Veterinary Parasiticides Market Report

Published Date: 31 January 2026 | Report Code: veterinary-parasiticides

Veterinary Parasiticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Veterinary Parasiticides market, highlighting key insights, regional breakdowns, market size forecasts, and trends from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

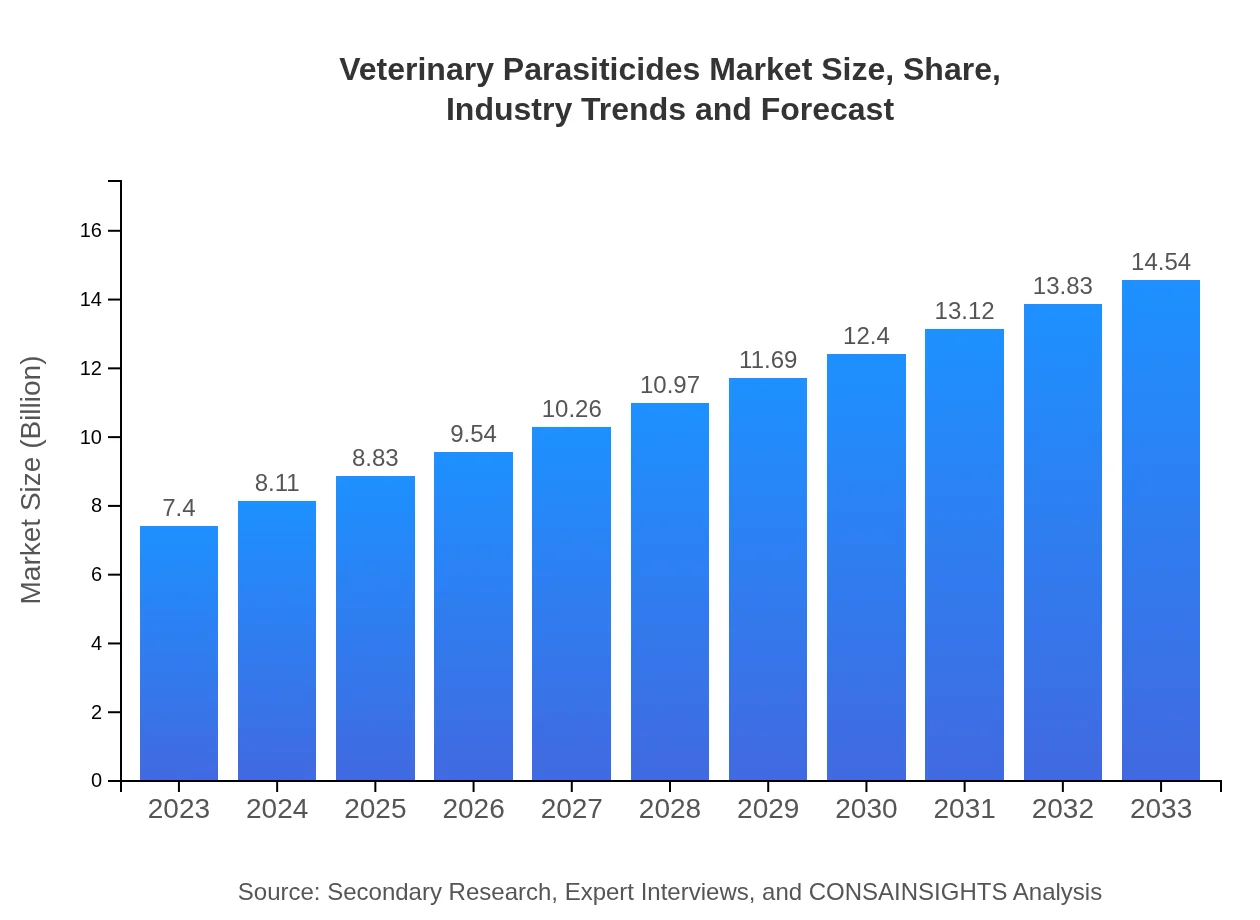

| 2023 Market Size | $7.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.54 Billion |

| Top Companies | Zoetis, Boehringer Ingelheim, Merck Animal Health, Elanco, Bayer Animal Health |

| Last Modified Date | 31 January 2026 |

Veterinary Parasiticides Market Overview

Customize Veterinary Parasiticides Market Report market research report

- ✔ Get in-depth analysis of Veterinary Parasiticides market size, growth, and forecasts.

