Veterinary Imaging Market Report

Published Date: 31 January 2026 | Report Code: veterinary-imaging

Veterinary Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Veterinary Imaging market, focusing on current trends, forecasts, and insights from 2023 to 2033. It covers market size, segmentation, regional analysis, and leading companies, offering valuable information for stakeholders and decision-makers.

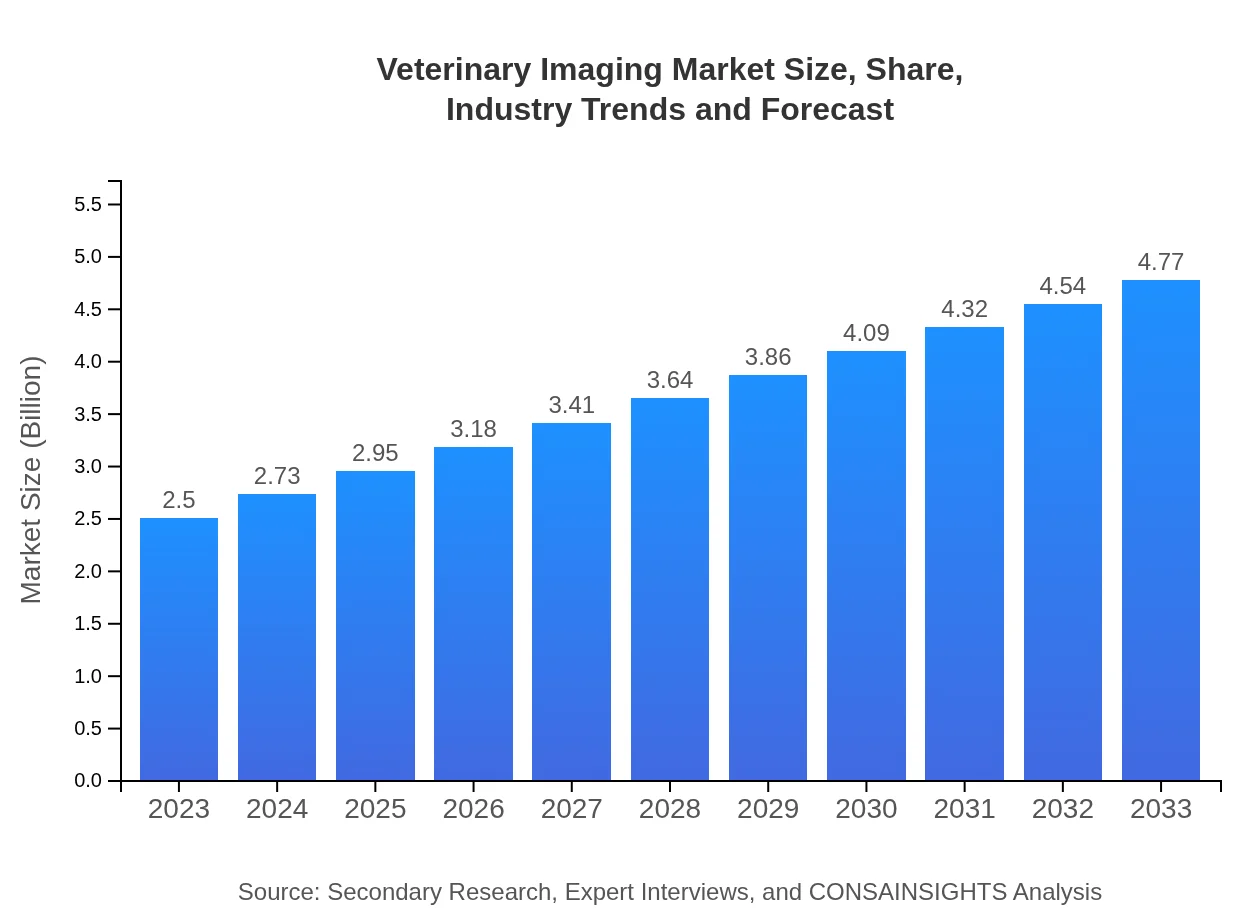

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $4.77 Billion |

| Top Companies | Idexx Laboratories, Inc., Carestream Health, Siemens Healthineers, GE Healthcare, Vet-Ray |

| Last Modified Date | 31 January 2026 |

Veterinary Imaging Market Overview

Customize Veterinary Imaging Market Report market research report

- ✔ Get in-depth analysis of Veterinary Imaging market size, growth, and forecasts.

