Vascular Imaging Market Report

Published Date: 31 January 2026 | Report Code: vascular-imaging

Vascular Imaging Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the Vascular Imaging market provides insights into market dynamics, size estimates, segmentation, regional analysis, technology trends, key players, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

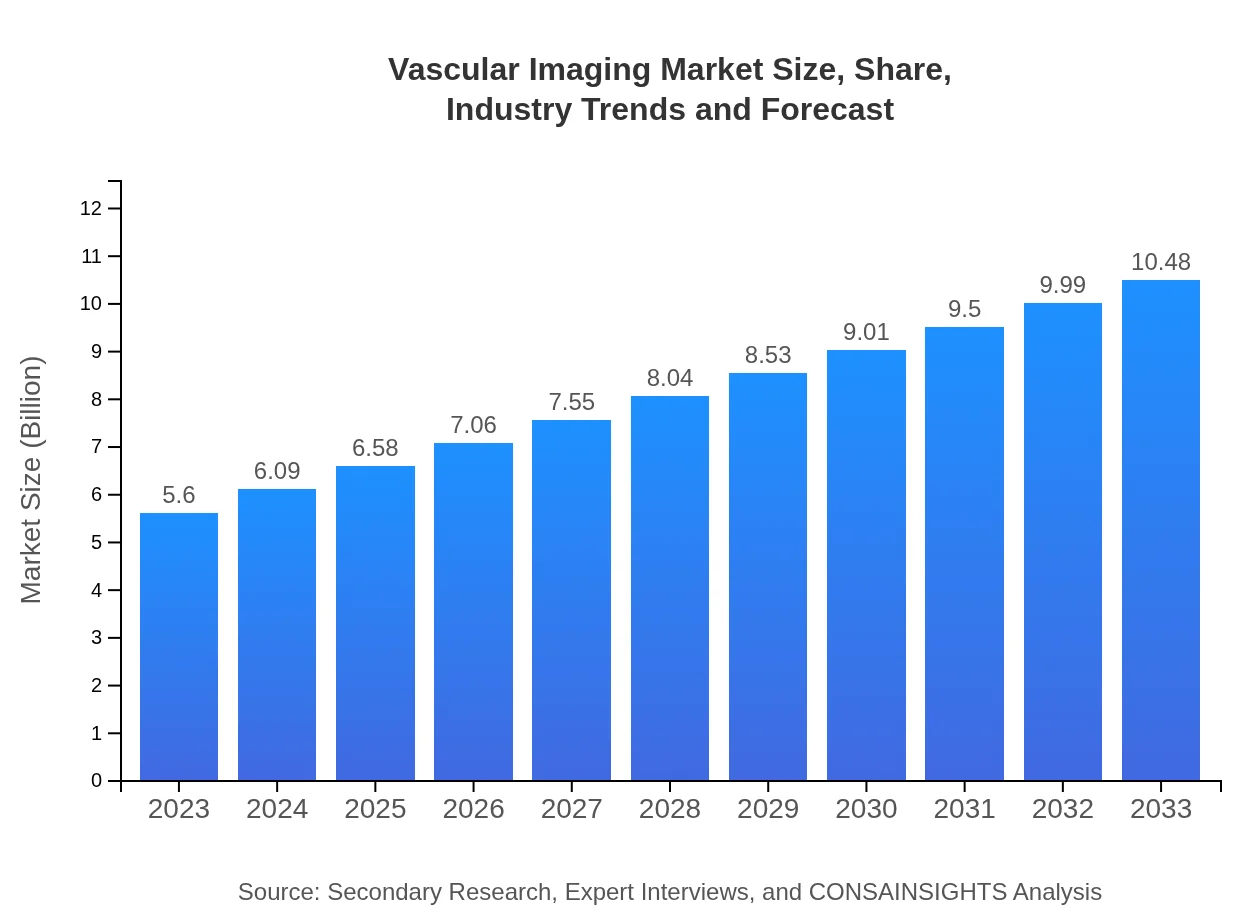

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $10.48 Billion |

| Top Companies | Siemens Healthineers, Philips Healthcare, GE Healthcare, Canon Medical Systems, Medtronic |

| Last Modified Date | 31 January 2026 |

Vascular Imaging Market Overview

Customize Vascular Imaging Market Report market research report

- ✔ Get in-depth analysis of Vascular Imaging market size, growth, and forecasts.

