Vaccine Contract Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: vaccine-contract-manufacturing

Vaccine Contract Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global Vaccine Contract Manufacturing market from 2023 to 2033. It explores market dynamics, size, trends, segmentation, and leading companies, offering actionable insights for stakeholders in this vital industry.

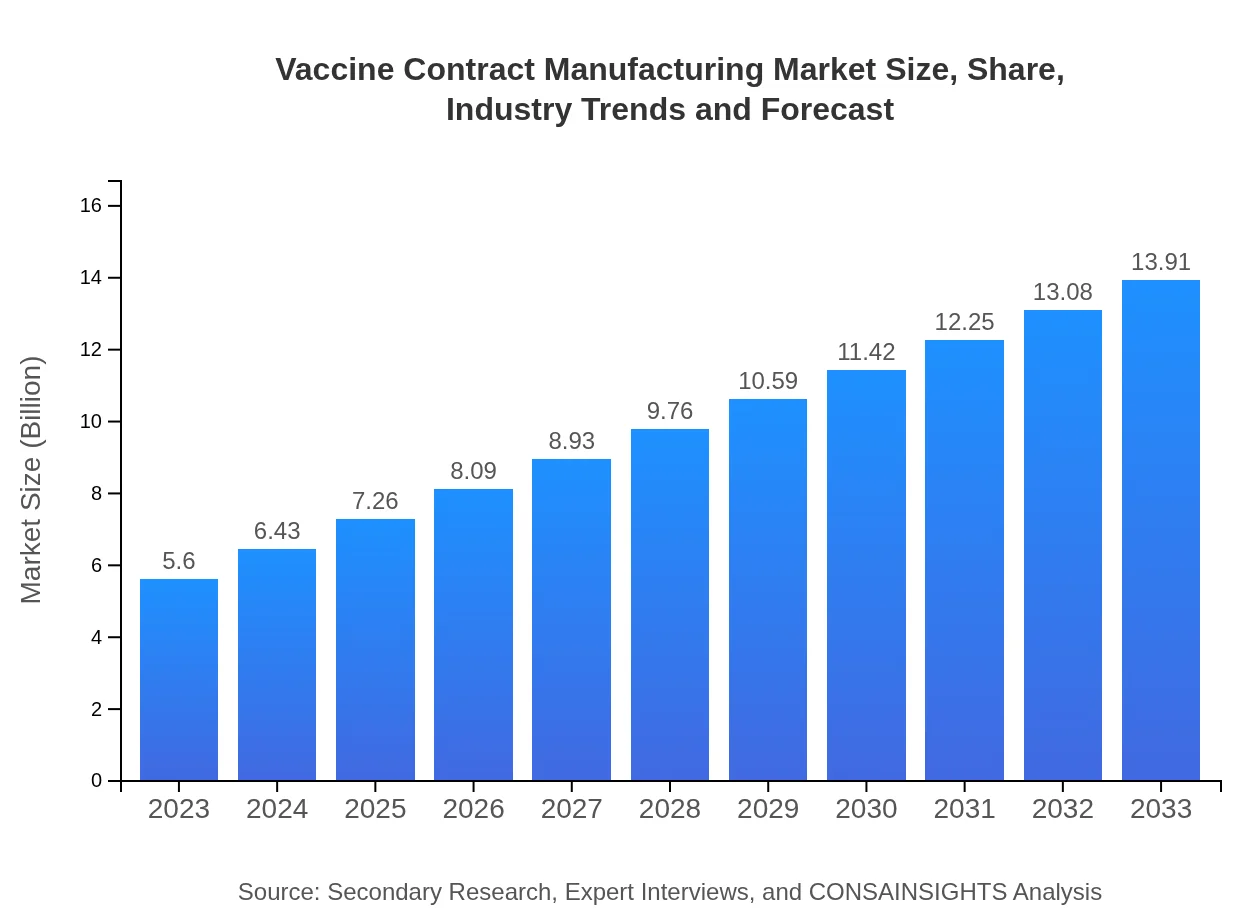

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Thermo Fisher Scientific, Lonza Group, Catalent, Inc., WuXi AppTec |

| Last Modified Date | 31 January 2026 |

Vaccine Contract Manufacturing Market Overview

Customize Vaccine Contract Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Vaccine Contract Manufacturing market size, growth, and forecasts.

