Veterinary Molecular Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: veterinary-molecular-diagnostics

Veterinary Molecular Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Veterinary Molecular Diagnostics market, including an overview, segmentation, technology analysis, and regional dynamics from 2023 to 2033. Key trends, forecasts, and competitive landscapes are also explored to aid stakeholders in strategic decision-making.

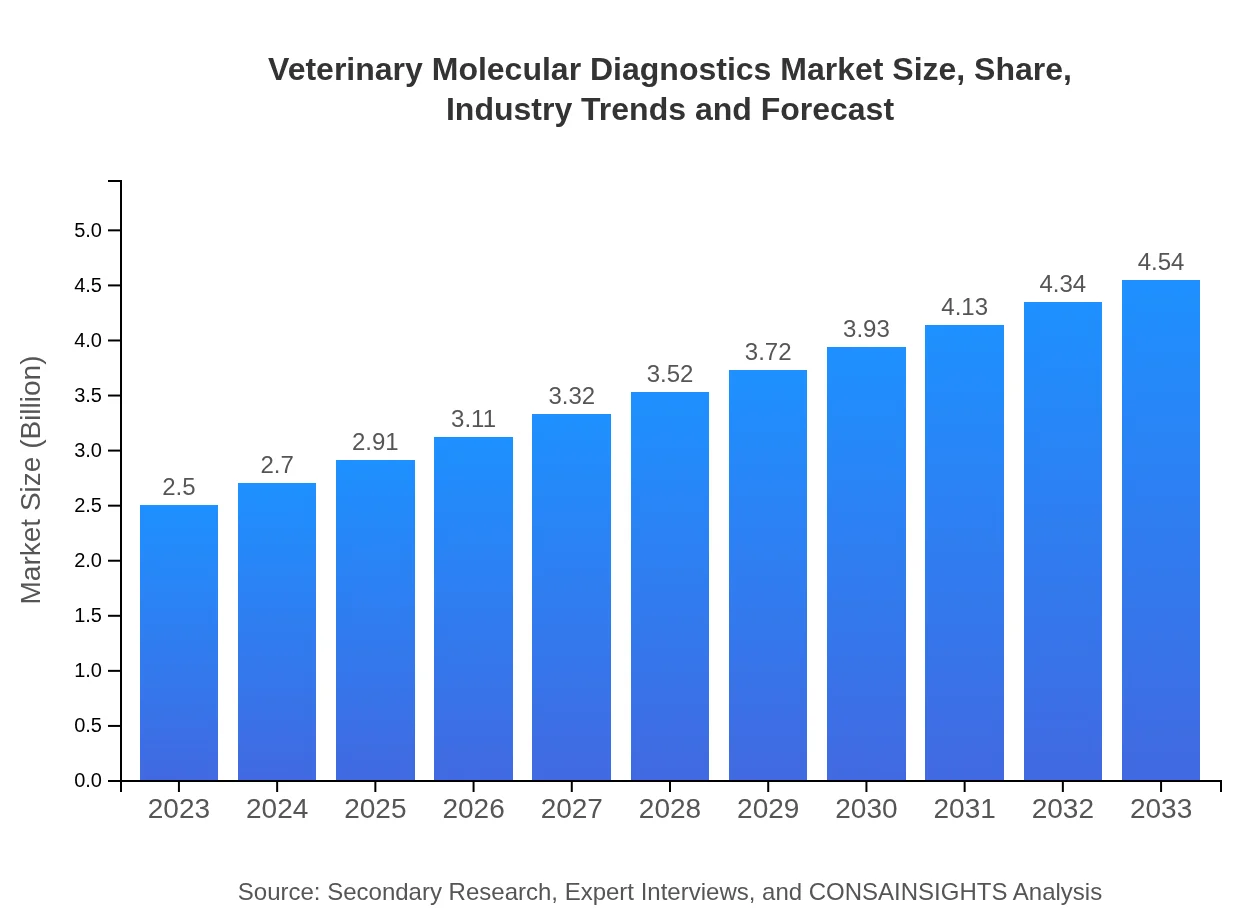

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $4.54 Billion |

| Top Companies | Zoetis, IDEXX Laboratories, Neogen Corporation, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Veterinary Molecular Diagnostics Market Overview

Customize Veterinary Molecular Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Veterinary Molecular Diagnostics market size, growth, and forecasts.

