Utility Tractor Market Report

Published Date: 02 February 2026 | Report Code: utility-tractor

Utility Tractor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Utility Tractor market, focusing on current trends, projections, and detailed insights from 2023 to 2033. It covers market size, growth rates, regional analysis, and the competitive landscape within the industry.

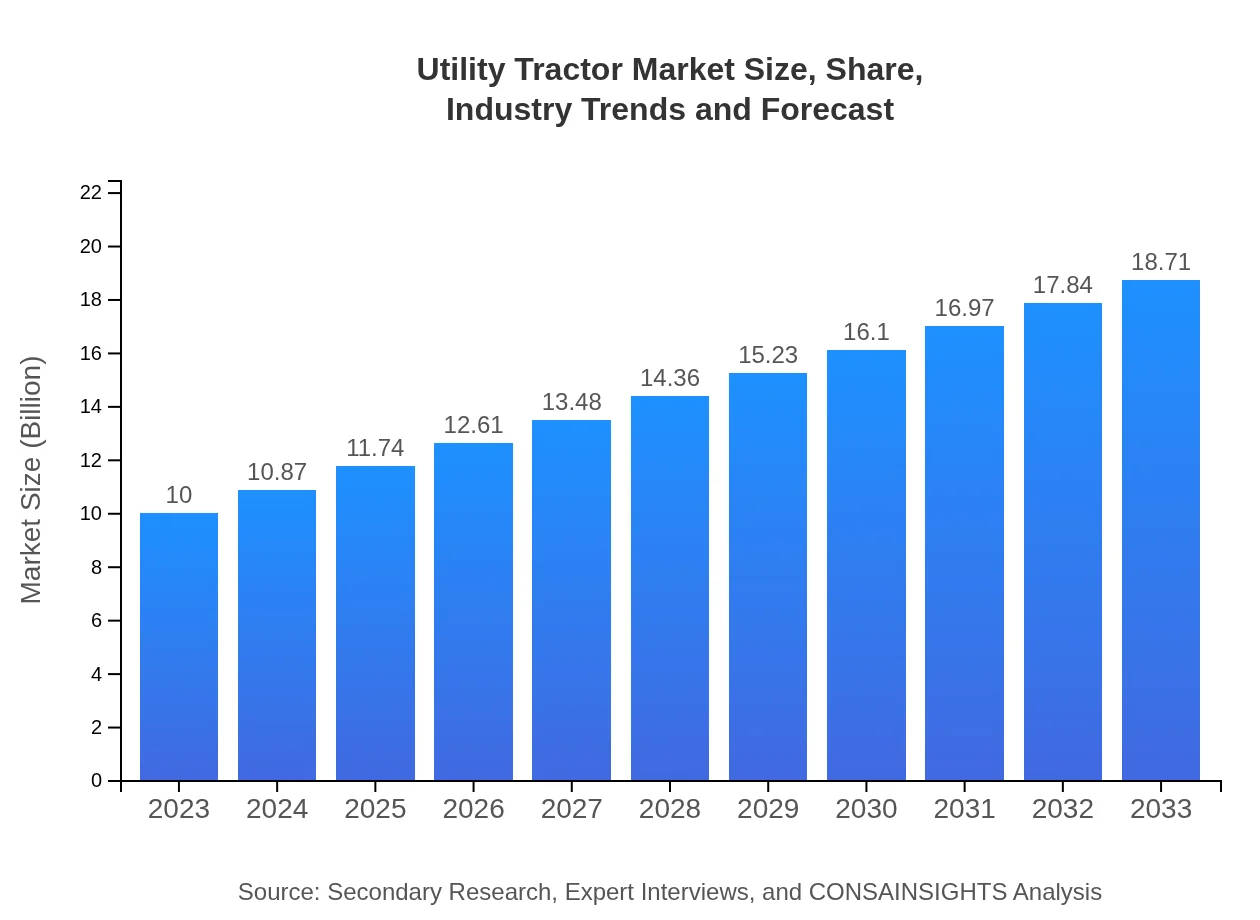

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $18.71 Billion |

| Top Companies | John Deere, Kubota Corporation, Mahindra & Mahindra, New Holland, Case IH |

| Last Modified Date | 02 February 2026 |

Utility Tractor Market Overview

Customize Utility Tractor Market Report market research report

- ✔ Get in-depth analysis of Utility Tractor market size, growth, and forecasts.

