Valve Controller Market Report

Published Date: 22 January 2026 | Report Code: valve-controller

Valve Controller Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Valve Controller market, including market size, CAGR, segmented insights, regional analysis, and trends from 2023 to 2033. Forecasts and critical insights are shared to inform stakeholders in strategic decision-making.

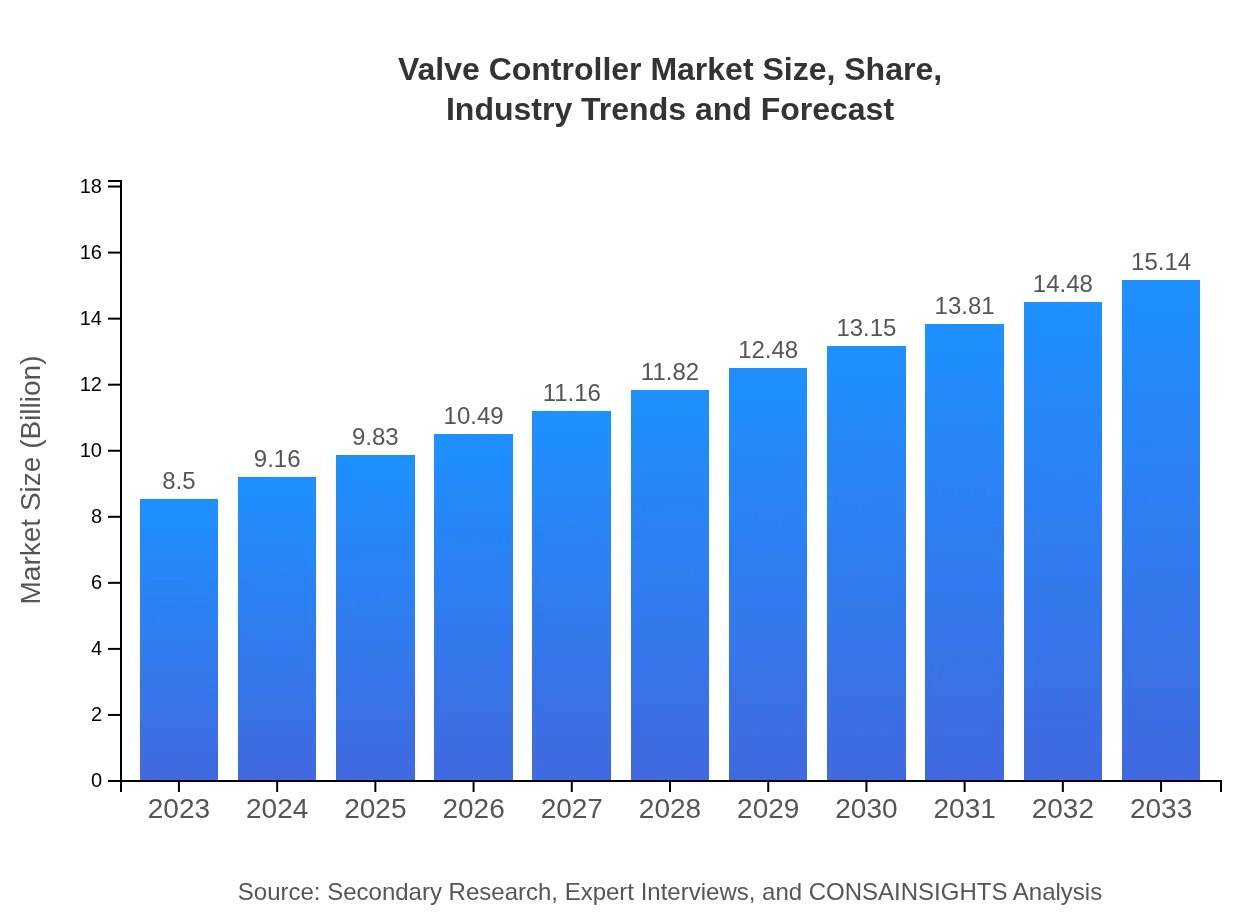

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $15.14 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., Schneider Electric, Siemens AG |

| Last Modified Date | 22 January 2026 |

Valve Controller Market Overview

Customize Valve Controller Market Report market research report

- ✔ Get in-depth analysis of Valve Controller market size, growth, and forecasts.

