Veterinary Anti Infectives Market Report

Published Date: 31 January 2026 | Report Code: veterinary-anti-infectives

Veterinary Anti Infectives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Veterinary Anti Infectives market, offering insights into current trends, market size, forecasts for 2023-2033, regional dynamics, and key industry players impacting growth.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

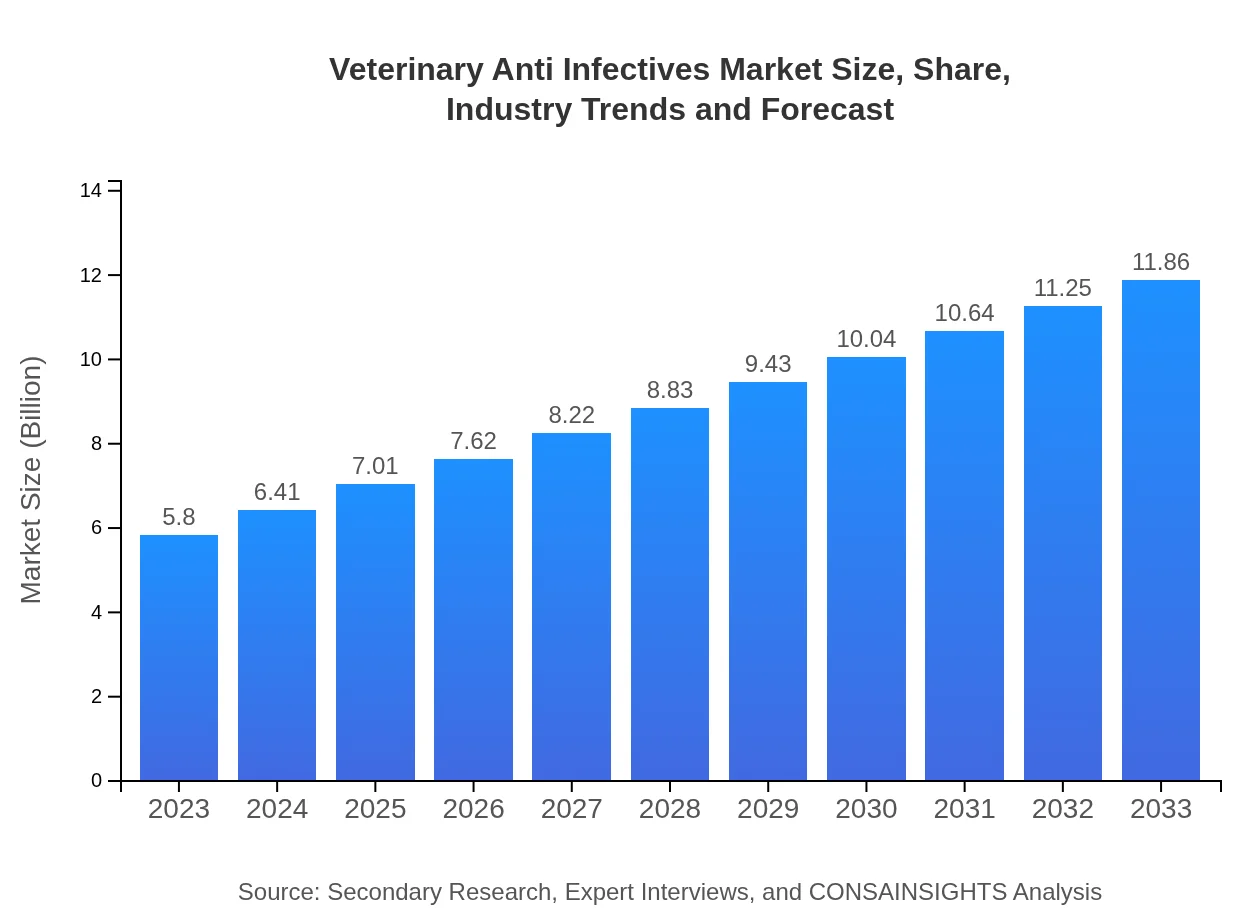

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.86 Billion |

| Top Companies | Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health |

| Last Modified Date | 31 January 2026 |

Veterinary Anti Infectives Market Overview

Customize Veterinary Anti Infectives Market Report market research report

- ✔ Get in-depth analysis of Veterinary Anti Infectives market size, growth, and forecasts.