- ✔ Understand Utility Tractor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Utility Tractor

What is the Market Size & CAGR of Utility Tractor market in 2023?

Utility Tractor Industry Analysis

Utility Tractor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Utility Tractor Market Analysis Report by Region

Europe Utility Tractor Market Report:

The European market is projected to increase significantly from $3.10 billion in 2023 to $5.80 billion by 2033. Emphasis on sustainable agricultural practices and strict regulations on emissions are propelling the demand for electric and smart tractors across key markets like Germany and France.Asia Pacific Utility Tractor Market Report:

The Utility Tractor market in the Asia Pacific region is set to grow from a market size of $1.83 billion in 2023 to $3.43 billion by 2033. The increasing focus on modernizing farming techniques and infrastructure development is driving demand for utility tractors, especially in countries like India and China where agriculture dominates the economy.North America Utility Tractor Market Report:

North America shows a promising market trajectory, expanding from $3.79 billion in 2023 to $7.09 billion by 2033. The growing trend towards advanced farming technology and the increasing shift towards sustainable solutions are significant drivers in the U.S. and Canada, favoring the growth of utility tractors.South America Utility Tractor Market Report:

In South America, the market is anticipated to grow from $0.60 billion in 2023 to $1.12 billion in 2033. Increased agricultural activities and investments in mechanization across Brazil and Argentina are key factors driving growth in this region, as farmers seek to enhance productivity.Middle East & Africa Utility Tractor Market Report:

The Middle East and Africa region expect growth from $0.68 billion in 2023 to $1.27 billion by 2033. The drive towards mechanizing agricultural processes, alongside investment in infrastructure, presents vast opportunities for utility tractor applications in countries like South Africa and Kenya.Tell us your focus area and get a customized research report.

