Vendor Neutral Archive Vna And Pacs Market Report

Published Date: 31 January 2026 | Report Code: vendor-neutral-archive-vna-and-pacs

Vendor Neutral Archive Vna And Pacs Market Size, Share, Industry Trends and Forecast to 2033

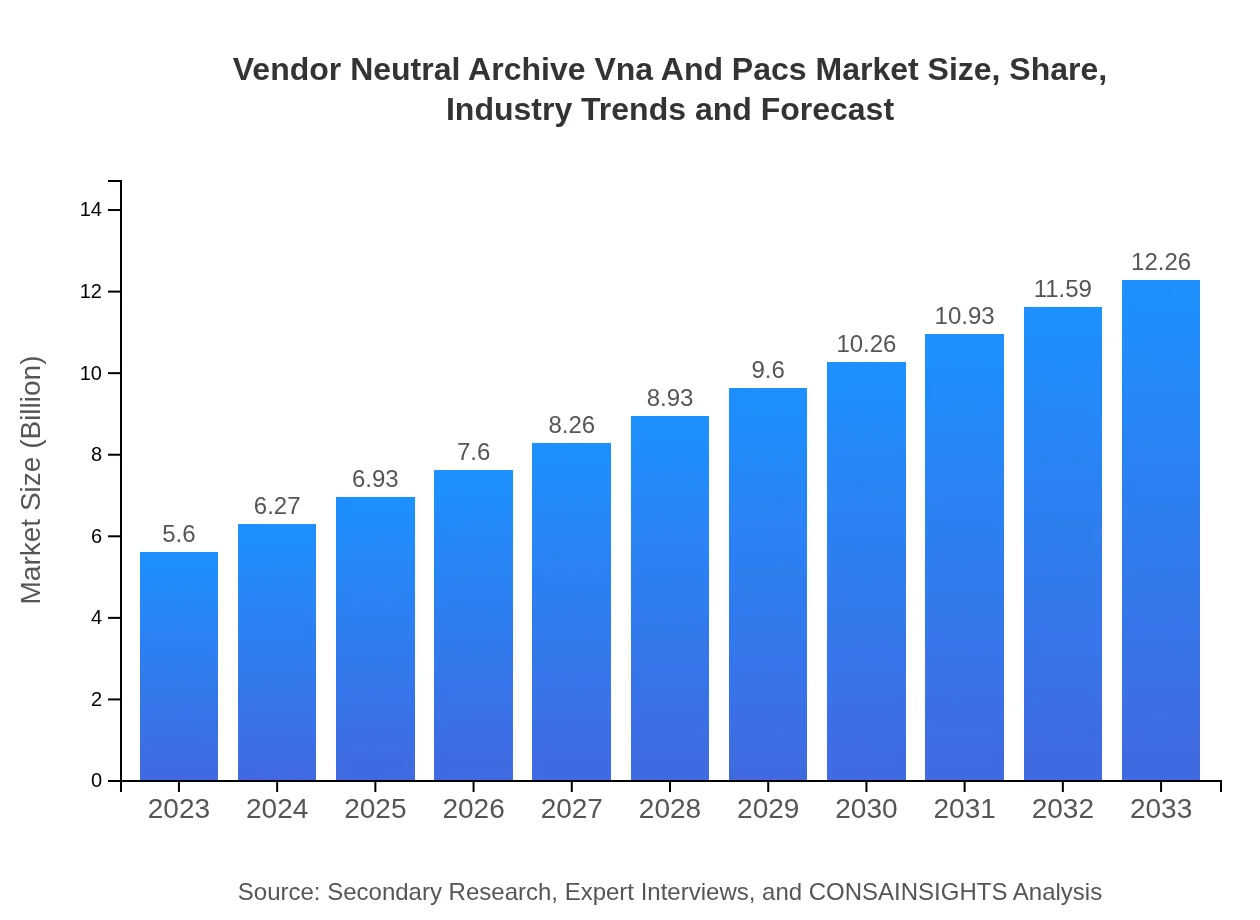

This report provides an in-depth analysis of the Vendor Neutral Archive (VNA) and Picture Archiving and Communication Systems (PACS) market, covering forecasts from 2023 to 2033. Insights include market size, growth rates, technology trends, and regional explorations, aimed at empowering stakeholders with comprehensive data.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.9% |

| 2033 Market Size | $12.26 Billion |

| Top Companies | GE Healthcare, Philips Healthcare, Siemens Healthineers, Carestream Health, McKesson Corporation |

| Last Modified Date | 31 January 2026 |

Vendor Neutral Archive Vna And Pacs Market Overview

Customize Vendor Neutral Archive Vna And Pacs Market Report market research report

- ✔ Get in-depth analysis of Vendor Neutral Archive Vna And Pacs market size, growth, and forecasts.

