Urban Pest Management Market Report

Published Date: 02 February 2026 | Report Code: urban-pest-management

Urban Pest Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Urban Pest Management market, examining current market conditions, segmentation, regional insights, competitive landscape, and future trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

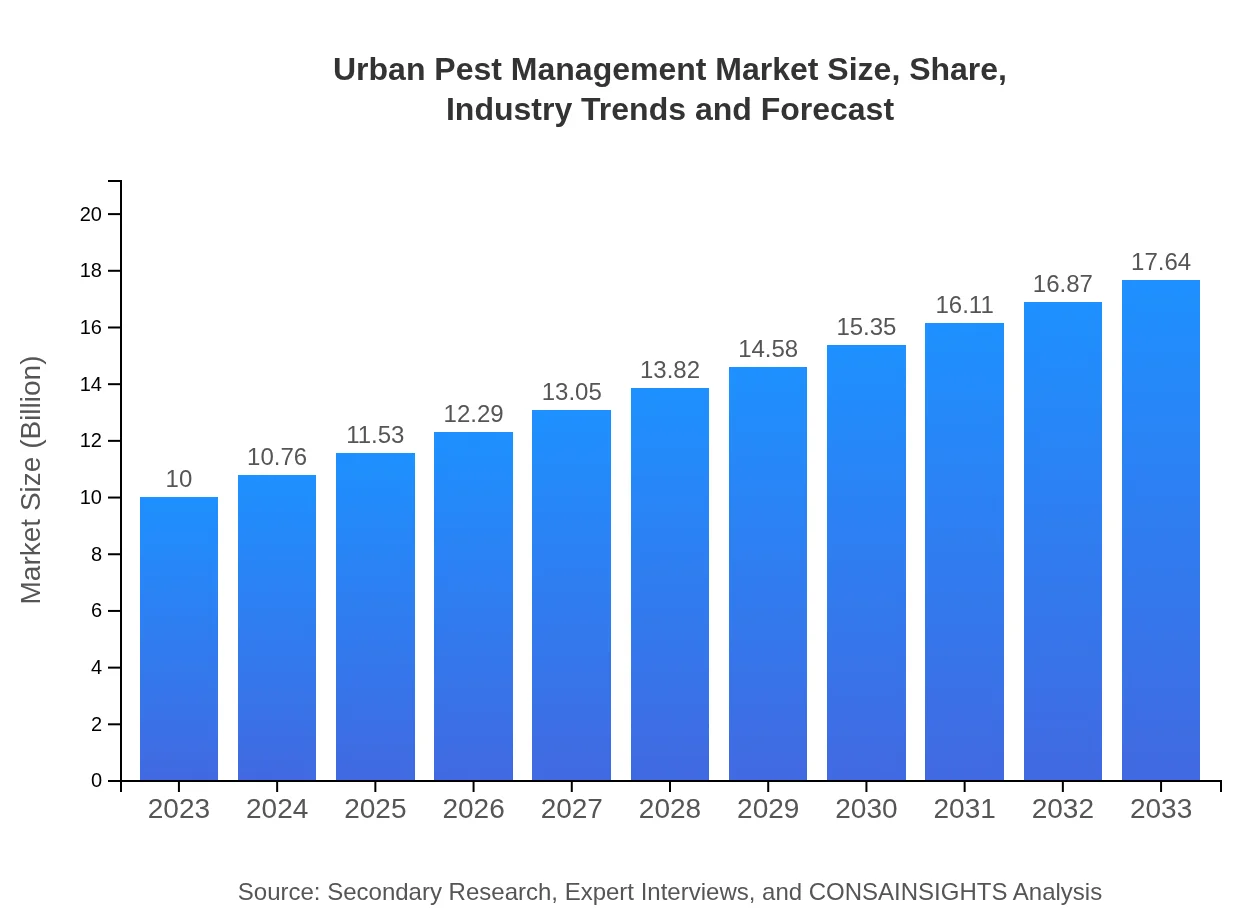

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $17.64 Billion |

| Top Companies | Terminix Global Holdings, Inc., Rentokil Initial plc, Ecolab Inc., Anticimex, Rollins, Inc. |

| Last Modified Date | 02 February 2026 |

Urban Pest Management Market Overview

Customize Urban Pest Management Market Report market research report

- ✔ Get in-depth analysis of Urban Pest Management market size, growth, and forecasts.

