Valve Driver Market Report

Published Date: 22 January 2026 | Report Code: valve-driver

Valve Driver Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Valve Driver market, including insights into market size, trends, and forecasts from 2023 to 2033. It examines the industry landscape, regional dynamics, technological advancements, and identifies key players driving growth in this sector.

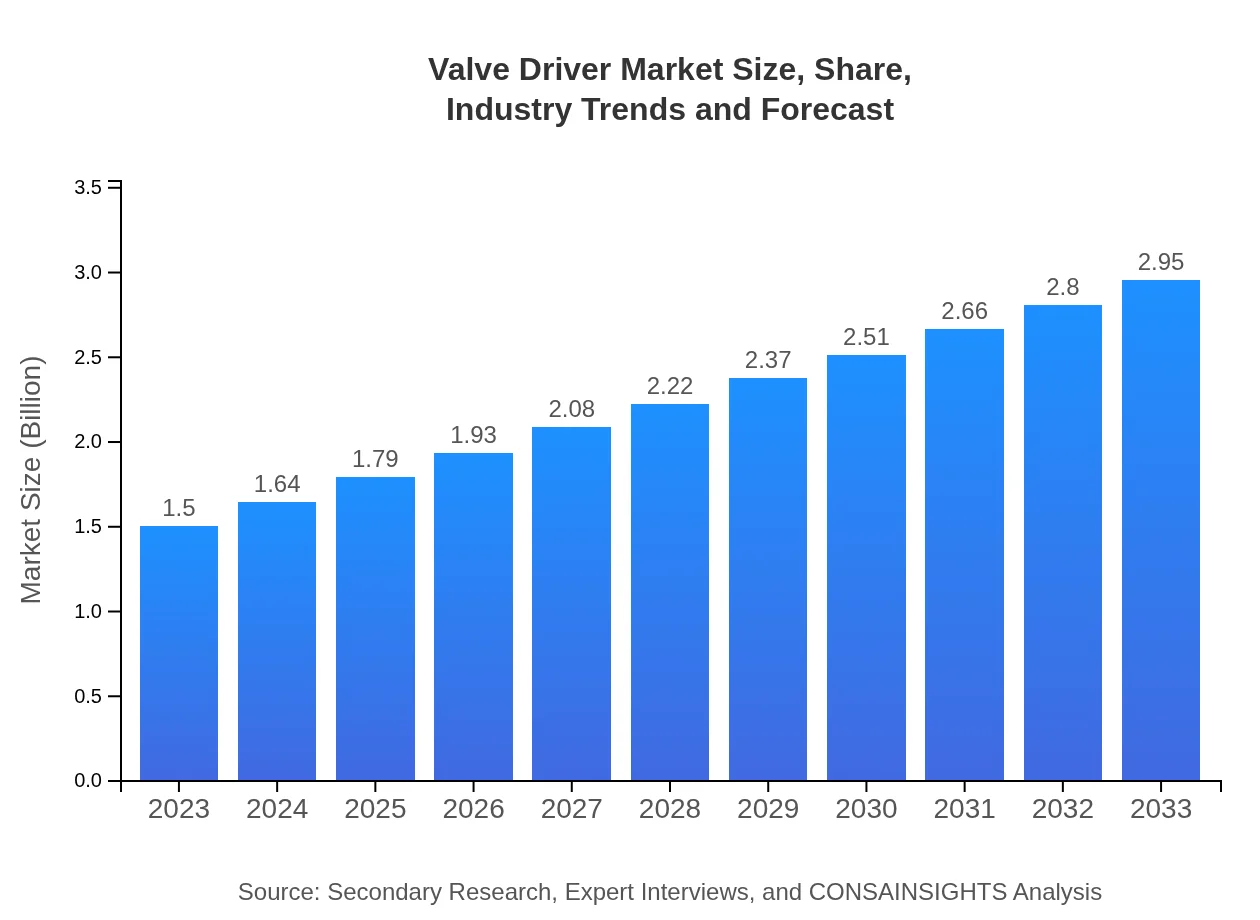

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Emerson Electric Co., Siemens AG, Schneider Electric |

| Last Modified Date | 22 January 2026 |

Valve Driver Market Overview

Customize Valve Driver Market Report market research report

- ✔ Get in-depth analysis of Valve Driver market size, growth, and forecasts.