- ✔ Understand Veterinary Parasiticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Parasiticides

What is the Market Size & CAGR of Veterinary Parasiticides market in 2023?

Veterinary Parasiticides Industry Analysis

Veterinary Parasiticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Parasiticides Market Analysis Report by Region

Europe Veterinary Parasiticides Market Report:

Europe's Veterinary Parasiticides market is expected to rise from USD 2.40 billion in 2023 to USD 4.72 billion by 2033. Increased awareness of animal welfare, stringent regulations for animal healthcare products, and technological advancements play significant roles in this growth.Asia Pacific Veterinary Parasiticides Market Report:

The Asia Pacific Veterinary Parasiticides market is expected to grow from USD 1.40 billion in 2023 to USD 2.76 billion by 2033, with a notable CAGR due to rising pet population and agricultural activities. Increasing awareness regarding livestock health and disease management fuels this growth.North America Veterinary Parasiticides Market Report:

North America remains a prominent market, with projections from USD 2.67 billion in 2023 to USD 5.24 billion by 2033. The high spending on pet care, strong presence of major manufacturers, and technological innovations are critical factors contributing to market growth.South America Veterinary Parasiticides Market Report:

In South America, the market is projected to increase from USD 0.69 billion in 2023 to USD 1.35 billion by 2033. The growing livestock industry and demand for better animal healthcare are key drivers, along with an increase in the number of veterinary clinics.Middle East & Africa Veterinary Parasiticides Market Report:

In the Middle East and Africa, the market is anticipated to grow from USD 0.24 billion in 2023 to USD 0.47 billion by 2033, driven by a growing awareness of veterinary care and improvements in agricultural practices.Tell us your focus area and get a customized research report.