- ✔ Understand Vascular Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vascular Imaging

What is the Market Size & CAGR of Vascular Imaging market in 2033?

Vascular Imaging Industry Analysis

Vascular Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vascular Imaging Market Analysis Report by Region

Europe Vascular Imaging Market Report:

The European Vascular Imaging market is set to expand from $1.46 billion in 2023 to $2.73 billion by 2033. Strong regulatory frameworks and technological advancements contribute to market growth, particularly in Western European nations.Asia Pacific Vascular Imaging Market Report:

The Asia Pacific Vascular Imaging market is expected to grow from $1.12 billion in 2023 to $2.10 billion by 2033, at a CAGR of 6.7%. Significant investments in healthcare infrastructure and increasing awareness regarding vascular diseases are driving market growth in countries like India and China.North America Vascular Imaging Market Report:

North America is a leading region in the Vascular Imaging market, anticipated to grow from $1.82 billion in 2023 to $3.40 billion by 2033. Advanced healthcare services, favorable reimbursement scenarios, and a high prevalence of cardiovascular conditions strongly support market growth.South America Vascular Imaging Market Report:

In South America, the Vascular Imaging market is projected to rise from $0.46 billion in 2023 to $0.86 billion in 2033. The region’s growth is influenced by improving healthcare access and an increase in chronic diseases.Middle East & Africa Vascular Imaging Market Report:

In the Middle East and Africa, the Vascular Imaging market is estimated to grow from $0.74 billion in 2023 to $1.39 billion by 2033. Rising investments in healthcare infrastructure and increasing incidences of lifestyle diseases are stimulating market expansion in this region.Tell us your focus area and get a customized research report.

