Vendor Management Software Market Report

Published Date: 31 January 2026 | Report Code: vendor-management-software

Vendor Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vendor Management Software market from 2023 to 2033, highlighting market trends, growth projections, technological advancements, and regional dynamics.

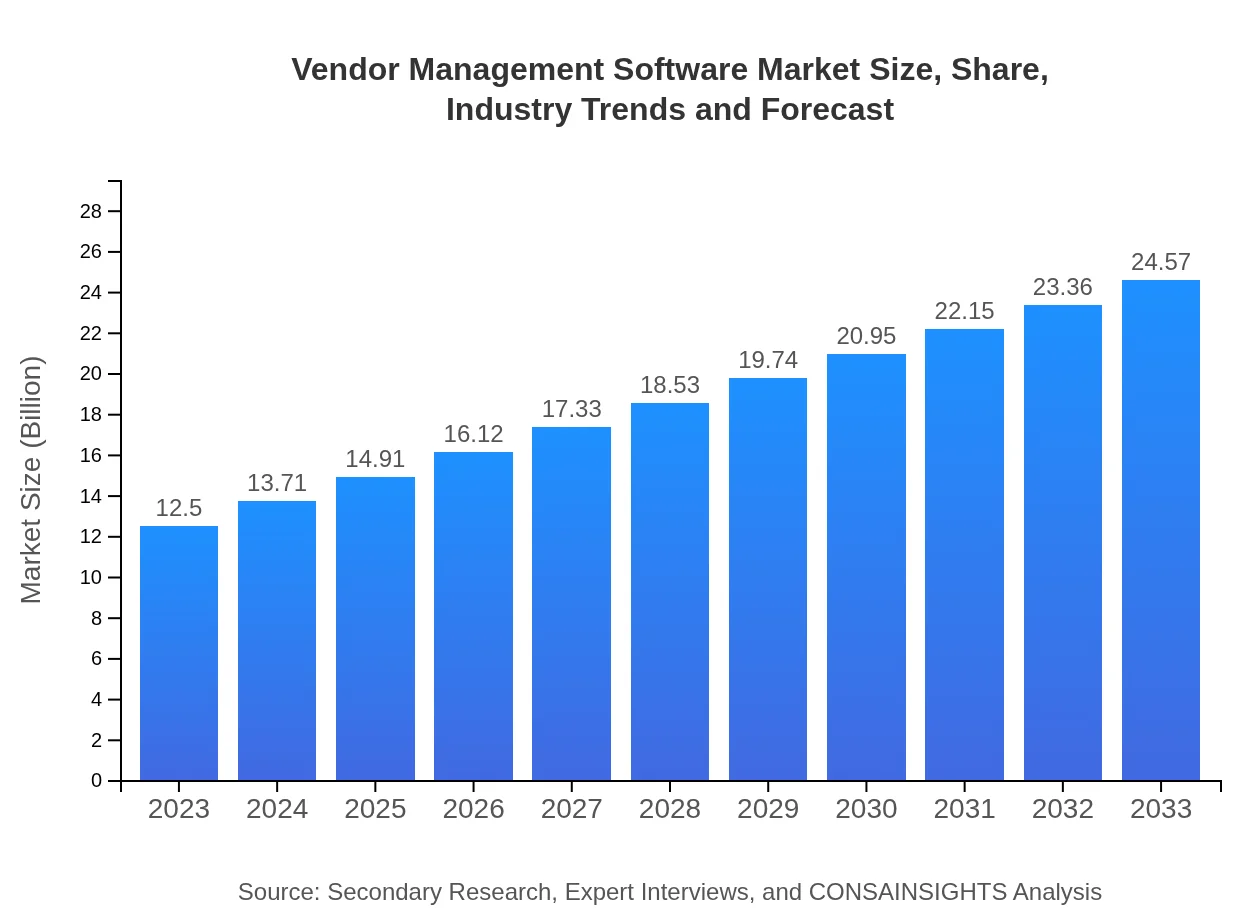

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | SAP Ariba, ProcurementExpress.com, Oracle Procurement Cloud, Coupa Software, GEP SMART |

| Last Modified Date | 31 January 2026 |

Vendor Management Software Market Overview

Customize Vendor Management Software Market Report market research report

- ✔ Get in-depth analysis of Vendor Management Software market size, growth, and forecasts.

