Urban Air Mobility Uam

Published Date: 31 January 2026 | Report Code: urban-air-mobility-uam

Urban Air Mobility Uam Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Urban Air Mobility (UAM) market, focusing on key insights, market dynamics, and future trends for the forecast period from 2024 to 2033.

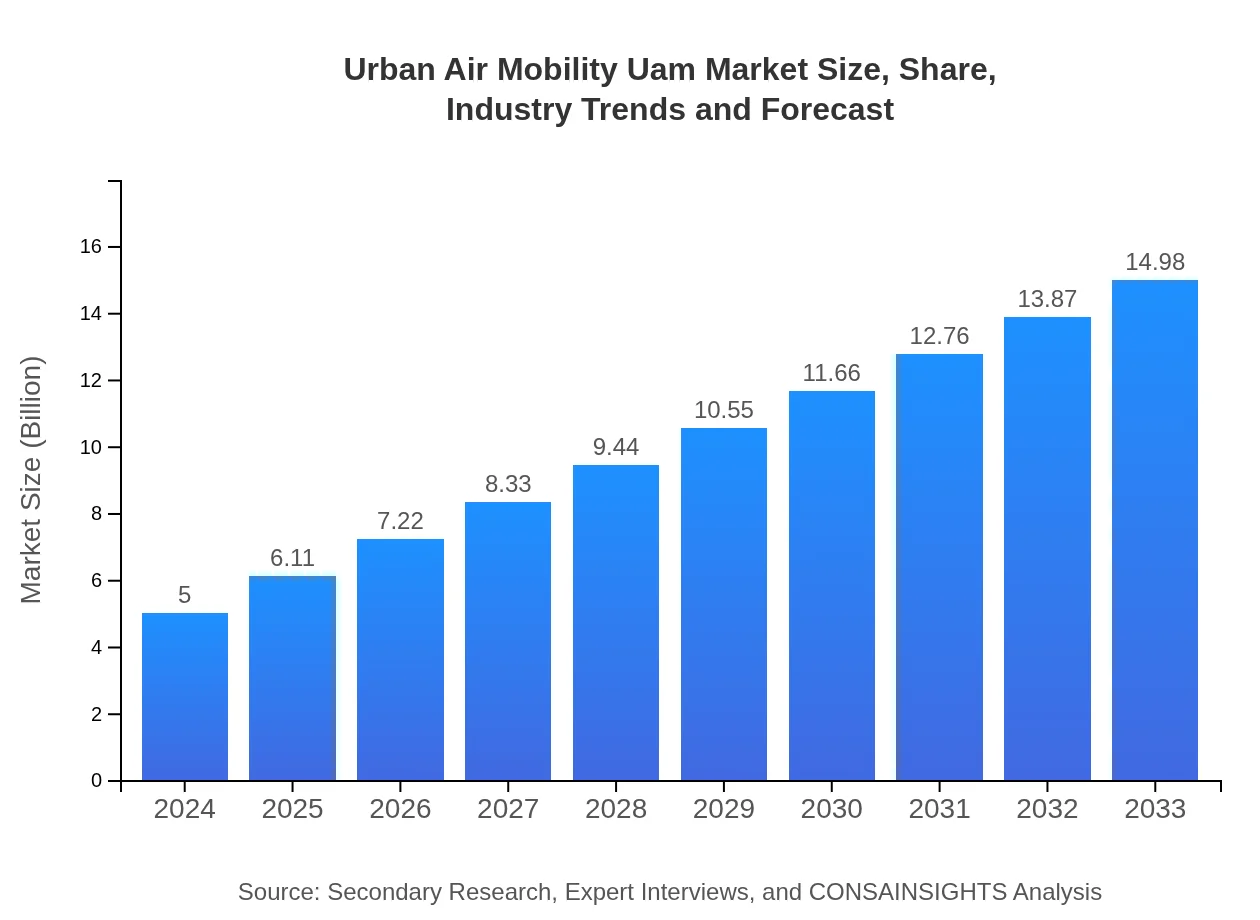

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $5.00 Billion |

| CAGR (2024-2033) | 12.4% |

| 2033 Market Size | $14.98 Billion |

| Top Companies | Joby Aviation, Volocopter, Lilium, Urban Aeronautics, Airbus |

| Last Modified Date | 31 January 2026 |

Urban Air Mobility UAM Market Overview

Customize Urban Air Mobility Uam market research report

- ✔ Get in-depth analysis of Urban Air Mobility Uam market size, growth, and forecasts.