- ✔ Understand Veterinary Anti Infectives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Anti Infectives

What is the Market Size & CAGR of Veterinary Anti Infectives market in 2023?

Veterinary Anti Infectives Industry Analysis

Veterinary Anti Infectives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Anti Infectives Market Analysis Report by Region

Europe Veterinary Anti Infectives Market Report:

Europe’s Veterinary Anti Infectives market is projected to grow from $1.67 billion in 2023 to $3.41 billion by 2033, driven by stringent animal health regulations and a rise in awareness about zoonotic diseases.Asia Pacific Veterinary Anti Infectives Market Report:

The Asia Pacific Veterinary Anti Infectives market is forecasted to grow from $1.17 billion in 2023 to $2.40 billion in 2033. Factors driving this growth include a booming pet population, rising disposable income, and advancements in veterinary healthcare services.North America Veterinary Anti Infectives Market Report:

North America's market size is anticipated to rise from $2.02 billion in 2023 to $4.14 billion in 2033, supported by high pet ownership rates and innovations in veterinary treatments.South America Veterinary Anti Infectives Market Report:

In South America, the market is expected to expand from $0.37 billion in 2023 to $0.75 billion by 2033, fueled by an increase in livestock production and a growing emphasis on animal health.Middle East & Africa Veterinary Anti Infectives Market Report:

The Middle East and Africa segment will witness growth from $0.57 billion in 2023 to $1.17 billion in 2033, owing to increasing investments in agricultural and veterinary infrastructure.Tell us your focus area and get a customized research report.