- ✔ Understand Vendor Neutral Archive Vna And Pacs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vendor Neutral Archive Vna And Pacs

What is the Market Size & CAGR of Vendor Neutral Archive Vna And Pacs market in 2023?

Vendor Neutral Archive Vna And Pacs Industry Analysis

Vendor Neutral Archive Vna And Pacs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vendor Neutral Archive Vna And Pacs Market Analysis Report by Region

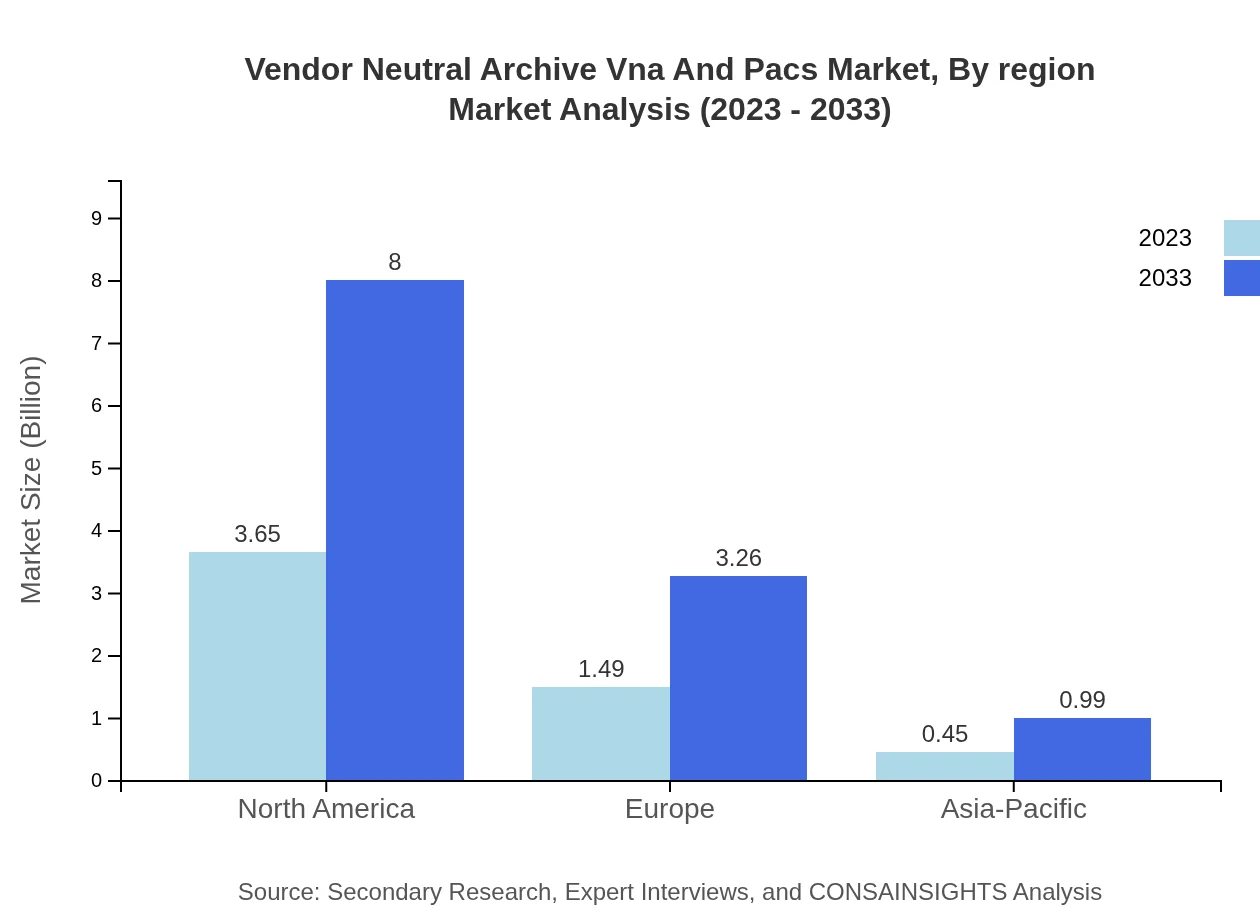

Europe Vendor Neutral Archive Vna And Pacs Market Report:

The European VNA and PACS market is set to grow from $1.53 billion in 2023 to $3.35 billion by 2033. The region's focus on data protection and interoperability standards is expected to enhance market growth.Asia Pacific Vendor Neutral Archive Vna And Pacs Market Report:

The VNA and PACS market in Asia-Pacific is estimated to reach $2.33 billion by 2033, up from $1.07 billion in 2023. Growing healthcare IT investments and digitization initiatives are the primary drivers in this region, alongside increasing patient volumes.North America Vendor Neutral Archive Vna And Pacs Market Report:

North America holds the largest share of the VNA and PACS market, with a projected size of $4.61 billion in 2033, rising from $2.10 billion in 2023. This growth is fueled by the presence of key market players and a robust healthcare infrastructure.South America Vendor Neutral Archive Vna And Pacs Market Report:

In South America, the VNA and PACS market is projected to grow from $0.34 billion in 2023 to $0.74 billion by 2033, driven by rising healthcare expenditures and increased demand for quality imaging services.Middle East & Africa Vendor Neutral Archive Vna And Pacs Market Report:

The VNA and PACS market in the Middle East and Africa is projected to increase from $0.56 billion in 2023 to $1.23 billion by 2033, with investments in advanced healthcare systems playing a significant role in this growth.Tell us your focus area and get a customized research report.