- ✔ Understand Valve Controller's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Valve Controller

What is the Market Size & CAGR of the Valve Controller market in 2033?

Valve Controller Industry Analysis

Valve Controller Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Valve Controller Market Analysis Report by Region

Europe Valve Controller Market Report:

Europe is anticipated to see significant growth, from $2.68 billion in 2023 to $4.78 billion by 2033. The region's commitment to maintaining high technical standards and regulatory compliance in industries like oil and gas enhances demand for advanced valve control solutions.Asia Pacific Valve Controller Market Report:

The Asia Pacific region is projected to grow from $1.71 billion in 2023 to $3.05 billion by 2033, driven by rapid industrialization, increasing demand for energy, and growing infrastructure investments particularly in countries like China and India.North America Valve Controller Market Report:

North America's market is poised for growth from $2.77 billion in 2023 to $4.93 billion in 2033. The region's strong focus on technological innovation and automation in various sectors is attributed to its thriving manufacturing environment.South America Valve Controller Market Report:

In South America, market growth is expected to rise from $0.70 billion in 2023 to $1.24 billion in 2033. Factors such as the expansion of industrial activities and investment in sustainable water and energy solutions will contribute to this increase.Middle East & Africa Valve Controller Market Report:

The Middle East and Africa market is expected to grow from $0.64 billion in 2023 to $1.14 billion by 2033, driven by investments in oil and gas, water management, and an increasing push towards smart infrastructure.Tell us your focus area and get a customized research report.

