Vascular Access Devices Market Report

Published Date: 31 January 2026 | Report Code: vascular-access-devices

Vascular Access Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vascular Access Devices market, including detailed insights into market size, growth rates, trends, and forecasts for the years 2023 to 2033.

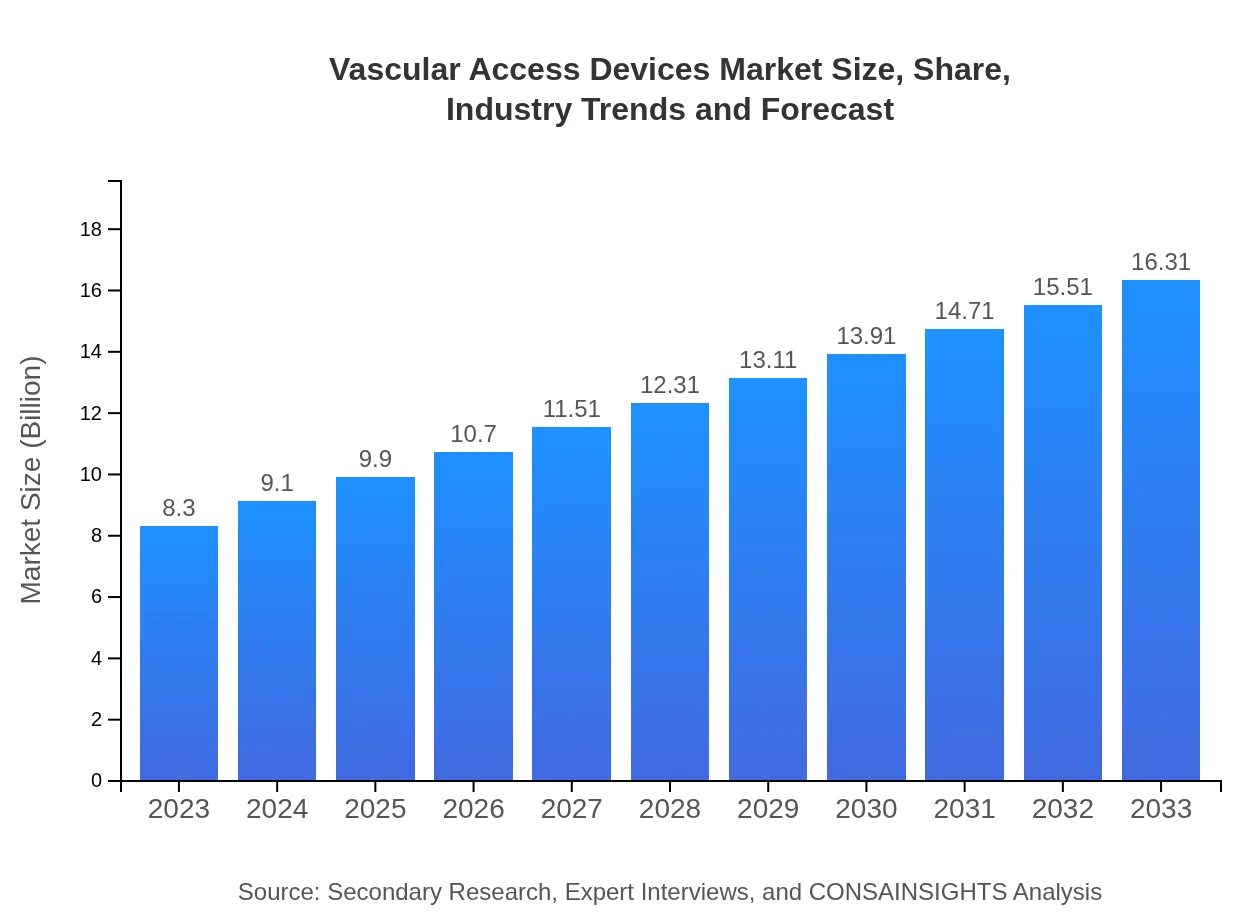

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.31 Billion |

| Top Companies | Becton, Dickinson and Company (BD), Medtronic , Smiths Medical, Teleflex Incorporated, Boston Scientific |

| Last Modified Date | 31 January 2026 |

Vascular Access Devices Market Overview

Customize Vascular Access Devices Market Report market research report

- ✔ Get in-depth analysis of Vascular Access Devices market size, growth, and forecasts.

