Valves And Actuators Market Report

Published Date: 22 January 2026 | Report Code: valves-and-actuators

Valves And Actuators Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Valves and Actuators market, offering insights into its current landscape, segmentation, and regional performance. We forecast significant trends and developments from 2023 to 2033, helping businesses to navigate future challenges and opportunities.

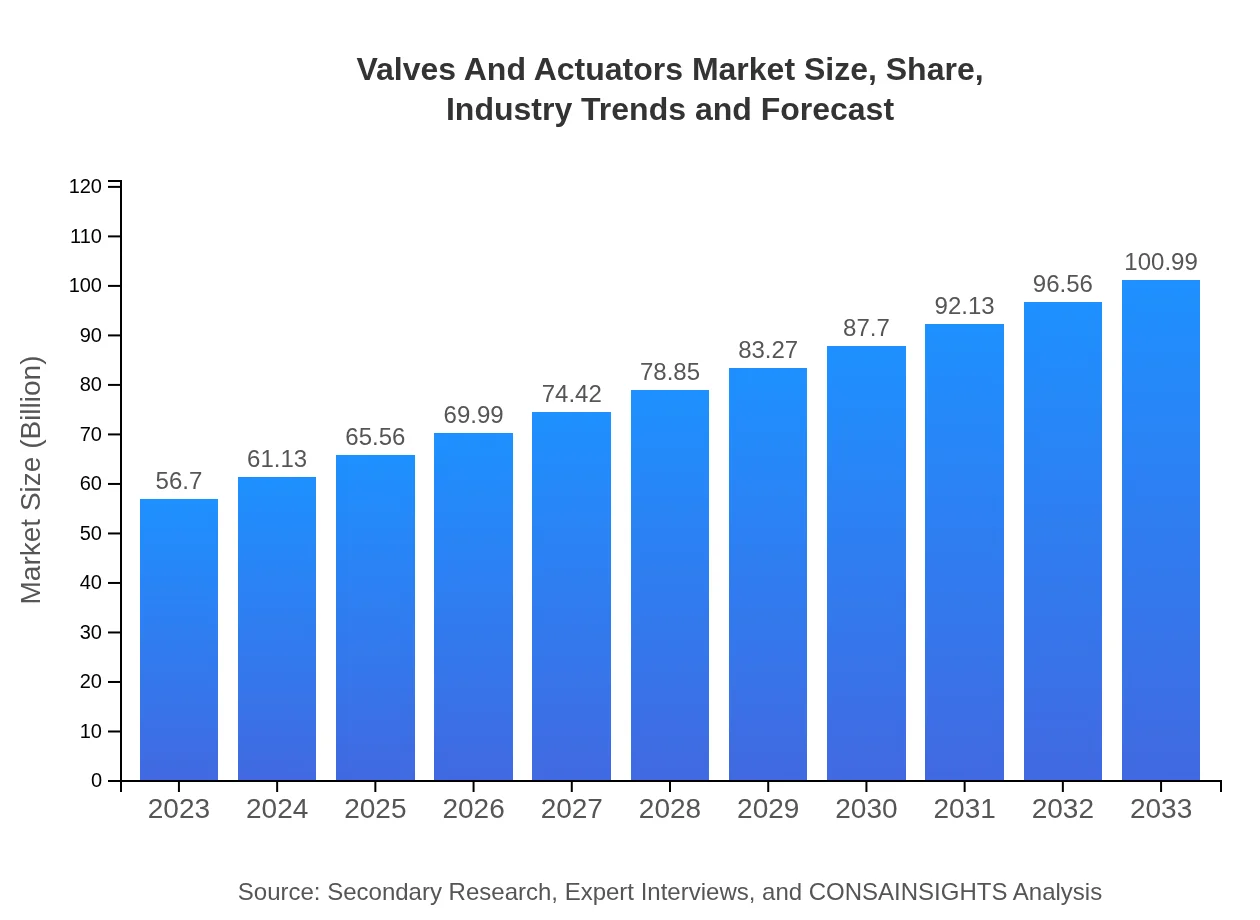

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $56.70 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $100.99 Billion |

| Top Companies | Emerson Electric Co., Flowserve Corporation, Parker Hannifin Corporation, Siemens AG, Valmet Corporation |

| Last Modified Date | 22 January 2026 |

Valves And Actuators Market Overview

Customize Valves And Actuators Market Report market research report

- ✔ Get in-depth analysis of Valves And Actuators market size, growth, and forecasts.