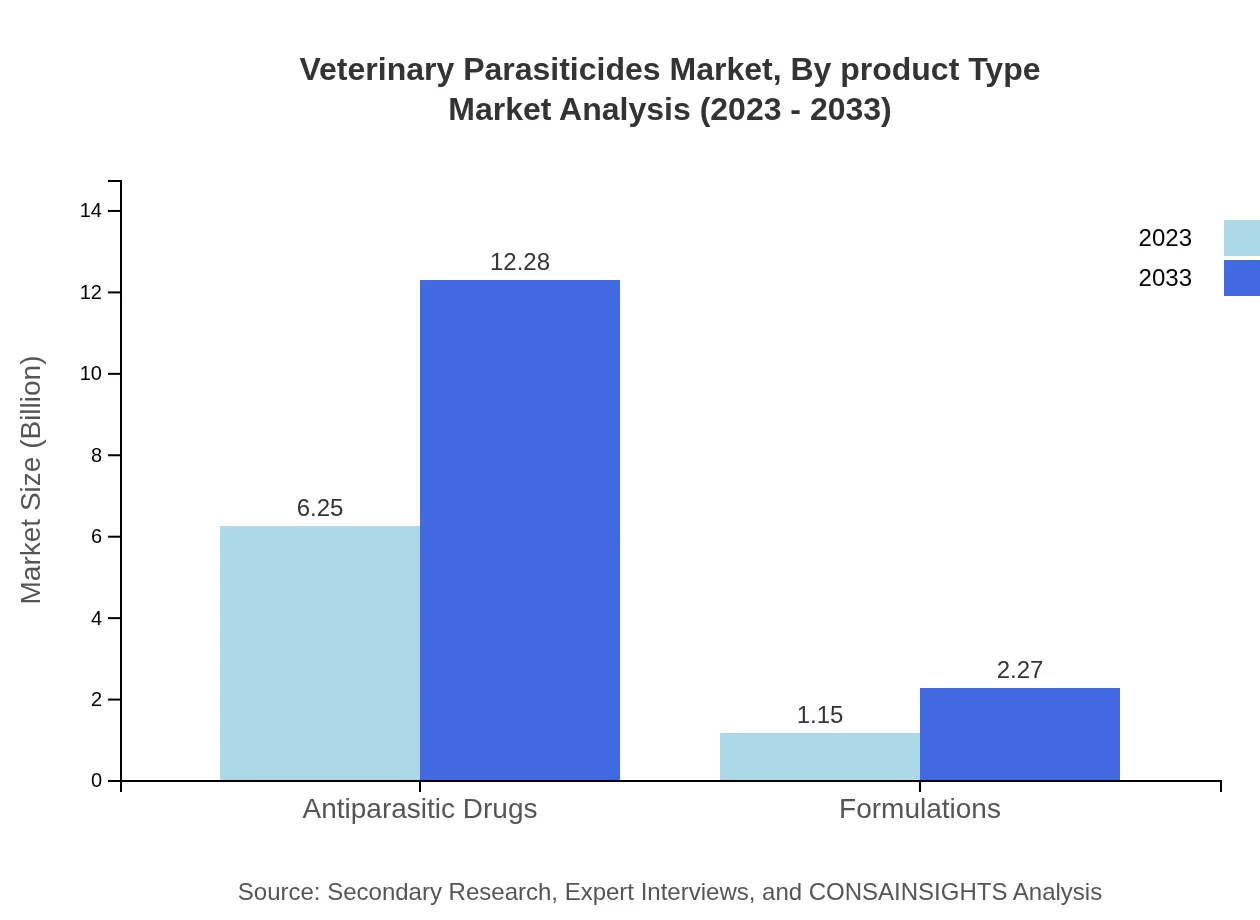

Veterinary Parasiticides Market Analysis By Product Type

The market for antiparasitic drugs is expected to grow significantly, with oral formulations leading in adoption due to ease of administration. Topical products are also popular among pet owners and livestock farmers seeking effective solutions for external parasites. Injectable products are anticipated to rise as new delivery technologies emerge, ensuring prolonged efficacy and ease of use.