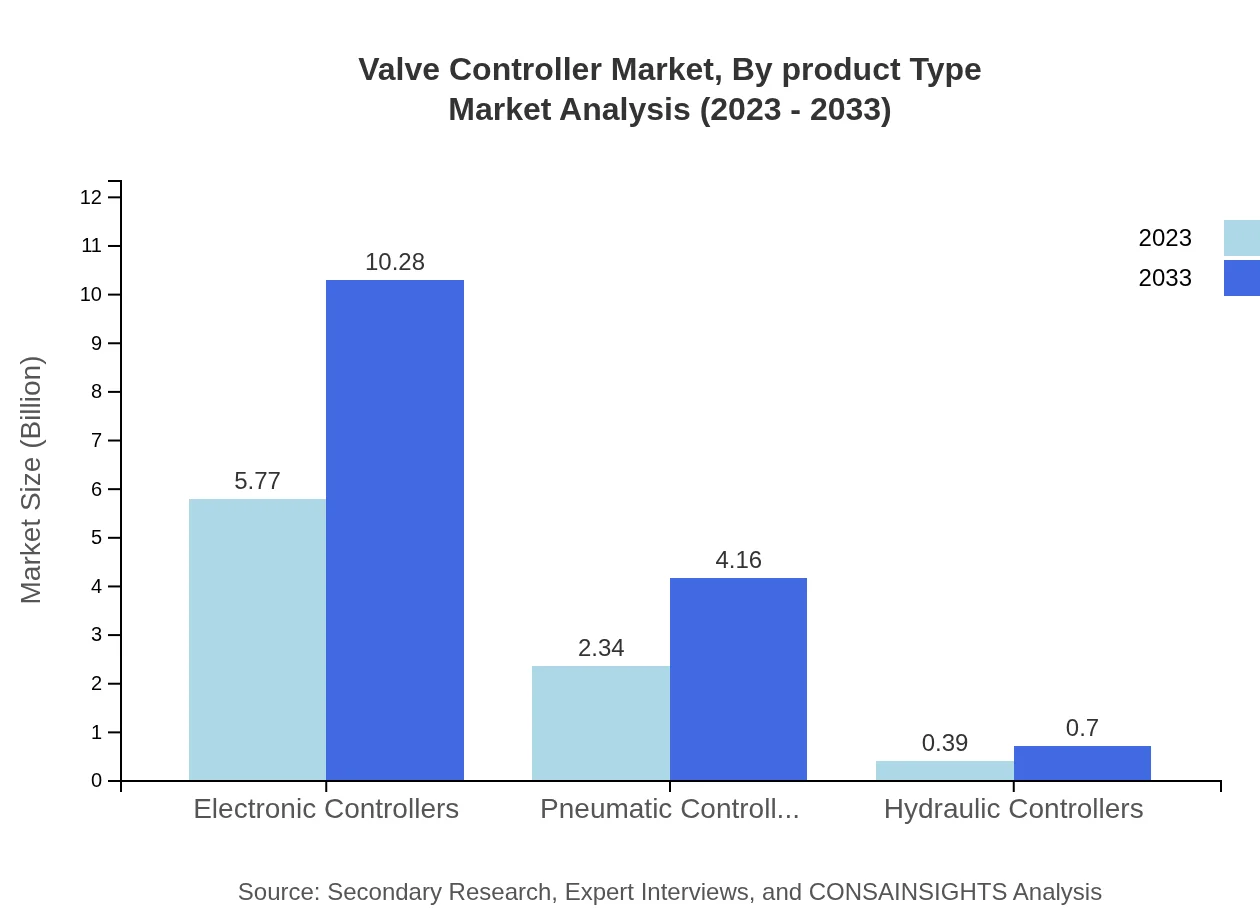

Valve Controller Market Analysis By Product Type

In 2023, the electronic controllers segment dominates the market with a size of $5.77 billion, reflecting a share of 67.87%. Pneumatic controllers and hydraulic controllers follow, with market sizes of $2.34 billion and $0.39 billion respectively. This trend shows a gradual increase in automation and digital solutions within the industry.

