Vanilla Bean Market Report

Published Date: 02 February 2026 | Report Code: vanilla-bean

Vanilla Bean Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Vanilla Bean market from 2023 to 2033, providing insights on market size, growth trends, industry analysis, and regional performances. It also covers product segmentation and key market players to give a comprehensive review of the market landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $4.41 Billion |

| Top Companies | Symrise AG, Givaudan SA, Firmenich SA, Vanilla Food Company |

| Last Modified Date | 02 February 2026 |

Vanilla Bean Market Overview

Customize Vanilla Bean Market Report market research report

- ✔ Get in-depth analysis of Vanilla Bean market size, growth, and forecasts.

- ✔ Understand Vanilla Bean's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vanilla Bean

What is the Market Size & CAGR of Vanilla Bean market in 2023?

Vanilla Bean Industry Analysis

Vanilla Bean Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vanilla Bean Market Analysis Report by Region

Europe Vanilla Bean Market Report:

The European market for Vanilla Beans is expected to grow from $0.68 billion in 2023 to $1.20 billion by 2033. Increasing demand for organic products and strict regulations on flavoring agents are steering the market towards natural vanilla sources.Asia Pacific Vanilla Bean Market Report:

The Asia Pacific region has shown promising growth in the Vanilla Bean market, with a projected size of $0.48 billion in 2023 and expected to reach $0.85 billion by 2033. Demand is driven by increasing disposable incomes and a growing inclination towards natural food products in China and India.North America Vanilla Bean Market Report:

North America demonstrates significant market potential, with a size of $0.84 billion in 2023, projected to increase to $1.49 billion by 2033. The market growth is propelled by advancements in food technology and a strong consumer preference for natural flavors.South America Vanilla Bean Market Report:

In South America, the Vanilla Bean market was valued at $0.16 billion in 2023, expected to grow to $0.29 billion by 2033. Factors like the rise in culinary tourism and an increase in the popularity of gourmet products are boosting market potential.Middle East & Africa Vanilla Bean Market Report:

The Middle East and Africa region currently has a Vanilla Bean market size of $0.34 billion in 2023 with an anticipated growth to $0.59 billion by 2033. Emerging trends in gourmet food production and rising health consciousness are driving the market forward.Tell us your focus area and get a customized research report.

