Uxo Detection Market Report

Published Date: 03 February 2026 | Report Code: uxo-detection

Uxo Detection Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Uxo Detection market, analyzing market dynamics, trends, opportunities, and challenges from 2023 to 2033. The report includes data on market size, growth rates, technology advancements, and regional insights to assist stakeholders in making informed decisions.

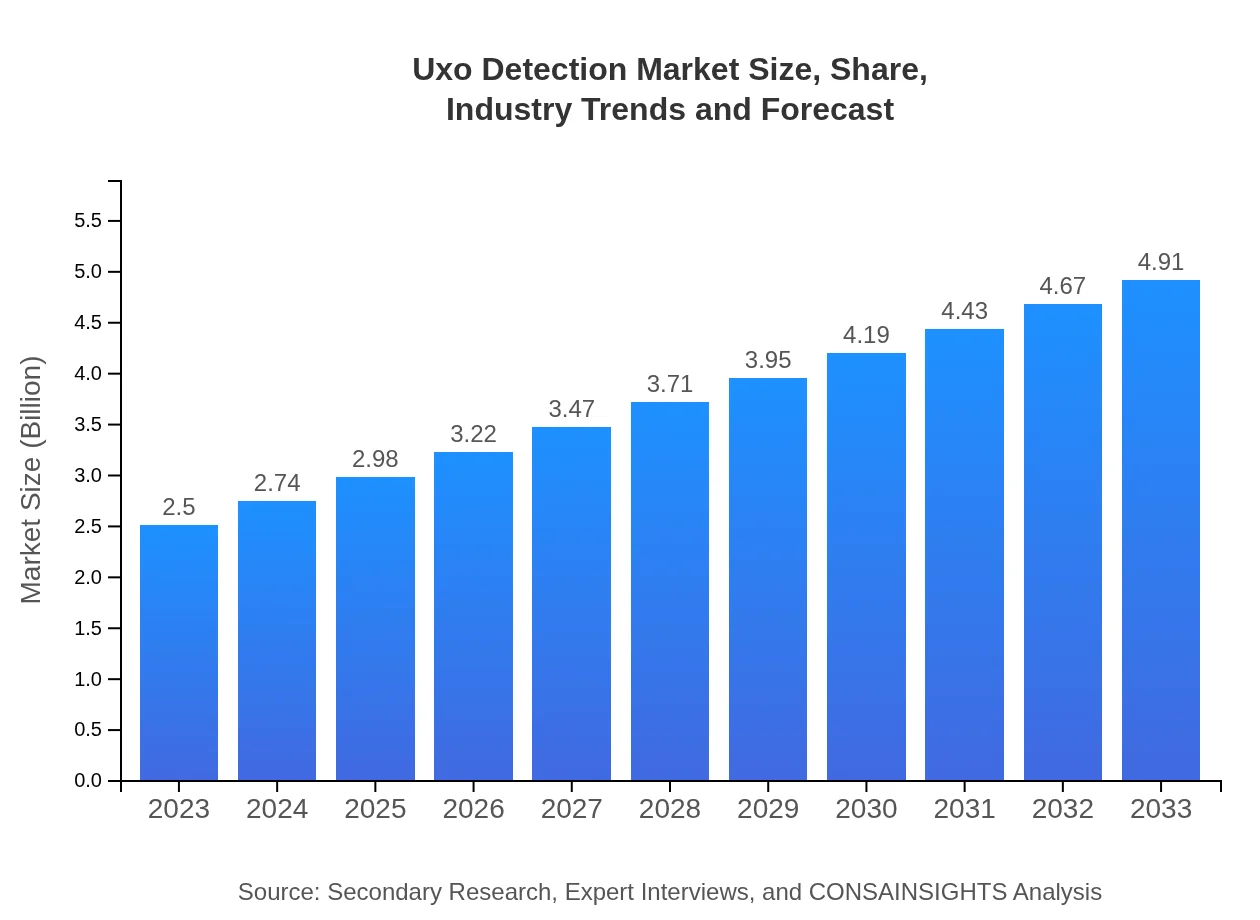

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Expending Technologies, ClearPath Solutions, Ordnance Disposal Services, Safety First Corporation |

| Last Modified Date | 03 February 2026 |

Uxo Detection Market Overview

Customize Uxo Detection Market Report market research report

- ✔ Get in-depth analysis of Uxo Detection market size, growth, and forecasts.