- ✔ Understand Veterinary Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Imaging

What is the Market Size & CAGR of Veterinary Imaging market in 2023?

Veterinary Imaging Industry Analysis

Veterinary Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Imaging Market Analysis Report by Region

Europe Veterinary Imaging Market Report:

In Europe, the Veterinary Imaging market is projected to grow from $0.72 billion in 2023 to $1.37 billion by 2033. This region is characterized by a strong emphasis on animal welfare and health, leading to increased investment in veterinary practices. The integration of advanced imaging technologies and practices across various countries is further propelling the market.Asia Pacific Veterinary Imaging Market Report:

The Asia Pacific region shows a promising growth trajectory for the Veterinary Imaging market, projected to rise from $0.53 billion in 2023 to about $1.02 billion by 2033. Factors contributing to this growth include increasing pet ownership in developing countries, improving veterinary healthcare infrastructure, and growing awareness of pet health. Countries such as China and India are witnessing a surge in demand for advanced diagnostic tools, further fueling market growth.North America Veterinary Imaging Market Report:

North America remains a leader in the Veterinary Imaging market, with a projected increase from $0.87 billion in 2023 to $1.66 billion by 2033. The region benefits from a high concentration of veterinary clinics and hospitals, coupled with significant investments in cutting-edge imaging technologies. The rising trends in pet adoption and the accompanying increase in demand for specialized veterinary services drive market growth.South America Veterinary Imaging Market Report:

In South America, the Veterinary Imaging market is expected to expand from $0.08 billion in 2023 to $0.16 billion by 2033. The growth is largely driven by increasing disposable income, changing consumer attitudes towards pet care, and the expansion of veterinary services. The market is still emerging, with new players entering to meet the growing demand for imaging technologies.Middle East & Africa Veterinary Imaging Market Report:

The Middle East and Africa are witnessing gradual growth in the Veterinary Imaging market, expected to increase from $0.30 billion in 2023 to $0.57 billion by 2033. Factors influencing this growth include urbanization, increased pet adoption, and enhanced healthcare standards in veterinary practices. However, the market remains challenged by varying economic conditions and the need for more advanced veterinary infrastructure.Tell us your focus area and get a customized research report.

