Vanillin Market Report

Published Date: 31 January 2026 | Report Code: vanillin

Vanillin Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Vanillin market from 2023 to 2033, including insights on market size, growth, trends, and competitive landscape, focusing on forecasts and significant developments within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Symrise AG, Firmenich SA, International Flavors & Fragrances Inc., Givaudan SA |

| Last Modified Date | 31 January 2026 |

Vanillin Market Overview

Customize Vanillin Market Report market research report

- ✔ Get in-depth analysis of Vanillin market size, growth, and forecasts.

- ✔ Understand Vanillin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vanillin

What is the Market Size & CAGR of Vanillin market in 2023?

Vanillin Industry Analysis

Vanillin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vanillin Market Analysis Report by Region

Europe Vanillin Market Report:

The European vanillin market was valued at USD 25.59 million in 2023, forecasted to reach USD 42.12 million by 2033. The region's strong growth is attributed to the sophisticated food industry, where quality and flavor integrity is crucial. Countries such as France and Germany are significant contributors due to their dominance in the packaged food and beverages market.Asia Pacific Vanillin Market Report:

The Asia Pacific vanillin market was valued at USD 20.61 million in 2023, anticipated to reach USD 33.92 million by 2033, propelled by burgeoning urbanization and increased consumer spending on food and beverages. Countries like China and India are leading in growth due to expanding food processing industries and growing disposable income among consumers.North America Vanillin Market Report:

In North America, the vanillin market is set to rise from USD 32.96 million in 2023 to USD 54.24 million by 2033. The market's growth is driven by high demand from the food and beverages sector, including the bakery and confectionery industries, and an increasing trend towards natural vanillin due to health consciousness among consumers.South America Vanillin Market Report:

In South America, the market for vanillin is projected to grow from USD 9.23 million in 2023 to USD 15.19 million by 2033. This growth is primary due to the rising consumption of processed foods and beverages, particularly in Brazil and Argentina, where there is a growing trend towards natural flavoring agents.Middle East & Africa Vanillin Market Report:

In the Middle East and Africa, the vanillin market is expected to grow from USD 11.61 million in 2023 to USD 19.11 million by 2033. The increasing demand for flavoring agents in the food industry, coupled with the growing cosmetics sector, are primary drivers of market growth in this region.Tell us your focus area and get a customized research report.