- ✔ Understand Uxo Detection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Uxo Detection

What is the Market Size & CAGR of Uxo Detection Market in 2023?

Uxo Detection Industry Analysis

Uxo Detection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Uxo Detection Market Analysis Report by Region

Europe Uxo Detection Market Report:

The European Uxo Detection market is estimated at $0.67 billion in 2023, forecasted to double to $1.31 billion by 2033. Europe’s historical remnants of conflicts necessitate ongoing management of UXOs, driving the demand for sophisticated detection technologies.Asia Pacific Uxo Detection Market Report:

In Asia Pacific, the Uxo Detection market is projected to grow from $0.48 billion in 2023 to $0.94 billion by 2033. Rapid urbanization, coupled with rising incidences of land contamination from past conflicts, amplifies the need for advanced UXO detection technologies.North America Uxo Detection Market Report:

North America is the largest market, valued at $0.96 billion in 2023, expected to reach $1.89 billion by 2033. Significant investments in defense and homeland security, alongside a strong emphasis on safety regulations, underscore growth prospects in this region.South America Uxo Detection Market Report:

The South American market, starting at $0.15 billion in 2023, is anticipated to expand to $0.29 billion by 2033. Government initiatives aimed at land reclamation and safety post-conflict are driving demand for detection services.Middle East & Africa Uxo Detection Market Report:

In the Middle East and Africa, the market is expected to grow from $0.24 billion in 2023 to $0.48 billion by 2033, primarily due to conflicts in the region leading to significant UXO challenges that need addressing.Tell us your focus area and get a customized research report.

