Veterinary Radiography Market Report

Published Date: 31 January 2026 | Report Code: veterinary-radiography

Veterinary Radiography Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Veterinary Radiography market from 2023 to 2033, covering trends, regional insights, and forecasts. It aims to deliver detailed insights into market dynamics, segmentation, and leading companies shaping the future of this industry.

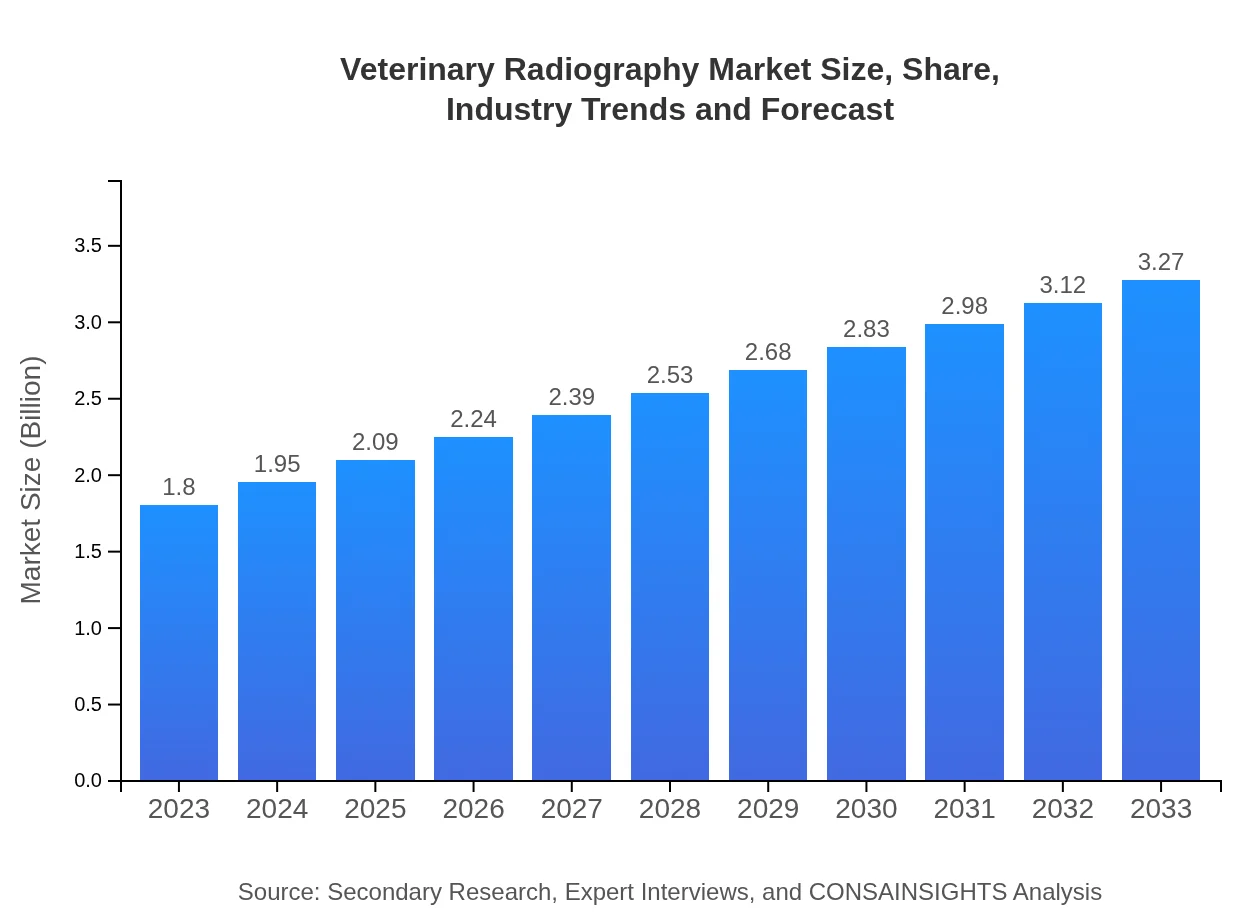

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $3.27 Billion |

| Top Companies | Idexx Laboratories, Agfa-Gevaert Group, GE Healthcare, Fujifilm, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Veterinary Radiography Market Overview

Customize Veterinary Radiography Market Report market research report

- ✔ Get in-depth analysis of Veterinary Radiography market size, growth, and forecasts.

