Vascular Guidewires Market Report

Published Date: 31 January 2026 | Report Code: vascular-guidewires

Vascular Guidewires Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the vascular guidewires market, examining the growth trends, applications, and regional insights with a forecast extending from 2023 to 2033.

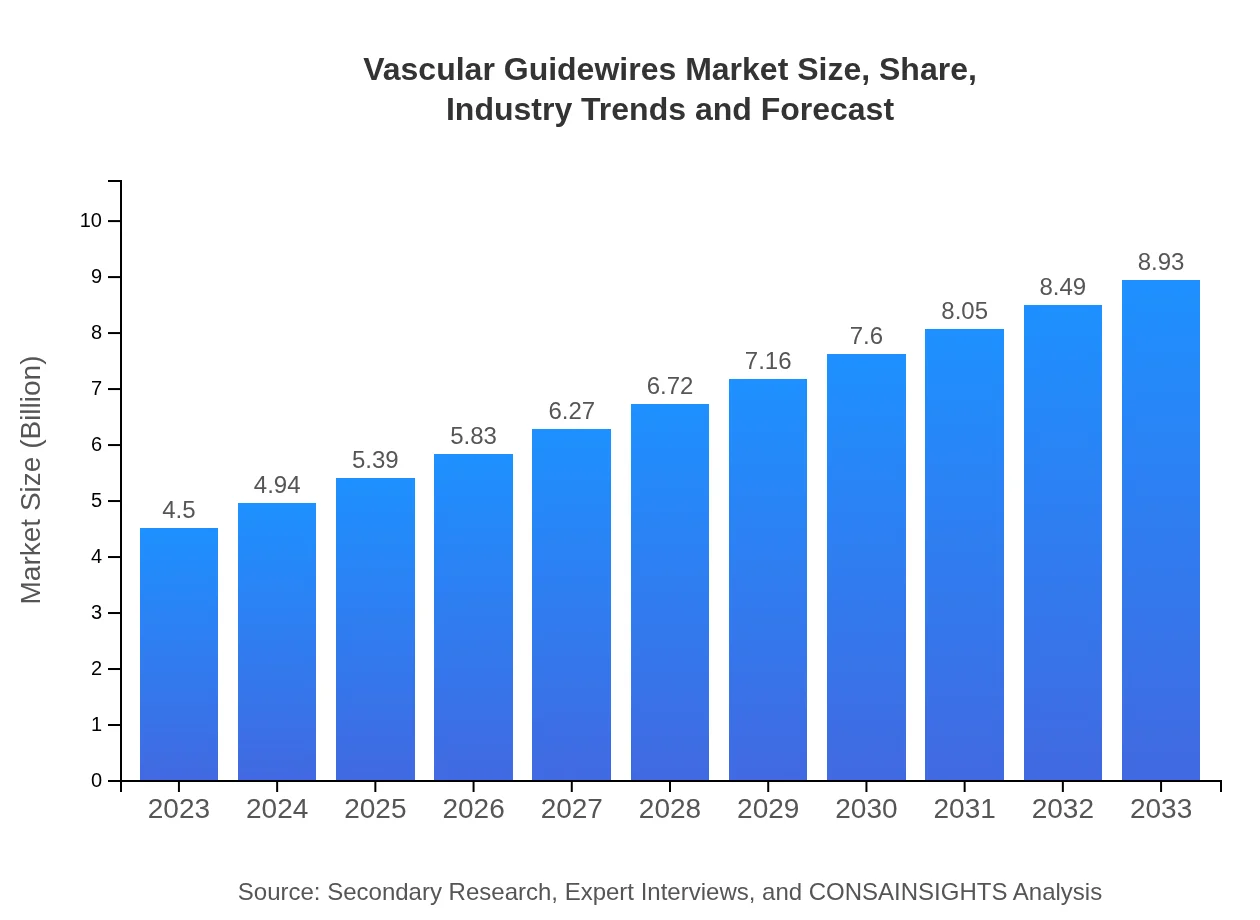

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.9% |

| 2033 Market Size | $8.93 Billion |

| Top Companies | Boston Scientific Corporation, Medtronic , Terumo Corporation, Abbott Laboratories, B.Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

Vascular Guidewires Market Overview

Customize Vascular Guidewires Market Report market research report

- ✔ Get in-depth analysis of Vascular Guidewires market size, growth, and forecasts.

