Veterinary Diagnostic Imaging Market Report

Published Date: 31 January 2026 | Report Code: veterinary-diagnostic-imaging

Veterinary Diagnostic Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Veterinary Diagnostic Imaging market, offering forecasts from 2023 to 2033. It covers key insights regarding market size, trends, and regional dynamics for stakeholders in the veterinary field.

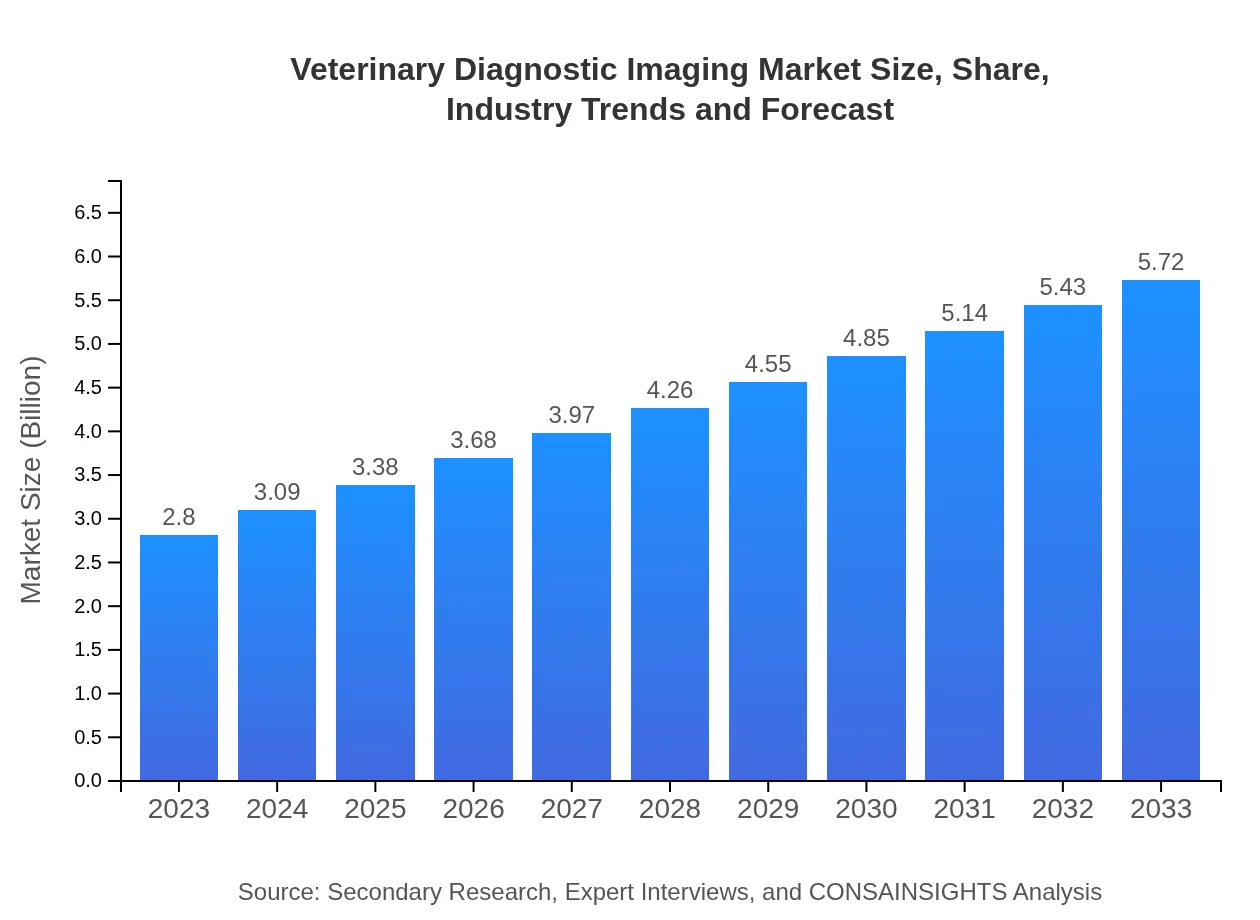

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.72 Billion |

| Top Companies | GE Healthcare, Philips Healthcare, Imaging Diagnostics, Fujifilm, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Veterinary Diagnostic Imaging Market Overview

Customize Veterinary Diagnostic Imaging Market Report market research report

- ✔ Get in-depth analysis of Veterinary Diagnostic Imaging market size, growth, and forecasts.