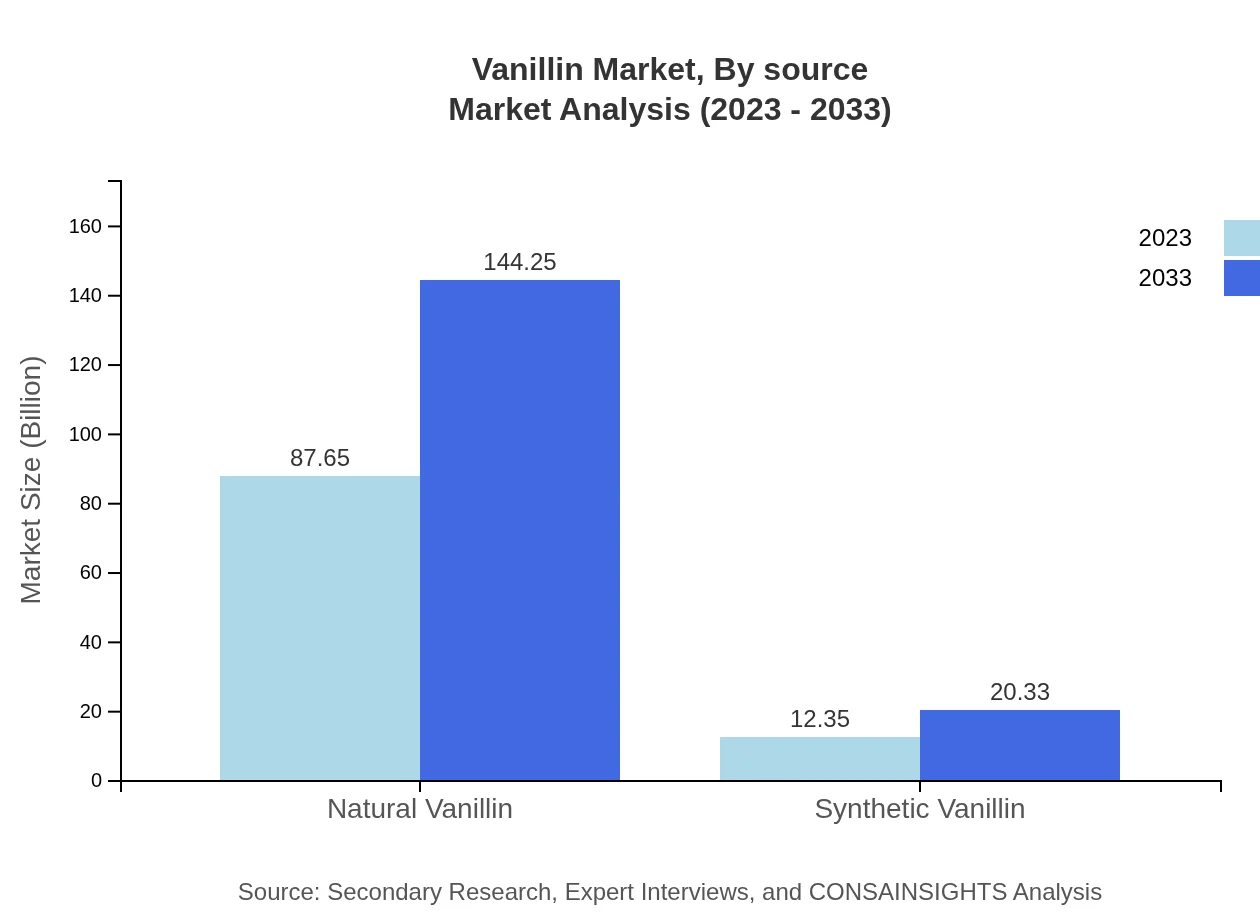

Vanillin Market Analysis By Source

The vanillin market segment by source is bifurcated into natural and synthetic vanillin. The natural vanillin segment holds a significant share due to the rising trend among consumers for natural ingredients. In 2023, the market share of natural vanillin reached USD 87.65 million and is projected to grow to USD 144.25 million by 2033. Synthetic vanillin, while accounting for a smaller portion (USD 12.35 million in 2023 to USD 20.33 million by 2033), maintains a stable demand, particularly in cost-sensitive applications.

