Veterinary Orthopedics Market Report

Published Date: 31 January 2026 | Report Code: veterinary-orthopedics

Veterinary Orthopedics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Veterinary Orthopedics market from 2023 to 2033, exploring key trends, market size and growth prospects, segmentation analysis, regional insights, industry dynamics, and major players shaping this evolving sector.

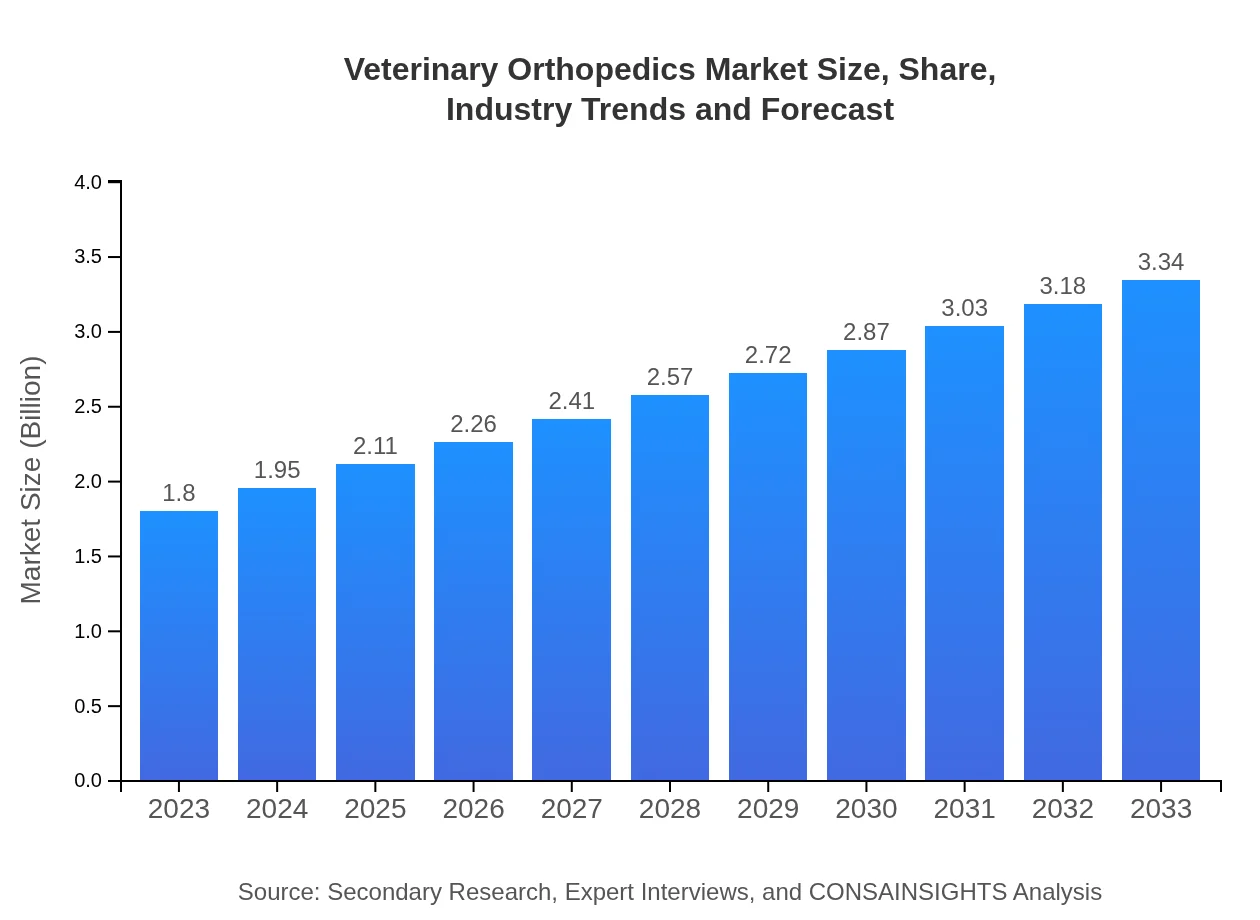

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Veterinary Orthopedic Innovations, Implant Innovations Inc., Zoetis Inc., Boehringer Ingelheim |

| Last Modified Date | 31 January 2026 |

Veterinary Orthopedics Market Overview

Customize Veterinary Orthopedics Market Report market research report

- ✔ Get in-depth analysis of Veterinary Orthopedics market size, growth, and forecasts.