- ✔ Understand Vascular Guidewires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vascular Guidewires

What is the Market Size & CAGR of Vascular Guidewires market in 2023?

Vascular Guidewires Industry Analysis

Vascular Guidewires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vascular Guidewires Market Analysis Report by Region

Europe Vascular Guidewires Market Report:

The European vascular guidewires market is expected to witness growth from $1.14 billion in 2023 to $2.27 billion by 2033. The rise in cardiovascular disorders and technological advancements in healthcare are critical factors driving this growth. Furthermore, stringent healthcare regulations in the region encourage the adoption of high-quality medical devices.Asia Pacific Vascular Guidewires Market Report:

The Asia Pacific vascular guidewires market is expected to grow from $0.89 billion in 2023 to $1.77 billion by 2033. The expansion is driven by increasing healthcare expenditures, rising prevalence of vascular diseases, and a burgeoning geriatric population. Governments in the region are also investing in healthcare infrastructure improvements, which will further enhance access to medical technologies.North America Vascular Guidewires Market Report:

North America remains the largest market for vascular guidewires, projected to escalate from $1.62 billion in 2023 to $3.21 billion by 2033. This growth is attributed to high healthcare spending, advanced research, and robust demand for innovative minimally invasive procedures. Moreover, the presence of leading manufacturers enhances market maturity.South America Vascular Guidewires Market Report:

In South America, the market is poised to grow from $0.44 billion in 2023 to $0.88 billion by 2033. Growth factors include increasing awareness of advanced surgical techniques and improving healthcare access. Additionally, partnerships between local healthcare providers and global firms are expected to boost the adoption of vascular guidewires.Middle East & Africa Vascular Guidewires Market Report:

In the Middle East and Africa, the market is forecasted to grow from $0.40 billion in 2023 to $0.80 billion by 2033. The region is experiencing a gradual increase in healthcare investment, and greater emphasis on reducing the burden of cardiovascular diseases is boosting the demand for vascular guidewires.Tell us your focus area and get a customized research report.

