Utility Drones Market Report

Published Date: 03 February 2026 | Report Code: utility-drones

Utility Drones Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Utility Drones market, offering insights into market size, growth rates, trends, and forecasts from 2023 to 2033.

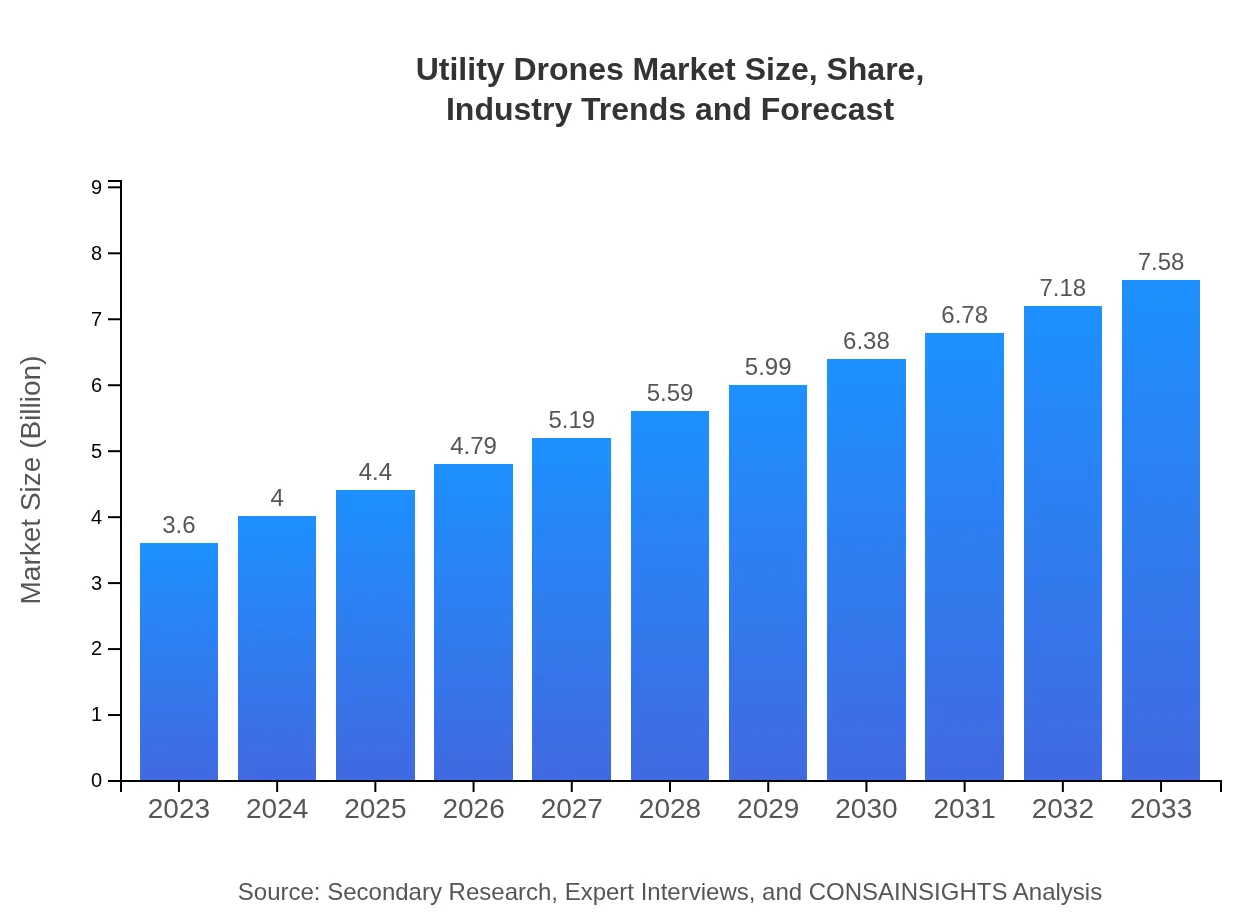

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $7.58 Billion |

| Top Companies | DJI, Parrot Drones SAS, Unity Robotics, senseFly, Aeryon Labs Inc. |

| Last Modified Date | 03 February 2026 |

Utility Drones Market Overview

Customize Utility Drones Market Report market research report

- ✔ Get in-depth analysis of Utility Drones market size, growth, and forecasts.