- ✔ Understand Veterinary Orthopedics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Orthopedics

What is the Market Size & CAGR of Veterinary Orthopedics market in 2023?

Veterinary Orthopedics Industry Analysis

Veterinary Orthopedics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

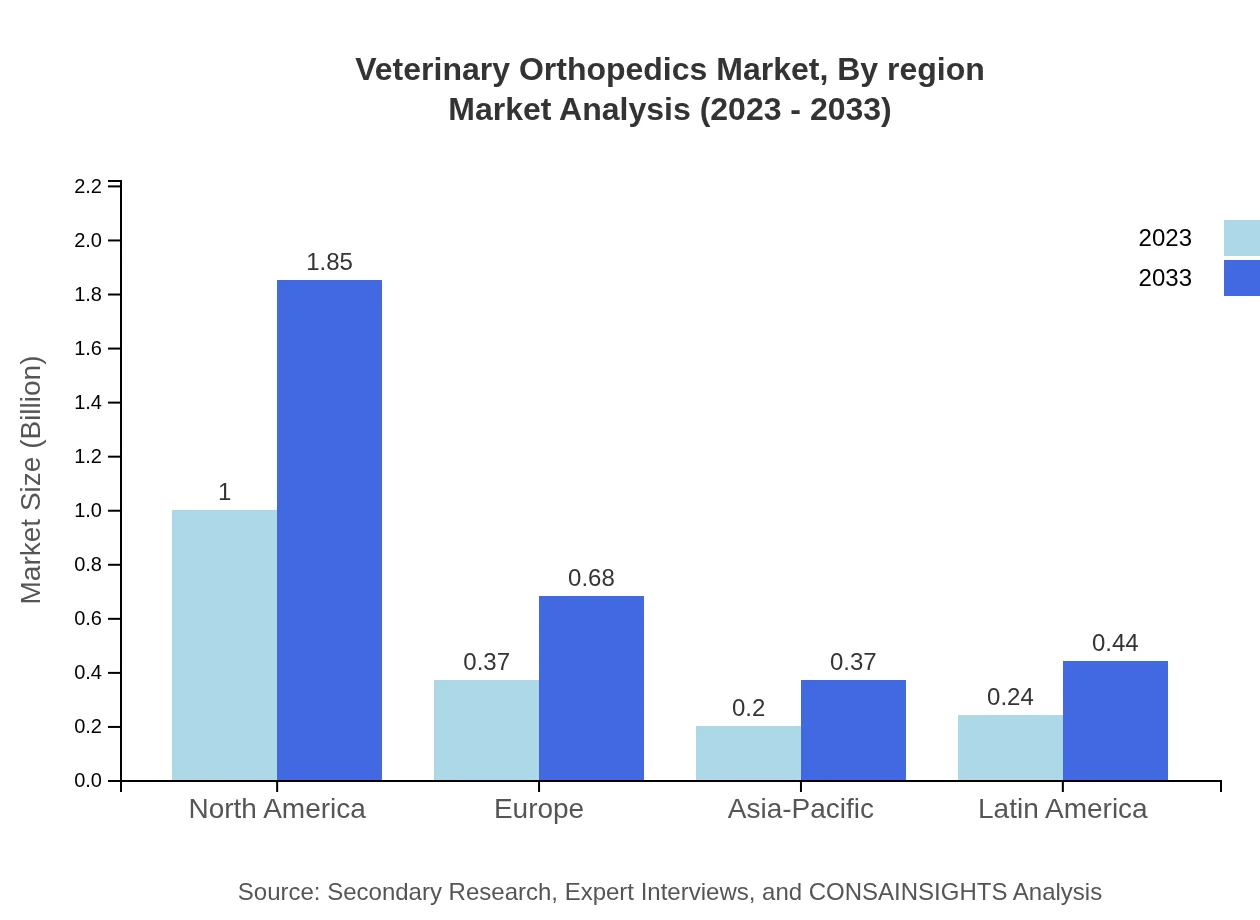

Veterinary Orthopedics Market Analysis Report by Region

Europe Veterinary Orthopedics Market Report:

The Veterinary Orthopedics market in Europe is anticipated to expand from $0.61 billion in 2023 to $1.13 billion by 2033. European countries are witnessing an increase in pet adoption and spending on veterinary care, driven by higher income levels and growing awareness of animal welfare.Asia Pacific Veterinary Orthopedics Market Report:

In Asia Pacific, the Veterinary Orthopedics market was valued at $0.31 billion in 2023 and is projected to reach $0.58 billion by 2033. Rapid urbanization and increasing pet ownership in countries like China and India, combined with rising veterinary healthcare expenditures, are driving market growth in this region.North America Veterinary Orthopedics Market Report:

North America has the largest share of the Veterinary Orthopedics market, estimated at $0.62 billion in 2023 and projected to grow to $1.15 billion by 2033. High pet ownership rates, increasing healthcare awareness among pet owners, and advancements in veterinary practices contribute to the market's robust growth in this region.South America Veterinary Orthopedics Market Report:

The South American market for Veterinary Orthopedics was valued at $0.10 billion in 2023 and is expected to grow to $0.19 billion by 2033. Market growth is propelled by a rising demand for advanced veterinary services, especially in Brazil and Argentina, as pet owners seek specialized care.Middle East & Africa Veterinary Orthopedics Market Report:

The Middle East and Africa market is expected to enhance from $0.16 billion in 2023 to $0.29 billion by 2033, influenced by rising vet clinics and advancements in veterinary education, especially across the Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