- ✔ Understand Vaccine Contract Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vaccine Contract Manufacturing

What is the Market Size & CAGR of Vaccine Contract Manufacturing market in 2023?

Vaccine Contract Manufacturing Industry Analysis

Vaccine Contract Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vaccine Contract Manufacturing Market Analysis Report by Region

Europe Vaccine Contract Manufacturing Market Report:

Europe's market is anticipated to grow from $2.05 billion in 2023 to $5.10 billion in 2033. The robust healthcare frameworks and increased public-private collaborations in vaccine development drive this growth.Asia Pacific Vaccine Contract Manufacturing Market Report:

In the Asia-Pacific region, the Vaccine Contract Manufacturing market is projected to grow from $0.96 billion in 2023 to $2.39 billion by 2033, driven by increasing vaccine development initiatives and government support for health infrastructure improvements.North America Vaccine Contract Manufacturing Market Report:

North America dominated the market in 2023, with a value of $1.83 billion, projected to reach $4.56 billion by 2033. The region benefits from advanced technology adoption, leading biopharmaceutical companies, and significant funding for vaccine research and development.South America Vaccine Contract Manufacturing Market Report:

The South American market is expected to rise from $0.15 billion in 2023 to $0.36 billion by 2033. National vaccination campaigns and partnerships with international organizations are key growth drivers in this region.Middle East & Africa Vaccine Contract Manufacturing Market Report:

The Middle East and Africa market will see growth from $0.61 billion in 2023 to $1.51 billion in 2033, as countries ramp up vaccination efforts to combat endemic diseases and improve public health outcomes.Tell us your focus area and get a customized research report.

