Vascular Closure Device Market Report

Published Date: 31 January 2026 | Report Code: vascular-closure-device

Vascular Closure Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vascular Closure Device market, covering market trends, forecasts from 2023 to 2033, industry dynamics, and segmentation insights. It aims to equip stakeholders with relevant data and insights to navigate the evolving landscape of this medical device market.

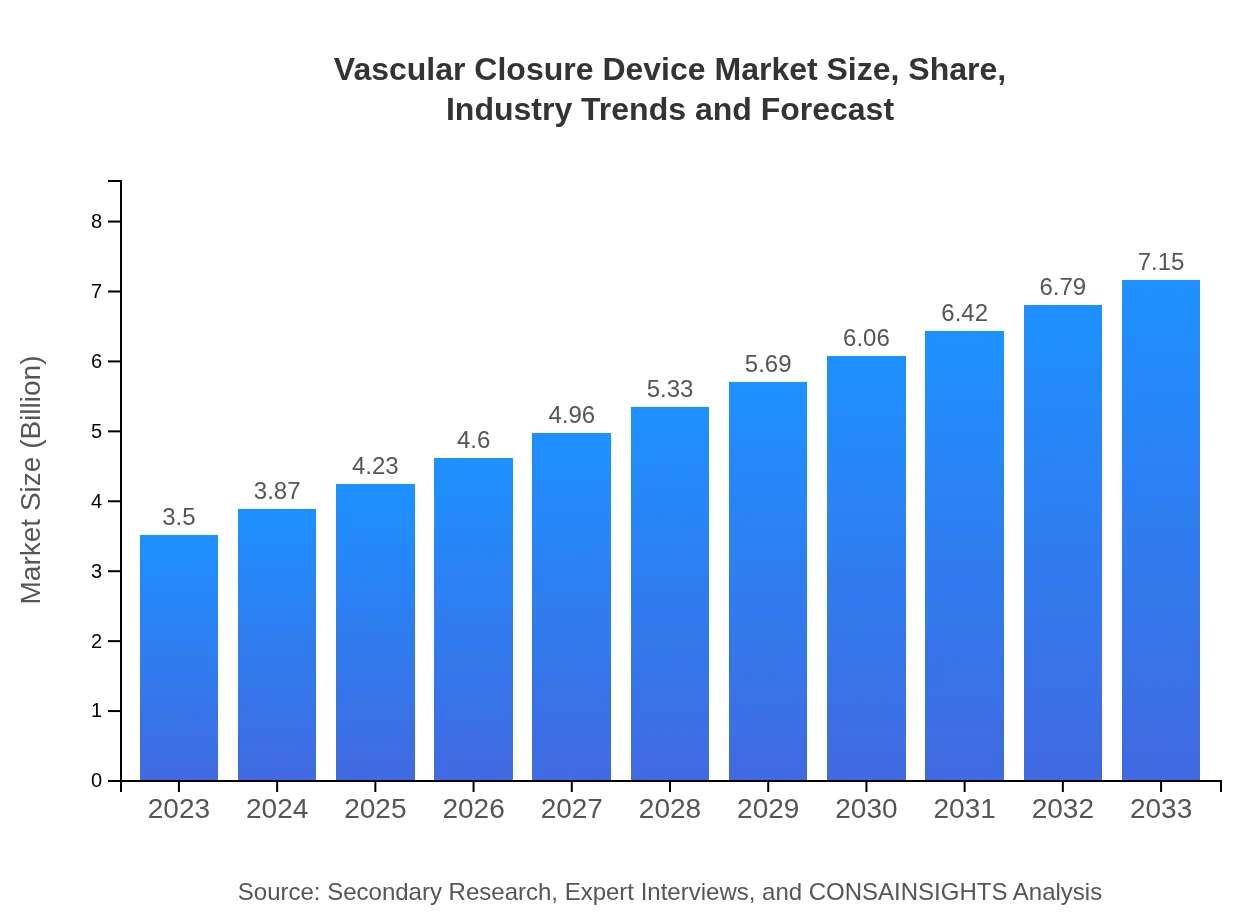

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Abbott Laboratories, Terumo Corporation, Medtronic , Boston Scientific Corporation |

| Last Modified Date | 31 January 2026 |

Vascular Closure Device Market Overview

Customize Vascular Closure Device Market Report market research report

- ✔ Get in-depth analysis of Vascular Closure Device market size, growth, and forecasts.

