Veterinary Drugs Market Report

Published Date: 31 January 2026 | Report Code: veterinary-drugs

Veterinary Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Veterinary Drugs market, focusing on trends, market size, growth forecasts from 2023 to 2033, and insights across various segments and regions.

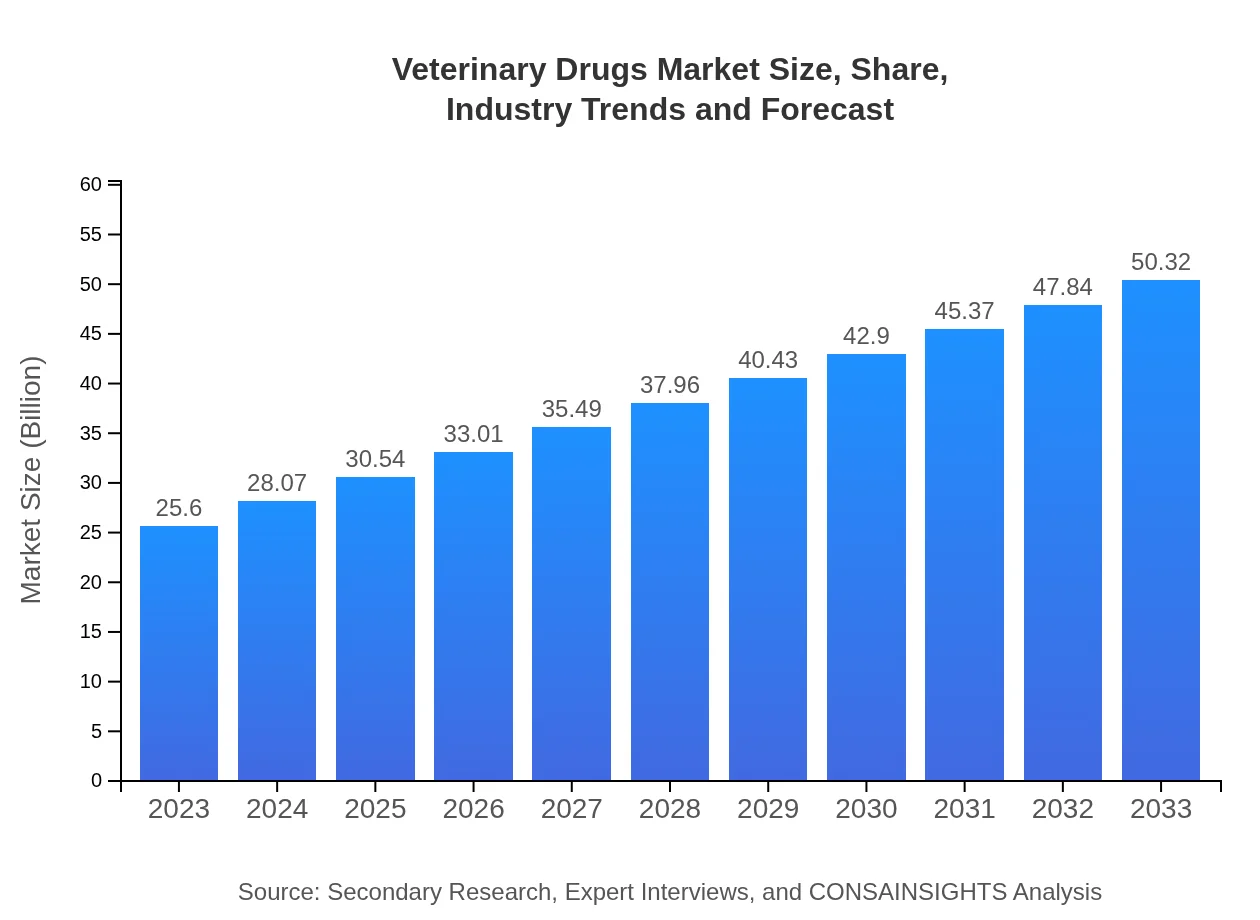

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Ceva Santé Animale |

| Last Modified Date | 31 January 2026 |

Veterinary Drugs Market Overview

Customize Veterinary Drugs Market Report market research report

- ✔ Get in-depth analysis of Veterinary Drugs market size, growth, and forecasts.