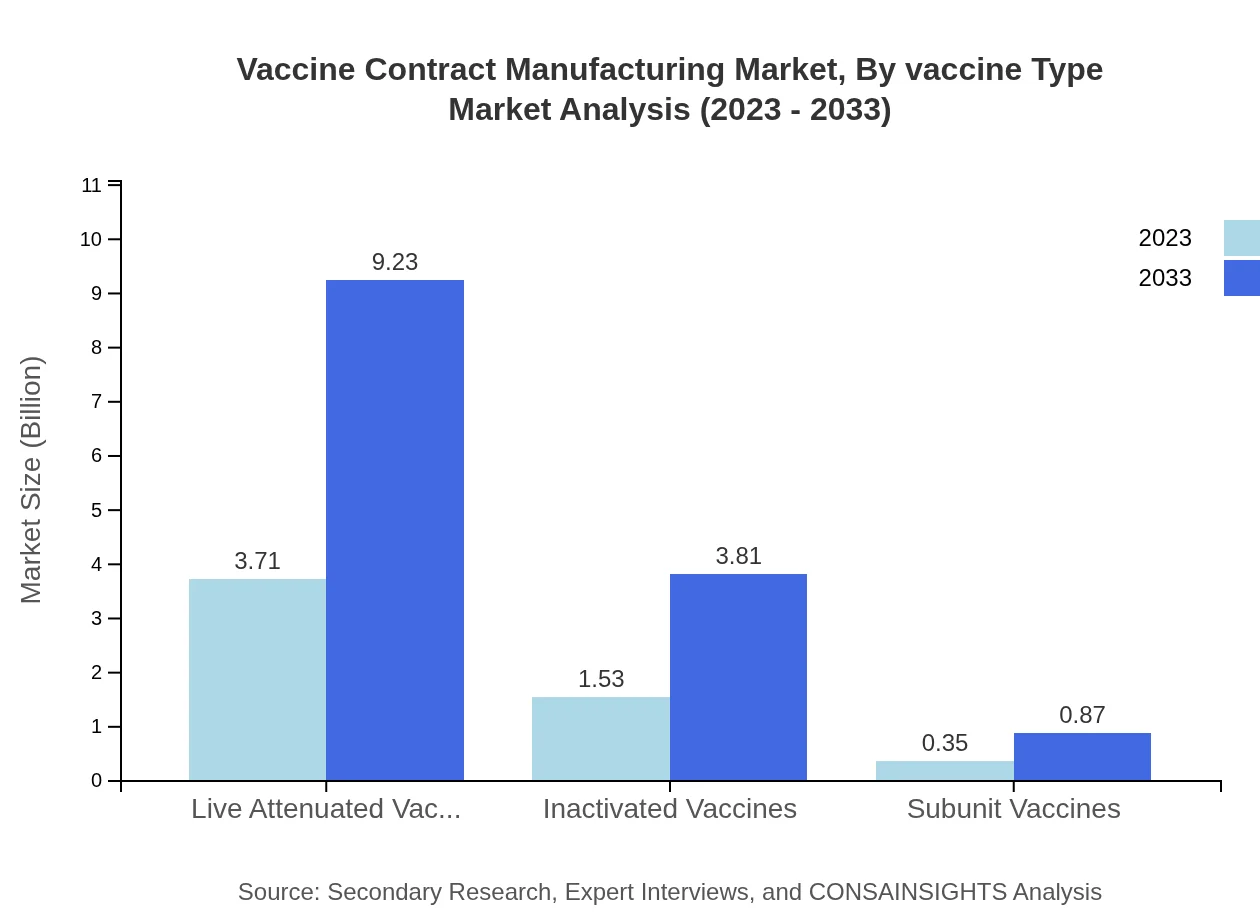

Vaccine Contract Manufacturing Market Analysis By Vaccine Type

The Vaccine Contract Manufacturing market, segmented by vaccine type, includes: - Live Attenuated Vaccines, valued at $3.71 billion in 2023 and projected to reach $9.23 billion by 2033, holding a market share of 66.32% throughout the period. - Inactivated Vaccines, starting at $1.53 billion in 2023 and expected to grow to $3.81 billion by 2033, maintaining a 27.4% share. - Subunit Vaccines, with a market size of $0.35 billion in 2023 and growing to $0.87 billion by 2033, representing a 6.28% share.