- ✔ Understand Vendor Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vendor Management Software

What is the Market Size & CAGR of Vendor Management Software market in 2023?

Vendor Management Software Industry Analysis

Vendor Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vendor Management Software Market Analysis Report by Region

Europe Vendor Management Software Market Report:

The European market for Vendor Management Software is projected to grow significantly from USD 3.97 billion in 2023 to USD 7.81 billion by 2033. Regulatory compliance in various sectors pushes businesses towards more sophisticated vendor management strategies, accompanied by substantial investments in digital solutions.Asia Pacific Vendor Management Software Market Report:

In the Asia Pacific region, the Vendor Management Software market is projected to grow from USD 2.17 billion in 2023 to USD 4.26 billion by 2033, reflecting a notable increase due to expanding industries and the digital transformation of businesses. The integration of cloud solutions is particularly driving demand as enterprises seek scalable vendor management tools.North America Vendor Management Software Market Report:

North America is expected to lead the market, growing from USD 4.51 billion in 2023 to USD 8.87 billion by 2033. The region's strong adoption of advanced technologies, professional services, and intricate supply chains play a vital role in the escalating demand for comprehensive vendor management solutions.South America Vendor Management Software Market Report:

South America shows a gradual growth trajectory, with the market anticipated to grow from USD 0.19 billion in 2023 to USD 0.38 billion in 2033. The increase is driven by the growing need for compliance and vendor risk management strategies within key sectors like finance and logistics.Middle East & Africa Vendor Management Software Market Report:

The Middle East and Africa market is projected to experience growth from USD 1.65 billion in 2023 to USD 3.25 billion by 2033. The expansion of both local businesses and multinational corporations drives the adoption of vendor management solutions amidst increasing operational complexities.Tell us your focus area and get a customized research report.

