Vetronics Market Report

Published Date: 03 February 2026 | Report Code: vetronics

Vetronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vetronics market, highlighting key insights from 2023 to 2033. It includes market size, CAGR, regional analysis, technology trends, and forecasts to equip stakeholders with actionable data.

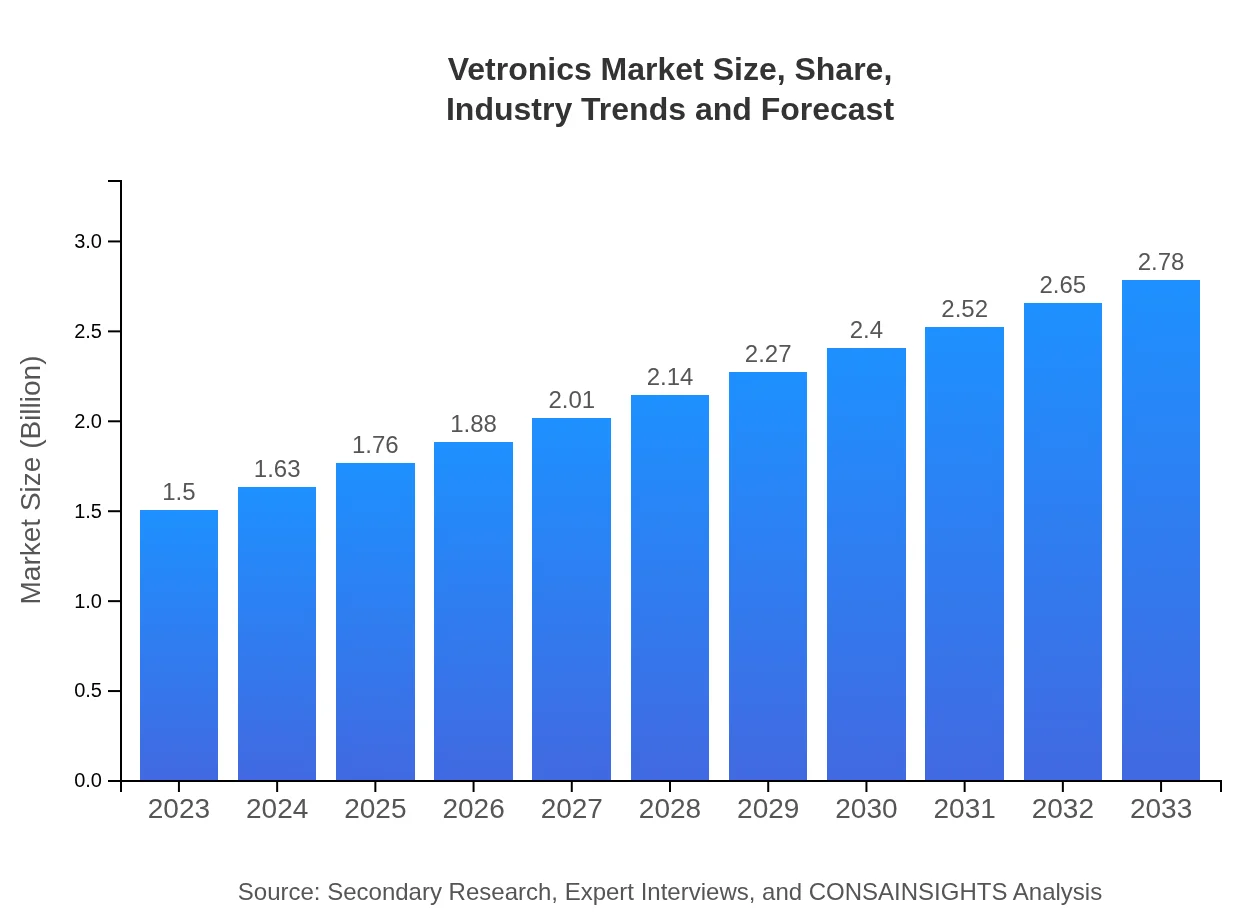

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Thales Group, General Dynamics, Lockheed Martin, BAE Systems, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Vetronics Market Overview

Customize Vetronics Market Report market research report

- ✔ Get in-depth analysis of Vetronics market size, growth, and forecasts.