- ✔ Understand Urban Pest Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Urban Pest Management

What is the Market Size & CAGR of Urban Pest Management market in 2023?

Urban Pest Management Industry Analysis

Urban Pest Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Urban Pest Management Market Analysis Report by Region

Europe Urban Pest Management Market Report:

Europe's Urban Pest Management market is set to grow from USD 2.61 billion in 2023 to USD 4.60 billion in 2033. This growth is bolstered by stringent environmental regulations and an increasing demand for sustainable pest management practices.Asia Pacific Urban Pest Management Market Report:

In the Asia-Pacific region, the Urban Pest Management market is expected to grow from USD 2.07 billion in 2023 to USD 3.65 billion in 2033. The growth is driven by rapid urbanization, increased disposable income, and a booming real estate sector, necessitating pest management solutions.North America Urban Pest Management Market Report:

North America holds a significant share of the market, projected to increase from USD 3.73 billion in 2023 to USD 6.59 billion by 2033, driven by rigorous health regulations and a preference for advanced pest management technologies.South America Urban Pest Management Market Report:

The South American market is anticipated to reach USD 1.36 billion by 2033, up from USD 0.77 billion in 2023, supported by a growing awareness of pest-related health issues and a rise in urban populations demanding pest control services.Middle East & Africa Urban Pest Management Market Report:

In the Middle East and Africa, the market is forecasted to rise from USD 0.82 billion in 2023 to USD 1.44 billion in 2033, buoyed by improving living conditions and a growing focus on pest management in urban developments.Tell us your focus area and get a customized research report.