- ✔ Understand Urban Air Mobility Uam's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Urban Air Mobility Uam

What is the Market Size & CAGR of Urban Air Mobility UAM market in 2024?

Urban Air Mobility UAM Industry Analysis

Urban Air Mobility UAM Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Urban Air Mobility UAM Market Analysis Report by Region

Europe Urban Air Mobility Uam:

The European UAM market is expected to see steady growth, increasing from $1.56 billion in 2024 to $4.67 billion by 2033. European nations are leading in regulatory advancements and pilot programs aimed at integrating UAM into existing transport systems.Asia Pacific Urban Air Mobility Uam:

The Asia Pacific region is projected to grow significantly, with the market size reaching $0.91 billion in 2024 and potentially growing to $2.73 billion by 2033. This growth will be propelled by rapid urbanization and an increase in investments from governments and private entities in transportation infrastructure.North America Urban Air Mobility Uam:

North America is a frontrunner in the UAM sector, with an anticipated market size of $1.79 billion in 2024, escalating to $5.36 billion by 2033. The presence of major aerospace manufacturers and favorable government policies will significantly contribute to this growth.South America Urban Air Mobility Uam:

In South America, the UAM market is expected to reach $0.42 billion by 2024 and grow to $1.25 billion by 2033. The region's focus on enhancing urban transport systems, along with the development of regulatory frameworks, will drive market expansion.Middle East & Africa Urban Air Mobility Uam:

The Middle East and Africa region's market size is expected to expand from $0.33 billion in 2024 to $0.98 billion by 2033. Investment in smart city initiatives and the need for rapid transportation solutions will drive growth in this area.Tell us your focus area and get a customized research report.