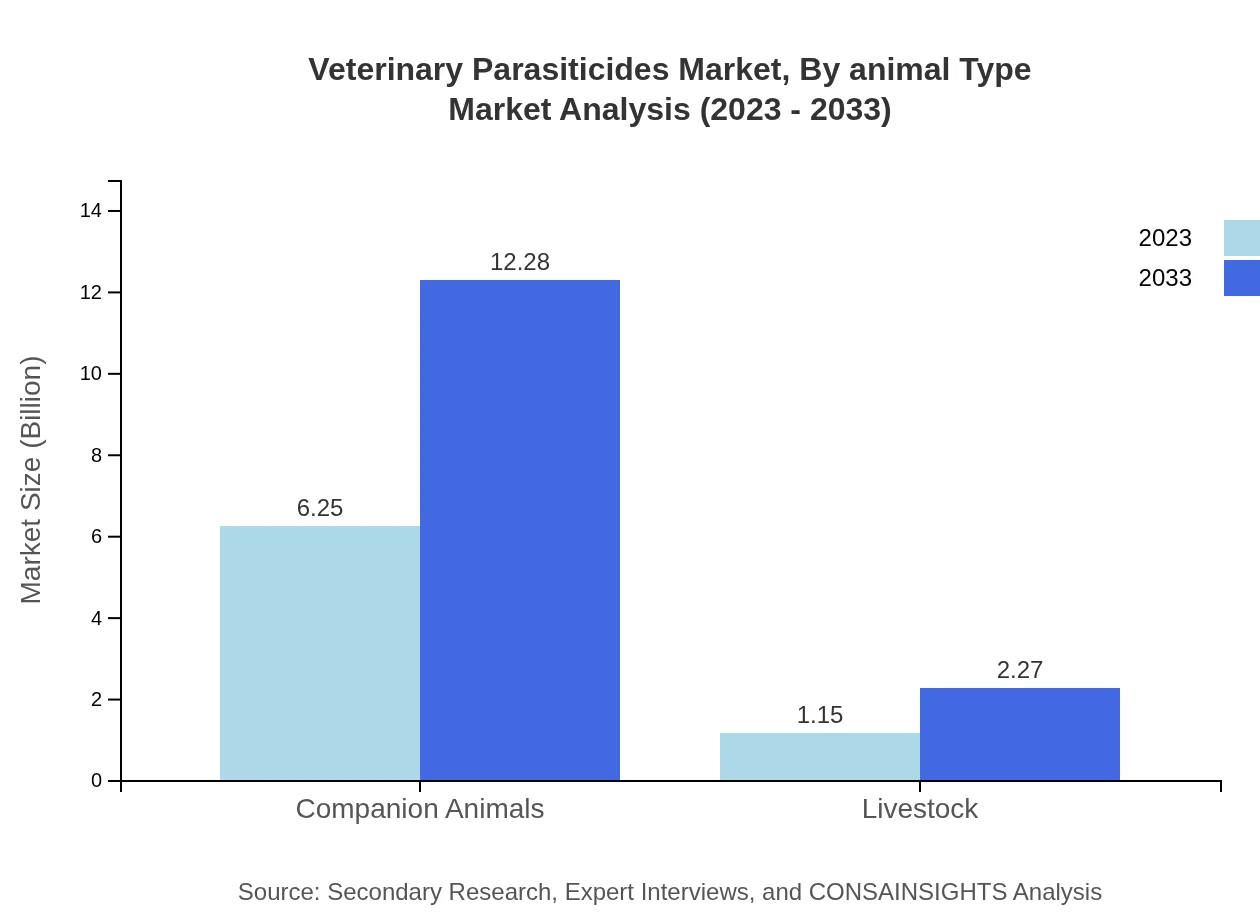

Veterinary Parasiticides Market Analysis By Animal Type

The companion animals segment dominates the market, with significant contributions from the rising pet ownership globally. The livestock segment, while smaller, is poised for growth driven by agricultural demands and livestock health management, emphasizing the importance of antiround and antitapeworm treatments.

