Vendor Risk Management Market Report

Published Date: 31 January 2026 | Report Code: vendor-risk-management

Vendor Risk Management Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Vendor Risk Management market, offering insights into its growth, key players, regional dynamics, and trends expected from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.34 Billion |

| Top Companies | SAP SE, IBM Corporation, RSA Security LLC, MetricStream |

| Last Modified Date | 31 January 2026 |

Vendor Risk Management Market Overview

Customize Vendor Risk Management Market Report market research report

- ✔ Get in-depth analysis of Vendor Risk Management market size, growth, and forecasts.

- ✔ Understand Vendor Risk Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vendor Risk Management

What is the Market Size & CAGR of Vendor Risk Management market in 2023?

Vendor Risk Management Industry Analysis

Vendor Risk Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vendor Risk Management Market Analysis Report by Region

Europe Vendor Risk Management Market Report:

In Europe, the market is expected to grow from $2.89 billion in 2023 to $7.18 billion by 2033. Strong data protection regulations such as GDPR stimulate organizations to enhance their vendor risk management strategies and tools.Asia Pacific Vendor Risk Management Market Report:

The Asia Pacific region reflects a market size of $2.04 billion in 2023, projected to grow to $5.07 billion by 2033. Growth is driven by rapid digitalization, increasing regulatory compliance requirements, and significant investment in technology solutions, fostering a greater focus on vendor risk management.North America Vendor Risk Management Market Report:

North America holds a significant share of the market, valued at $3.99 billion in 2023, with expectations to grow to $9.90 billion by 2033. Increasing regulatory scrutiny in sectors such as finance and healthcare drives organizations to adopt robust vendor risk management practices.South America Vendor Risk Management Market Report:

The South American market is relatively smaller, estimated at $0.22 billion in 2023, expected to reach $0.54 billion by 2033. The gradual adoption of digital solutions and the need for risk management frameworks are key factors contributing to this growth.Middle East & Africa Vendor Risk Management Market Report:

The Middle East and Africa market had an estimated size of $1.46 billion in 2023, forecasted to increase to $3.63 billion by 2033. The growing emphasis on cybersecurity and digital transformation initiatives is propelling growth in this region.Tell us your focus area and get a customized research report.