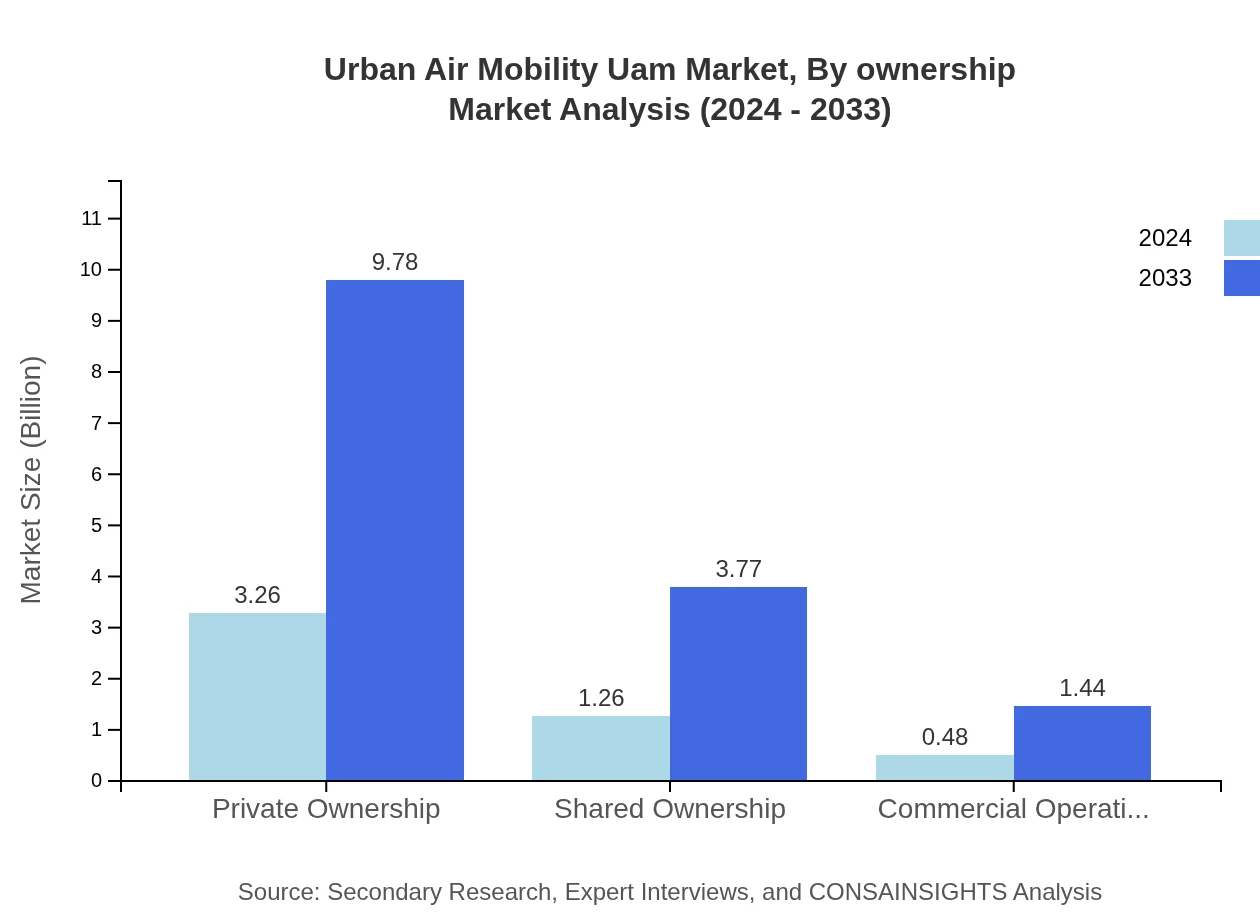

Urban Air Mobility Uam Market Analysis By Ownership

The UAM market can be categorized across ownership models such as Private Ownership, Shared Ownership, and Commercial Operations. Private ownership is projected to reach a market size of $3.26 billion in 2024 and $9.78 billion by 2033, holding a dominant share of 65.26%. Meanwhile, shared ownership is expected to grow from $1.26 billion to $3.77 billion, while commercial operations will increase from $0.48 billion to $1.44 billion. These trends indicate a shift towards varied ownership and operation models to meet urban mobility demands.