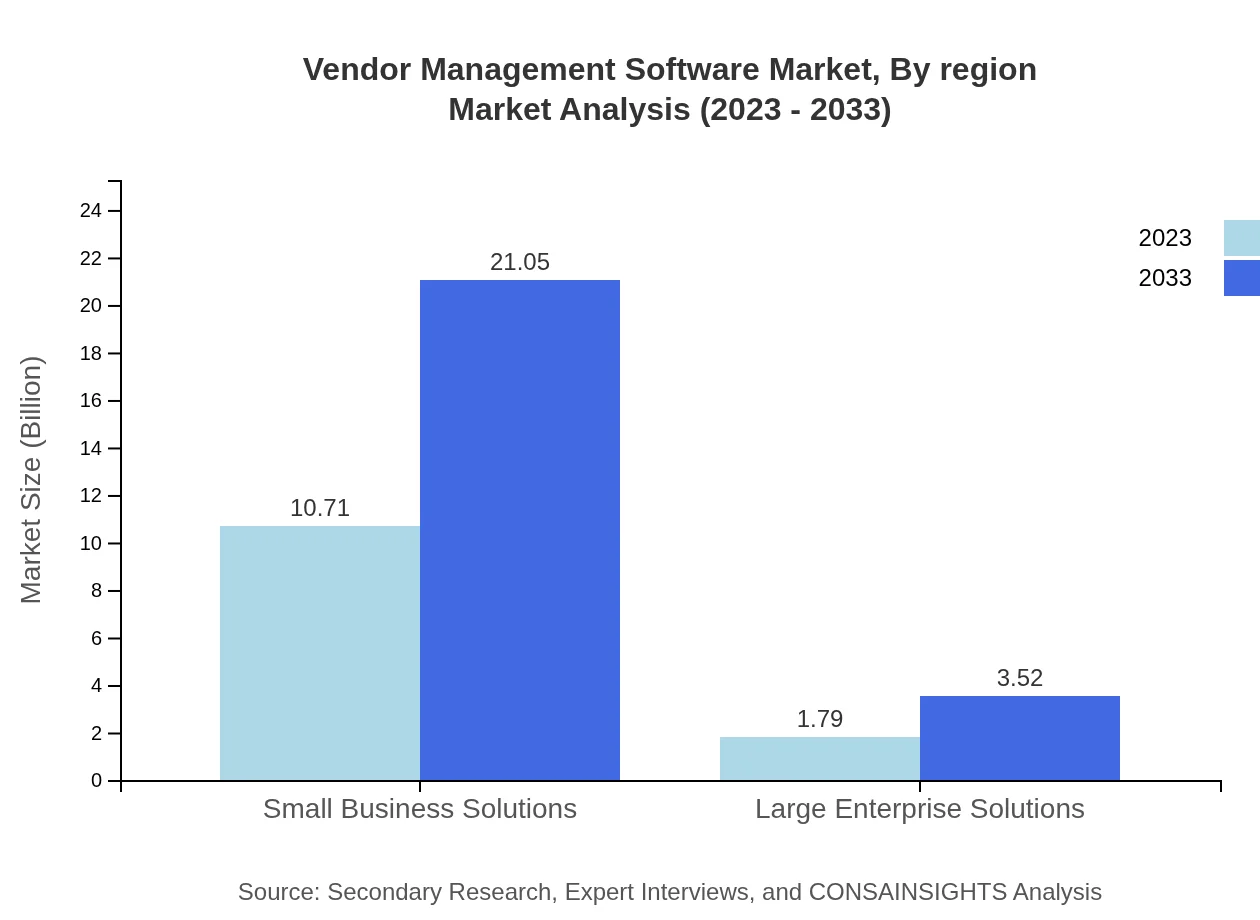

Vendor Management Software Market Analysis By Product Type

The market is segmented by product type, including small business solutions and large enterprise solutions. Small business solutions are anticipated to dominate due to their affordability and accessibility, growing from USD 10.71 billion in 2023 to USD 21.05 billion by 2033. Large enterprise solutions will also witness significant growth from USD 1.79 billion in 2023 to USD 3.52 billion by 2033, driven by the need for comprehensive vendor oversight within large operations.