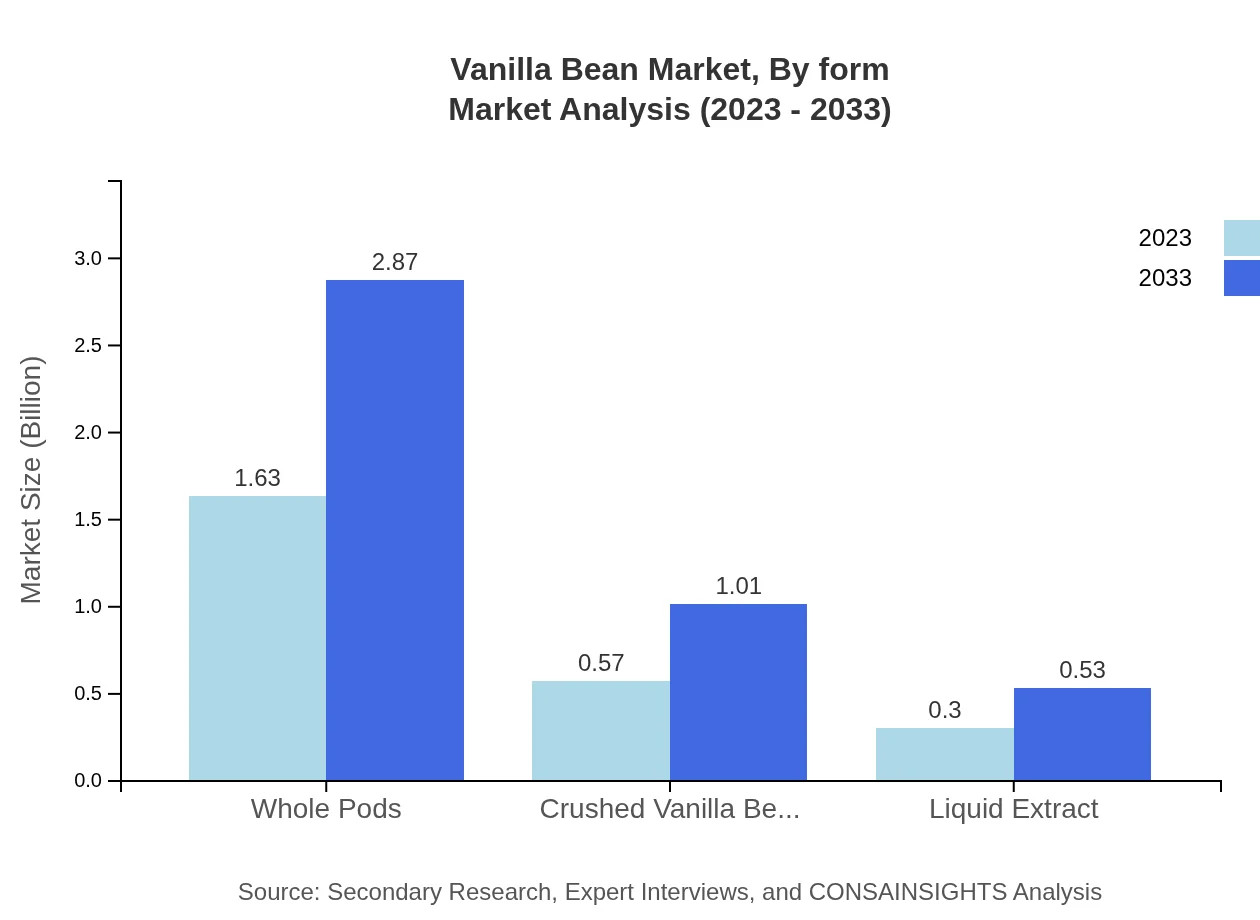

Vanilla Bean Market Analysis By Product Type

The Whole Pods segment is leading the Vanilla Bean market with a size of $1.63 billion in 2023, growing to $2.87 billion by 2033, capturing 65.15% market share. Crushed Vanilla Beans follow with a market size of $0.57 billion in 2023, expected to reach $1.01 billion by 2033, holding a share of 22.81%. Liquid Extracts contribute to the sector, with a size of $0.30 billion in 2023 forecasted to grow to $0.53 billion by 2033, accounting for 12.04% share.