- ✔ Understand Veterinary Radiography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Veterinary Radiography

What is the Market Size & CAGR of the Veterinary Radiography market in 2023?

Veterinary Radiography Industry Analysis

Veterinary Radiography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Veterinary Radiography Market Analysis Report by Region

Europe Veterinary Radiography Market Report:

The European market for veterinary radiography is anticipated to grow from USD 0.51 billion in 2023 to USD 0.92 billion by 2033. The emphasis on animal welfare, stringent healthcare regulations, and an increase in veterinary visits contribute to this growth, making Europe a key player in veterinary imaging solutions.Asia Pacific Veterinary Radiography Market Report:

The Asia-Pacific Veterinary Radiography market is expected to grow from USD 0.36 billion in 2023 to USD 0.65 billion by 2033. This growth can be attributed to the rising pet population and increasing investments in veterinary care infrastructure across countries like China and India. The expanding veterinary healthcare expenditure indicates a positive trend toward incorporating advanced imaging technologies into routine practices.North America Veterinary Radiography Market Report:

North America stands as the largest market, expanding from USD 0.66 billion in 2023 to USD 1.20 billion by 2033. The region's growth is driven by advanced veterinary practices, significant pet expenditure, and robust technological adoption, highlighting the region's leadership in veterinary radiology innovations.South America Veterinary Radiography Market Report:

In South America, the market is projected to increase from USD 0.06 billion in 2023 to USD 0.11 billion by 2033. Despite being a smaller market, there is a growing interest in enhancing veterinary services, supported by rising disposable income and pet ownership trends in urban areas.Middle East & Africa Veterinary Radiography Market Report:

In the Middle East and Africa, the market is expected to rise from USD 0.22 billion in 2023 to USD 0.39 billion by 2033. The increasing awareness of veterinary diagnostics and the rising demand for animal healthcare services are pivotal in driving the growth of veterinary radiography in this region.Tell us your focus area and get a customized research report.

