Veterinary Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: veterinary-diagnostics

Veterinary Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Veterinary Diagnostics market, examining current trends, market size, forecasts from 2023 to 2033, and key players in the industry. Insights include market segmentation, regional analysis, and future trends that impact decision-making.

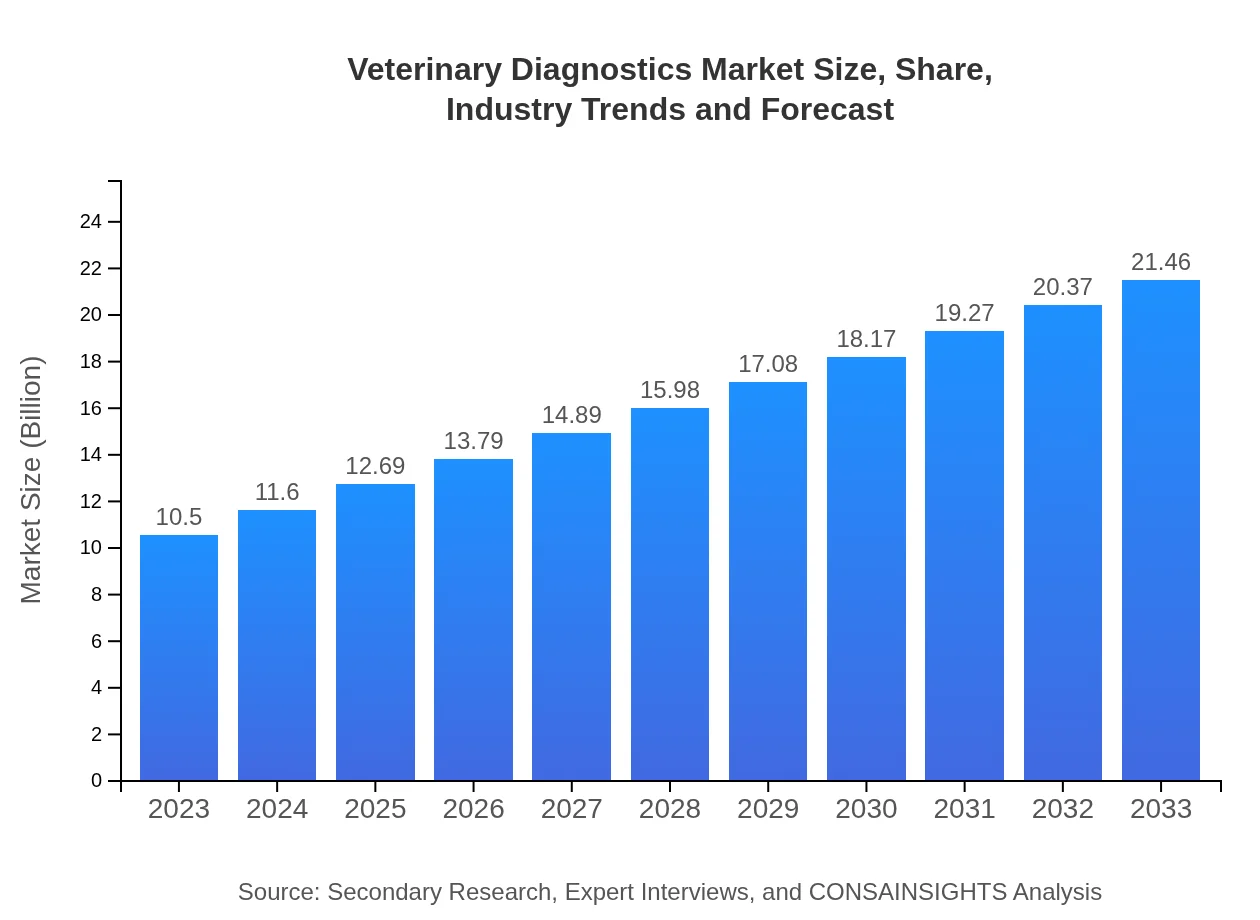

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Zoetis Inc., IDEXX Laboratories, Inc., Thermo Fisher Scientific Inc., Virbac S.A. |

| Last Modified Date | 31 January 2026 |

Veterinary Diagnostics Market Overview

Customize Veterinary Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Veterinary Diagnostics market size, growth, and forecasts.

