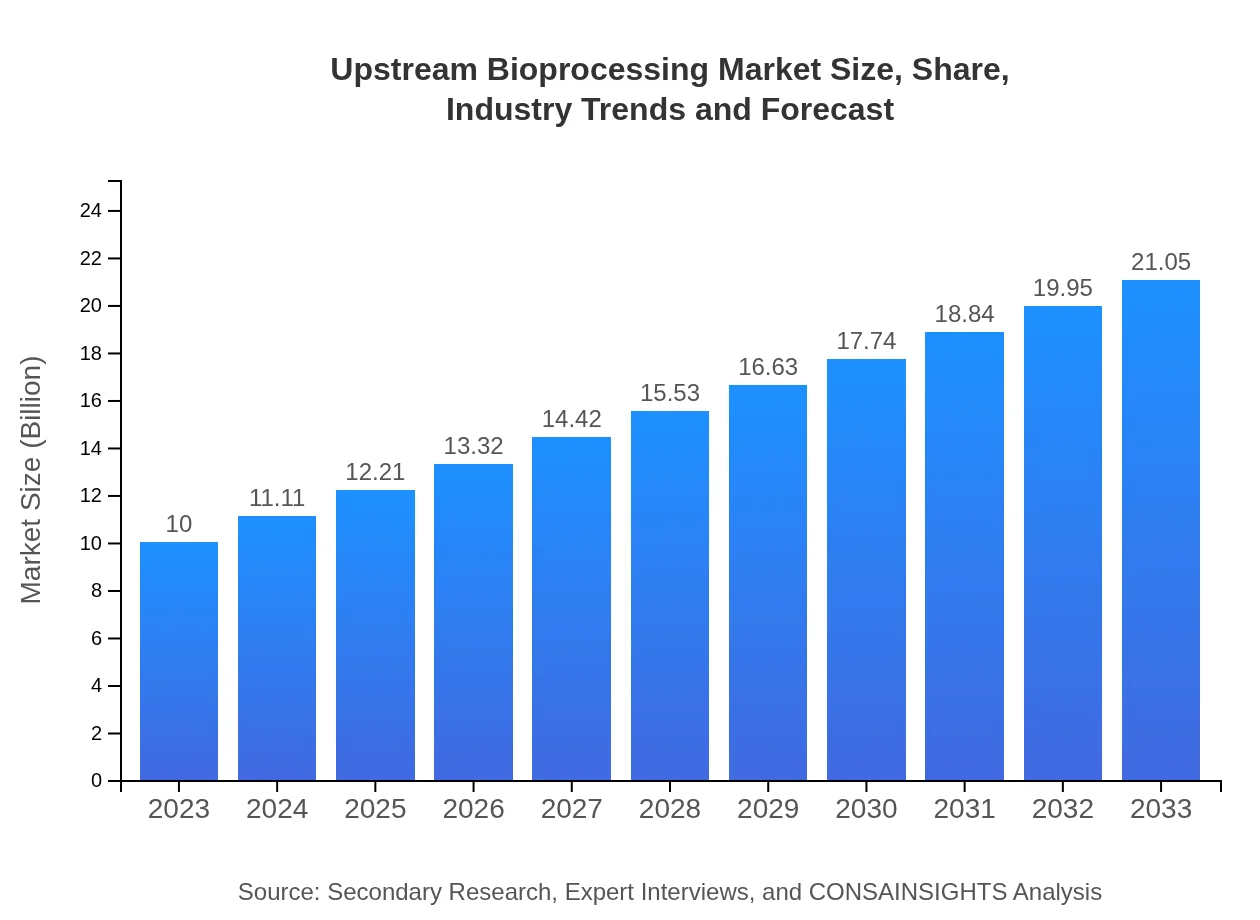

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $21.05 Billion |

| Top Companies | Thermo Fisher Scientific, Merck KGaA, GE Healthcare, Sartorius AG, AbbVie Inc. |

| Last Modified Date | 31 January 2026 |

Upstream Bioprocessing Market Overview

Customize Upstream Bioprocessing Market Report market research report

- ✔ Get in-depth analysis of Upstream Bioprocessing market size, growth, and forecasts.