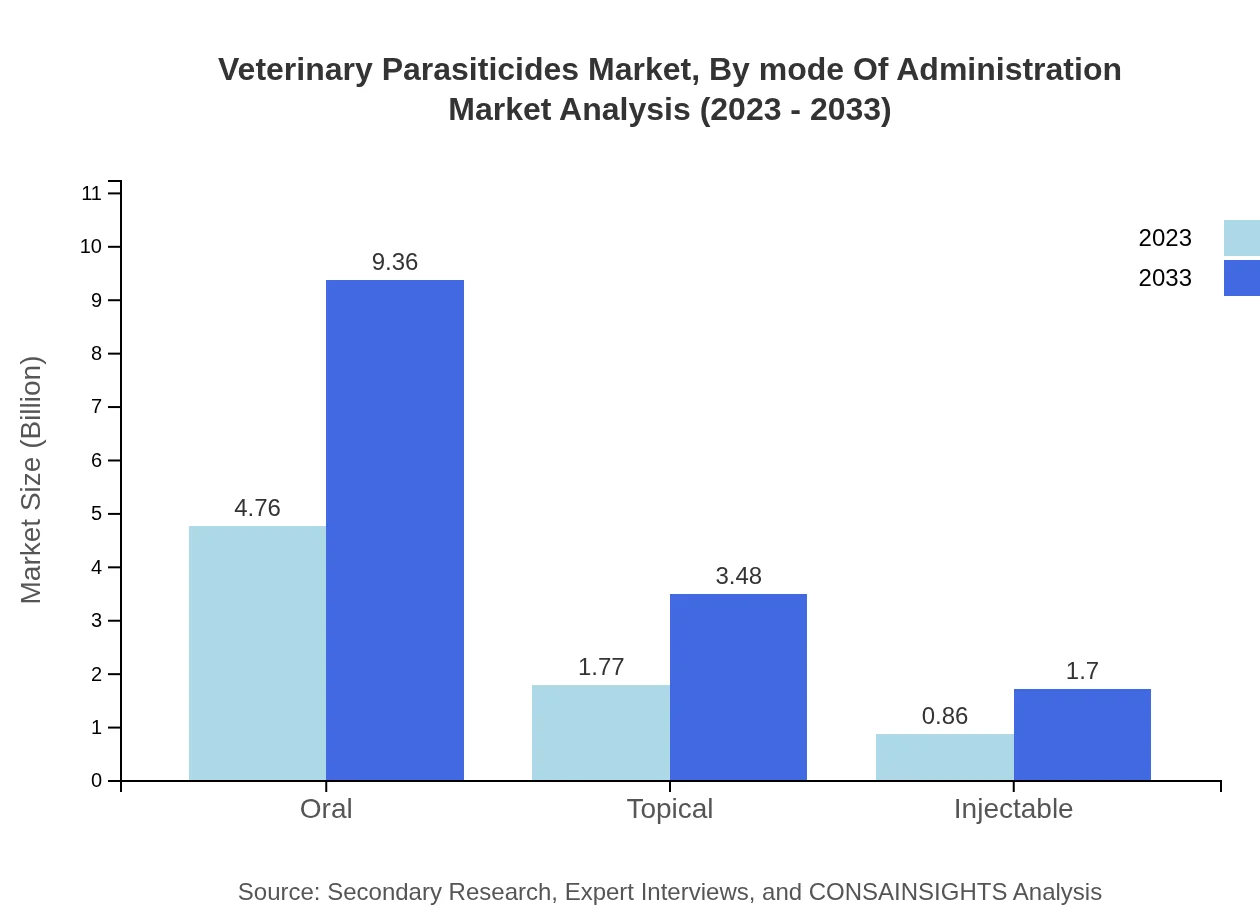

Veterinary Parasiticides Market Analysis By Mode Of Administration

Oral administration remains the most common mode due to its convenience and effectiveness, comprising a substantial share of the market. Topical and injectable methods are also essential, providing targeted approaches for both pets and livestock, especially for difficult-to-treat external parasites.