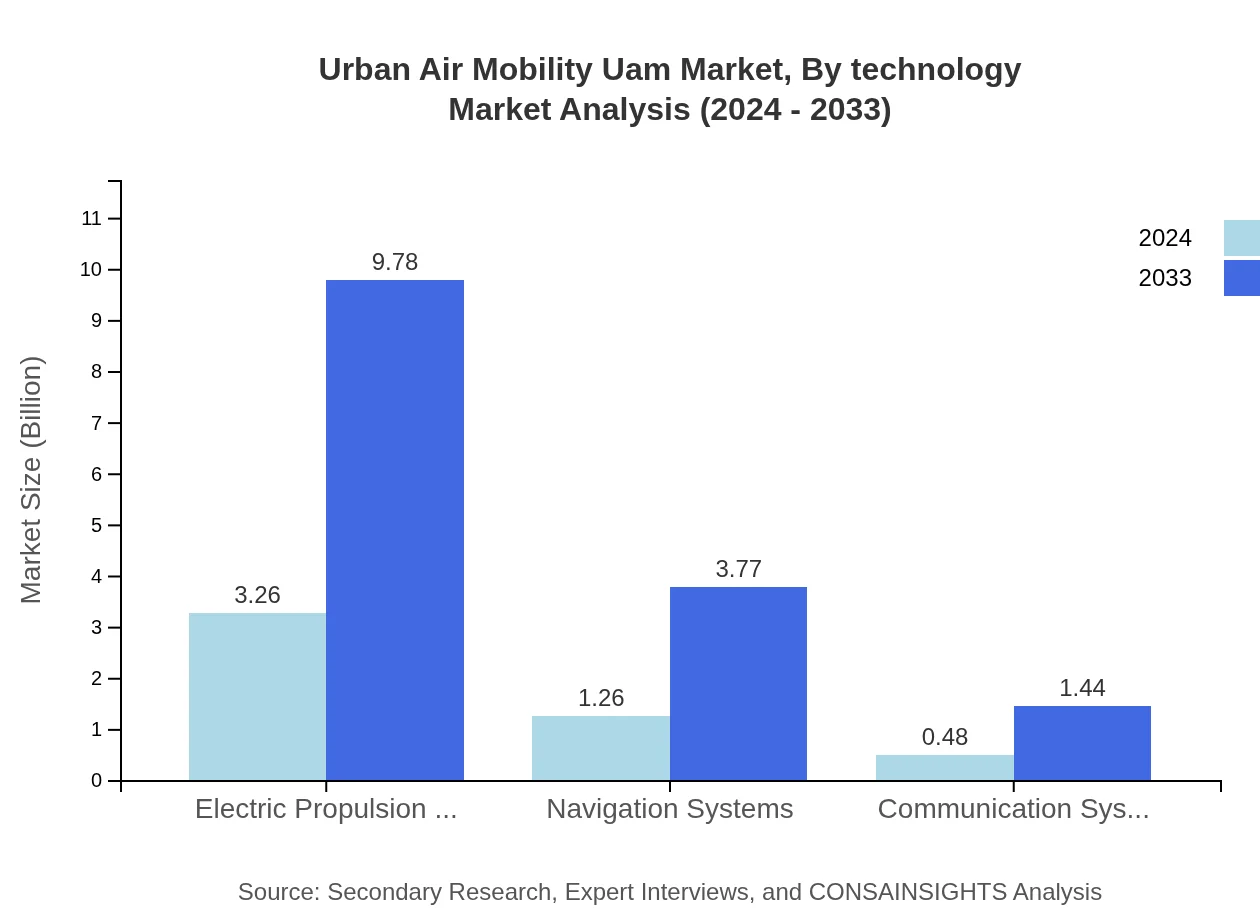

Urban Air Mobility Uam Market Analysis By Technology

In terms of the technology landscape, key segments include Electric Propulsion Systems, Navigation Systems, and Communication Systems. Electric propulsion, a core component, is projected to have a size increase from $3.26 billion in 2024 to $9.78 billion by 2033, maintaining a share of 65.26%. Navigation systems will contribute significantly, from $1.26 billion to $3.77 billion, addressing the demand for advanced aerial traffic management.