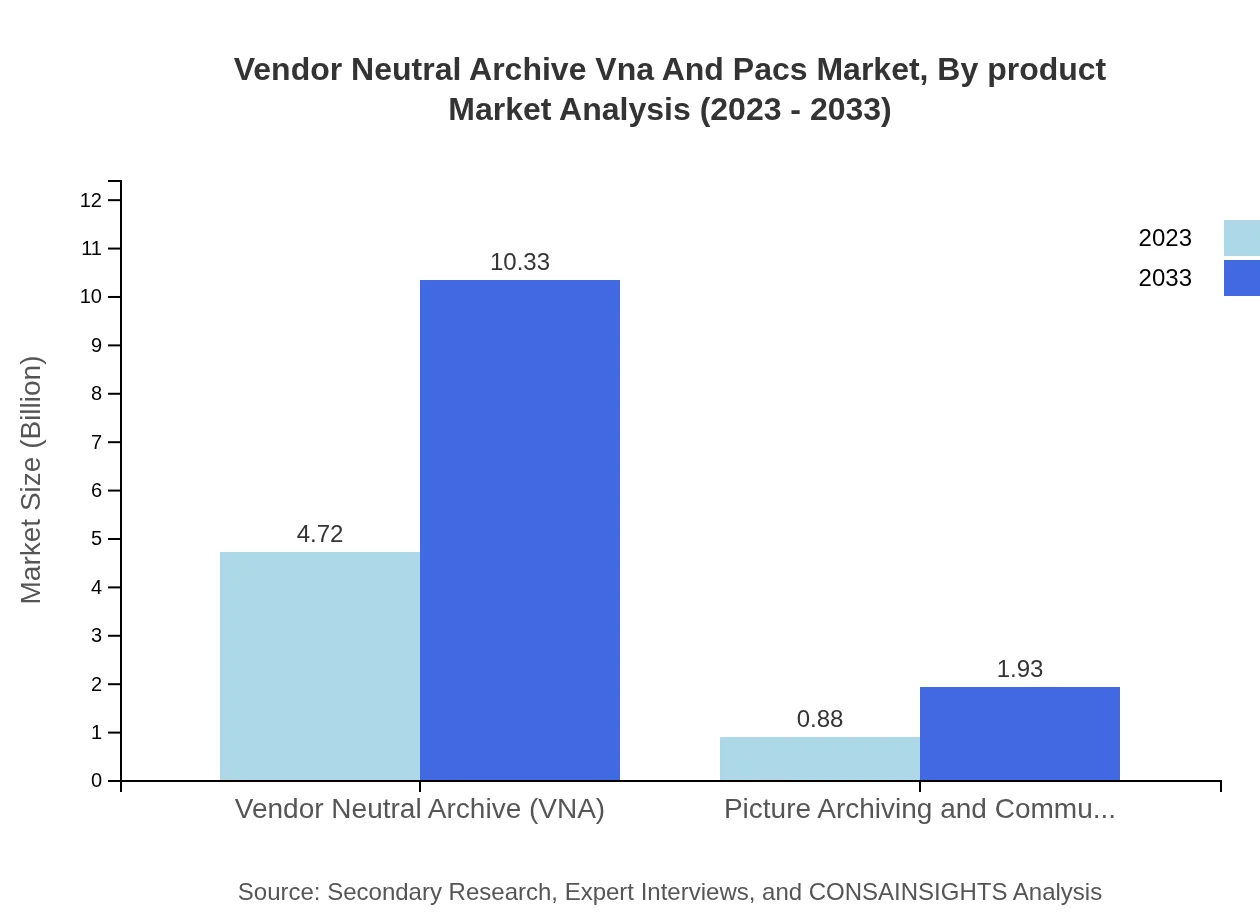

Vendor Neutral Archive Vna And Pacs Market Analysis By Product

VNA products dominate the market, accounting for approximately 84.24% of the share in 2023, and are expected to drive significant growth due to their flexibility and interoperability benefits. PACS holds 15.76% of the market, reflecting its essential role in traditional imaging practices. Both product segments are crucial for comprehensive medical imaging solutions.