- ✔ Understand Valves And Actuators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Valves And Actuators

What is the Market Size & CAGR of Valves And Actuators market in 2023?

Valves And Actuators Industry Analysis

Valves And Actuators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Valves And Actuators Market Analysis Report by Region

Europe Valves And Actuators Market Report:

Europe's market is expected to grow from $17.71 billion in 2023 to $31.55 billion by 2033. The region is characterized by stringent regulations on energy and emissions, boosting the demand for efficient valves and actuators across industries such as power generation and water treatment.Asia Pacific Valves And Actuators Market Report:

In the Asia Pacific region, the Valves and Actuators market is projected to grow from $9.69 billion in 2023 to $17.26 billion by 2033. Rapid industrialization, along with significant investments in infrastructure development, are major growth drivers. Countries such as China and India contribute substantially to the demand, supported by a growing manufacturing base.North America Valves And Actuators Market Report:

The North American region, with a market size of $21.77 billion in 2023 and expected to reach $38.78 billion by 2033, benefits from advanced industrial automation technologies and a strong focus on energy efficiency. The U.S. predominates due to its significant manufacturing sector.South America Valves And Actuators Market Report:

South America shows moderate growth potential with the market size expanding from $3.08 billion in 2023 to $5.48 billion by 2033. Investments in the energy sector and water management systems are key areas fostering growth within the region.Middle East & Africa Valves And Actuators Market Report:

In the Middle East and Africa, the market is estimated to grow from $4.45 billion in 2023 to $7.92 billion by 2033. The oil and gas sector remains a significant consumer of valves and actuators, driven by industrial expansion and the push for sustainable energy solutions.Tell us your focus area and get a customized research report.