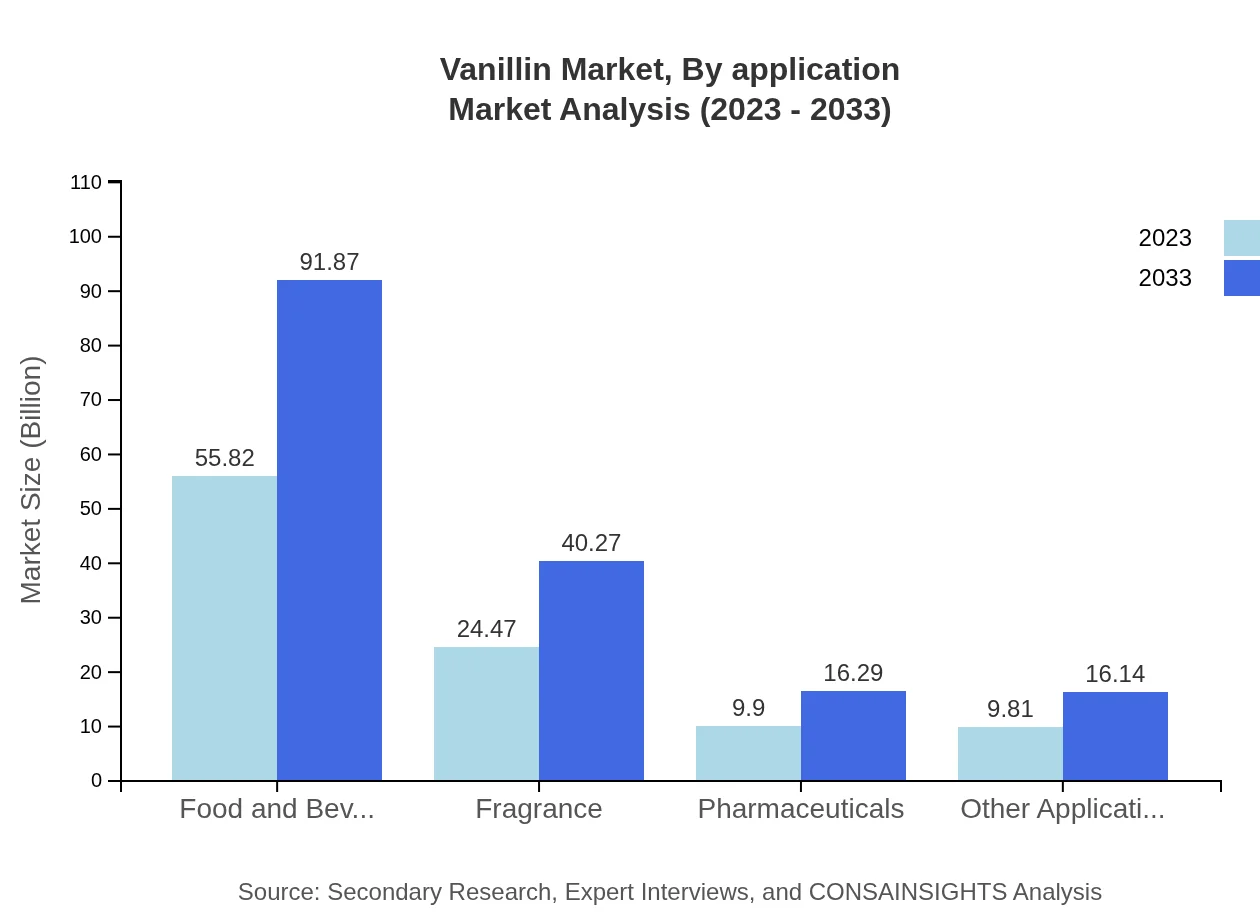

Vanillin Market Analysis By Application

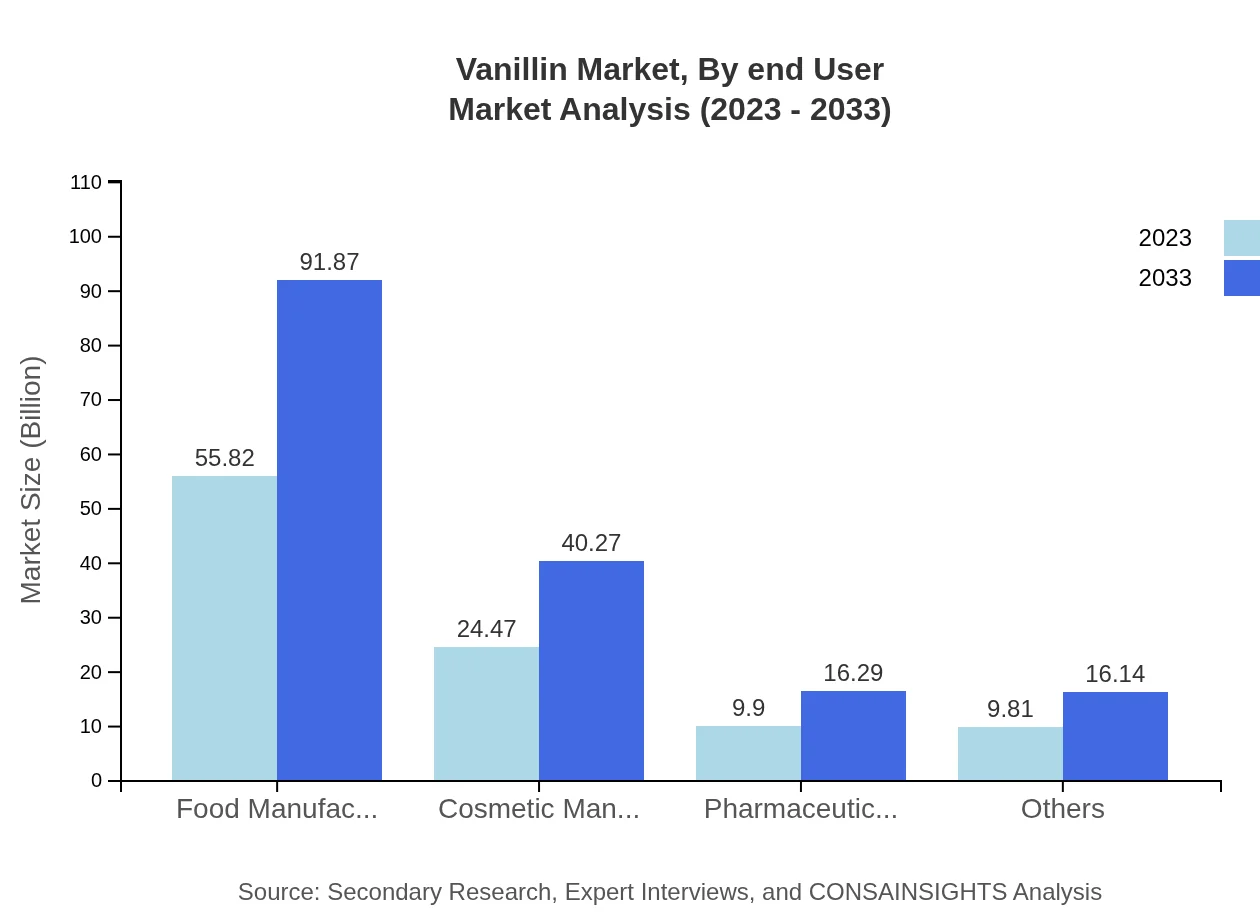

The market is also segmented by application, where food and beverages hold the largest share at USD 55.82 million in 2023 and projected to reach USD 91.87 million by 2033. Cosmetic manufacturers have a significant footprint in the market as well, expanding from USD 24.47 million in 2023 to USD 40.27 million in 2033. Meanwhile, the pharmaceutical sector is growing steadily with a rise from USD 9.90 million to USD 16.29 million.