- ✔ Understand Upstream Bioprocessing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Upstream Bioprocessing

What is the Market Size & CAGR of Upstream Bioprocessing market in 2023 and 2033?

Upstream Bioprocessing Industry Analysis

Upstream Bioprocessing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

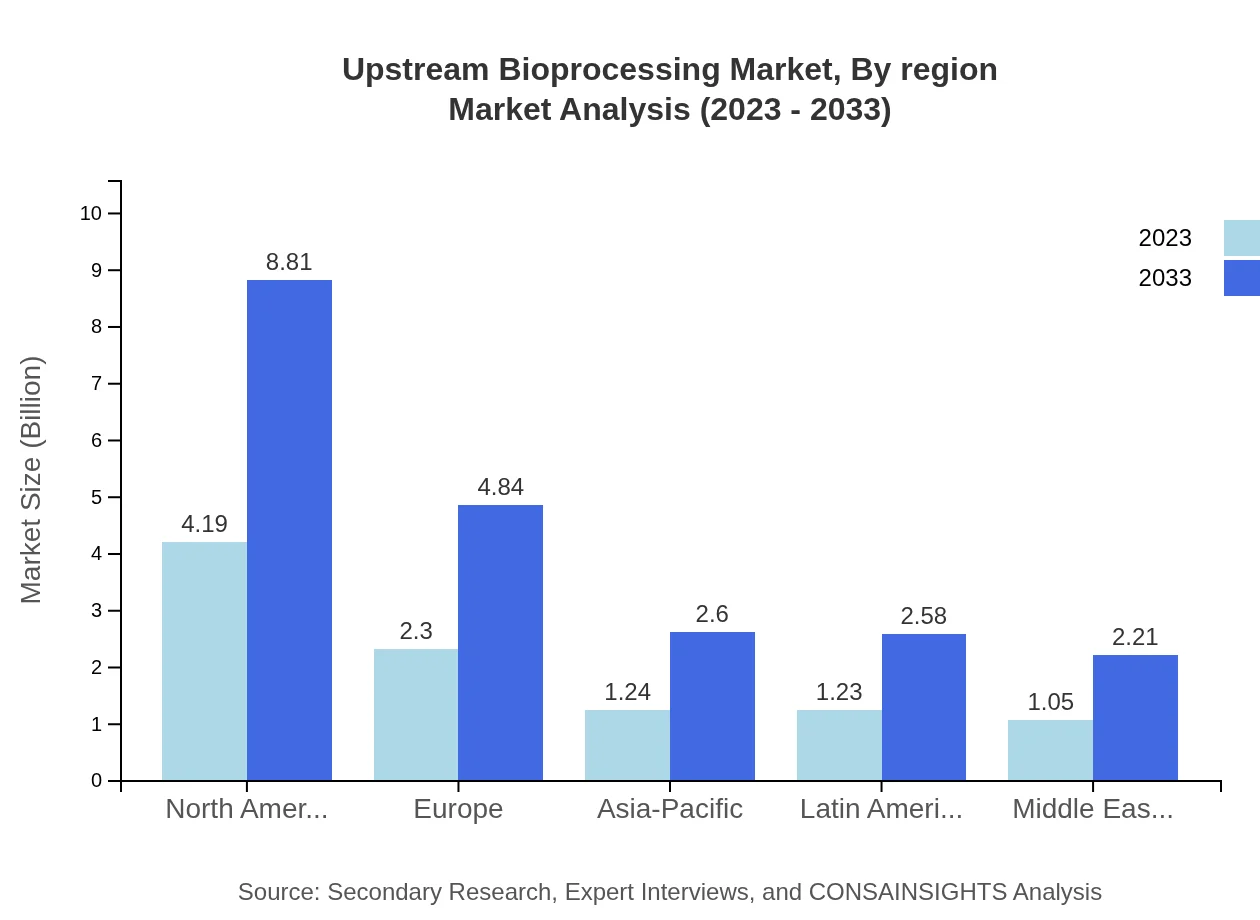

Upstream Bioprocessing Market Analysis Report by Region

Europe Upstream Bioprocessing Market Report:

Europe's market is estimated to expand from $3.39 billion in 2023 to $7.14 billion by 2033. Key factors include a robust regulatory framework promoting biotechnological advancements and a strong emphasis on research and development.Asia Pacific Upstream Bioprocessing Market Report:

The Asia Pacific region is growing rapidly with a market size projected to increase from $1.68 billion in 2023 to $3.53 billion in 2033. This growth is driven by expanding biotechnology industries and increased investments in healthcare research.North America Upstream Bioprocessing Market Report:

North America dominates the market with a size projected to grow from $3.59 billion in 2023 to $7.56 billion in 2033. The region benefits from a strong biopharmaceutical industry, technological innovations, and extensive research activities.South America Upstream Bioprocessing Market Report:

In South America, the Upstream Bioprocessing market is expected to rise from $0.11 billion in 2023 to $0.23 billion in 2033. Growth in this region is supported by increasing awareness of biopharmaceuticals and rising healthcare expenditures.Middle East & Africa Upstream Bioprocessing Market Report:

The Middle East and Africa market for Upstream Bioprocessing is projected to grow from $1.23 billion in 2023 to $2.59 billion in 2033. The region is experiencing increased investment in healthcare infrastructure and biopharmaceutical capabilities.Tell us your focus area and get a customized research report.

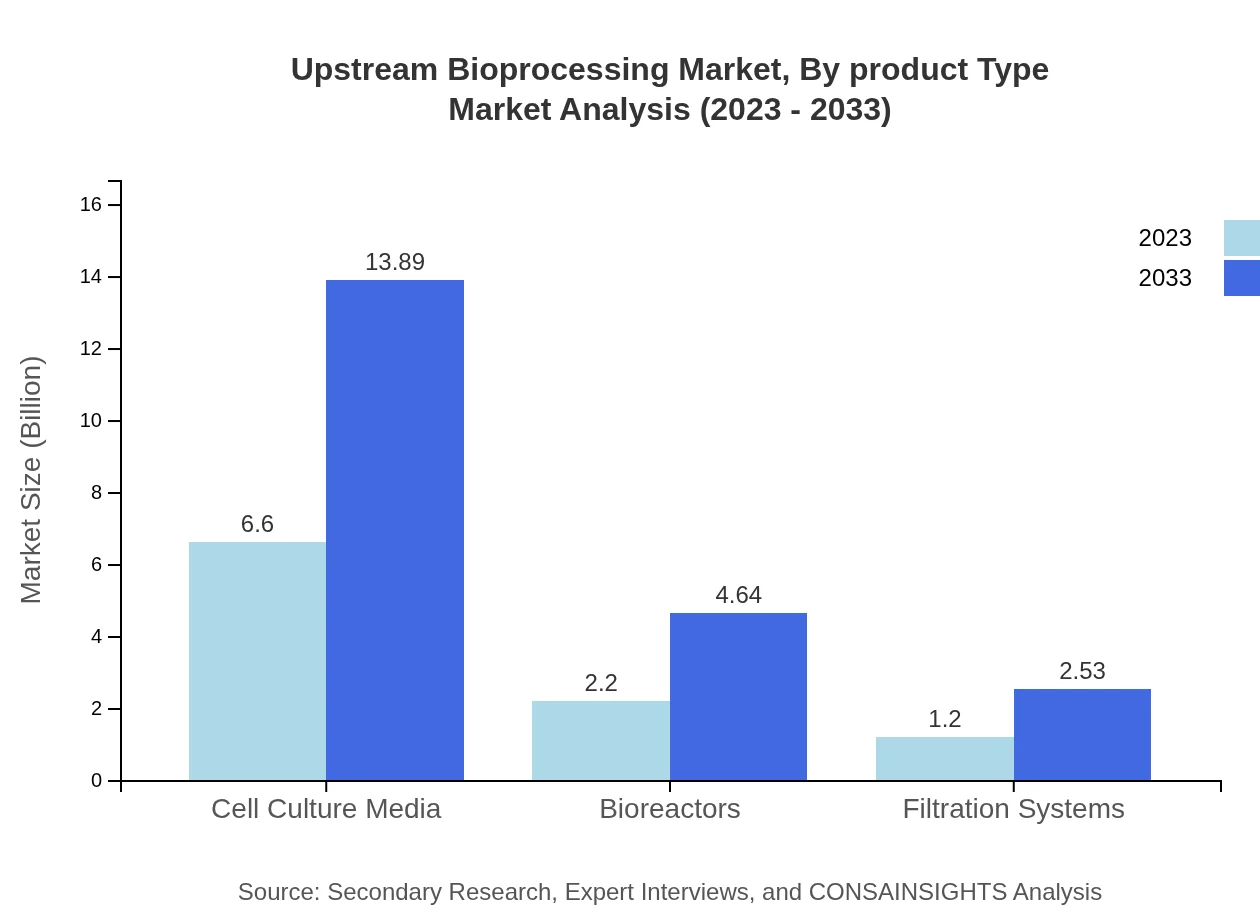

Upstream Bioprocessing Market Analysis By Product Type

The Upstream Bioprocessing market is categorized into various product types, including cell culture media, bioreactors, and filtration systems. Cell culture media occupy the largest share at approximately 65.98% in 2023, primarily due to its critical role in various biopharmaceutical processes. Bioreactors, representing 22.02% of the market, are crucial for scaling production, while filtration systems account for 12.00%, serving vital purposes in the purification and separation stages.