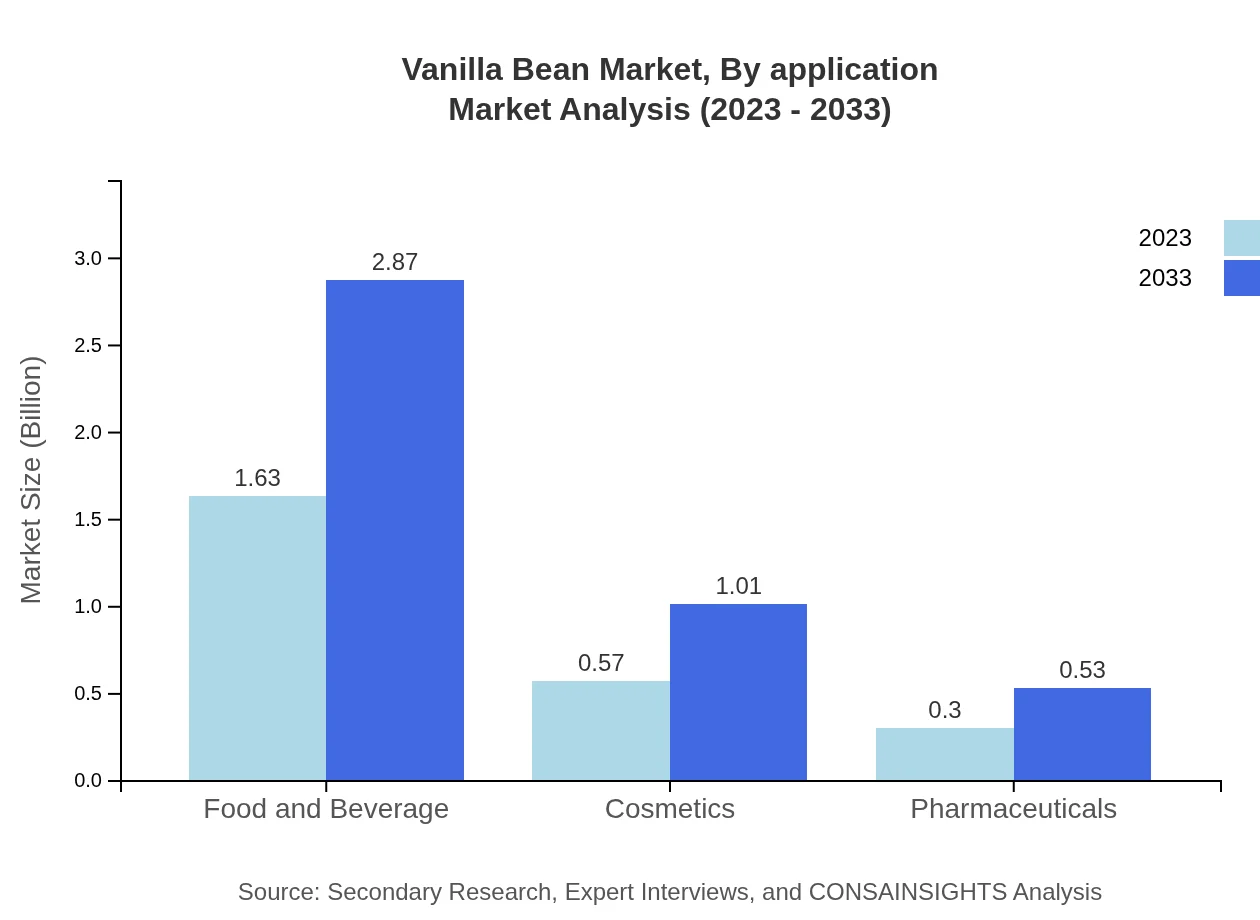

Vanilla Bean Market Analysis By Application

In application segments, Food and Beverage takes the lead, valued at $1.63 billion in 2023, projected to grow to $2.87 billion by 2033, representing 65.15% of the market share. Cosmetics applications follow closely at $0.57 billion, expected to reach $1.01 billion by 2033 with a share of 22.81%. Pharmaceuticals are forecasted to grow from $0.30 billion in 2023 to $0.53 billion by 2033, capturing 12.04% of the market.