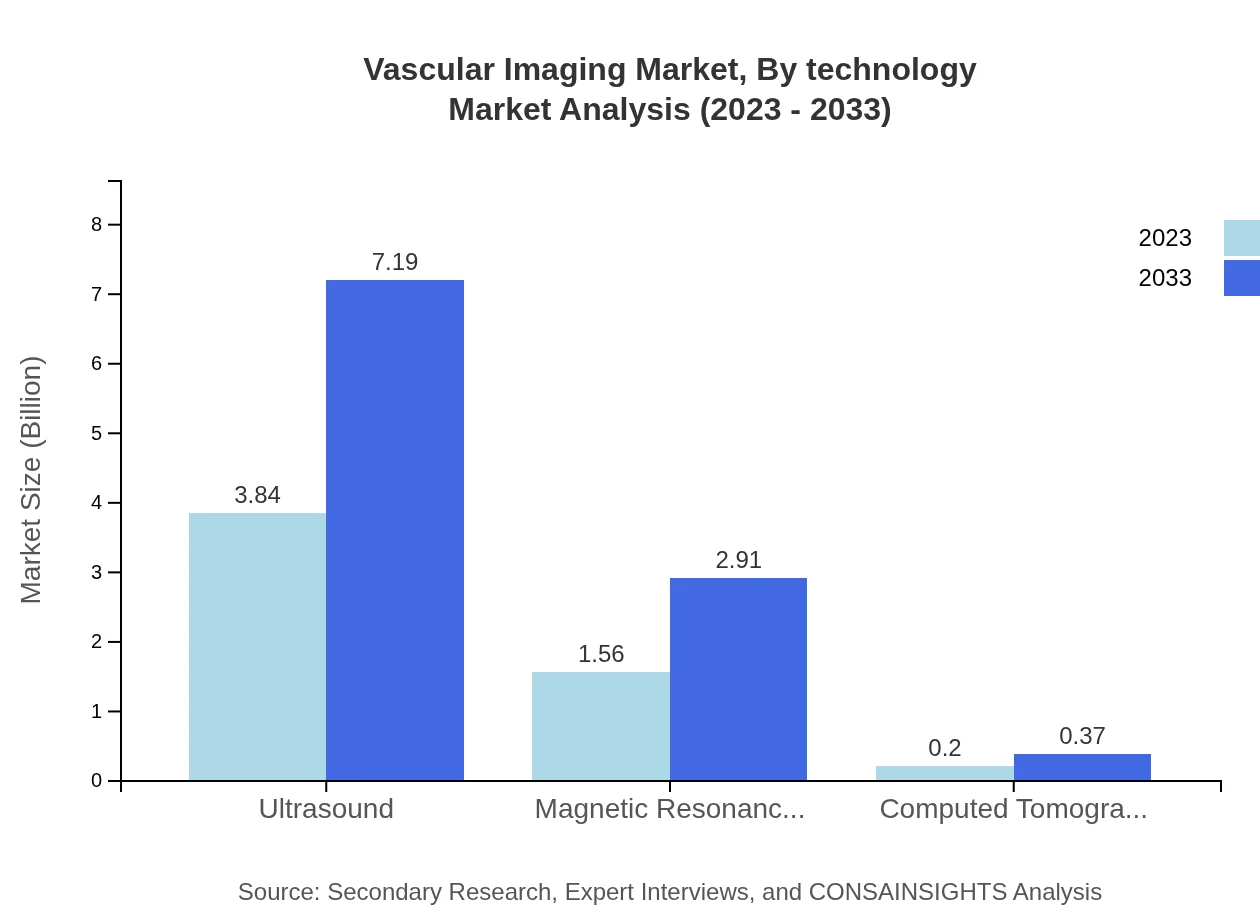

Vascular Imaging Market Analysis By Technology

The Vascular Imaging market by technology encompasses Ultrasound, MRI, and CT imaging modalities. Ultrasound is the largest segment, valued at $3.84 billion in 2023, with projections of reaching $7.19 billion by 2033. MRI and CT follow as significant segments with expected growth thanks to their enhanced imaging capabilities and applications in vascular assessment.