- ✔ Understand Veterinary Diagnostic Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Diagnostic Imaging

What is the Market Size & CAGR of Veterinary Diagnostic Imaging market over the forecast period?

Veterinary Diagnostic Imaging Industry Analysis

Veterinary Diagnostic Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Diagnostic Imaging Market Analysis Report by Region

Europe Veterinary Diagnostic Imaging Market Report:

Europe is experiencing steady growth in the Veterinary Diagnostic Imaging market, starting at a value of $0.76 billion in 2023 and expected to reach $1.55 billion in 2033. The rise in pet ownership and the demand for advanced imaging technologies are crucial factors supporting this growth, alongside a regulatory environment that encourages innovation.Asia Pacific Veterinary Diagnostic Imaging Market Report:

In the Asia-Pacific region, the Veterinary Diagnostic Imaging market was valued at approximately $0.60 billion in 2023 and is projected to reach $1.23 billion by 2033. This growth is driven by increasing pet ownership, advancements in veterinary healthcare infrastructure, and rising awareness among pet owners regarding animal health. The adoption of advanced imaging technologies is also contributing significantly to market expansion in countries like China and India.North America Veterinary Diagnostic Imaging Market Report:

North America holds a significant share of the Veterinary Diagnostic Imaging market, valued at $0.98 billion in 2023 and projected to reach $2.00 billion by 2033. This growth is largely attributed to high spending on pet healthcare, increased awareness about advanced diagnostic technologies, and a well-established network of veterinary clinics and hospitals.South America Veterinary Diagnostic Imaging Market Report:

In South America, the market is relatively smaller, valued at $0.11 billion in 2023, anticipating growth to $0.22 billion by 2033. Factors such as rising disposable incomes, increased pet adoption, and improving healthcare standards in veterinary practices are expected to drive growth in this market.Middle East & Africa Veterinary Diagnostic Imaging Market Report:

The Middle East and Africa region has a developing Veterinary Diagnostic Imaging market, valued at $0.35 billion in 2023 and projected to increase to $0.72 billion by 2033. Factors influencing this growth include rising disposable incomes, increased investment in animal healthcare, and the growing trend of pet ownership, especially in urban areas.Tell us your focus area and get a customized research report.