- ✔ Understand Vascular Access Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vascular Access Devices

What is the Market Size & CAGR of Vascular Access Devices market in 2023 and 2033?

Vascular Access Devices Industry Analysis

Vascular Access Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vascular Access Devices Market Analysis Report by Region

Europe Vascular Access Devices Market Report:

Europe’s market will expand from $2.11 billion in 2023 to $4.15 billion by 2033, fueled by rising investments in healthcare innovation and strong regulatory support for new device technologies.Asia Pacific Vascular Access Devices Market Report:

The Asia Pacific region is emerging rapidly, with a market size expected to grow from $1.62 billion in 2023 to $3.18 billion by 2033. Factors contributing to this growth include increased healthcare spending, a burgeoning patient population, and expanding hospital infrastructure.North America Vascular Access Devices Market Report:

North America remains the largest market for Vascular Access Devices, projected to grow from $2.99 billion in 2023 to $5.88 billion by 2033. The region benefits from advanced healthcare infrastructure, high demand for novel medical devices, and a concentration of key industry players.South America Vascular Access Devices Market Report:

South America’s market, although relatively smaller, is poised for growth from $0.59 billion in 2023 to $1.16 billion by 2033, driven by an increase in healthcare accessibility and awareness of vascular access technologies across the region.Middle East & Africa Vascular Access Devices Market Report:

The Middle East and Africa market is expected to grow from $0.98 billion in 2023 to $1.93 billion by 2033, influenced by rising healthcare investments and the growing prevalence of chronic diseases.Tell us your focus area and get a customized research report.