- ✔ Understand Veterinary Molecular Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Molecular Diagnostics

What is the Market Size & CAGR of Veterinary Molecular Diagnostics market in 2023?

Veterinary Molecular Diagnostics Industry Analysis

Veterinary Molecular Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Molecular Diagnostics Market Analysis Report by Region

Europe Veterinary Molecular Diagnostics Market Report:

In Europe, the market is projected to increase from $0.80 billion in 2023 to $1.45 billion by 2033, fueled by stringent regulations regarding animal health and a growing trend towards preventive medicine.Asia Pacific Veterinary Molecular Diagnostics Market Report:

In the Asia Pacific region, the Veterinary Molecular Diagnostics market is valued at $0.40 billion in 2023 and is projected to reach $0.73 billion by 2033, driven by increasing pet ownership and awareness of animal health.North America Veterinary Molecular Diagnostics Market Report:

North America remains a dominant player, with the market valued at $0.93 billion in 2023 and anticipated to grow to $1.70 billion by 2033, supported by heightened awareness of pet healthcare and sophisticated veterinary practices.South America Veterinary Molecular Diagnostics Market Report:

The Latin American market for Veterinary Molecular Diagnostics is expected to grow from $0.22 billion in 2023 to $0.40 billion by 2033, spurred by advancements in veterinary healthcare and a growing livestock market.Middle East & Africa Veterinary Molecular Diagnostics Market Report:

The Middle East and Africa market is expected to rise from $0.15 billion in 2023 to $0.27 billion by 2033, as veterinary diagnostics gain traction with increased livestock farming and attention on zoonotic disease control.Tell us your focus area and get a customized research report.