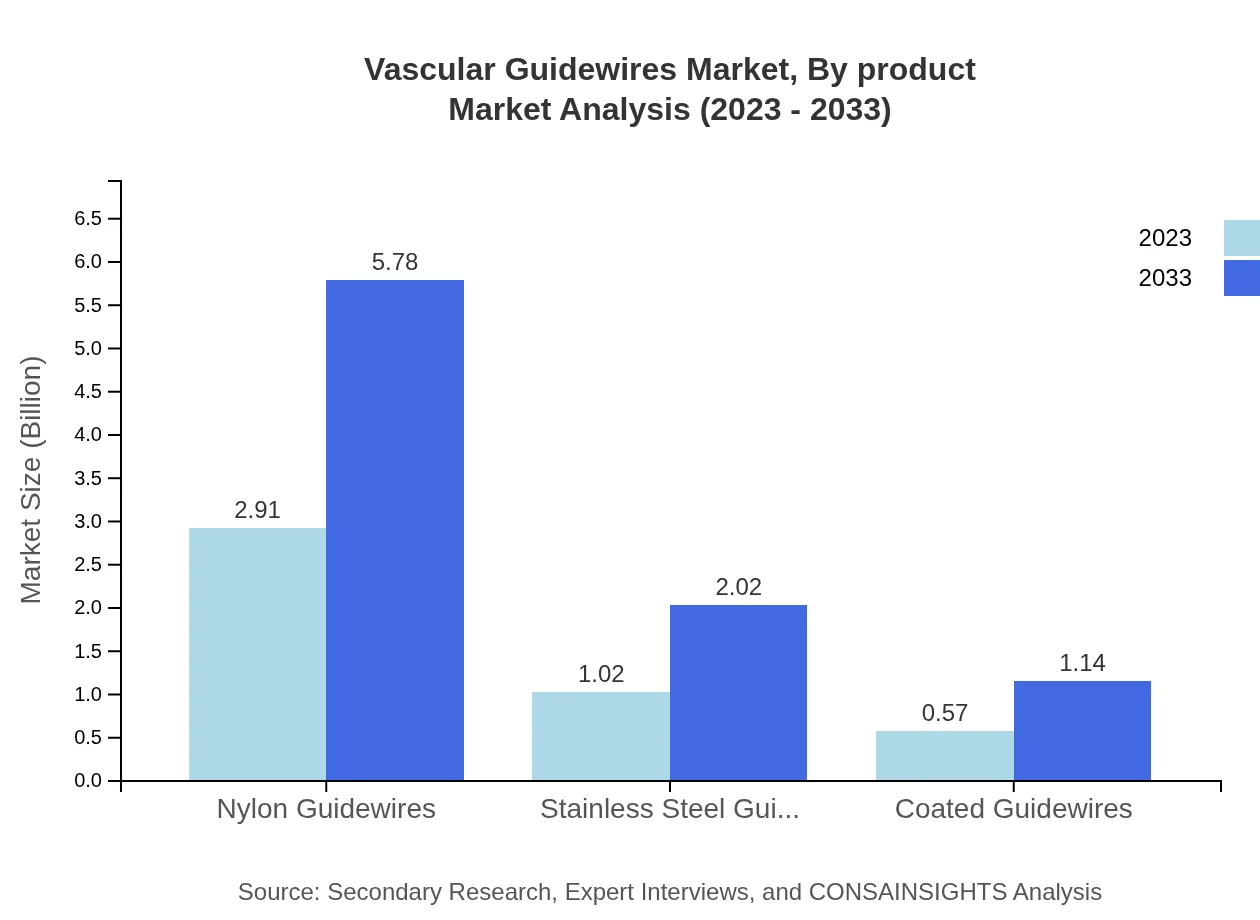

Vascular Guidewires Market Analysis By Product

Nylon guidewires dominate the market, expected to grow from $2.91 billion in 2023 to $5.78 billion by 2033, capturing 64.66% market share. Stainless steel guidewires are projected to reach $2.02 billion from $1.02 billion, giving a share of 22.6%. Meanwhile, coated guidewires will grow to $1.14 billion from $0.57 billion, maintaining a share of 12.74%.