- ✔ Understand Veterinary Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Diagnostics

What is the Market Size & CAGR of Veterinary Diagnostics market in 2023?

Veterinary Diagnostics Industry Analysis

Veterinary Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Diagnostics Market Analysis Report by Region

Europe Veterinary Diagnostics Market Report:

The European market is set to grow from $2.96 billion in 2023 to $6.04 billion by 2033. Factors including stringent regulations for animal health management, along with a strong emphasis on research and development in veterinary solutions, contribute to this robust market expansion.Asia Pacific Veterinary Diagnostics Market Report:

The Asia Pacific region is experiencing notable growth in the Veterinary Diagnostics market, expected to reach $4.43 billion by 2033 from $2.17 billion in 2023. This increase is bolstered by rising disposable incomes, pet ownership, and a greater awareness of animal health issues, particularly in countries like China and India.North America Veterinary Diagnostics Market Report:

North America stands out with the largest share of the Veterinary Diagnostics market, projected to increase from $3.74 billion in 2023 to $7.64 billion in 2033. The region's advanced healthcare infrastructure, coupled with high pet ownership rates and a robust focus on preventive healthcare, positions it as a leader in the application of cutting-edge diagnostic technologies.South America Veterinary Diagnostics Market Report:

In South America, the market is projected to grow from $0.87 billion in 2023 to approximately $1.77 billion by 2033. The expansion of veterinary services and increasing investments in animal health are key factors driving this growth, alongside government initiatives to bolster livestock health security.Middle East & Africa Veterinary Diagnostics Market Report:

The Middle East and Africa market is gradually evolving, expected to increase from $0.78 billion in 2023 to $1.59 billion by 2033. Although growth is slower compared to other regions, factors such as rising livestock populations and government initiatives in animal health improvements are beginning to drive this sector forward.Tell us your focus area and get a customized research report.