- ✔ Understand Utility Drones's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Utility Drones

What is the Market Size & CAGR of Utility Drones market in 2023?

Utility Drones Industry Analysis

Utility Drones Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Utility Drones Market Analysis Report by Region

Europe Utility Drones Market Report:

The European Utility Drones market is estimated to increase significantly from $0.93 billion in 2023 to $1.96 billion by 2033. The market is driven by stringent environmental regulations and increasing demand for efficiency in monitoring and inspection through drone technology.Asia Pacific Utility Drones Market Report:

In the Asia-Pacific region, the Utility Drones market is expected to witness substantial growth, with a market size projected to reach approximately $1.47 billion by 2033, up from $0.70 billion in 2023. This growth is driven by increased agricultural activities, urbanization, and significant investments in drone technology.North America Utility Drones Market Report:

North America, particularly the United States, dominates the Utility Drones market, projected to grow from $1.25 billion in 2023 to $2.63 billion by 2033. This growth is fueled by widespread adoption in agriculture, construction, and emergency services, supported by favorable regulations and advanced technologies.South America Utility Drones Market Report:

The South American Utility Drones market is expected to grow from $0.22 billion in 2023 to $0.47 billion by 2033. The growth is attributed to increasing investments in agriculture and environmental monitoring, along with a gradual adoption of drone technology by local governments for infrastructure development.Middle East & Africa Utility Drones Market Report:

The Middle East and Africa market is anticipated to grow from $0.50 billion in 2023 to $1.05 billion by 2033. The growth is attributed to increasing use in urban planning and surveillance applications, especially in developing countries, along with a focus on sustainability.Tell us your focus area and get a customized research report.