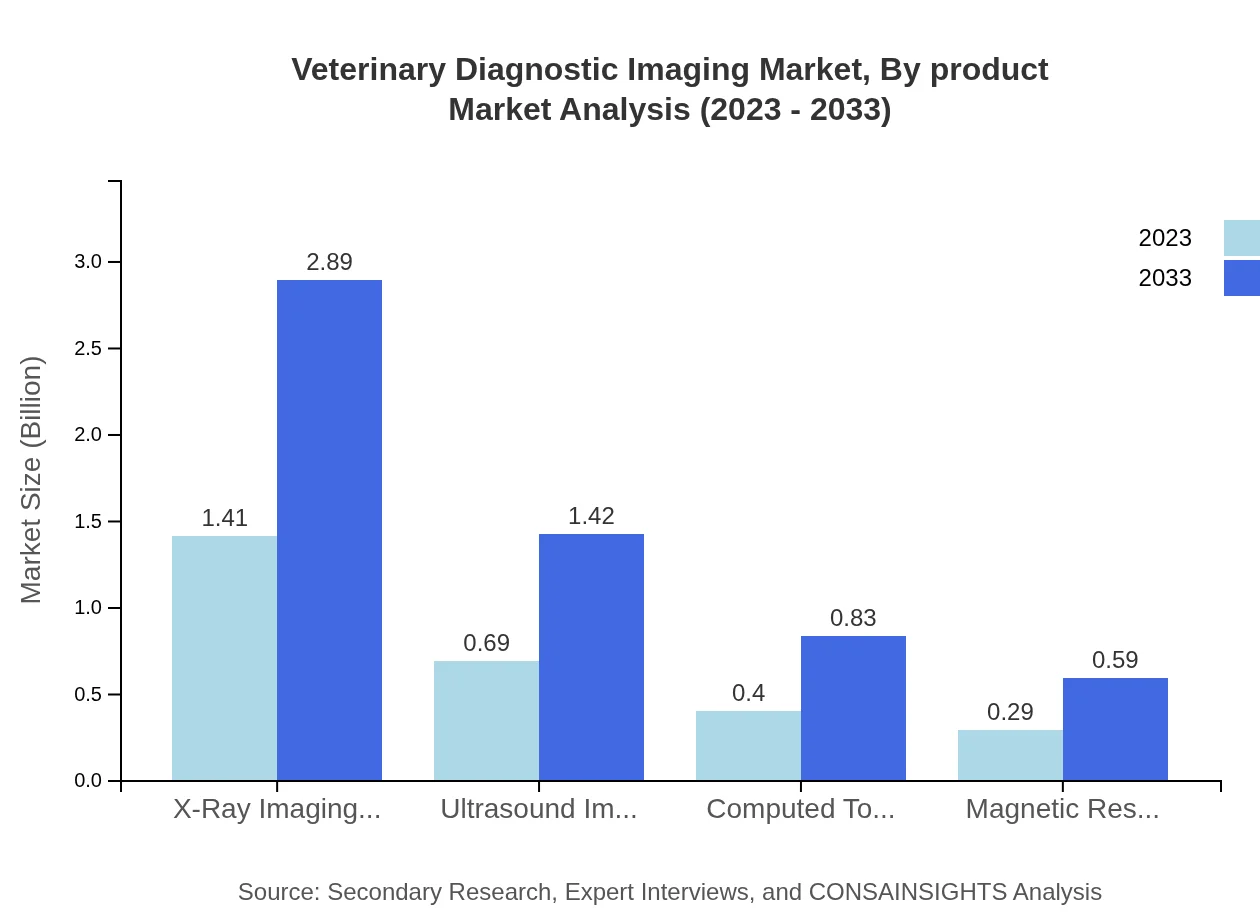

Veterinary Diagnostic Imaging Market Analysis By Product

The veterinary diagnostic imaging market is segmented into various product types, with significant emphasis on X-ray imaging systems, ultrasound imaging systems, computed tomography (CT), and magnetic resonance imaging (MRI). X-ray imaging systems generate the largest market share at 50.44% in 2023, valued at $1.41 billion, and are projected to increase to $2.89 billion by 2033. Ultrasound systems follow with a market size of $0.69 billion in 2023, growing to $1.42 billion by 2033, holding a 24.75% market share. The computed tomography segment, valued at $0.40 billion in 2023, is expected to grow to $0.83 billion, while MRI is expected to increase from $0.29 billion to $0.59 billion during the same period.