- ✔ Understand Vetronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vetronics

What is the Market Size & CAGR of Vetronics market in 2023?

Vetronics Industry Analysis

Vetronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vetronics Market Analysis Report by Region

Europe Vetronics Market Report:

The European Vetronics market was valued at $0.46 billion in 2023, with expectations to reach approximately $0.85 billion by 2033. NATO initiatives and procurement programs highlight the necessity of modernizing defense forces, fueling demand for advanced systems.Asia Pacific Vetronics Market Report:

In the Asia Pacific region, the Vetronics market was valued at $0.30 billion in 2023, expected to grow to $0.55 billion by 2033. Countries like China and India are substantially investing in military capabilities and technology enhancements, driving demand for advanced vetronics systems.North America Vetronics Market Report:

As one of the largest markets, North America's Vetronics segment totaled approximately $0.49 billion in 2023, forecasted to grow to $0.91 billion by 2033. The U.S. defense budget prioritizes modernization and technological superiority, significantly boosting market growth.South America Vetronics Market Report:

South America represents a smaller market share, with a value of $0.08 billion in 2023, projected to double to $0.16 billion by 2033. Defense spending is gradually increasing due to evolving security threats, although the pace is slower compared to North America and Europe.Middle East & Africa Vetronics Market Report:

The Middle East and Africa market stood at $0.17 billion in 2023, anticipated to grow to $0.32 billion by 2033. Regional conflicts and geopolitical tensions drive defense investments, creating opportunities for innovative vetronics solutions.Tell us your focus area and get a customized research report.