- ✔ Understand Veterinary Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Drugs

What is the Market Size & CAGR of Veterinary Drugs market in 2023?

Veterinary Drugs Industry Analysis

Veterinary Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Drugs Market Analysis Report by Region

Europe Veterinary Drugs Market Report:

The Veterinary Drugs market in Europe is predicted to grow from $6.78 billion in 2023 to $13.33 billion by 2033. Strict regulations regarding animal welfare and a high level of awareness regarding preventive veterinary care are key growth factors in this market.Asia Pacific Veterinary Drugs Market Report:

Asia Pacific is experiencing rapid growth in the Veterinary Drugs market, projected to reach $9.71 billion by 2033, up from $4.94 billion in 2023. Factors such as an increasing pet ownership rate, enhanced livestock management practices, and improved access to veterinary care are driving the demand in this region.North America Veterinary Drugs Market Report:

North America holds a significant share of the Veterinary Drugs market, with a projected market size of $17.69 billion by 2033, growing from $9.00 billion in 2023. The region's growth is driven by high disposable incomes, a robust pet culture, and continuous advancements in veterinary medical technologies.South America Veterinary Drugs Market Report:

The South American Veterinary Drugs market is expected to expand from $1.79 billion in 2023 to $3.52 billion by 2033. The growth is attributed to rising investment in animal health and the optimization of livestock yields, spurred by the increasing demand for protein-rich foods.Middle East & Africa Veterinary Drugs Market Report:

In the Middle East and Africa, the Veterinary Drugs market size is expected to increase from $3.09 billion in 2023 to $6.07 billion by 2033. This growth is supported by the demand for improved veterinary services amidst rising livestock populaces and increasing pet ownership across urban areas.Tell us your focus area and get a customized research report.