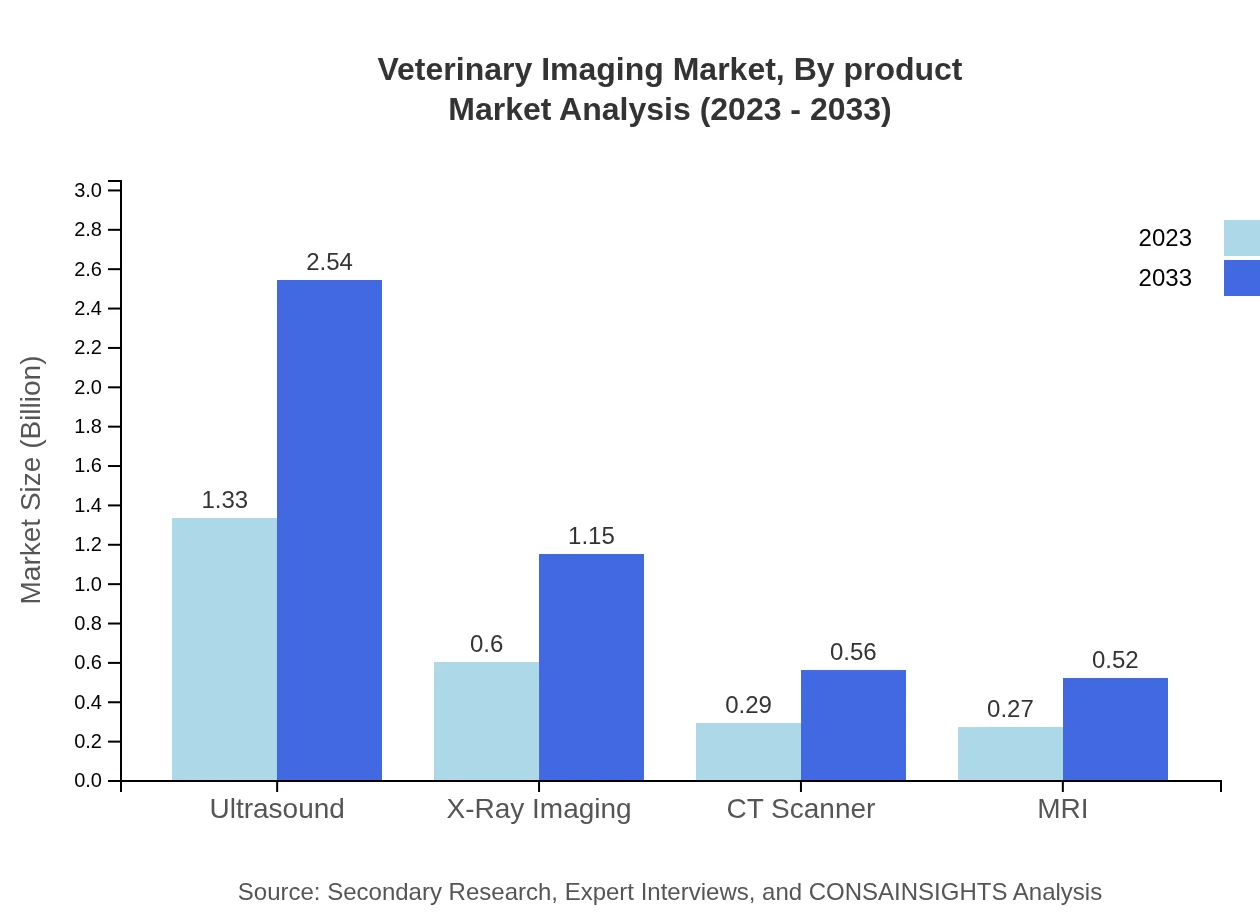

Veterinary Imaging Market Analysis By Product

In 2023, the ultrasound segment dominates the Veterinary Imaging market with a size of approximately $1.33 billion, maintaining a share of 53.33%. The segment is projected to grow significantly, reaching around $2.54 billion by 2033. X-ray imaging is also a critical segment, with a market size of $0.60 billion in 2023, expected to increase to $1.15 billion in 2033, holding a share of 24.2%. Other segments include CT scanners, MRI, and digital imaging, which collectively contribute to the growth of the market as veterinary practices evolve.