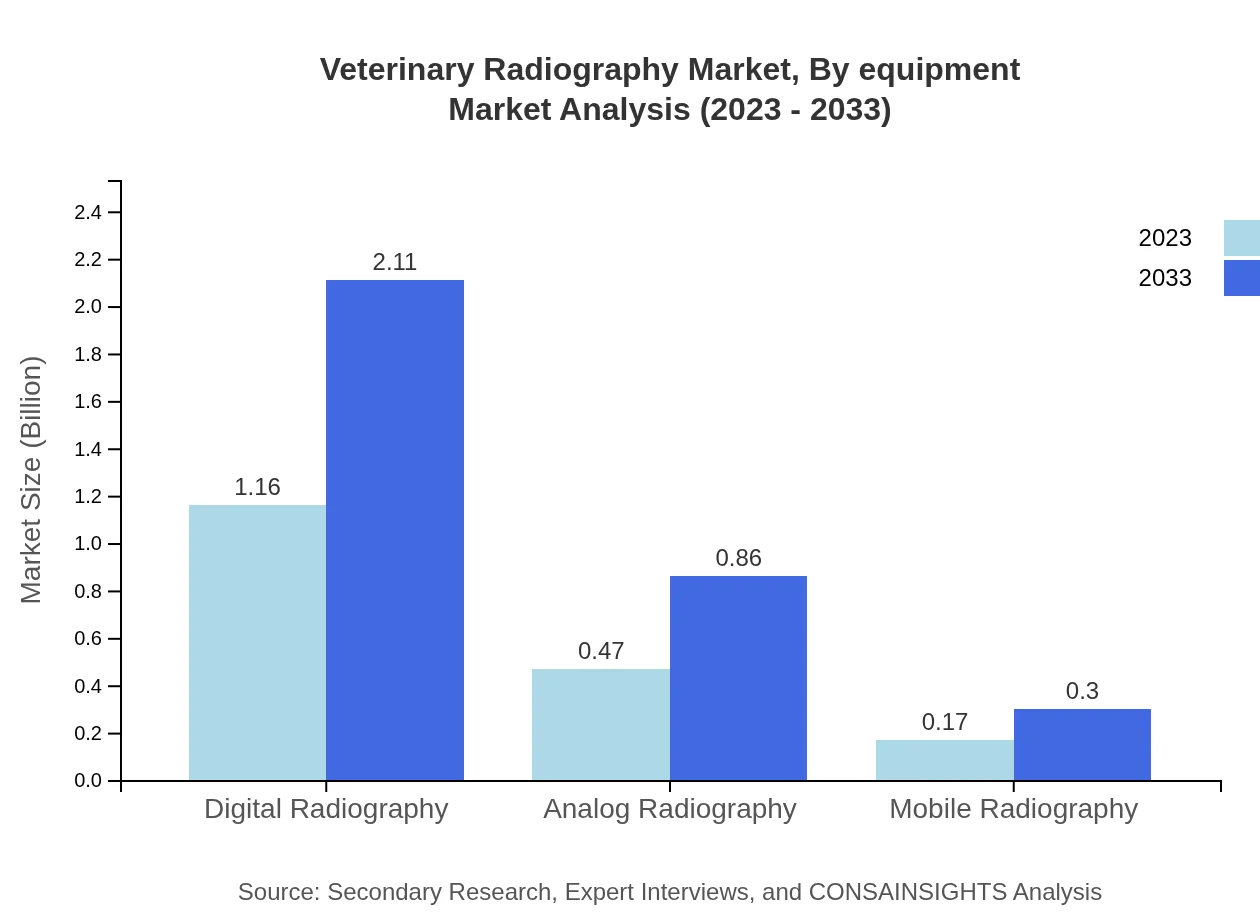

Veterinary Radiography Market Analysis By Equipment

In 2023, the digital radiography segment holds a significant market share of USD 1.16 billion (64.44%), with expectations to grow to USD 2.11 billion by 2033. Conversely, analog radiography is valued at USD 0.47 billion (26.36%), expected to increase to USD 0.86 billion. Mobile radiography, while smaller, shows potential growth from USD 0.17 billion (9.2%) to USD 0.30 billion, highlighting the trend towards portable solutions in veterinary practices.