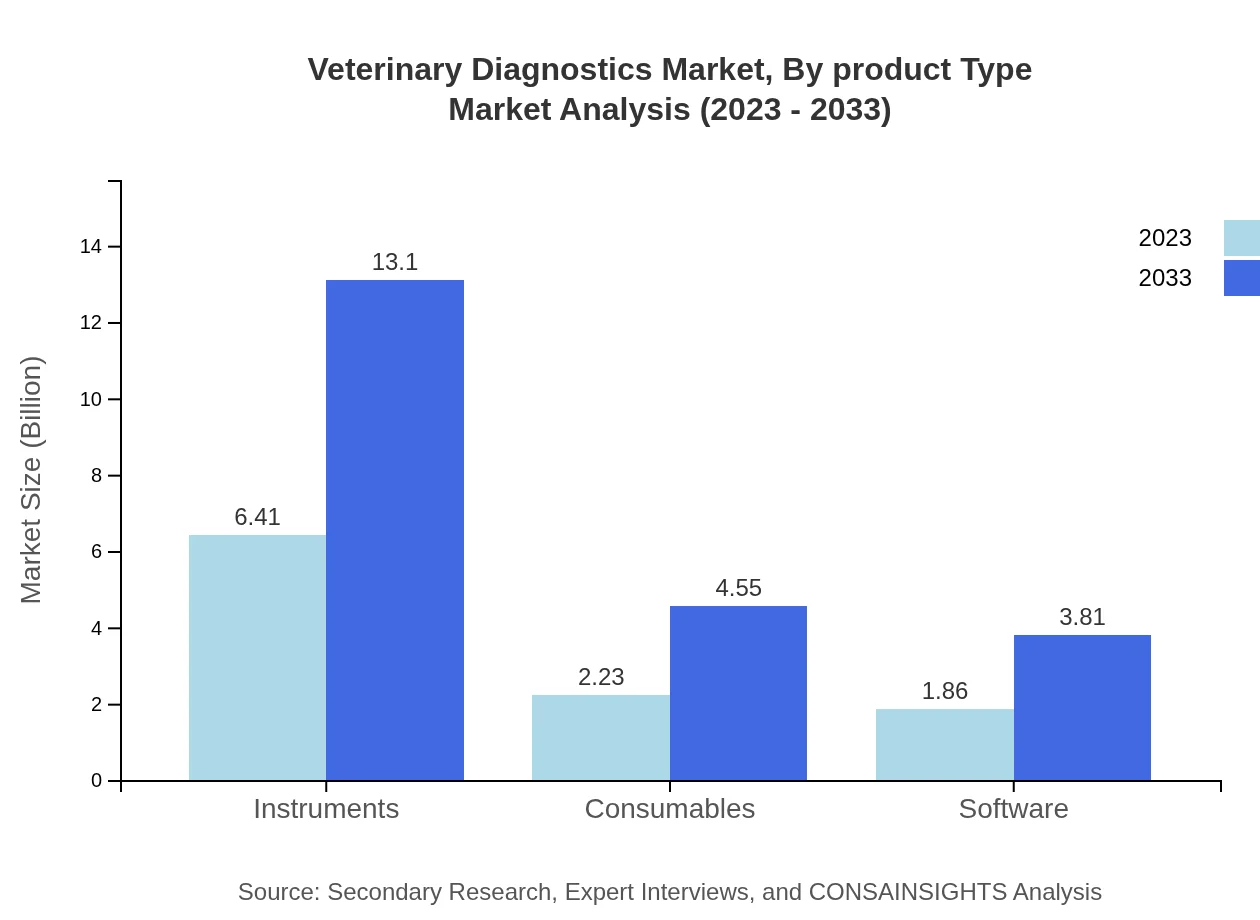

Veterinary Diagnostics Market Analysis By Product Type

The product type segment constitutes significant areas such as immunodiagnostics, molecular diagnostics, diagnostic instruments, and consumables. For 2023, immunodiagnostics holds the largest market share of approximately 61.04%, with its contribution expected to remain significant through the forecast period, reaching 61.04% in 2033. This dominance is followed by molecular diagnostics and hematology, reflecting the continuous demand for innovative diagnostic solutions across veterinary practices.