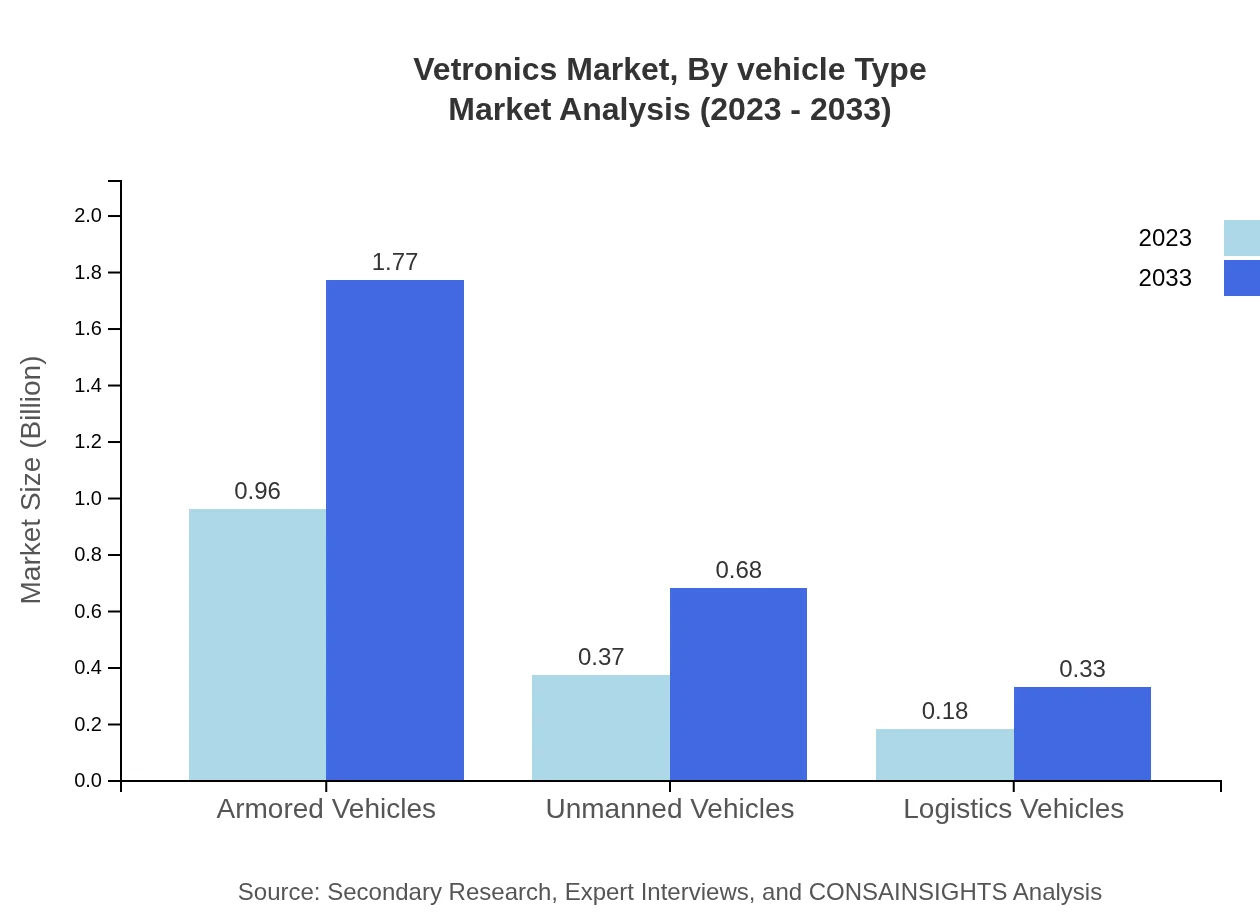

Vetronics Market Analysis By Vehicle Type

The Vetronics market by vehicle type reveals significant investments in armored and unmanned vehicles, which together account for over 63% of the market share in 2023. Armored vehicles exhibit a substantial growth from $0.96 billion to $1.77 billion by 2033, while unmanned vehicles rise from $0.37 billion to $0.68 billion over the same timeframe. The growing focus on survivability and autonomy in military operations drives the expansion in these categories.

