Usage Based Insurance Market Report

Published Date: 02 February 2026 | Report Code: usage-based-insurance

Usage Based Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Usage Based Insurance market from 2023 to 2033, focusing on market insights, trends, and forecasts. It covers regional dynamics, technological advancements, regulatory environments, and key player profiles in the industry.

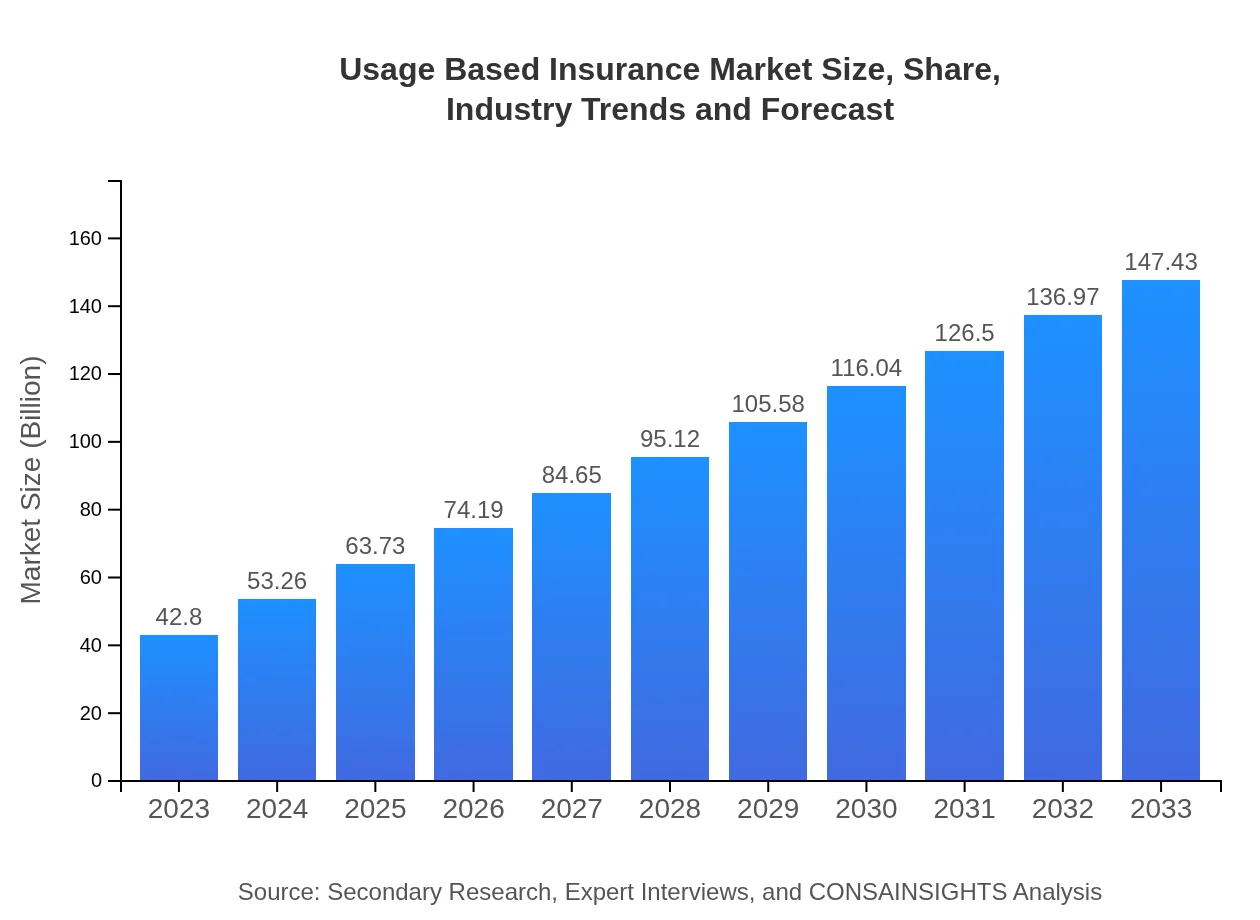

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $42.80 Billion |

| CAGR (2023-2033) | 12.6% |

| 2033 Market Size | $147.43 Billion |

| Top Companies | Progressive Insurance, Allianz SE, Metromile, Liberty Mutual |

| Last Modified Date | 02 February 2026 |

Usage Based Insurance Market Overview

Customize Usage Based Insurance Market Report market research report

- ✔ Get in-depth analysis of Usage Based Insurance market size, growth, and forecasts.