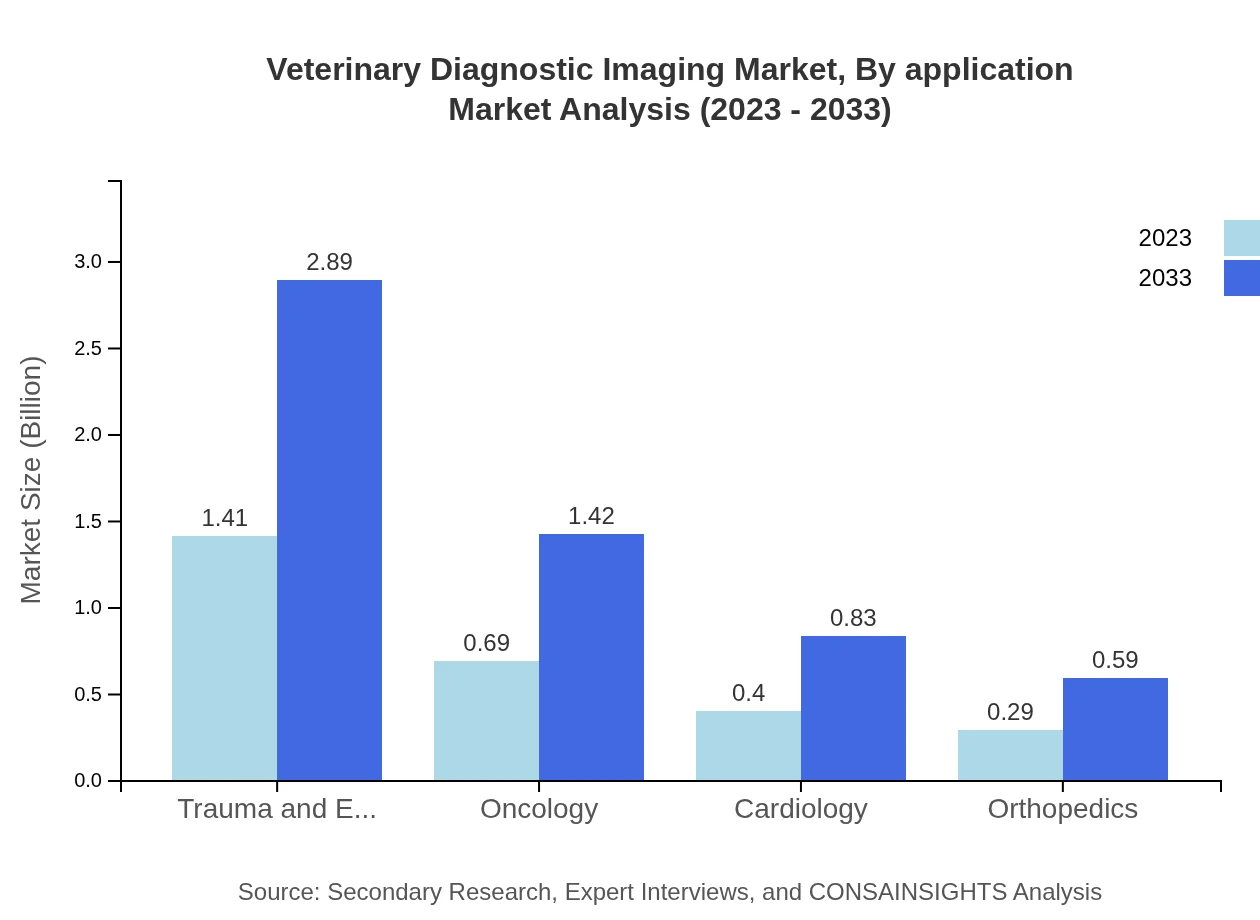

Veterinary Diagnostic Imaging Market Analysis By Application

The applications of veterinary diagnostic imaging include trauma and emergency, oncology, cardiology, and orthopedics. The trauma and emergency application dominates with a market size of $1.41 billion in 2023, anticipated to grow to $2.89 billion by 2033. The oncology segment, starting at $0.69 billion, is expected to increase to $1.42 billion. Cardiology and orthopedics applications follow with market sizes of $0.40 billion and $0.29 billion, respectively, projected to grow steadily in forthcoming years.