- ✔ Understand Vascular Closure Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vascular Closure Device

What is the Market Size & CAGR of Vascular Closure Device market in 2023?

Vascular Closure Device Industry Analysis

Vascular Closure Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vascular Closure Device Market Analysis Report by Region

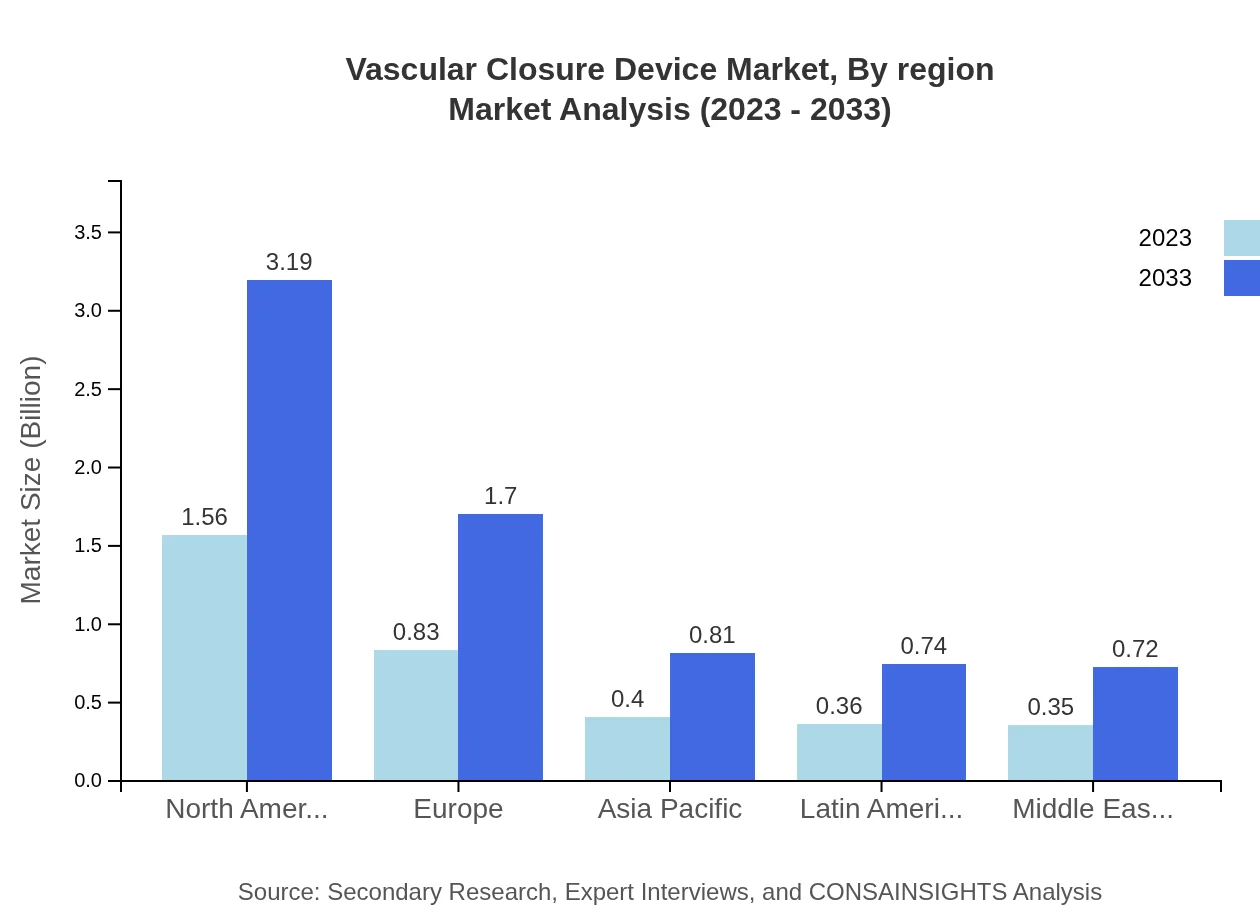

Europe Vascular Closure Device Market Report:

The European Vascular Closure Device market is expected to reach USD 1.20 billion in 2023, with projections of USD 2.44 billion by 2033. Factors such as a growing geriatric population and enhanced healthcare accessibility contribute to this positive trend.Asia Pacific Vascular Closure Device Market Report:

In 2023, the Asia Pacific region marked a market size of USD 0.65 billion, anticipated to grow to USD 1.33 billion by 2033, driven by increasing healthcare investments and rising patient loads. Emerging economies within this region are witnessing a surge in healthcare infrastructure development which is anticipated to drive demand for Vascular Closure Devices.North America Vascular Closure Device Market Report:

In North America, the market size for 2023 stands at around USD 1.13 billion, projected to evolve into USD 2.31 billion by 2033. The North American market benefits from high healthcare expenditure, a strong prevalence of cardiovascular diseases, and robust research & innovation in medical devices.South America Vascular Closure Device Market Report:

The South America market for Vascular Closure Devices is estimated to be USD 0.26 billion in 2023, and expected to double reaching approximately USD 0.52 billion by 2033. An increasing focus on improving healthcare systems and the rise in cardiovascular diseases are key growth drivers within this region.Middle East & Africa Vascular Closure Device Market Report:

In the Middle East and Africa, the Vascular Closure Device market size is anticipated to increase from USD 0.26 billion in 2023 to USD 0.54 billion by 2033, driven by growing healthcare reforms and rising prevalence of cardiovascular diseases.Tell us your focus area and get a customized research report.