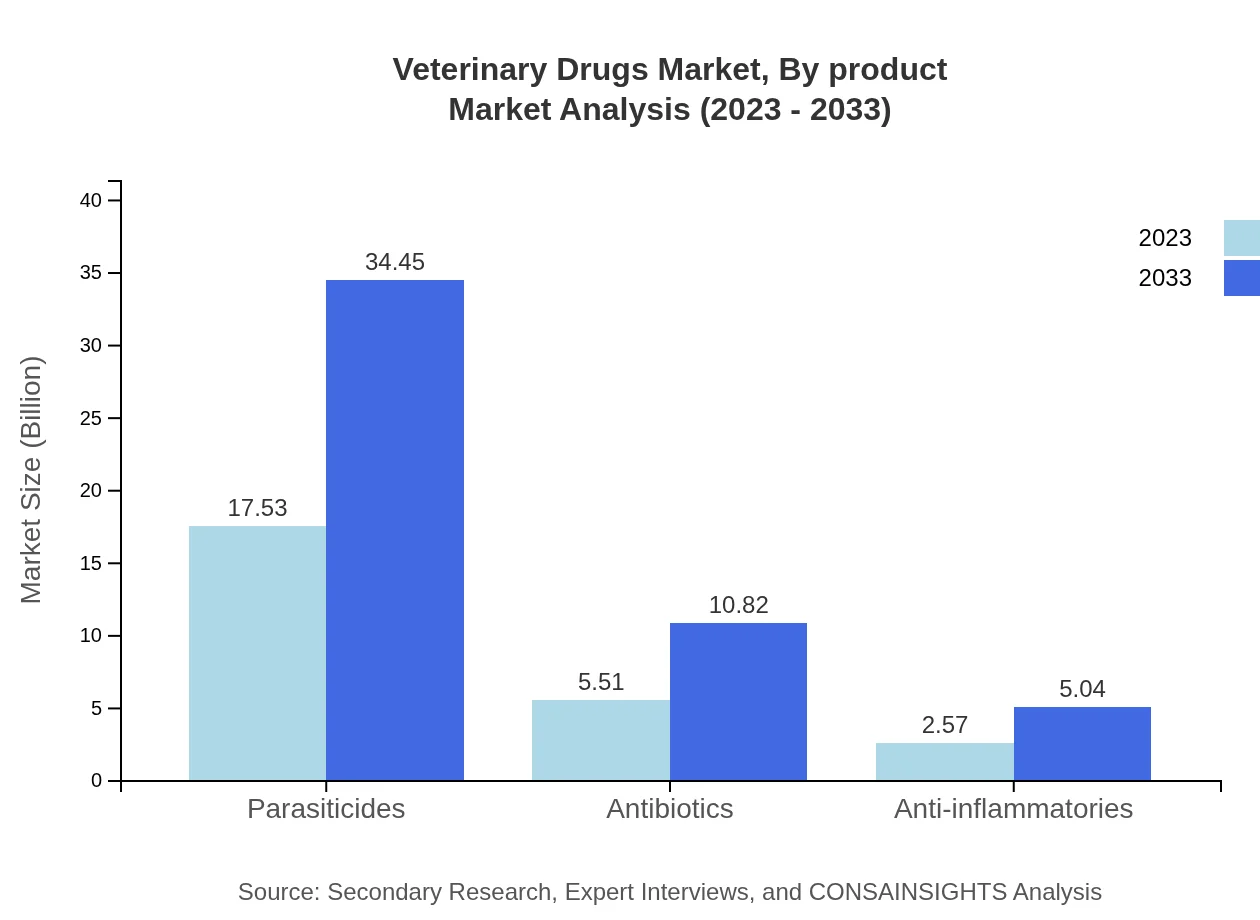

Veterinary Drugs Market Analysis By Product

In the product segment, parasiticides represent a substantial portion of the market, valued at $17.53 billion in 2023 and expected to double to $34.45 billion by 2033. Antibiotics and anti-inflammatories follow, with antibiotic sales projected to rise from $5.51 billion to $10.82 billion in the same period. This growth reflects an ongoing need for effective infectious disease treatments in both companion and farm animals.