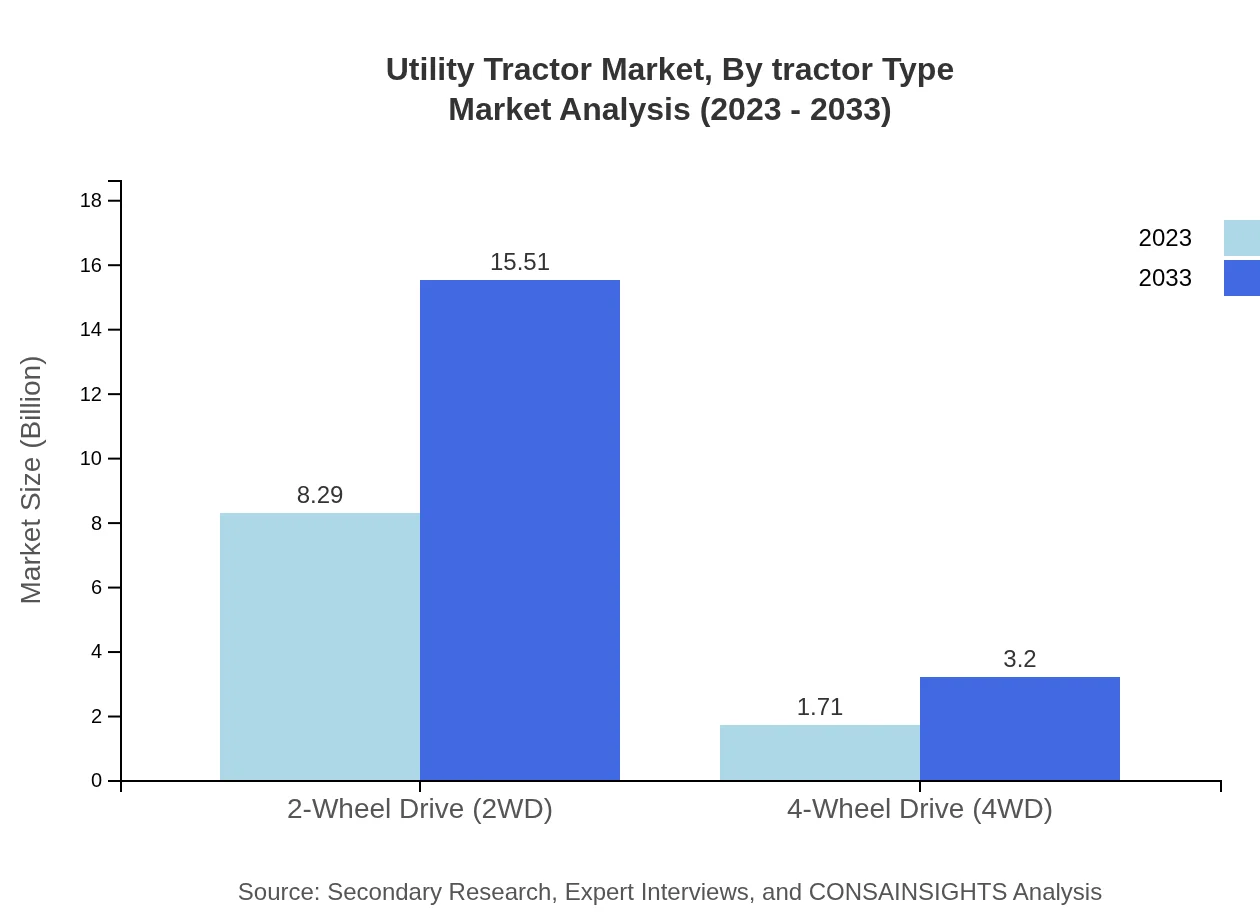

Utility Tractor Market Analysis By Tractor Type

The Utility Tractor Market is categorized into 2-Wheel Drive (2WD) and 4-Wheel Drive (4WD) tractors. As of 2023, 2WD tractors dominate with a market size of $8.29 billion (82.88% share), while 4WD tractors account for $1.71 billion (17.12% share). This trend is expected to continue, with 2WD tractors projected to grow to $15.51 billion by 2033, showcasing their widespread utility in various agricultural applications.