Vanilla Bean Market Analysis By Source

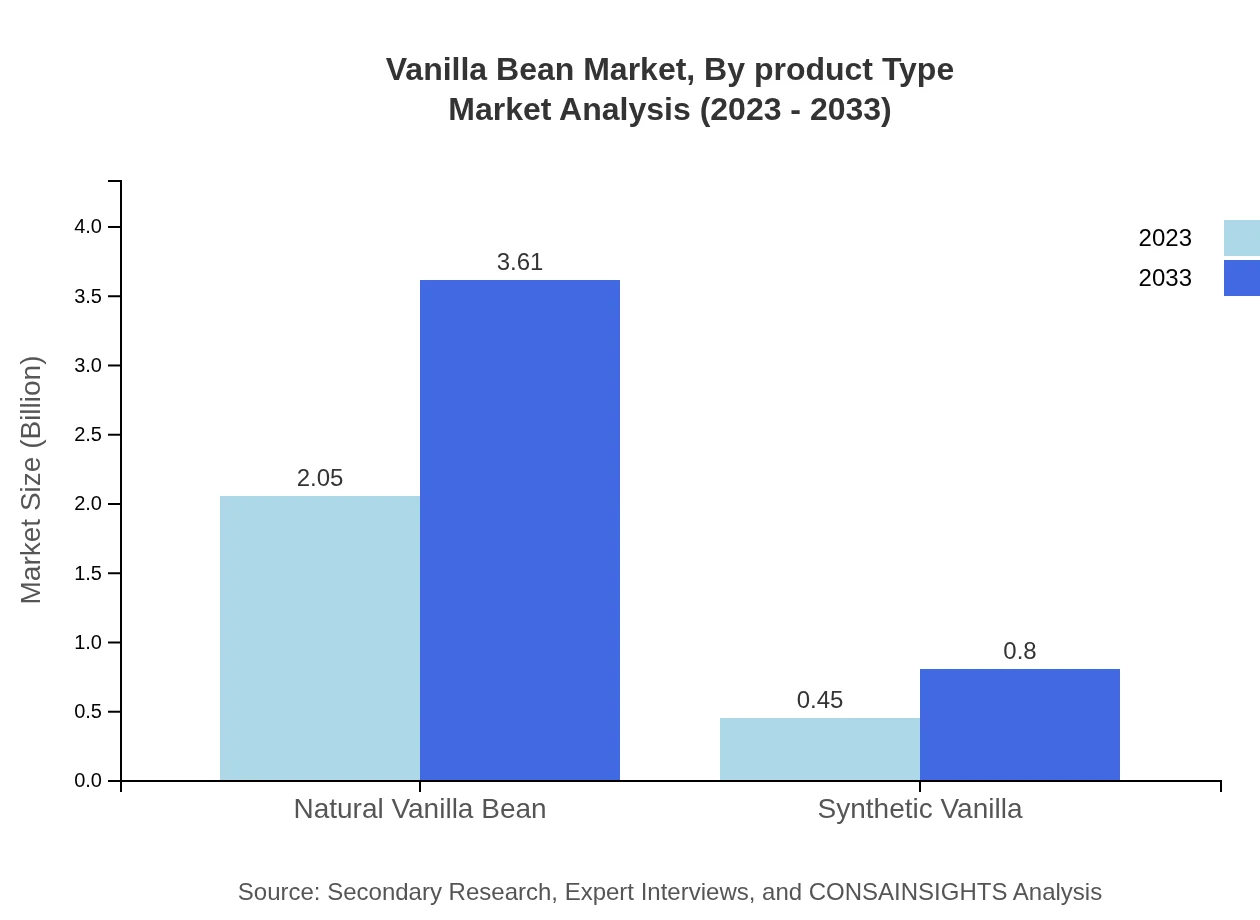

Natural Vanilla Beans dominate the market with a size of $2.05 billion in 2023, expected to grow to $3.61 billion by 2033, capturing 81.95% of the total market share. In contrast, Synthetic Vanilla holds a smaller proportion at $0.45 billion in 2023, anticipated to reach $0.80 billion by 2033, comprising 18.05% of the share.

Vanilla Bean Market Analysis By Form

The Vanilla Bean market reflects versatile product forms catering to various consumer needs. Whole Pods lead the market, seen as the premium choice, while crushed vanilla beans offer convenience for baked goods. Liquid extracts remain popular due to their ease of use in beverage applications.

Vanilla Bean Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vanilla Bean Industry

Symrise AG:

A leading company in global flavor and fragrance marketing known for its sustainable sourcing of natural ingredients, including vanilla.Givaudan SA:

This Swiss company is recognized for its innovative flavor solutions and strong commitment to sustainable vanilla sourcing.Firmenich SA:

A prominent player known for its efforts in innovation and sustainability in the vanilla supply chain.Vanilla Food Company:

Specializes in high-quality gourmet vanilla products sourced from around the world, focusing on organic and ethical practices.We're grateful to work with incredible clients.

FAQs

What is the market size of vanilla Bean?

The global vanilla bean market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.7% leading up to 2033. This expanding market reflects growing consumer demand across various sectors, primarily in food and beverages.

What are the key market players or companies in this vanilla Bean industry?

Key players in the vanilla bean industry include Pure Vanilla, Nielsen-Massey, and Heilala Vanilla. These companies are well-known for their quality offerings and commitment to sustainable sourcing practices, essential for maintaining a robust market presence.

What are the primary factors driving the growth in the vanilla bean industry?

Growth in the vanilla bean industry is driven by increasing demand for natural flavors, particularly in food and beverages. Additionally, trends towards organic and non-GMO products have led to greater interest in real vanilla bean, enhancing its market appeal.

Which region is the fastest Growing in the vanilla bean?

North America is the fastest-growing region for vanilla beans, set to rise from $0.84 billion in 2023 to $1.49 billion by 2033. This growth is spurred by heightened consumer awareness of flavor quality and the trend towards artisanal products.

Does ConsaInsights provide customized market report data for the vanilla bean industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the vanilla bean industry. These reports can include detailed analysis and forecasts to align with unique business strategies and objectives.

What deliverables can I expect from this vanilla bean market research project?

Expect comprehensive deliverables from the vanilla bean market research project, including detailed market analysis, segmentation reports, and growth forecasts to support strategic decision-making for stakeholders and industry players.

What are the market trends of vanilla bean?

Current trends in the vanilla bean market include a shift towards premiumization, with a growing preference for natural over synthetic vanilla. The market is also responding to sustainability trends, focusing on ethical sourcing practices and organic product availability.