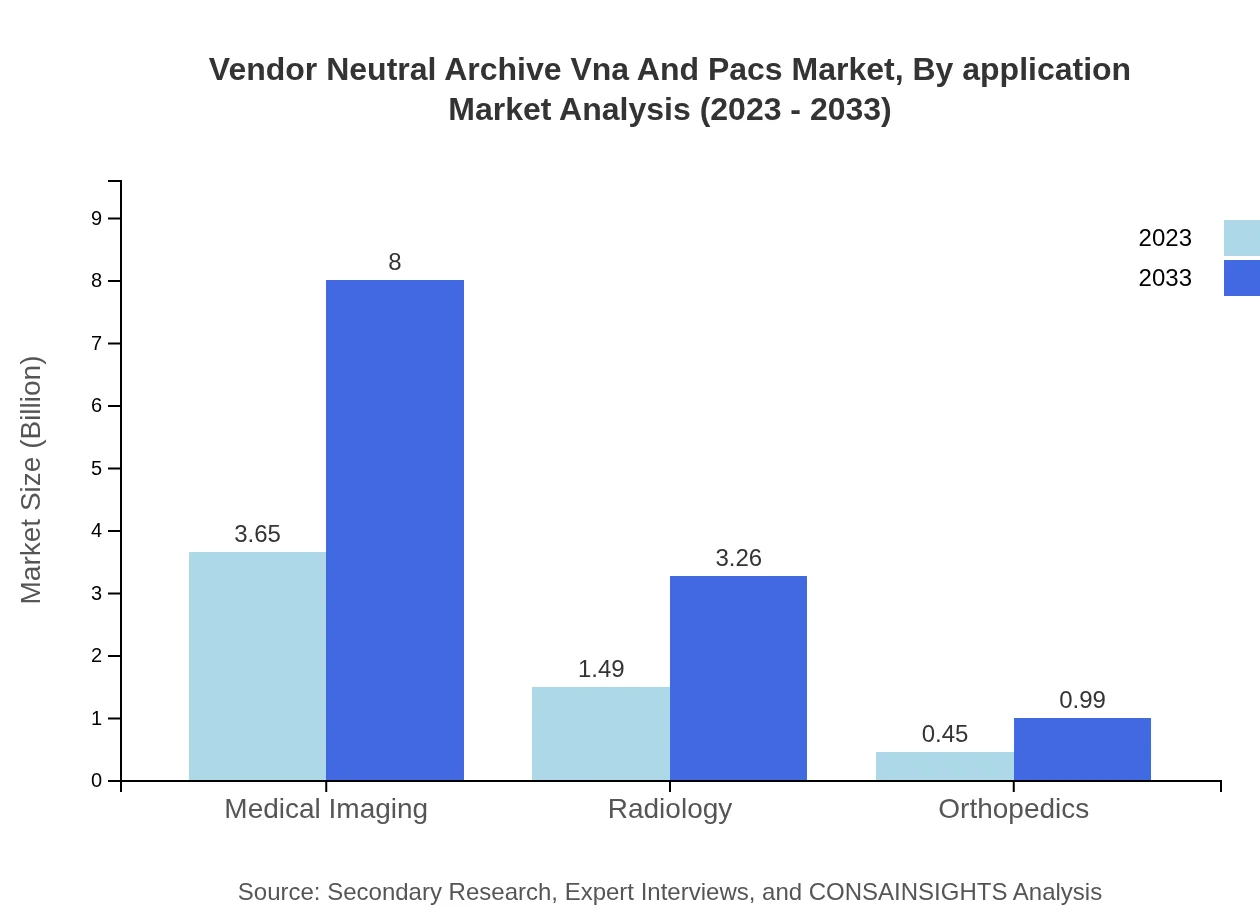

Vendor Neutral Archive Vna And Pacs Market Analysis By Application

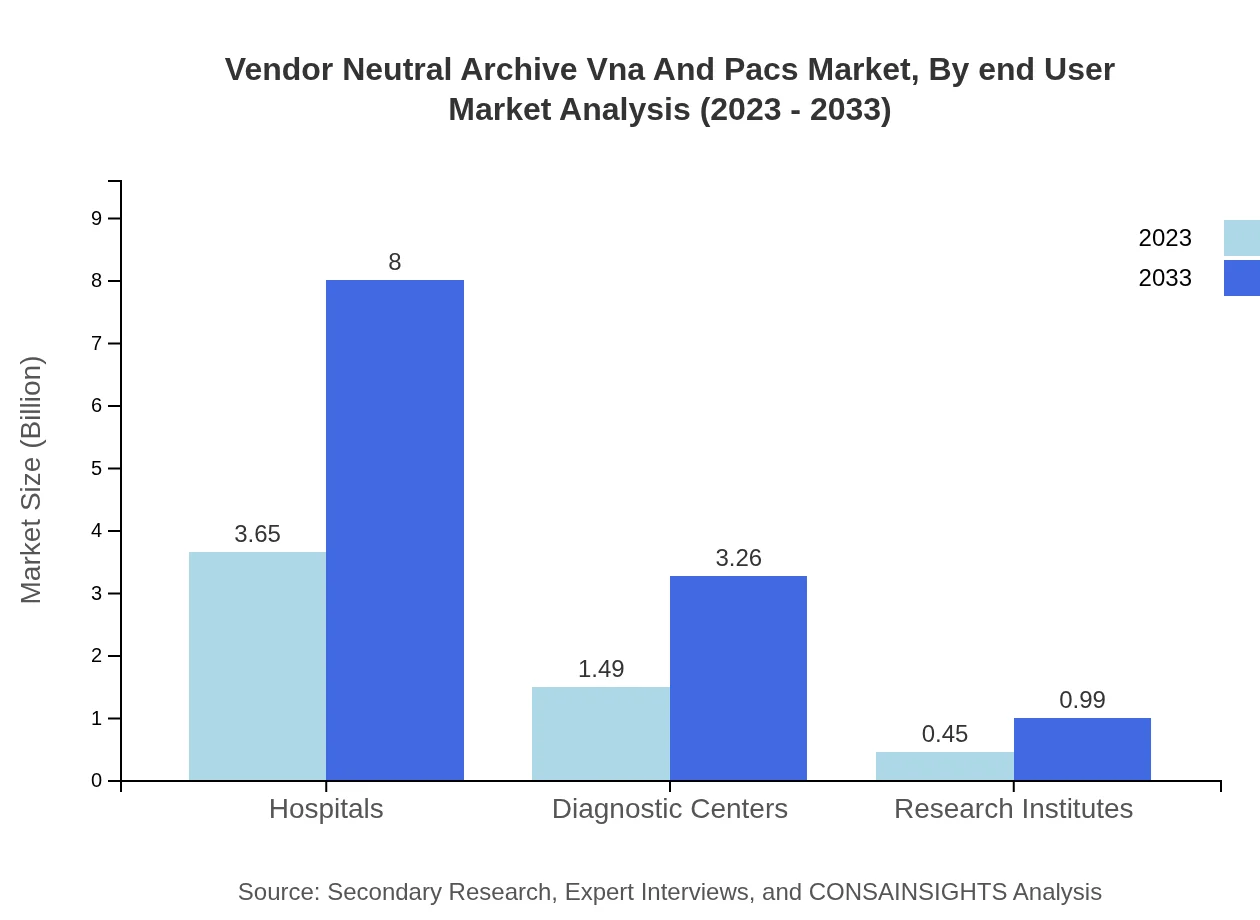

In the application segment, hospitals represent the largest end-user market, contributing to 65.26% in 2023, growing steadily as healthcare providers adopt integrated imaging systems. Diagnostic centers follow with a significant share of 26.63%, reflecting their reliance on efficient data management for patient diagnostics.