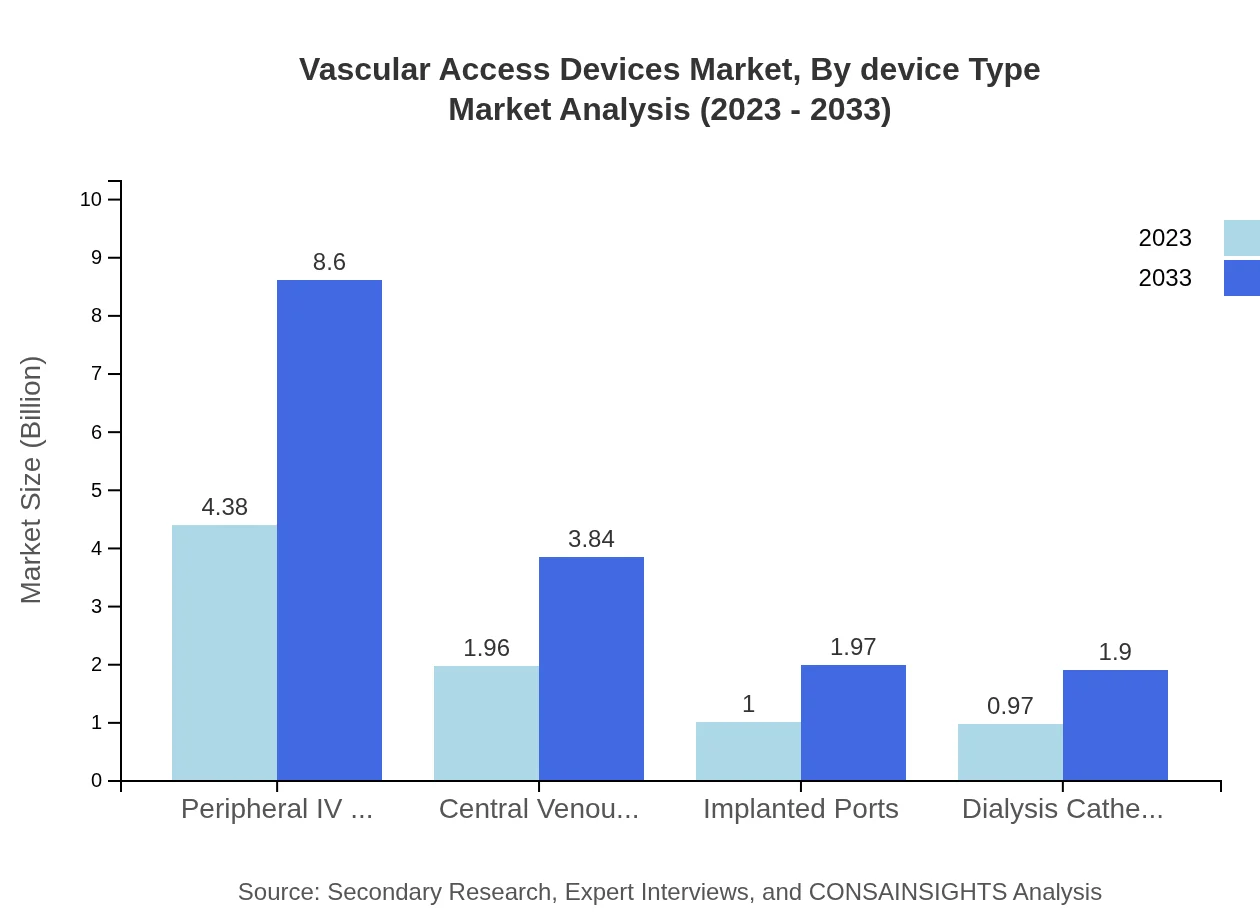

Vascular Access Devices Market Analysis By Device Type

The device types within the Vascular Access Devices market include Peripheral IV Catheters, Central Venous Catheters, and Implanted Ports. Peripheral IV catheters dominate the market with a size of $4.38 billion in 2023 expected to double to $8.60 billion by 2033, reflecting its widespread usage in healthcare facilities.