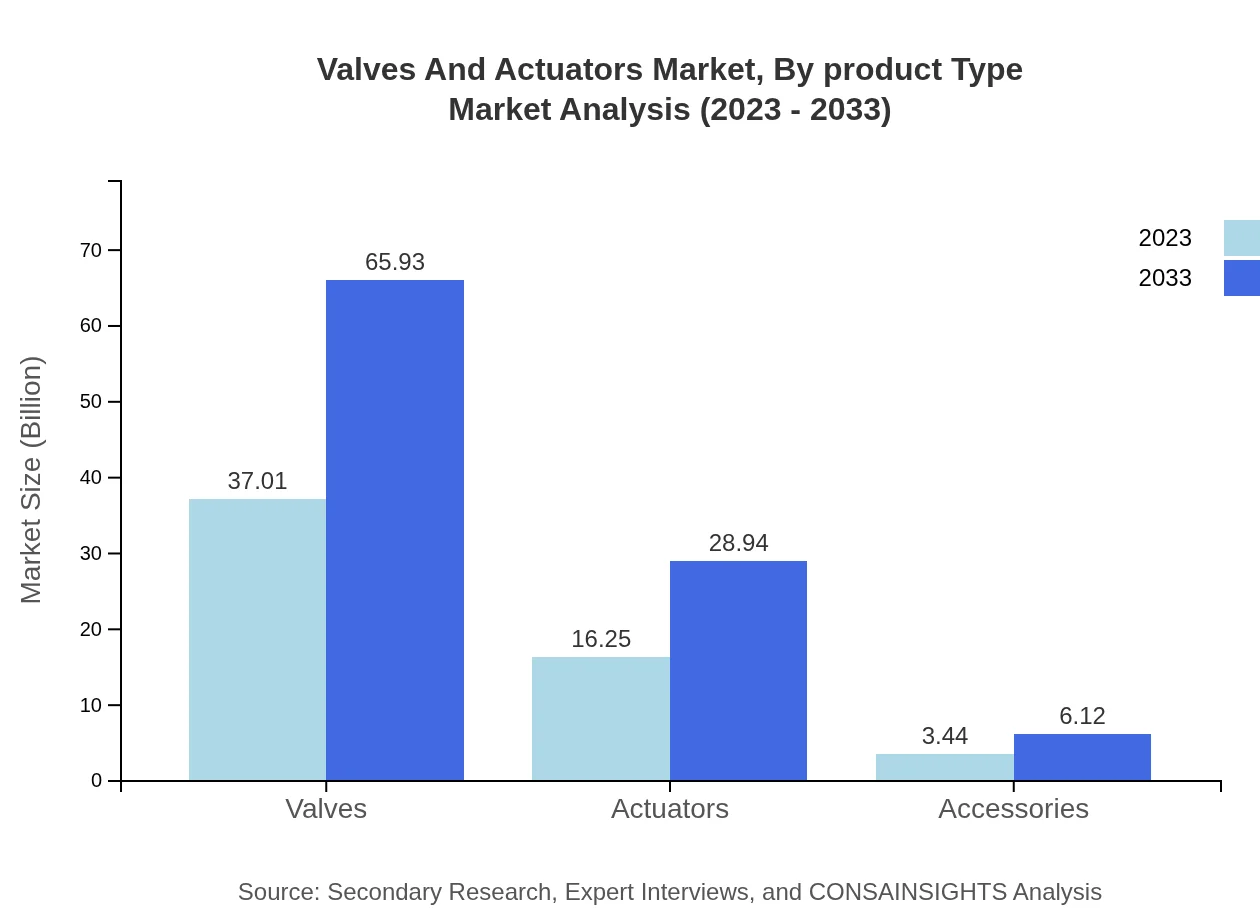

Valves And Actuators Market Analysis By Product Type

The Valves and Actuators market, by product type, is dominated by valves, expected to grow from $37.01 billion in 2023 to $65.93 billion by 2033, holding a share of 65.28%. Actuators follow, growing from $16.25 billion to $28.94 billion, with a steady share of 28.66%. Accessories account for the smallest segment, increasing from $3.44 billion to $6.12 billion.