- ✔ Understand Valve Driver's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Valve Driver

What is the Market Size & CAGR of Valve Driver market in 2023-2033?

Valve Driver Industry Analysis

Valve Driver Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Valve Driver Market Analysis Report by Region

Europe Valve Driver Market Report:

The European market is projected to grow from USD 0.43 billion in 2023 to USD 0.85 billion by 2033, supported by stringent regulations on energy efficiency and increasing demand for innovative valve solutions across various industries.Asia Pacific Valve Driver Market Report:

The Asia Pacific region is expected to witness significant growth, with the market valued at approximately USD 0.29 billion in 2023 and projected to reach USD 0.57 billion by 2033. This growth is propelled by rapid industrialization, increased investment in manufacturing infrastructure, and a rising emphasis on energy-efficient solutions.North America Valve Driver Market Report:

North America represents a substantial portion of the global market, with projections showing growth from USD 0.54 billion in 2023 to approximately USD 1.06 billion by 2033. This region benefits from high technological adoption rates and a strong focus on industrial automation and smart technology.South America Valve Driver Market Report:

In South America, the Valve Driver market is anticipated to grow from USD 0.04 billion in 2023 to USD 0.08 billion by 2033. Growth is driven by increasing investments in the energy and construction sectors, necessitating enhanced valve management systems.Middle East & Africa Valve Driver Market Report:

The Middle East and Africa market is expected to increase from USD 0.20 billion in 2023 to USD 0.39 billion by 2033 as infrastructural developments heighten the need for advanced valve systems, particularly in oil and gas and water management.Tell us your focus area and get a customized research report.