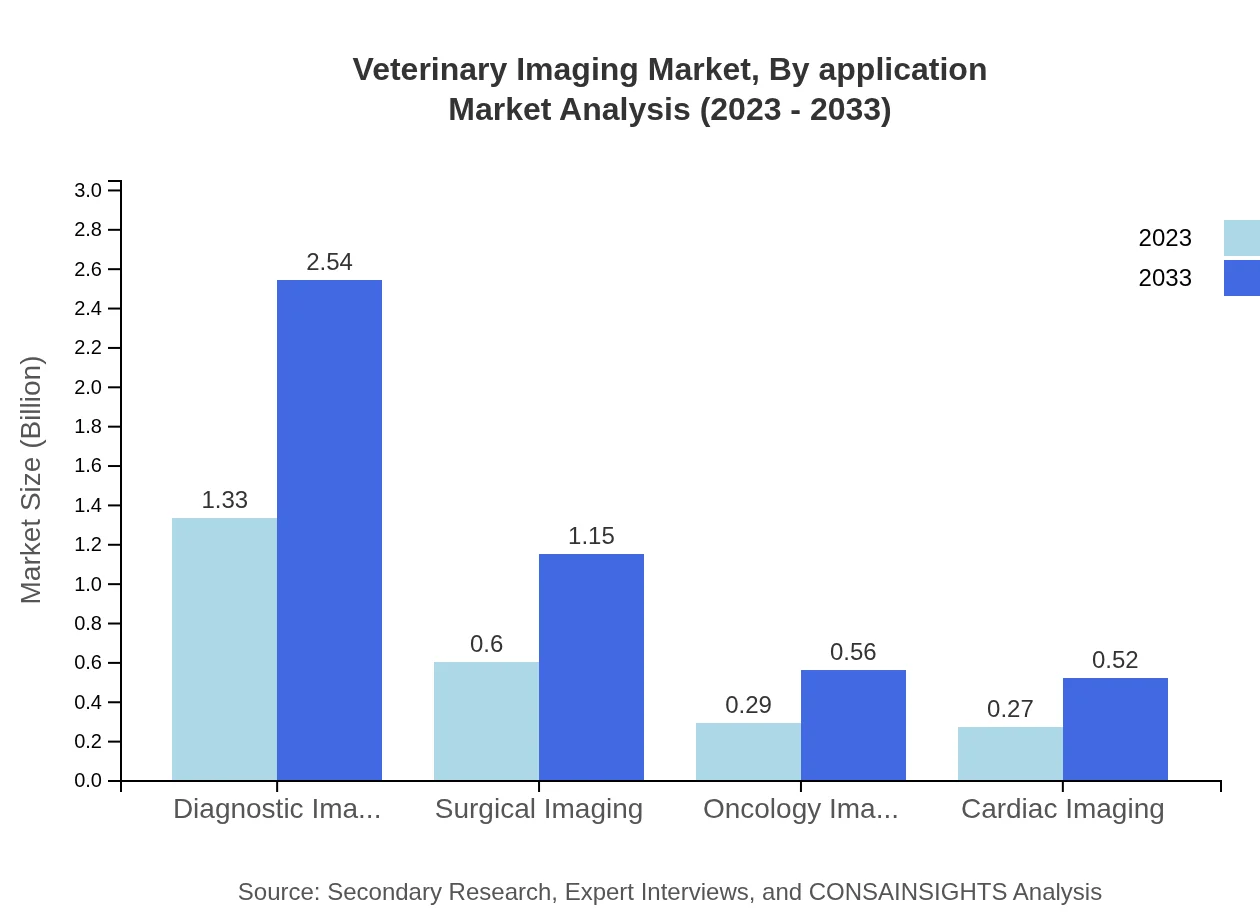

Veterinary Imaging Market Analysis By Application

The application's segmentation includes diagnostic imaging, surgical imaging, oncological imaging, and cardiac imaging. Diagnostic imaging leads with a market size of $1.33 billion in 2023, with expected growth to $2.54 billion by 2033, reflecting its essential role in routine checks. Surgical imaging and oncology imaging also contribute significantly to the market, with surgical imaging at $0.60 billion and oncology imaging at $0.29 billion, both projected to grow by 2033.