Utility Tractor Market Analysis By Application

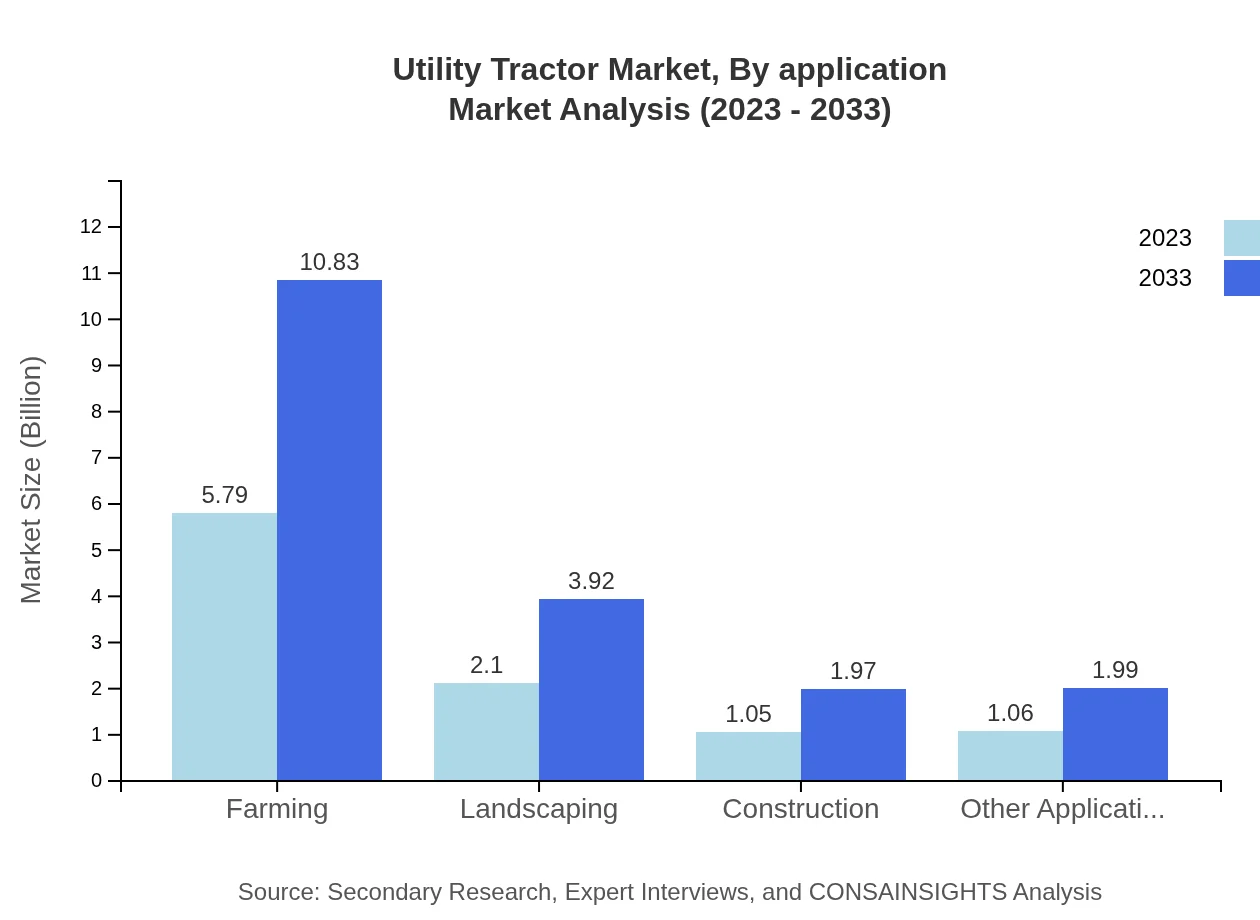

Segmented by application, the Utility Tractor Market is led by farming, which holds a substantial market share of 57.86% ($5.79 billion in 2023, growing to $10.83 billion by 2033). Landscaping (20.97%) and construction (10.52%) applications also play significant roles, reflecting diverse usage in non-agricultural sectors. The evolving landscape of agricultural needs continues to encourage tractor production across various applications.