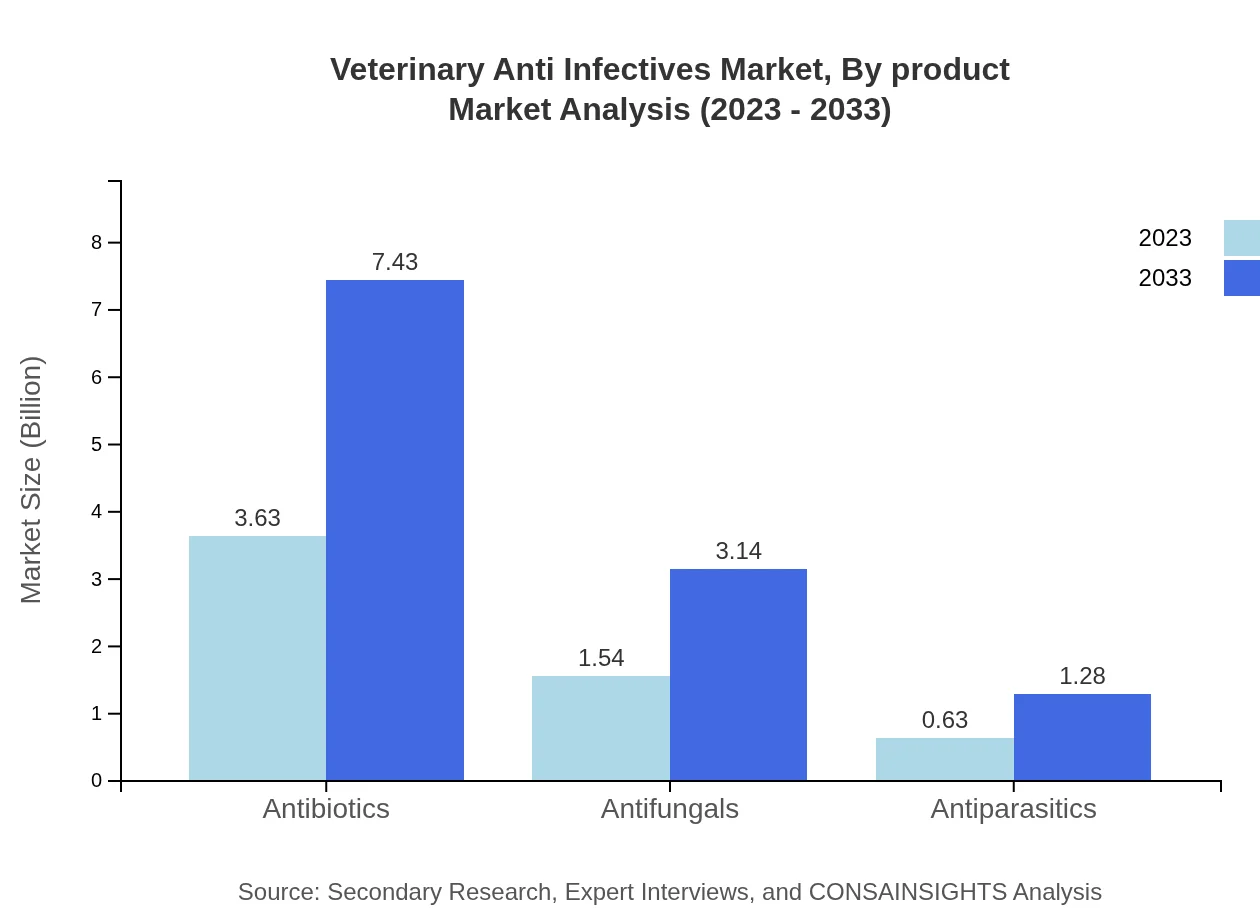

Veterinary Anti Infectives Market Analysis By Product

Antibiotics are a significant segment, with a market size expected to reach $3.63 billion in 2023 and grow to $7.43 billion by 2033. Antifungals and antiparasitics follow, contributing $1.54 billion and $0.63 billion in 2023, respectively, and expected growth in the same period.