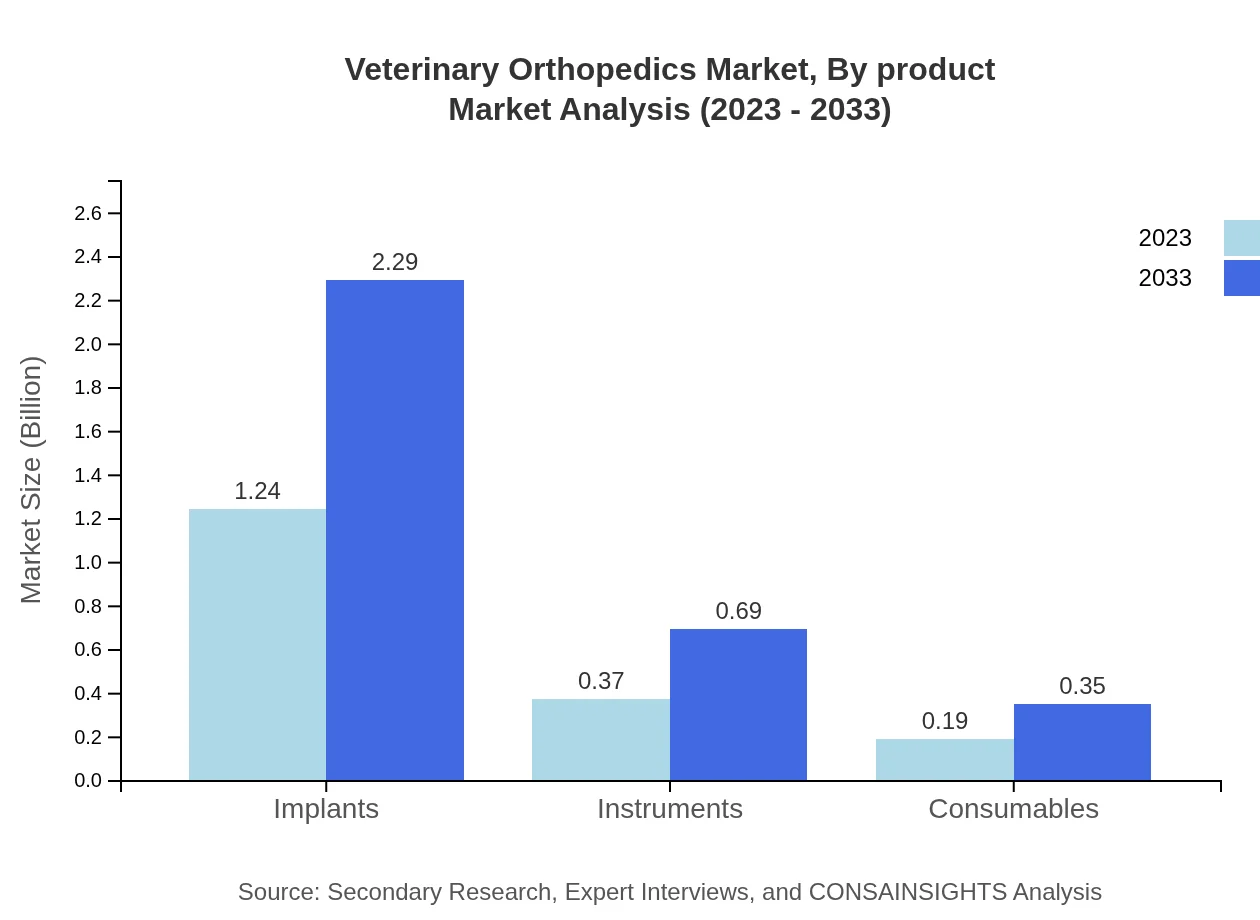

Veterinary Orthopedics Market Analysis By Product

The Veterinary Orthopedics market by product type is dominated by surgical implants, accounting for $1.24 billion in 2023 and expected to reach $2.29 billion by 2033, reflecting a share of 68.78%. Instruments and consumables also contribute significantly, with a projected growth in demand for innovative surgical tools and rehabilitation products.