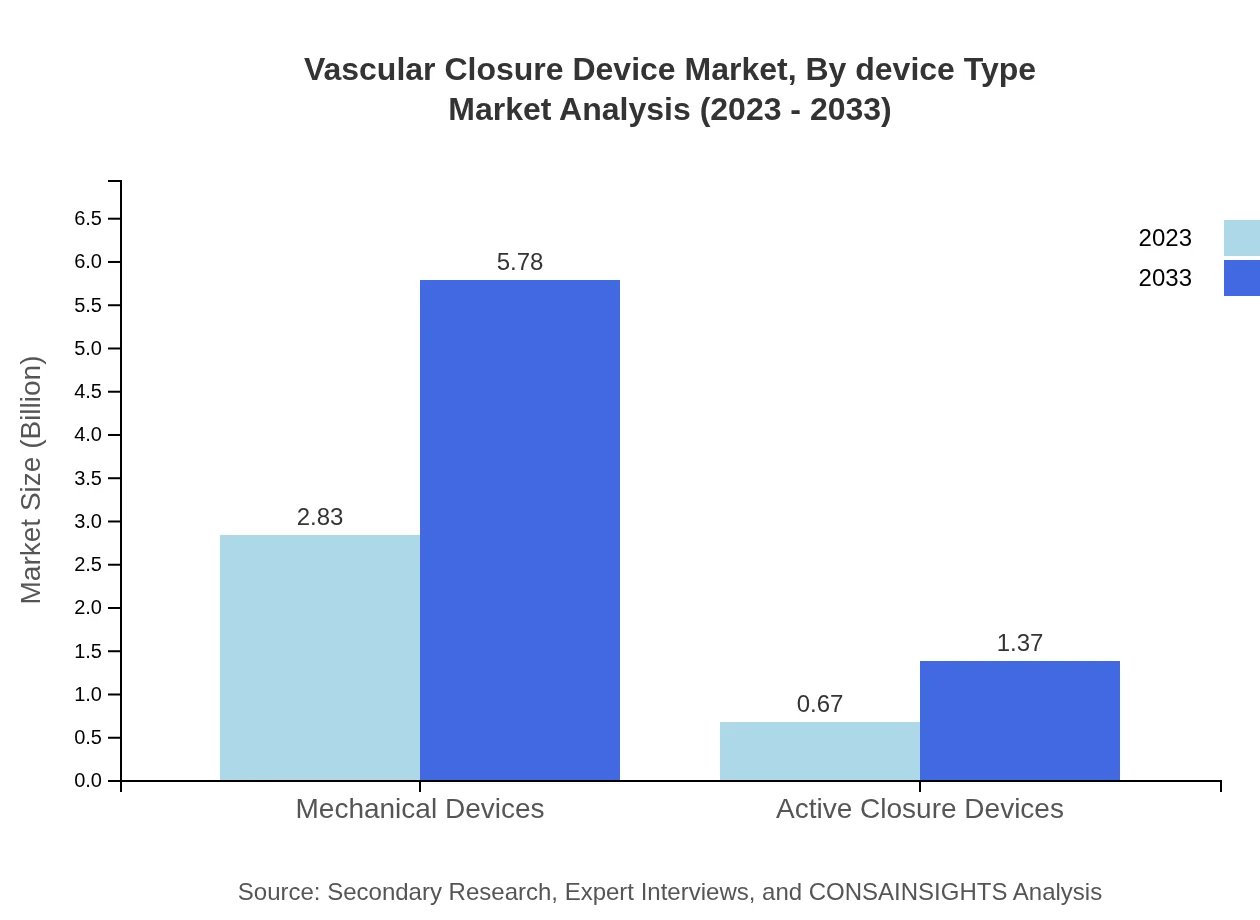

Vascular Closure Device Market Analysis By Device Type

The market is primarily comprised of mechanical devices and active closure devices. Mechanical devices account for approximately 80.84% of the market share as of 2023, with a projected market size growth from USD 2.83 billion to USD 5.78 billion by 2033. Active closure devices, while lesser in size, are crucial due to their specialized applications and growing adoption among healthcare providers.