- ✔ Understand Usage Based Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Usage Based Insurance

What is the Market Size & CAGR of Usage Based Insurance Market in 2023?

Usage Based Insurance Industry Analysis

Usage Based Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Usage Based Insurance Market Analysis Report by Region

Europe Usage Based Insurance Market Report:

The European UBI market is projected to grow from $14.14 billion in 2023 to $48.70 billion in 2033. This growth is aided by stringent regulatory standards advocating for safer driving and insurance personalization, alongside growing consumer awareness of UBI benefits.Asia Pacific Usage Based Insurance Market Report:

The Asia Pacific region shows robust growth for UBI, forecasted to expand from $8.15 billion in 2023 to $28.09 billion by 2033, driven by rising smartphone penetration, increased utilization of telematics, and a growing middle-class population requiring flexible insurance options.North America Usage Based Insurance Market Report:

North America is expected to remain a leader in the UBI market, expanding from $14.04 billion in 2023 to $48.37 billion by 2033. The region benefits from advanced telematics technology, regulatory support for usage-based models, and a strong trend toward personalized insurance.South America Usage Based Insurance Market Report:

In South America, the UBI market is anticipated to grow from $0.81 billion to $2.80 billion from 2023 to 2033. Factors contributing to this growth include improving economic conditions, increased digital infrastructure, and the push toward smart mobility solutions.Middle East & Africa Usage Based Insurance Market Report:

In the Middle East and Africa, the UBI market is anticipated to grow from $5.65 billion in 2023 to $19.48 billion by 2033, driven by increasing urbanization, a growing young population eager for innovative solutions, and improving economic conditions.Tell us your focus area and get a customized research report.

