Vascular Graft Market Report

Published Date: 31 January 2026 | Report Code: vascular-graft

Vascular Graft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vascular Graft market, covering key trends, market size, and growth forecasts for the years 2023 to 2033.

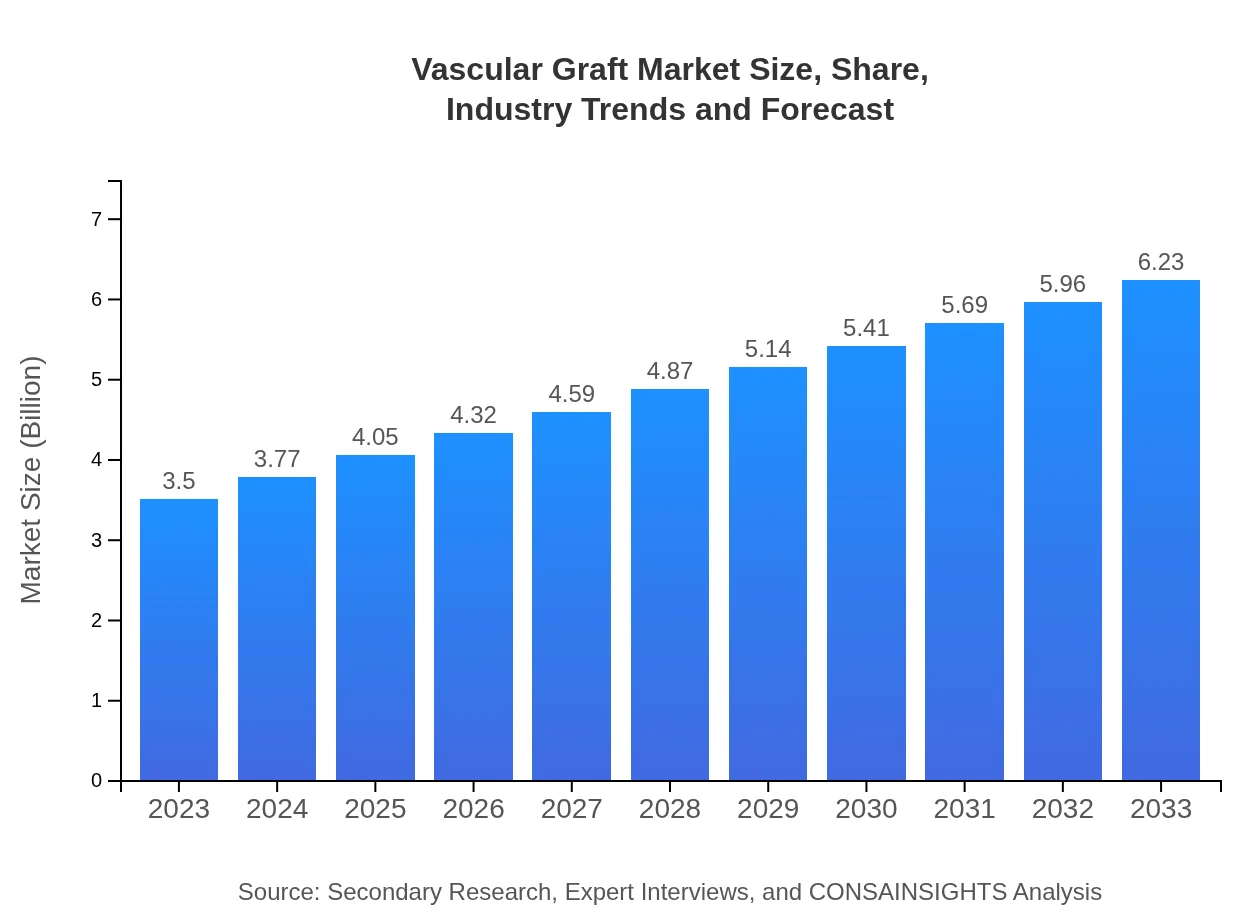

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $6.23 Billion |

| Top Companies | Gore Medical, Boston Scientific, Medtronic , Terumo Corporation, B. Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

Vascular Graft Market Overview

Customize Vascular Graft Market Report market research report

- ✔ Get in-depth analysis of Vascular Graft market size, growth, and forecasts.