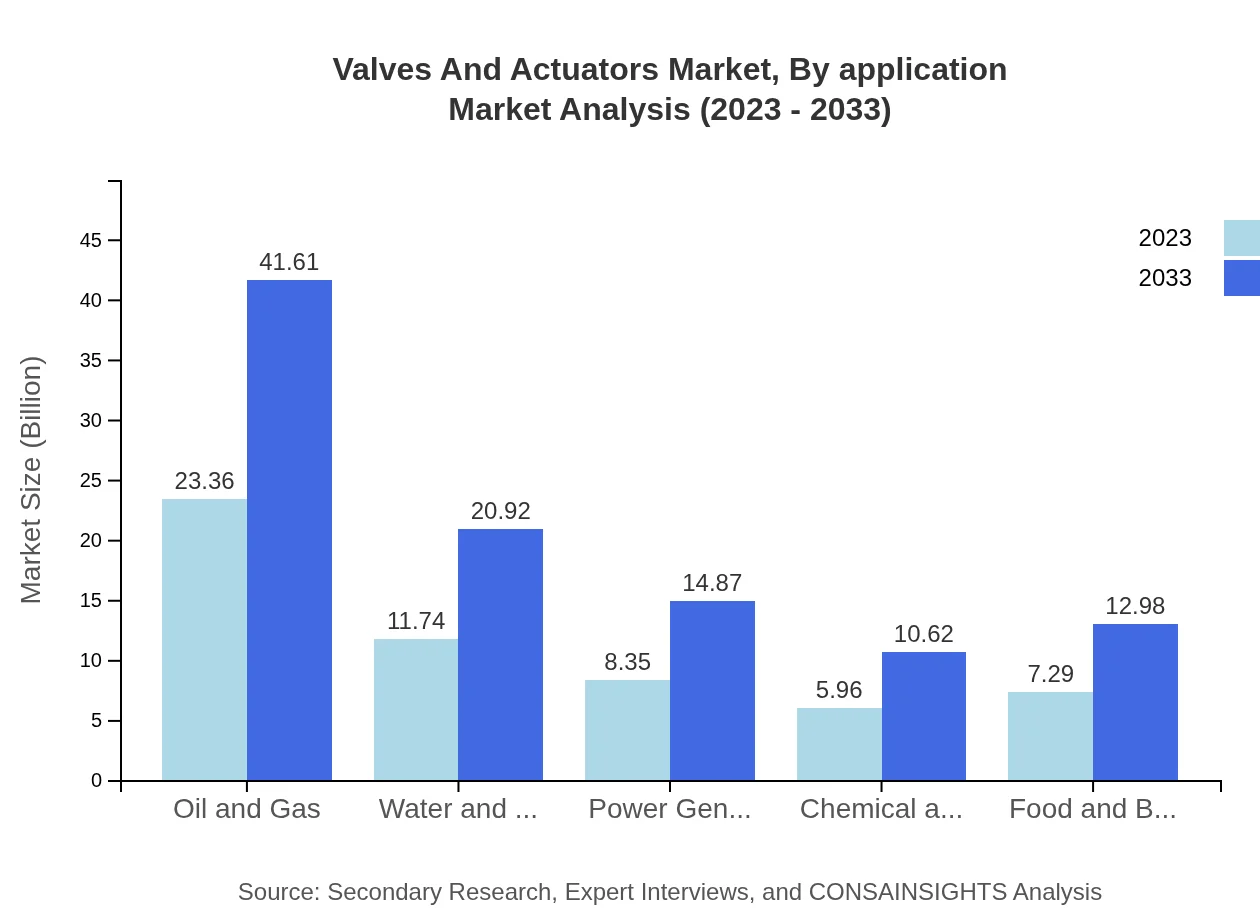

Valves And Actuators Market Analysis By Application

Within application segments, the oil and gas industry leads with a market size of $23.36 billion projected to reach $41.61 billion by 2033, reflecting a share of 41.2%. Other significant applications include water and wastewater management ($11.74 billion to $20.92 billion), and power generation ($8.35 billion to $14.87 billion), highlighting broad industrial reliance.

