Vanilla Market Report

Published Date: 31 January 2026 | Report Code: vanilla

Vanilla Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the vanilla market from 2023 to 2033, including market size, growth projections, and regional insights, helping stakeholders make informed decisions.

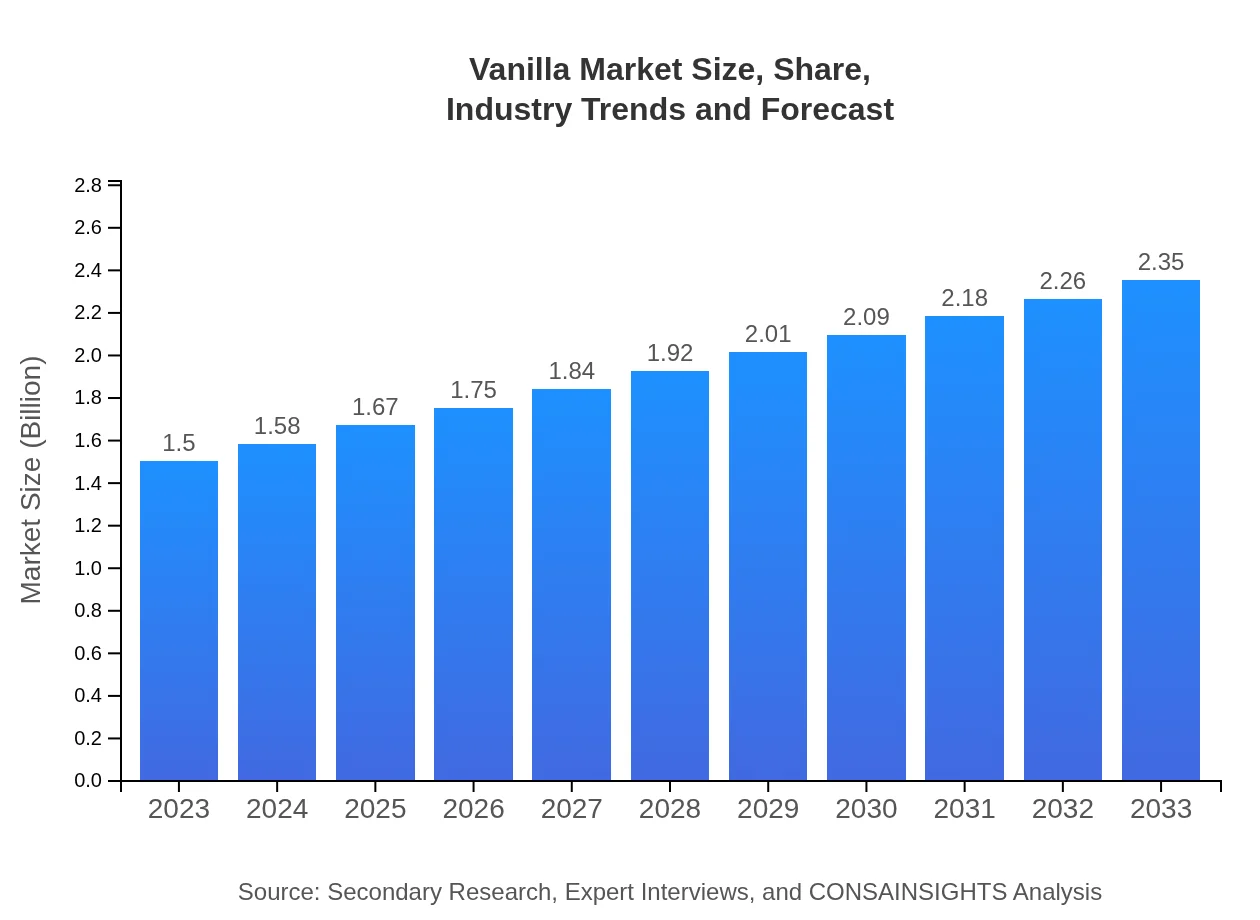

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $2.35 Billion |

| Top Companies | Vanilla Food Company, Sambavanam Naturals, Agro Products and Agencies |

| Last Modified Date | 31 January 2026 |

Vanilla Market Overview

Customize Vanilla Market Report market research report

- ✔ Get in-depth analysis of Vanilla market size, growth, and forecasts.