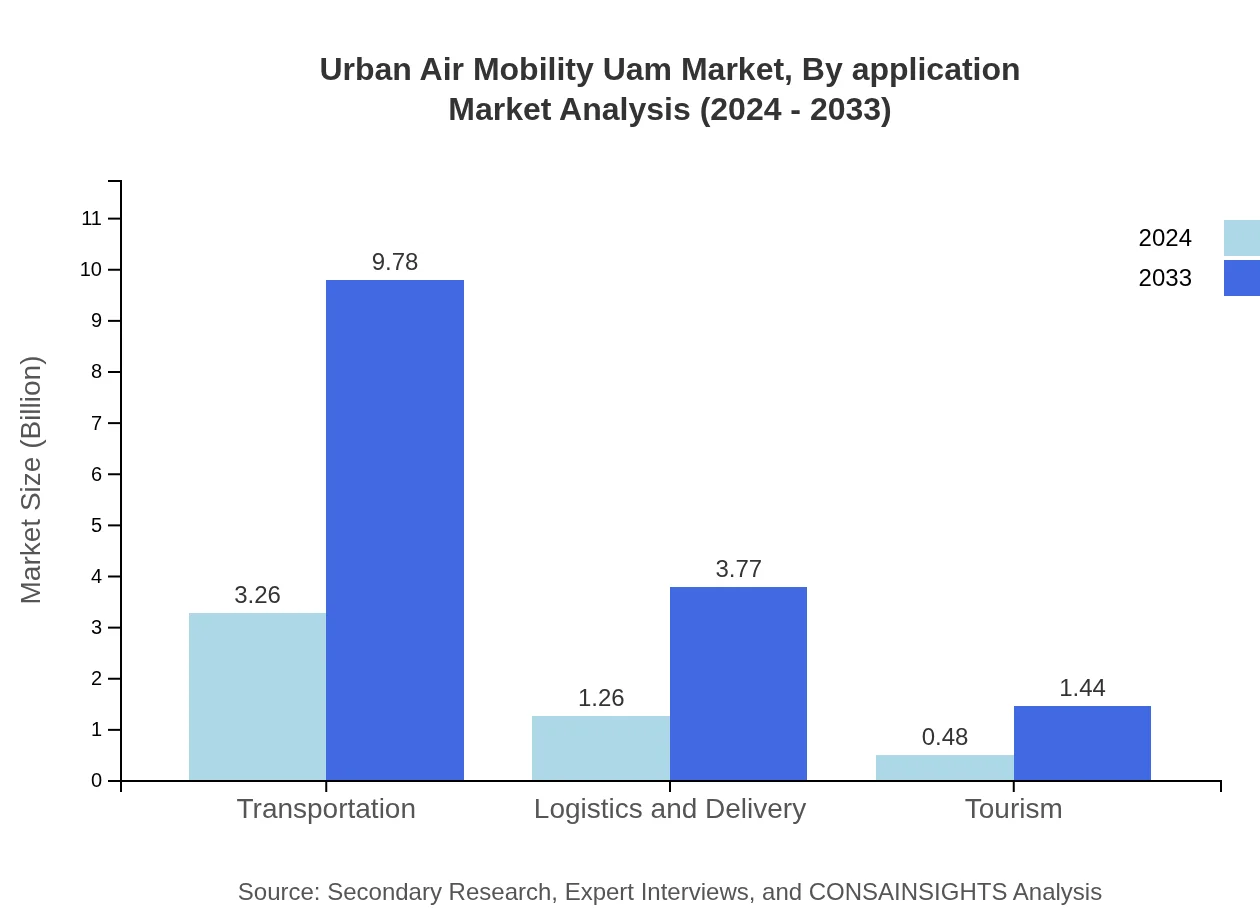

Urban Air Mobility Uam Market Analysis By Application

Applications of UAM encompass Transportation, Logistics and Delivery, and Tourism. Particularly, transportation is set to grow significantly, from $3.26 billion in 2024 to $9.78 billion by 2033. Logistics will rise from $1.26 billion to $3.77 billion, indicating a growing role for drones in package delivery, while tourism-related services will also expand modestly, as new aerial options attract leisure travelers.