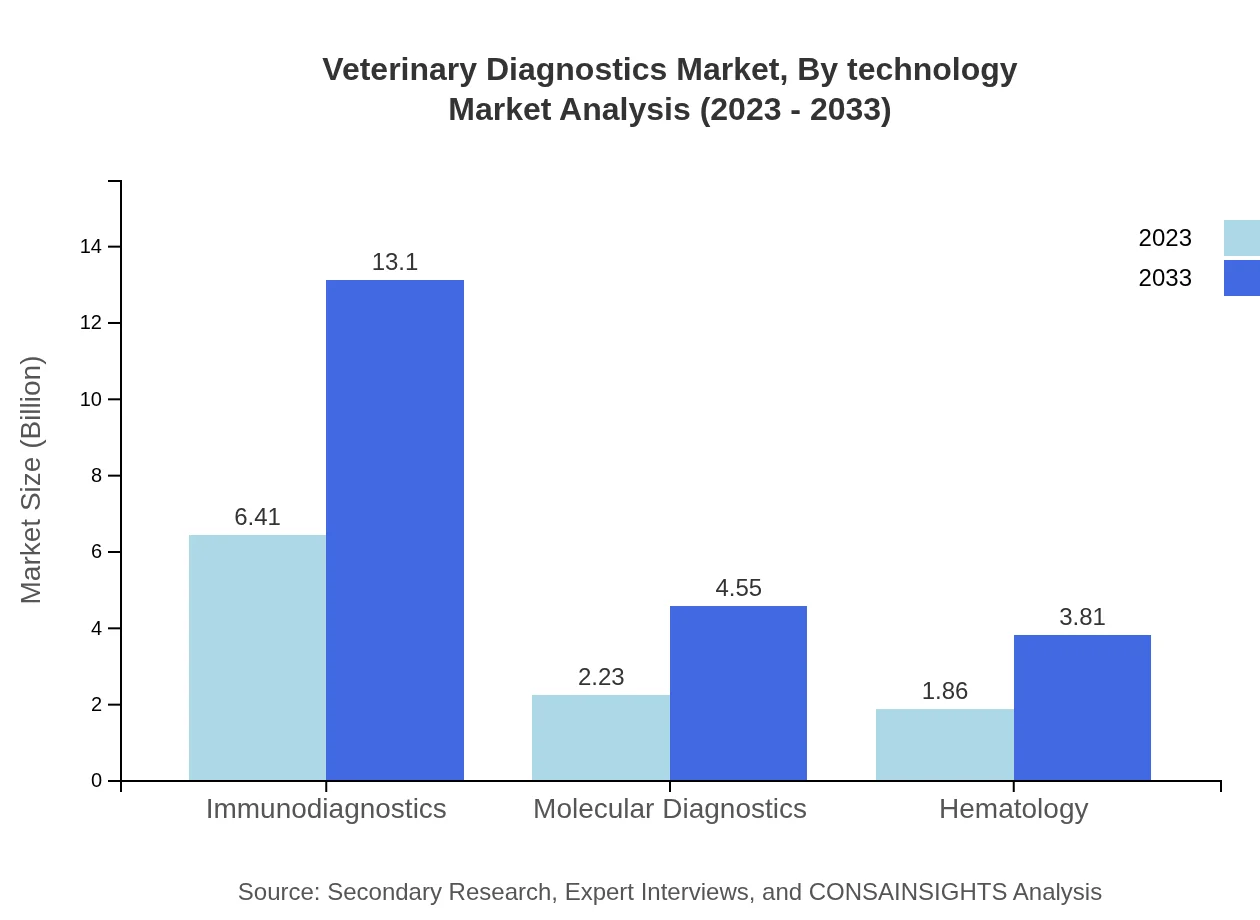

Veterinary Diagnostics Market Analysis By Technology

Technological advancements like point-of-care diagnostics and advancements in imaging techniques are revolutionizing the market. The focus on rapid and accurate diagnoses is pivotal, with companies expanding their capabilities through research and development. The sector sees a noticeable trend toward integrated diagnostics solutions, enhancing efficiency in veterinary practices.