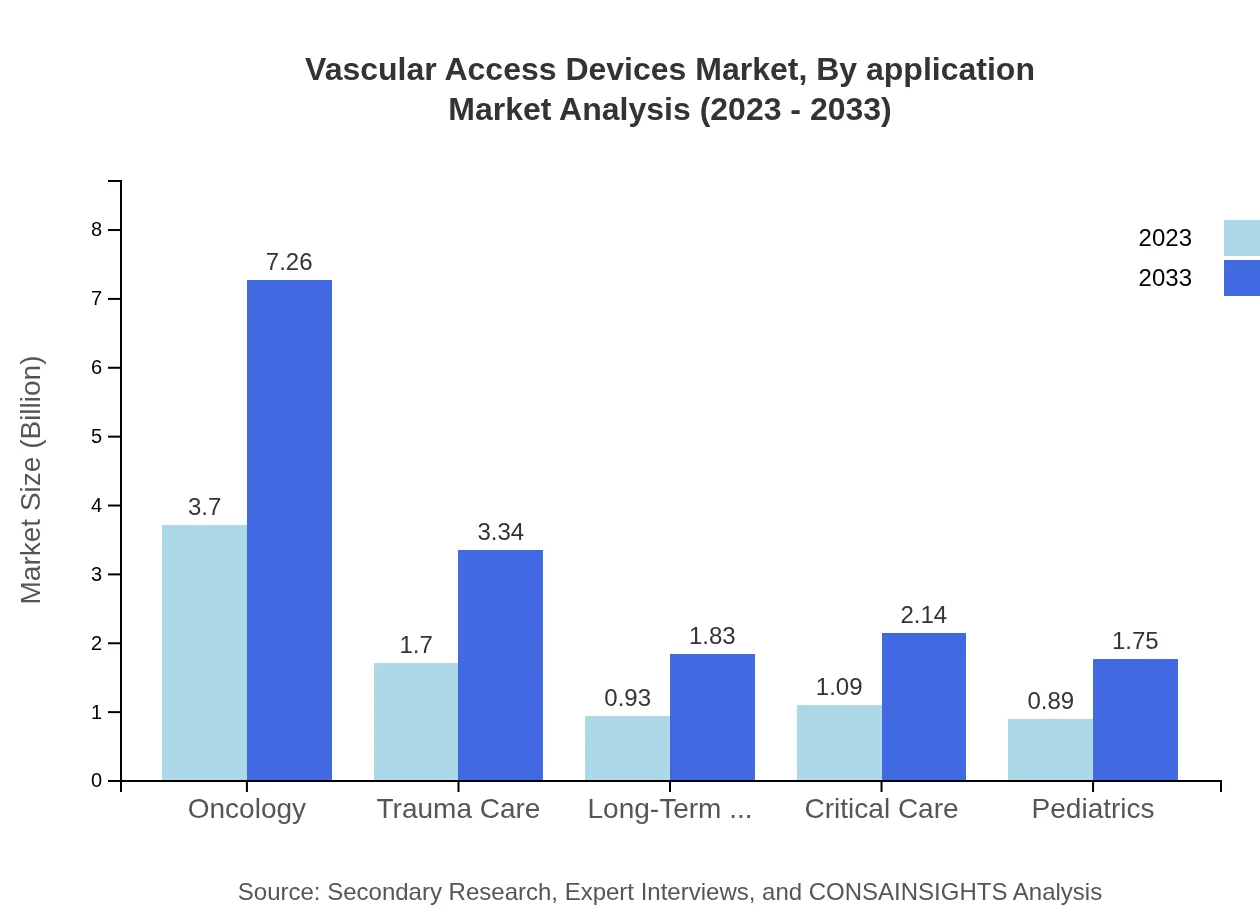

Vascular Access Devices Market Analysis By Application

Applications such as Oncology, Cardiology, and Critical Care show strong growth rates, with Oncology expected to rise from $3.70 billion in 2023 to $7.26 billion by 2033, driven by rising cancer cases requiring vascular access for treatments.