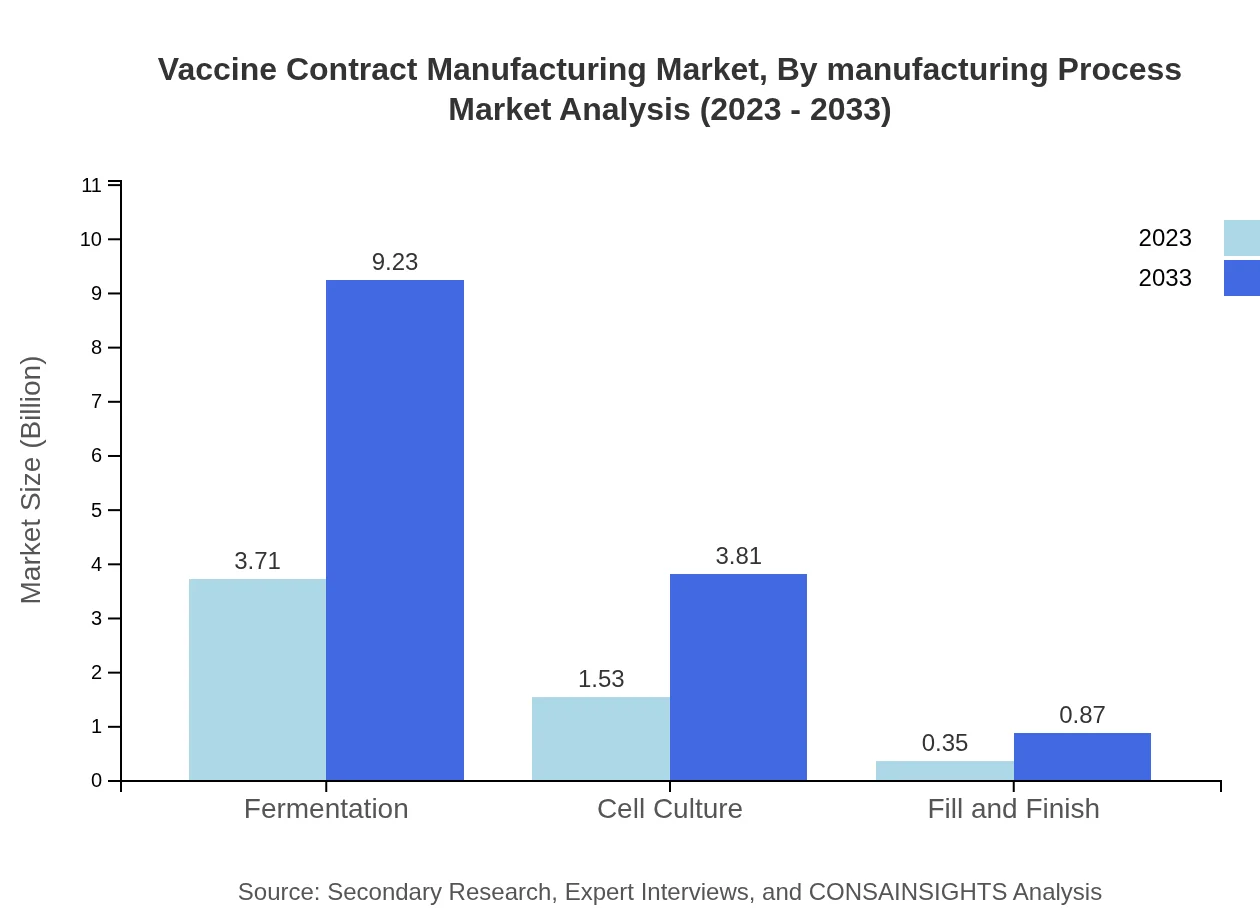

Vaccine Contract Manufacturing Market Analysis By Manufacturing Process

Analyzing the market by manufacturing process reveals: - Fermentation processes generate $3.71 billion in 2023, with a growth forecast reaching $9.23 billion by 2033 (66.32%). - Cell Culture approaches start at $1.53 billion in 2023, growing to $3.81 billion by 2033 (27.4%). - Fill and Finish services are expected to increase from $0.35 billion in 2023 to $0.87 billion by 2033 (6.28%).