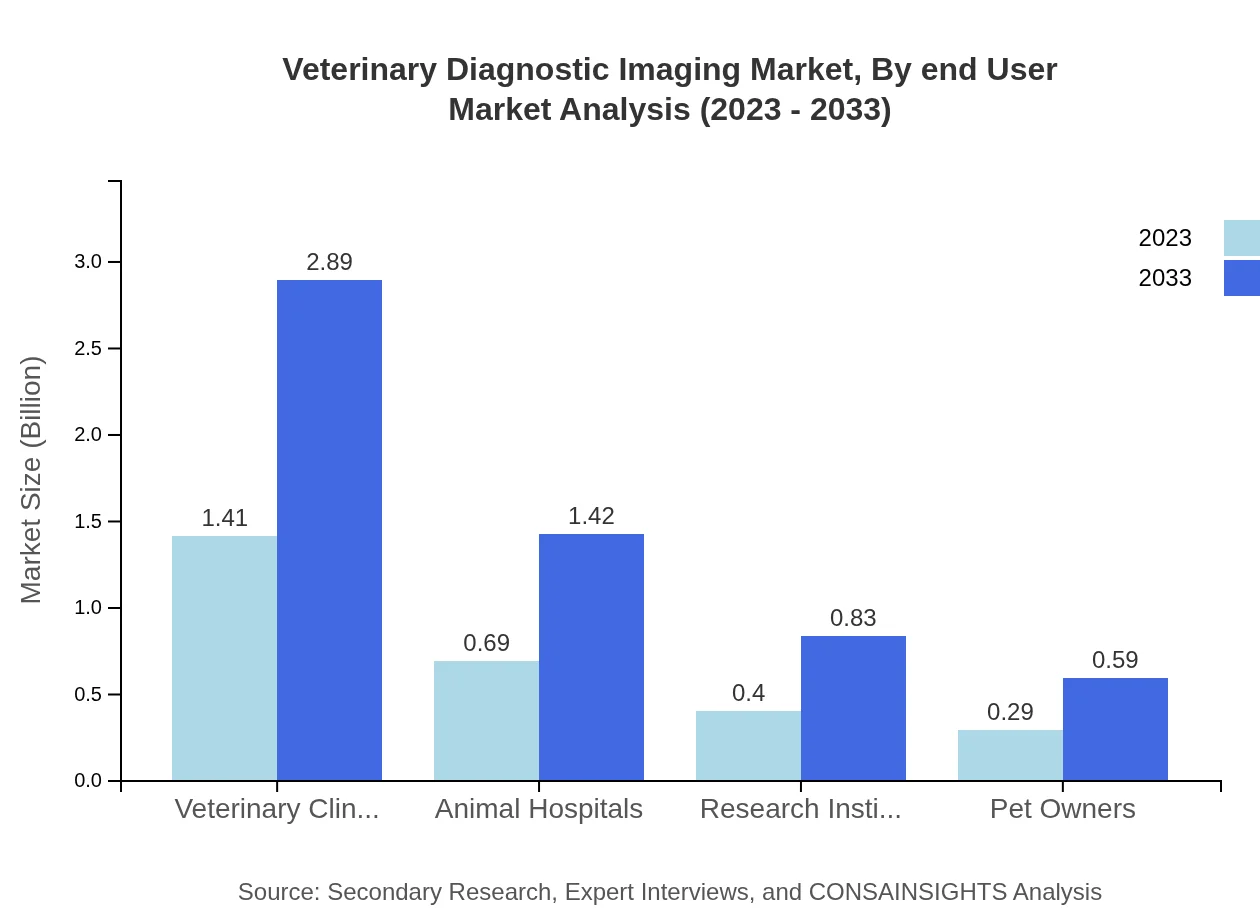

Veterinary Diagnostic Imaging Market Analysis By End User

End-users of veterinary diagnostic imaging include veterinary clinics, animal hospitals, research institutes, and pet owners. Veterinary clinics and animal hospitals account for a significant market share, with clinics valued at $1.41 billion in 2023 and projected to reach $2.89 billion by 2033. Animal hospitals start at $0.69 billion, with expectations to rise to $1.42 billion. Research institutes, valued at $0.40 billion, and pet owners at $0.29 billion also contribute to the market, indicating the breadth of end-user dependency on advanced imaging technologies.