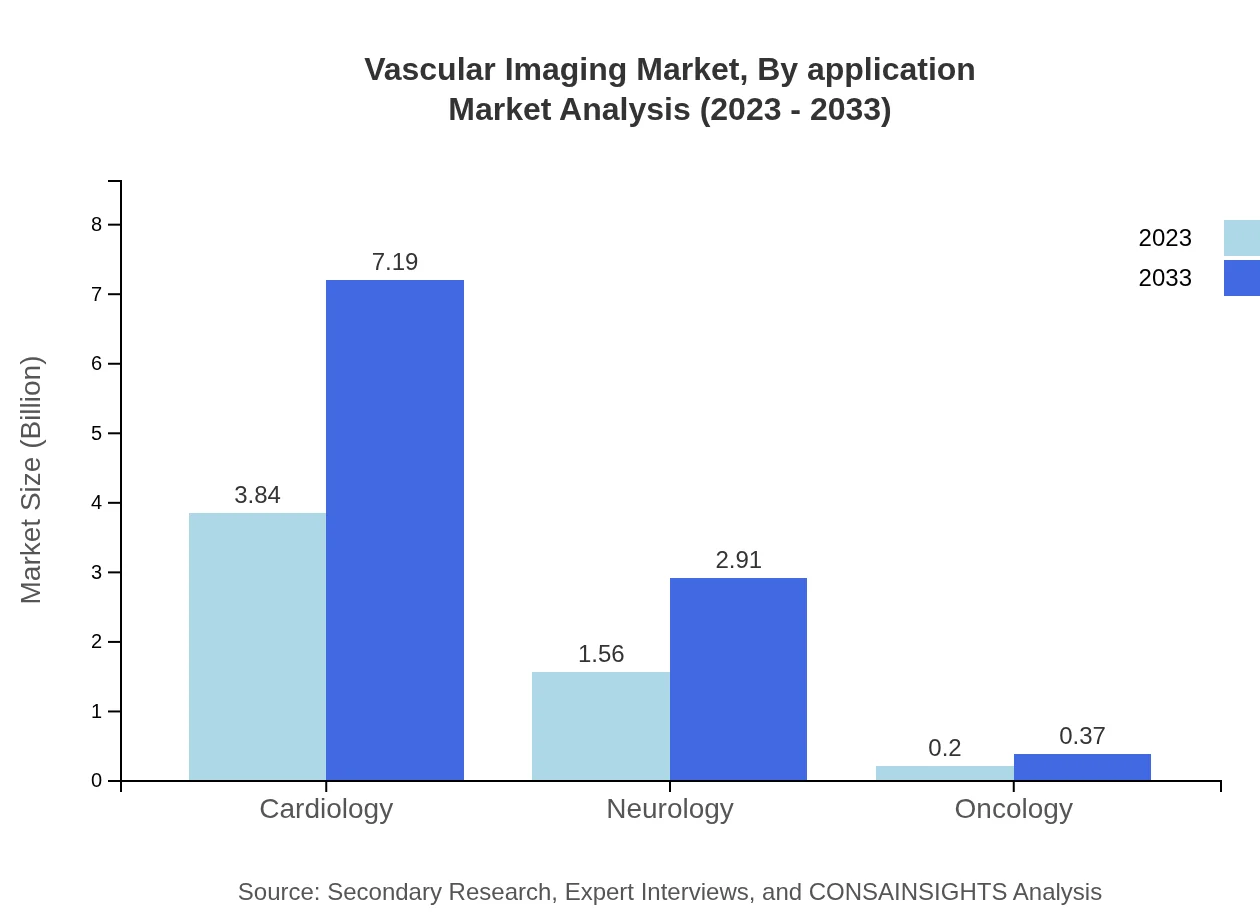

Vascular Imaging Market Analysis By Application

The application segment reveals that Cardiology dominates the space, accounting for $3.84 billion in 2023. Neurology and Oncology follow with respective valuations of $1.56 billion and $0.20 billion in 2023. The continual rise in cardiovascular disease incidence contributes significantly to the demand for vascular imaging services.