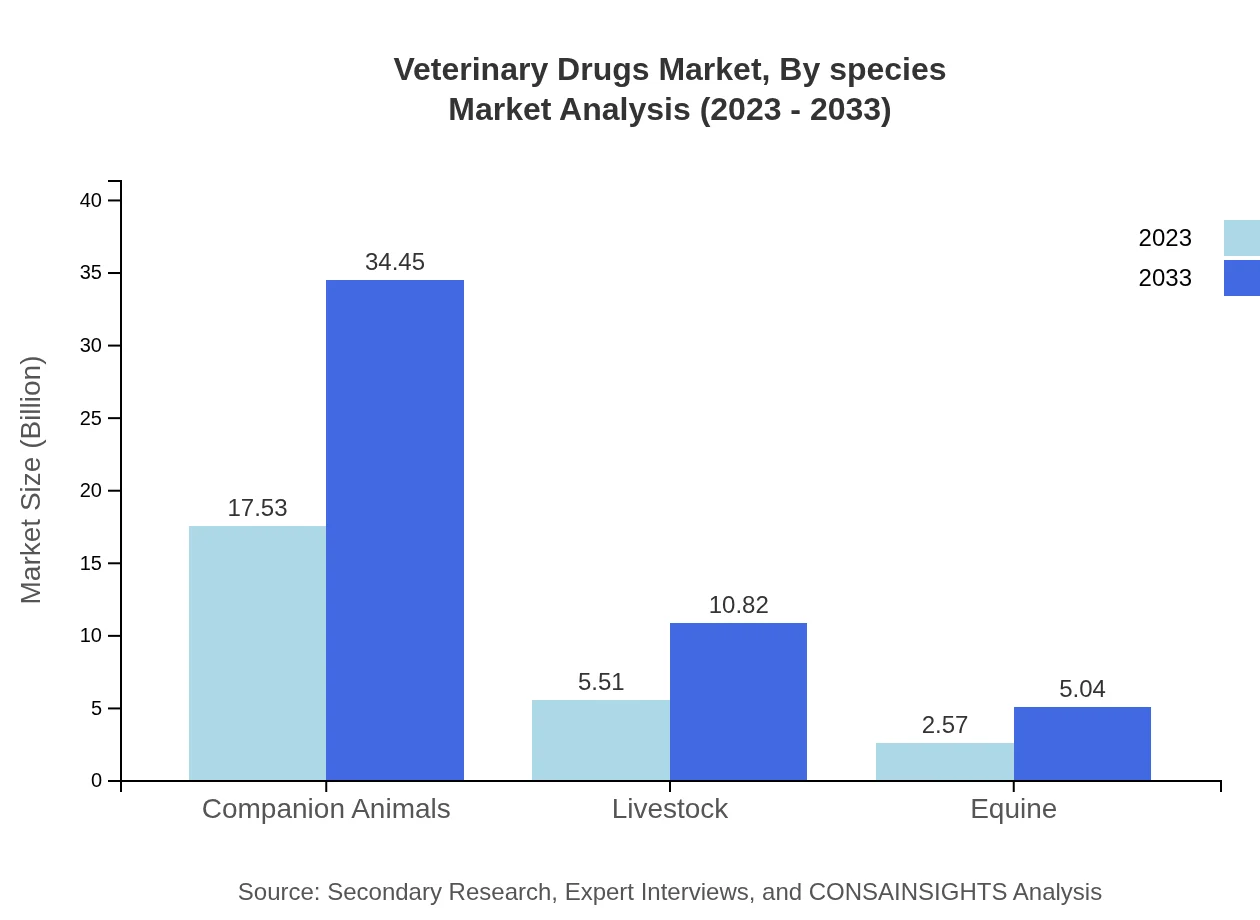

Veterinary Drugs Market Analysis By Species

The companion animal segment will dominate the market, growing from $17.53 billion in 2023 to $34.45 billion by 2033, driven by increased pet ownership and owners’ willingness to spend on advanced treatments. The livestock segment also plays a vital role, expanding from $5.51 billion to $10.82 billion, reflecting a focus on enhancing livestock health for better yield.