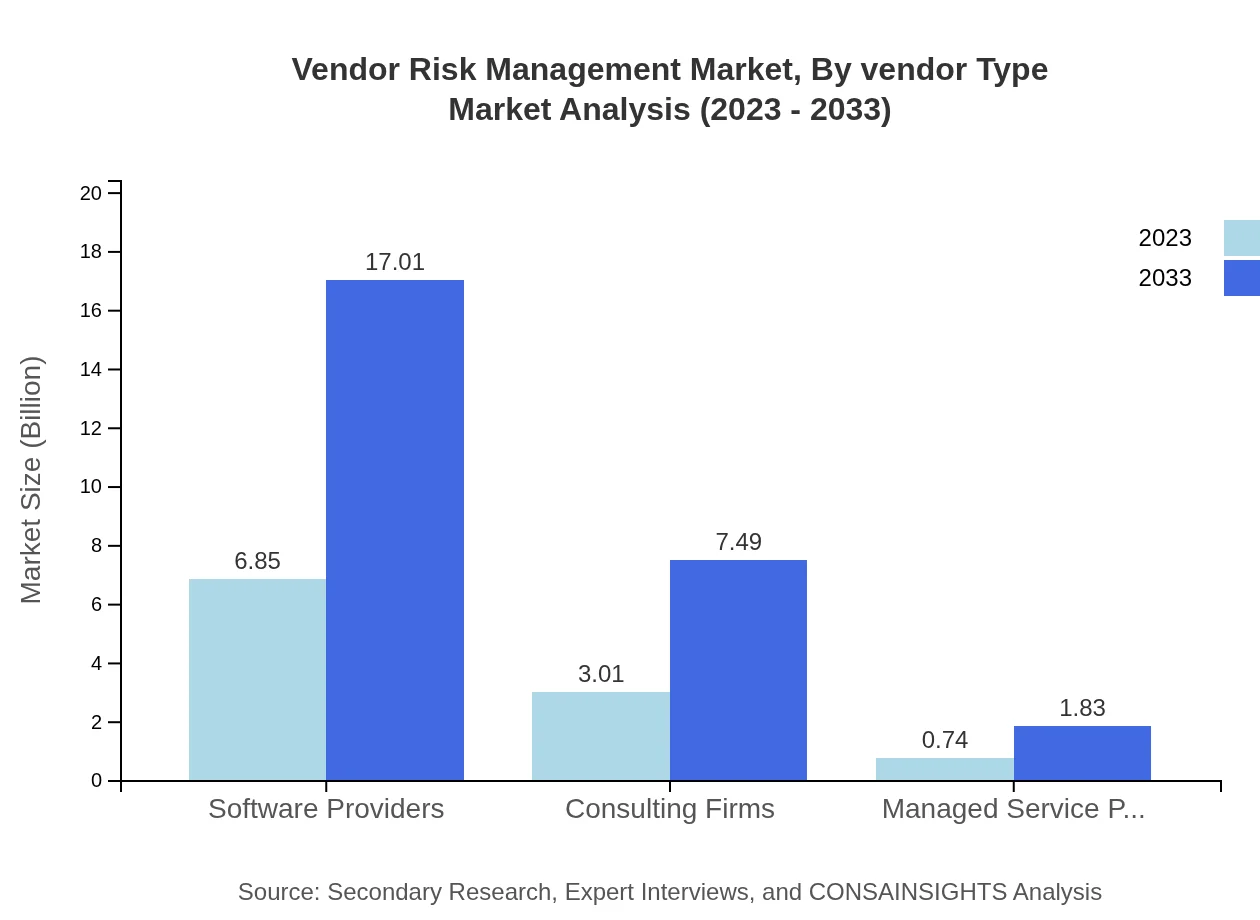

Vendor Risk Management Market Analysis By Vendor Type

In 2023, Software Providers dominate the market, accounting for $6.85 billion, expected to rise to $17.01 billion by 2033, capturing 64.6% of the market share. Consulting Firms follow with a market value of $3.01 billion in 2023, predicted to grow to $7.49 billion, holding 28.44% market share. Managed Service Providers currently account for $0.74 billion, projected to increase to $1.83 billion, representing 6.96% of the share.