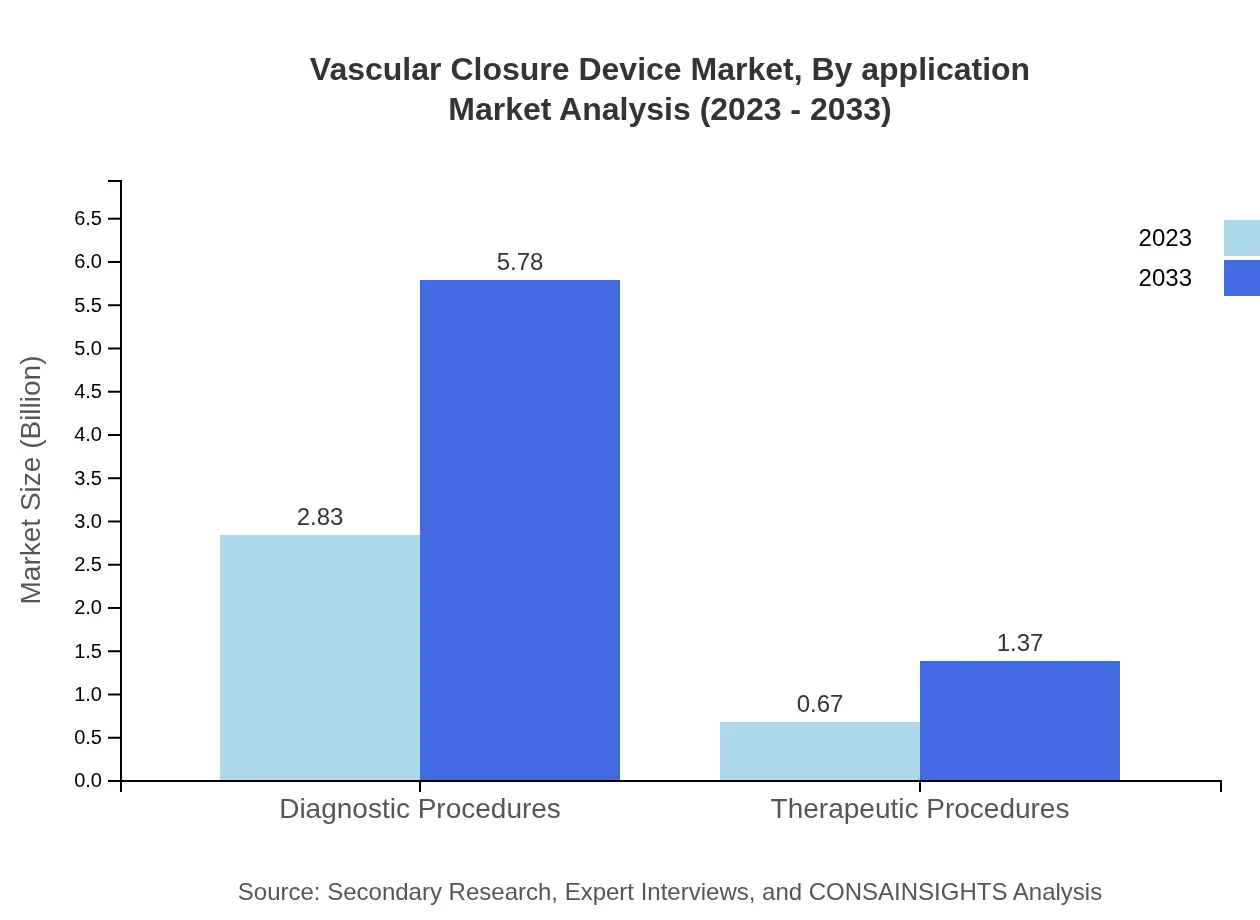

Vascular Closure Device Market Analysis By Application

The application segment primarily divides into diagnostic and therapeutic procedures, with diagnostic procedures holding an 80.84% market share in 2023, growing to USD 5.78 billion by 2033, reflecting the increasing need for diagnostic interventions in the healthcare segment.