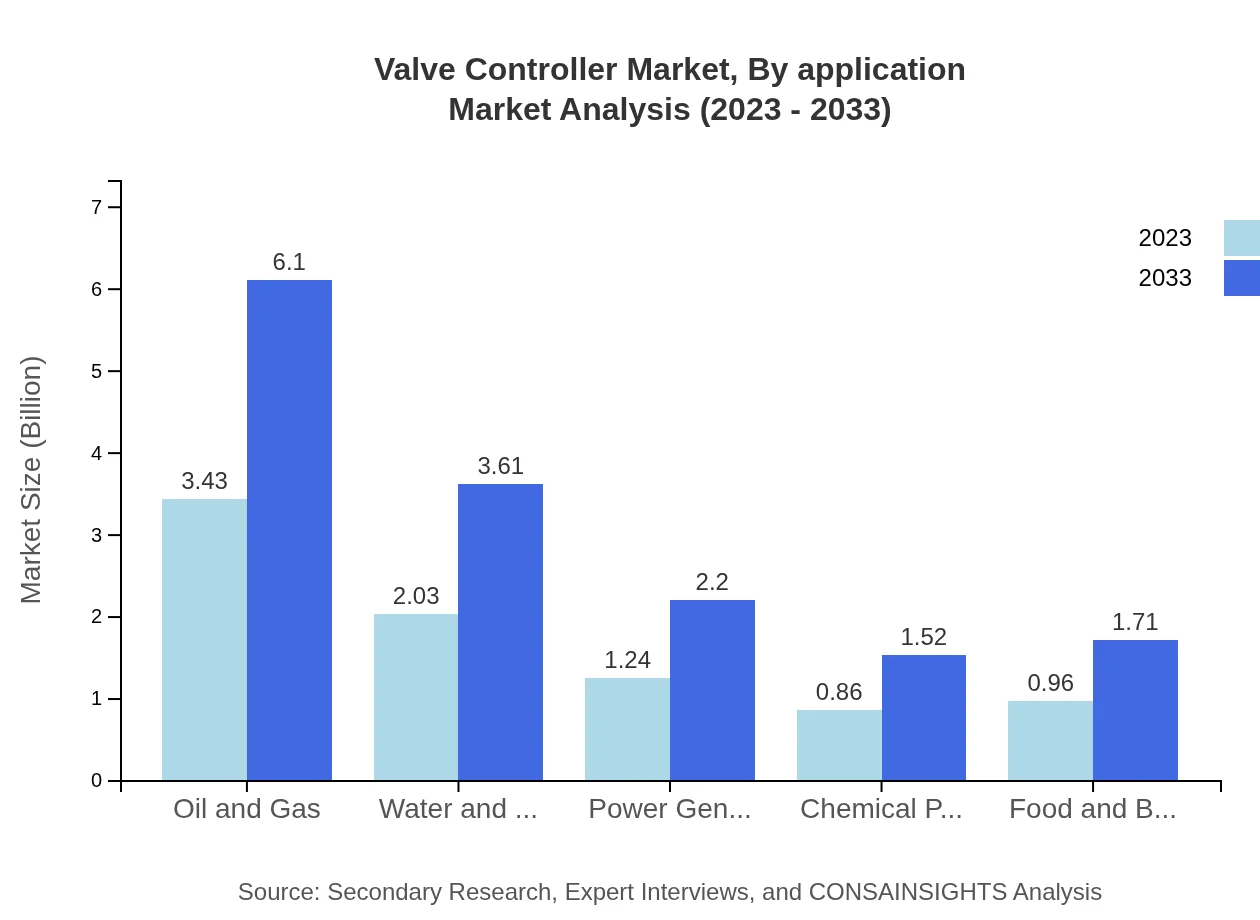

Valve Controller Market Analysis By Application

Industrial manufacturing, contributing $3.43 billion in 2023, commands a significant market share of 40.3%. Other notable applications include energy and utilities ($2.03 billion), water and wastewater management ($2.03 billion), and building automation ($1.24 billion). These sectors are key beneficiaries of advanced valve technology.