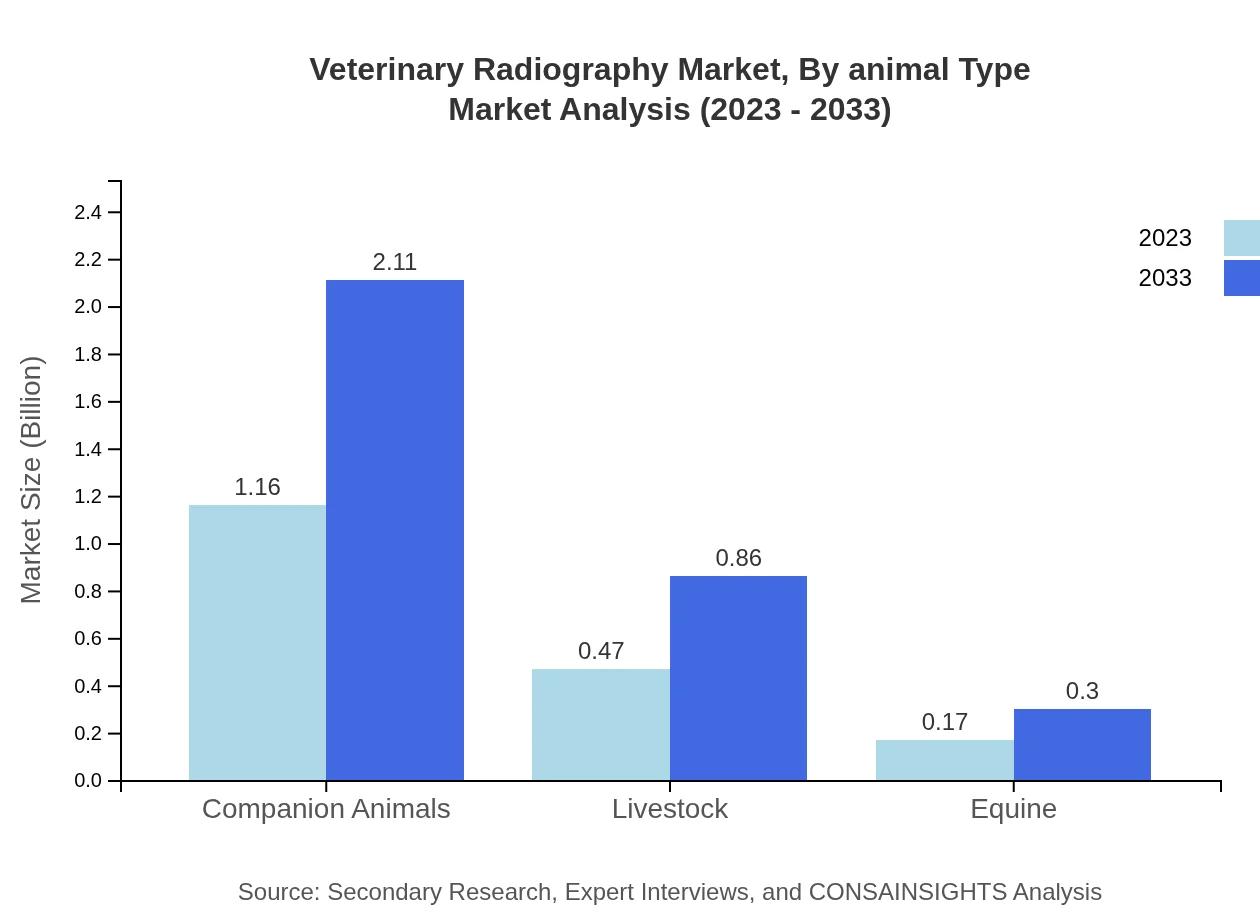

Veterinary Radiography Market Analysis By Animal Type

For 2023, the companion animals segment represents the largest share with a market value of USD 1.16 billion (64.44%), projected to reach USD 2.11 billion by 2033. Livestock accounts for USD 0.47 billion (26.36%), anticipated to reach USD 0.86 billion. The equine segment, though smaller, is growing with projections from USD 0.17 billion to USD 0.30 billion, reflecting broader applications of radiography in animal health diagnostics.