Vendor Management Software Market Analysis By Application Area

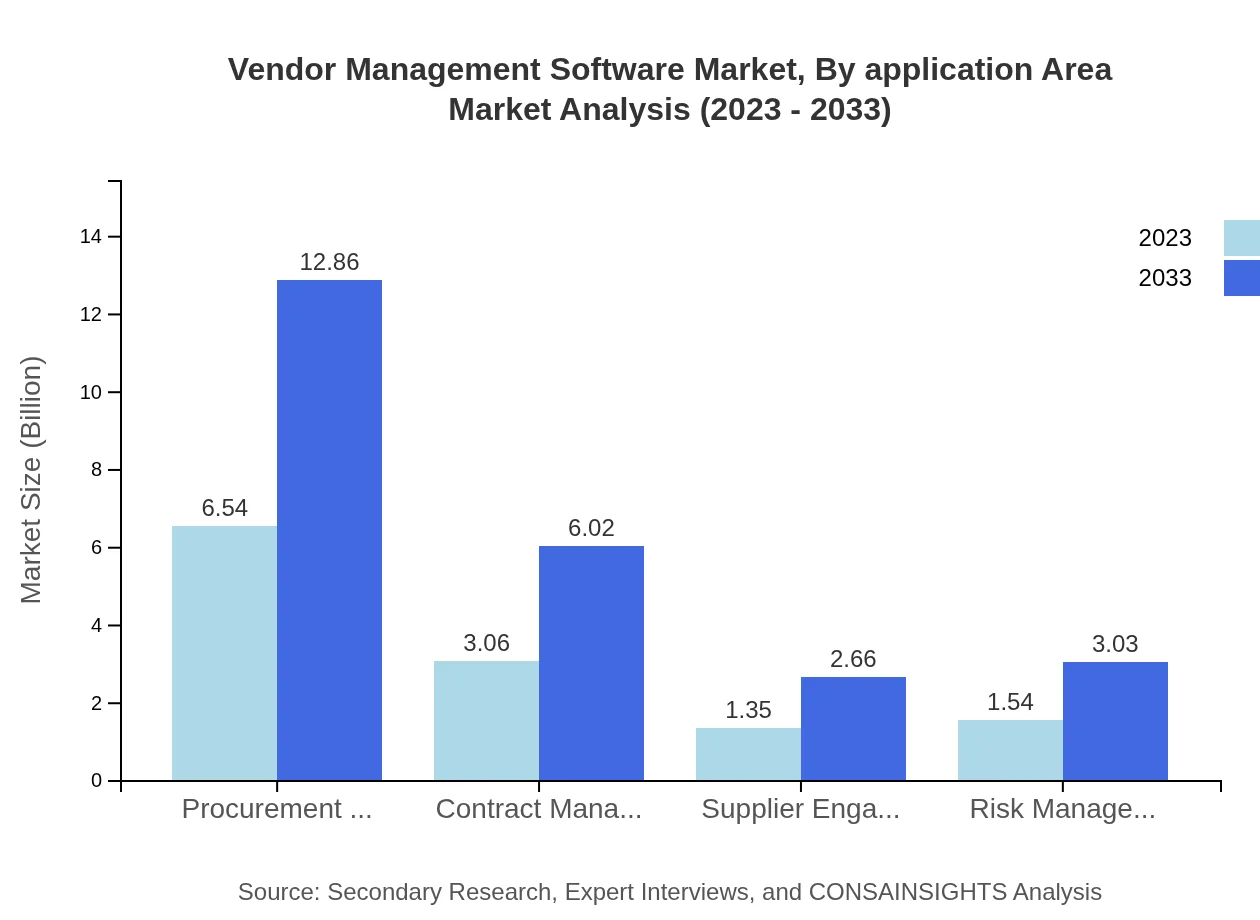

Key application areas include vendor selection, performance evaluation, compliance management, and procurement management. Vendor selection stands out with a projected growth from USD 6.54 billion in 2023 to USD 12.86 billion by 2033. Performance evaluation and compliance management also see strong demand, reflecting the industry's focus on vendor accountability and risk mitigation.