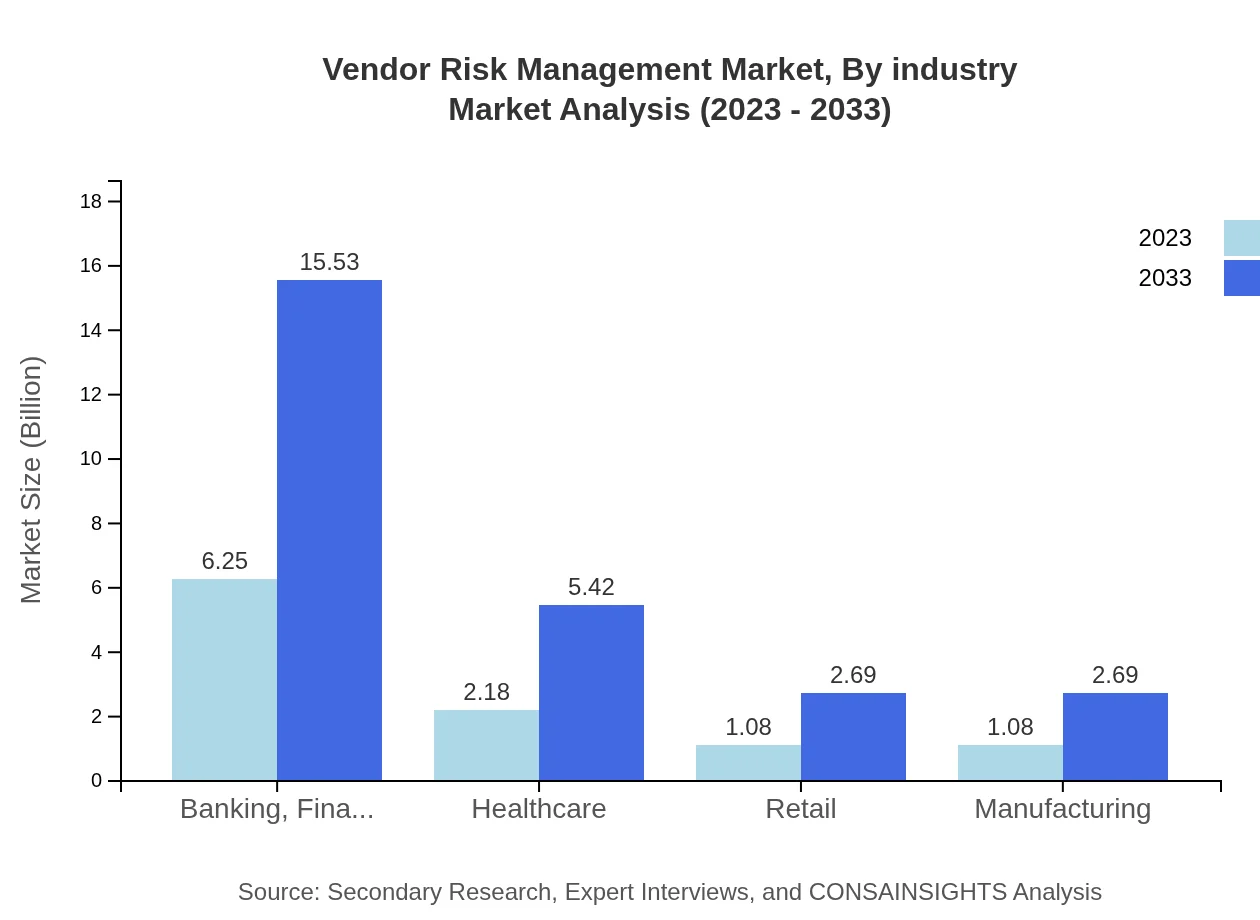

Vendor Risk Management Market Analysis By Industry

The BFSI segment leads the market with a size of $6.25 billion in 2023 and anticipated growth to $15.53 billion by 2033, comprising 58.97% of the market share. The Healthcare segment shows a market value of $2.18 billion in 2023, expected to reach $5.42 billion, corresponding to 20.58% market share. Retail and Manufacturing segments both share a market size of $1.08 billion each in 2023, projected to grow similarly to $2.69 billion by 2033, reflecting 10.23% and 10.22% respectively.