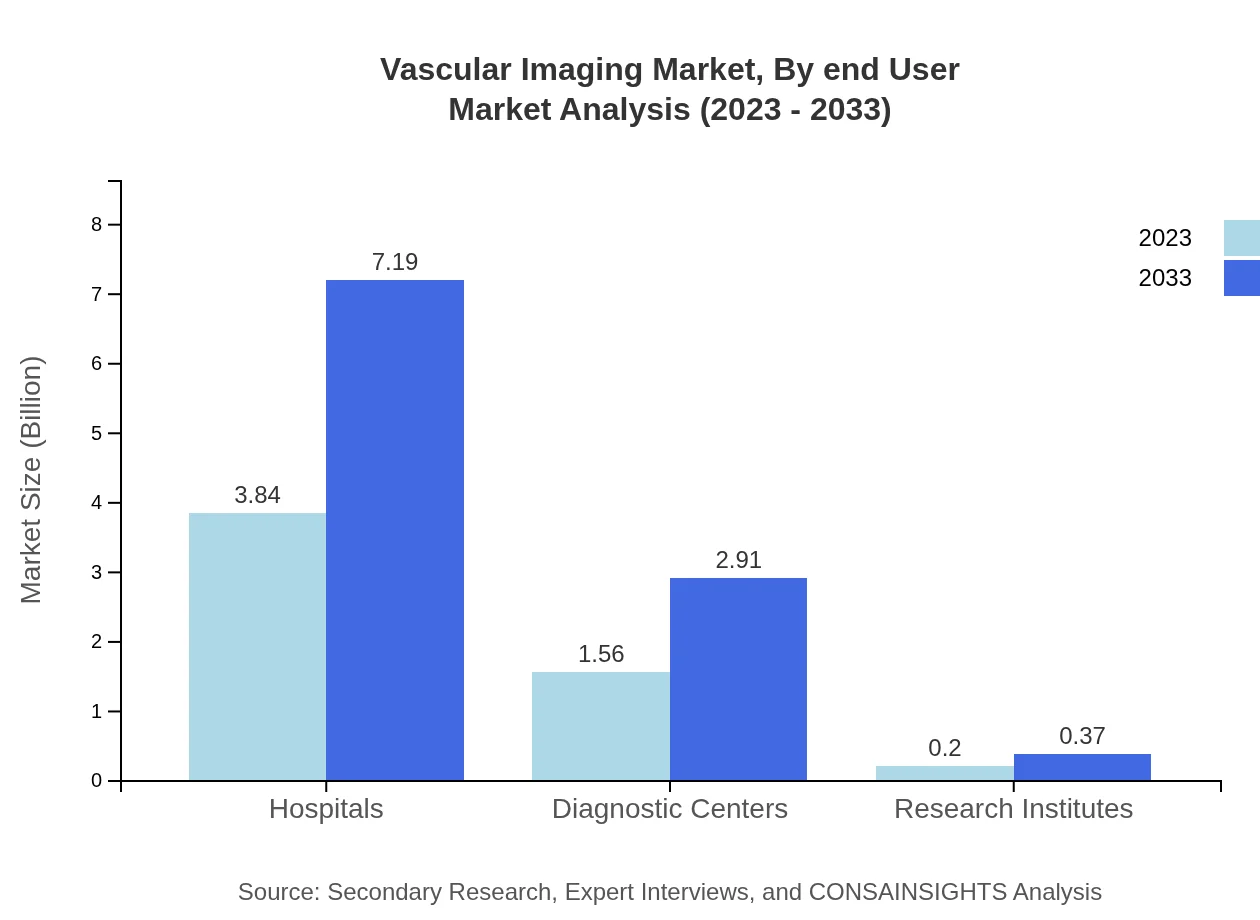

Vascular Imaging Market Analysis By End User

In the Vascular Imaging market, Hospitals are the largest end-user segment with $3.84 billion in 2023. Diagnostic Centers are also a crucial segment comprising approximately $1.56 billion. Research Institutes contribute significantly, particularly in clinical studies and trials focused on vascular diseases.