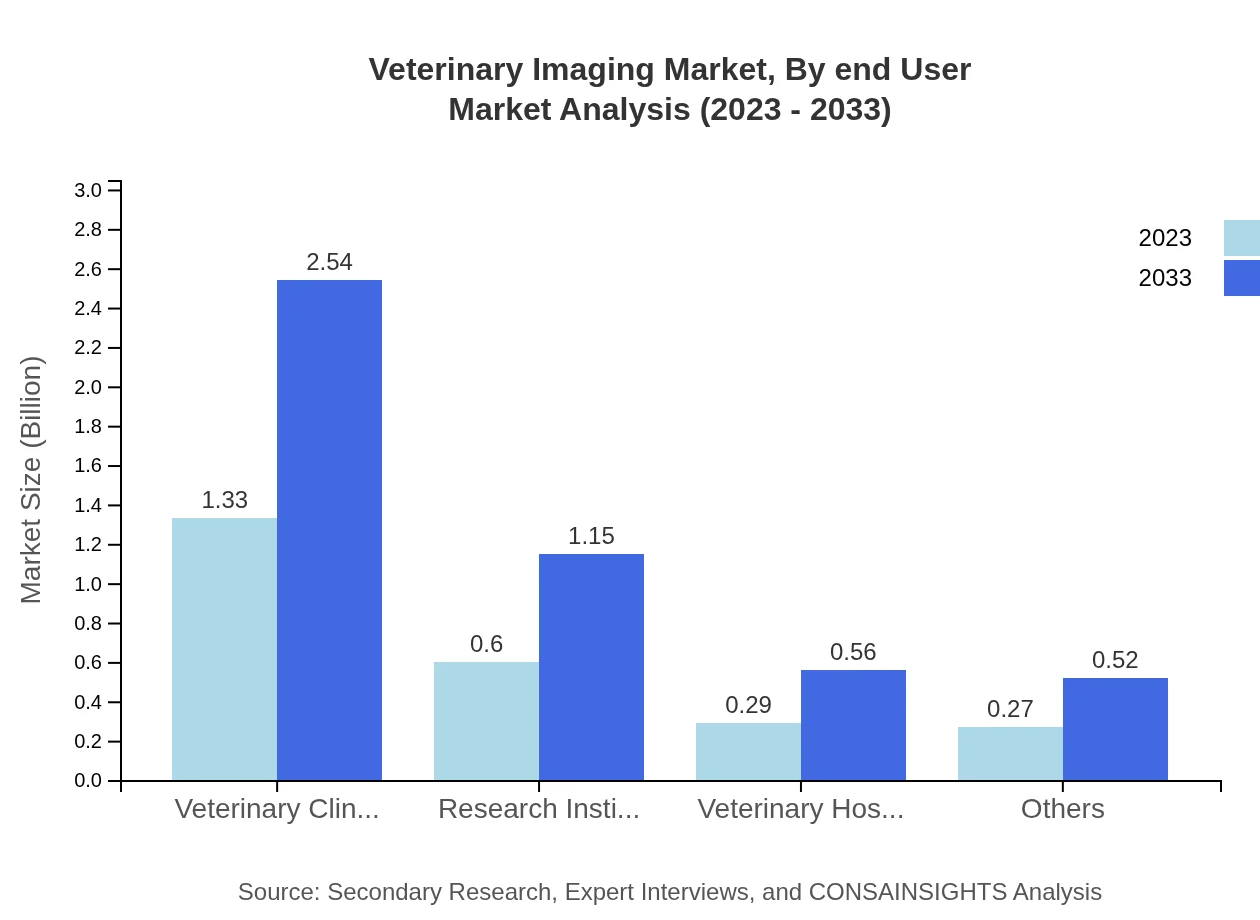

Veterinary Imaging Market Analysis By End User

Veterinary clinics are the primary end-users, with a size of $1.33 billion in 2023 and projected growth to $2.54 billion by 2033, representing a 53.33% market share. Research institutions follow, valued at $0.60 billion, growing to $1.15 billion, while veterinary hospitals contribute $0.29 billion and are projected to reach $0.56 billion by 2033. This segmentation highlights the varied applications and demands across different veterinary settings.