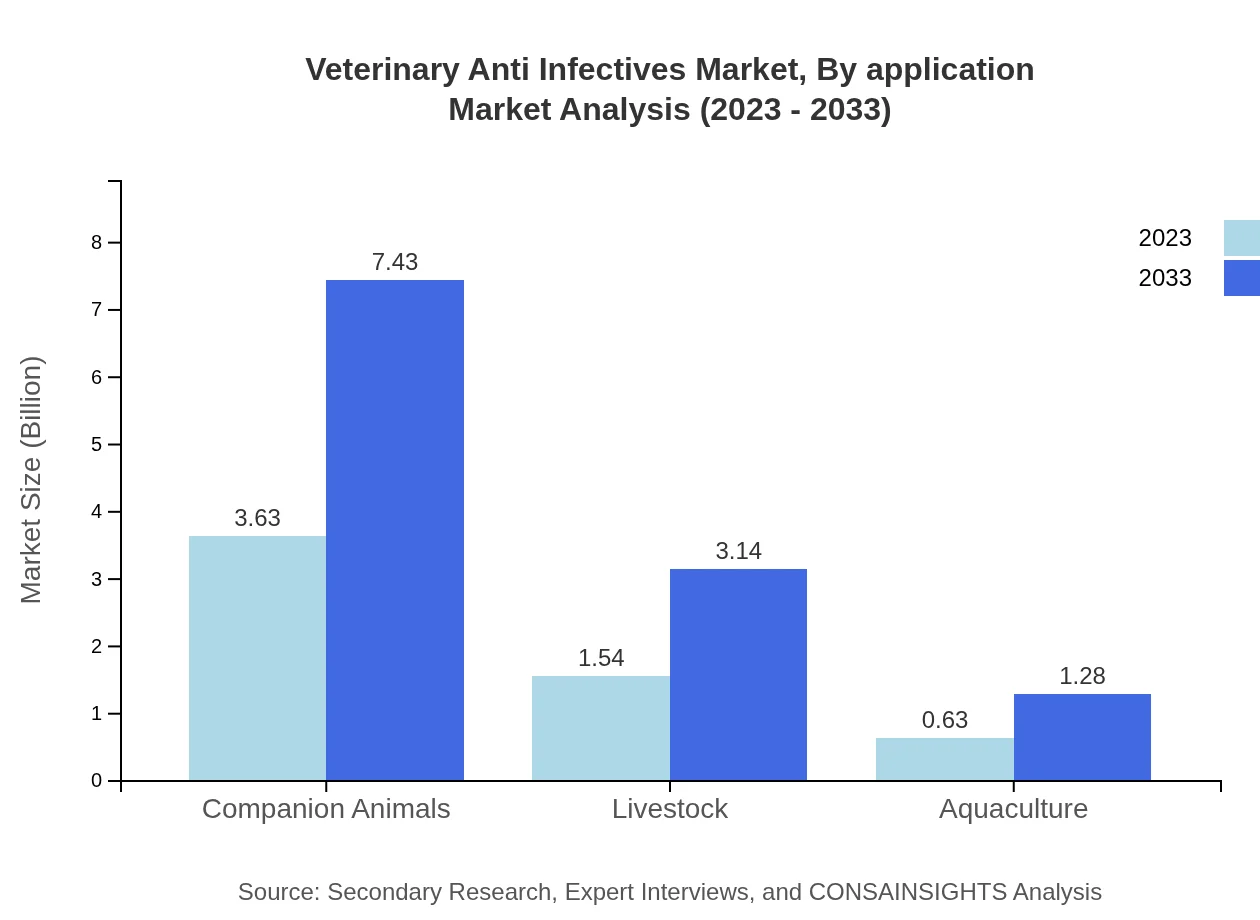

Veterinary Anti Infectives Market Analysis By Application

The market for companion animals holds the highest share, with a size of $3.63 billion in 2023, while livestock and aquaculture account for $1.54 billion and $0.63 billion, respectively. These segments continue to grow as pet ownership increases and poultry and aquaculture farming expands.