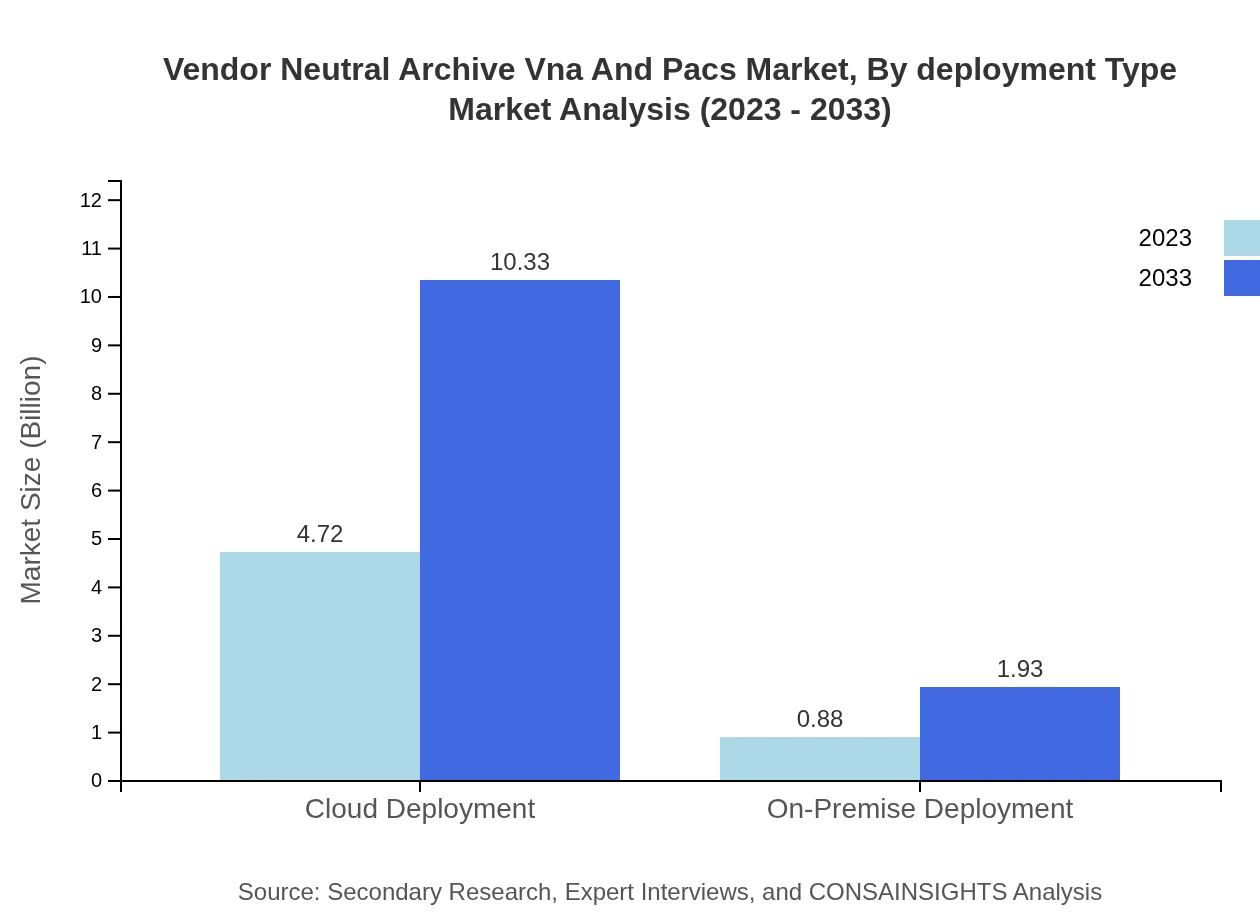

Vendor Neutral Archive Vna And Pacs Market Analysis By Deployment Type

Cloud deployment is preferred due to its 84.24% share in the market, driven by its cost-effectiveness and accessibility. On-premise deployment accounts for 15.76% as some organizations prefer retaining data on-site for compliance and security reasons.

Vendor Neutral Archive Vna And Pacs Market Analysis By End User

The end-user landscape showcases a strong inclination towards hospitals, contributing significantly with a market share of 65.26% in 2023, while diagnostic centers hold 26.63%, emphasizing the need for robust imaging solutions in patient care environments.

Vendor Neutral Archive Vna And Pacs Market Analysis By Region

Regional analysis reveals North America as the largest market area with a size of $4.61 billion by 2033. Europe and Asia-Pacific are also critical regions showing robust growth due to increasing investments in health facilities and technological advancements.

Vendor Neutral Archive Vna And Pacs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vendor Neutral Archive Vna And Pacs Industry

GE Healthcare:

GE Healthcare is a leading player offering innovative imaging solutions that enhance workflow efficiency and patient care standards.Philips Healthcare:

Philips is known for its advanced VNA and PACS systems, focusing on personalized healthcare and improved clinical outcomes.Siemens Healthineers:

Siemens provides integrated imaging solutions with advanced analytics capabilities as part of its PACS and VNA offerings.Carestream Health:

Carestream Health specializes in imaging and healthcare IT solutions, enhancing diagnostic and operational efficiencies.McKesson Corporation:

McKesson is a prominent healthcare provider that integrates VNA solutions into its distribution and pharmacy services.We're grateful to work with incredible clients.

FAQs

What is the market size of vendor Neutral Archive Vna And Pacs?