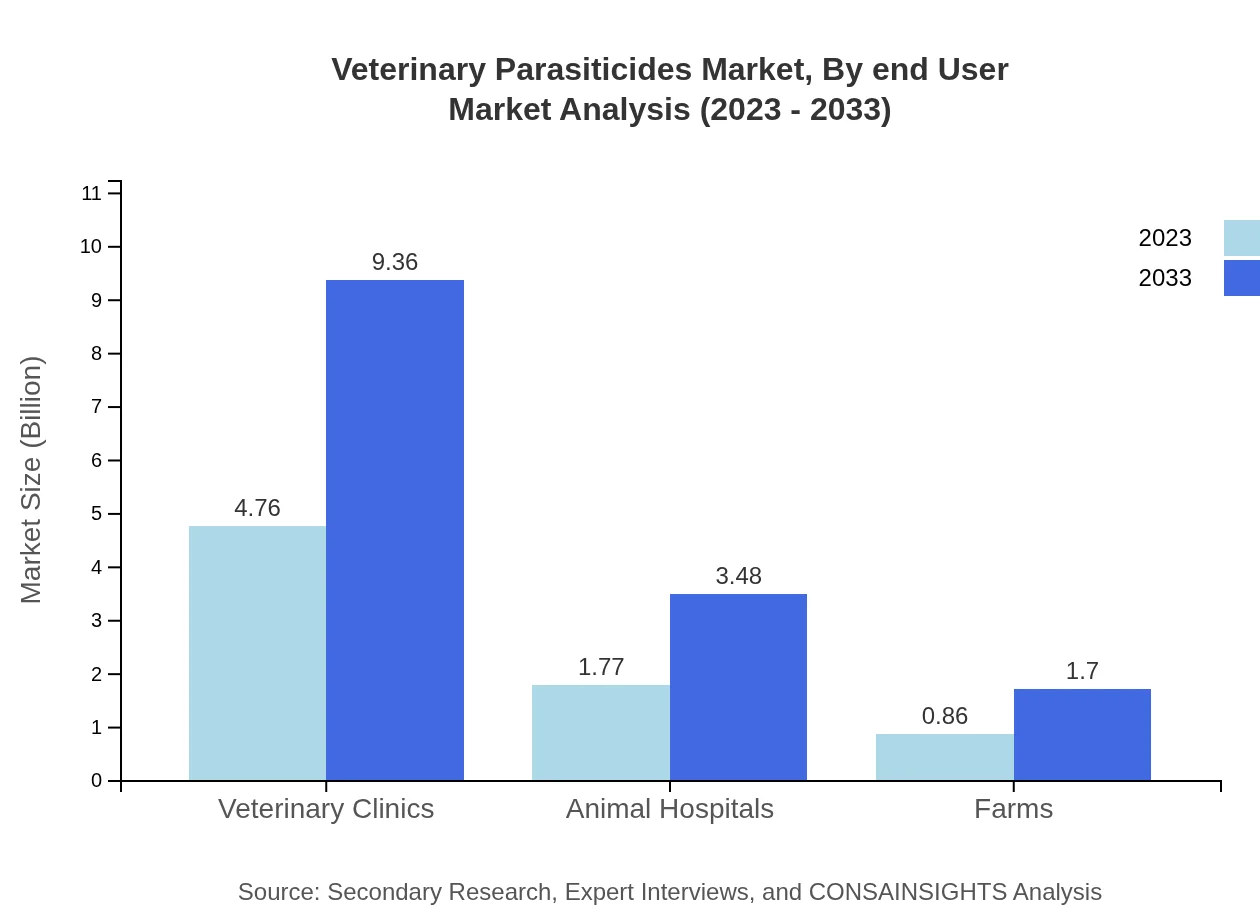

Veterinary Parasiticides Market Analysis By End User

Veterinary clinics are the primary end-users, utilizing a range of parasiticides to treat pets. The growth in the animal hospital segment indicates an expanding focus on specialized veterinary care, while farms are increasingly adopting parasiticide solutions to ensure the health and productivity of livestock.