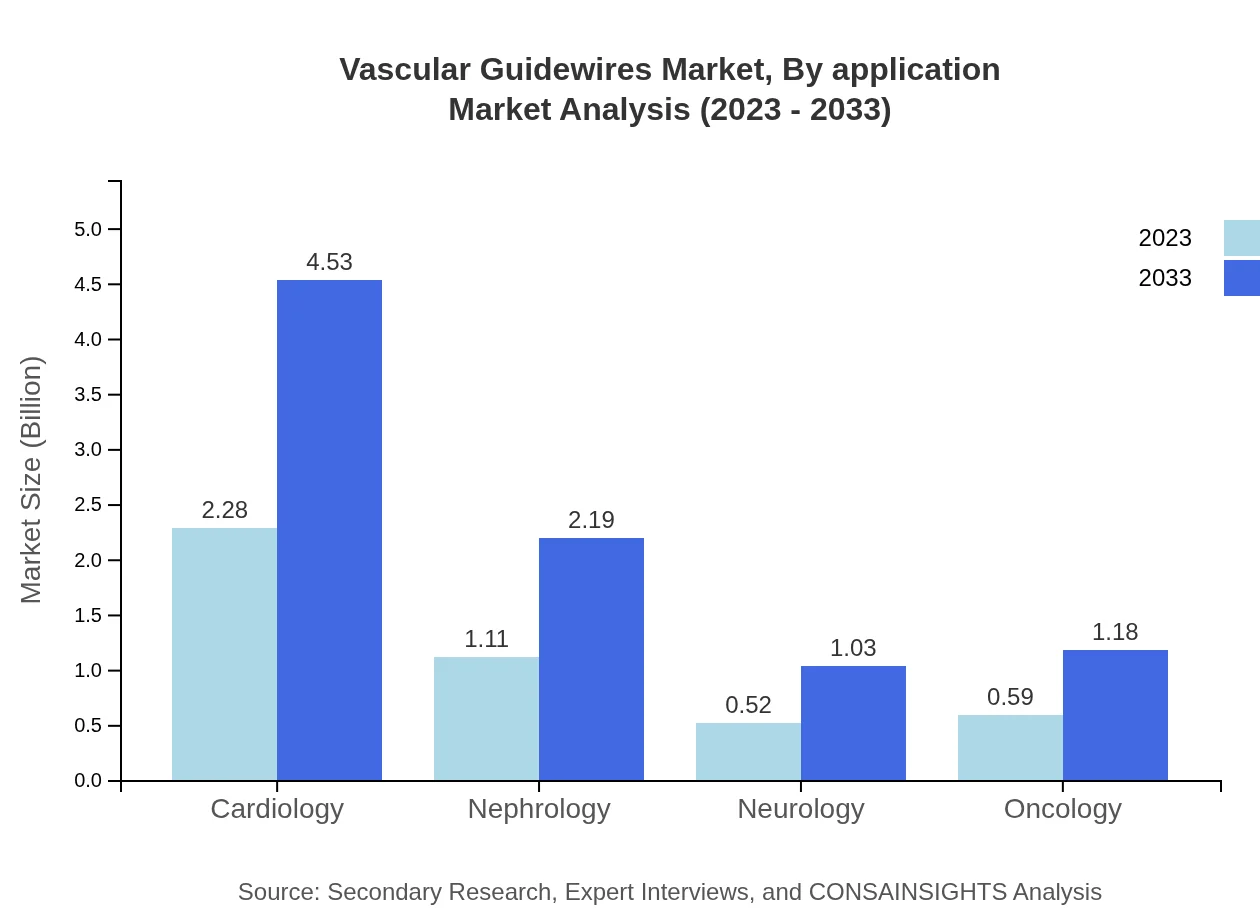

Vascular Guidewires Market Analysis By Application

The cardiology segment leads with a market size expected to increase from $2.28 billion in 2023 to $4.53 billion by 2033, commanding a 50.69% share. Nephrology applications will grow to $2.19 billion, while neurology and oncology applications will reach $1.03 billion and $1.18 billion, respectively, showing strong demand across diverse medical specialties.