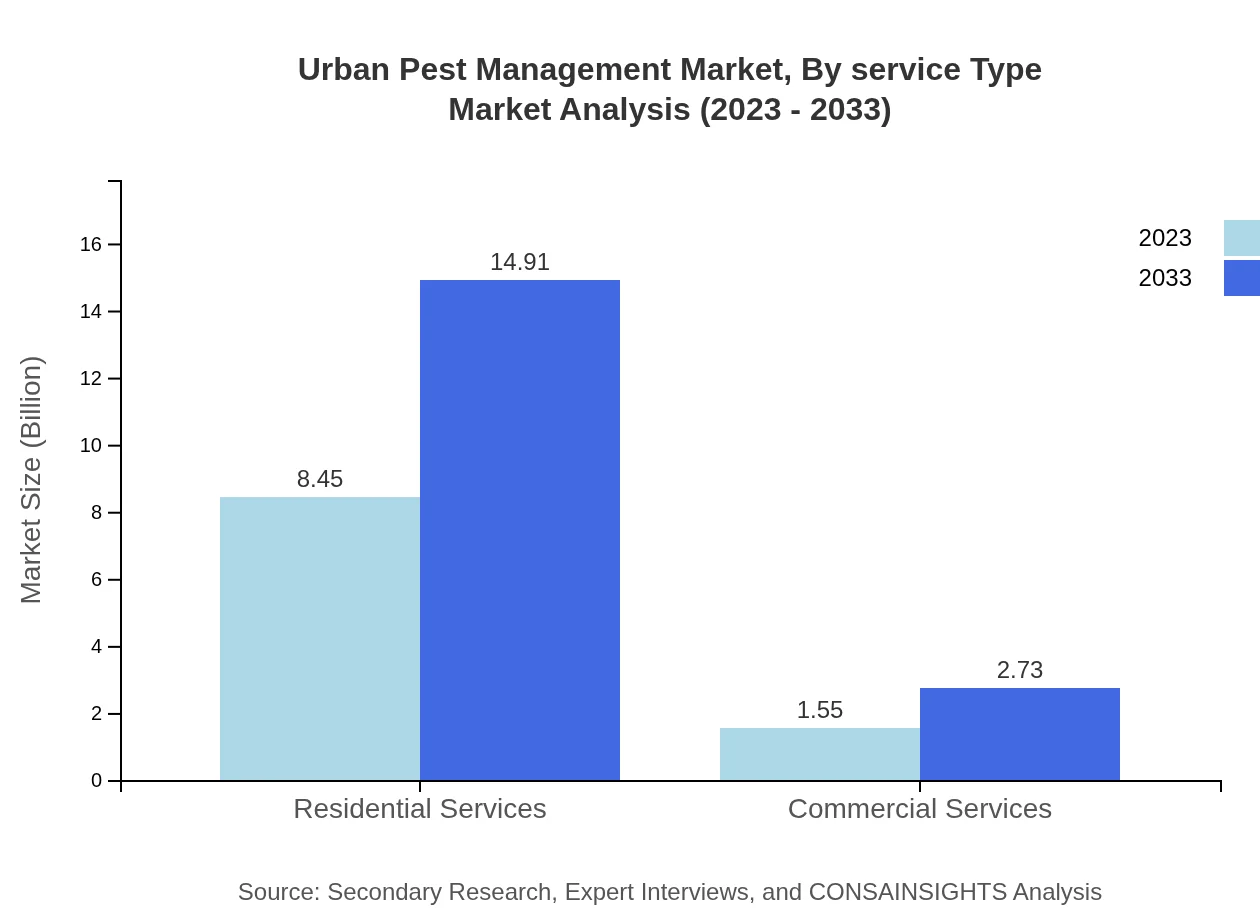

Urban Pest Management Market Analysis By Service Type

The Urban Pest Management market by service type is primarily divided into residential, commercial, and agricultural segments. Residential services dominate the market with a share of 84.54% in 2023, expected to maintain this leadership through to 2033 as urban households increasingly engage professional pest management services. Commercial services, accounting for 15.46% of the market, are also anticipated to grow as businesses recognize the importance of pest control in maintaining health and safety standards.