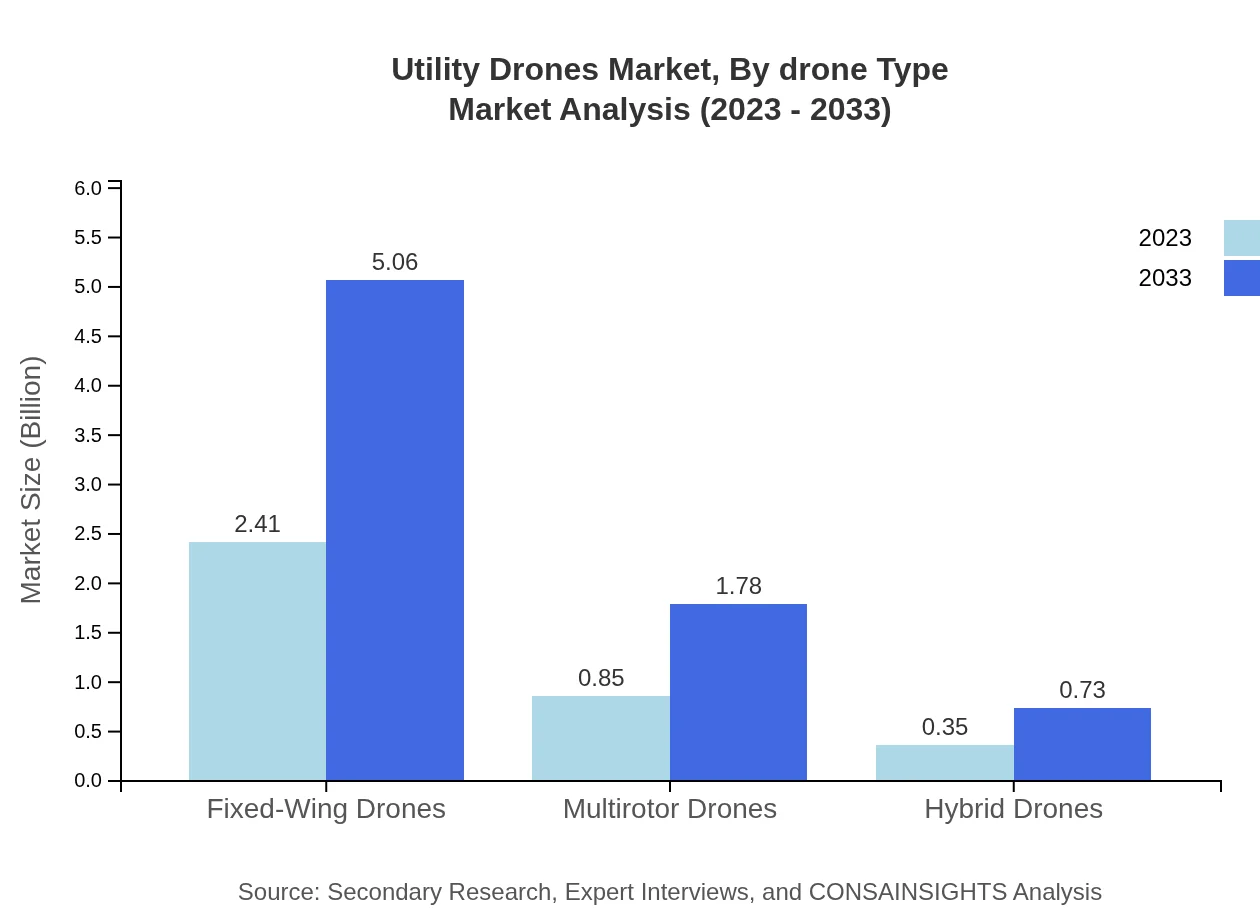

Utility Drones Market Analysis By Drone Type

The Utility Drones market by type shows a strong preference for Fixed-Wing Drones, holding a market share of 66.82% in 2023, projected to grow to 66.82% by 2033, significantly outperforming Multirotor and Hybrid Drones. For instance, Fixed-Wing Drones are expected to grow from $2.41 billion to $5.06 billion during the forecast period, indicating their relevance in larger geographical survey applications. Multirotor Drones, primarily noted for their versatility, will grow from $0.85 billion to $1.78 billion, while Hybrid Drones are expected to see moderate growth from $0.35 billion to $0.73 billion.