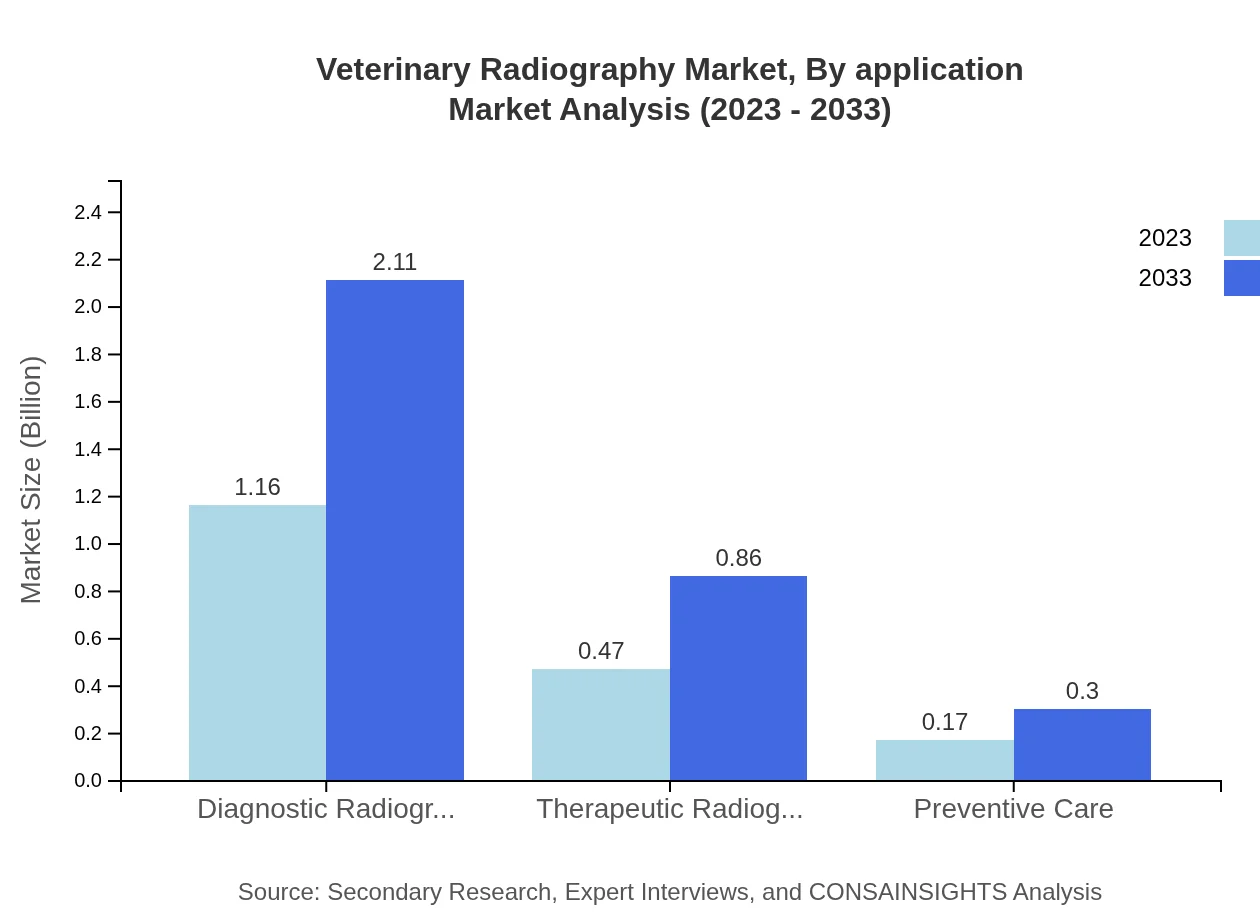

Veterinary Radiography Market Analysis By Application

In terms of applications, diagnostic radiography leads with a market size of USD 1.16 billion (64.44%) in 2023, expected to grow to USD 2.11 billion by 2033. Therapeutic radiography follows, growing from USD 0.47 billion (26.36%) to USD 0.86 billion. The preventive care segment is also noteworthy, growing from USD 0.17 billion (9.2%) to USD 0.30 billion as awareness of preventive measures rises within the veterinary sector.