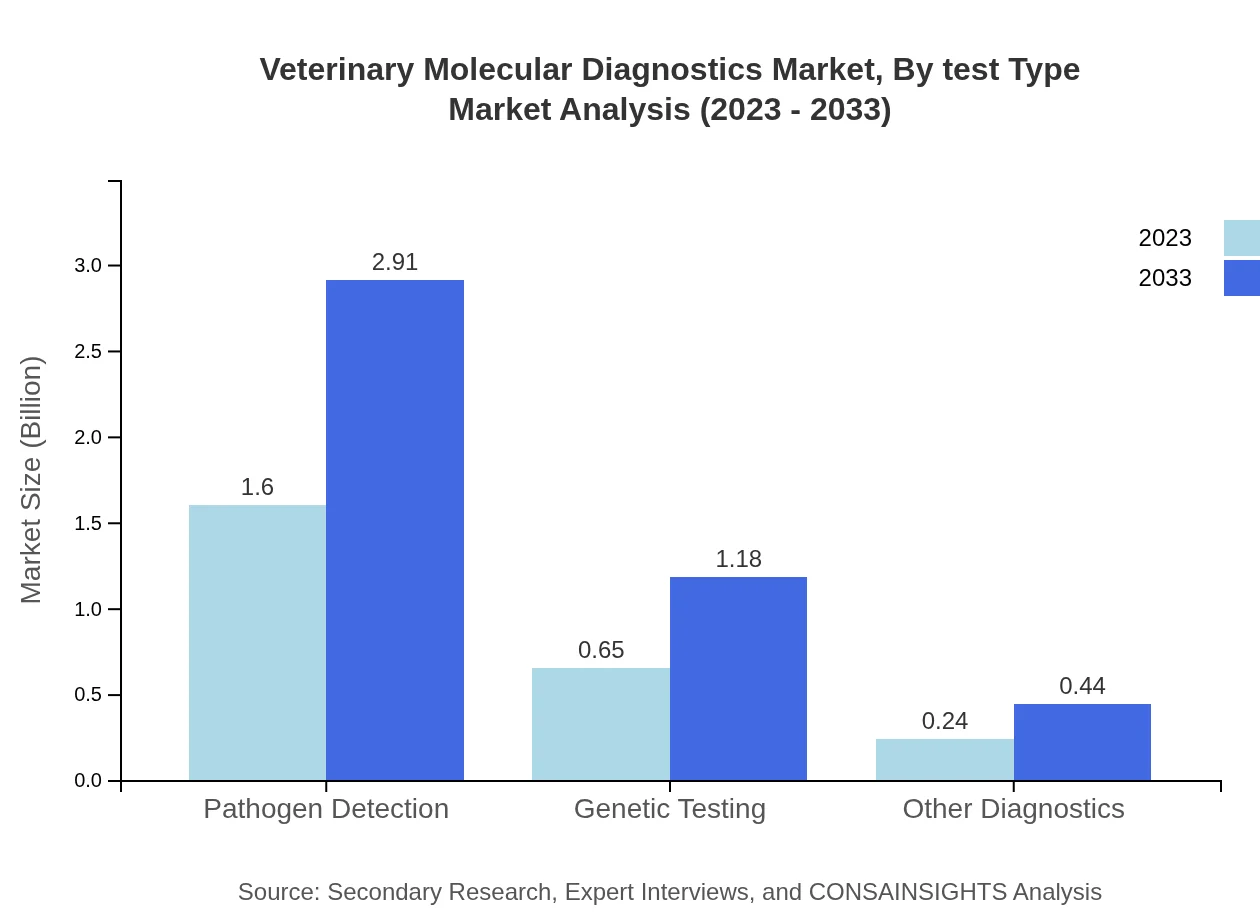

Veterinary Molecular Diagnostics Market Analysis By Test Type

The market valuation by test type highlights that Pathogen Detection dominates with a market size of $1.60 billion in 2023, expected to rise to $2.91 billion by 2033, constituting approximately 64.17% share. Genetic Testing follows with a 26.06% share, growing from $0.65 billion to $1.18 billion. Other Diagnostics, including various screening methods, hold a 9.77% share, currently valued at $0.24 billion and expected to grow steadily.