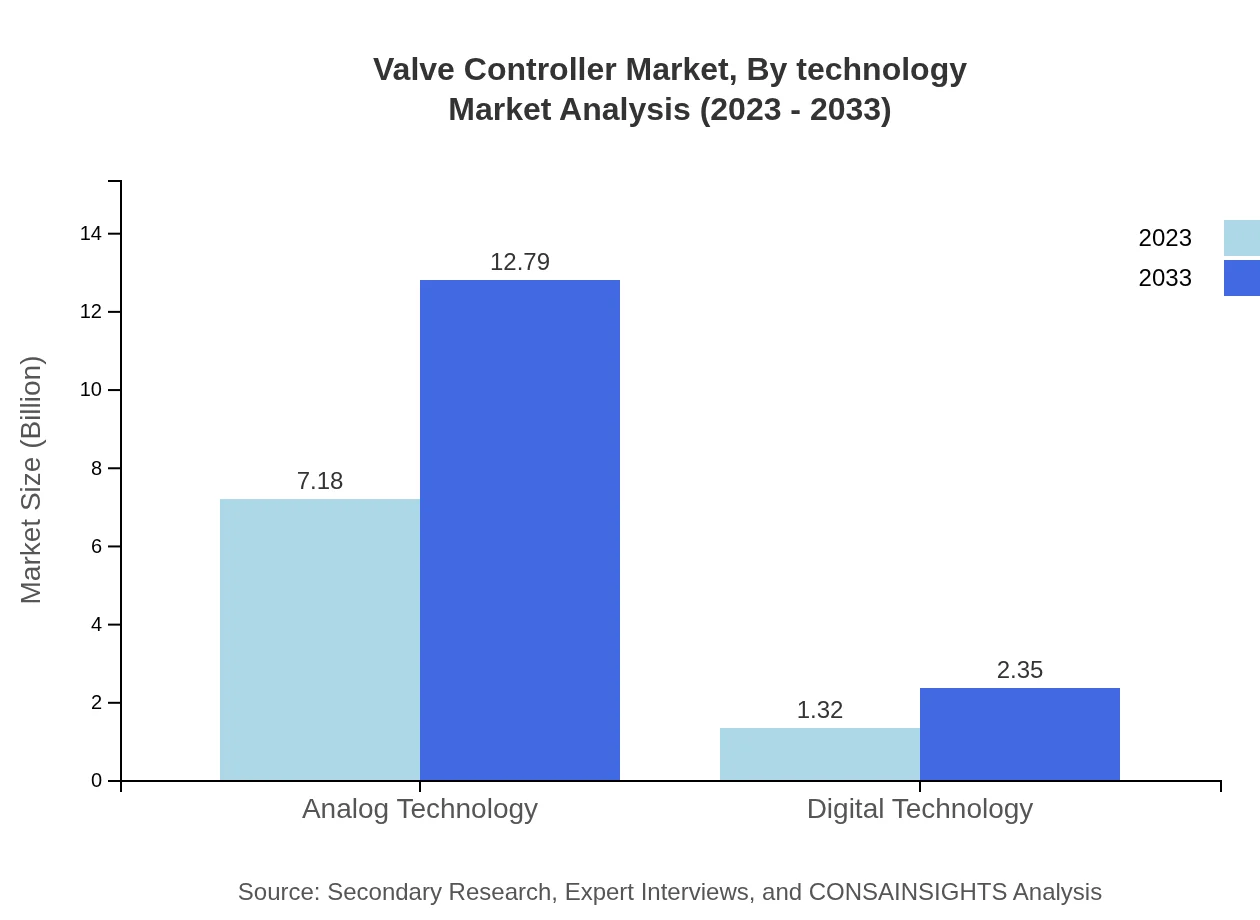

Valve Controller Market Analysis By Technology

The market is divided into analog and digital technologies. In 2023, analog technology controls $7.18 billion of the market at an 84.49% share, illustrating its predominant presence, while digital technology accounts for $1.32 billion (15.51%). Innovations in digital technology promise a gradual shift toward efficiency and automation.