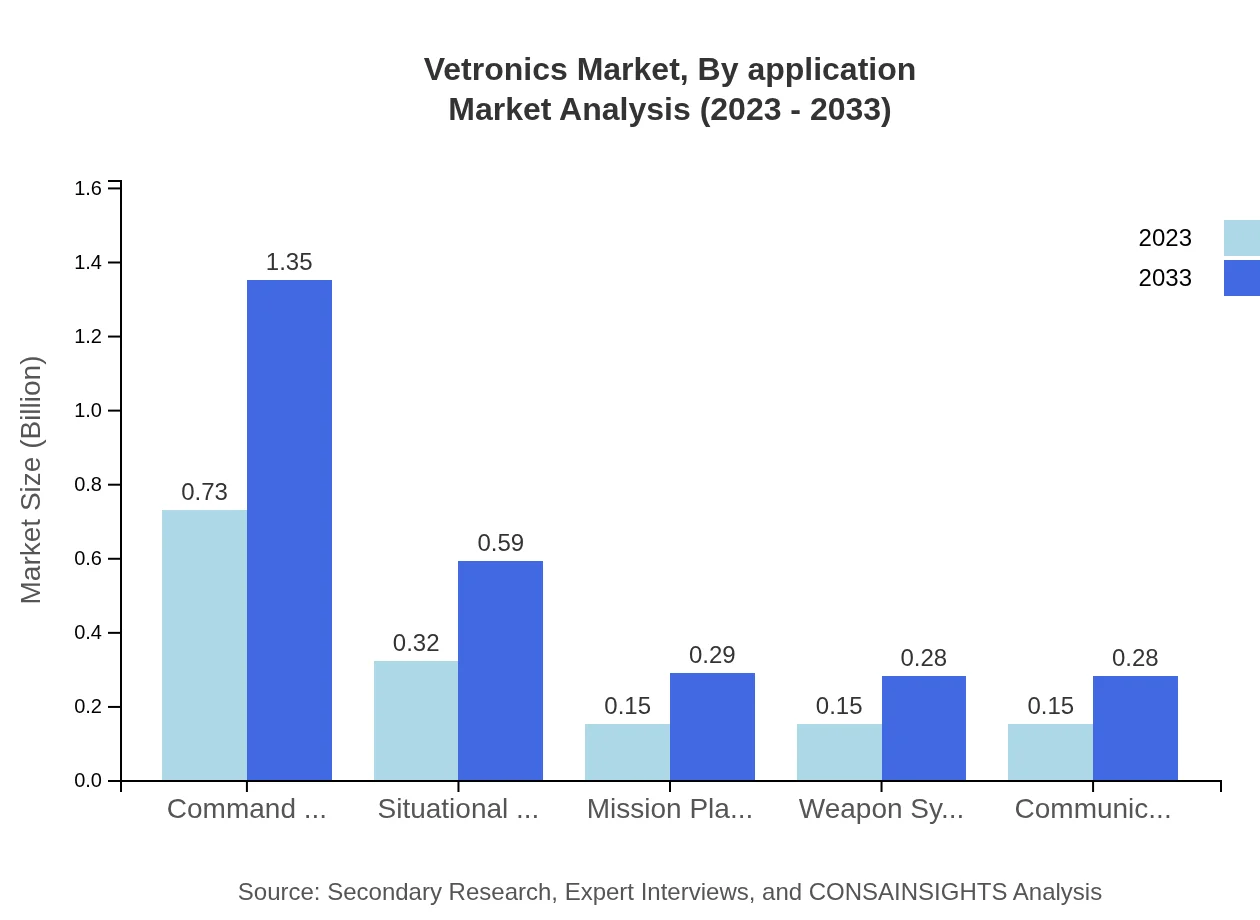

Vetronics Market Analysis By Application

Applications such as command and control represent a significant portion of the market, reflecting the need for effective coordination in military operations. This segment alone grows from $0.73 billion to $1.35 billion between 2023 and 2033. Situational awareness and mission planning applications also show robust growth, highlighting ongoing investments in enhancing operational intelligence.