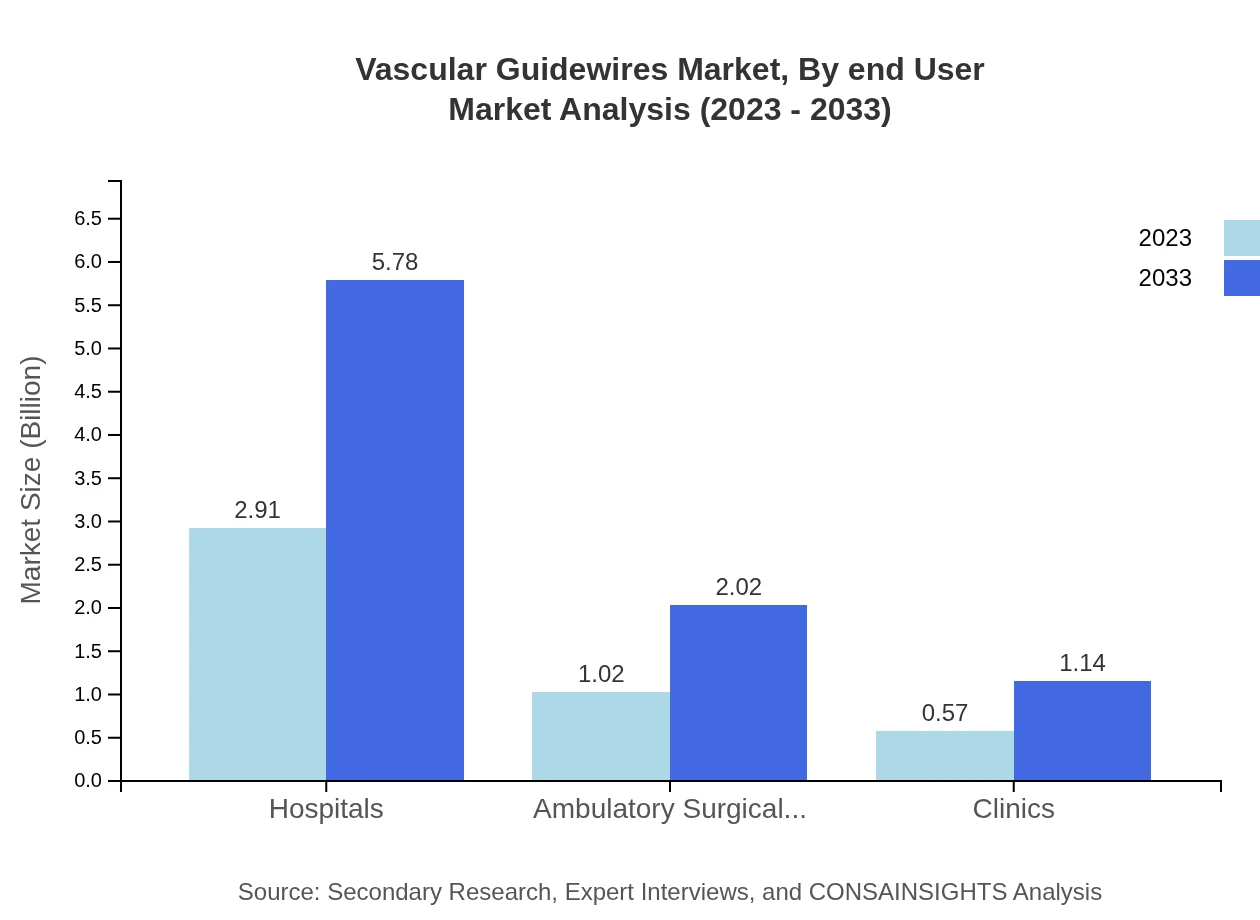

Vascular Guidewires Market Analysis By End User

Hospitals represent the major end-user, expected to grow from $2.91 billion in 2023 to $5.78 billion by 2033. Ambulatory surgical centers and clinics are also important, growing to $2.02 billion and $1.14 billion respectively, reflecting a shift toward outpatient procedures and community healthcare.