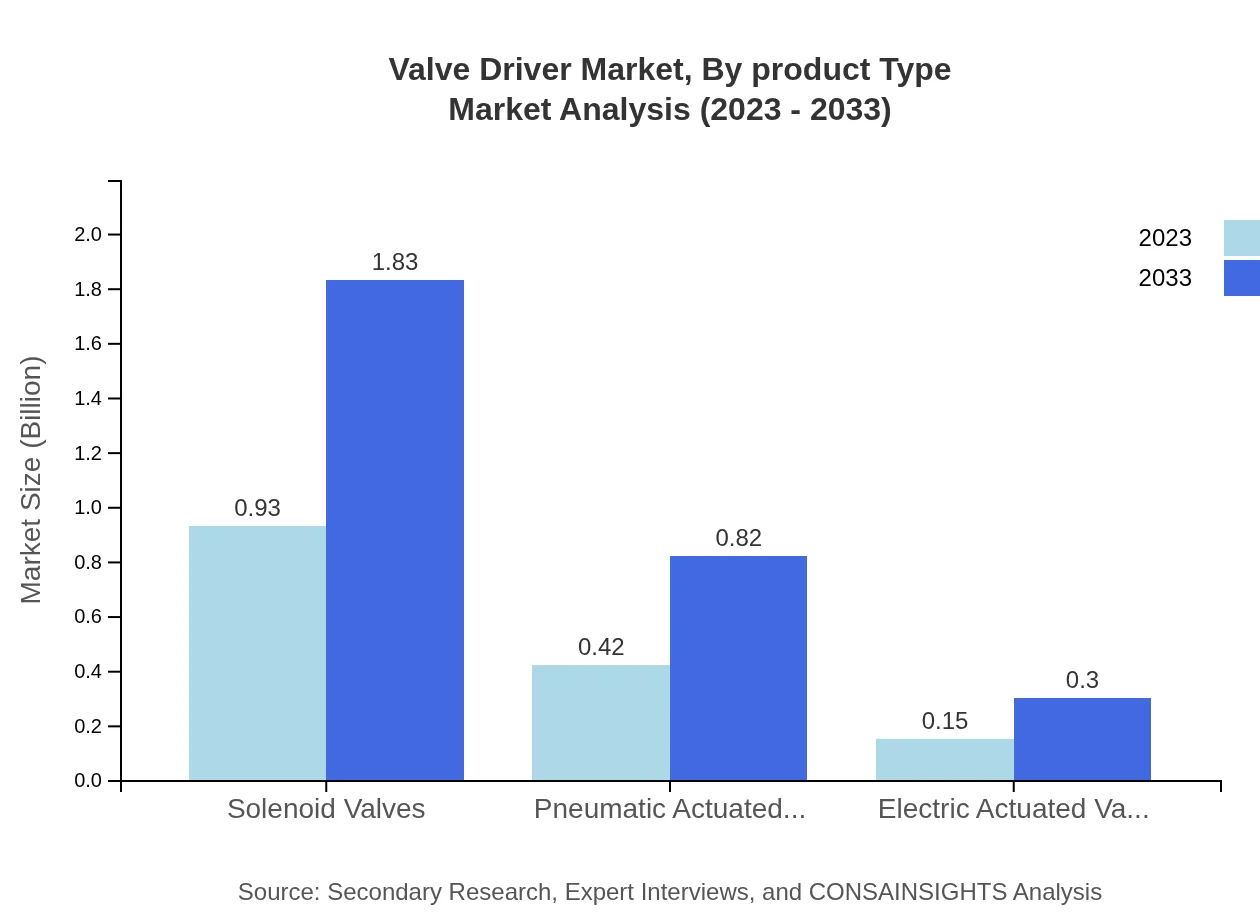

Valve Driver Market Analysis By Product Type

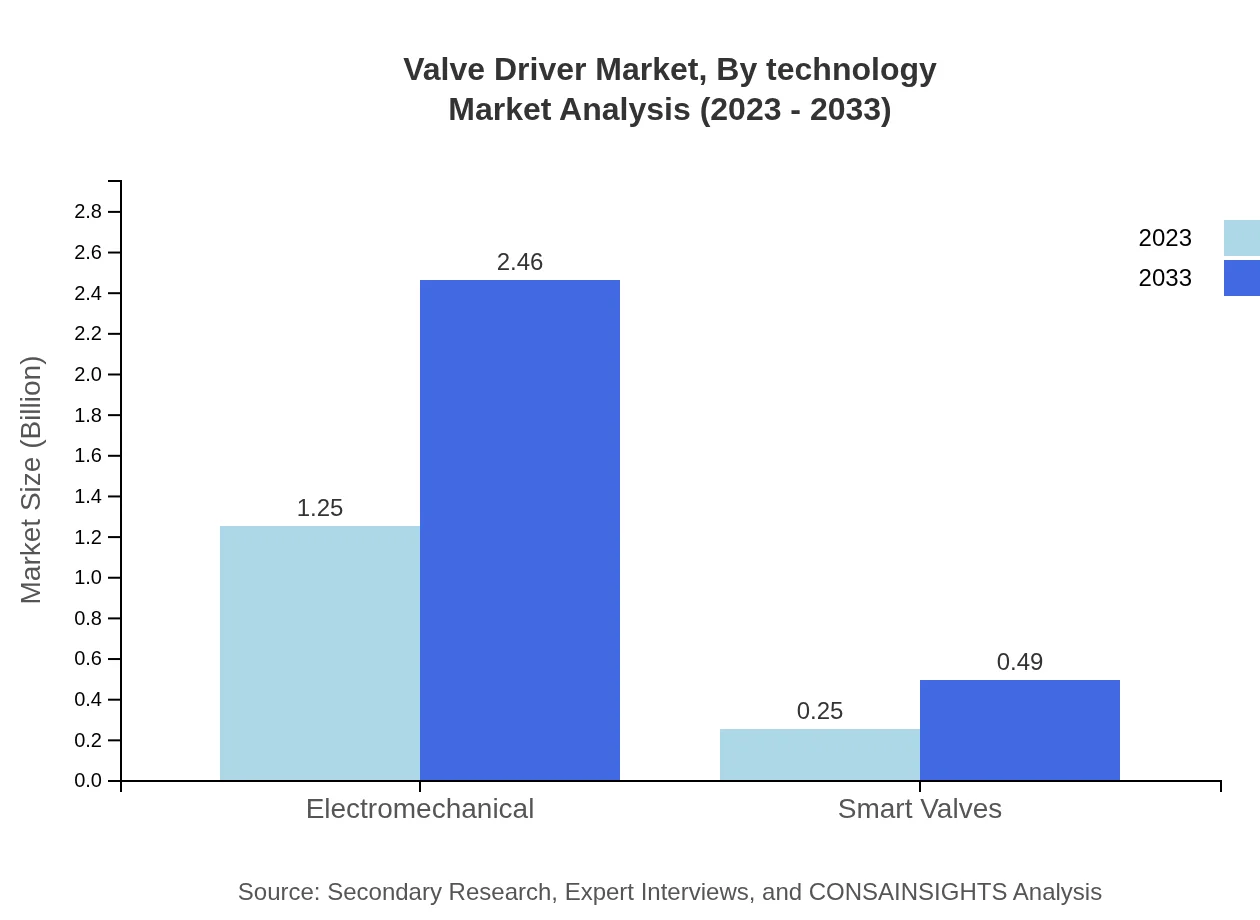

In terms of product type, the market is dominated by Electromechanical devices, accounting for USD 1.25 billion in 2023, expected to rise to USD 2.46 billion by 2033 (83.33% market share). Solenoid Valves follow with a market size of USD 0.93 billion slated to reach USD 1.83 billion. Smart Valves show promising growth potential, projected to increase from USD 0.25 billion to USD 0.49 billion, capturing 16.67% of market share.