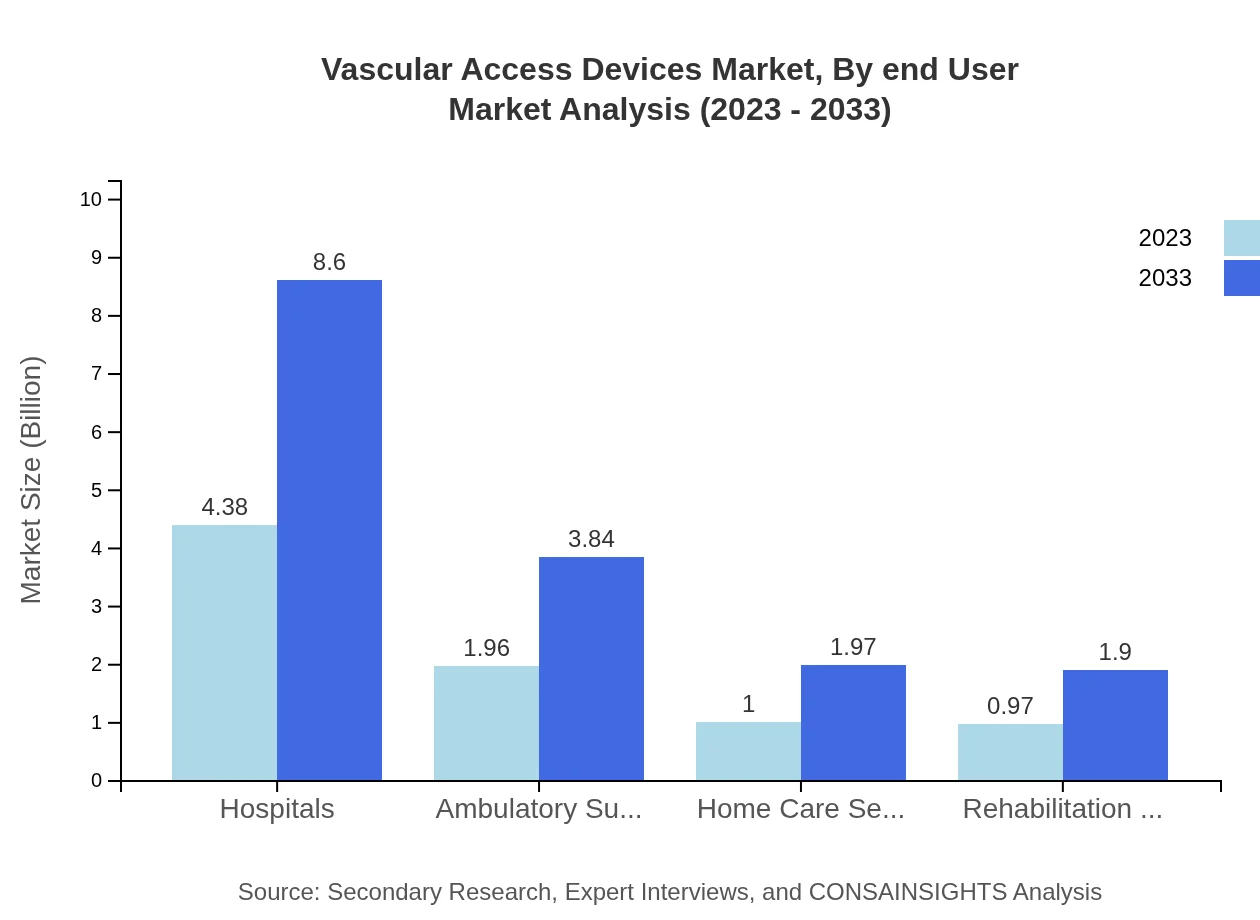

Vascular Access Devices Market Analysis By End User

The key end-users include Hospitals, Ambulatory Surgical Centers, and Home Care Settings. Hospitals hold the largest share, accounting for $4.38 billion in 2023 and projected to grow to $8.60 billion by 2033, demonstrating the sector's reliance on vascular access technology.