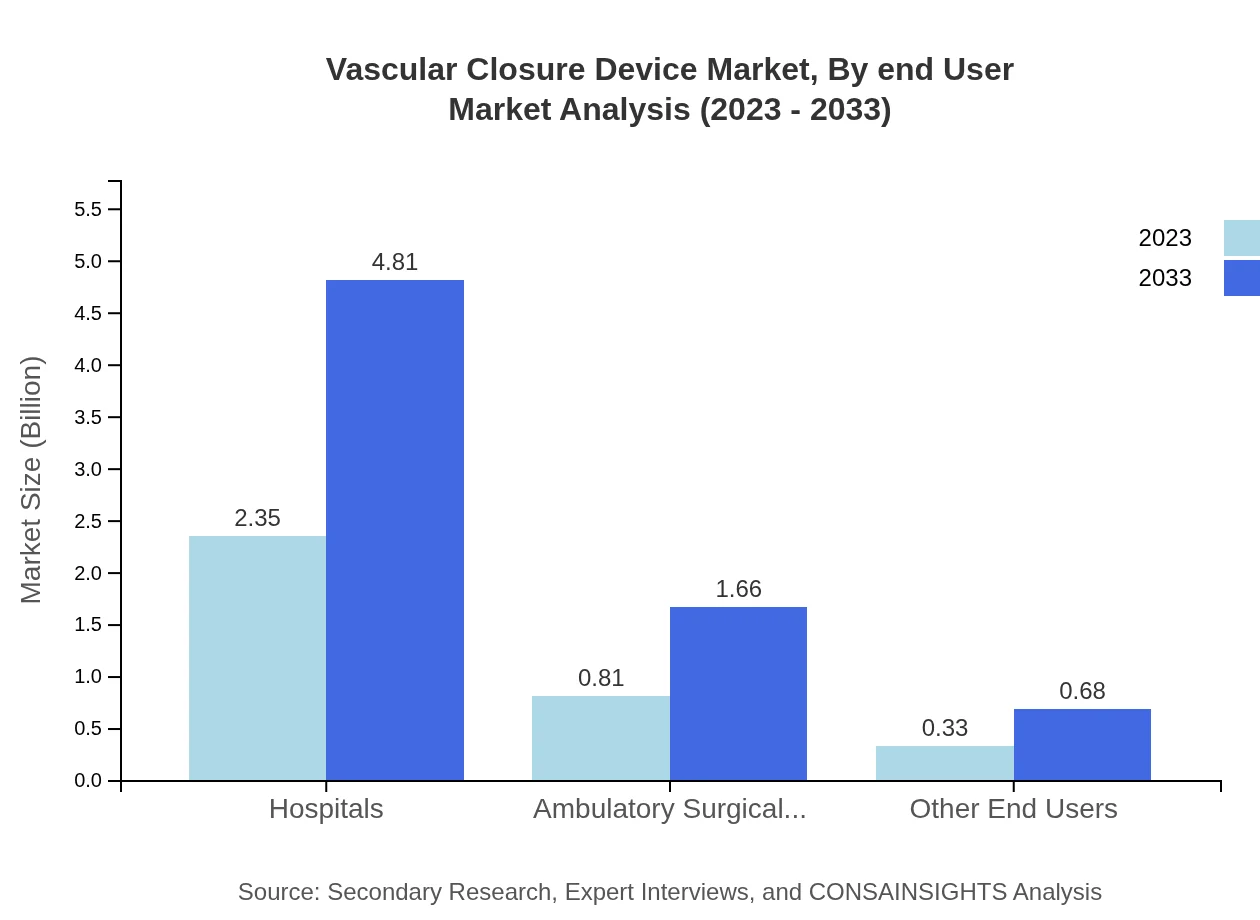

Vascular Closure Device Market Analysis By End User

Hospitals dominate the end-user segment with a share of 67.21%, reflecting the high volume of procedures performed within hospital settings. This segment is expected to grow from USD 2.35 billion in 2023 to USD 4.81 billion by 2033.