Vendor Management Software Market Analysis By End User Industry

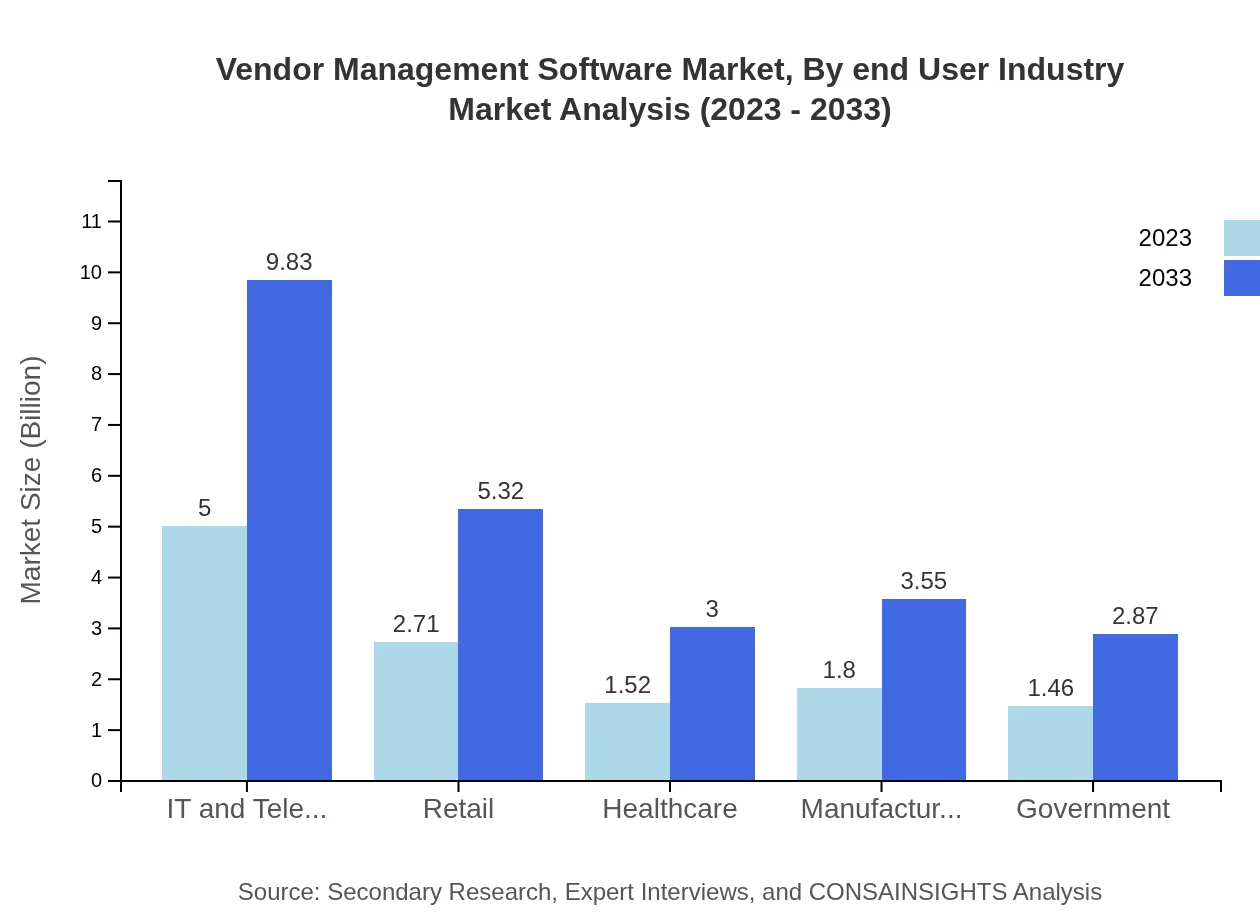

The market is deeply influenced by various end-user industries including IT and telecom, retail, healthcare, manufacturing, and government sectors. The IT and telecom industry represents a significant share, valued at USD 5.00 billion in 2023, while the retail sector, valued at USD 2.71 billion, is also growing impressively, with heightened demand for streamlined vendor processes.