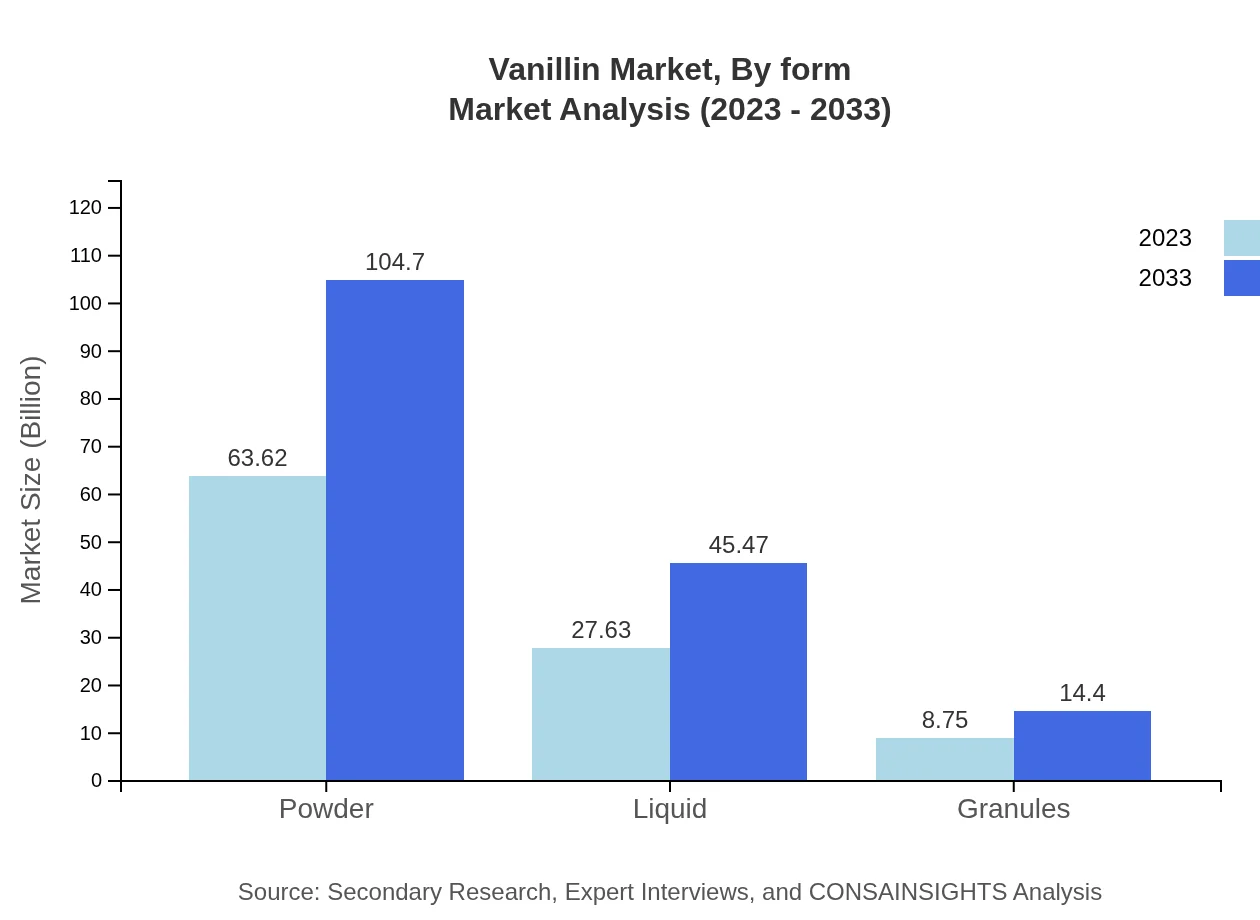

Vanillin Market Analysis By Form

The by-form segmentation highlights powder, liquid, and granule forms of vanillin. The powdered form of vanillin leads the market with an estimate of USD 63.62 million in 2023, expected to grow to USD 104.70 million by 2033. The liquid and granules forms, while smaller in shares, are also witnessing growth, reaching USD 45.47 million and USD 14.40 million respectively by 2033.