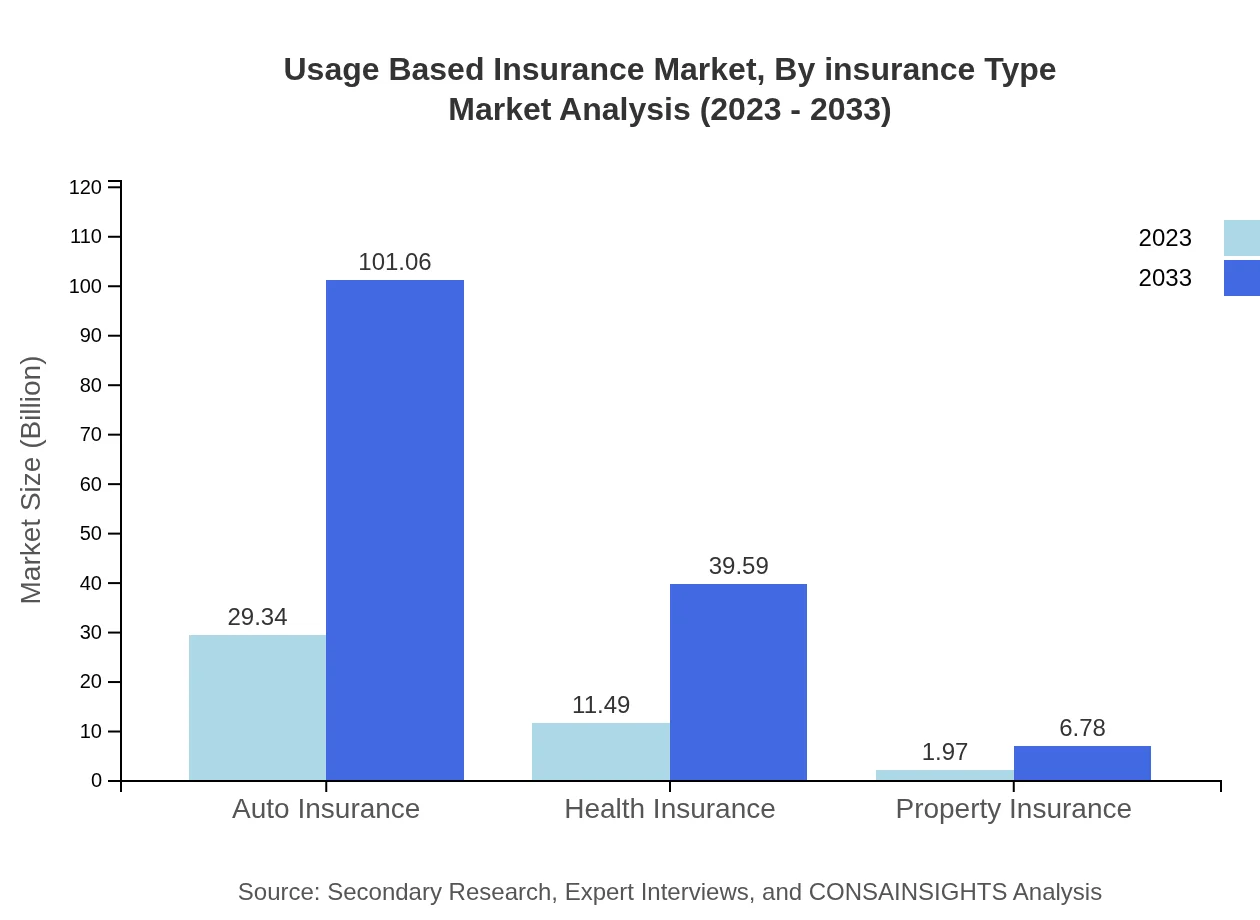

Usage Based Insurance Market Analysis By Insurance Type

The Usage-Based Insurance market is significantly segmented by insurance type into Auto, Health, and Property Insurance. The Auto Insurance segment dominates the market, projected to account for $29.34 billion in 2023, further increasing to $101.06 billion by 2033. Health Insurance follows, shifting from $11.49 billion to $39.59 billion in the same period, while Property Insurance lags at $1.97 billion to $6.78 billion.