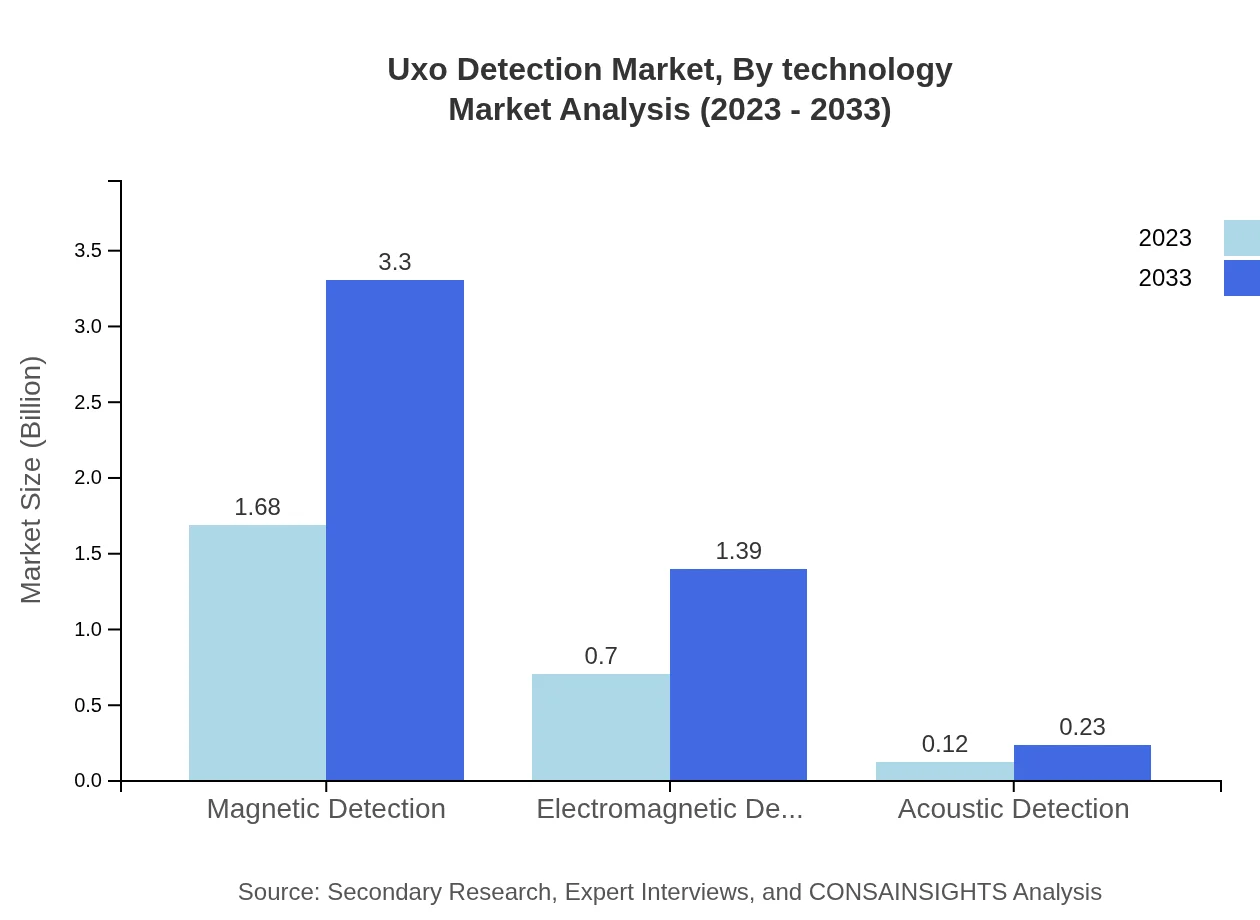

Uxo Detection Market Analysis By Technology

The market is significantly influenced by detection technologies. Magnetic detection leads the segment, valued at $1.68 billion in 2023, projected to rise to $3.30 billion by 2033, holding a 67.11% market share. Electromagnetic detection and acoustic detection follow, reflecting growing demand for diverse technological solutions.