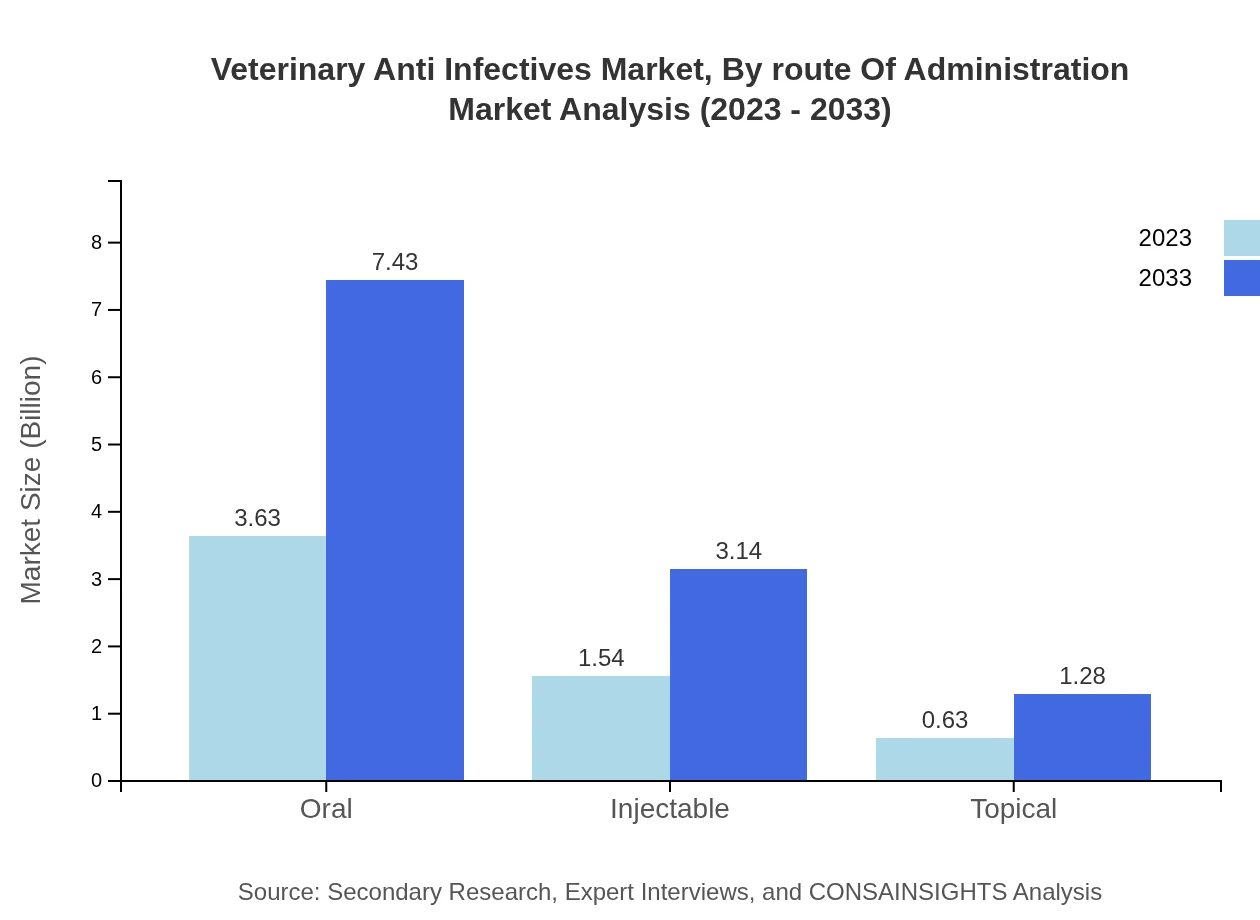

Veterinary Anti Infectives Market Analysis By Route Of Administration

In terms of administration routes, oral formulations dominate with a market size of $3.63 billion in 2023, while injectables and topical solutions are also significant, projected at $1.54 billion and $0.63 billion, respectively.