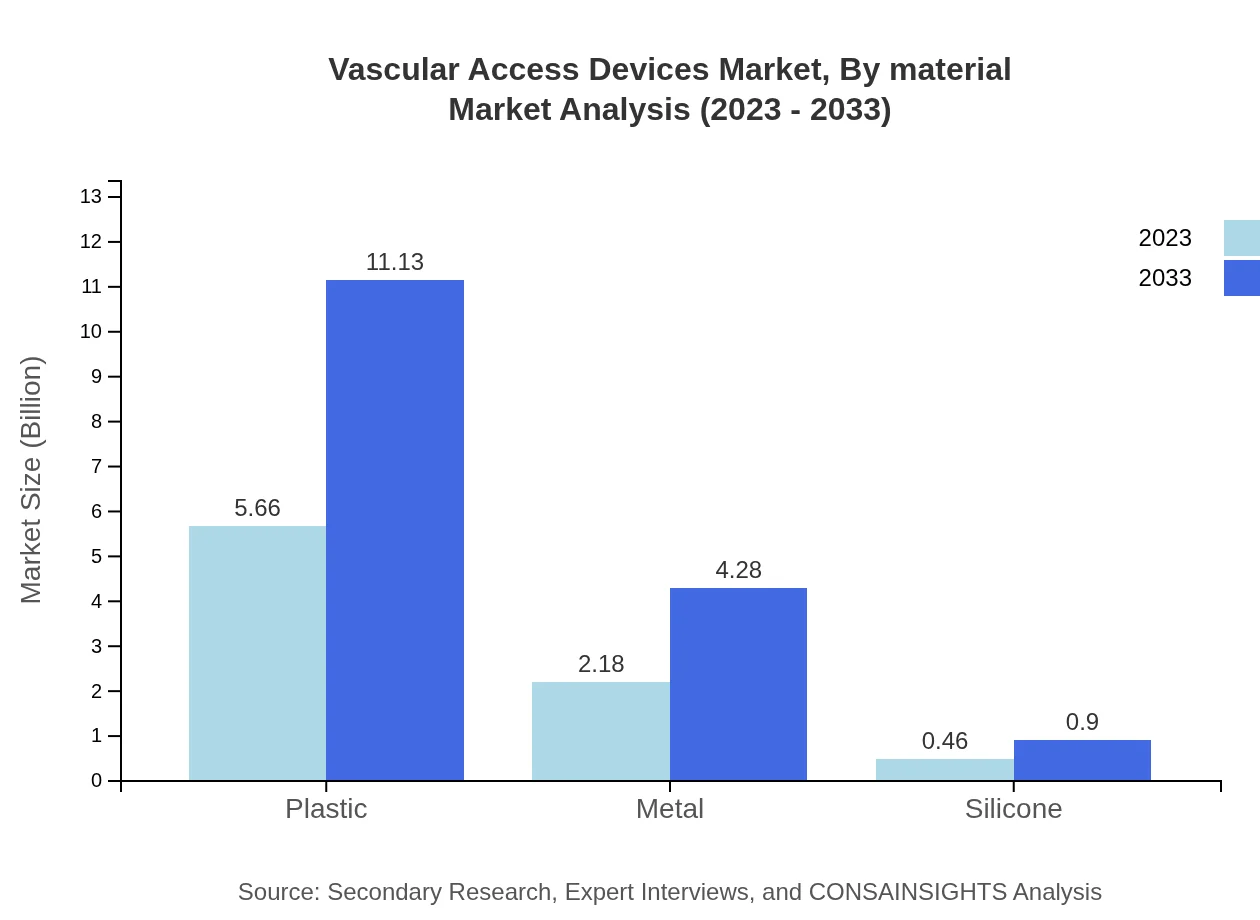

Vascular Access Devices Market Analysis By Material

Materials used in Vascular Access Devices primarily include Plastic, Metal, and Silicone. Plastic accounts for 68.24% of the market share and is anticipated to grow from $5.66 billion in 2023 to $11.13 billion by 2033, reaffirming its dominance.