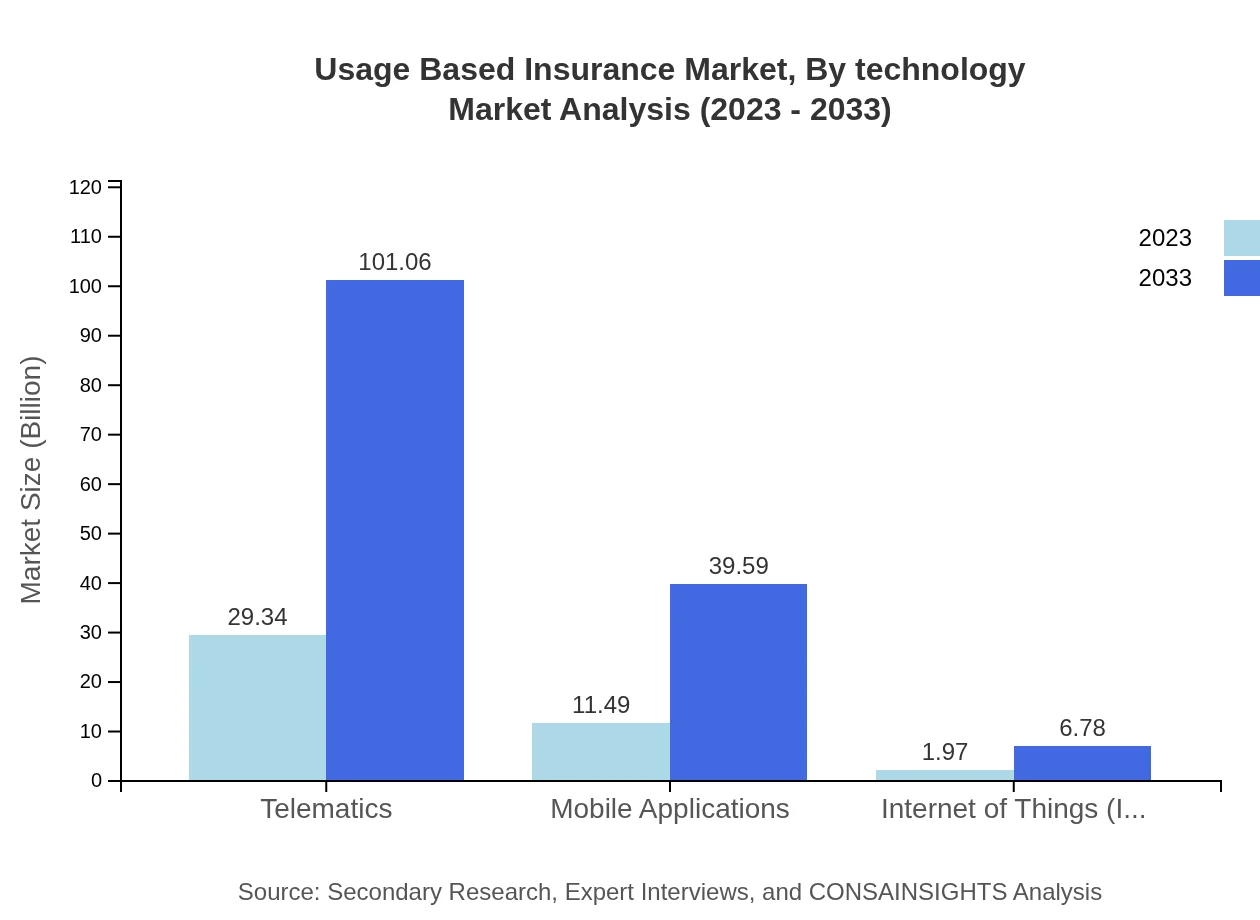

Usage Based Insurance Market Analysis By Technology

Technological innovations are crucial to the UBI landscape, with telematics holding the largest revenue share at $29.34 billion in 2023, growing to $101.06 billion by 2033. Mobile applications and IoT devices also play vital roles, with projected sizes of $11.49 billion to $39.59 billion and $1.97 billion to $6.78 billion, respectively. This technology-driven segmentation reflects the market's evolution toward data-centric insurance models.