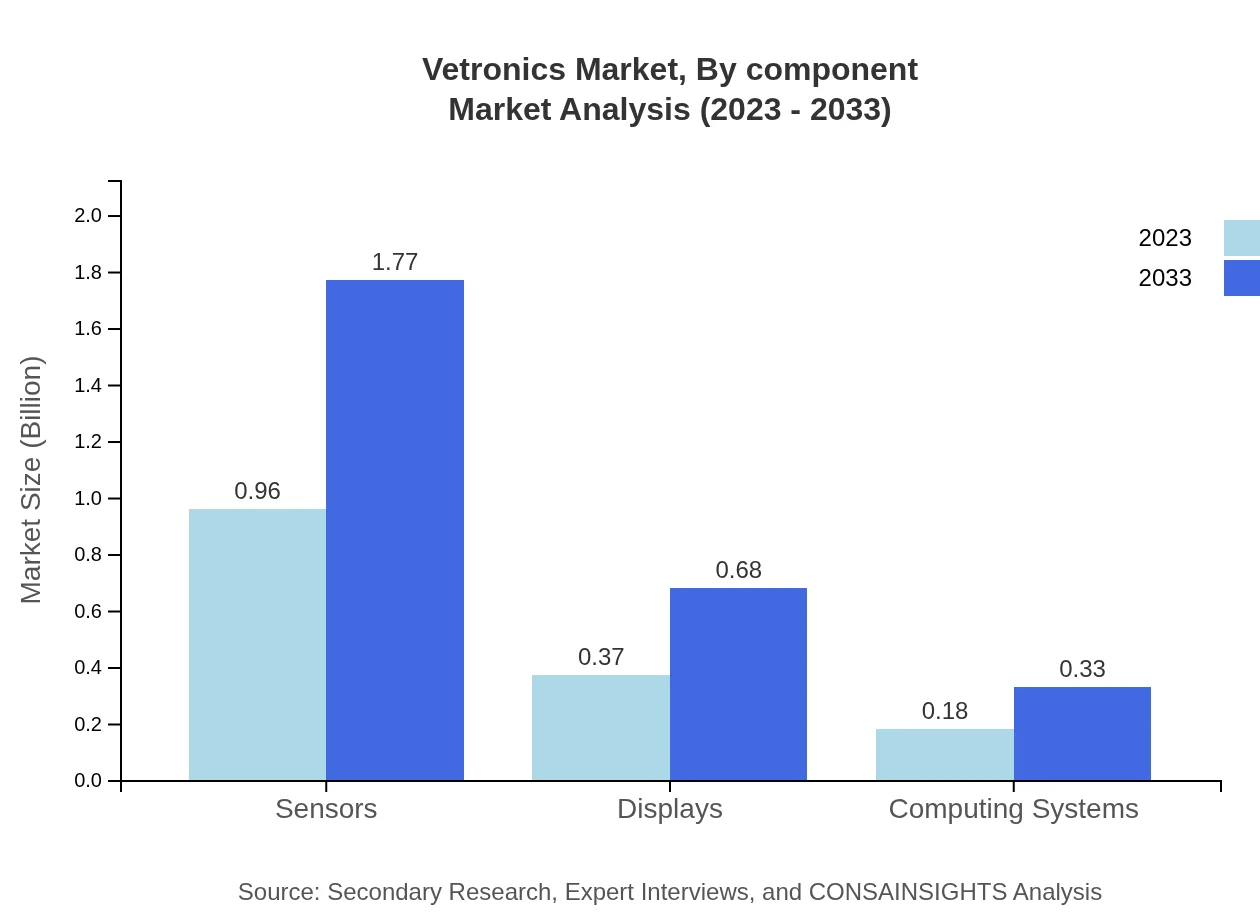

Vetronics Market Analysis By Component

Sensors dominate the Vetronics market, valued at $0.96 billion in 2023 and expected to reach $1.77 billion by 2033. Displays and integrated systems also play crucial roles, as they are imperative for data visualization and operational decision-making. Emerging technologies are leading to more sophisticated components that enhance system interoperability and reliability.