Vascular Imaging Market Analysis By Region

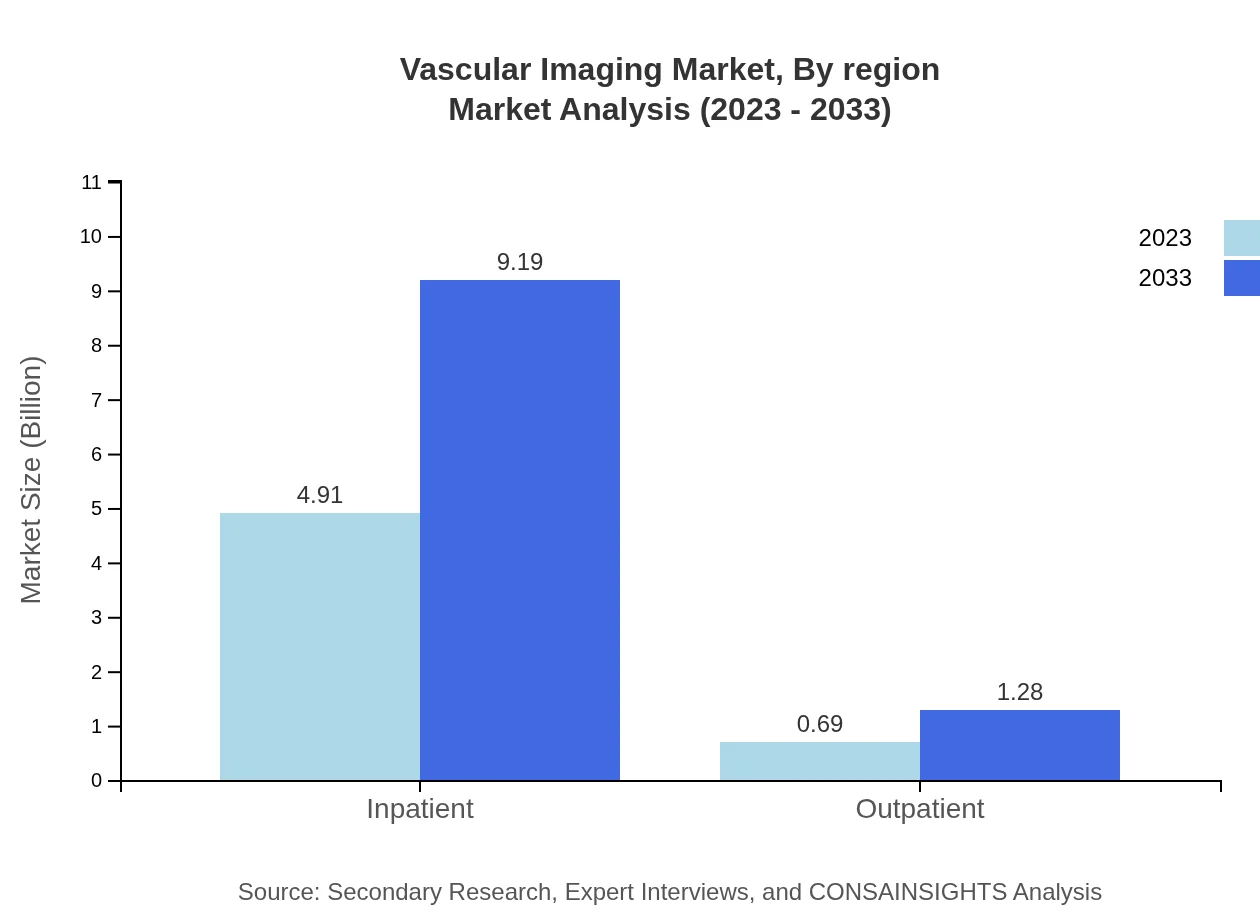

This segment indicates that inpatient settings are accountable for a market value of $4.91 billion in 2023 as compared to outpatient settings at $0.69 billion. Diagnostic Centers also play a vital role, reflecting increasing demand for vascular assessments outside hospital inpatients.

Vascular Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vascular Imaging Industry

Siemens Healthineers:

A leading provider of healthcare technology, Siemens Healthineers offers advanced imaging solutions, including MRI and ultrasound systems focused on vascular imaging.Philips Healthcare:

Philips specializes in innovative healthcare technologies, creating powerful ultrasound and MRI systems used extensively for vascular diagnostics.GE Healthcare:

GE Healthcare provides a comprehensive range of imaging technologies, focusing on enhancing vascular imaging through their CT and MRI offerings.Canon Medical Systems:

Canon Medical Systems is known for its cutting-edge imaging solutions, particularly in ultrasound and CT, crucial for accurate vascular assessments.Medtronic :

Medtronic contributes significantly to the vascular imaging market through its advancements in imaging technology along with treatment solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of vascular imaging?

The global vascular imaging market was valued at approximately $5.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.3%, indicating significant growth potential by 2033.

What are the key market players or companies in the vascular imaging industry?

Key market players in the vascular imaging industry include leading medical device companies and imaging solution providers known for their advanced technologies, such as ultrasound, MRI, and CT scan equipment.

What are the primary factors driving the growth in the vascular imaging industry?

Growth in the vascular imaging sector is primarily driven by the increasing prevalence of vascular diseases, advancements in imaging technology, and rising healthcare expenditure alongside a growing elderly population.

Which region is the fastest Growing in the vascular imaging market?

North America is the fastest-growing region in the vascular imaging market, projected to grow from $1.82 billion in 2023 to $3.40 billion by 2033, reflecting a significant regional increase.

Does ConsaInsights provide customized market report data for the vascular imaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the vascular imaging industry, ensuring insights are relevant to the client's strategic goals.

What deliverables can I expect from this vascular imaging market research project?

The vascular imaging market research project will deliver comprehensive reports, data analysis, market forecasts, and insights on competitive landscapes and segmentations.

What are the market trends of vascular imaging?

Current trends in vascular imaging include increased adoption of non-invasive imaging techniques and technological advancements, along with a shift towards outpatient services enhancing patient accessibility.