- ✔ Understand Vascular Graft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vascular Graft

What is the Market Size & CAGR of Vascular Graft market in 2023 and 2033?

Vascular Graft Industry Analysis

Vascular Graft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

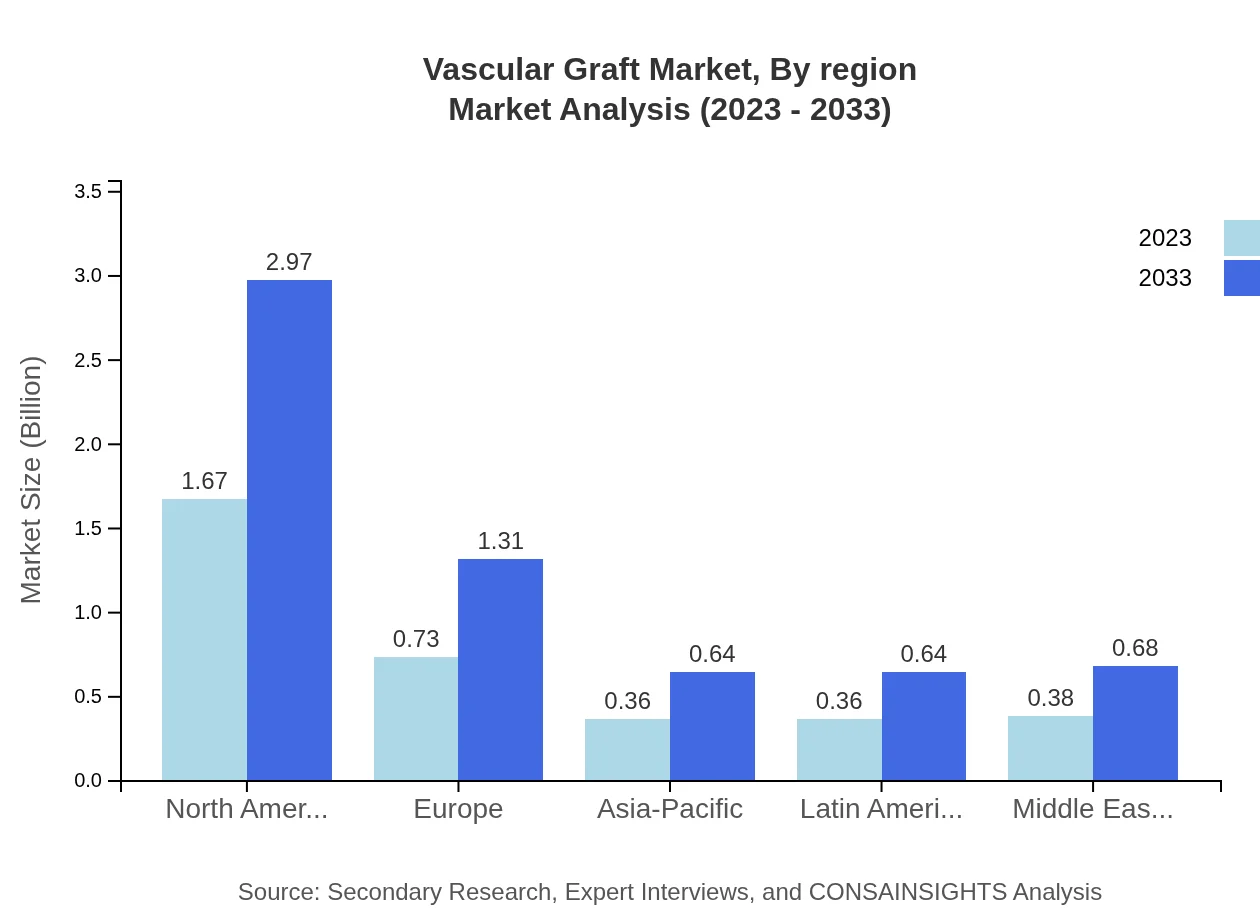

Vascular Graft Market Analysis Report by Region

Europe Vascular Graft Market Report:

The European market for vascular grafts is estimated at $0.89 billion in 2023 and expected to reach $1.58 billion by 2033. Growing awareness about cardiovascular diseases and an aging population are key drivers here. With countries like Germany, France, and the UK leading in healthcare expenditures, the region continues to facilitate growth in this sector.Asia Pacific Vascular Graft Market Report:

The Asia Pacific region, valued at approximately $0.70 billion in 2023, is anticipated to reach $1.25 billion by 2033. The growth is driven by increasing healthcare expenditure, a growing elderly population, and advancements in medical technology. Countries like China and India are emerging as significant market players due to their increasing patient pool, leading to a rise in surgical procedures.North America Vascular Graft Market Report:

North America dominates the vascular graft market, with projections to grow from $1.24 billion in 2023 to $2.21 billion by 2033. The high prevalence of cardiovascular conditions, along with advanced healthcare infrastructure and significant investments in research and development, propel the region's market position. The U.S. remains the largest contributor, accounting for a prominent share of the global market.South America Vascular Graft Market Report:

In South America, the market is projected to grow from $0.27 billion in 2023 to $0.49 billion by 2033. Factors such as a rising incidence of cardiovascular diseases and improving healthcare systems are contributing to market growth in the region. Brazil, being the largest market, is focusing on expanding healthcare access to its population.Middle East & Africa Vascular Graft Market Report:

The Middle East and Africa region, valued at $0.40 billion in 2023, is projected to grow to $0.71 billion by 2033. Although growth is slower compared to other regions, increased investment in healthcare infrastructure and rising health issues are anticipated to boost market prospects over the forecast period.Tell us your focus area and get a customized research report.