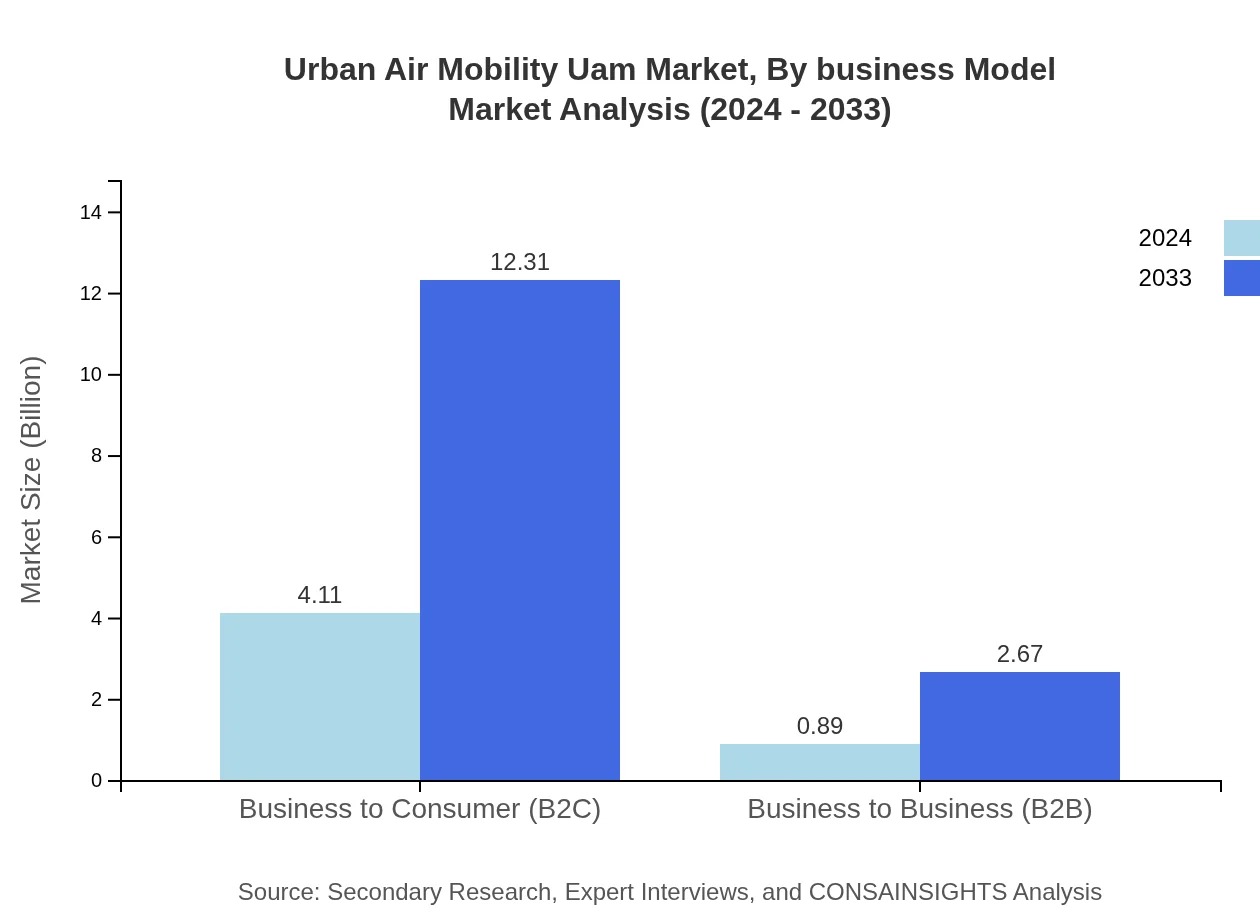

Urban Air Mobility Uam Market Analysis By Business Model

The UAM industry is shaped by diverse business models, with Business to Consumer (B2C) dominating the landscape. The B2C segment is expected to grow from $4.11 billion to $12.31 billion, attributing to public demand for instant mobility solutions. Conversely, the Business to Business (B2B) segment will also see growth, from $0.89 billion to $2.67 billion, aiding enterprises in logistics and urban transportation solutions.

Urban Air Mobility UAM Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Urban Air Mobility UAM Industry

Joby Aviation:

Joby Aviation is a leader in the eVTOL aircraft sector, focusing on developing electric air taxis designed for urban commuting. Their innovative designs emphasize sustainability and efficiency.Volocopter:

Volocopter is a pioneer in urban air mobility, dedicated to developing electric aerial vehicles for passenger transport and logistics, actively involved in regulatory efforts to enable air taxi services.Lilium:

Lilium designs and manufactures electric flying taxis, engineered for speed and short-distance travel, positioning itself as a key player in the UAM market with extensive testing programs.Urban Aeronautics:

Urban Aeronautics is working on the develop hybrid aircraft solutions designed for urban environments, focusing on vertical take-off and landing capabilities.Airbus:

As a major aerospace manufacturer, Airbus is investing heavily in Urban Air Mobility technologies, with projects aimed at integrating flying cars into existing transport infrastructures.We're grateful to work with incredible clients.

FAQs

What is the market size of Urban Air Mobility (UAM)?

The Urban Air Mobility (UAM) market is projected to reach approximately $5 billion by 2033, with a robust compound annual growth rate (CAGR) of 12.4% from the base year. This growth reflects increasing urbanization and the demand for advanced transportation solutions.

What are the key market players or companies in the UAM industry?

Key players in the UAM industry include aerospace manufacturers, technology firms, and ride-sharing companies. Leading names include companies specializing in electric vertical takeoff and landing (eVTOL) aircraft, which are at the forefront of innovative aerial mobility solutions.

What are the primary factors driving the growth in the UAM industry?

Major factors fueling UAM growth include technological advancements in eVTOL designs, increased urban congestion necessitating alternative transport solutions, and strong government support for infrastructure development and regulatory frameworks aimed at integrating UAM into existing transportation networks.

Which region is the fastest Growing in the UAM market?

North America is poised to be the fastest-growing region within the UAM market, expanding from $1.79 billion in 2024 to $5.36 billion by 2033. This growth is propelled by technological innovations and significant investments in urban infrastructure for air mobility.

Does ConsaInsights provide customized market report data for the UAM industry?

Yes, ConsaInsights offers customized market report data for the UAM industry. Our tailored services provide detailed insights specific to clients' needs, encompassing market trends, regional analyses, and competitive landscapes, ensuring valuable strategic decision-making.

What deliverables can I expect from the UAM market research project?

The UAM market research project will deliver comprehensive reports that include market size analyses, growth forecasts, competitive benchmarking, regional breakdowns, and segmentation data, providing stakeholders with actionable insights to navigate the dynamic UAM landscape.

What are the market trends of UAM?

Current trends in the UAM market include increasing investment in electric propulsion technology, a surge in public and private partnerships, rising consumer interest in air taxi services, and ongoing advancements in drone delivery systems, shaping the future of urban mobility.