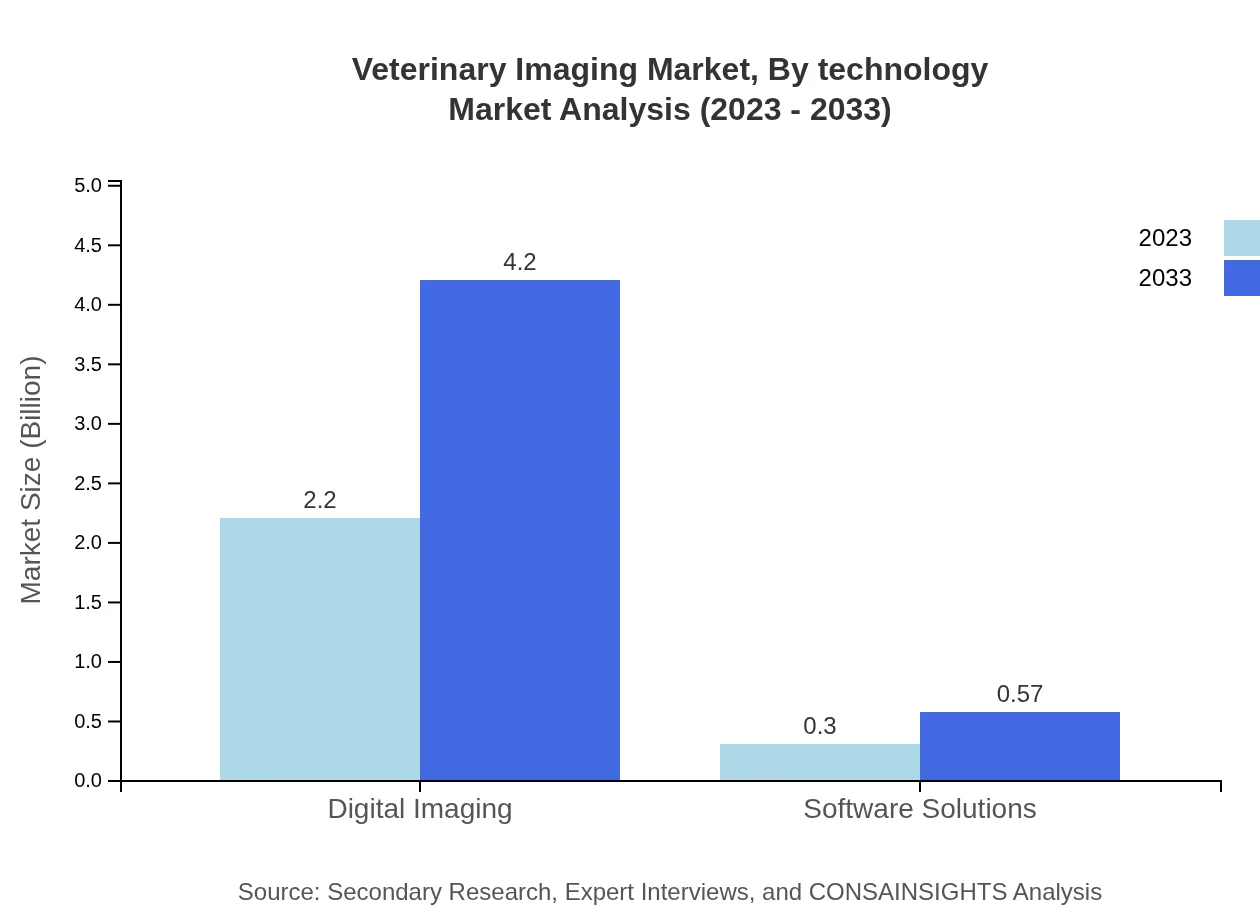

Veterinary Imaging Market Analysis By Technology

Technology plays a crucial role; digital imaging is at the forefront, valued at $2.20 billion in 2023, with growth to $4.20 billion expected by 2033. Software solutions also play a significant role, with a size of $0.30 billion in 2023, projected to increase to $0.57 billion in the coming decade. The advancement in imaging technologies is making diagnostics easier and more efficient.

Veterinary Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Imaging Industry

Idexx Laboratories, Inc.:

A leading provider of veterinary diagnostic products and services, Idexx is known for its advanced imaging technologies and comprehensive software systems that enhance veterinary diagnostics and patient care efficiency.Carestream Health:

Carestream Health specializes in digital imaging solutions and has a significant footprint in the veterinary segment, offering innovative imaging systems that integrate seamlessly with veterinary workflows.Siemens Healthineers:

Siemens Healthineers provides medical imaging solutions, including veterinary imaging, focusing on cutting-edge technology in MRI and CT scanners that cater specifically to veterinary diagnostics.GE Healthcare:

GE Healthcare offers a wide range of imaging technologies and solutions for veterinary practices, emphasizing innovation and reliable diagnostic imaging systems.Vet-Ray:

Vet-Ray, a brand under the Digital Imaging Systems umbrella, is dedicated to providing innovative veterinary radiography solutions that enhance imaging capabilities and diagnostic accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary imaging?

The veterinary imaging market is valued at approximately $2.5 billion in 2023, with an anticipated CAGR of 6.5% through 2033, indicating strong growth and rising demand for advanced diagnostic imaging technologies.

What are the key market players or companies in the veterinary imaging industry?

Key market players in veterinary imaging include major companies like GE Healthcare, Siemens Healthineers, and Fujifilm, which specialize in innovative imaging technologies and solutions for veterinary applications.

What are the primary factors driving the growth in the veterinary imaging industry?

Factors driving growth in the veterinary imaging industry include increasing pet ownership, technological advancements in imaging modalities, and the rising emphasis on preventative healthcare in veterinary practices.

Which region is the fastest Growing in the veterinary imaging industry?

The fastest-growing region in the veterinary imaging industry is North America, with a market size projected to increase from $0.87 billion in 2023 to $1.66 billion by 2033, highlighting significant regional demand.

Does ConsaInsights provide customized market report data for the veterinary imaging industry?

Yes, ConsaInsights offers customized market report data tailored to the veterinary imaging industry, allowing clients to gain insights specific to their business needs and market conditions.

What deliverables can I expect from this veterinary imaging market research project?

Deliverables from this veterinary imaging market research project typically include comprehensive reports, data analyses, trend insights, and actionable recommendations tailored for stakeholders in the veterinary imaging market.

What are the market trends of veterinary imaging?

Market trends in veterinary imaging include the growing adoption of digital imaging technologies, enhanced software solutions for diagnostics, and a shift towards minimally invasive imaging techniques.