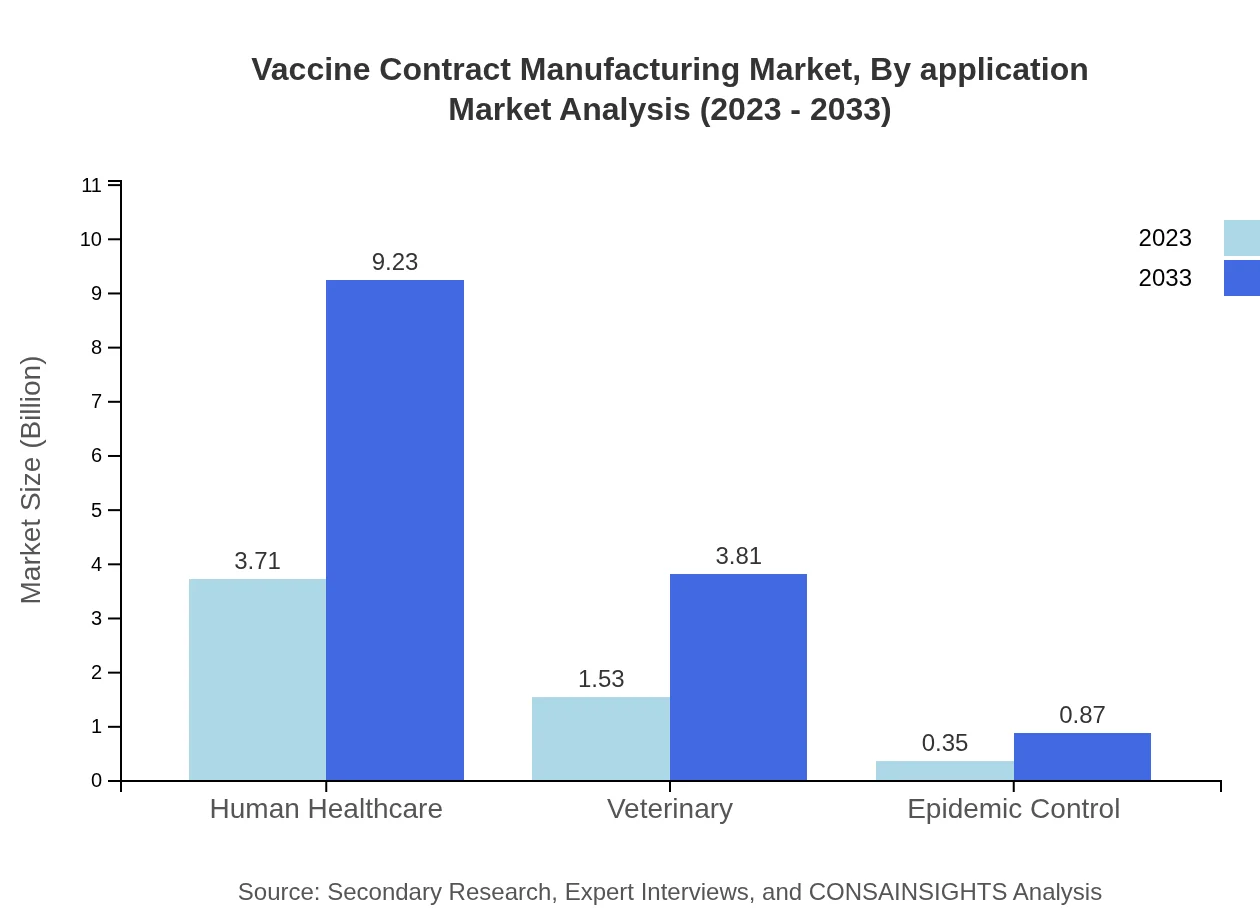

Vaccine Contract Manufacturing Market Analysis By Application

The market segmented by application includes: - Human Healthcare dominates with a market value of $3.71 billion in 2023, projected to reach $9.23 billion by 2033 (66.32%). - Veterinary applications start at $1.53 billion in 2023, expected to grow to $3.81 billion by 2033 (27.4%). - Epidemic Control measures account for $0.35 billion in 2023, rising to $0.87 billion by 2033 (6.28%).