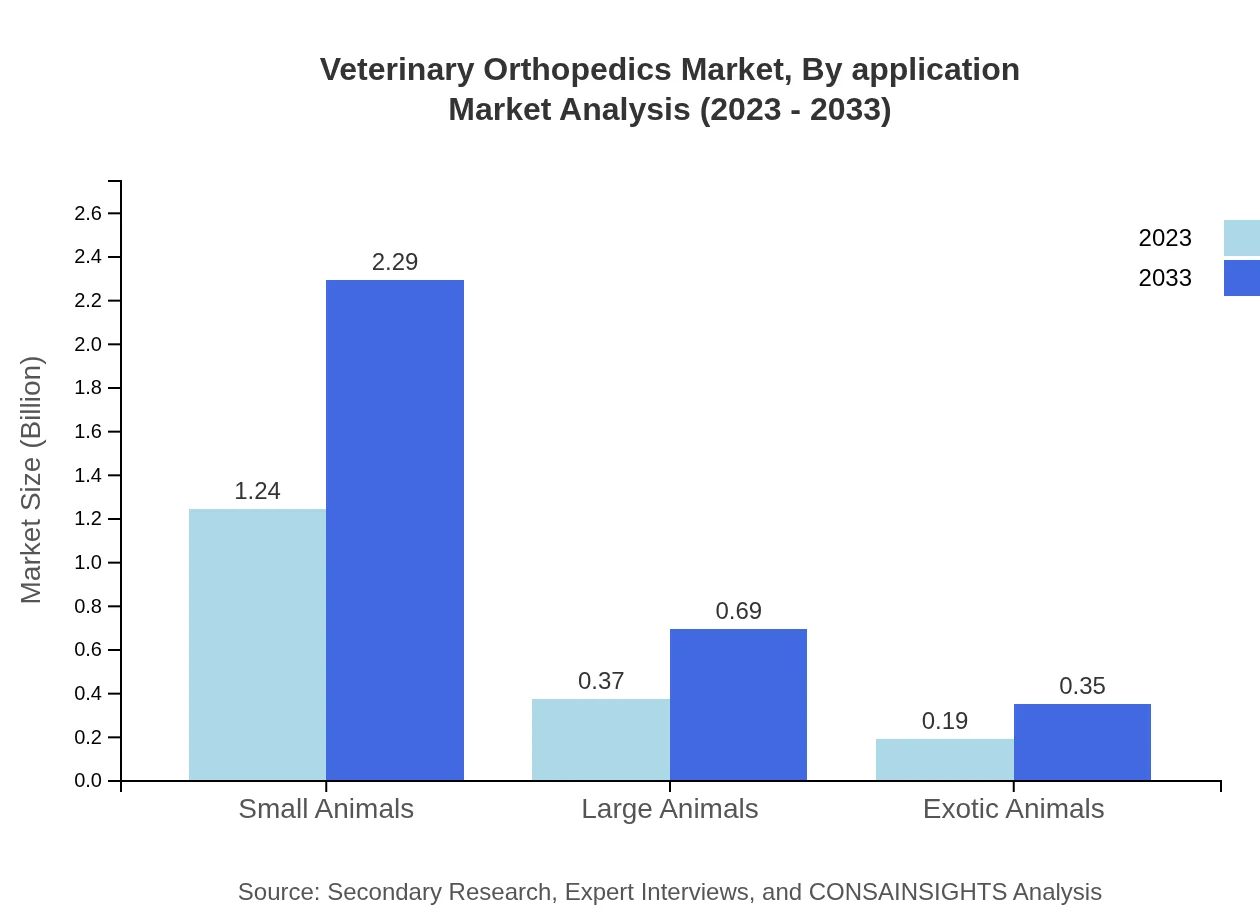

Veterinary Orthopedics Market Analysis By Application

In the application segment, orthopedic surgeries lead with a significant market share, while rehabilitation therapies are gaining importance. Growth in demand for specialized surgical techniques such as arthroscopy is further driving this segment's expansion.