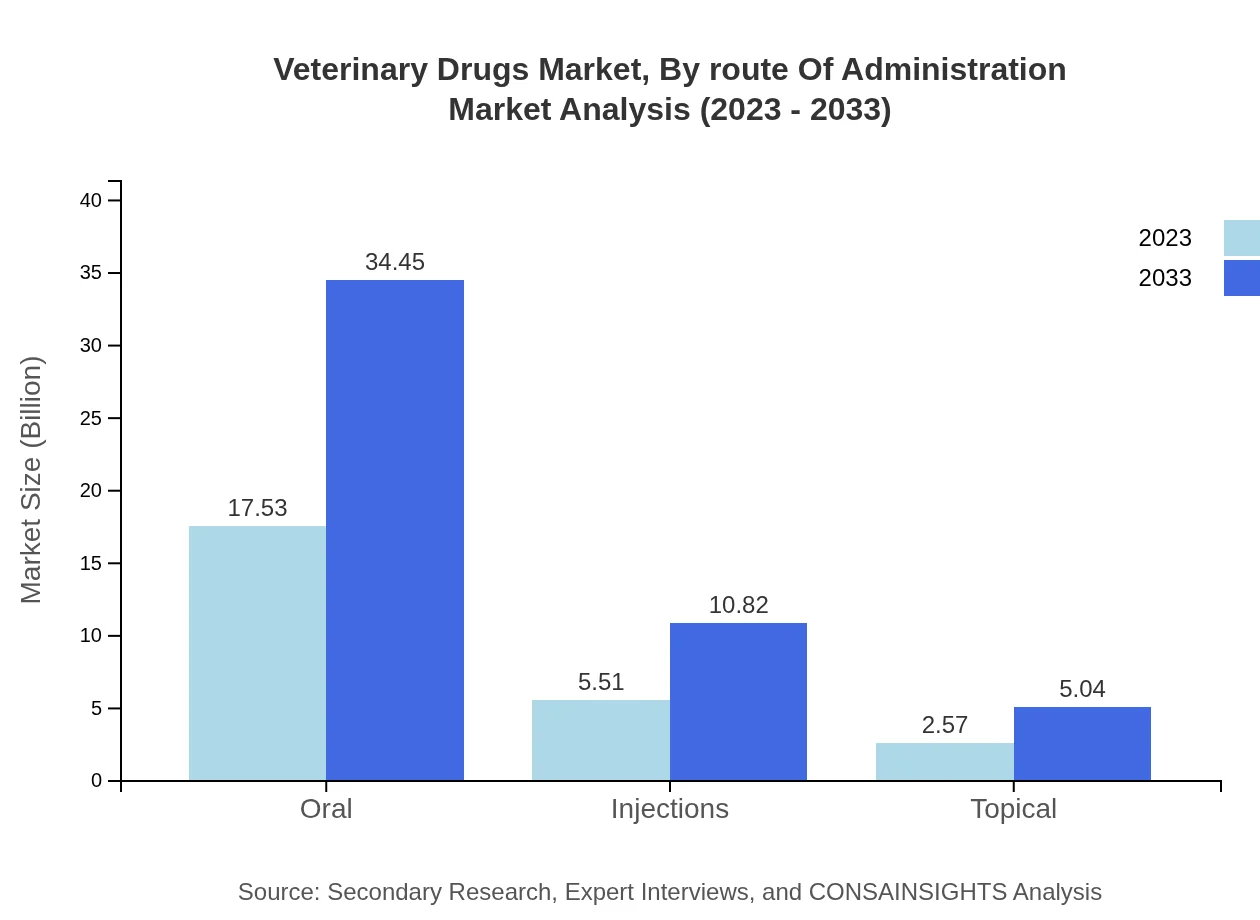

Veterinary Drugs Market Analysis By Route Of Administration

The oral administration route, holding a market share of 68.47%, shows robust growth from $17.53 billion in 2023 to $34.45 billion by 2033. Injections and topical applications are also relevant, with injections increasing from $5.51 billion to $10.82 billion, catering to immediate health needs.