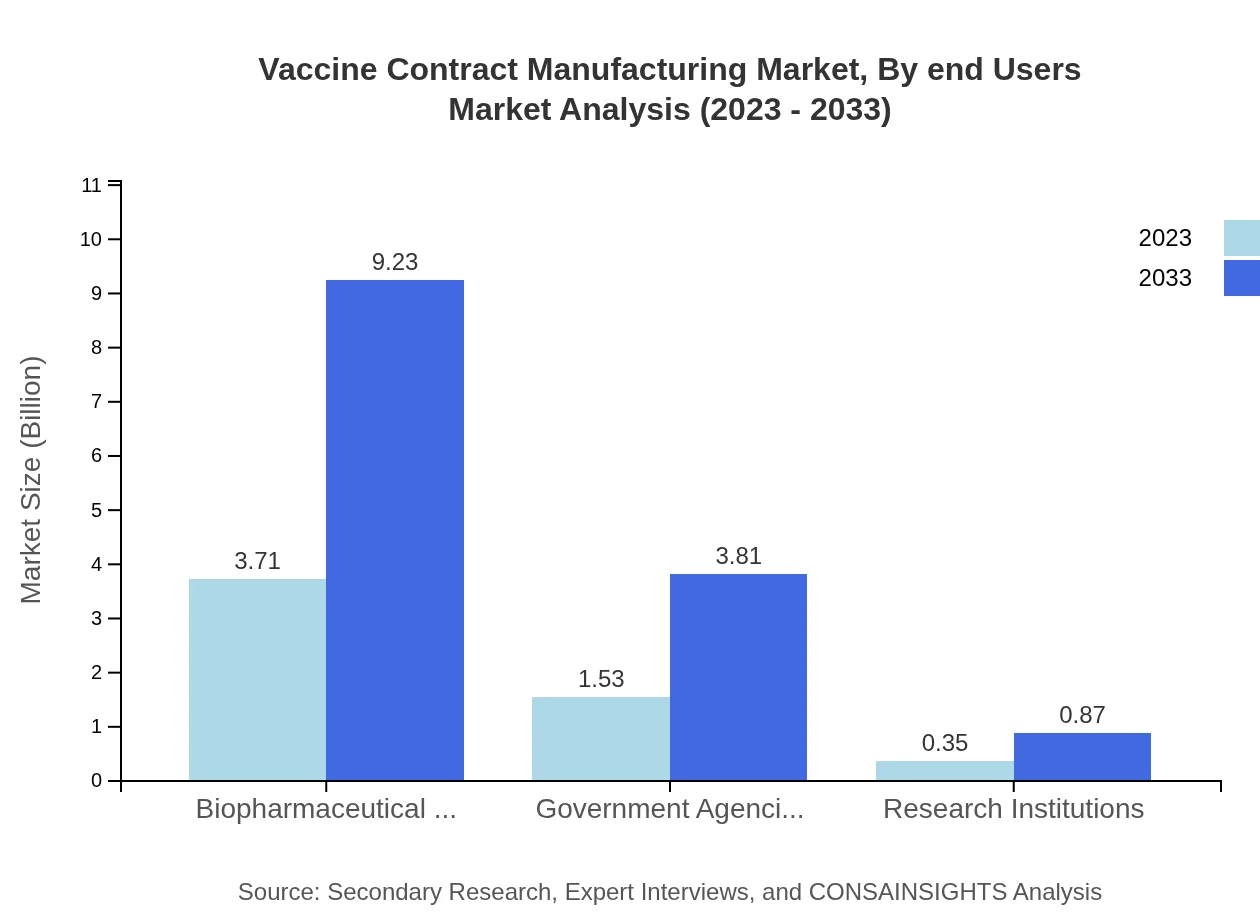

Vaccine Contract Manufacturing Market Analysis By End Users

The end-users of the Vaccine Contract Manufacturing market are characterized by: - Biopharmaceutical Companies, leading in size with $3.71 billion in 2023 and projected to reach $9.23 billion by 2033 (66.32% share). - Government Agencies, starting at $1.53 billion in 2023 and expected to grow to $3.81 billion by 2033 (27.4% share). - Research Institutions progress from $0.35 billion in 2023 to $0.87 billion in 2033 (6.28% share).

Vaccine Contract Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vaccine Contract Manufacturing Industry

Thermo Fisher Scientific:

A leading contract manufacturer known for its extensive biopharmaceutical services, including vaccine production, providing critical support to various health organizations.Lonza Group:

A Swiss company recognized for its pharmaceutical and biotechnology services, including manufacturing vaccines with advanced technologies and processes.Catalent, Inc.:

A global leader in advanced delivery technologies, Catalent offers integrated manufacturing solutions for vaccines that enhance efficiency and scalability.WuXi AppTec:

A prominent provider of R&D and manufacturing services, WuXi AppTec offers comprehensive solutions for vaccine development, manufacturing, and testing.We're grateful to work with incredible clients.

FAQs

What is the market size of vaccine Contract Manufacturing?

The global vaccine contract manufacturing market is valued at approximately $5.6 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 9.2% from 2023 to 2033, indicating robust growth expectations in the coming years.

What are the key market players or companies in this vaccine Contract Manufacturing industry?

Key players in the vaccine contract manufacturing industry include major biopharmaceutical companies specializing in vaccine production. These companies leverage advanced technologies and extensive expertise in manufacturing processes to meet the increasing demand for vaccines globally.

What are the primary factors driving the growth in the vaccine Contract Manufacturing industry?

The growth in the vaccine contract manufacturing industry is primarily driven by increased demand for vaccines, technological advancements in manufacturing processes, and collaborations between public and private sectors aimed at enhancing vaccine production capabilities and accessibility.

Which region is the fastest Growing in the vaccine Contract Manufacturing?

The fastest-growing region in the vaccine contract manufacturing market is projected to be Europe, expanding from $2.05 billion in 2023 to $5.10 billion by 2033. The Asia Pacific region also shows significant growth, with an increase from $0.96 billion to $2.39 billion during the same period.

Does ConsaInsights provide customized market report data for the vaccine Contract Manufacturing industry?

Yes, ConsaInsights offers customized market report data for the vaccine contract manufacturing industry, allowing stakeholders to gain tailored insights that align with their specific needs and strategic objectives within this dynamic market.

What deliverables can I expect from this vaccine Contract Manufacturing market research project?

From this market research project, you can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape assessments, and strategic recommendations tailored to your organization's needs in the vaccine contract manufacturing sector.

What are the market trends of vaccine Contract Manufacturing?

Current market trends in vaccine contract manufacturing include an increasing emphasis on biopharmaceutical collaborations, rising demand for personalized vaccines, and advancements in manufacturing technologies that streamline production processes, ultimately enhancing efficiency and yield.