The vendor-neutral archive (VNA) and picture archiving and communication systems (PACS) market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.9% from its current size.

What are the key market players or companies in this vendor Neutral Archive Vna And Pacs industry?

Key market players in the VNA and PACS industry include organizations that specialize in advanced imaging technologies, software solutions, and digital archiving systems that support healthcare facilities globally.

What are the primary factors driving the growth in the vendor Neutral Archive Vna And Pacs industry?

Growth in the VNA and PACS industry is driven by factors such as increasing demand for integrated healthcare solutions, advancements in imaging technologies, and the need for efficient data management in medical facilities.

Which region is the fastest Growing in the vendor Neutral Archive Vna And Pacs?

The Asia-Pacific region is the fastest-growing market for VNA and PACS, expected to expand from $1.07 billion in 2023 to $2.33 billion by 2033, driven by increasing healthcare investments.

Does ConsaInsights provide customized market report data for the vendor Neutral Archive Vna And Pacs industry?

Yes, ConsaInsights offers customized market report data tailored to client needs within the vendor-neutral archive and PACS industry, ensuring relevant insights and analytics.

What deliverables can I expect from this vendor Neutral Archive Vna And Pacs market research project?

Deliverables include comprehensive market analysis reports, forecasts, segment data, competitor analysis, and insights into regional trends tailored to your specific industry focus.

What are the market trends of vendor Neutral Archive Vna And Pacs?

Key trends include the increasing adoption of cloud-based solutions, integration of AI in medical imaging, and a shift towards patient-centric healthcare models, indicating a transformative shift in healthcare data management.