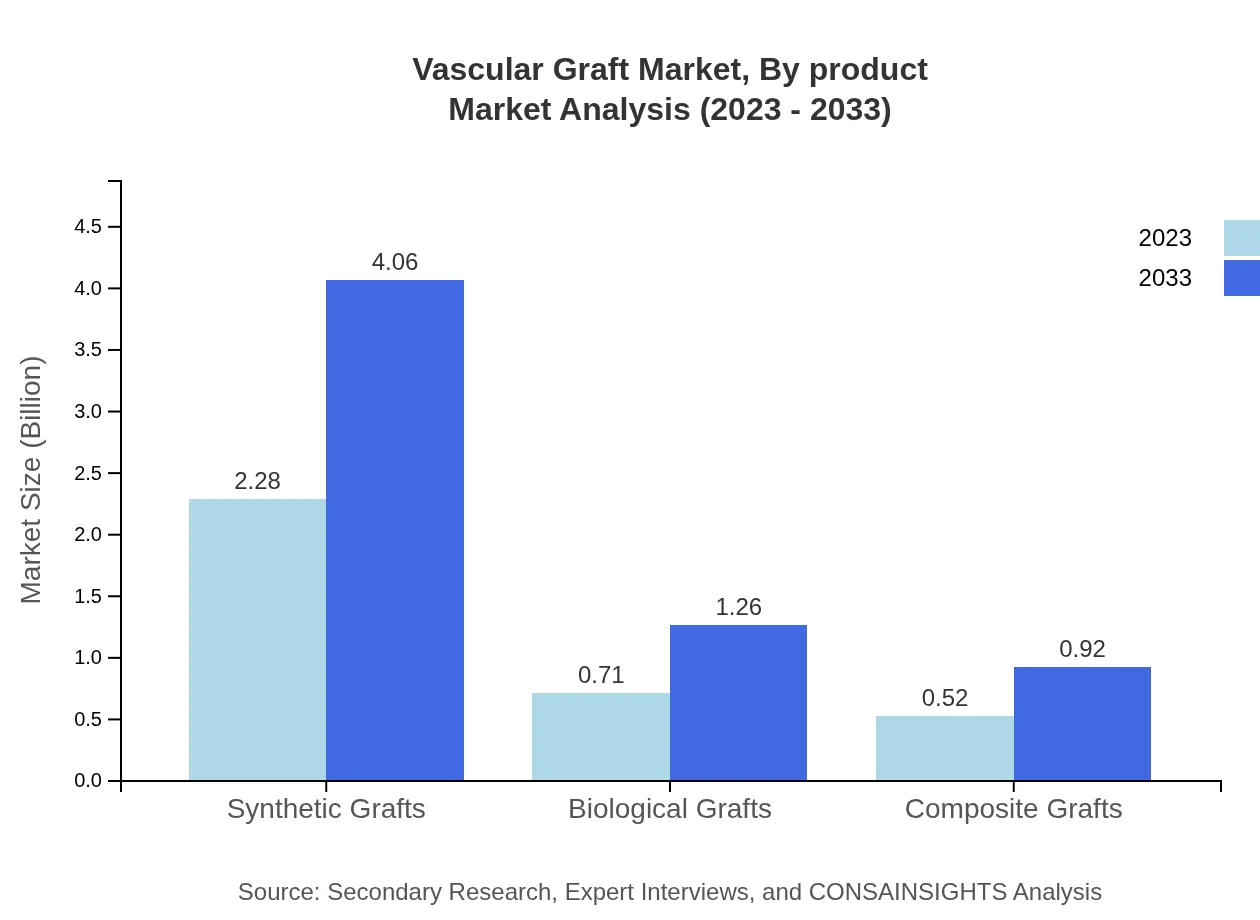

Vascular Graft Market Analysis By Product

The synthetic grafts segment is the largest, accounting for $2.28 billion in 2023, projected to rise to $4.06 billion by 2033. Synthetic grafts represent 65.09% of the market share. Biological grafts, valued at $0.71 billion in 2023 and $1.26 billion by 2033, hold 20.19% of the share, while composite grafts show a market size rising from $0.52 billion to $0.92 billion, making up 14.72% of the market.