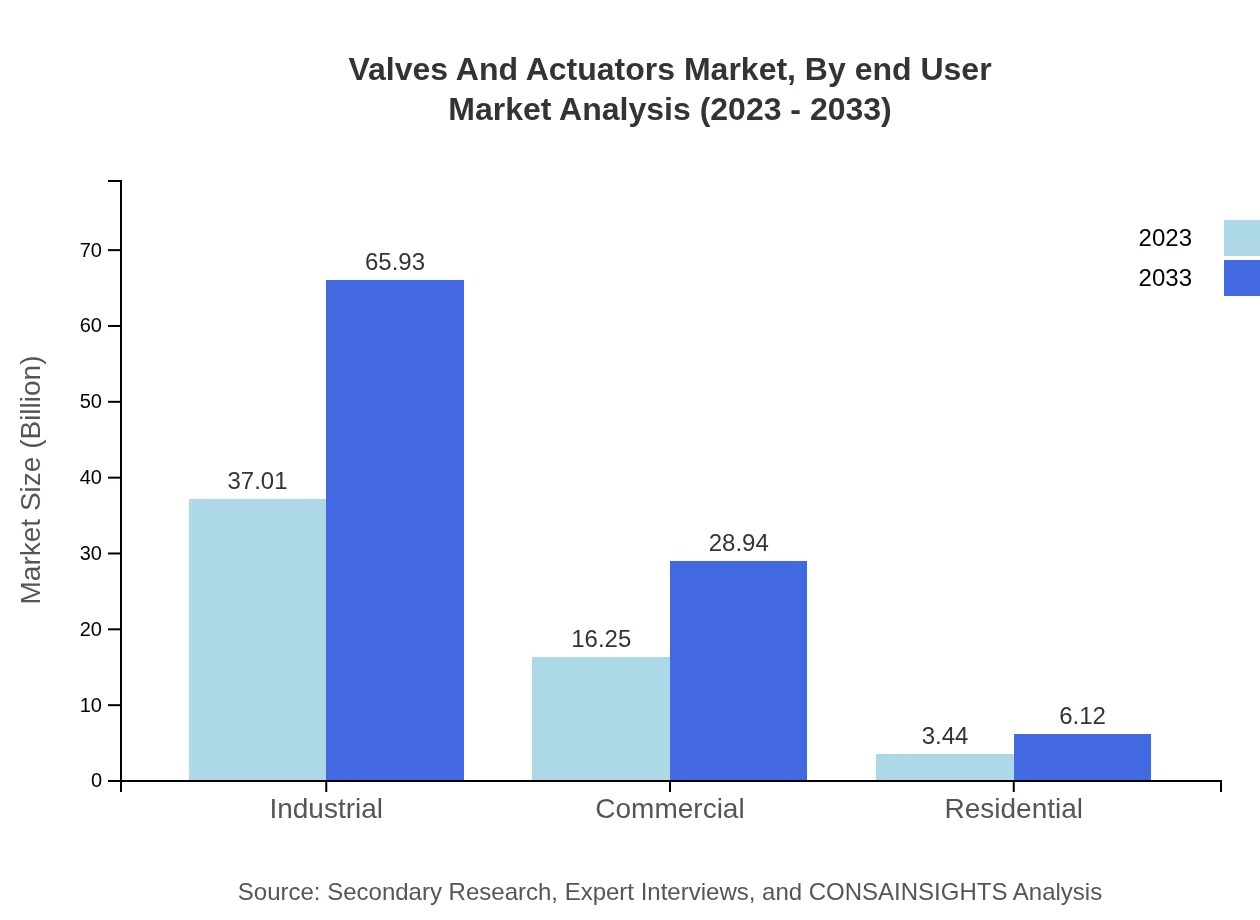

Valves And Actuators Market Analysis By End User

The industrial segment dominates the market with a size of $37.01 billion in 2023 and projected to grow to $65.93 billion, holding a steady share of 65.28%. The commercial sector follows with growth from $16.25 billion to $28.94 billion, and residential applications will increase from $3.44 billion to $6.12 billion.