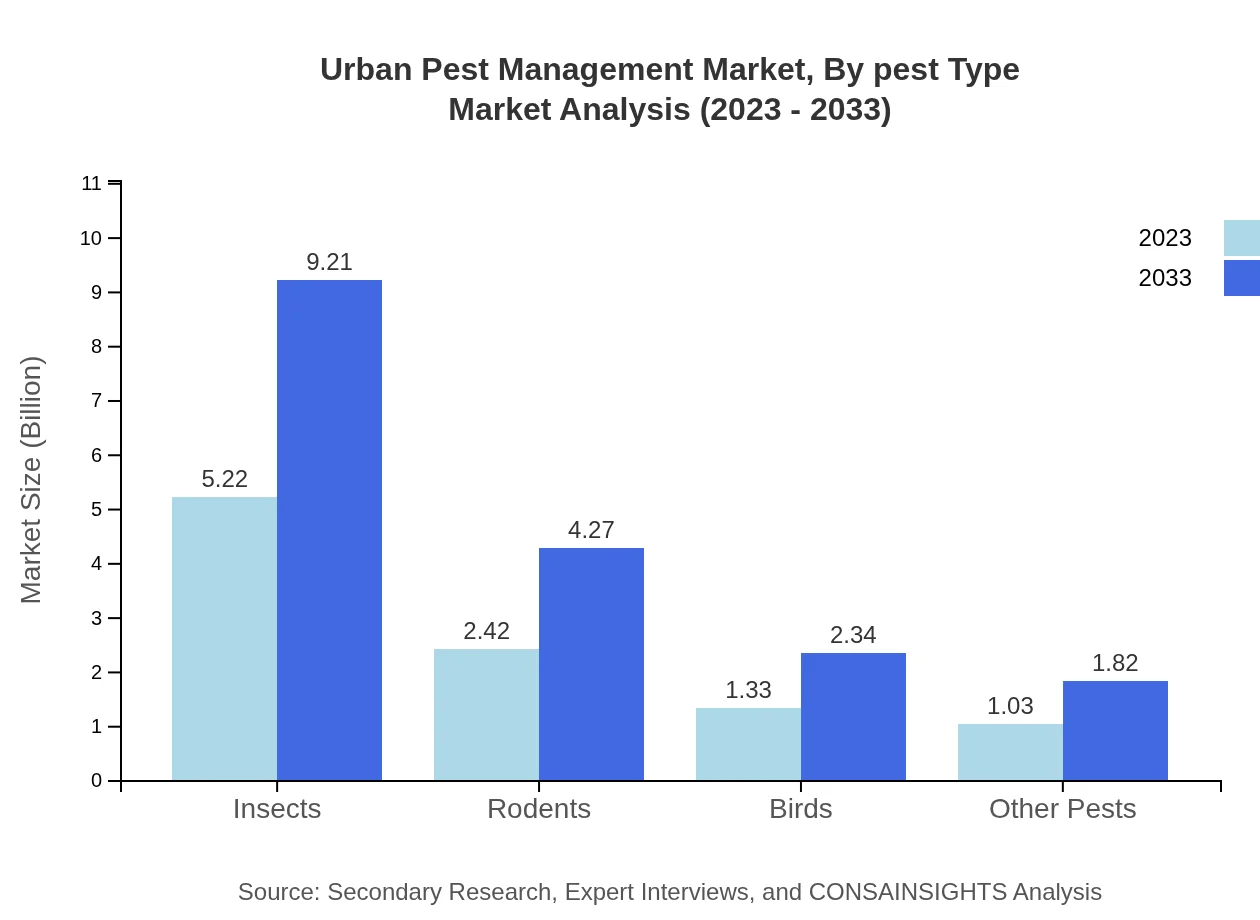

Urban Pest Management Market Analysis By Pest Type

In terms of pest type, the Urban Pest Management market experiences significant demand from the insect segment, which constitutes 52.21% of the market in 2023. Rodents follow closely, representing 24.2%. As awareness of pest-related health risks rises, the focus on controlling these pests also increases, driving further investment in integrated management strategies.