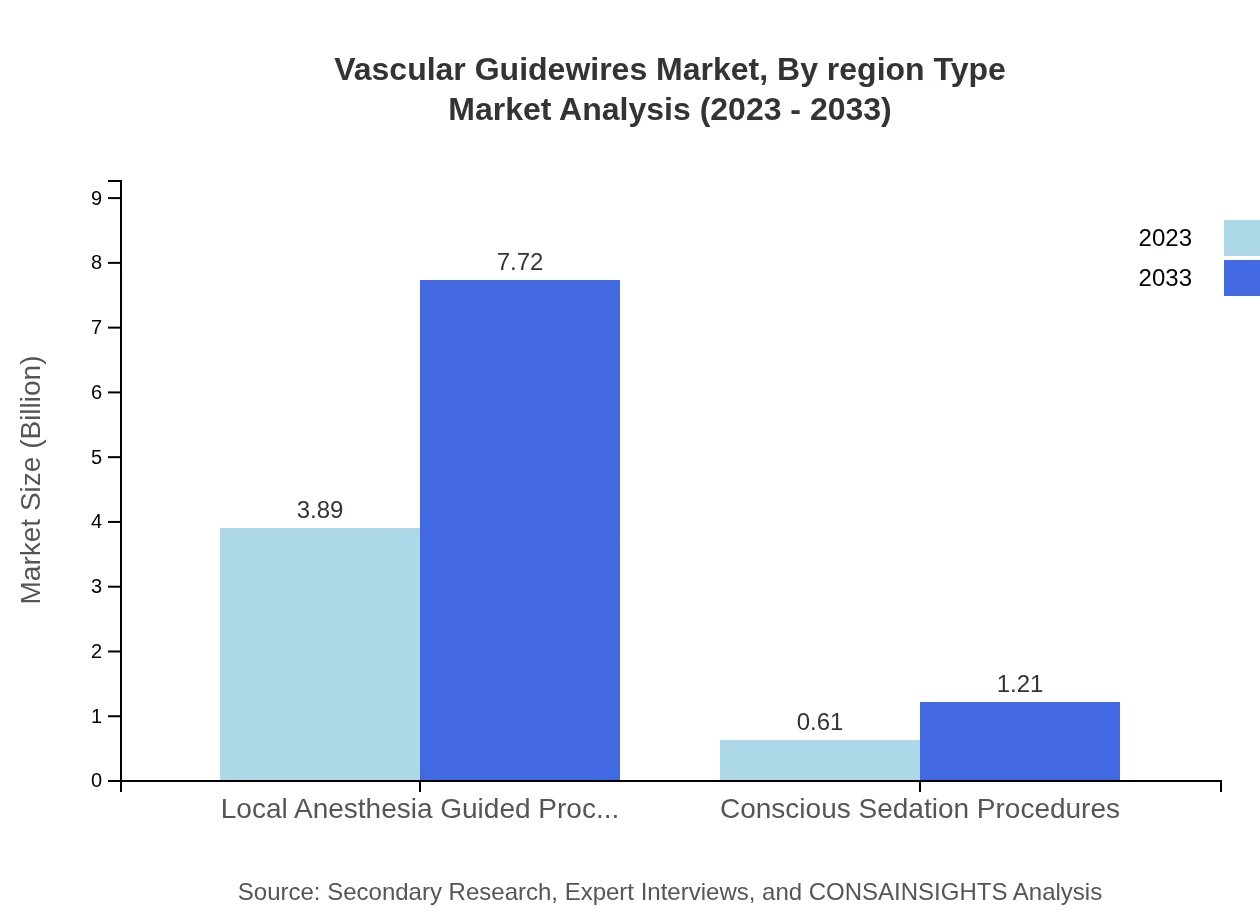

Vascular Guidewires Market Analysis By Region Type

Regionally, North America is expected to lead, followed by Europe and the Asia Pacific. Each region's distinct characteristics and healthcare needs will significantly influence vascular guidewire demand and market configurations.