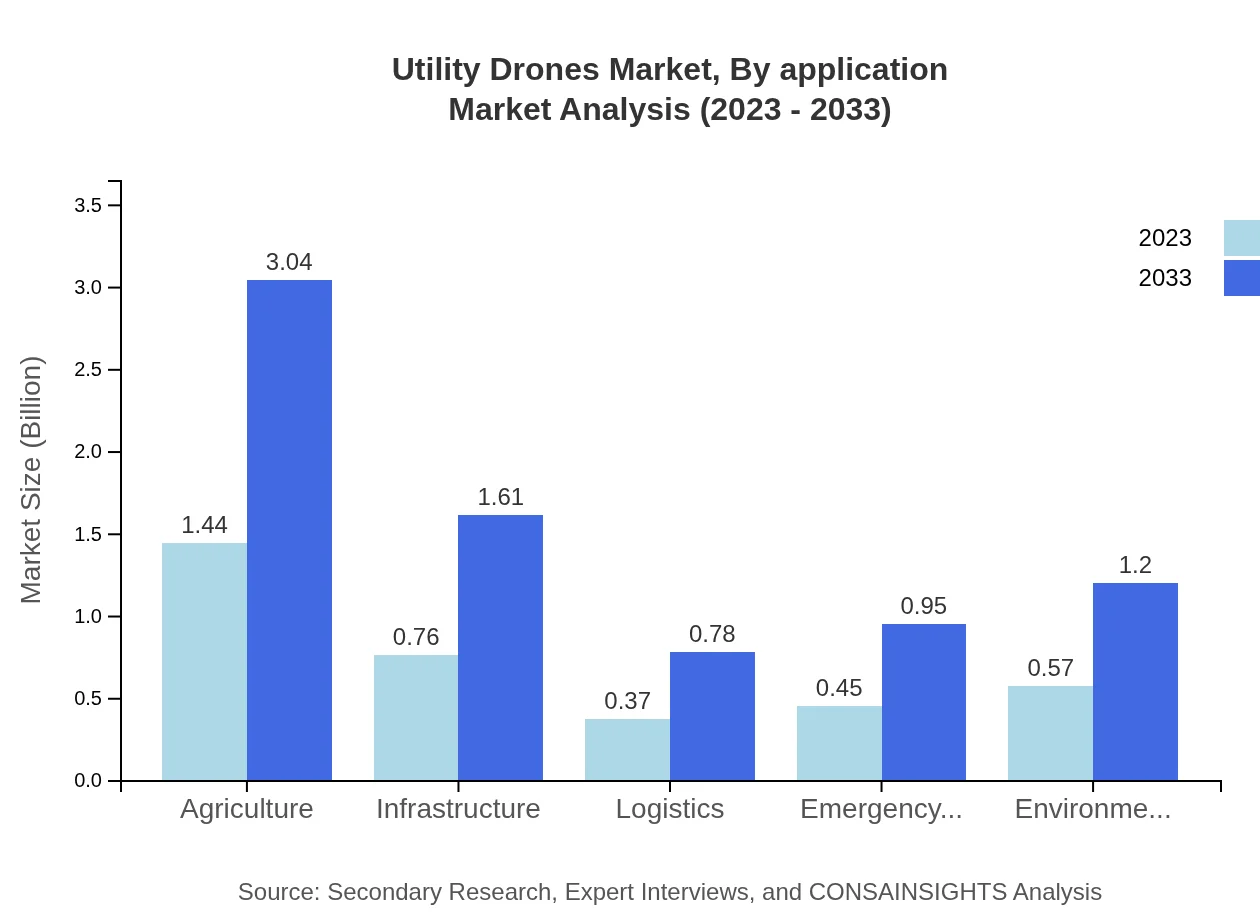

Utility Drones Market Analysis By Application

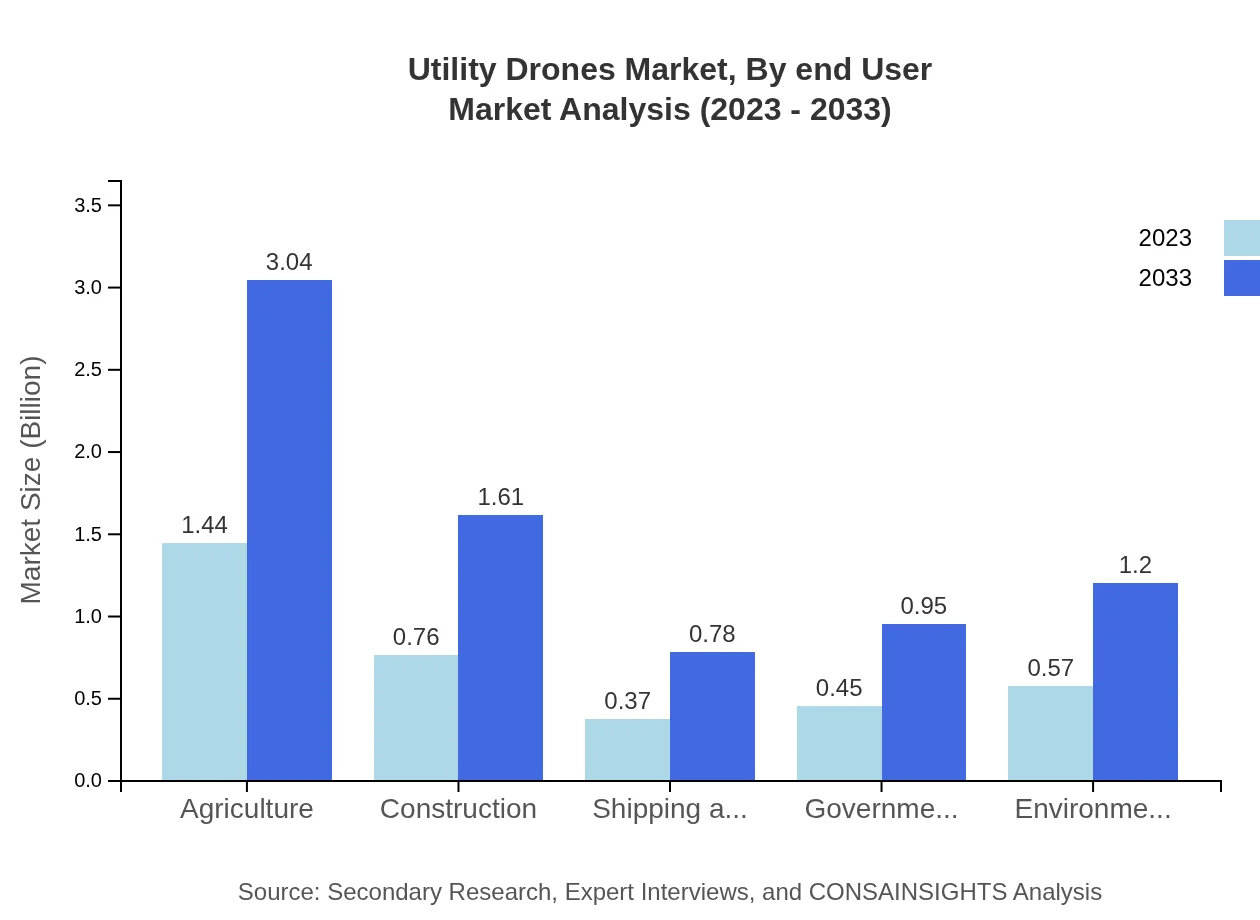

The market segmentation by application indicates Agriculture leads at a market share of 40.1%, valued at $1.44 billion in 2023 and expected to grow to $3.04 billion by 2033. Applications in Infrastructure and Environmental Monitoring also hold significant shares, reflecting increasing demand for inspections and data collection, with respective market sizes of $0.76 billion to $1.61 billion and $0.57 billion to $1.20 billion during the forecast period. Overall, emerging applications in Logistics and Emergency Services are also notable, reflecting a growing realization of the effectiveness and efficiency of drones.