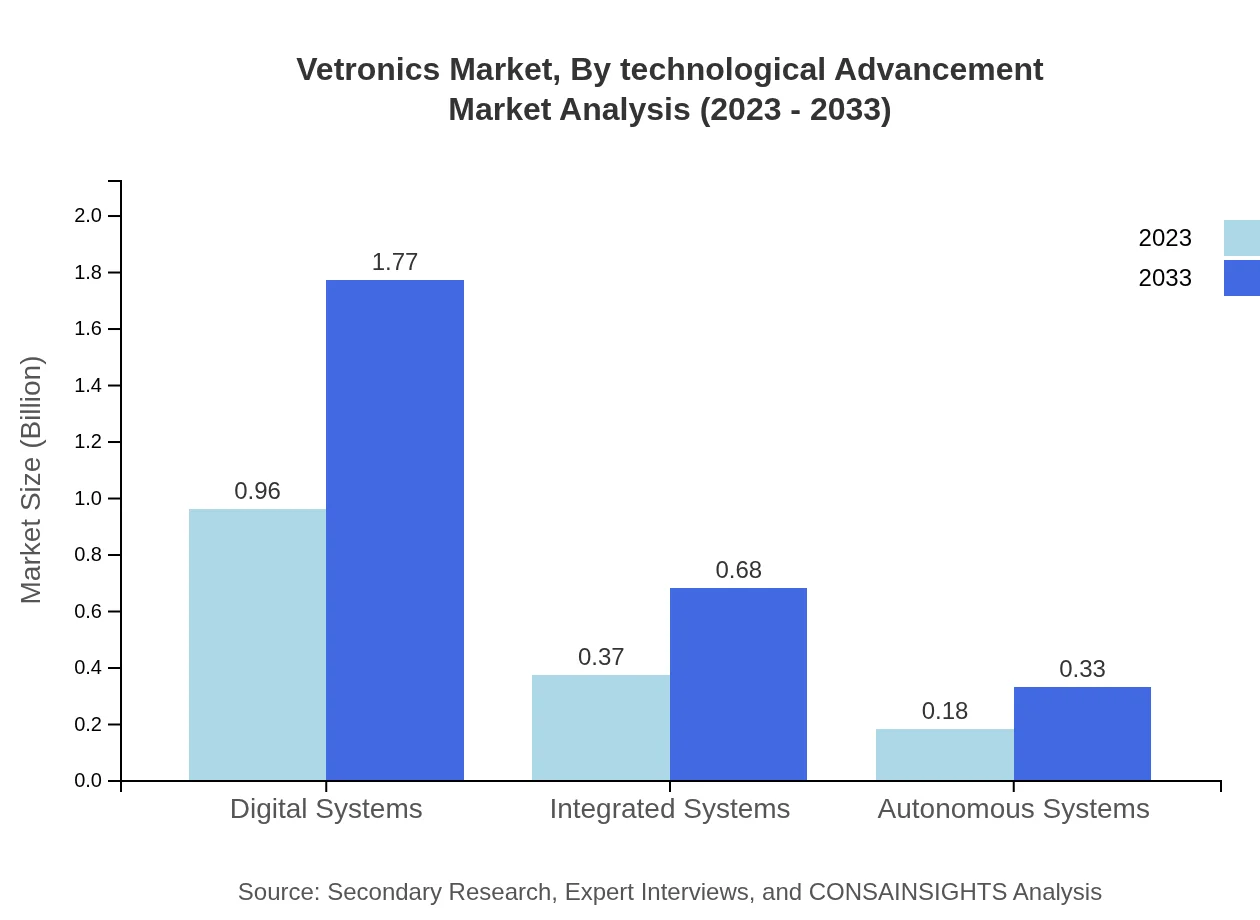

Vetronics Market Analysis By Technological Advancement

Innovations like AI-driven analytics, enhanced cybersecurity measures, and data integration frameworks are reshaping the Vetronics landscape. As these technologies evolve, there is an increasing need to adopt them across various applications, ensuring military forces maintain technological superiority amid emerging threats.

Vetronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vetronics Industry

Thales Group:

Thales is a leading player known for its cutting-edge communication systems and integrated technology solutions for military applications.General Dynamics:

General Dynamics provides a broad range of defense products and services, including advanced vetronics systems for armored vehicles and command and control solutions.Lockheed Martin:

Lockheed Martin specializes in various defense technologies, heavily investing in R&D for innovative vetronics applications across air and ground systems.BAE Systems:

BAE Systems is recognized for its contributions to advanced electronics for defense applications, focusing on integrated systems for operational efficiency.Raytheon Technologies:

Raytheon offers advanced missile systems and cybersecurity solutions, which are critical components in the Vetronics market.We're grateful to work with incredible clients.

FAQs

What is the market size of vetronics?

The global vetronics market is valued at $1.5 billion in 2023 and is forecasted to grow at a CAGR of 6.2%. By 2033, the market is expected to see significant growth, indicating strong demand for advanced vehicular electronics.

What are the key market players or companies in this vetronics industry?

The vetronics market consists of major players including Thales Group, Northrop Grumman, and Harris Corporation, which are recognized for their advanced technology solutions and strategic collaborations to enhance product offerings.

What are the primary factors driving the growth in the vetronics industry?

Key factors driving the growth in the vetronics industry include a rise in defense budgets, increased demand for advanced military vehicles, and the integration of next-generation technologies in command and control systems.

Which region is the fastest Growing in the vetronics?

The fastest-growing region in the vetronics market is North America, with the market size expected to grow from $0.49 billion in 2023 to $0.91 billion by 2033. Europe and Asia Pacific also demonstrate robust growth with significant investments.

Does ConsaInsights provide customized market report data for the vetronics industry?

Yes, ConsaInsights offers customized market report data for the vetronics industry, tailored to meet specific client needs. This includes detailed insights, forecasts, and analysis across various segments and geographies.

What deliverables can I expect from this vetronics market research project?

From the vetronics market research project, you can expect comprehensive reports that include market size, growth forecasts, competitive analysis, and segmented data on technologies and regions, along with actionable insights.

What are the market trends of vetronics?

Current market trends in vetronics include increased adoption of AI and IoT technologies, the shift towards autonomous systems, and enhanced digital communication capabilities within military vehicles, driving innovation and efficiency.