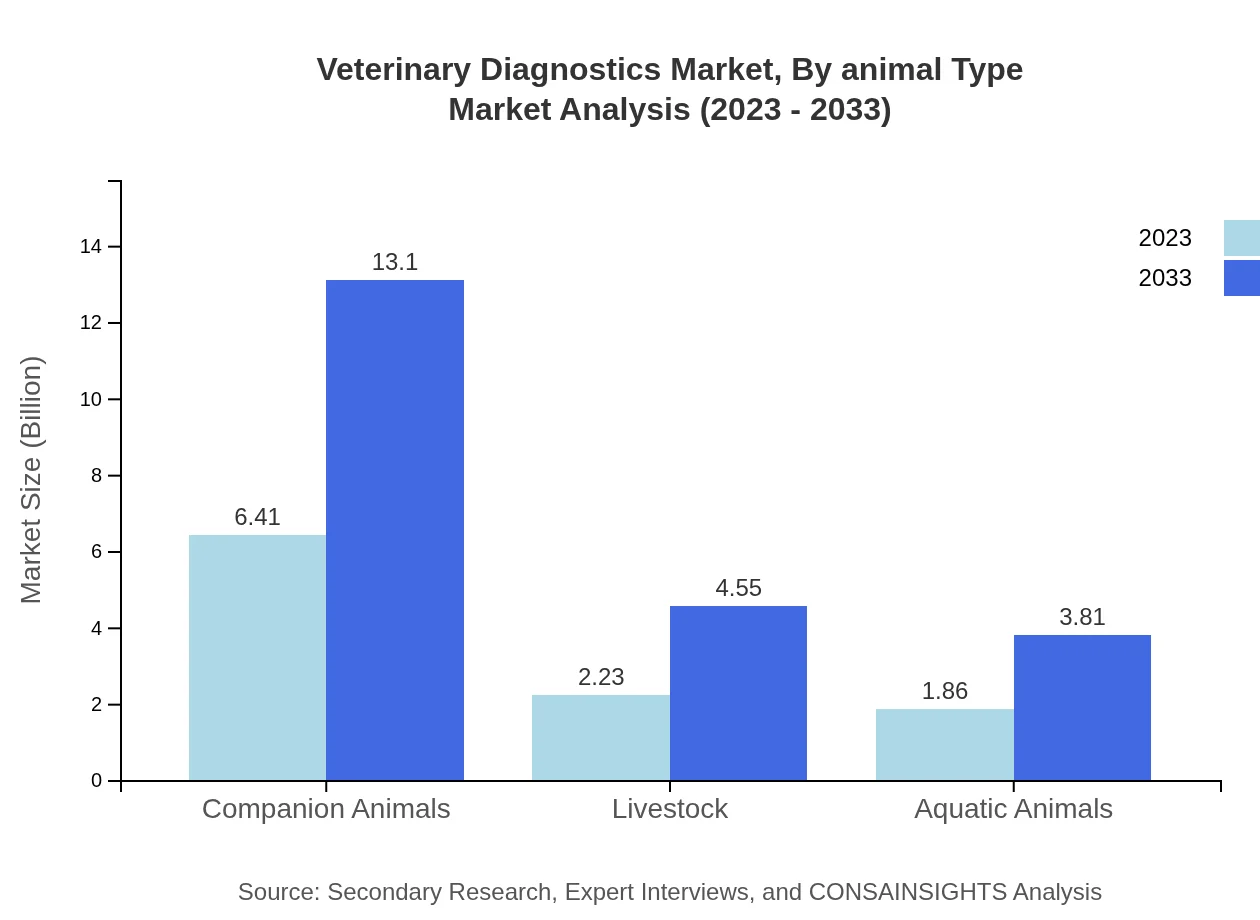

Veterinary Diagnostics Market Analysis By Animal Type

The animal type segmentation includes companion animals, livestock, and aquatic animals. Companion animals make up the largest segment, with a market size of $6.41 billion in 2023, expected to double to $13.10 billion by 2033. Livestock diagnostics follow suit given the essential need for health management in cattle and poultry, representing a significant part of the market as well.