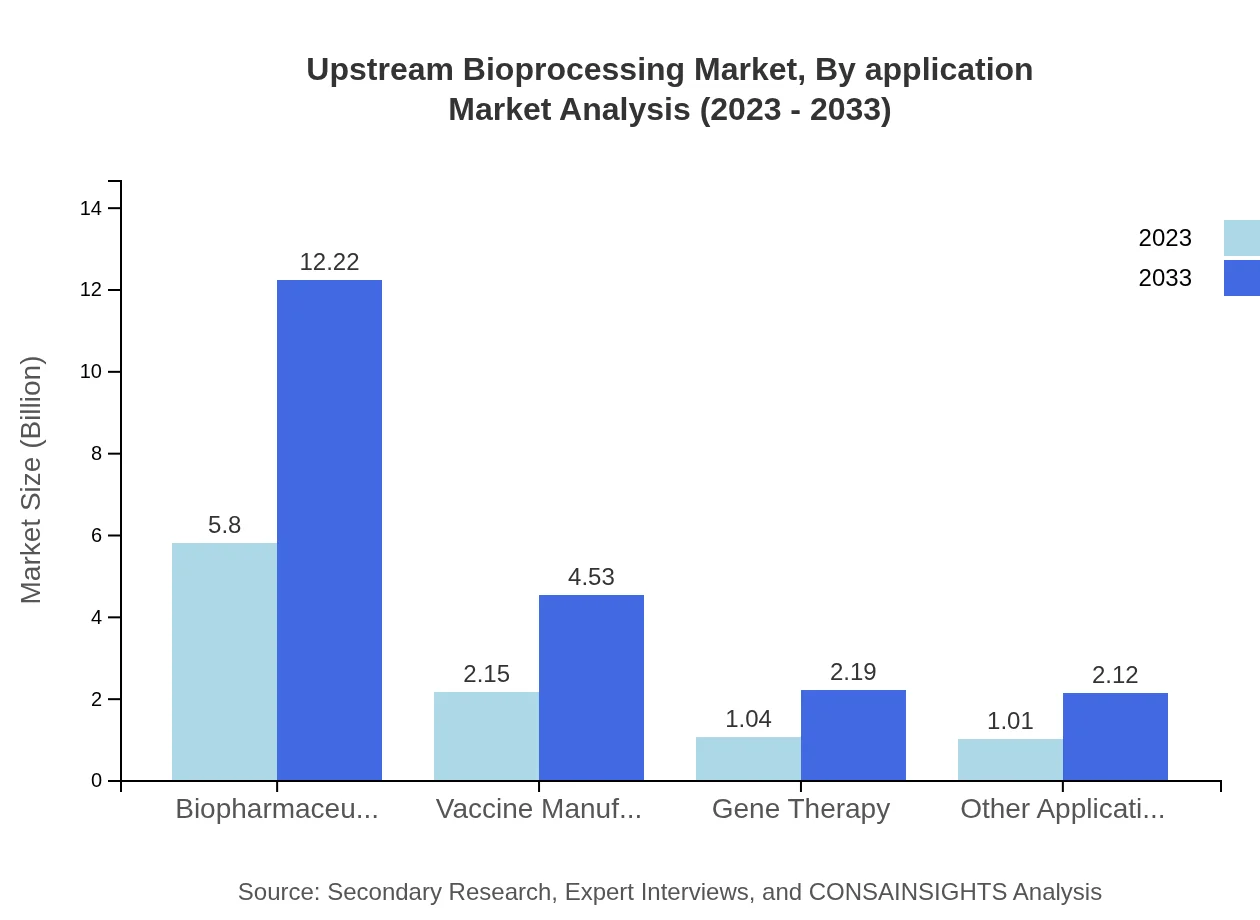

Upstream Bioprocessing Market Analysis By Application

Applications within the Upstream Bioprocessing market are diverse, encompassing biopharmaceutical production, vaccine manufacturing, gene therapy, and more. Biopharmaceutical production is expected to maintain a prominent share (58.04%) owing to its extensive use in therapeutic solutions. Vaccine manufacturing follows closely (21.52%), driven by the global health initiatives emphasizing vaccination campaigns. Gene therapy applications, while smaller in proportion (10.38%), are rapidly gaining traction with advancements in genetic technologies.