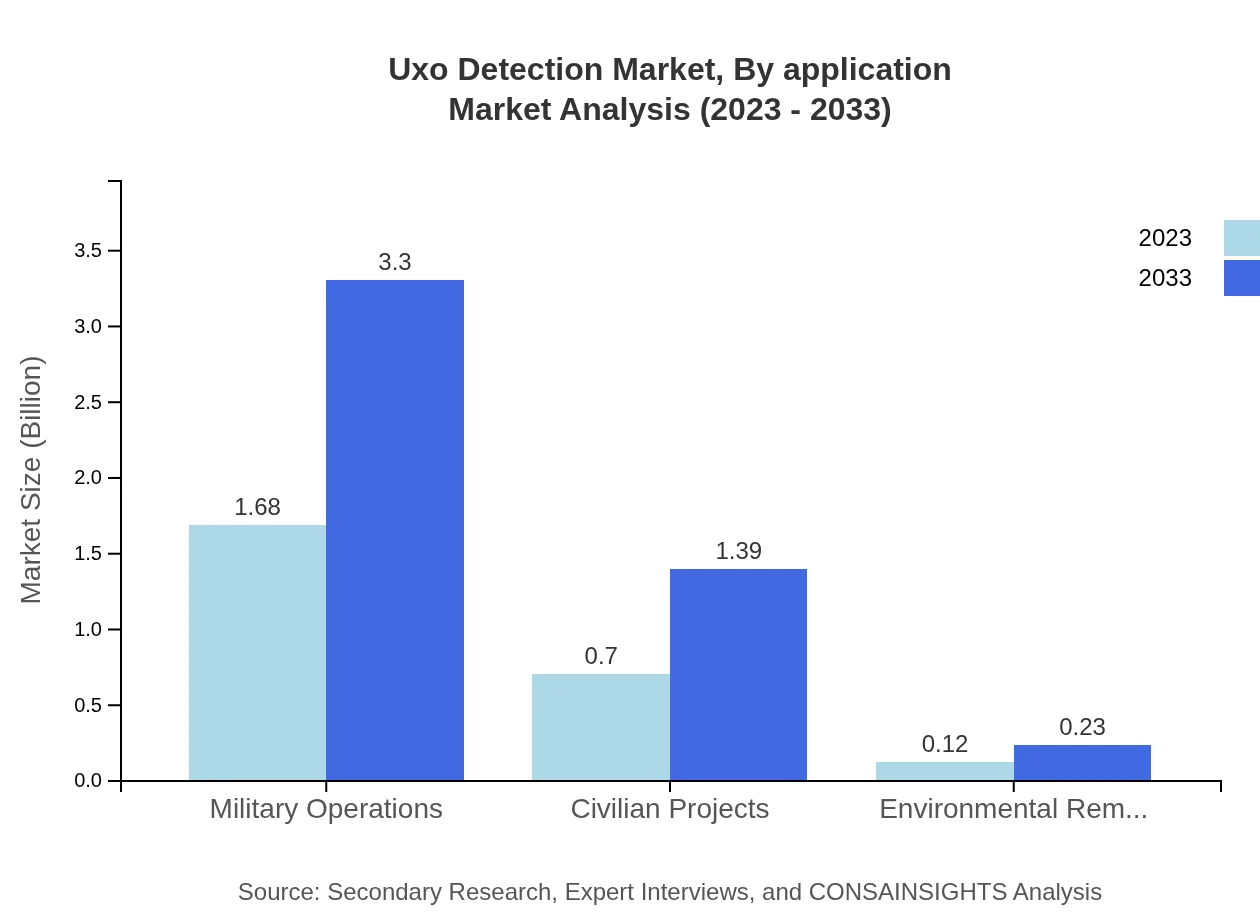

Uxo Detection Market Analysis By Application

Military operations constitute the largest application segment, with a market size of $1.68 billion in 2023, expected to reach $3.30 billion by 2033, capturing 67.11% market share. Civilian projects, with growing safety and environmental concerns, also represent a significant portion of the market.