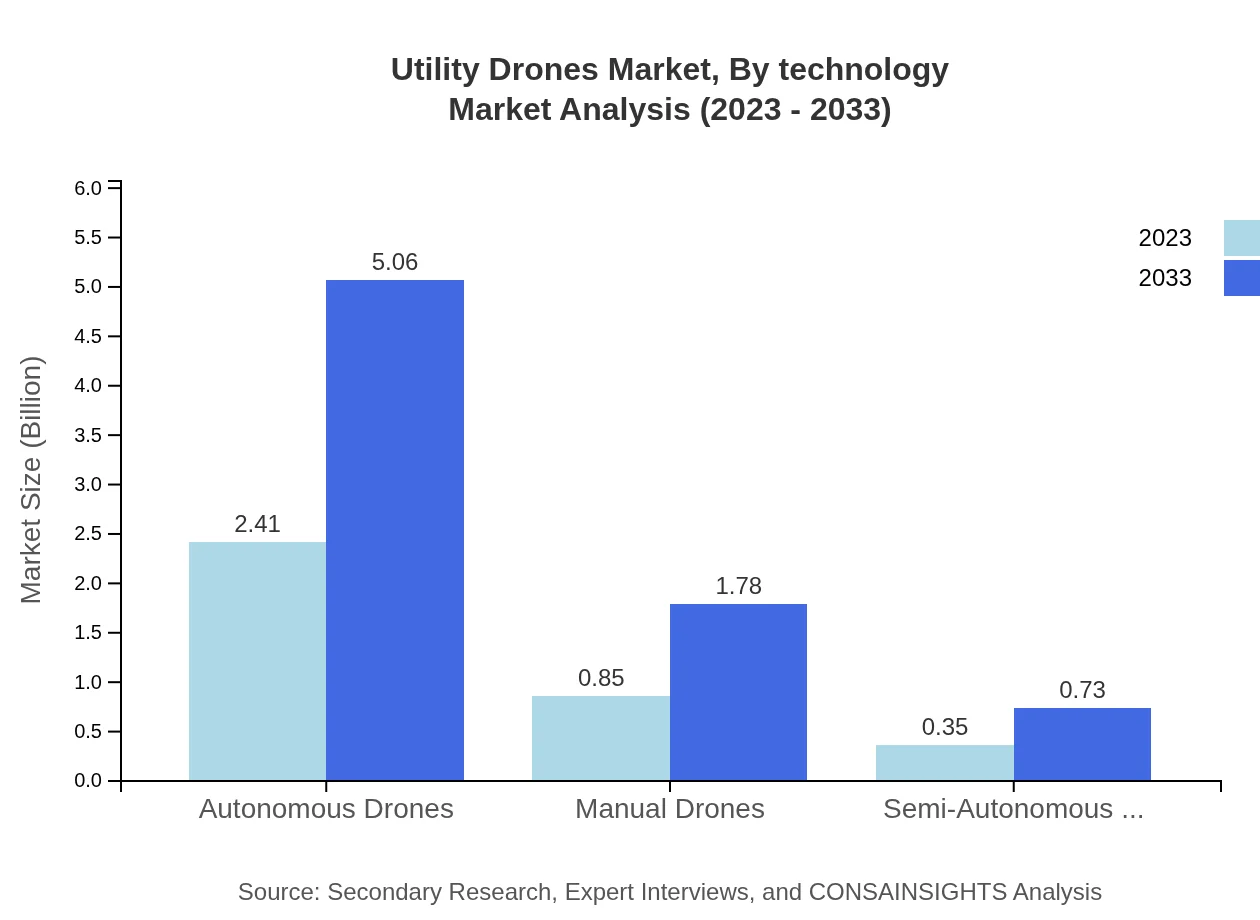

Utility Drones Market Analysis By Technology

The Utility Drones market by technology shows a significant dominance of Autonomous Drones, commanding a 66.82% market share in 2023, and expected to maintain this share through 2033. The market size for Autonomous Drones will grow from $2.41 billion to $5.06 billion, indicating a growing preference for automation in various applications. Manual and Semi-Autonomous Drones are also relevant but show slower growth trajectories, highlighting a market shift towards automated solutions that enhance efficiency.

Utility Drones Market Analysis By End User

The Utility Drones market exhibits a diverse range of end-users, with Agriculture accounting for a significant share of 40.1% in 2023, expanding to 40.1% by 2033. Construction follows closely, with a market size projected to grow from $0.76 billion to $1.61 billion, ensuring a solid growth trajectory due to increased infrastructure investments. Environmental Agencies utilizing drones for monitoring and data collection represent another growing end-user segment, with market expansion reflecting new sustainability initiatives worldwide.

Utility Drones Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Utility Drones Industry

DJI:

A leading drone manufacturer known for its innovative multi-rotor and fixed-wing drones, DJI has established a strong presence in both recreational and commercial sectors.Parrot Drones SAS:

Parrot Drones SAS focuses on professional drone solutions, particularly in agriculture and environmental monitoring, offering advanced drone capabilities.Unity Robotics:

Known for its advanced technologies in drones for utility surveying, Unity Robotics provides sophisticated solutions aimed at improving operational efficiencies for various industries.senseFly:

senseFly, part of the Parrot Group, specializes in fixed-wing drones aimed at professional mapping and surveying applications, particularly in agriculture and construction.Aeryon Labs Inc.:

Aeryon Labs designs and manufactures small drones for commercial use, focusing on applications in the security, military, and industrial sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of utility Drones?

The global utility drones market is projected to grow from $3.6 billion in 2023 to significant figures by 2033, with a CAGR of 7.5%. This growth indicates a robust expansion driven by various sectors utilizing drone technology for efficiency.

What are the key market players or companies in this utility Drones industry?

Key players in the utility drones market include major manufacturers, technology providers, and service companies that specialize in drone manufacturing, software integration, and aerial services. These companies are investing in research and development to enhance drone capabilities.

What are the primary factors driving the growth in the utility Drones industry?

Primary growth drivers include advancements in drone technology, increased demand for aerial surveillance and monitoring, applications in agriculture, construction, and logistics, as well as regulatory changes that promote drone use for commercial purposes.

Which region is the fastest Growing in the utility Drones?

North America is the fastest-growing region in the utility drones market, projected to increase from $1.25 billion in 2023 to $2.63 billion by 2033. Europe and Asia Pacific also show significant growth, targeting key applications across various sectors.

Does ConsaInsights provide customized market report data for the utility Drones industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and requirements of clients looking to navigate the utility drones market. This includes detailed analysis, regional insights, and segmentation data.

What deliverables can I expect from this utility Drones market research project?

From the utility drones market research project, clients can expect comprehensive reports, market size analysis, growth forecasts, competitive landscape overviews, and actionable insights tailored for strategic planning and decision-making.

What are the market trends of utility Drones?

Key market trends in utility drones include the increasing adoption of drones for precision agriculture, enhanced capabilities for environmental monitoring, the rise of autonomous drone technologies, and the expanding applications in emergency services and infrastructure assessment.