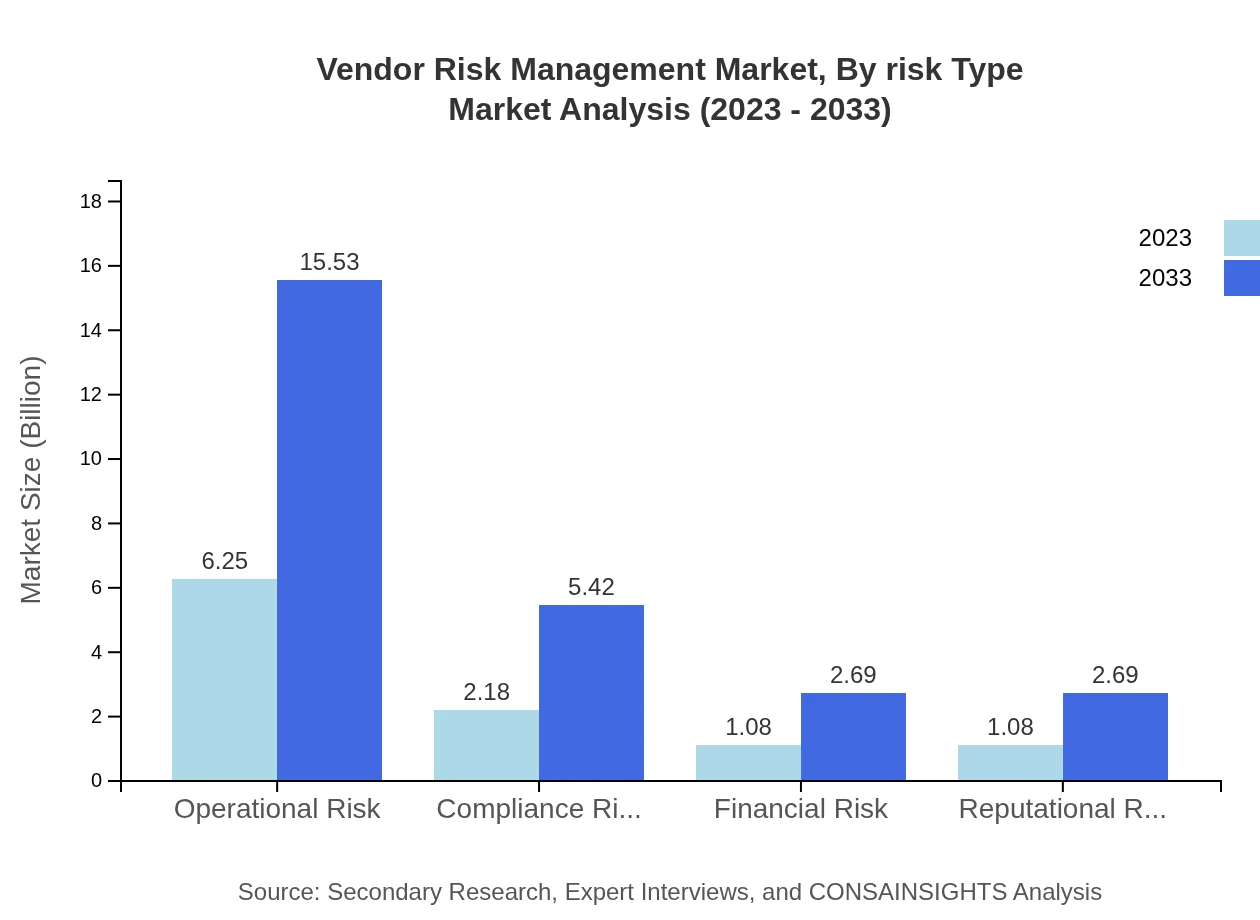

Vendor Risk Management Market Analysis By Risk Type

Operational Risk is the most significant segment, valued at $6.25 billion in 2023 and expected to grow to $15.53 billion by 2033, holding 58.97% of the market share. Compliance Risk follows closely with a market size of $2.18 billion in 2023, projected to reach $5.42 billion after 10 years, maintaining a share of 20.58%. Financial Risk and Reputational Risk both start at $1.08 billion in the current year, expecting growth to $2.69 billion over the next decade, representing shares of 10.23% and 10.22% respectively.