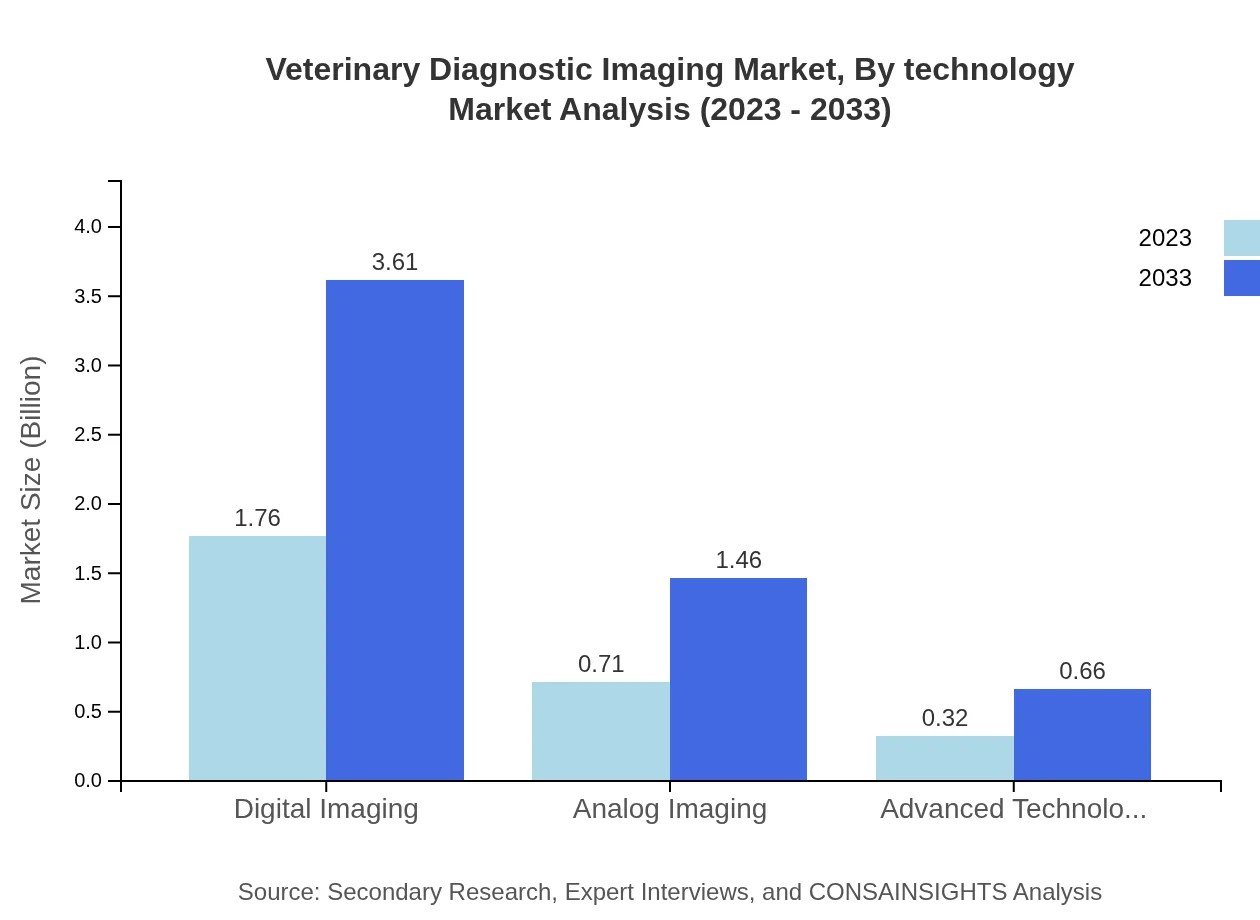

Veterinary Diagnostic Imaging Market Analysis By Technology

The technologies in veterinary diagnostic imaging consist of digital imaging, analog imaging, and advanced technologies. Digital imaging leads the market with a size of $1.76 billion in 2023 and an expected growth to $3.61 billion by 2033. Analog imaging, starting at $0.71 billion, anticipates growth to $1.46 billion. Advanced technologies, valued at $0.32 billion, are projected to reach $0.66 billion in the same timeframe, showcasing the ongoing innovation within the imaging landscape.