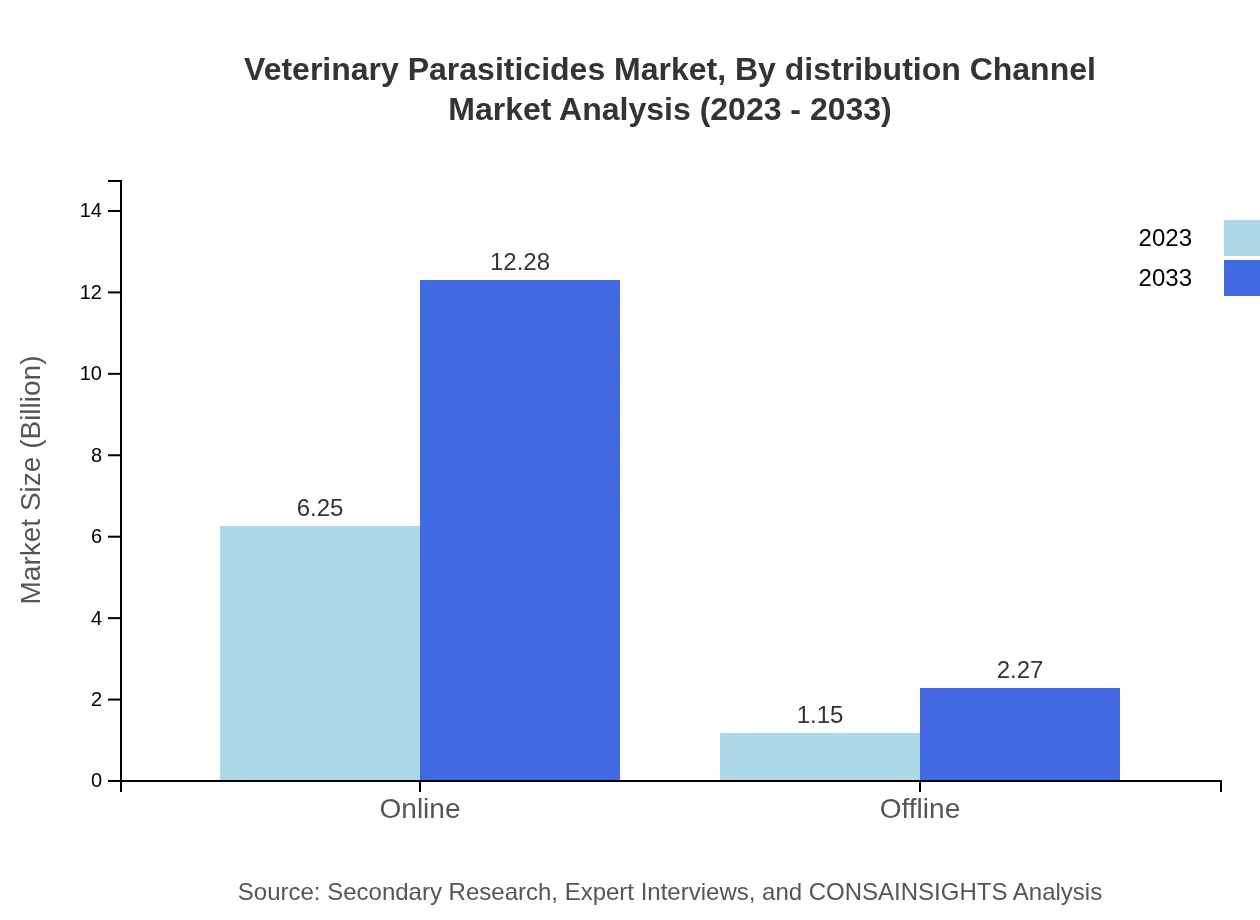

Veterinary Parasiticides Market Analysis By Distribution Channel

Online channels are growing rapidly due to rising e-commerce adoption, offering convenience for pet owners. Traditional offline channels such as veterinary outlets and pharmacies remain significant, providing trusted access to Veterinary Parasiticides for consumers.

Veterinary Parasiticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Parasiticides Industry

Zoetis:

Leading global animal health company and major provider of Veterinary Parasiticides, focusing on innovative treatments for parasite control.Boehringer Ingelheim:

The second-largest animal health company with a diverse portfolio, including Veterinary Parasiticides contributing significantly to the global market.Merck Animal Health:

A prominent player known for its wide range of parasiticides and ongoing investment in research and development of new products.Elanco:

An established provider of Veterinary Parasiticides, promoting safe and effective solutions for animal parasitic infections.Bayer Animal Health:

Renowned for its extensive range of Veterinary Parasiticides, focusing on both conventional and innovative treatment solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary Parasiticides?

The veterinary-parasiticides market is valued at approximately $7.4 billion in 2023, with a projected CAGR of 6.8% through 2033. This significant growth reflects rising demand for effective parasitic treatments in veterinary practices globally.

What are the key market players or companies in this veterinary Parasiticides industry?

Key players in the veterinary-parasiticides market include major pharmaceutical companies focusing on animal health. Notable companies often include Merck Animal Health, Zoetis, and Bayer Animal Health, which are known for their innovative parasiticidal products and solutions.

What are the primary factors driving the growth in the veterinary Parasiticides industry?

Factors such as increased pet ownership, awareness of zoonotic diseases, and advancements in veterinary medicine contribute to market growth. Furthermore, the rising nutritional needs of livestock and animal welfare regulations also play critical roles in expanding this market.

Which region is the fastest Growing in the veterinary Parasiticides?

The fastest-growing region in the veterinary-parasiticides market is North America. In 2023, its market size is $2.67 billion and is expected to reach $5.24 billion by 2033, driven by high veterinary expenditure and a robust healthcare system.

Does ConsaInsights provide customized market report data for the veterinary Parasiticides industry?

Yes, ConsaInsights offers customized market report data tailored to the veterinary-parasiticides industry. Clients can request specific insights and analyses to suit their business needs and strategic objectives, ensuring comprehensive market understanding.

What deliverables can I expect from this veterinary Parasiticides market research project?

Deliverables from the veterinary-parasiticides market research project typically include detailed market analysis reports, trend forecasts, competitor profiles, and insights into consumer behavior. These resources are designed to inform strategic decision-making.

What are the market trends of veterinary Parasiticides?

Current trends in the veterinary-parasiticides market include the rise of online distributions, a growing preference for oral formulations, and increasing demand for antiparasitic drugs. These trends highlight shifts in consumer purchasing behavior and preferences for administration methods.