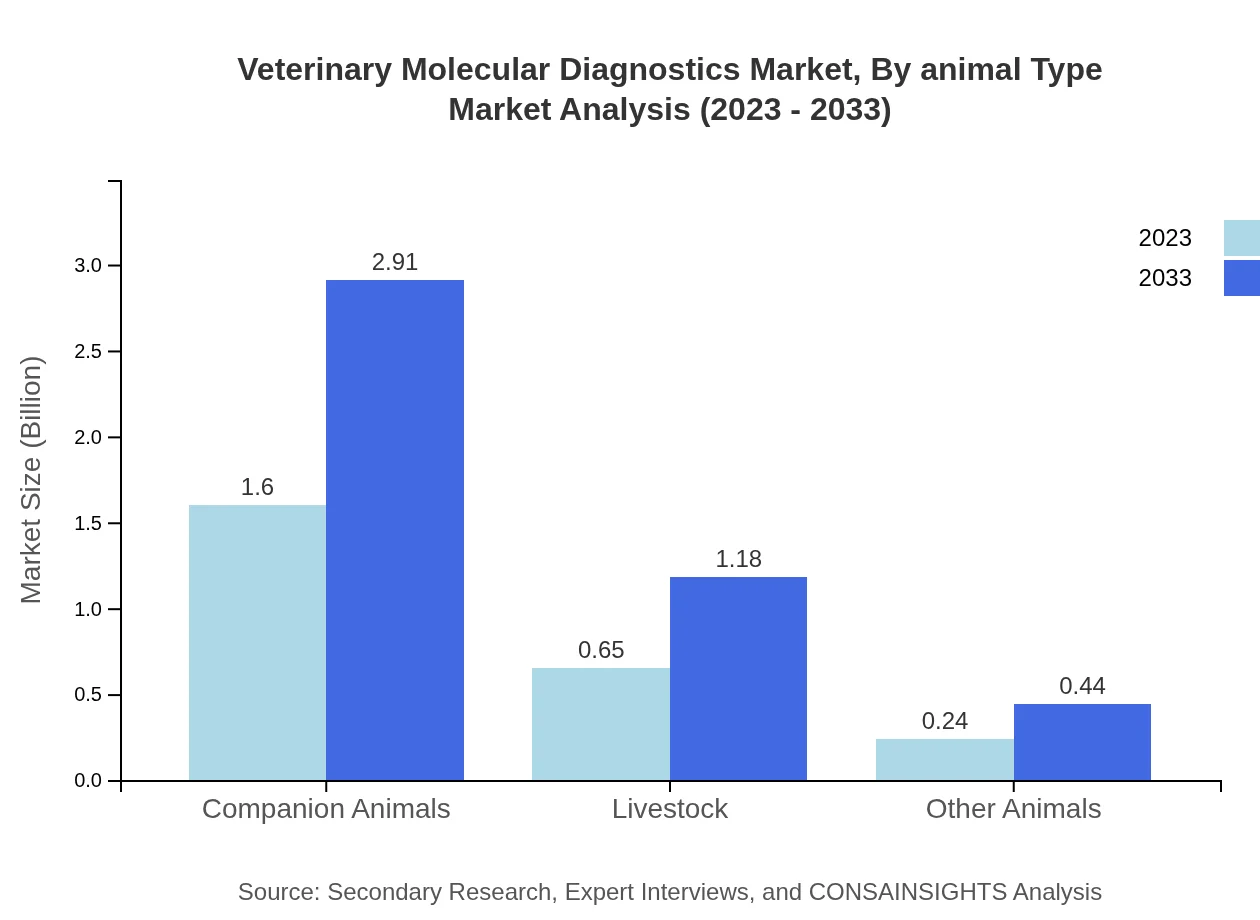

Veterinary Molecular Diagnostics Market Analysis By Animal Type

Companion Animals represent the largest segment, with revenues soaring from $1.60 billion in 2023 to $2.91 billion by 2033, maintaining a 64.17% market share. Livestock diagnostics are gaining traction, with market size anticipated to increase from $0.65 billion to $1.18 billion, thus holding 26.06% of the market. Other Animals, while smaller, are expected to grow from $0.24 billion to $0.44 billion.