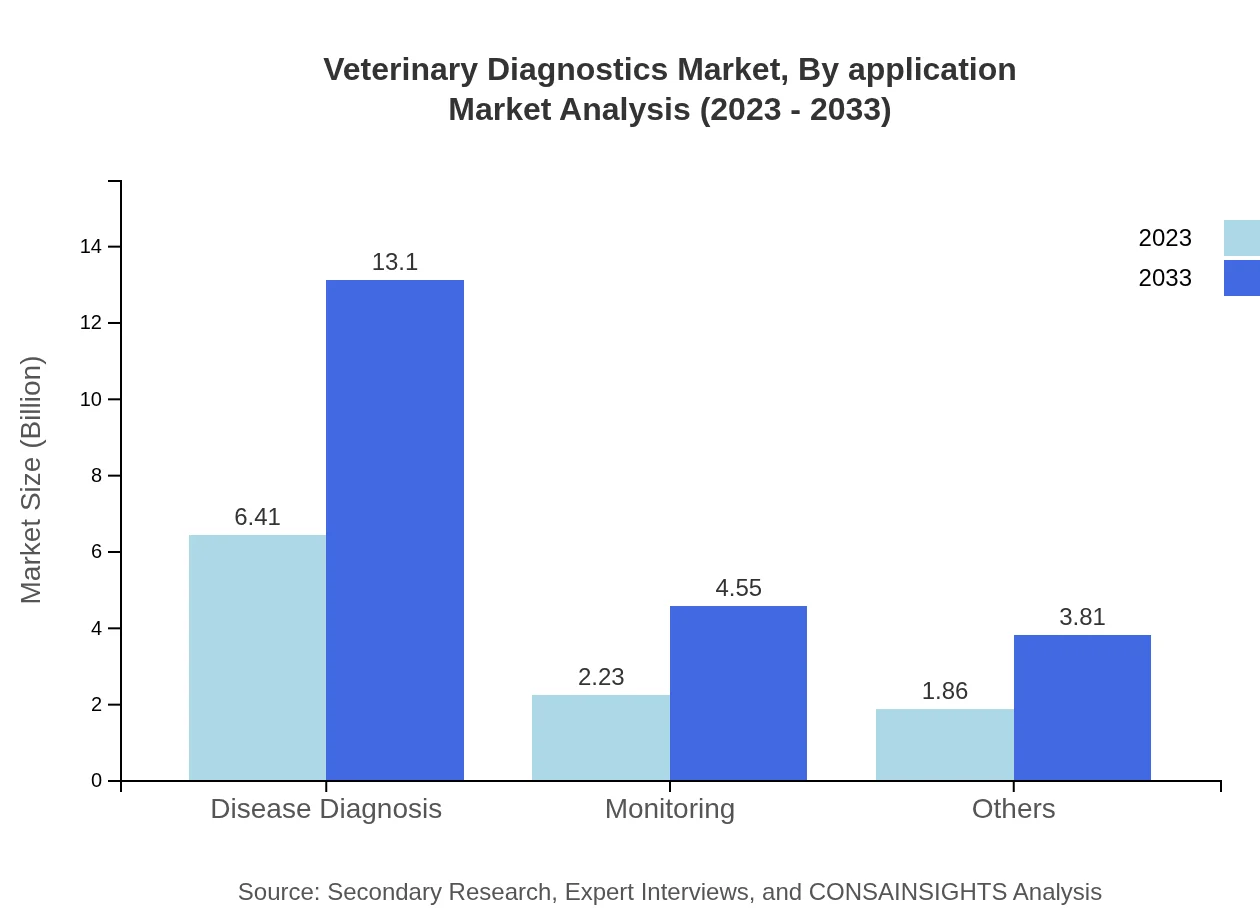

Veterinary Diagnostics Market Analysis By Application

The applications of veterinary diagnostics cover disease diagnosis, monitoring, and research. Disease diagnosis emerged as the leading application in 2023, contributing to 61.04% of the market share and projected to remain stable through 2033. Monitoring applications are also vital as they foster ongoing health assessments and preventive measures.