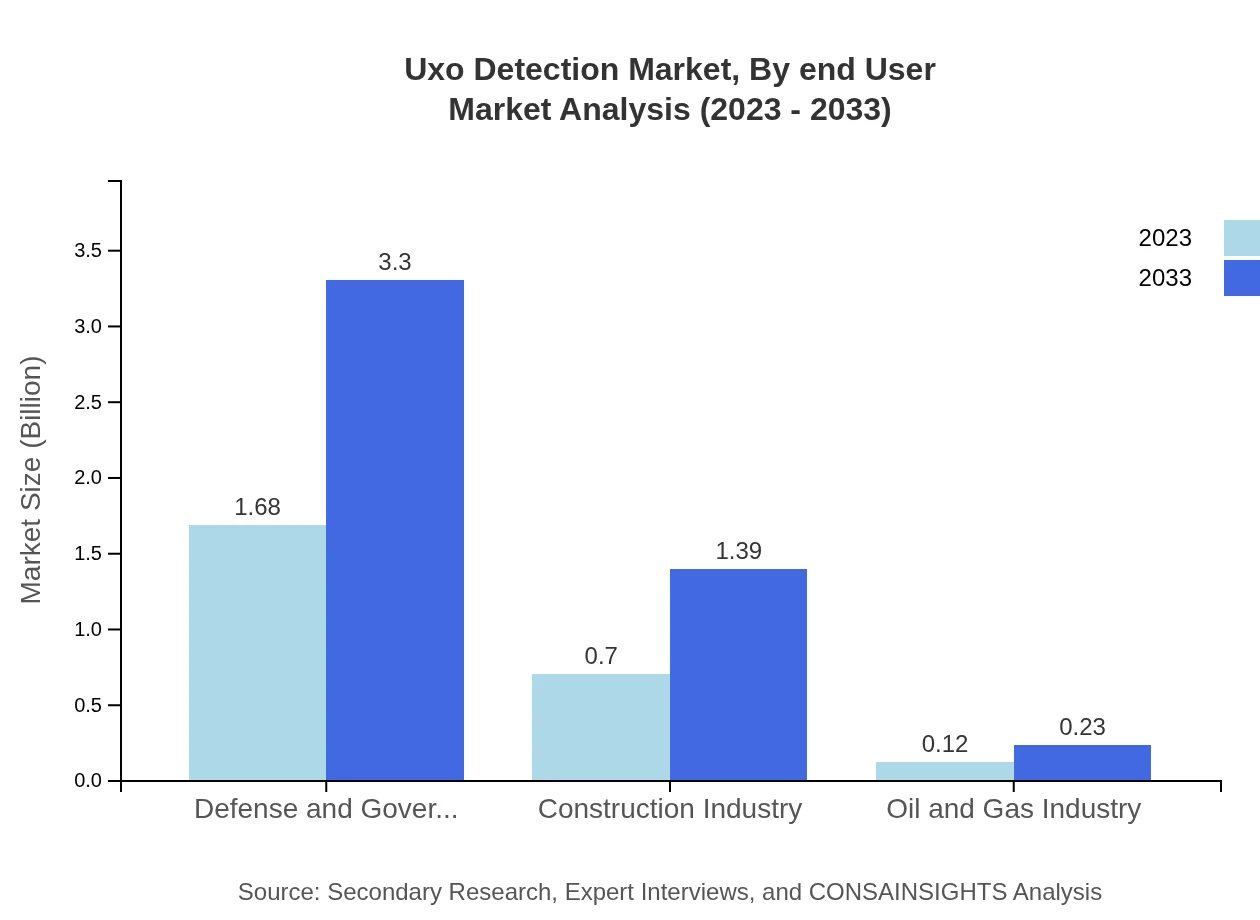

Uxo Detection Market Analysis By End User

The primary end-users include government and military agencies, accounting for the largest share of the market due to stringent compliance requirements for public safety and national security. The construction and oil industries are also noteworthy contributors to market demand.