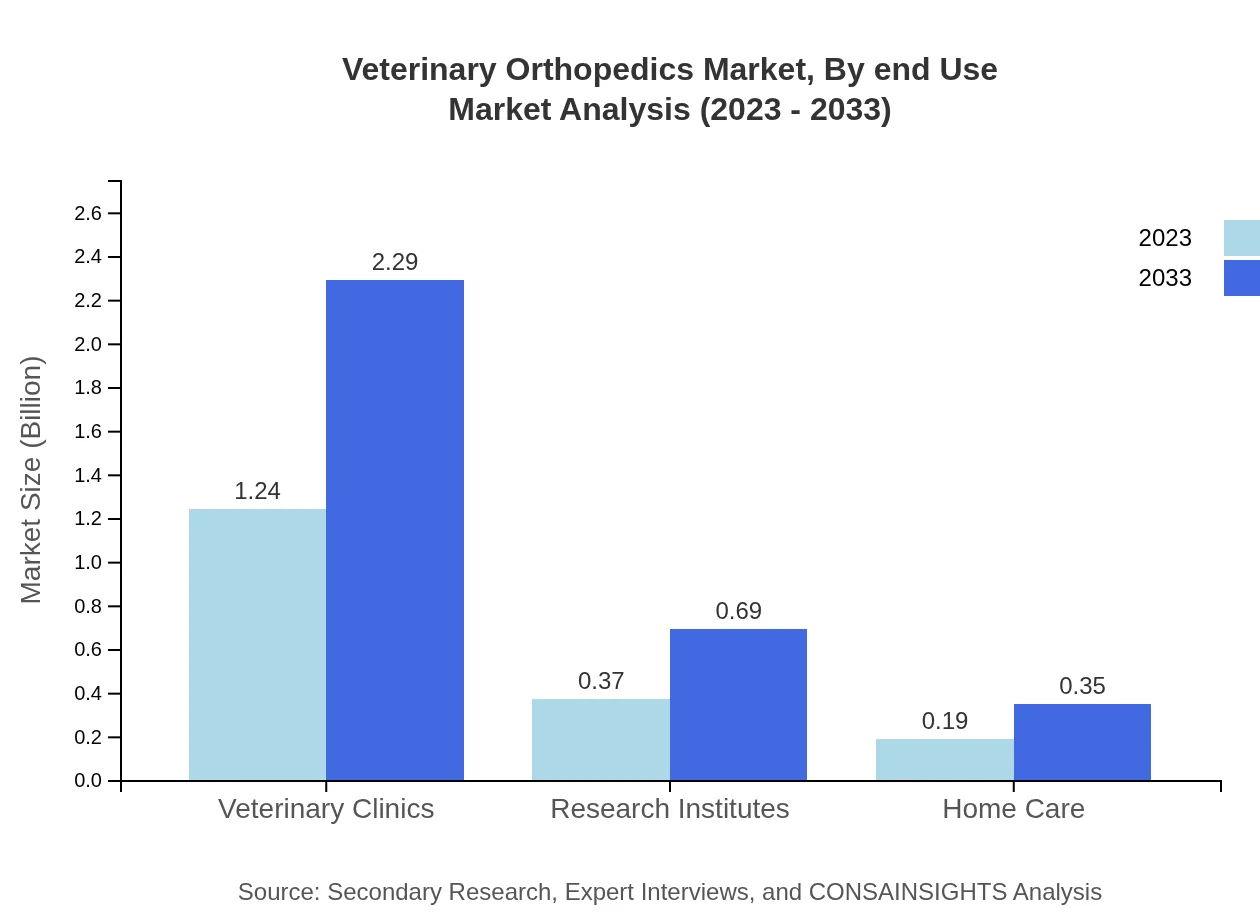

Veterinary Orthopedics Market Analysis By End Use

Veterinary clinics dominate the end-use market, holding a share of 68.78% in 2023, illustrating the central role of these facilities in providing specialized orthopedic care to pet owners, while research institutes and home care are also notable segments contributing to growth.

Veterinary Orthopedics Market Analysis By Region

Regional insights show North America leading with a market size significantly larger than other regions, followed by Europe, which reflects a strong veterinary practice landscape. The Asia Pacific region is rapidly gaining momentum due to increasing investments in animal healthcare.

Veterinary Orthopedics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Orthopedics Industry

Veterinary Orthopedic Innovations:

A pioneering company specializing in advanced orthopedic solutions, focusing on minimally invasive surgical techniques and rehabilitation technologies.Implant Innovations Inc.:

A leading manufacturer of veterinary surgical implants, known for their innovative designs that enhance surgical outcomes and recovery times.Zoetis Inc.:

One of the largest animal health companies globally, providing a wide range of orthopedic solutions for veterinary applications.Boehringer Ingelheim:

A global leader in animal health, Boehringer Ingelheim is committed to innovating new treatments for orthopedic conditions in animals.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary orthopedics?

The global veterinary orthopedics market is valued at $1.8 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching new heights by 2033, enhancing veterinary care across multiple sectors.

What are the key market players or companies in the veterinary orthopedics industry?

Key players in the veterinary orthopedics market include leading manufacturers of surgical implants, instruments, and consumables, coupled with veterinary clinics and research institutes that drive innovations in animal care.

What are the primary factors driving the growth in the veterinary orthopedics industry?

Factors driving growth include increased pet ownership, advancements in veterinary medicine, rising expenditures on pet health, and a growing awareness of specialized surgical options for animals.

Which region is the fastest Growing in veterinary orthopedics?

North America is anticipated to be the fastest-growing region, with the market size expanding from $0.62 billion in 2023 to $1.15 billion by 2033, signifying robust demand and investment in veterinary services.

Does Consainsights provide customized market report data for the veterinary orthopedics industry?

Yes, Consainsights offers customized market reports tailored to specific queries in the veterinary orthopedics industry, enabling stakeholders to access data aligned with their strategic objectives.

What deliverables can I expect from this veterinary orthopedics market research project?

Expect comprehensive deliverables including detailed market analysis reports, growth forecasts, competitive landscape assessments, and insights on trends impacting the veterinary orthopedics sector.

What are the market trends of veterinary orthopedics?

Market trends include the increasing use of advanced surgical techniques, a rise in minimally invasive procedures, and a shift towards preventive care, enhancing clinical outcomes in veterinary practices.