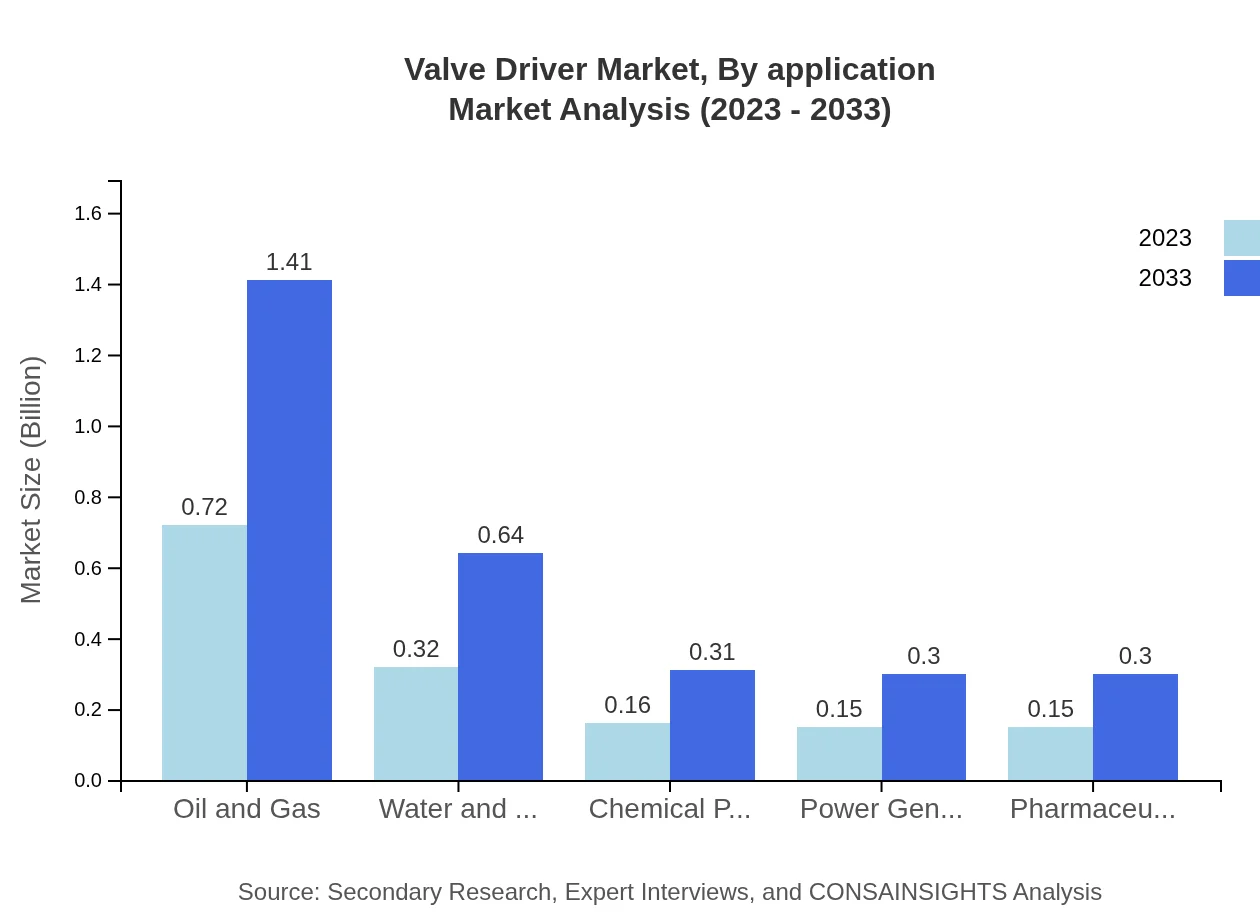

Valve Driver Market Analysis By Application

Key applications driving the Valve Driver market include Oil and Gas, which currently leads with USD 0.72 billion projected to grow to USD 1.41 billion by 2033. Water and Wastewater management follows with significant growth from USD 0.32 billion to USD 0.64 billion, while Chemical Processing remains a critical segment, growing from USD 0.16 billion to 0.31 billion.