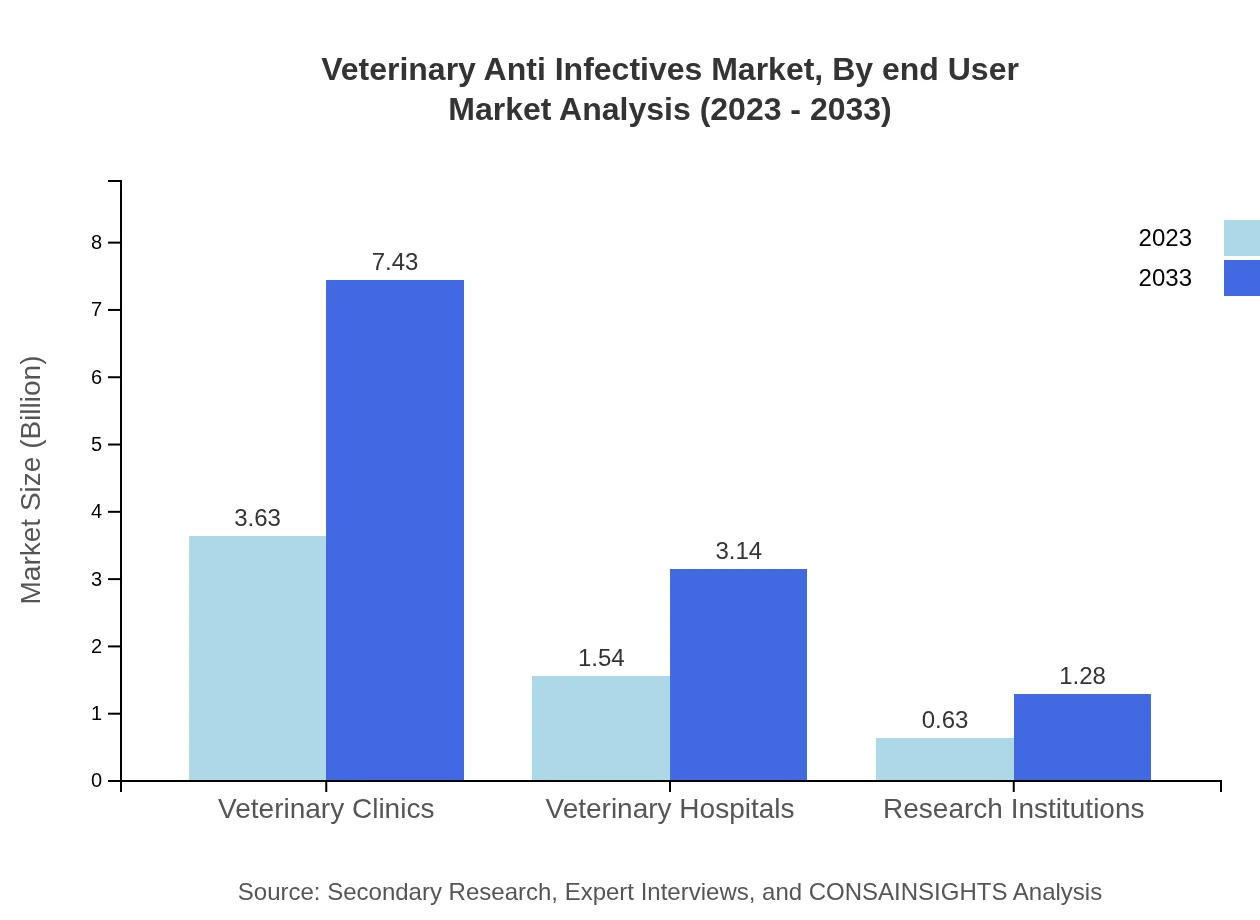

Veterinary Anti Infectives Market Analysis By End User

Veterinary clinics represent the largest user segment, with a market of $3.63 billion expected to reach $7.43 billion by 2033. Veterinary hospitals and research institutions hold respective shares contributing to the market growth.