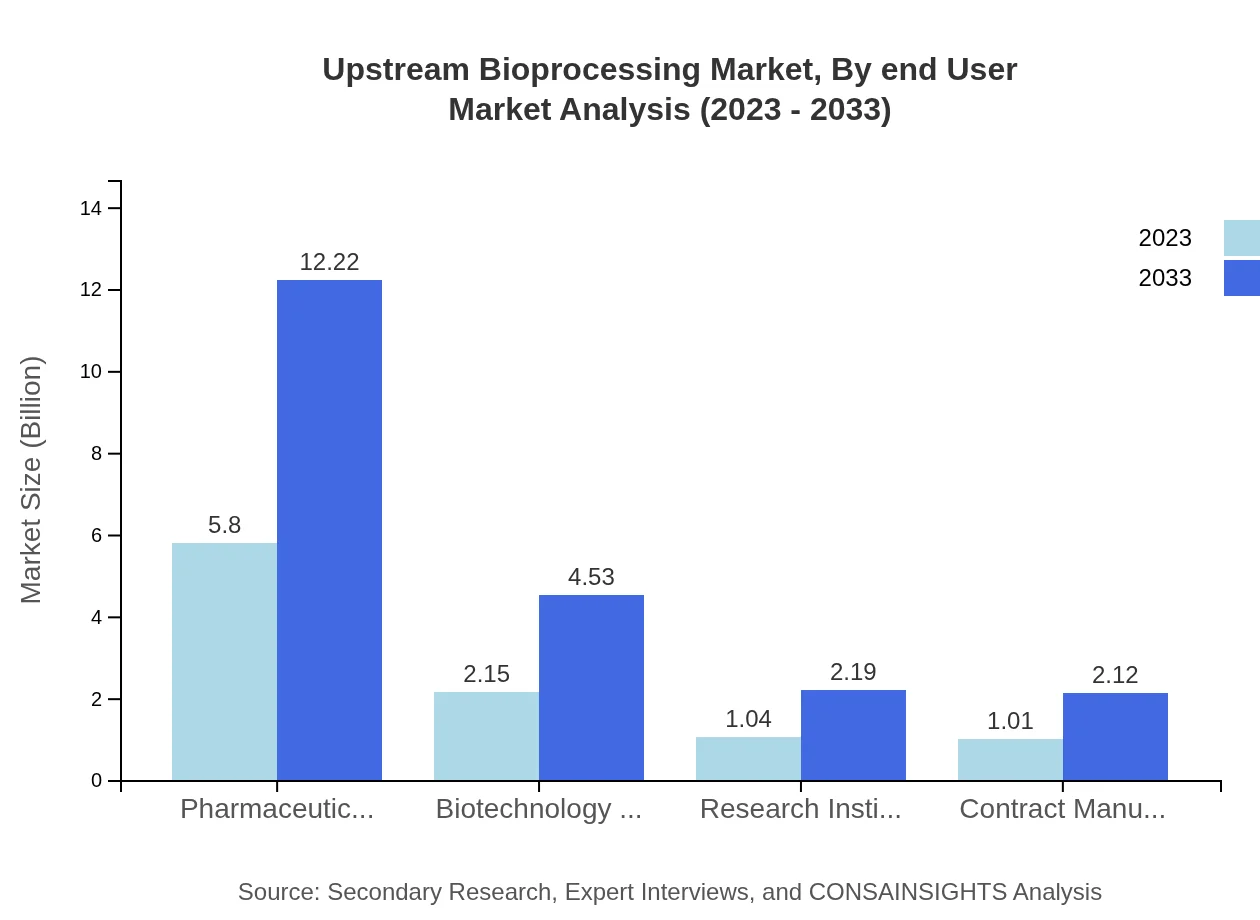

Upstream Bioprocessing Market Analysis By End User

The end-user analysis showcases significant contributions from pharmaceutical companies, which dominate the market share at 58.04% in 2023 due to their high requirement for bioprocessing technologies in drug development. Biotechnology companies follow (21.52%), leveraging bioprocessing for innovative product development. Research institutes and contract manufacturing organizations also play essential roles, contributing to the diverse application landscape.

Upstream Bioprocessing Market Analysis By Region

The regional analysis emphasizes distinct growth trajectories across various geographies. North America leads with a market size exceeding $4 billion, driven by governmental support in biotechnology innovation. Europe offers resilience with its established industry standards, while the Asia-Pacific region is gaining momentum through growing investments in biopharmaceutical operations, positioning itself as a future market leader.

Upstream Bioprocessing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Upstream Bioprocessing Industry

Thermo Fisher Scientific:

A leading company providing instrumentation, reagents, and consumables for biological research and pharmaceutical manufacturing, significantly impacting the Upstream Bioprocessing market with innovative solutions.Merck KGaA:

Known for its comprehensive portfolio of products and services for bioprocessing, Merck KGaA supports biopharmaceutical production with essential technologies aimed at enhancing productivity and efficiency.GE Healthcare:

A key player in the bioprocessing arena, GE Healthcare focuses on advancing bioprocessing technologies and solutions for enhancing biopharmaceutical development and production.Sartorius AG:

Sartorius provides laboratory and bioprocess solutions, including bioreactors and cell cultivation technologies essential for Upstream Bioprocessing applications.AbbVie Inc.:

A biopharmaceutical company that emphasizes formulation and manufacturing technologies contributing to upstream processing advancements in drug production.We're grateful to work with incredible clients.