Vascular Guidewires Market Analysis By Distribution Channel

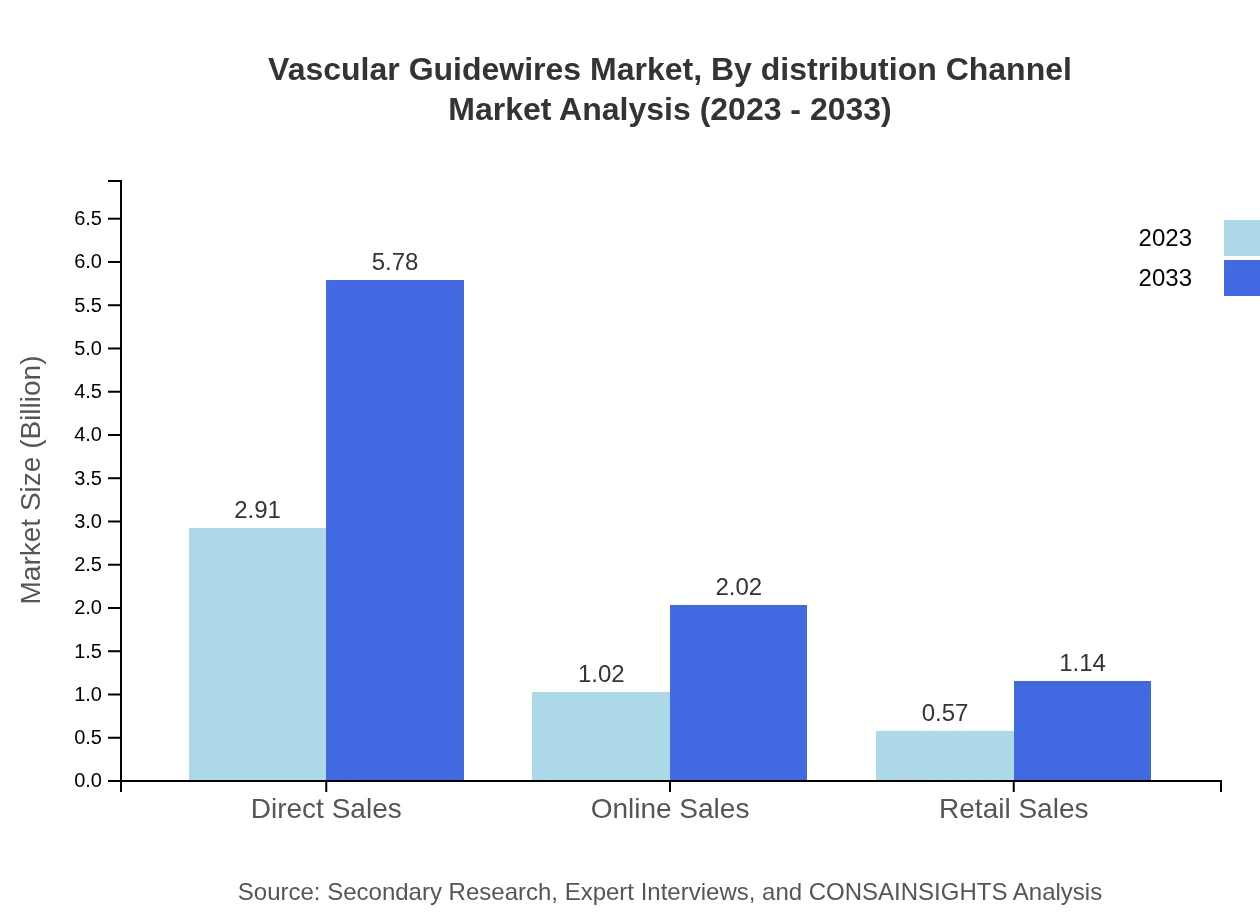

Direct sales dominate the distribution channel, projected to grow from $2.91 billion to $5.78 billion. Online sales are forecast to reach $2.02 billion, while retail sales will grow to $1.14 billion, reflecting the rising trend of e-commerce in healthcare.

Vascular Guidewires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vascular Guidewires Industry

Boston Scientific Corporation:

A leading global medical technology and device company known for its innovative solutions in interventional cardiology, including advanced vascular guidewires.Medtronic :

One of the largest medical device companies globally, Medtronic specializes in devices for surgical procedures, including various types of vascular guidewires.Terumo Corporation:

Terumo is renowned for its medical devices and tissue engineering, producing high-quality guidewires tailored for specific vascular applications.Abbott Laboratories:

Abbott is a key player in the medical devices industry, providing advanced vascular solutions, including innovative guidewire technologies.B.Braun Melsungen AG:

B.Braun focuses on medical and pharmaceutical products, offering a diverse range of vascular guidewires that enhance procedure efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of vascular Guidewires?

The global vascular guidewires market was valued at approximately 4.5 billion in 2023 and is projected to grow at a CAGR of 6.9% through 2033. This growth reflects the increasing demand for minimally invasive procedures.

What are the key market players or companies in the vascular Guidewires industry?

Key players in the vascular guidewires market include Medtronic, Boston Scientific, Abbott Laboratories, Johnson & Johnson, and Terumo Corporation. These companies hold significant market shares due to their innovation in medical devices and extensive distribution networks.

What are the primary factors driving the growth in the vascular guidewires industry?

The growth of the vascular guidewires industry is driven by an aging population, increasing prevalence of cardiovascular diseases, advancements in technology, and the rising demand for minimally invasive surgeries which enhance recovery times and reduce healthcare costs.

Which region is the fastest Growing in the vascular guidewires?

The Asia Pacific region is projected to be the fastest-growing market for vascular guidewires, expected to increase from 0.89 billion in 2023 to 1.77 billion by 2033. This growth is attributed to improving healthcare infrastructure and rising patient populations.

Does ConsaInsights provide customized market report data for the vascular guidewires industry?

Yes, ConsaInsights offers customized market reports tailored to specific client requirements in the vascular guidewires industry. These reports can include detailed analyses, forecasts, and insights based on varied market segments and regional dynamics.

What deliverables can I expect from this vascular guidewires market research project?

Deliverables from the vascular guidewires market research project include comprehensive reports, market trend analyses, competitive landscape assessments, and segmented market forecasts, all essential for informed business decisions and strategic planning.

What are the market trends of vascular guidewires?

Current market trends for vascular guidewires indicate a shift towards advanced materials like nylon and coated guidewires, increased adoption in outpatient settings, and a significant focus on developing innovative guidewire designs to enhance procedural efficiency and patient safety.