- ✔ Understand Vanilla's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vanilla

What is the Market Size & CAGR of Vanilla market in 2023?

Vanilla Industry Analysis

Vanilla Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vanilla Market Analysis Report by Region

Europe Vanilla Market Report:

Europe, with a market size of $0.43 billion in 2023 expected to grow to $0.68 billion by 2033, is characterized by a high demand for premium vanilla products mainly driven by the confectionery and baking industries.Asia Pacific Vanilla Market Report:

In the Asia Pacific region, the vanilla market is expected to grow from $0.27 billion in 2023 to $0.43 billion in 2033. Rising disposable incomes and changing dietary patterns fuel demand for flavored foods and beverages.North America Vanilla Market Report:

North America leads the market with a growth projection from $0.58 billion in 2023 to $0.90 billion in 2033. The demand is driven largely by the food and beverage sectors, where vanilla is a staple flavoring agent in both retail and gourmet cooking.South America Vanilla Market Report:

The South American vanilla market, albeit smaller, is projected to grow from $0.04 billion in 2023 to $0.07 billion in 2033. Influenced by trends in organic farming and increased interest in gourmet cooking, this region’s consumption of vanilla is set to rise.Middle East & Africa Vanilla Market Report:

The Middle East and Africa region's vanilla market is anticipated to grow from $0.18 billion in 2023 to $0.28 billion in 2033. Demand is growing due to the increasing popularity of global cuisines and gourmet cooking among the affluent population.Tell us your focus area and get a customized research report.