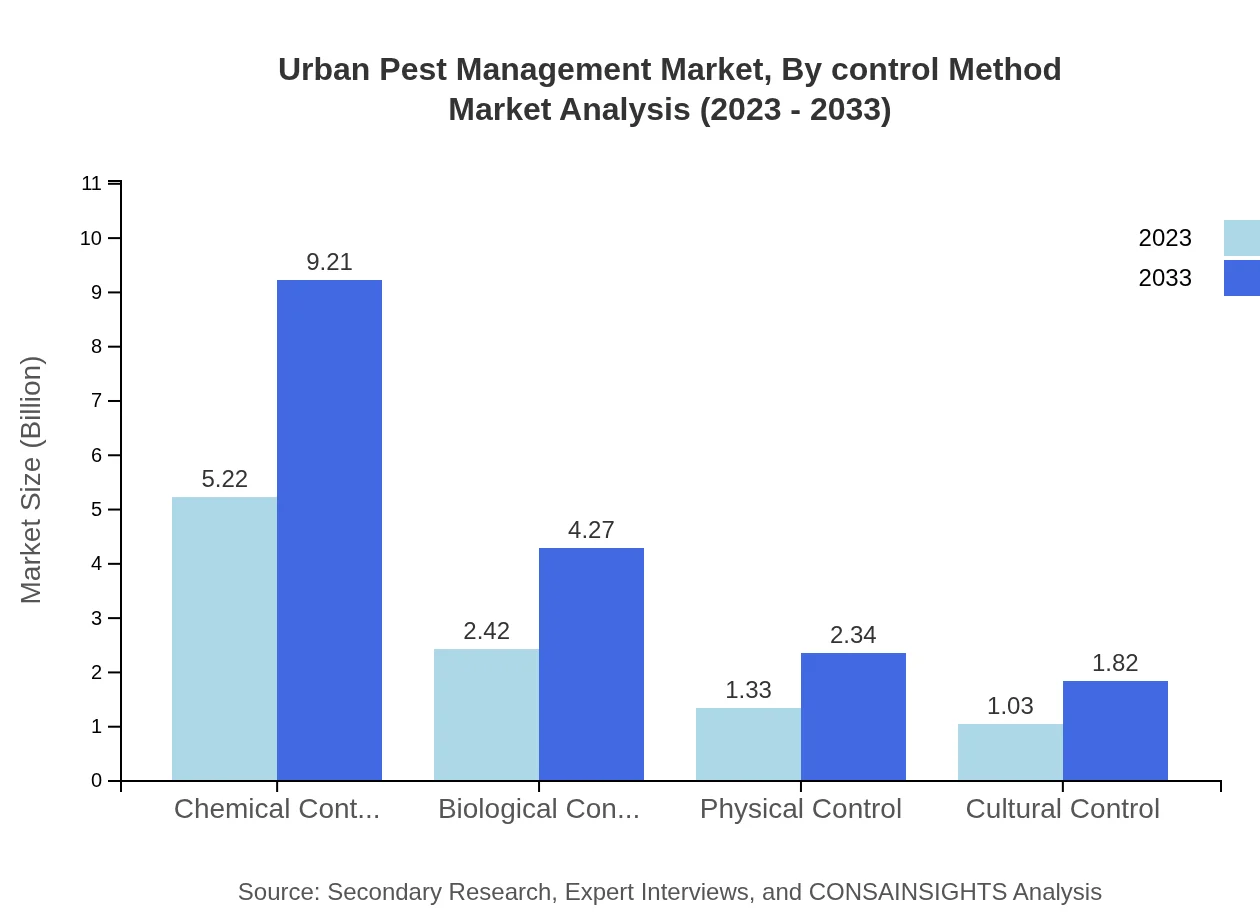

Urban Pest Management Market Analysis By Control Method

The control methods segment of the Urban Pest Management market showcases chemical control as a key method, holding a significant share of 52.21%. Biological control, while smaller at 24.2%, is gaining traction as consumers look for sustainable options. Physical and cultural controls are also vital as they represent integrated pest management, combining multiple tactics for the best results.