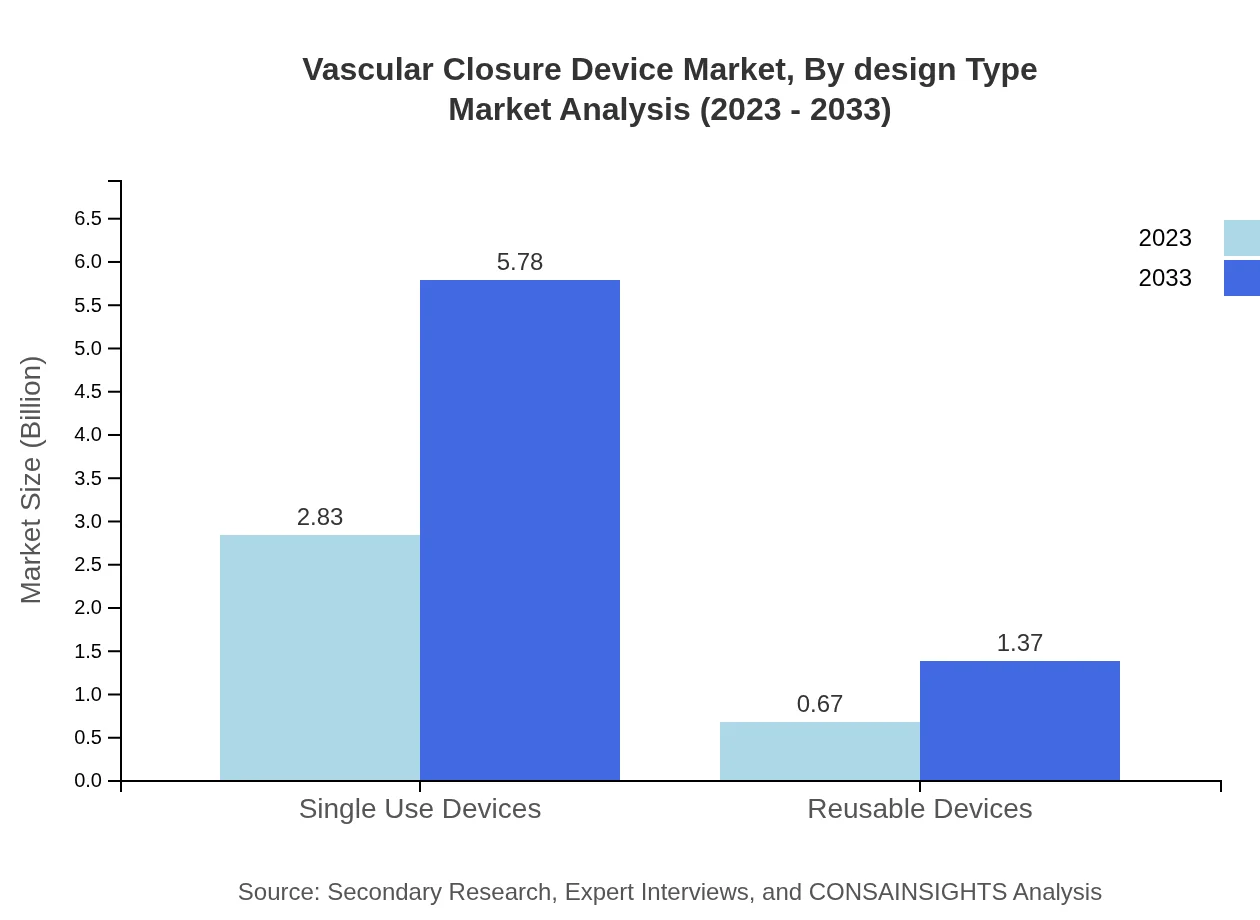

Vascular Closure Device Market Analysis By Design Type

The design type segment includes single-use devices and reusable devices. Single-use devices represent approximately 80.84% market share in 2023 with forecasts illustrating substantial growth reflecting preference trends towards hygiene and safety during surgical procedures.

Vascular Closure Device Market Analysis By Region

The regional analysis highlights varying growth rates, with North America leading the market share due to high healthcare investments, followed by Europe and Asia Pacific, showcasing significant expansion potential fueled by healthcare reforms and innovations.

Vascular Closure Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vascular Closure Device Industry

Abbott Laboratories:

A global leader in healthcare, Abbott provides a wide range of Vascular Closure Devices and is known for its innovative approach in cardiovascular healthcare solutions.Terumo Corporation:

Terumo is a prominent player in vascular access and related devices, emphasizing quality and innovation in developing their Vascular Closure Devices.Medtronic :

Medtronic is a leading medical technology company that develops a variety of Vascular Closure Devices, focusing on enhancing procedural safety and efficiency.Boston Scientific Corporation:

Boston Scientific specializes in less invasive technologies, providing various Vascular Closure Devices aimed at improving patient care and outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of vascular Closure Device?

The vascular closure device market is estimated to reach approximately $3.5 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 7.2% from 2023. This growth indicates a significant increase in demand and innovation throughout the sector.

What are the key market players or companies in this vascular Closure Device industry?

Key players in the vascular closure device market include industry giants such as Abbott Laboratories, Medtronic, Boston Scientific, and Terumo Corporation. These companies are critical for developing innovative technologies and capturing substantial market shares across the globe.

What are the primary factors driving the growth in the vascular Closure Device industry?

Growth in the vascular closure device industry is driven by increasing prevalence of cardiovascular diseases, technological advancements in medical devices, and a rise in minimally invasive procedures. Additionally, an aging population and growing awareness of procedural risks contribute to market expansion.

Which region is the fastest Growing in the vascular Closure Device market?

The fastest-growing region in the vascular closure device market is expected to be Europe, with the market forecasted to grow from $1.20 billion in 2023 to $2.44 billion by 2033. This region's growth is attributed to advanced healthcare infrastructure and increased investment in medical technologies.

Does ConsaInsights provide customized market report data for the vascular Closure Device industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the vascular closure device industry. Customers can request detailed insights and analyses focusing on their unique business requirements and market segments.

What deliverables can I expect from this vascular Closure Device market research project?

Deliverables from the vascular closure device market research project include detailed market analysis reports, competitor analysis, regional and segment data, trends overviews, forecasts, and actionable insights that aid in strategic decision-making.

What are the market trends of vascular Closure Device?

Trends in the vascular closure device market include a shift towards minimally invasive procedures, the development of bioresorbable devices, and increasing adoption of advanced closure techniques. These trends reflect ongoing innovations aimed at enhancing patient outcomes and procedural safety.