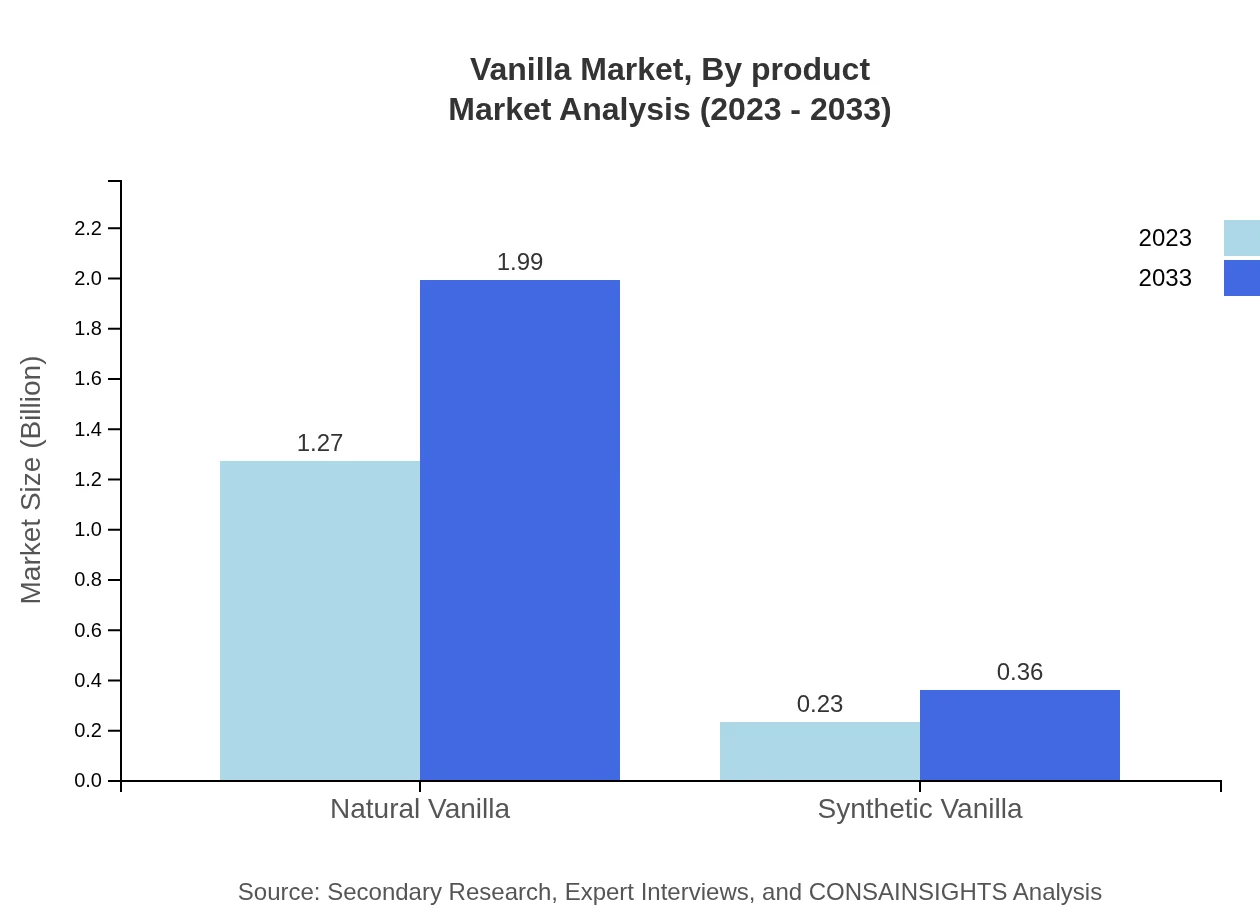

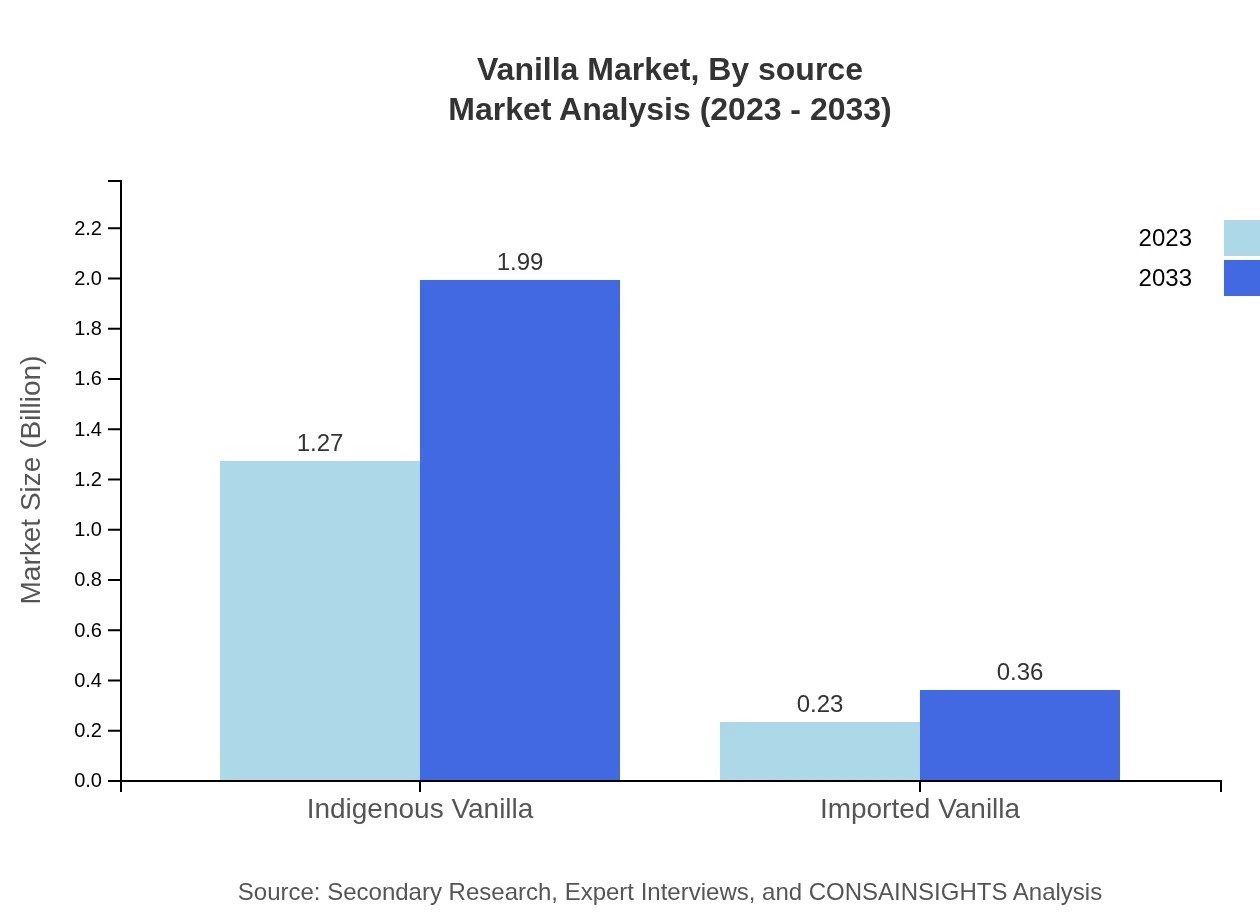

Vanilla Market Analysis By Product

The vanilla market segment reports significant variance in performance across product types. Natural vanilla leads the segment, with market size expanding from $1.27 billion in 2023 to $1.99 billion in 2033, reflecting its 84.55% market share. Synthetic vanilla, while smaller at $0.23 billion in 2023, is also projected to grow steadily, indicating a niche market preference.