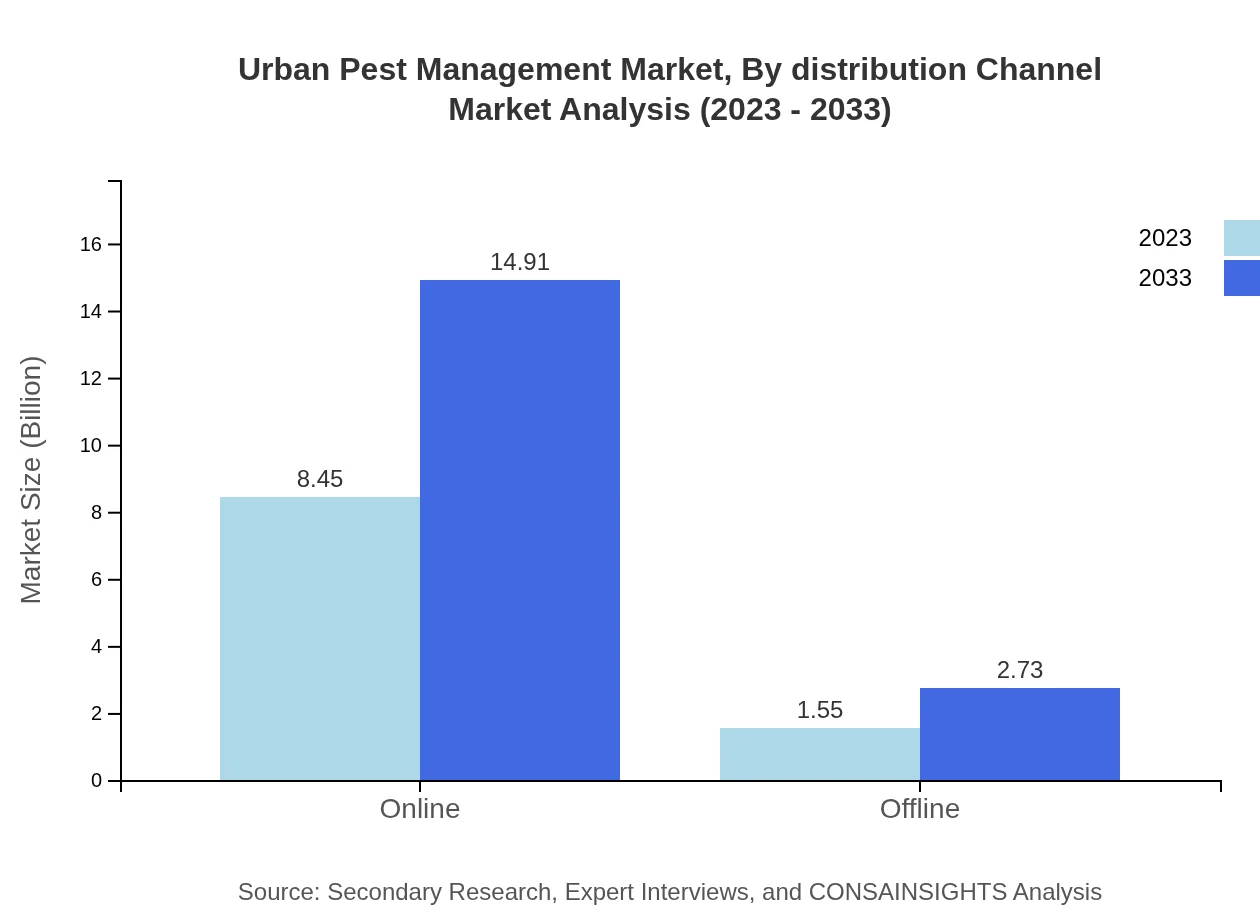

Urban Pest Management Market Analysis By Distribution Channel

Distribution channels in the Urban Pest Management market are categorized into online and offline sales. Online channels dominate with an 84.54% market share in 2023, as consumers increasingly prefer the convenience of accessing pest control services digitally. Offline channels will continue to provide crucial in-person service options.