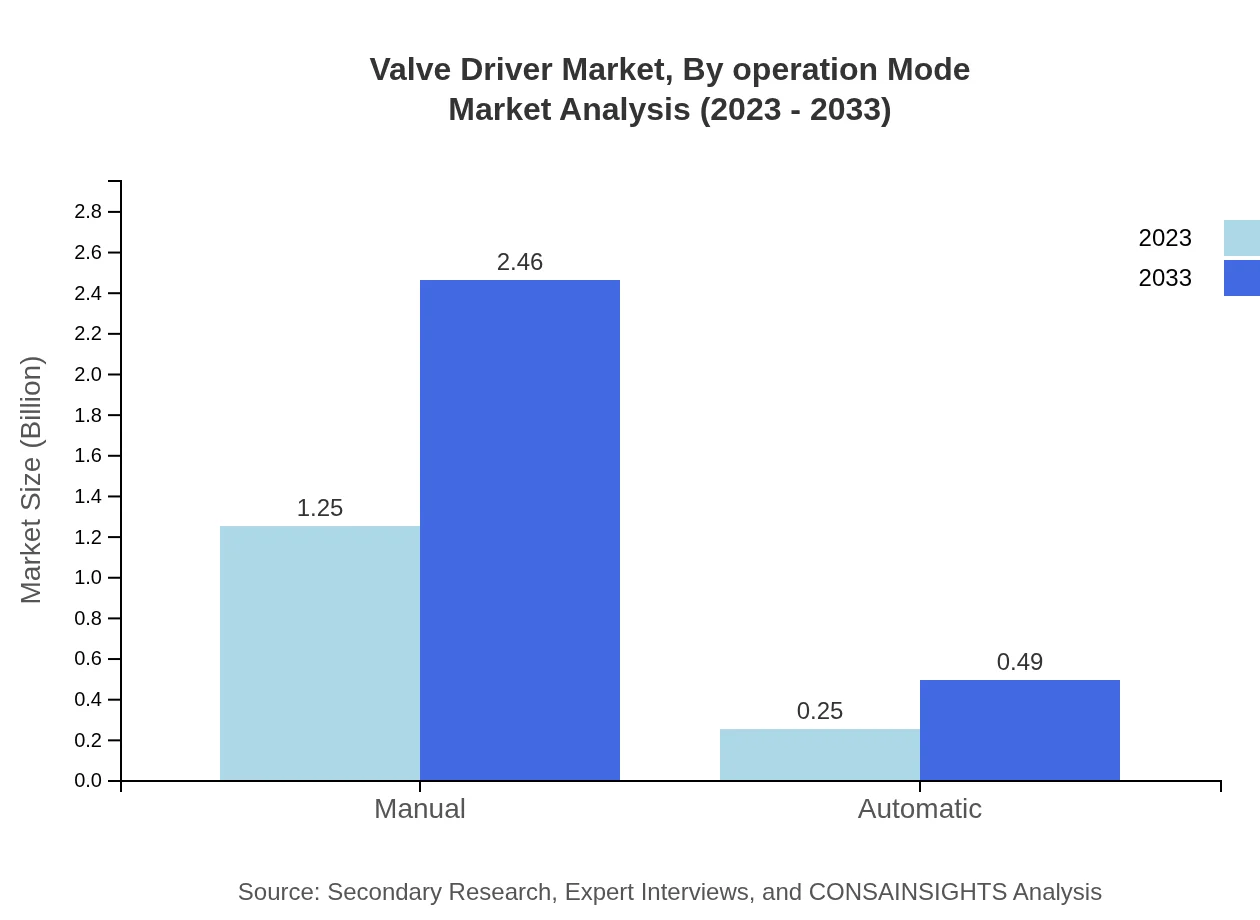

Valve Driver Market Analysis By Operation Mode

The market showcases two main operation modes: Manual and Automatic. Manual Valve Drivers dominate with USD 1.25 billion in 2023, projected to reach USD 2.46 billion (83.33% share), while Automatic segments, currently at USD 0.25 billion, are set to expand to USD 0.49 billion, translating to 16.67% market share.