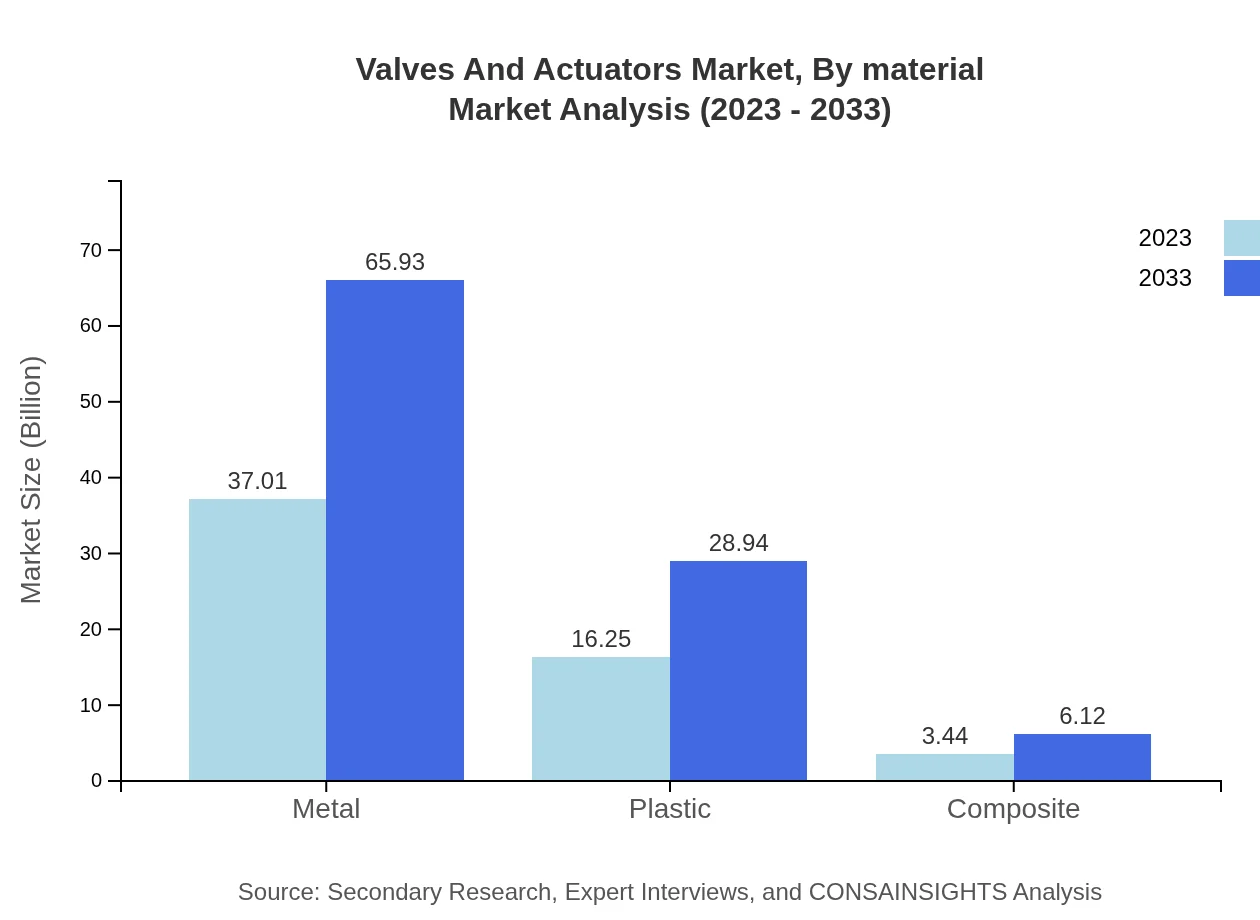

Valves And Actuators Market Analysis By Material

In terms of material, the metal segment is the most significant, projected to grow from $37.01 billion to $65.93 billion. Plastic valves and actuators, although smaller at $16.25 billion, are expected to reach $28.94 billion by 2033. Composite materials are also gaining traction, moving from $3.44 billion to $6.12 billion.

Valves And Actuators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Valves And Actuators Industry

Emerson Electric Co.:

A global leader in automation solutions, Emerson provides innovative technology solutions for various industries, including valves and actuators known for quality and reliability.Flowserve Corporation:

Flowserve specializes in fluid motion and control products, offering a range of valves and actuators tailored for various industrial applications with a focus on innovation and efficiency.Parker Hannifin Corporation:

Parker is a global leader in motion and control technologies, providing advanced valve and actuator solutions to enhance the operational efficiency of complex systems.Siemens AG:

Siemens is a worldwide engineering and technology company with a strong foothold in the valves and actuators market, focusing on automation and digitalization solutions.Valmet Corporation:

Valmet provides automation solutions and services for the pulp, paper, and energy industries, known for its quality valves and actuators that boost operational performance.We're grateful to work with incredible clients.

FAQs

What is the market size of valves and actuators?

The global valves and actuators market size was valued at $56.7 billion in 2023, with an expected CAGR of 5.8% from 2023 to 2033. The market is anticipated to grow significantly, driven by various industrial applications.

What are the key market players or companies in the valves and actuators industry?

Key players in the valves and actuators market include Emerson Electric Co., Flowserve Corporation, and Kitz Corporation. These companies dominate with innovative products and services, addressing various needs across sectors such as oil & gas, water treatment, and power generation.

What are the primary factors driving the growth in the valves and actuators industry?

Key drivers for the valves and actuators market growth include rising industrial automation, significant infrastructure developments, and increasing investments in oil & gas. Additionally, growing environmental concerns are pushing the demand for efficient and sustainable valve solutions.

Which region is the fastest Growing in the valves and actuators market?

The fastest-growing region in the valves and actuators market is North America, expecting to increase from $21.77 billion in 2023 to $38.78 billion by 2033. The region benefits from advanced technological adoption and a robust industrial base.

Does ConsaInsights provide customized market report data for the valves and actuators industry?

Yes, ConsaInsights offers tailored market reports for the valves and actuators industry. These reports cater to specific client needs, delivering insights into market trends, consumer behavior, competitive analysis, and growth forecasts.

What deliverables can I expect from this valves and actuators market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, growth forecasts, competitive landscape assessments, and regional insights. Each report is designed to assist stakeholders in making informed decisions and strategic planning.

What are the market trends of valves and actuators?

Current market trends include increasing adoption of smart valves and actuators, enhanced automation in manufacturing, and stringent regulations driving the demand for eco-friendly solutions. The focus on predictive maintenance further supports market growth in industrial applications.