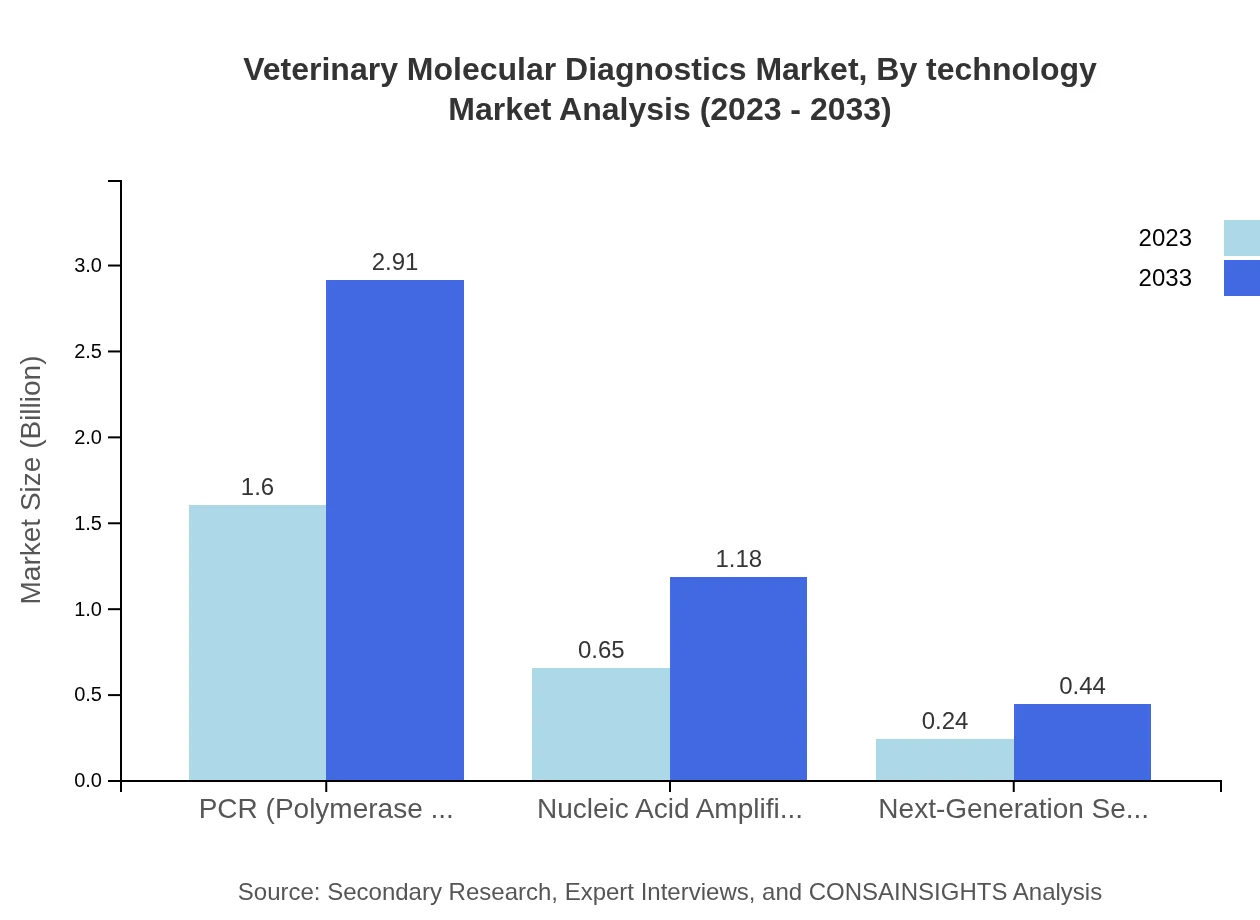

Veterinary Molecular Diagnostics Market Analysis By Technology

PCR technology remains vital in the industry, accounting for $1.60 billion in 2023 and expected to reach $2.91 billion by 2033, with a consistent 64.17% share. Nucleic Acid Amplification is projected to grow from $0.65 billion to $1.18 billion, representing 26.06% of the sector. Next-Generation Sequencing, though smaller, is gaining interest with an increase from $0.24 billion to $0.44 billion, showcasing rising advancements in molecular diagnostic technology.