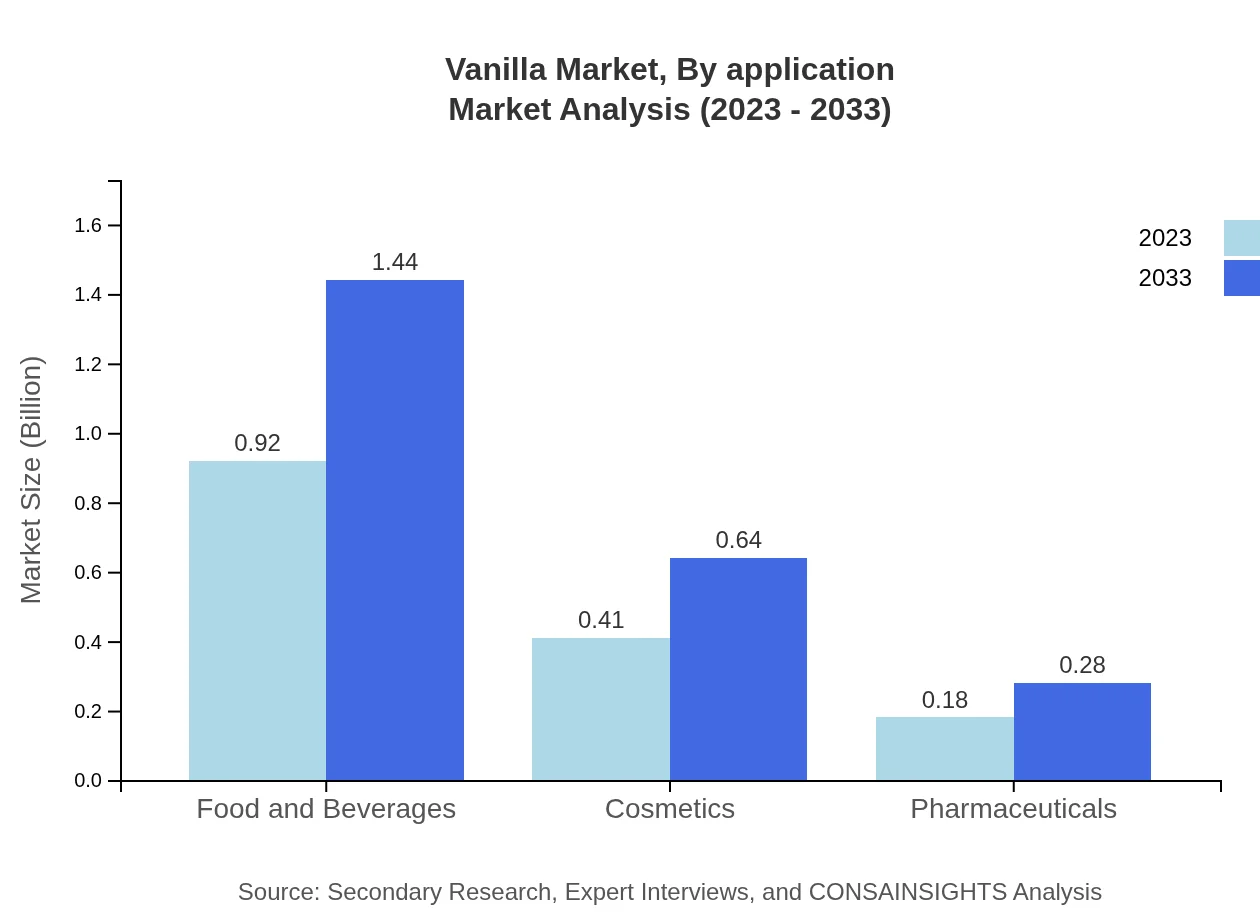

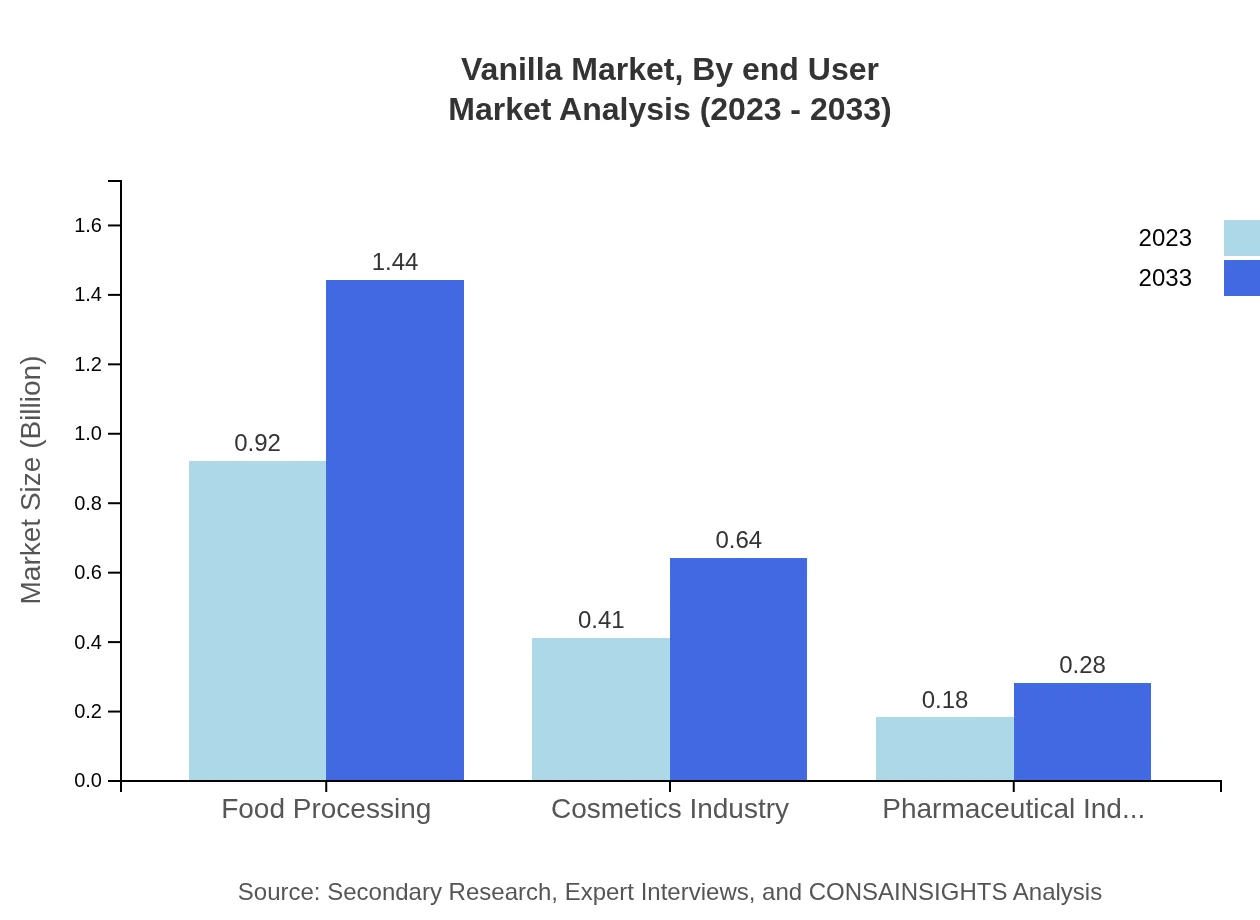

Vanilla Market Analysis By Application

The food processing industry holds the largest share of the vanilla market, with revenue expected to rise from $0.92 billion in 2023 to $1.44 billion in 2033. This segment constitutes over 60% of the total market share, driven by vanilla's integration in both commercial and artisanal culinary products.