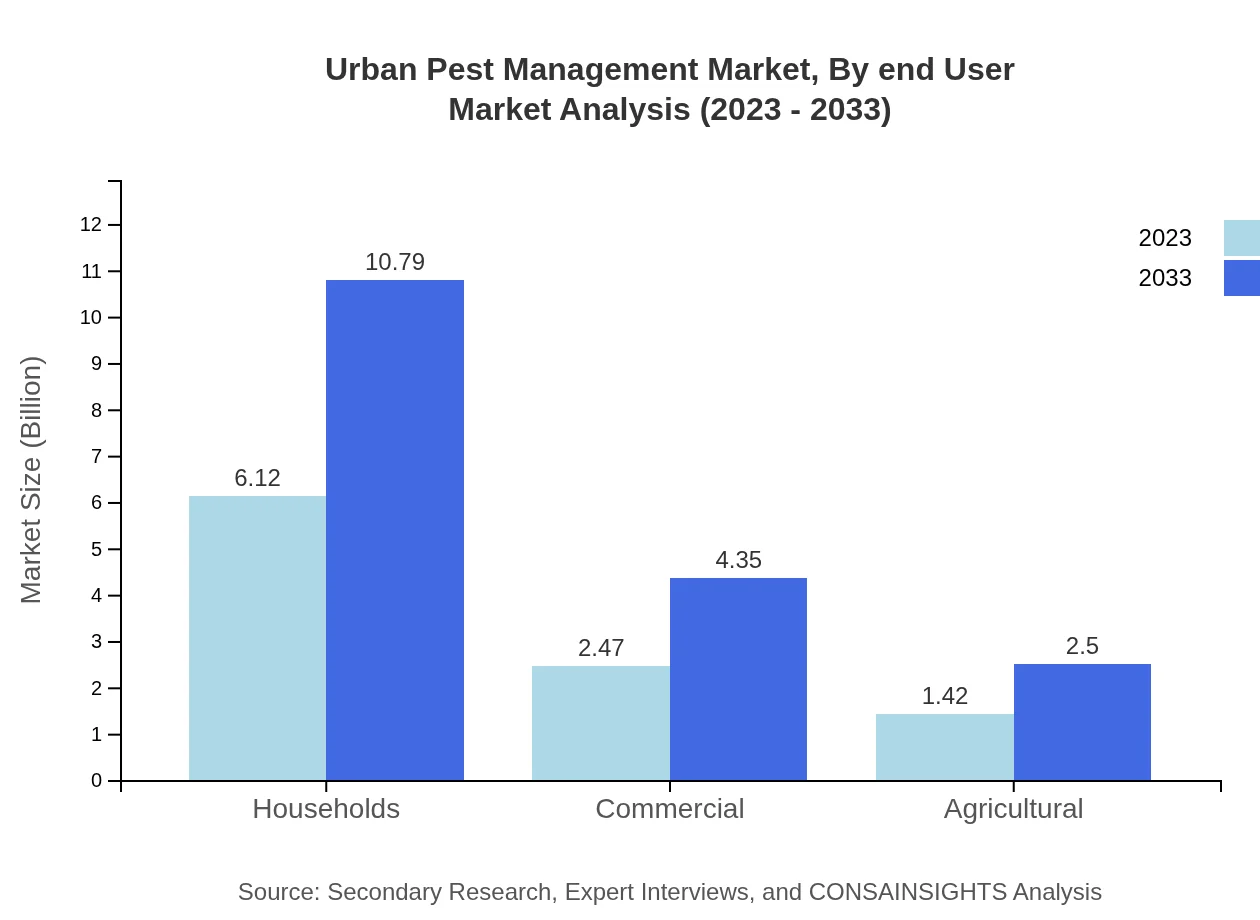

Urban Pest Management Market Analysis By End User

End-users in the Urban Pest Management market include residential, commercial, and agricultural sectors. The residential sector accounts for the majority share, driven by heightened awareness of pest-related health risks and demand for quality living standards. Commercial users also recognize the importance of maintaining a clean pest-free environment to uphold business reputation.

Urban Pest Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Urban Pest Management Industry

Terminix Global Holdings, Inc.:

A leading pest control provider in North America, Terminix specializes in residential and commercial pest management solutions, emphasizing innovation and customer satisfaction.Rentokil Initial plc:

With a global presence, Rentokil provides comprehensive pest control services and is noted for sustainable pest management solutions, leveraging advanced technology and expertise.Ecolab Inc.:

Ecolab delivers integrated pest management services across various industries, focusing on sustainable practices and innovative solutions to enhance pest control efficiency.Anticimex:

Anticimex specializes in digital pest control services, offering technologically advanced solutions to improve pest management accuracy and outcomes.Rollins, Inc.:

Rollins operates as a holding company for various pest control companies and focuses on providing effective pest management services in different market segments.We're grateful to work with incredible clients.

FAQs

What is the market size of urban Pest Management?

The global urban pest management market was valued at approximately $10 billion in 2023, with a projected CAGR of 5.7%. By 2033, the market is expected to see significant growth, driven by increasing urbanization and pest-related issues.

What are the key market players or companies in this urban Pest Management industry?

The urban pest management industry features several key players, including Terminix, Rentokil Initial, and Exterminators. These companies are recognized for their comprehensive pest control solutions and significant market shares, playing crucial roles in shaping industry trends and service standards.

What are the primary factors driving the growth in the urban Pest Management industry?

Key factors driving the urban pest management industry include rising urbanization resulting in higher pest infestations, increased population density, and the growing awareness of health and hygiene. Advancements in pest control technologies also contribute to market growth.

Which region is the fastest Growing in the urban Pest Management?

North America is the fastest-growing region in the urban pest management market, projected to expand from $3.73 billion in 2023 to $6.59 billion by 2033. Other significant regions include Europe and Asia Pacific, showing substantial growth rates.

Does ConsaInsights provide customized market report data for the urban Pest Management industry?

Yes, ConsaInsights offers customized market report data for the urban pest management industry, catering to specific client needs. This ensures that stakeholders receive tailored insights that align with their strategic objectives and market conditions.

What deliverables can I expect from this urban Pest Management market research project?

From the urban pest management market research project, you can expect comprehensive market analysis reports, segment insights, competitive landscape assessments, and regional trends. The deliverables will be designed to inform strategic planning and investment decisions.

What are the market trends of urban Pest Management?

Current market trends in urban pest management include a shift towards eco-friendly pest control methods, increasing demand for integrated pest management solutions, and the rise of digital tools in service delivery. These trends are crucial for adapting to changing consumer preferences.