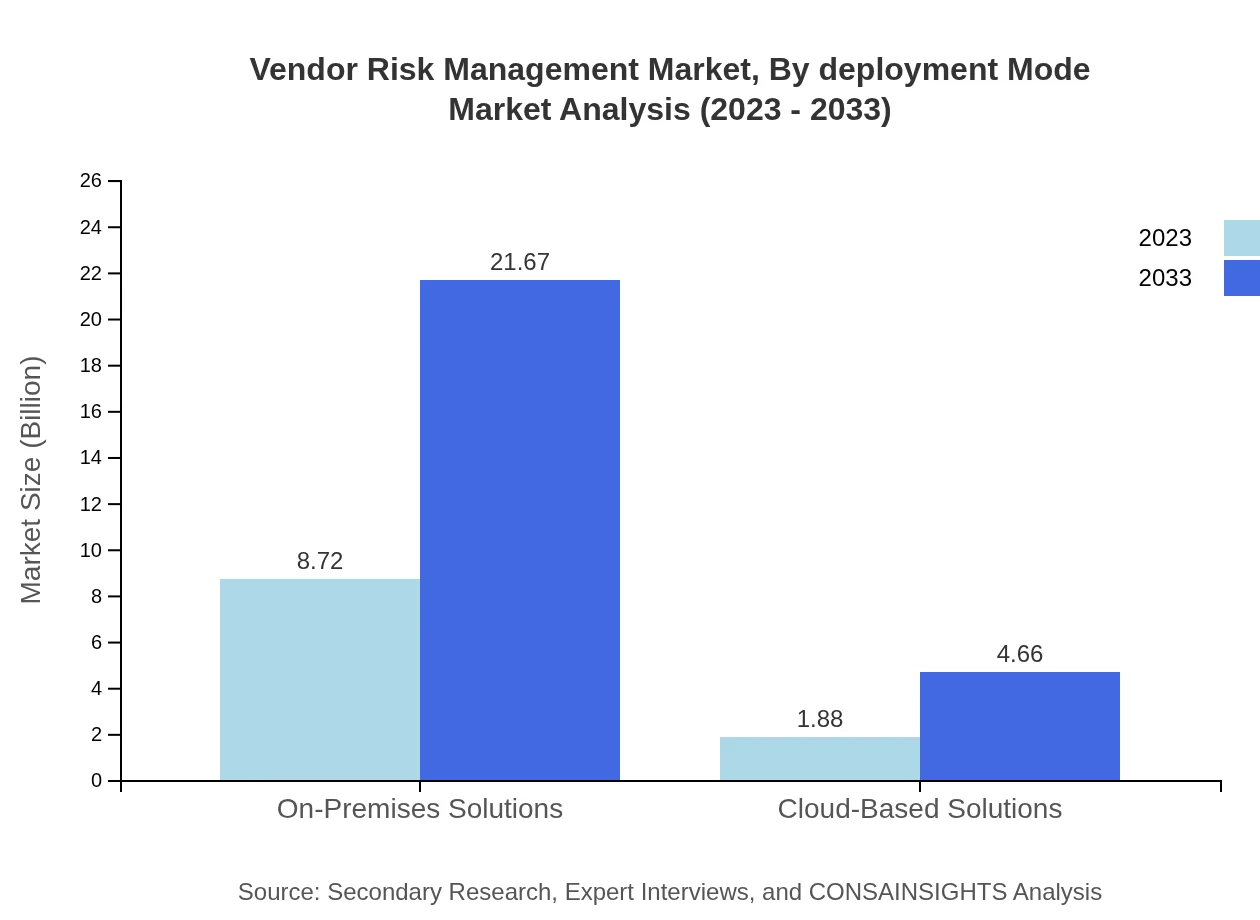

Vendor Risk Management Market Analysis By Deployment Mode

On-Premises Solutions dominate the deployment mode, with a market size of $8.72 billion expected to increase to $21.67 billion by 2033, capturing 82.3% of the market share. Cloud-Based Solutions, while smaller, are growing rapidly from $1.88 billion to $4.66 billion, representing 17.7% of the market share due to increased adoption of cloud technologies.

Vendor Risk Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vendor Risk Management Industry

SAP SE:

A global leader in enterprise application software, SAP provides advanced solutions for managing vendor risk, ensuring compliance and security across complex supply chains.IBM Corporation:

IBM offers a comprehensive risk management framework, focusing on third-party risk management solutions that leverage AI and machine learning for improved vendor assessments.RSA Security LLC:

RSA specializes in security solutions, providing tools and technologies for effective vendor risk management and governance, risk, and compliance (GRC) strategies.MetricStream:

A leader in governance, risk, and compliance solutions, MetricStream provides a powerful platform for evaluating and monitoring vendor risks across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Vendor Risk Management?

The global Vendor Risk Management market is estimated at $10.6 billion in 2023, with a projected growth rate of 9.2% CAGR. It is expected to grow significantly over the next decade as organizations increasingly prioritize vendor management.

What are the key market players or companies in the Vendor Risk Management industry?

Key players in the Vendor Risk Management industry include leading software providers and consulting firms that specialize in risk management solutions, as well as managed service providers offering comprehensive vendor risk assessment tools.

What are the primary factors driving the growth in the Vendor Risk Management industry?

Growth in the Vendor Risk Management industry is primarily driven by increasing regulatory compliance demands, rising cybersecurity concerns, and the growing need for efficient vendor management systems across various sectors.

Which region is the fastest Growing in the Vendor Risk Management?

The fastest-growing region for Vendor Risk Management is Europe, projected to expand from $2.89 billion in 2023 to $7.18 billion by 2033. Other significant regions include North America and Asia-Pacific, contributing to overall market growth.

Does ConsaInsights provide customized market report data for the Vendor Risk Management industry?

Yes, ConsaInsights offers customized market reports tailored to the strategic needs of clients in the Vendor Risk Management industry, capturing detailed insights and analytics specific to client requirements.

What deliverables can I expect from this Vendor Risk Management market research project?

Upon completion of the Vendor Risk Management market research project, clients can expect comprehensive reports, data analytics, strategic insights, and market forecasts tailored to inform decision-making and investment strategies.

What are the market trends of Vendor Risk Management?

Current market trends in Vendor Risk Management highlight a shift towards cloud-based solutions, increased adoption of AI-driven risk evaluation tools, and growing emphasis on regulatory compliance and cybersecurity measures among organizations.