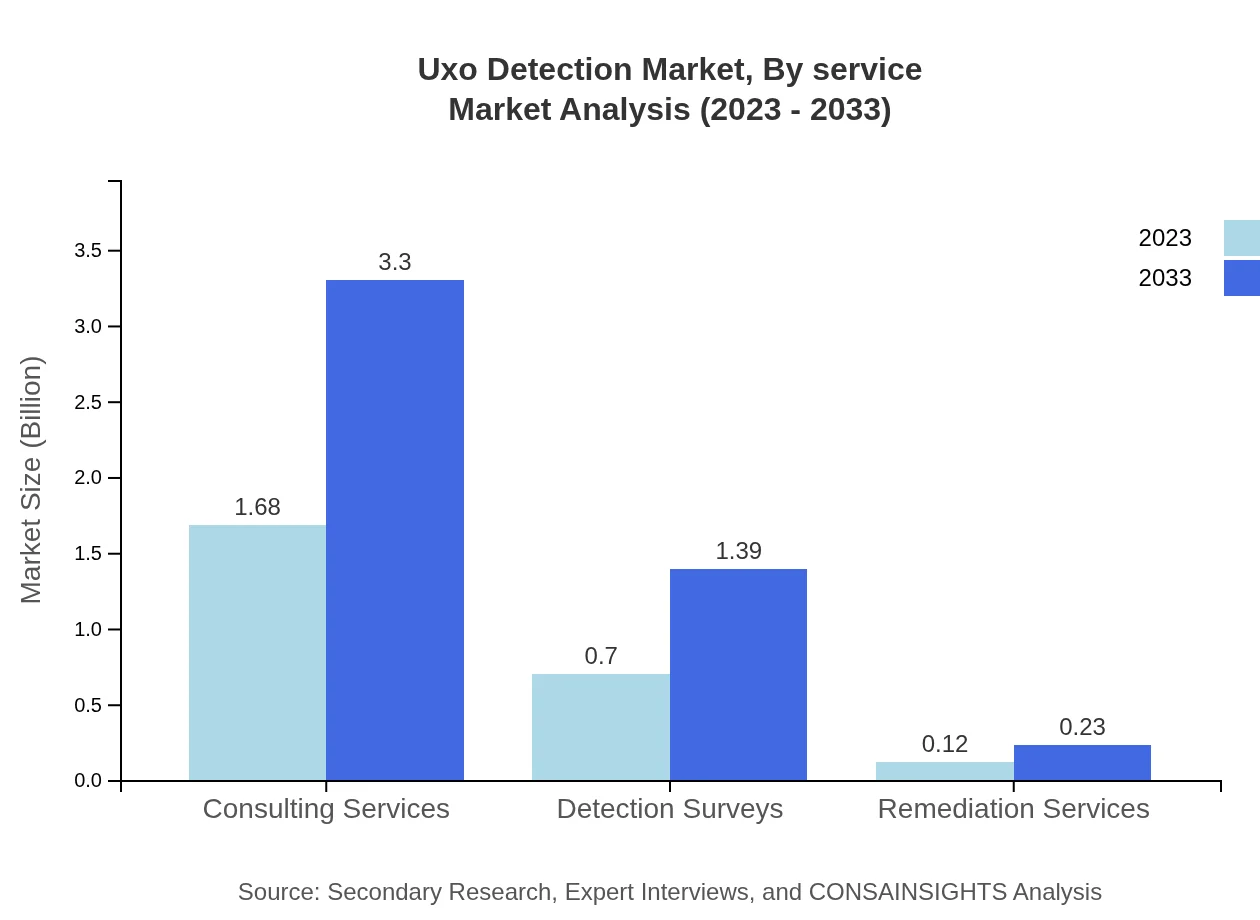

Uxo Detection Market Analysis By Service

Consulting services dominate the service type segment at $1.68 billion in 2023, projected to reach $3.30 billion by 2033, holding a robust 67.11% market share. Detection surveys and remediation services also contribute significantly, driven by increasing investments in safety assessments and land reclamation.