Utility Tractor Market Analysis By Engine Power

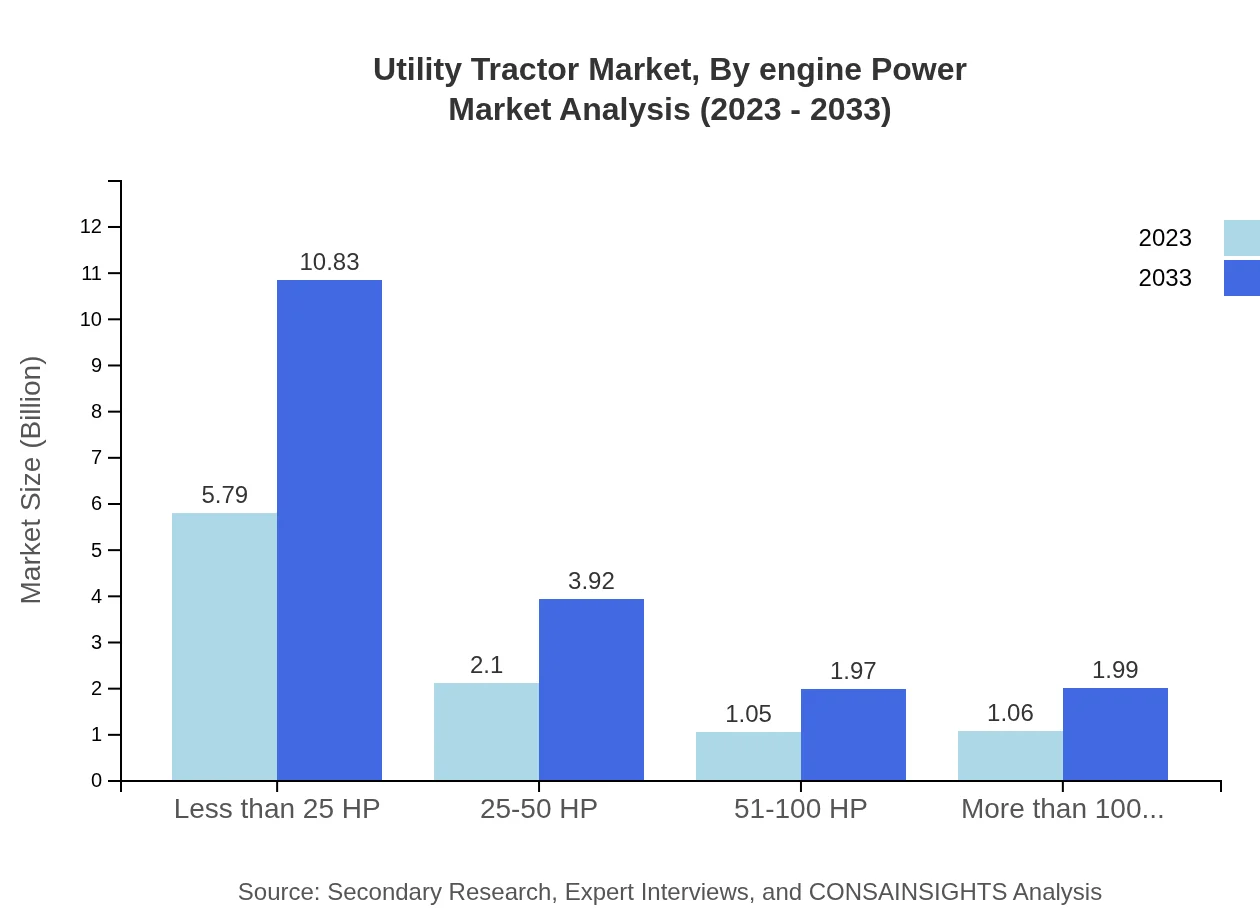

In terms of engine power, tractors with ‘Less than 25 HP’ account for the largest segment (57.86% share, $5.79 billion in 2023 to $10.83 billion in 2033). Segments of 25-50 HP and 51-100 HP are also notable, illustrating a broad spectrum of tractor applications depending on power needs, contributing to overall market growth.