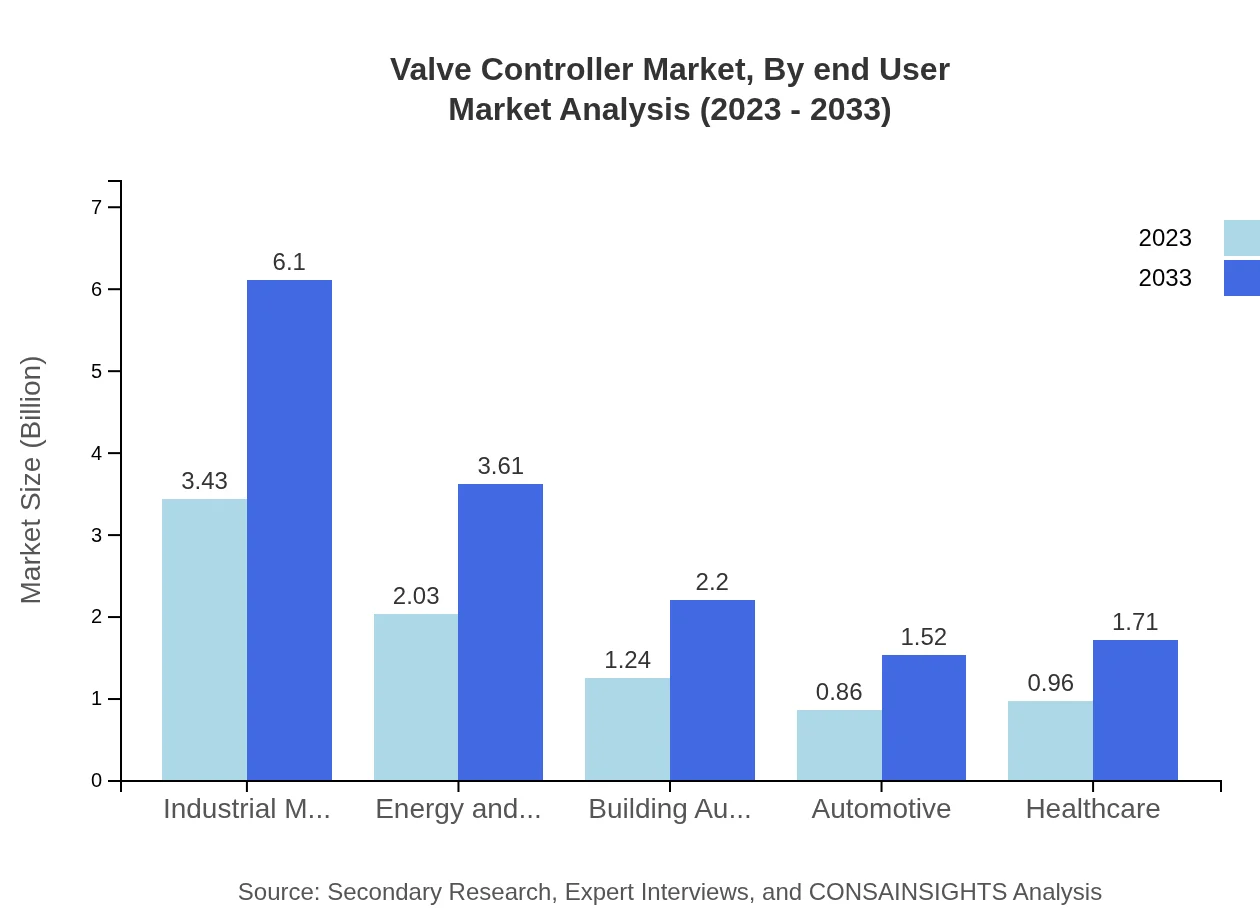

Valve Controller Market Analysis By End User

Key end-user industries include oil and gas ($3.43 billion), energy and utilities ($2.03 billion), and healthcare ($0.96 billion). With significant shares, these sectors emphasize optimal control systems to enhance operational efficiency.

Valve Controller Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Valve Controller Industry

Emerson Electric Co.:

A global leader in automation technology and engineering, Emerson provides innovative valve control solutions enhancing process efficiency.Honeywell International Inc.:

Known for its advanced technological solutions in various verticals, Honeywell excels in providing comprehensive valve control systems tailored for industrial applications.Schneider Electric:

Specializes in digital transformation of energy management and automation, offering an extensive range of valve control systems to enhance operational efficiency.Siemens AG:

An established player in the technology and automation sector, Siemens delivers innovative valve control solutions focusing on reliability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of valve controllers?

The global valve controller market is projected to reach approximately $8.5 billion by 2033, growing at a CAGR of 5.8% from 2023. This growth reflects increased automation and control needs across various industries.

What are the key market players or companies in this valve controller industry?

Key players in the valve controller market include major industrial automation firms, valve manufacturers, and technology providers who offer integrated control solutions. Their innovations drive market competitiveness and enhance product offerings.

What are the primary factors driving the growth in the valve controller industry?

Growth drivers include technological advancements in automation, increased demand for energy efficiency, and rising investments in infrastructure among various sectors such as oil and gas, water management, and manufacturing.

Which region is the fastest Growing in the valve controller market?

The Asia Pacific region is experiencing rapid growth in the valve controller market, expected to increase from $1.71 billion in 2023 to $3.05 billion by 2033, fueled by rising industrialization and infrastructure development.

Does ConsInsights provide customized market report data for the valve controller industry?

Yes, ConsInsights offers tailored market research reports that allow businesses to gain insights specific to their needs in the valve controller sector, focusing on market trends, forecasts, and competitive analysis.

What deliverables can I expect from this valve controller market research project?

Deliverables typically include a comprehensive market analysis report, detailed segmentation data, regional breakdowns, competitive landscape insights, and actionable recommendations tailored to stakeholder requirements.

What are the market trends of valve controllers?

Current market trends include the growing adoption of digital technologies, increased demand for smart controllers in industrial automation, and heightened focus on sustainability and energy efficiency across applications.