Vendor Management Software Market Analysis By Region

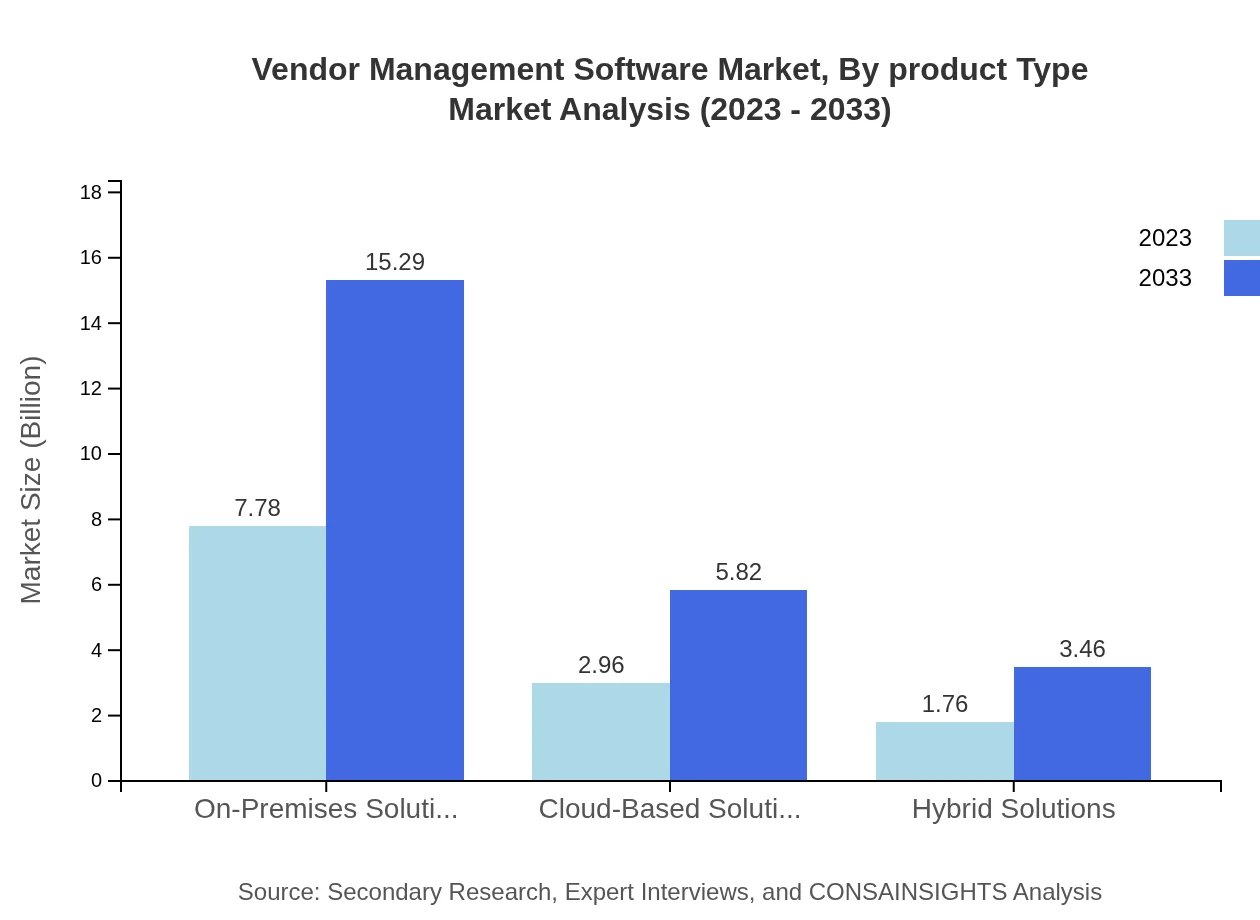

Vendor Management Software is categorized into cloud-based, on-premises, and hybrid solutions. The on-premises solutions hold a significant market share with USD 7.78 billion in 2023, as many large enterprises prefer these due to control. Nevertheless, cloud-based solutions are catching up, expected to grow from USD 2.96 billion in 2023 to USD 5.82 billion by 2033, reflecting organizational shifts towards digital transformations.