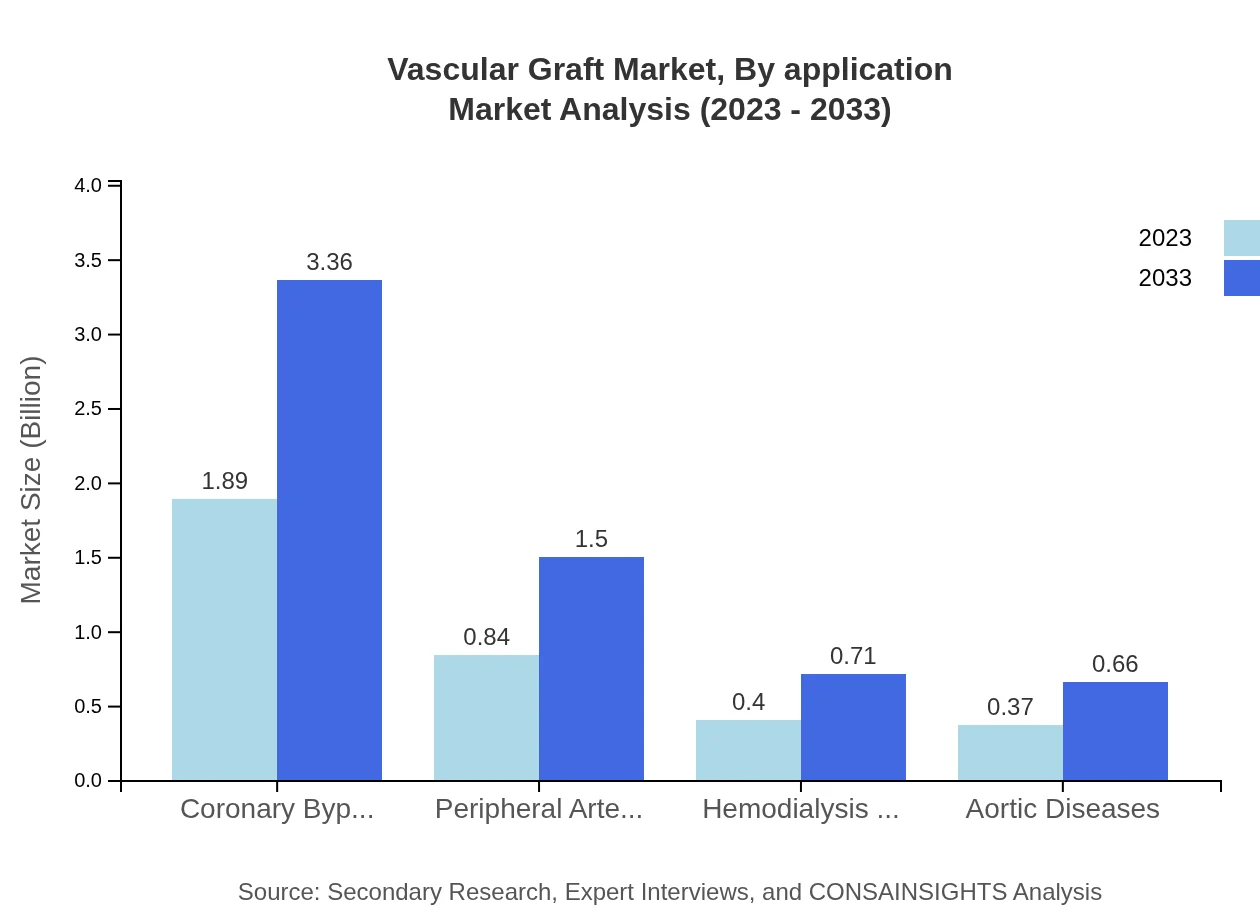

Vascular Graft Market Analysis By Application

Coronary bypass surgeries dominate the market with a share of 53.97%, growing from $1.89 billion in 2023 to $3.36 billion in 2033. Peripheral artery disease treatments account for 24.05% of the market, with values moving from $0.84 billion to $1.50 billion. Hemodialysis access, representing 11.39%, is increasing from $0.40 billion to $0.71 billion, while aortic diseases contribute 10.59% of the market.