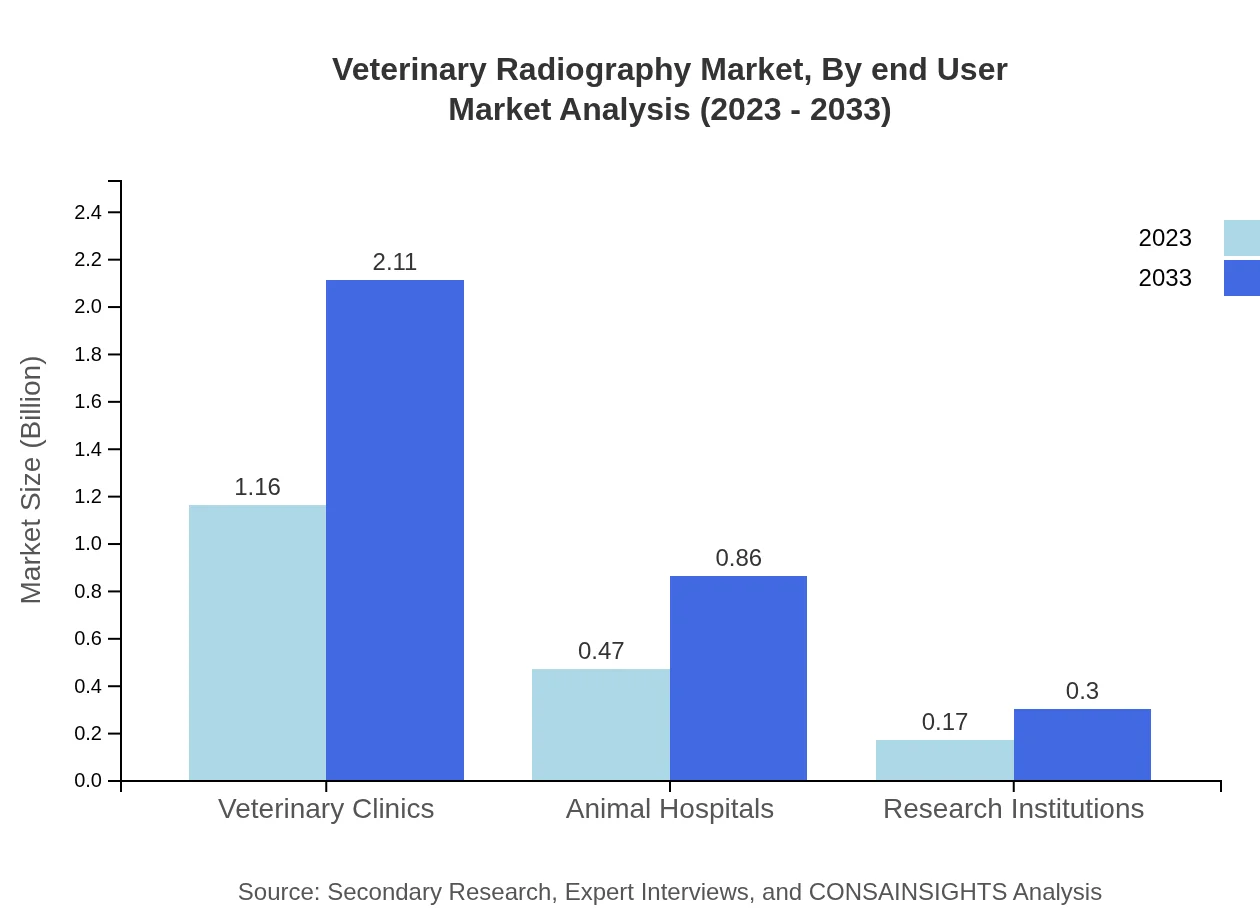

Veterinary Radiography Market Analysis By End User

Veterinary clinics dominate the end-user market with a size of USD 1.16 billion (64.44%), expected to grow to USD 2.11 billion by 2033. Animal hospitals represent USD 0.47 billion (26.36%) and are projected to increase to USD 0.86 billion. Research institutions account for USD 0.17 billion (9.2%), anticipated to rise to USD 0.30 billion, emphasizing the need for advanced imaging in veterinary research and clinical studies.

Veterinary Radiography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Veterinary Radiography Industry

Idexx Laboratories:

Idexx is a prominent player in the veterinary diagnostics market, offering a wide range of imaging solutions that enhance diagnostic accuracy and efficiency in veterinary practices.Agfa-Gevaert Group:

Agfa-Gevaert specializes in digital radiography solutions, contributing to advancements in veterinary imaging with high-quality products designed for fast and precise diagnostics.GE Healthcare:

GE Healthcare provides cutting-edge technologies and products for veterinary imaging, investing heavily in R&D to deliver innovative solutions to the veterinary community.Fujifilm:

Fujifilm's veterinary radiography products include advanced digital imaging systems designed to enhance workflow and provide high-resolution images for improved veterinary diagnostics.Canon Medical Systems:

Canon Medical Systems delivers comprehensive radiography solutions, focusing on developing technologies that address the unique challenges in the veterinary field.We're grateful to work with incredible clients.

FAQs

What is the market size of veterinary radiography?

The veterinary radiography market is valued at approximately $1.8 billion in 2023, with a projected CAGR of 6.0%, indicating substantial growth potential over the next decade.

What are the key market players or companies in veterinary radiography?

The key players in the veterinary radiography market include major manufacturers and suppliers of imaging equipment, providing advancements in digital and analog radiography technologies to enhance diagnostics for veterinary healthcare.

What are the primary factors driving the growth in the veterinary radiography industry?

Key growth factors include increasing pet ownership, technological advancements in radiographic systems, and the rising demand for accurate diagnostic tools in veterinary practices, driving innovation and market expansion.

Which region is the fastest Growing in veterinary radiography?

North America holds the largest market share in veterinary radiography, expected to grow from $0.66 billion in 2023 to $1.20 billion by 2033, showcasing rapid regional advancement.

Does ConsaInsights provide customized market report data for the veterinary radiography industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing detailed insights and data on market trends, key players, and segment analysis within the veterinary radiography industry.

What deliverables can I expect from this veterinary radiography market research project?

Deliverables include comprehensive reports, data visualization, market forecasts, segment analysis, and strategic insights that inform decision-making and investment in the veterinary radiography sector.

What are the market trends of veterinary radiography?

Current trends include the shift toward digital radiography, increased focus on companion animal care, and the rising adoption of advanced imaging technologies in veterinary clinics and hospitals.