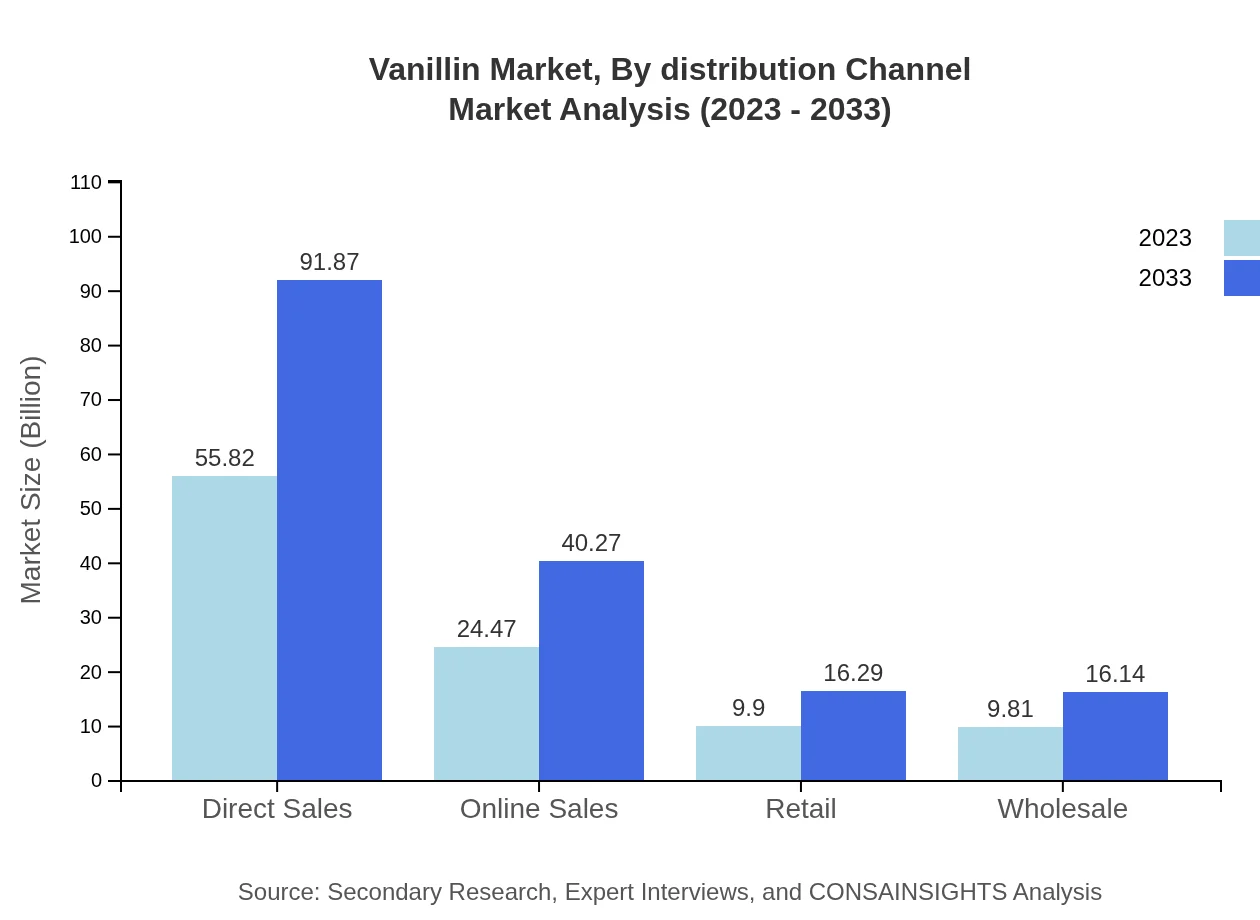

Vanillin Market Analysis By Distribution Channel

The distribution channels include direct sales, online sales, retail, and wholesale. Direct sales are expected to dominate the market with a value increase from USD 55.82 million in 2023 to USD 91.87 million by 2033, whereas online sales grow from USD 24.47 million to USD 40.27 million over the same period, reflecting a shift in consumer purchasing behavior.

Vanillin Market Analysis By End User

The end-user segmentation shows that food manufacturers consume the most vanillin, projected to grow from USD 55.82 million to USD 91.87 million. Cosmetic manufacturers and pharmaceuticals exhibit strong growth trends too, confirming the versatility of vanillin across different industries.

Vanillin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vanillin Industry

Symrise AG:

A leading global supplier of fragrance and flavor solutions, providing natural and synthetic vanillin to various sectors worldwide.Firmenich SA:

Top player in the flavor and fragrance market, produces both natural and synthetic vanillin, known for its innovative solutions and high-quality standards.International Flavors & Fragrances Inc.:

A major player in the global flavors and fragrances industry, offers an extensive portfolio including vanillin to enhance food products.Givaudan SA:

A Swiss multinational company known for creating flavors, fragrances, and active cosmetic ingredients, including vanillin among its unique offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of vanillin?

The vanillin market is estimated at $100 million in 2023, with a projected CAGR of 5%. By 2033, the market size is expected to grow significantly, reflecting the increasing demand for this flavor and fragrance compound.

What are the key market players or companies in the vanillin industry?

Key players in the vanillin market include major producers and suppliers such as Solvay, Advanced Biochemicals, and others focused on both natural and synthetic vanillin. Together, these companies drive innovation and address market demand across various sectors.

What are the primary factors driving the growth in the vanillin industry?

Growth in the vanillin industry is primarily driven by rising demand in food and beverage sectors, increasing consumer preference for natural flavors, and the expansion of the cosmetic and pharmaceutical applications, all contributing to a robust market expansion.

Which region is the fastest Growing in the vanillin market?

The Asia Pacific region is expected to be the fastest-growing market for vanillin, with growth from $20.61 million in 2023 to $33.92 million by 2033. This growth is supported by rising consumption in food and beverages.

Does ConsaInsights provide customized market report data for the vanillin industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the vanillin industry. Clients can request detailed insights that cover market dynamics, trends, and projections based on unique parameters.

What deliverables can I expect from this vanillin market research project?

Deliverables from the vanillin market research project include comprehensive market reports, segmented analysis, competitive landscape reviews, and detailed projections for specific regions and product types to aid strategic decision-making.

What are the market trends of vanillin?

Current market trends in vanillin include the shift towards natural ingredients, increased use in premium products, and rising e-commerce sales channels. These trends highlight the evolving landscape and potential growth opportunities within the sector.