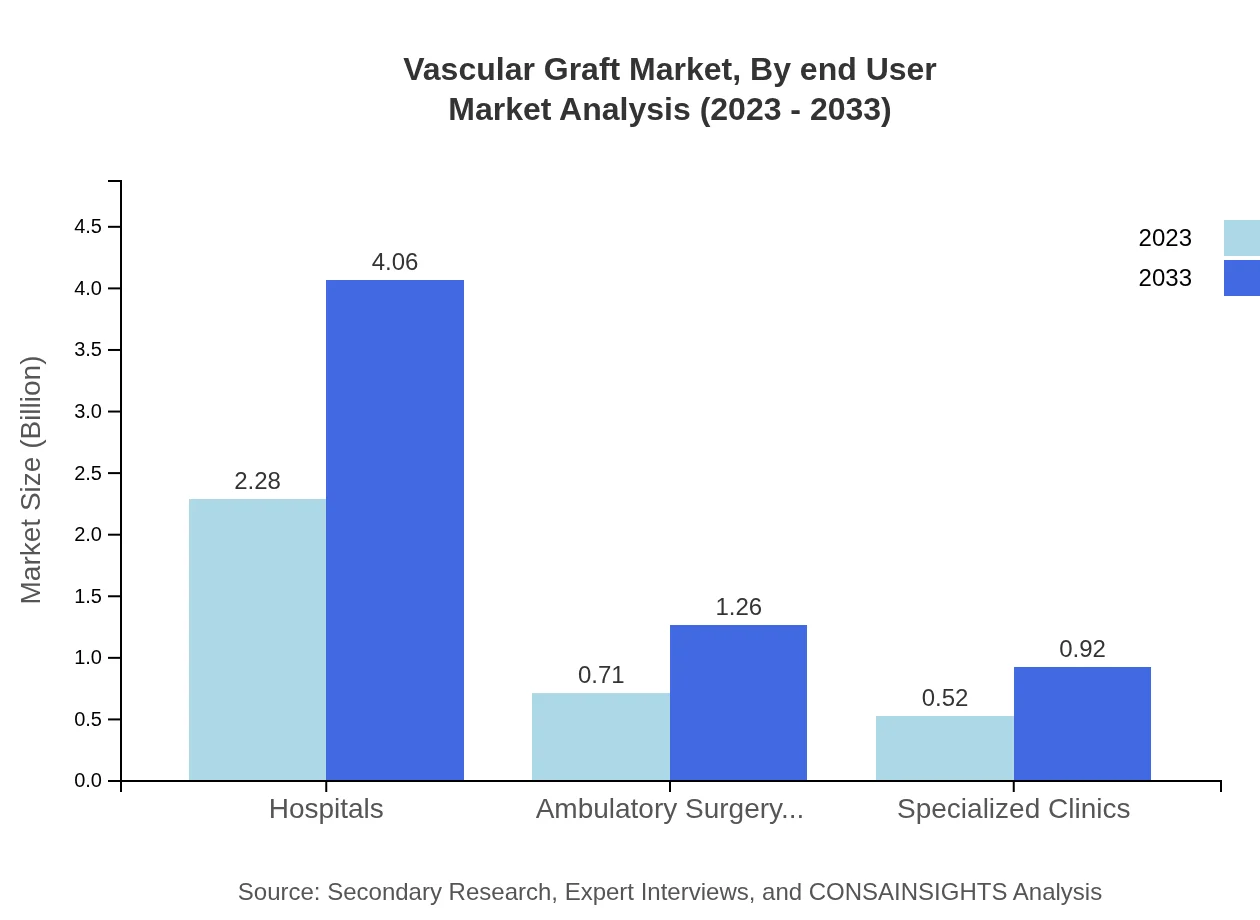

Vascular Graft Market Analysis By End User

Hospitals are the primary end-user, with market values at $2.28 billion in 2023, expected to rise to $4.06 billion by 2033, holding a significant share of 65.09%. Ambulatory surgery centers are also significant, with a share of 20.19%, growing from $0.71 billion to $1.26 billion. Specialized clinics contribute 14.72%, expanding from $0.52 billion to $0.92 billion.

Vascular Graft Market Analysis By Region

Regionally, North America leads with a market size of $1.24 billion in 2023 and $2.21 billion by 2033. Europe ranks next, growing from $0.89 billion to $1.58 billion. The Asia Pacific follows, rising from $0.70 billion to $1.25 billion, while South America and the Middle East and Africa show modest growth but essential market contributions.

Vascular Graft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vascular Graft Industry

Gore Medical:

A leader in innovative medical devices, Gore is known for its high-quality vascular grafts, including the GORE-TEX and GORE PROPATEN grafts, which are frequently used in surgical interventions.Boston Scientific:

This company specializes in interventional medical solutions, including vascular graft technologies. The innovation in their product offerings positions them as a pivotal player in the graft market.Medtronic :

As a global leader in medical technology, Medtronic's vascular grafts are integral to treating a range of vascular diseases. They focus on providing high-quality solutions that enhance patient outcomes.Terumo Corporation:

Focusing on innovative medical devices, Terumo offers a range of vascular intervention products, including grafts that provide value in surgical settings.B. Braun Melsungen AG:

B. Braun’s contributions to surgical solutions, including vascular grafts, bolster its position as a trusted name in the vascular graft industry.We're grateful to work with incredible clients.

FAQs

What is the market size of vascular Graft?

The vascular graft market is projected to grow from $3.5 billion in 2023 to an estimated value significantly higher by 2033, expanding at a CAGR of 5.8% over the next decade.

What are the key market players or companies in the vascular Graft industry?

Key players in the vascular graft market include major companies focusing on synthetic and biological grafts, with significant investments in R&D for innovative vascular solutions.

What are the primary factors driving the growth in the vascular graft industry?

Major drivers include the increasing prevalence of cardiovascular diseases, technological advancements in graft materials, and rising healthcare expenditures globally, contributing to market growth.

Which region is the fastest Growing in the vascular graft?

The North American region leads the vascular graft market, expected to grow significantly from $1.24 billion in 2023 to $2.21 billion by 2033, reflecting strong healthcare infrastructure.

Does ConsaInsights provide customized market report data for the vascular graft industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, providing in-depth analysis and insights into the vascular graft industry.

What deliverables can I expect from this vascular Graft market research project?

Deliverables include comprehensive market analysis reports, detailed insights on segments, competitive landscape assessments, and forecast data to aid strategic decision-making.

What are the market trends of vascular graft?

Current trends include increasing use of minimally invasive procedures, the development of advanced biomaterials for implants, and a shift towards biological grafts due to better patient compatibility.