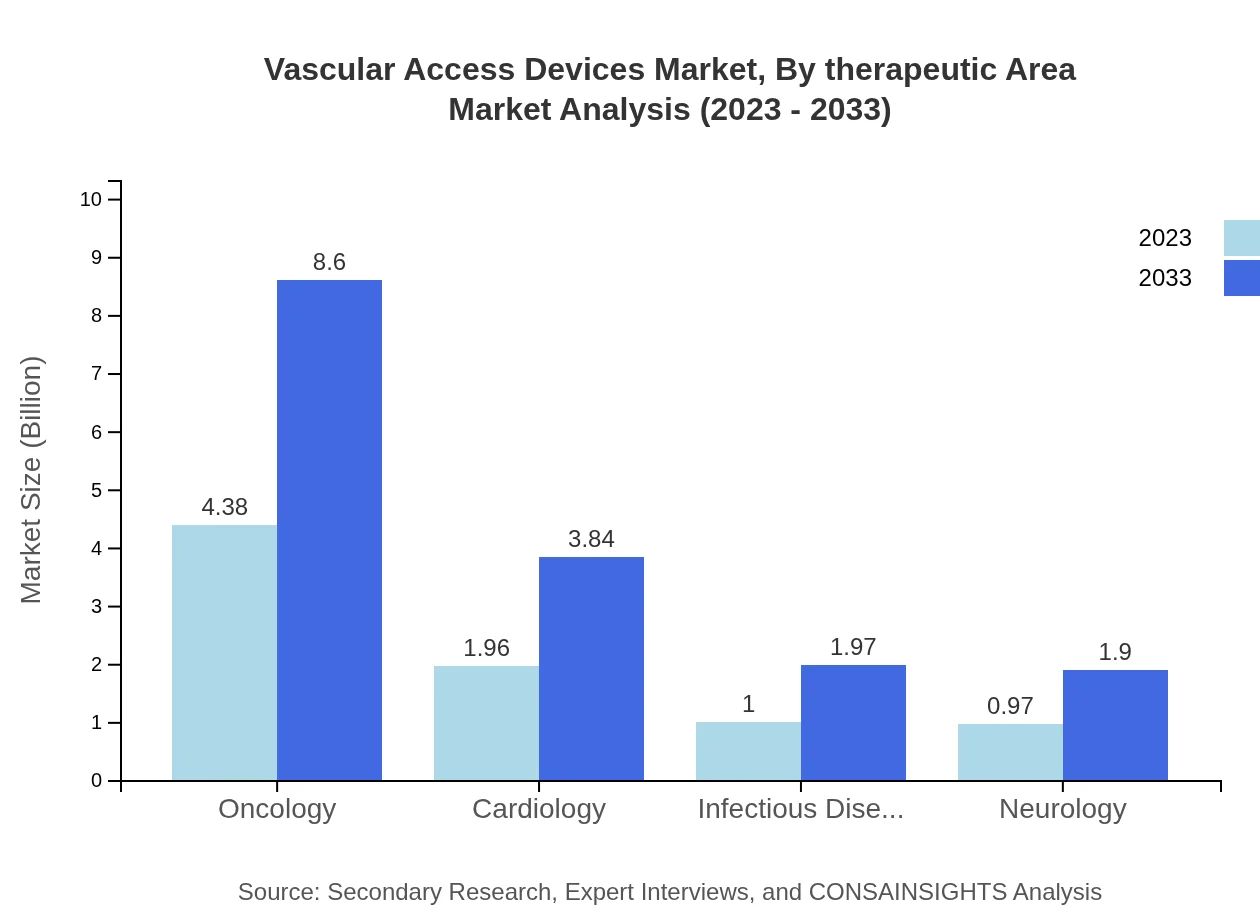

Vascular Access Devices Market Analysis By Therapeutic Area

The therapeutic areas served by Vascular Access Devices encompass Oncology, Infectious Diseases, Neurology, and Trauma Care. Oncology remains highly significant, expected to rise from $4.38 billion in 2023 to $8.60 billion by 2033, reflecting the high demand for vascular access in cancer treatment.

Vascular Access Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vascular Access Devices Industry

Becton, Dickinson and Company (BD):

A global leader in medical technology, BD provides innovative solutions to enhance healthcare delivery, notably in vascular access devices such as IV catheters and infusion products.Medtronic :

A major player in the medical device sector, Medtronic specializes in advanced vascular access technologies and has pioneered significant innovations in catheter design.Smiths Medical:

Focusing on patient safety and comfort, Smiths Medical develops vascular access products that are widely utilized in hospitals and surgical settings.Teleflex Incorporated:

Teleflex offers a diverse range of products including vascular access devices and has a strong reputation for quality and innovation in the market.Boston Scientific:

Renowned for its medical solutions, Boston Scientific invests heavily in research and development to introduce cutting-edge vascular access technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of vascular access devices?

The vascular access devices market size reached approximately $8.3 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8% over the forecast period. By 2033, the market is anticipated to grow significantly, reflecting increased healthcare demands.

What are the key market players or companies in this vascular access devices industry?

Key market players in the vascular access devices industry include significant multinational corporations as well as specialized manufacturers of medical devices, each contributing to innovative technologies and expanding product lines to enhance patient care.

What are the primary factors driving the growth in the vascular access devices industry?

Growth in the vascular access devices industry is primarily driven by the rise in the prevalence of chronic diseases, advancements in technology, and an increase in surgical procedures requiring efficient vascular access solutions.

Which region is the fastest Growing in the vascular access devices?

The fastest-growing region in the vascular access devices market is Asia Pacific, projected to grow from $1.62 billion in 2023 to $3.18 billion in 2033, indicating a robust opportunity for market expansion within this geography.

Does ConsaInsights provide customized market report data for the vascular access devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the vascular access devices industry, ensuring relevant insights and detailed analysis aligned with precise business objectives.

What deliverables can I expect from this vascular access devices market research project?

Deliverables from the vascular access devices market research project typically include comprehensive reports, data tables, analyses of market trends, competitive landscape evaluations, and forecasts segmented by various factors such as region and device type.

What are the market trends of vascular access devices?

Current market trends in vascular access devices highlight increased adoption of advanced materials, development of integrated solutions, growing preference for minimally invasive techniques, and a focus on patient-centric healthcare solutions.