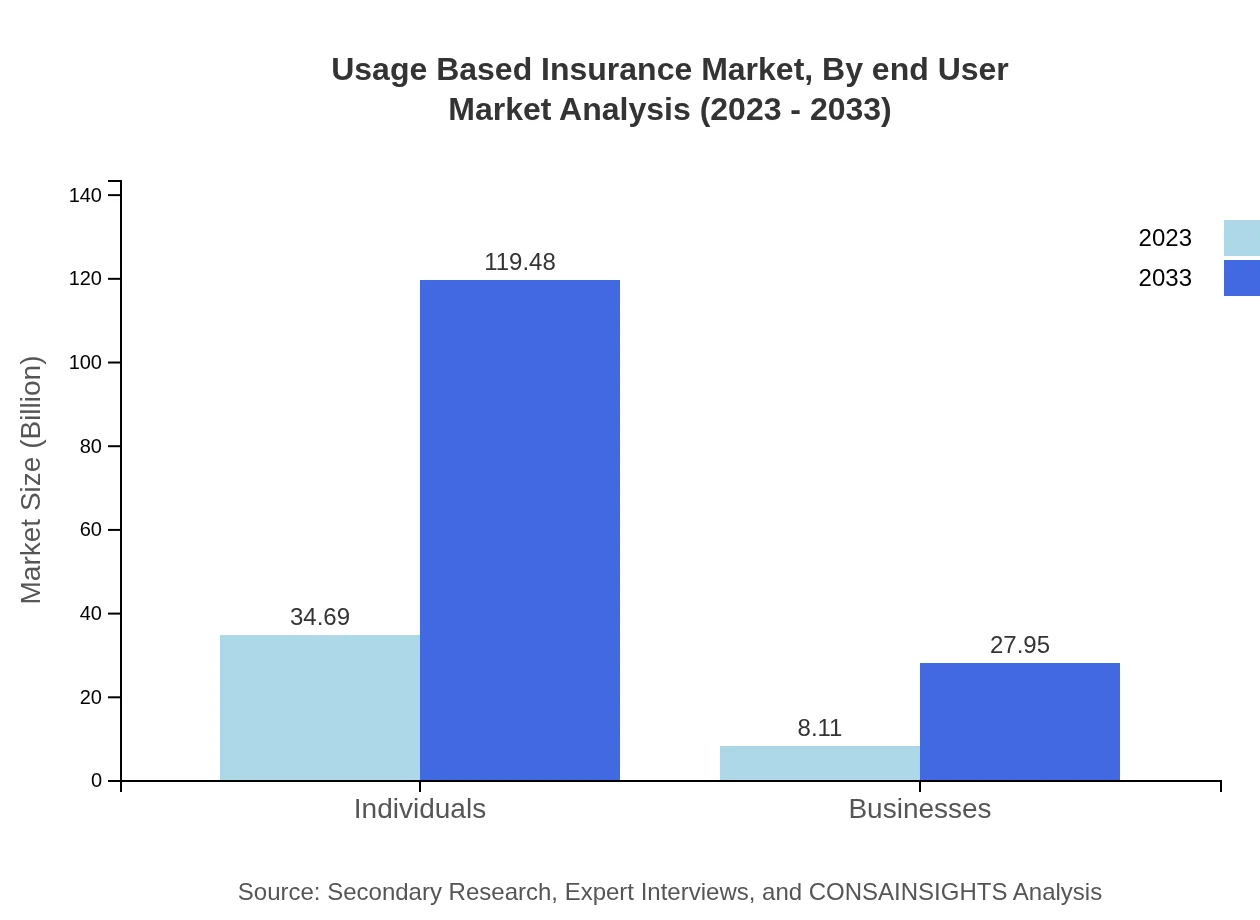

Usage Based Insurance Market Analysis By End User

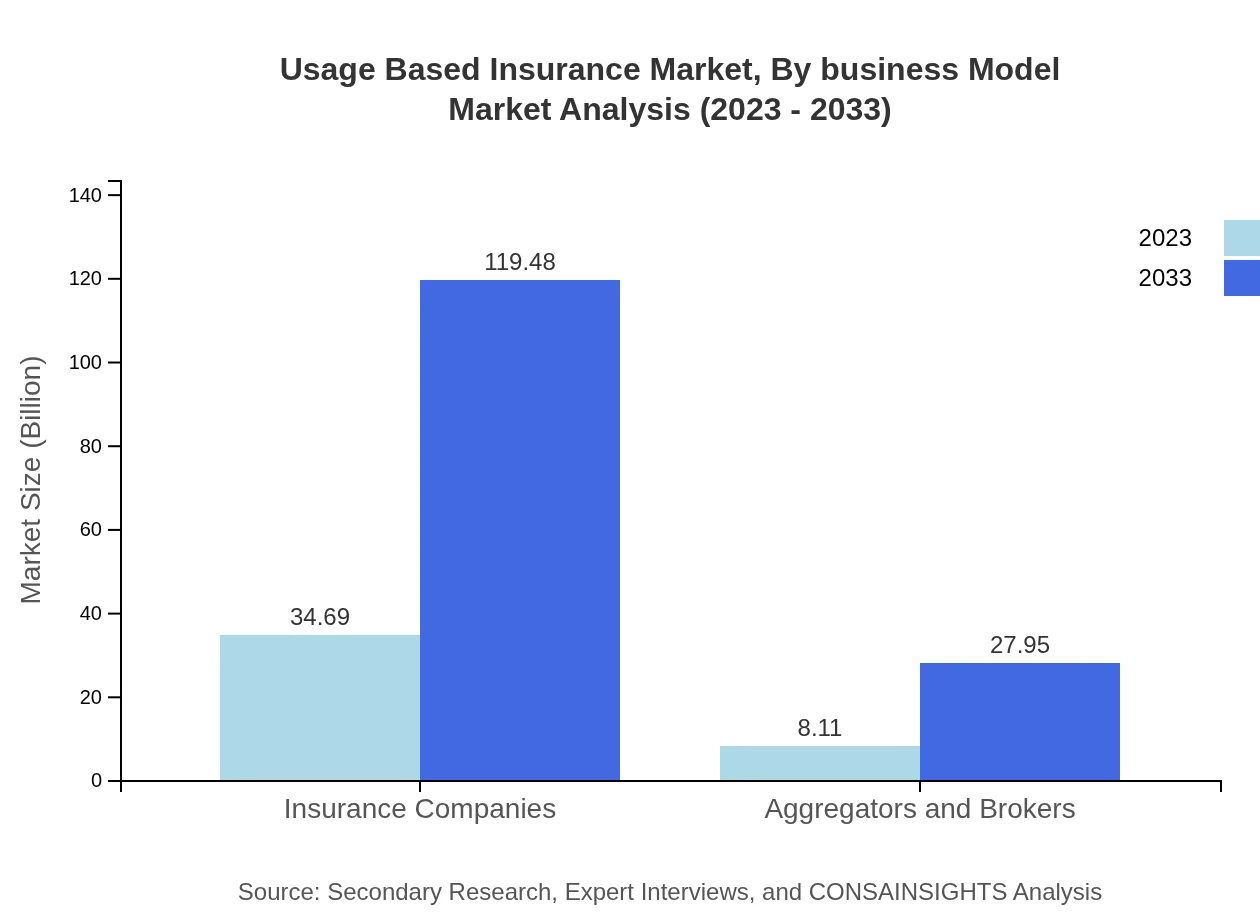

The end-user segmentation is subdivided into Individuals and Businesses. Individuals dominate the segment, moving from $34.69 billion to $119.48 billion, while Businesses show growth from $8.11 billion to $27.95 billion. This illustrates a strong preference for personalized UBI offerings among individual consumers.

Usage Based Insurance Market Analysis By Business Model

The UBI market's business model analysis highlights diverse strategies, predominantly focusing on direct-to-consumer and broker-assisted approaches. Direct models capitalize on technology for consumer engagement, while brokers still play crucial roles in navigating complex UBI offerings. Both models are evolving as insurers seek to optimize customer experience.