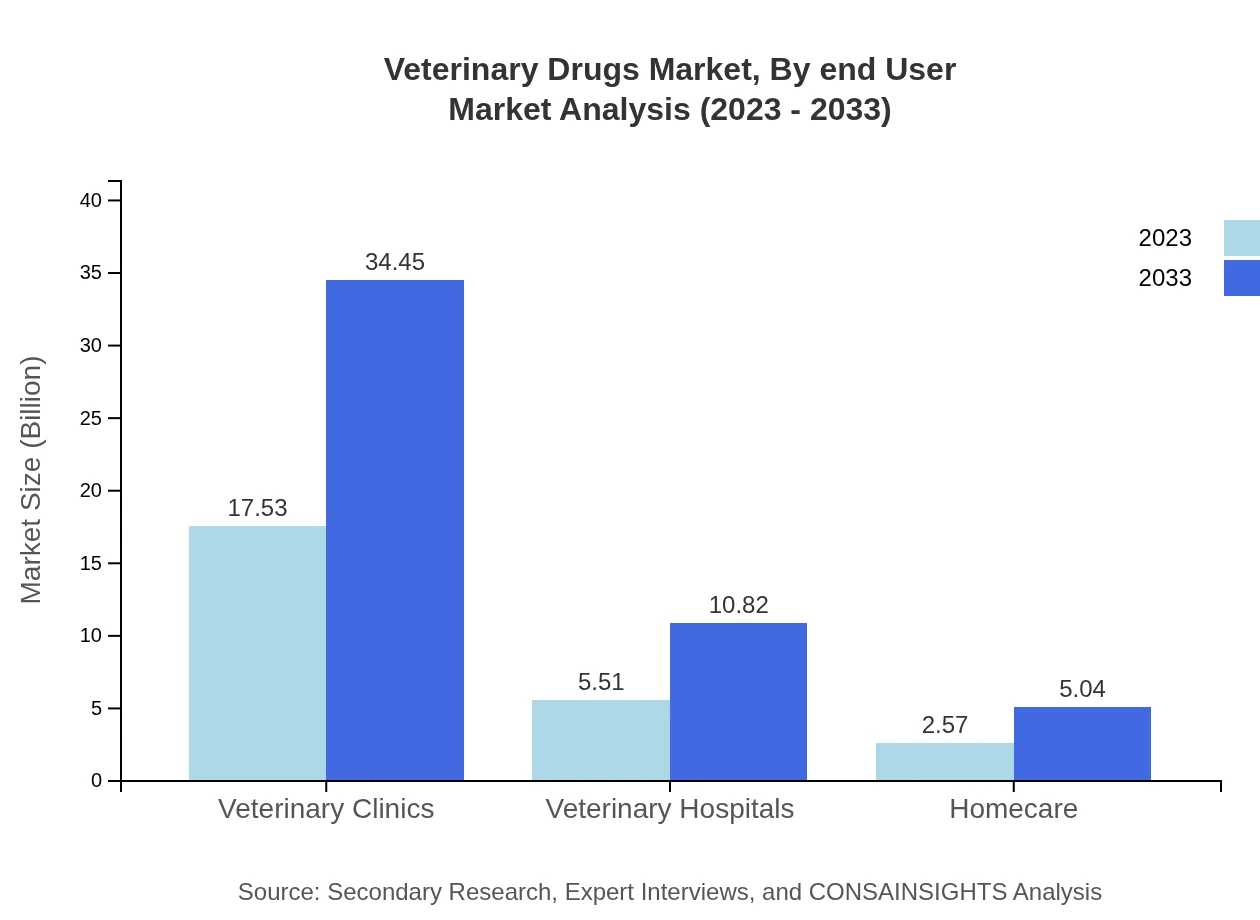

Veterinary Drugs Market Analysis By End User

Veterinary clinics continue to be the primary end-user in the Veterinary Drugs market, projected to expand significantly from $17.53 billion in 2023 to $34.45 billion by 2033. Veterinary hospitals and homecare services contribute notably, supporting extensive healthcare coverage for animals.