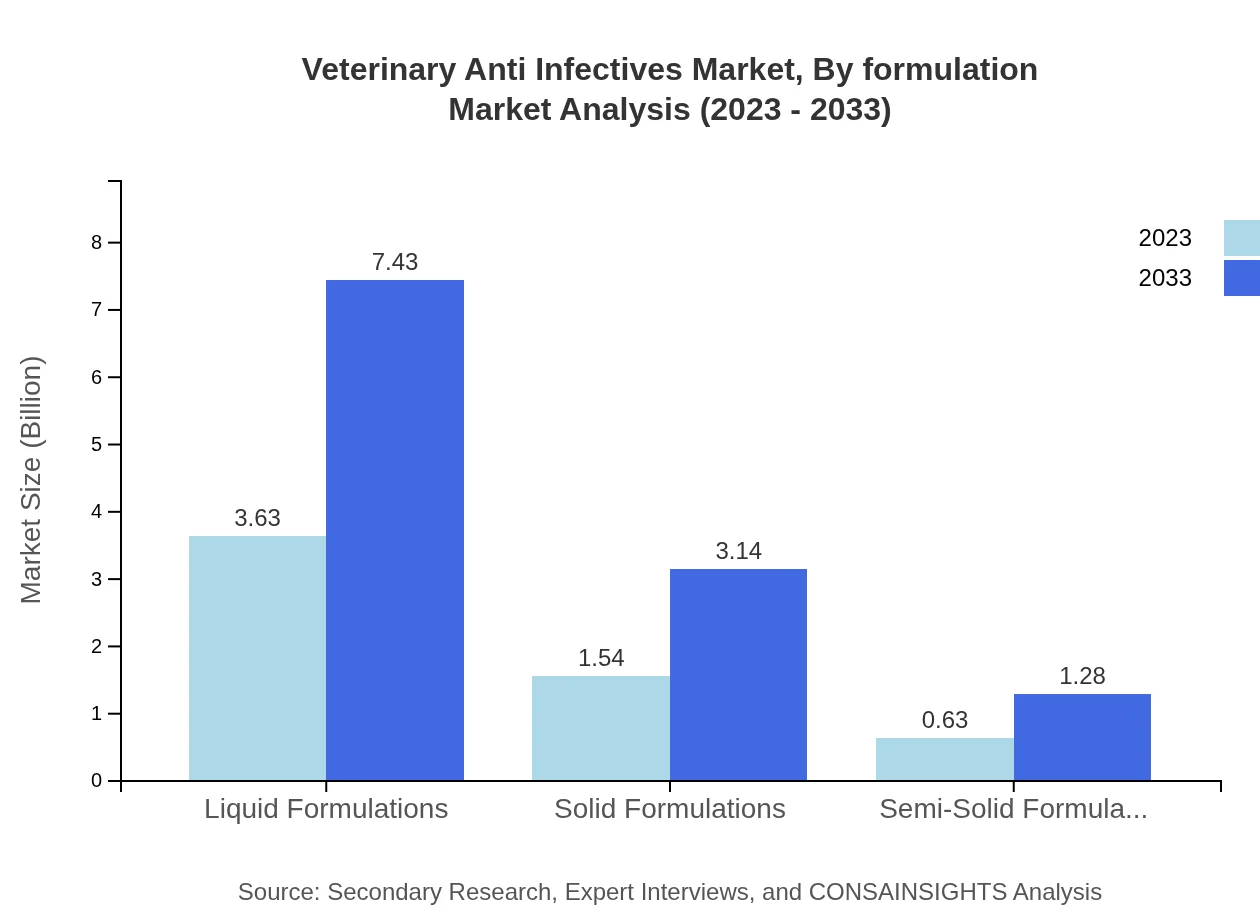

Veterinary Anti Infectives Market Analysis By Formulation

Liquid formulations lead the market, with a size of $3.63 billion in 2023, while solid and semi-solid formulations follow. Innovations in formulation technologies enhance stability and efficacy, supporting market expansion.

Veterinary Anti Infectives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Anti Infectives Industry

Zoetis Inc.:

A leading global animal health company offering a diverse portfolio of vaccines, medicines, and diagnostic products for various animal species.Boehringer Ingelheim:

An established player in the veterinary sector, known for its innovative therapies and vaccines aimed at improving the health of companion animals and livestock.Merck Animal Health:

Part of Merck & Co., Inc., focusing on the development and marketing of a wide range of pharmaceuticals and vaccines for animals.Elanco Animal Health:

A global animal health company that delivers innovative products to enhance the health and well-being of pets and livestock.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary anti Infectives?

The veterinary anti-infectives market is valued at approximately $5.8 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period up to 2033.

What are the key market players or companies in the veterinary anti Infectives industry?

Key players in the veterinary anti-infectives market include Zoetis, Merck & Co., Boehringer Ingelheim, Elanco Animal Health, and Bayer AG, contributing significantly to innovation and market share growth.

What are the primary factors driving the growth in the veterinary anti Infectives industry?

Factors driving growth include increasing pet ownership, rising awareness of veterinary care, advancements in pharmaceuticals, and heightened demand for effective antibiotic treatments in livestock.

Which region is the fastest Growing in the veterinary anti Infectives market?

The Asia Pacific region is the fastest-growing market for veterinary anti-infectives, projected to increase from $1.17 billion in 2023 to $2.40 billion by 2033, showcasing significant growth potential.

Does ConsaInsights provide customized market report data for the veterinary anti Infectives industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing clients to gain deeper insights and facilitate strategic decision-making in the veterinary anti-infectives sector.

What deliverables can I expect from this veterinary anti Infectives market research project?

Deliverables include comprehensive market analysis reports, detailed competitor assessments, trend evaluations, and forecasts, specifically outlining future market dynamics and growth opportunities.

What are the market trends of veterinary anti Infectives?

Current trends include a shift toward antibiotic alternatives, increased regulatory scrutiny on antibiotic use, and a growing focus on immunological therapies and precision veterinary medicine.