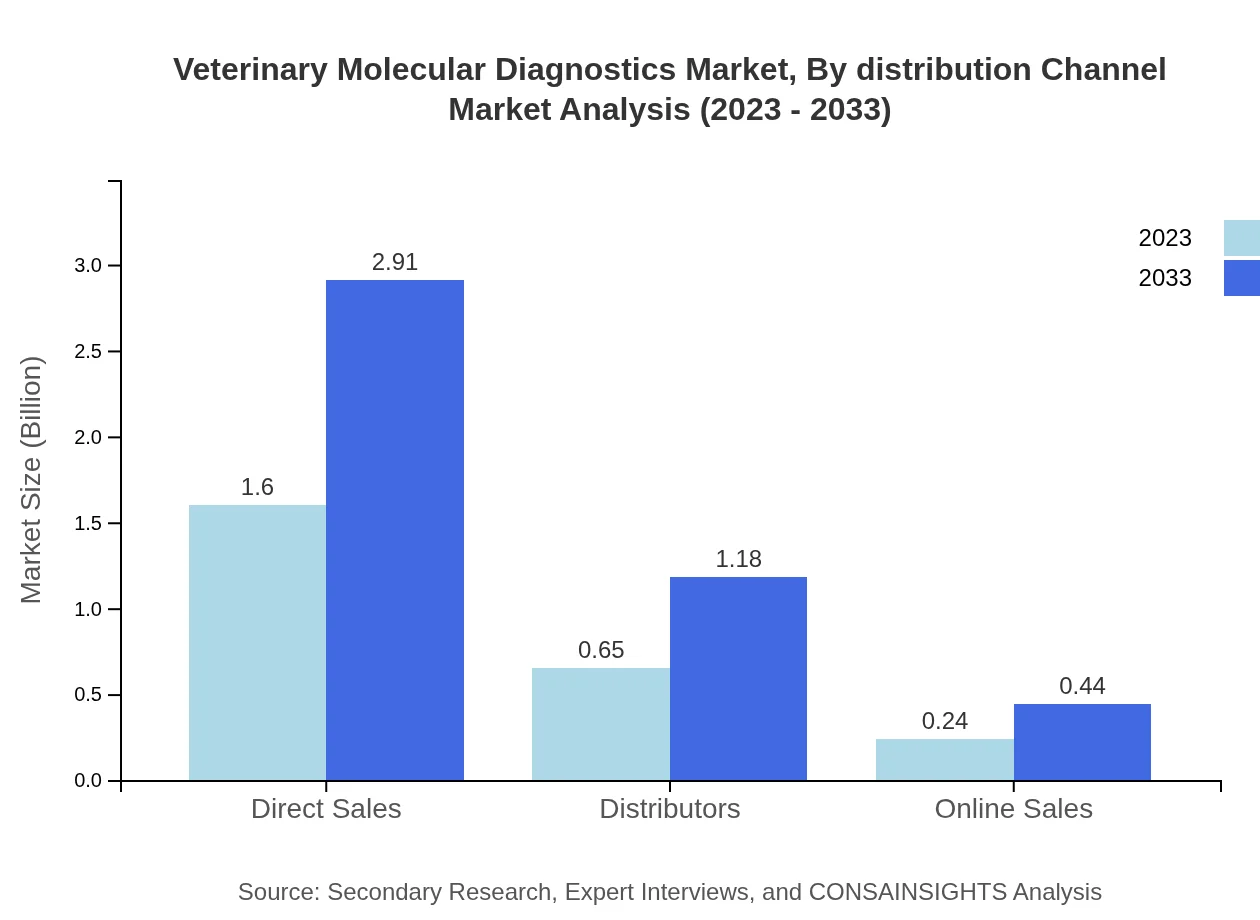

Veterinary Molecular Diagnostics Market Analysis By Distribution Channel

Direct Sales maintains a substantial market lead at $1.60 billion in 2023, projected to grow to $2.91 billion by 2033, securing 64.17% of the market. Distributors follow closely with $0.65 billion and expected growth to $1.18 billion. Online Sales, though the smallest channel, is developing with growth predictions from $0.24 billion to $0.44 billion, reflecting the shift towards e-commerce in veterinary products.