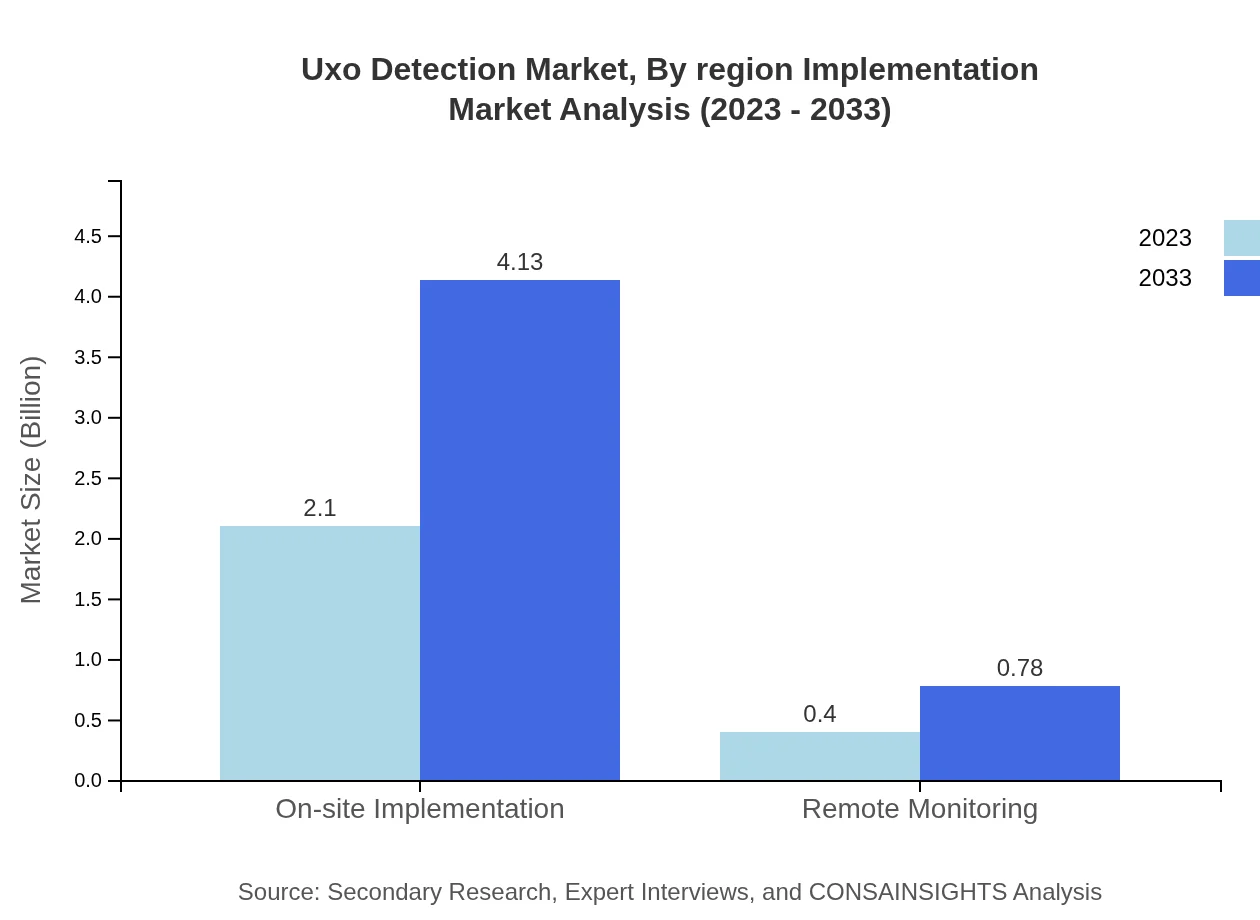

Uxo Detection Market Analysis By Region Implementation

On-site implementations lead this segment due to their effectiveness in tailored UXO clearance operations. Projected growth from $2.10 billion in 2023 to $4.13 billion by 2033 establishes its critical role in the implementation strategy, accounting for 84.03% of market share.

Uxo Detection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Uxo Detection Industry

Expending Technologies:

Specializes in advanced UXO detection technologies, integrating drone technology with traditional methods for enhanced efficiency.ClearPath Solutions:

Focuses on comprehensive UXO clearance solutions, offering consulting and remediation services for both military and civilian projects.Ordnance Disposal Services:

A leader in UXO detection and clearance services, known for leveraging advanced sensing technologies for effective detection and remediation.Safety First Corporation:

Provides consulting and detection services, integrating safety standards into UXO detection processes across multiple sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of uxo Detection?

The global UXO Detection market is currently valued at approximately $2.5 billion and is projected to grow at a CAGR of 6.8% over the next decade. By 2033, the market is expected to see substantial growth, driven by increased demand.

What are the key market players or companies in this uxo Detection industry?

Key players in the UXO Detection industry include leading defense contractors, specialized survey firms, and environmental service companies that provide innovative detection technologies and remediation solutions to mitigate unexploded ordnance threats.

What are the primary factors driving the growth in the uxo Detection industry?

Significant factors include rising global military expenditures, increasing need for safety in construction zones, advancements in detection technologies, and heightened awareness of unexploded ordnance hazards in post-conflict regions.

Which region is the fastest Growing in the uxo Detection?

North America is currently the fastest-growing region in the UXO Detection market. By 2033, its market size is expected to reach $1.89 billion, significantly expanding due to heightened military activities and infrastructure development.

Does ConsaInsights provide customized market report data for the uxo Detection industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the UXO Detection industry, including detailed analysis, forecasts, and insights that are relevant to particular segments and regions.

What deliverables can I expect from this uxo Detection market research project?

Deliverables include comprehensive reports featuring market size analysis, growth rates, trends, competitive landscape, regional insights, and in-depth segment analysis, ensuring informed decision-making for stakeholders.

What are the market trends of uxo Detection?

Current trends include the adoption of advanced detection technologies, increasing deployment of automated solutions, emphasis on environmental safety, and a focus on public safety in military and civilian projects.