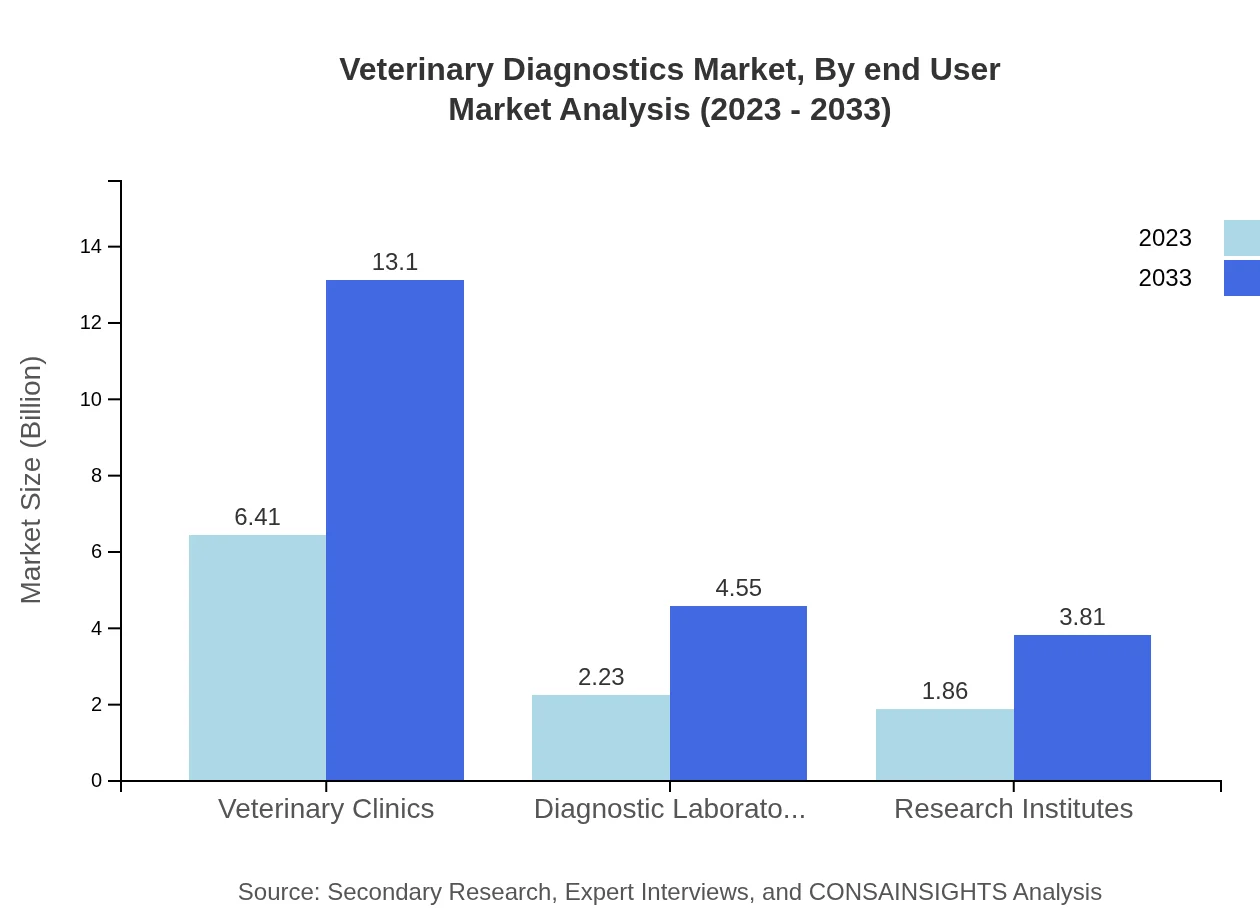

Veterinary Diagnostics Market Analysis By End User

End-users of veterinary diagnostics primarily include veterinary clinics, diagnostic laboratories, and research institutes. In 2023, veterinary clinics capture over 61% of the total market share, with expectations of growing needs for accurate diagnostics in clinical settings driving continuous expansion into 2033.

Veterinary Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Diagnostics Industry

Zoetis Inc.:

A leading animal health company focusing on innovative diagnostics and therapeutics drawing on extensive research and development.IDEXX Laboratories, Inc.:

Pioneers in veterinary diagnostics, providing comprehensive services, including laboratory testing and diagnostic imaging.Thermo Fisher Scientific Inc.:

Offering cutting-edge veterinary diagnostics products, including advanced molecular testing solutions tailored for various animal species.Virbac S.A.:

A global player committed to improving animal health through innovative diagnostic solutions and pharmaceuticals.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary Diagnostics?

The global veterinary diagnostics market is valued at approximately $10.5 billion as of 2023 and is expected to grow at a CAGR of 7.2%, reaching new heights by 2033.

What are the key market players or companies in this veterinary Diagnostics industry?

Key players in the veterinary diagnostics market include IDEXX Laboratories, Zoetis Inc., and Neogen Corporation, which lead with innovative products and extensive distribution networks.

What are the primary factors driving the growth in the veterinary Diagnostics industry?

Growth is driven by increased pet ownership, advancements in diagnostic technologies, rising awareness of animal health, and the need for early disease detection in livestock and companion animals.

Which region is the fastest Growing in the veterinary Diagnostics?

North America leads the market with $3.74 billion in 2023, projected to grow to $7.64 billion by 2033, while the Asia Pacific region also shows significant growth potential, expanding from $2.17 billion to $4.43 billion.

Does ConsaInsights provide customized market report data for the veterinary Diagnostics industry?

Yes, ConsaInsights offers tailored market report data that aligns with specific needs and focuses on various aspects of the veterinary diagnostics industry to provide actionable insights.

What deliverables can I expect from this veterinary Diagnostics market research project?

Expect detailed reports including market size, forecasts, segmented analysis, competitive landscape, and strategic recommendations to inform decision-making in the veterinary diagnostics sector.

What are the market trends of veterinary Diagnostics?

Trends include a shift towards point-of-care testing, increased adoption of digital technologies in diagnostics, rising demand for personalized veterinary medicine, and greater emphasis on preventive care.