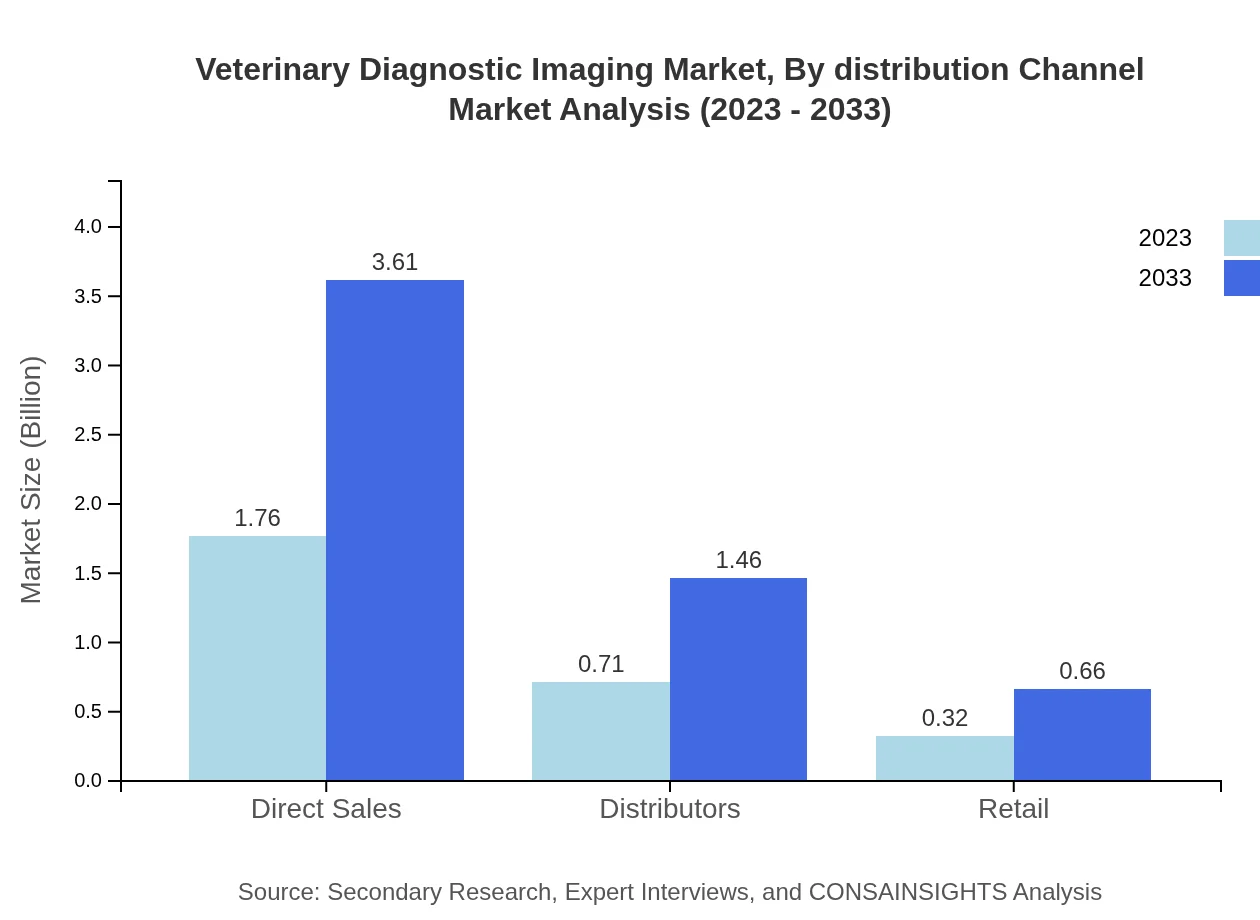

Veterinary Diagnostic Imaging Market Analysis By Distribution Channel

Distribution channels for veterinary diagnostic imaging include direct sales, distributors, and retail. Direct sales are the predominant channel, valued at $1.76 billion in 2023, projected to grow to $3.61 billion by 2033. Distributors also mark their presence effectively, with a current size of $0.71 billion to increase to $1.46 billion. Retail channels, although smaller initially at $0.32 billion, are expected to scale to $0.66 billion, illustrating diverse avenues for market penetration.

Veterinary Diagnostic Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Diagnostic Imaging Industry

GE Healthcare:

GE Healthcare is a global leader in imaging technologies, providing advanced systems for veterinary applications. Their continued investment in research and development has led to innovation in diagnostic imaging equipment for animal healthcare.Philips Healthcare:

Philips Healthcare specializes in high-quality imaging solutions, offering advanced ultrasound systems and other diagnostic equipment tailored for veterinary practices. Their focus on user-friendly designs and imaging precision makes them a key player in the industry.Imaging Diagnostics:

Imaging Diagnostics focuses on developing cutting-edge imaging systems specifically designed for veterinary hospitals and clinics. Their state-of-the-art technology enhances diagnostic capabilities for animal health.Fujifilm:

Fujifilm has a strong presence in the veterinary imaging market, providing high-resolution imaging systems that cater to a range of veterinary applications. Their commitment to quality has established them as a trusted supplier.Siemens Healthineers:

A leader in medical imaging, Siemens Healthineers also serves the veterinary sector, advancing MR imaging and CT systems that enhance diagnostics for veterinarians worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary Diagnostic Imaging?

The global veterinary diagnostic imaging market is estimated at $2.8 billion in 2023, with a projected CAGR of 7.2% from 2023 to 2033. The market growth is driven by advancements in imaging technology and increased veterinary healthcare expenditure.