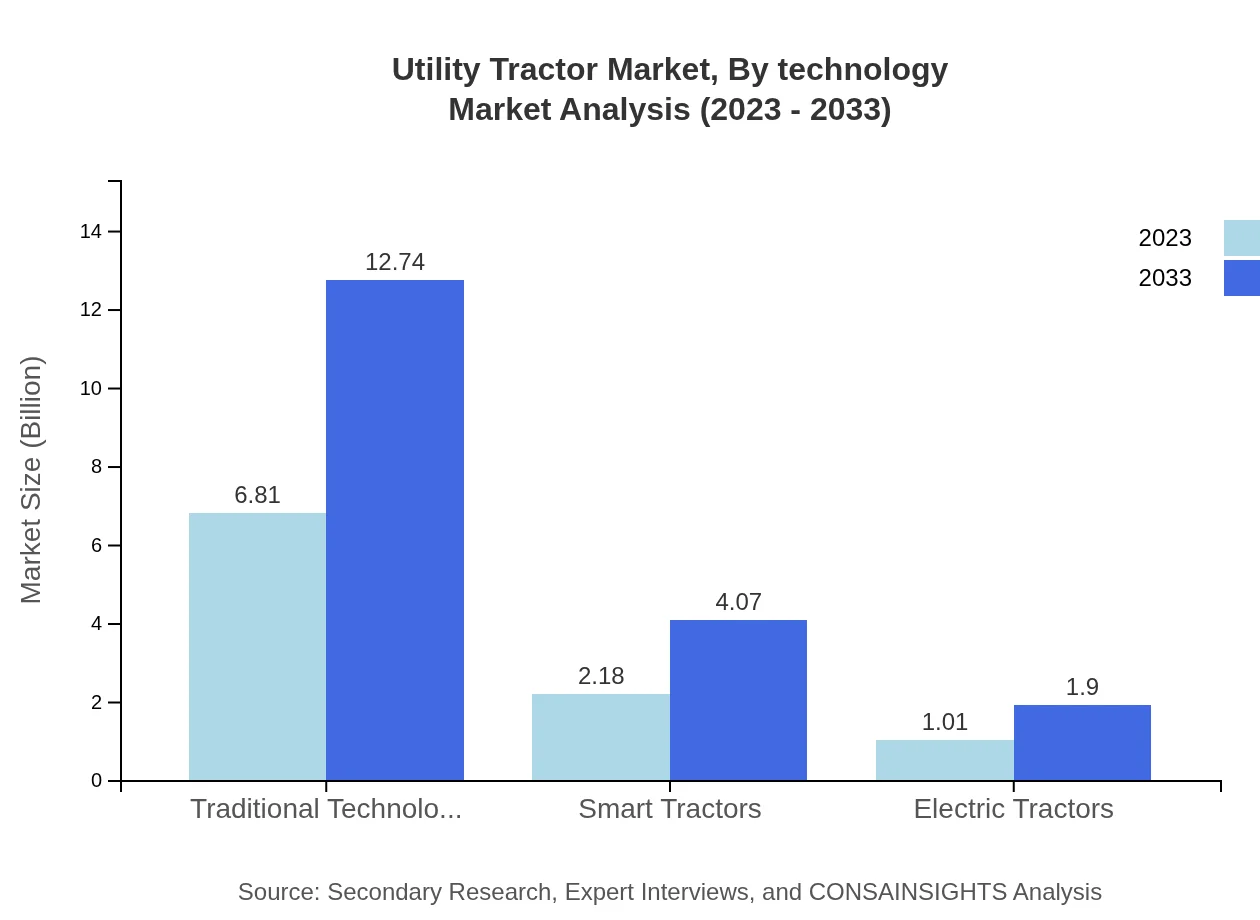

Utility Tractor Market Analysis By Technology

The Utility Tractor market is also analyzed by technology types: Traditional Technology, Smart Tractors, and Electric Tractors. Traditional Technology remains dominant, with a market size of $6.81 billion (68.1% share in 2023), while Smart Tractors and Electric Tractors combinations account for $2.18 billion (21.76%) and $1.01 billion (10.14%) respectively. Advancements towards smarter and eco-friendly tractors are anticipated to reshape the market towards 2033.

Utility Tractor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Utility Tractor Industry

John Deere:

John Deere is a leading manufacturer of agricultural machinery with a significant presence in the utility tractor market. Innovative technology integration and extensive dealer networks strengthen the company's market position.Kubota Corporation:

Kubota specializes in compact tractors, known for their high performance and reliability, catering to diverse agricultural and landscaping applications.Mahindra & Mahindra:

As one of the world's largest tractor manufacturers, Mahindra offers a wide range of utility tractors tailored to meet the needs of farmers in emerging markets.New Holland:

New Holland, a subsidiary of CNH Industrial, produces a diverse portfolio of tractors aimed at maximizing efficiency, productivity, and sustainability in agricultural practices.Case IH:

Case IH is renowned for advanced agricultural solutions, focusing on innovative technology and equipment that enhance farm productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of utility Tractor?

The global utility tractor market is currently valued at approximately $10 billion, with a notable CAGR of 6.3% expected over the next decade. This significant growth reflects the increasing demand across various sectors including agriculture and landscaping.

What are the key market players or companies in the utility Tractor industry?

Key players in the utility tractor market include industry giants like John Deere, Massey Ferguson, Kubota, and New Holland. These companies are renowned for their innovation, product quality, and extensive distribution networks, solidifying their market positions.

What are the primary factors driving the growth in the utility tractor industry?

Growth in the utility tractor industry is driven by factors such as technological advancements, increasing mechanization in agriculture, and rising demand for efficient farming practices. Additionally, government initiatives supporting agricultural development further fuel market expansion.

Which region is the fastest Growing in the utility tractor market?

The fastest-growing region in the utility tractor market is North America, projected to grow from $3.79 billion in 2023 to $7.09 billion by 2033. This growth is driven by advanced agricultural practices and significant investments in mechanization.

Does ConsaInsights provide customized market report data for the utility tractor industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements within the utility tractor industry. Clients can request detailed insights based on particular regions, segments, and trends.

What deliverables can I expect from this utility tractor market research project?

In a utility tractor market research project, clients can expect comprehensive reports detailing market size, growth projections, competitive landscape analyses, regional insights, and segmentation data, all designed to inform strategic decisions.

What are the market trends of utility tractor?

Current market trends in the utility tractor sector include the shift towards smart and electric tractors and increasing demand for eco-friendly agricultural solutions. The market is also witnessing a rise in segmentation based on power capacity and drive types.