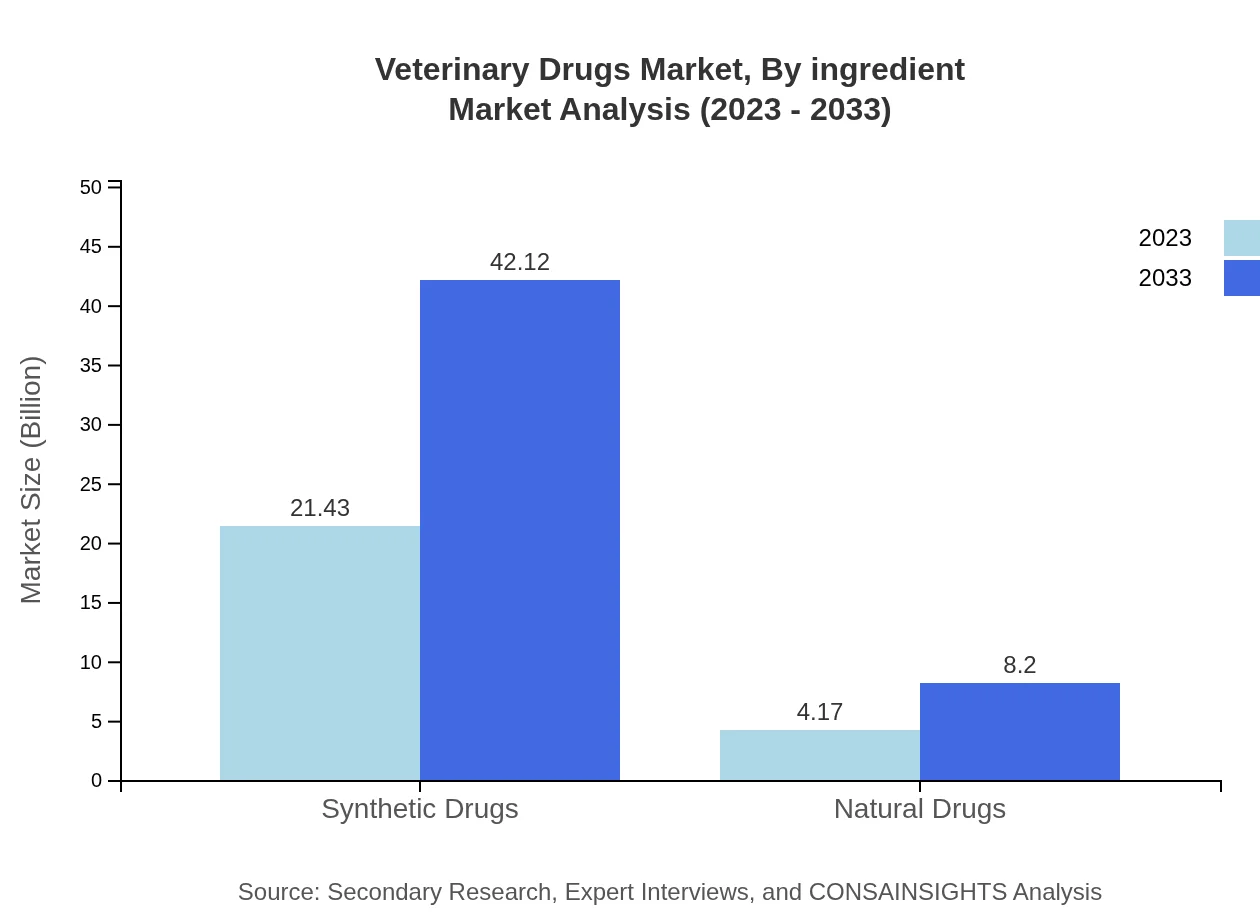

Veterinary Drugs Market Analysis By Ingredient

Synthetic drugs dominate the ingredient market, with a size of $21.43 billion in 2023 and expected to reach $42.12 billion by 2033. Natural drugs, although smaller, show potential growth from $4.17 billion to $8.20 billion, as consumers increasingly prefer holistic health solutions for their pets.

Veterinary Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Drugs Industry

Zoetis:

A leading provider of veterinary pharmaceuticals and diagnostics, Zoetis is known for its innovative solutions aimed at improving the health of animals and the productivity of livestock.Merck Animal Health:

Part of Merck & Co., this company focuses on delivering a broad range of veterinary pharmaceuticals, vaccine products, and services globally, contributing to the health and wellness of animals.Boehringer Ingelheim:

Boehringer Ingelheim is a global leader in animal health, providing innovative medications and diagnostics that enhance the quality of life for animals and extend their longevity.Elanco Animal Health:

Dedicated to serving the needs of animal owners, Elanco develops and markets innovative products for livestock and pets that improve animal health and food safety.Ceva Santé Animale:

Ceva is a global animal health company engaged in research and development, production, and marketing of veterinary products and services that ensure livestock health and promote animal welfare.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary drugs?

The veterinary drugs market is currently valued at $25.6 billion, with a projected CAGR of 6.8% from 2023 to 2033, indicating significant growth potential in this sector over the next decade.

What are the key market players or companies in the veterinary drugs industry?

Key players in the veterinary drugs industry include well-established companies such as Pfizer Inc., Zoetis Inc., Merck & Co., Elanco Animal Health, and Bayer AG, along with numerous emerging biotech firms.

What are the primary factors driving the growth in the veterinary drugs industry?

Growth in the veterinary drugs industry is driven primarily by increasing pet ownership, rising expenditure on pet care, advancements in veterinary medicine, and growing awareness of animal health and welfare among owners.

Which region is the fastest Growing in the veterinary drugs market?

The fastest-growing region in the veterinary drugs market is North America, projected to grow from $9.00 billion in 2023 to $17.69 billion by 2033, reflecting a robust increase in demand for veterinary healthcare.

Does ConsaInsights provide customized market report data for the veterinary drugs industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the veterinary drugs industry, ensuring relevant insights and actionable intelligence for various stakeholders.

What deliverables can I expect from this veterinary drugs market research project?

Deliverables from the veterinary drugs market research project include comprehensive market analysis reports, segmentation data, regional insights, competitive landscape evaluation, and growth forecasts to guide strategic decisions.

What are the market trends of veterinary drugs?

Current trends in the veterinary drugs market include an increasing shift towards preventive care, growth in biologics, rising demand for novel therapies, and a focus on sustainability in drug development.