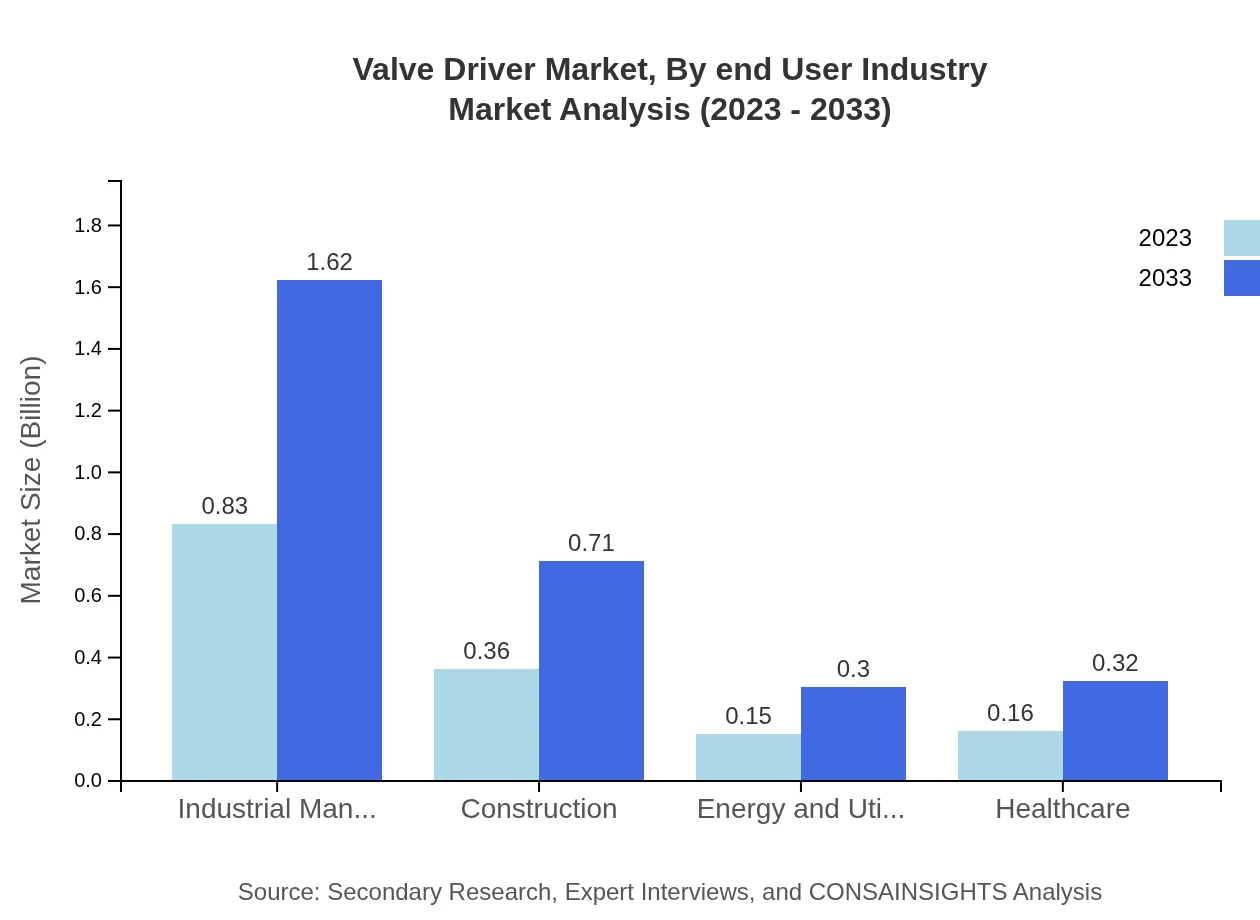

Valve Driver Market Analysis By End User Industry

The industrial manufacturing sector leads the end-user industries, driving a substantial share with a market size of USD 0.83 billion in 2023, growing to USD 1.62 billion by 2033. Other notable sectors include Construction and Energy and Utilities, which contribute significantly to the overall market size and growth trajectory.

Valve Driver Market Analysis By Technology

Technologically, the market is influenced heavily by advancements in smart controllable valves and IoT integration. Companies are investing in R&D to improve product functionality and enhance connectivity features, which is reshaping traditional operations and setting trends for the future.

Valve Driver Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Valve Driver Industry

Emerson Electric Co.:

A leading global technology and engineering company, Emerson provides innovative solutions for industrial automation and has a strong portfolio of valve drivers and associated technologies.Siemens AG:

Siemens specializes in the field of automation and digitalization in the process and manufacturing industries, offering a wide range of sophisticated valve actuation systems.Schneider Electric:

Schneider Electric is focused on digital transformation and offers a diverse product line in valve drivers that enhance energy efficiency and operational performance.We're grateful to work with incredible clients.

FAQs

What is the market size of Valve Driver?

The global Valve Driver market is valued at approximately $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.8% expected through to 2033.

What are the key market players or companies in this Valve Driver industry?

Key players in the Valve Driver industry include Emerson Electric Co., Honeywell International Inc., and Siemens AG, which dominate the market with their innovative technologies and extensive distribution networks.

What are the primary factors driving the growth in the Valve Driver industry?

Growth in the Valve Driver industry is driven by increasing demand for automation in industries, advancements in smart valve technology, and the need for efficient control systems in sectors like oil and gas, and water management.

Which region is the fastest Growing in the Valve Driver?

The fastest-growing region for the Valve Driver market is North America, where the market is expected to grow from $0.54 billion in 2023 to $1.06 billion by 2033, driven by industrial growth and infrastructural investments.

Does ConsaInsights provide customized market report data for the Valve Driver industry?

Yes, ConsaInsights offers customized market reports for the Valve Driver industry, tailored to meet specific research needs and providing deeper insights into market trends and dynamics.

What deliverables can I expect from this Valve Driver market research project?

Deliverables from the Valve Driver market research project include comprehensive market analysis reports, forecasts, competitive landscape assessments, and segmentation data providing insights across different regions and market segments.

What are the market trends of Valve Driver?

Current trends in the Valve Driver market include a shift towards automation, increased adoption of smart valve technology, and rising demand for eco-friendly solutions across various industries.