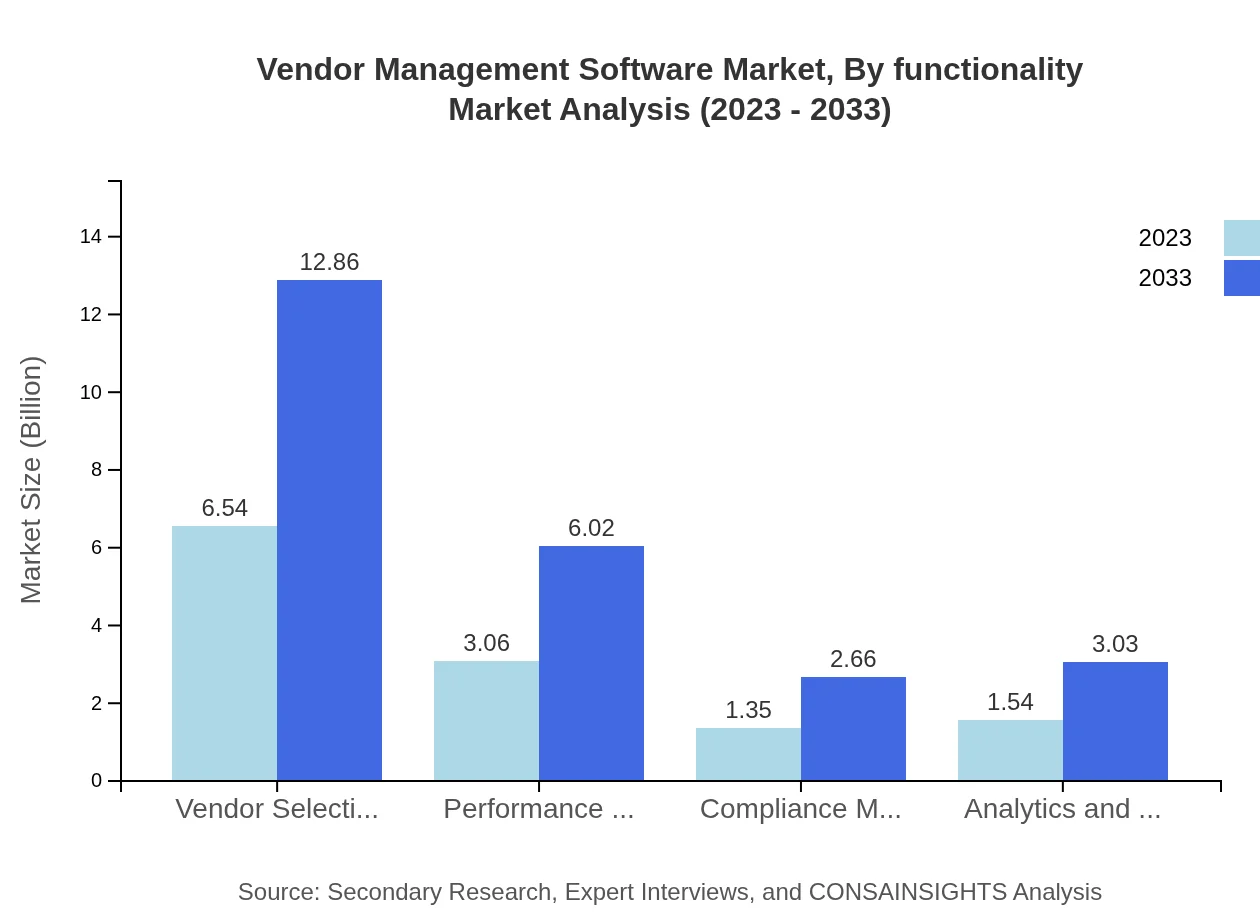

Vendor Management Software Market Analysis By Functionality

Functionally, the market can be divided into critical areas like risk management, supplier engagement, and analytics and reporting. Each of these functionalities addresses unique needs of organizations, enhancing decision-making processes. Notably, risk management solutions are anticipated to grow from USD 1.54 billion in 2023 to USD 3.03 billion by 2033, highlighting the increasing importance of vendor risk oversight.

Vendor Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vendor Management Software Industry

SAP Ariba:

SAP Ariba is a leading provider of procurement software, offering robust VMS solutions that enable businesses to manage suppliers effectively, optimizing procurement and compliance.ProcurementExpress.com:

ProcurementExpress.com delivers intuitive spend management software with vendor management capabilities tailored for small to medium enterprises, facilitating better control and transparency.Oracle Procurement Cloud:

Oracle’s Procurement Cloud provides organizations with comprehensive tools for managing supplier engagements and fostering compliance within a user-friendly dashboard.Coupa Software:

Coupa Software offers a unified platform for procurement and vendor management, enabling organizations to streamline processes and enhance visibility across the supply chain.GEP SMART:

GEP SMART is an intelligent procurement and vendor management platform that harnesses advanced analytics to optimize supplier collaboration and sourcing strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of vendor Management Software?

The vendor management software market is sized at approximately $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%. It is anticipated to grow significantly by 2033, reflecting the increasing importance of vendor management.

What are the key market players or companies in the vendor Management Software industry?

Key players in the vendor management software market typically include industry giants like SAP, Oracle, and Coupa. They dominate various market segments through innovative solutions and strategic partnerships, facilitating improved vendor relationships and operational efficiency.

What are the primary factors driving the growth in the vendor management software industry?

Key growth factors in the vendor management software industry include increasing globalization of supply chains, the need for compliance and risk management, and the rising demand for data analytics, all contributing to greater operational efficiencies and cost reductions.

Which region is the fastest Growing in the vendor management software?

The fastest-growing region for vendor management software is projected to be Europe, with market size increasing from $3.97 billion in 2023 to $7.81 billion by 2033. Asia Pacific follows closely, reflecting strong economic growth and digital transformation initiatives.

Does ConsaInsights provide customized market report data for the vendor management software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the vendor management software industry. This service ensures relevant insights and forecasts aligned with individual business objectives and strategic planning.

What deliverables can I expect from this vendor management software market research project?

Deliverables from the vendor management software market research project typically include detailed market analysis reports, trend forecasts, competitive landscape insights, and actionable recommendations tailored to your business needs.

What are the market trends of vendor management software?

Current market trends in vendor management software include a shift towards cloud-based solutions, integration of AI and machine learning for analytics, and an emphasis on compliance management, highlighting the evolving landscape of vendor relationships.