FAQs

What is the market size of upstream Bioprocessing?

The upstream bioprocessing market is valued at approximately $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.5% leading to substantial growth through 2033.

What are the key market players or companies in this upstream Bioprocessing industry?

Prominent players in the upstream bioprocessing market include established pharmaceutical and biotechnology companies, contract manufacturing organizations (CMOs), and research institutes, all contributing significantly to market growth and innovation.

What are the primary factors driving the growth in the upstream Bioprocessing industry?

Major growth drivers in upstream bioprocessing stem from advancements in biopharmaceutical manufacturing technologies, rising demand for vaccines and advanced therapies, and increased investments in research and development across the biotechnology sector.

Which region is the fastest Growing in the upstream Bioprocessing?

North America is the fastest-growing region in upstream bioprocessing, anticipated to expand from $3.59 billion in 2023 to $7.56 billion by 2033, leading the market growth due to its strong pharmaceutical industry.

Does ConsaInsights provide customized market report data for the upstream Bioprocessing industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the upstream bioprocessing industry, enabling clients to gain detailed insights relevant to their business goals and market segments.

What deliverables can I expect from this upstream Bioprocessing market research project?

Clients can expect comprehensive deliverables from the upstream bioprocessing market research, including detailed market analysis, growth forecasts, competitive landscape assessments, and insights on key market trends and drivers.

What are the market trends of upstream Bioprocessing?

Current trends in upstream bioprocessing include increasing adoption of single-use technologies, a shift towards process automation, and enhanced investments in personalized medicine, which are shaping the industry landscape significantly.