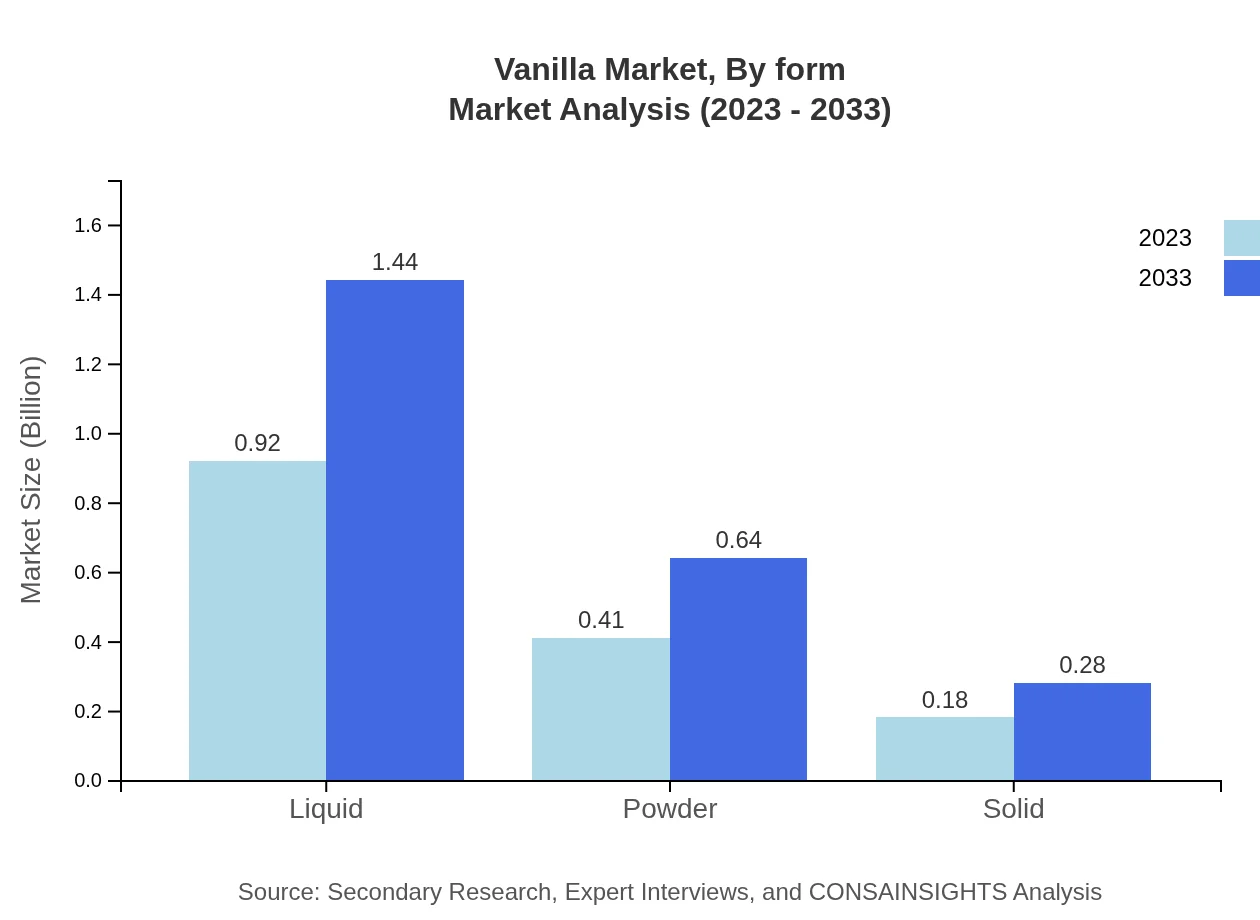

Vanilla Market Analysis By Form

In terms of form, liquid vanilla dominates the market with a projected size of $0.92 billion in 2023, increasing to $1.44 billion by 2033. Powdered vanilla is also notable, with growth from $0.41 billion to $0.64 billion over the same period.

Vanilla Market Analysis By End User

Across end-users, the food and beverage sector remains the largest consumer of vanilla, accounting for over 60% of sales. In contrast to this, the cosmetics industry represents approximately 27.18% of the market, highlighting a growing trend towards natural fragrances in beauty products.

Vanilla Market Analysis By Source

A detailed breakdown of sources indicates indigenous vanilla as the dominant source, correlating to increasing consumer demand for authenticity, accounting for a market share of 84.55% in 2023. Imported vanilla sources continue to play a crucial role, especially in regions with limited local production capabilities.

Vanilla Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vanilla Industry

Vanilla Food Company:

A leading producer of natural vanilla extracts with a commitment to sustainable and ethical sourcing practices.Sambavanam Naturals:

Specializes in organic vanilla products and innovations in extraction processes, aiming to cater to health-conscious consumers.Agro Products and Agencies:

An established player in the vanilla market, known for its supply chain efficiency and broad product range covering both food and cosmetic segments.We're grateful to work with incredible clients.

FAQs

What is the market size of vanilla?

The global vanilla market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 4.5% from 2023 to 2033. This growth is indicative of the increasing demand for vanilla and its diverse applications in various industries.

What are the key market players or companies in the vanilla industry?

Key players in the vanilla market include major producers and suppliers such as Nielsen-Massey Vanillas, Tahiti Vanilla Bean, and other agricultural firms. These companies lead through quality, innovation, and strategic partnerships in the vanilla supply chain.

What are the primary factors driving the growth in the vanilla industry?

The growth in the vanilla industry is primarily driven by the rising demand for natural flavorings in food and beverages, increased consumer preference for organic products, and expanding applications in the cosmetics and pharmaceutical sectors.

Which region is the fastest Growing in the vanilla market?

Asia Pacific is the fastest-growing region for the vanilla market, with a growth from $0.27 billion in 2023 to $0.43 billion by 2033. Europe's market is also growing, reaching $0.68 billion by 2033, but not as rapidly as Asia Pacific.

Does ConsaInsights provide customized market report data for the vanilla industry?

Yes, ConsaInsights offers customized market report data tailored to client requirements in the vanilla industry. This service allows for specific insights related to market segments, trends, and regional performances, enhancing decision-making.

What deliverables can I expect from this vanilla market research project?

From the vanilla market research project, expect comprehensive reports including market size analysis, forecast data, competitive landscape, segmentation insights, and regional breakdown, facilitating a strategic understanding of the vanilla market.

What are the market trends of vanilla?

Current market trends in vanilla include a surge in demand for sustainable sourcing, growth in natural vanilla over synthetic options, and innovations in product application across food, cosmetics, and pharmaceuticals. Adaptations in consumer preferences significantly influence these trends.