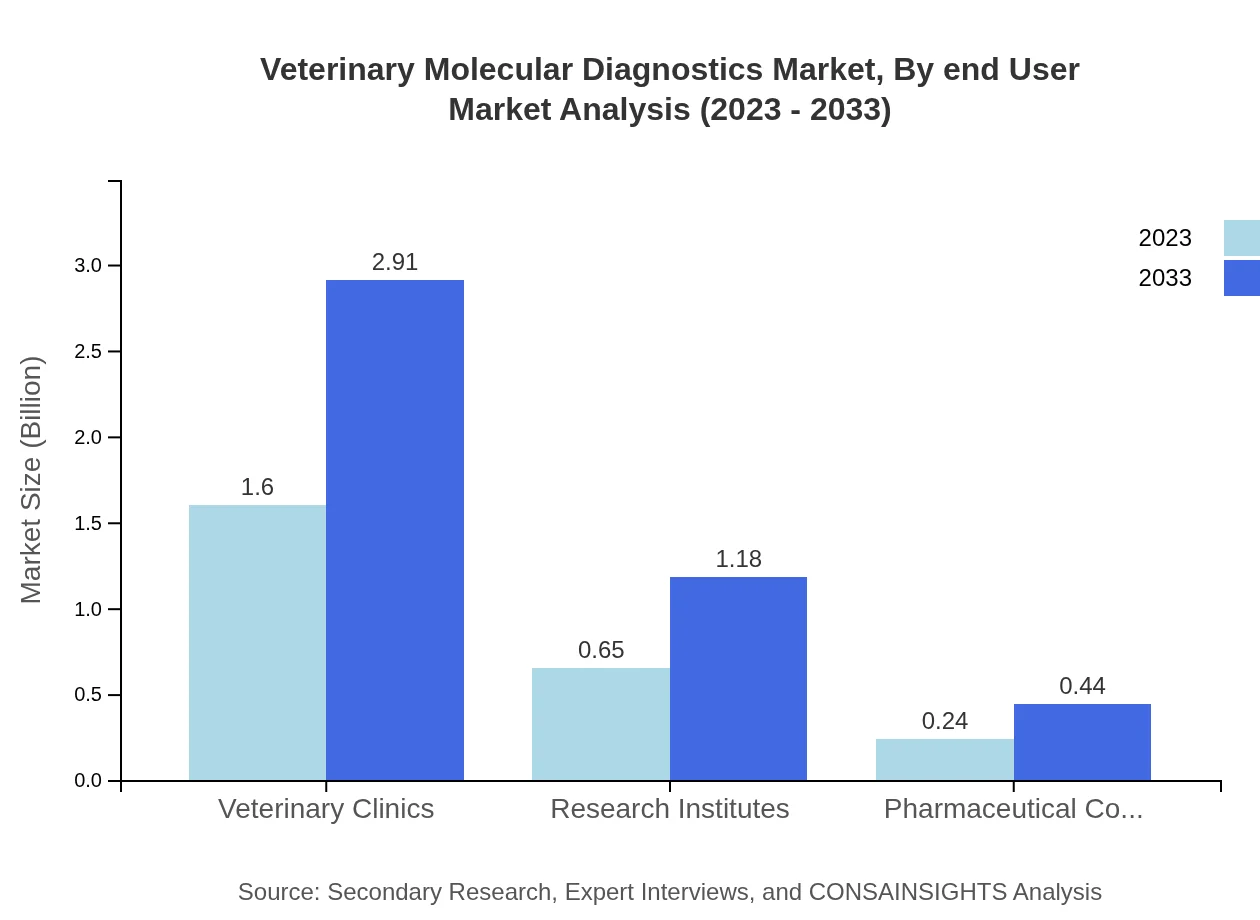

Veterinary Molecular Diagnostics Market Analysis By End User

Veterinary Clinics command the market with $1.60 billion in 2023 and projected growth to $2.91 billion by 2033, holding a 64.17% share. Research Institutes are significant players, increasing from $0.65 billion to $1.18 billion, covering a 26.06% sector share. Pharmaceutical Companies, while smaller, show growth potential from $0.24 billion to $0.44 billion, currently at 9.77% share.

Veterinary Molecular Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Molecular Diagnostics Industry

Zoetis:

As a global leader in animal health, Zoetis offers a broad portfolio of diagnostic products and services, excelling in molecular diagnostics to enhance animal welfare and productivity.IDEXX Laboratories:

IDEXX Laboratories specializes in veterinary diagnostics, providing advanced technologies and proven solutions to foster improvements in animal health and client relations.Neogen Corporation:

Neogen provides innovative diagnostics for food and animal safety, emphasizing molecular testing products for livestock and companion animals.Thermo Fisher Scientific:

Thermo Fisher offers extensive molecular diagnostic solutions, notable for their high-throughput sequencing and PCR technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary Molecular Diagnostics?

The veterinary molecular diagnostics market is valued at $2.5 billion in 2023, with an anticipated growth rate of 6% CAGR through 2033. Growth factors include technological advancements, increased pet ownership, and rising demand for efficient diagnostic tools.

What are the key market players or companies in this veterinary Molecular Diagnostics industry?

Key players in the veterinary molecular diagnostics market include Thermo Fisher Scientific, IDEXX Laboratories, and Neogen Corporation. These companies are recognized for their innovation and comprehensive product offerings, which cater to various diagnostic needs in veterinary care.

What are the primary factors driving the growth in the veterinary Molecular Diagnostics industry?

Growth in the veterinary molecular diagnostics industry is driven by factors such as increasing pet ownership, advancements in diagnostic technologies, heightened awareness of animal diseases, and a demand for early disease detection that can improve pet health outcomes.

Which region is the fastest Growing in the veterinary Molecular Diagnostics market?

Asia Pacific is the fastest-growing region in the veterinary molecular diagnostics market, projected to grow from $0.40 billion in 2023 to $0.73 billion by 2033. The growth is fueled by rising pet ownership and demand for advanced diagnostic services.

Does ConsaInsights provide customized market report data for the veterinary Molecular Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the veterinary molecular diagnostics industry. This enables clients to gain in-depth insights pertinent to their operational or strategic requirements.

What deliverables can I expect from this veterinary Molecular Diagnostics market research project?

Deliverables from the veterinary molecular diagnostics market research project include comprehensive market analysis, trend identification, competitive landscape overview, detailed segment data, and actionable insights for strategic planning and decision-making.

What are the market trends of veterinary Molecular Diagnostics?

Current market trends in veterinary molecular diagnostics include the rising popularity of PCR and next-generation sequencing technologies, an increase in genetic testing services, and a growing focus on diagnostics for companion animals and livestock, enhancing overall veterinary care.