What are the key market players or companies in the veterinary Diagnostic Imaging industry?

Key players in the veterinary diagnostic imaging industry include leading companies like IDEXX Laboratories, GE Healthcare, and Siemens Healthineers. These companies leverage advanced technologies to enhance imaging solutions for veterinary practices, driving competitive growth.

What are the primary factors driving the growth in the veterinary Diagnostic Imaging industry?

Growth in the veterinary diagnostic imaging field is driven by the rising pet population, increased awareness of animal health, technological advancements in imaging modalities, and a growing preference for preventive veterinary care among pet owners.

Which region is the fastest Growing in the veterinary Diagnostic Imaging?

The fastest-growing regions for veterinary diagnostic imaging are North America and Europe. By 2033, North America is projected to reach $2.00 billion, while Europe is expected to expand to $1.55 billion, reflecting a robust demand for advanced imaging solutions.

Does Consainsights provide customized market report data for the veterinary Diagnostic Imaging industry?

Yes, Consainsights offers customized market reports tailored to the veterinary diagnostic imaging industry. Clients can request specific data insights, trends, and forecasts that align with their unique business needs and strategic goals.

What deliverables can I expect from this veterinary Diagnostic Imaging market research project?

Deliverables from the research project include in-depth market analysis, competitive landscape reviews, segmentation insights, and regional forecasts, alongside tailored recommendations for strategy formulation and market entry planning.

What are the market trends of veterinary Diagnostic Imaging?

Trends in the veterinary diagnostic imaging market include growing adoption of digital imaging technologies, increased use of telemedicine, and advancements in imaging modalities such as ultrasound and MRI, catering to diverse veterinary healthcare needs.