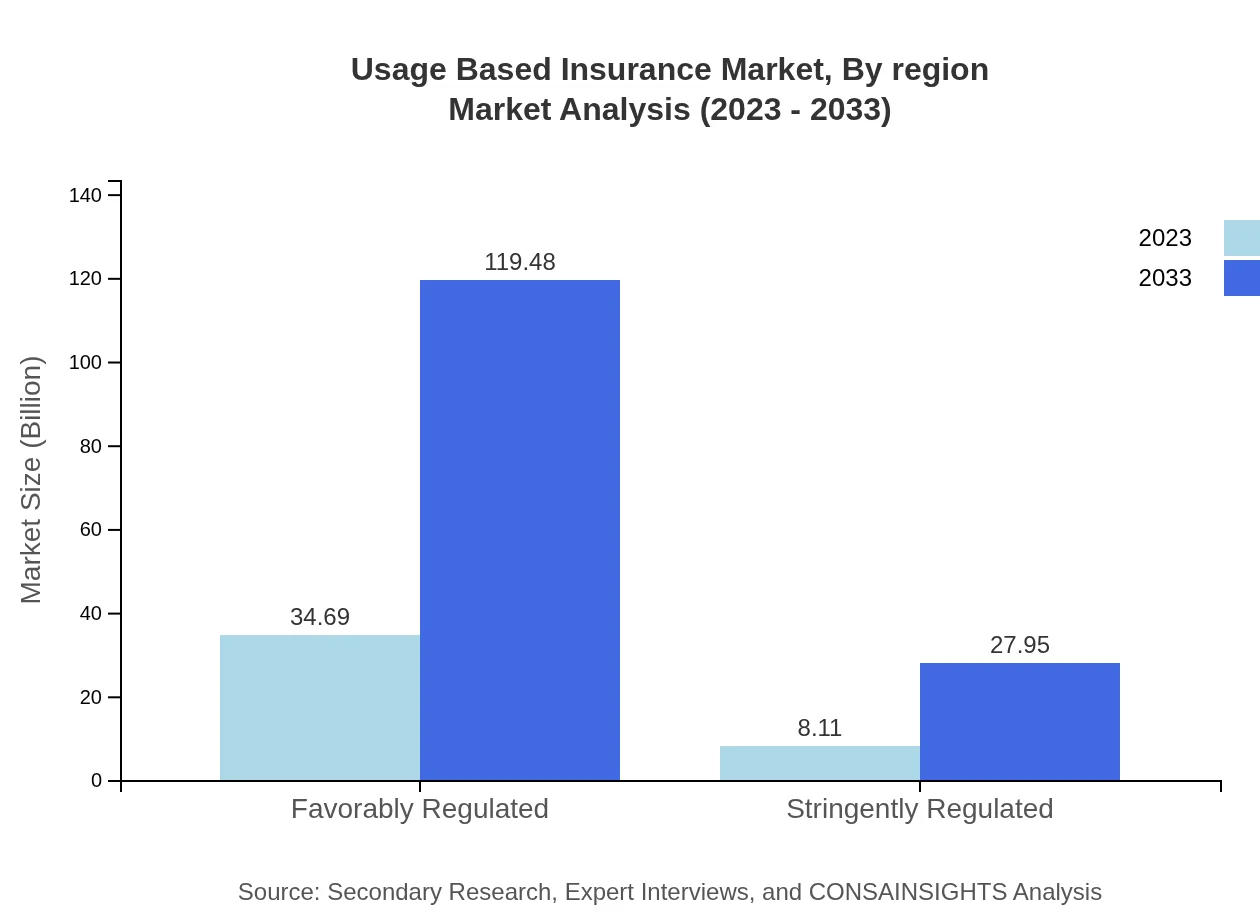

Usage Based Insurance Market Analysis By Region

The regulatory environment in which UBI operates plays a significant role in shaping market dynamics. Favorably regulated markets demonstrate a higher acceptance rate, with a segment size projected to grow from $34.69 billion to $119.48 billion through 2033. Stringently regulated environments, while more cautious, are also increasing in size, from $8.11 billion to $27.95 billion.

Usage Based Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Usage Based Insurance Industry

Progressive Insurance:

Progressive is a leading provider of UBI solutions in the U.S., known for its Snapshot program, which offers personalized auto insurance usage based on driving behavior.Allianz SE:

Allianz SE is a global insurance leader that incorporates UBI models into its offerings, focusing on telematics to enhance customer engagement and risk management.Metromile:

Metromile specializes in pay-per-mile insurance, combining telematics technology with flexible pricing strategies to cater to urban drivers.Liberty Mutual:

Liberty Mutual offers innovative UBI options that leverage data analytics to provide competitive pricing and personalized insurance products.We're grateful to work with incredible clients.

FAQs

What is the market size of usage Based insurance?

The global usage-based insurance market size is projected to reach approximately $42.8 billion by 2033, growing at a CAGR of 12.6% from 2023. This growth reflects the increasing demand for innovative insurance solutions tailored to individual usage patterns.

What are the key market players or companies in the usage Based insurance industry?

Key players in the usage-based insurance market include major insurance companies, technology providers, and data analytics firms. Prominent companies leverage advanced telematics and mobile applications to enhance service offerings in the insurance sector.

What are the primary factors driving the growth in the usage Based insurance industry?

The growth of the usage-based insurance market is driven by factors such as rising demand for personalized insurance products, technological advancements in telematics, and the increasing adoption of IoT devices. Additionally, growing customer awareness about cost-effective insurance options contributes significantly.

Which region is the fastest Growing in the usage Based insurance?

The Asia Pacific region is anticipated to be the fastest-growing market for usage-based insurance, with market size growing from $8.15 billion in 2023 to $28.09 billion in 2033. This rapid growth is supported by increasing digitalization and urbanization.

Does ConsaInsights provide customized market report data for the usage Based insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the usage-based insurance industry. Clients can obtain valuable insights that align with their strategic goals and market understanding.

What deliverables can I expect from this usage Based insurance market research project?

The deliverables from the usage-based insurance market research project typically include comprehensive market analysis reports, statistical data on market size and growth projections, and detailed insights focusing on key segments and geographical analysis.

What are the market trends of usage Based insurance?

Current market trends in usage-based insurance include the shift towards IoT integration, the rise of mobile applications for insurance management, and increasing consumer preference for tailored insurance solutions based on actual usage metrics.