Vibration Monitoring Market Report

Published Date: 22 January 2026 | Report Code: vibration-monitoring

Vibration Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Vibration Monitoring market, covering key insights and trends from 2023 to 2033, including market size, growth rates, technological advancements, and regional dynamics.

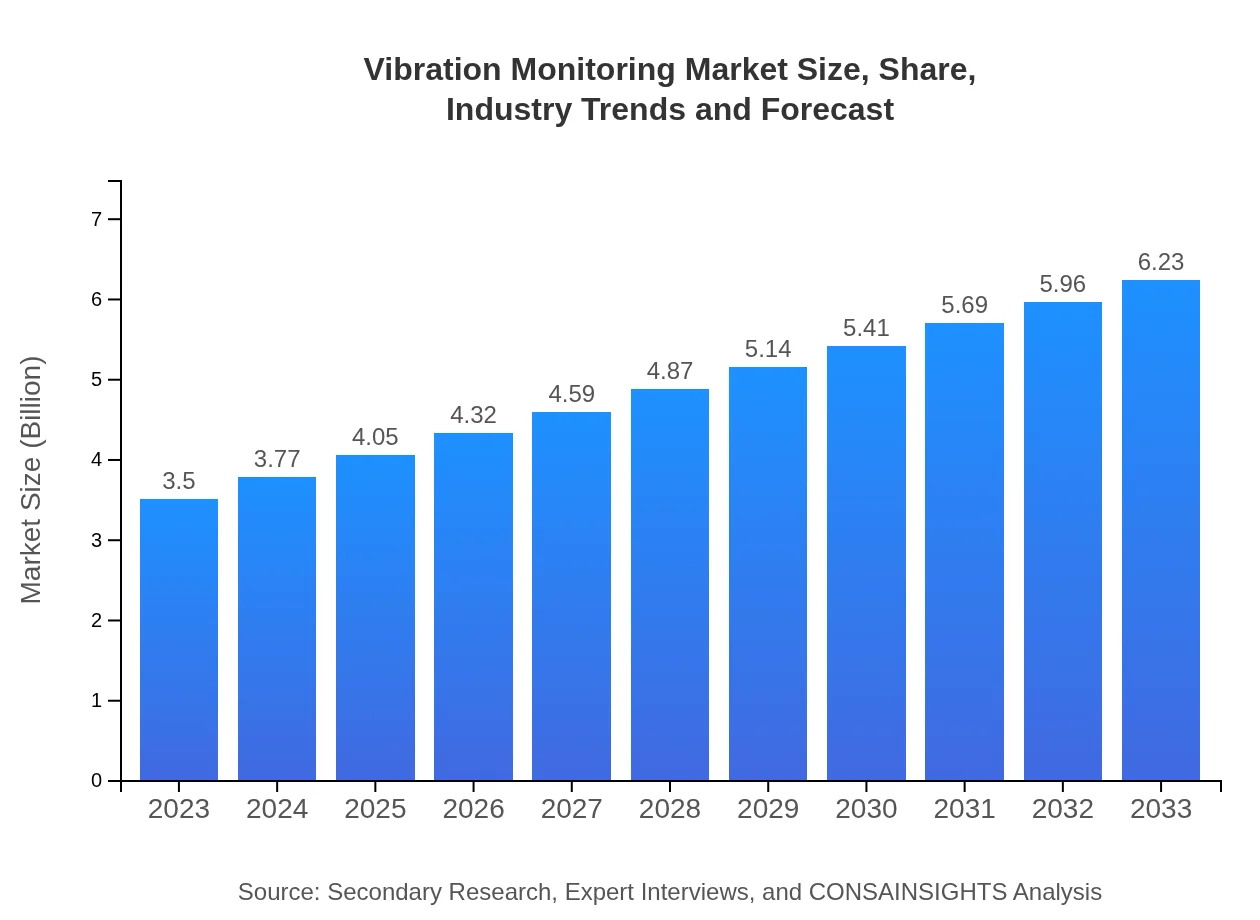

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $6.23 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Honeywell International Inc., Baker Hughes, Emerson Electric Co. |

| Last Modified Date | 22 January 2026 |

Vibration Monitoring Market Overview

Customize Vibration Monitoring Market Report market research report

- ✔ Get in-depth analysis of Vibration Monitoring market size, growth, and forecasts.

- ✔ Understand Vibration Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vibration Monitoring

What is the Market Size & CAGR of the Vibration Monitoring market in 2033?

Vibration Monitoring Industry Analysis

Vibration Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vibration Monitoring Market Analysis Report by Region

Europe Vibration Monitoring Market Report:

The European market is expected to grow from $1.10 billion in 2023 to $1.95 billion by 2033. The focus on energy efficiency and sustainability initiatives enhances the demand for vibration monitoring systems across various sectors.Asia Pacific Vibration Monitoring Market Report:

In 2023, the Asia Pacific region accounts for a market size of $0.61 billion. By 2033, this figure is projected to grow to approximately $1.09 billion, reflecting a significant growth trajectory driven by industrial growth and modernization in countries like China and India. Increasing investments in infrastructure and smart cities also bolster demand for robust monitoring systems.North America Vibration Monitoring Market Report:

North America is a leading market for vibration monitoring, with a size of $1.31 billion in 2023, expected to grow to $2.34 billion by 2033. This area's growth is fueled by mature industries adopting advanced monitoring solutions for predictive maintenance as part of digital transformation strategies.South America Vibration Monitoring Market Report:

The South American market, valued at $0.11 billion in 2023, is expected to grow to $0.20 billion by 2033. The growth in this region is attributed to the emerging industrial sector and an increasing focus on optimizing operational processes in key industries such as mining and energy.Middle East & Africa Vibration Monitoring Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.36 billion in 2023 to $0.65 billion by 2033. The region's increasing industrialization and the need for improved asset management strategies drive this growth.Tell us your focus area and get a customized research report.

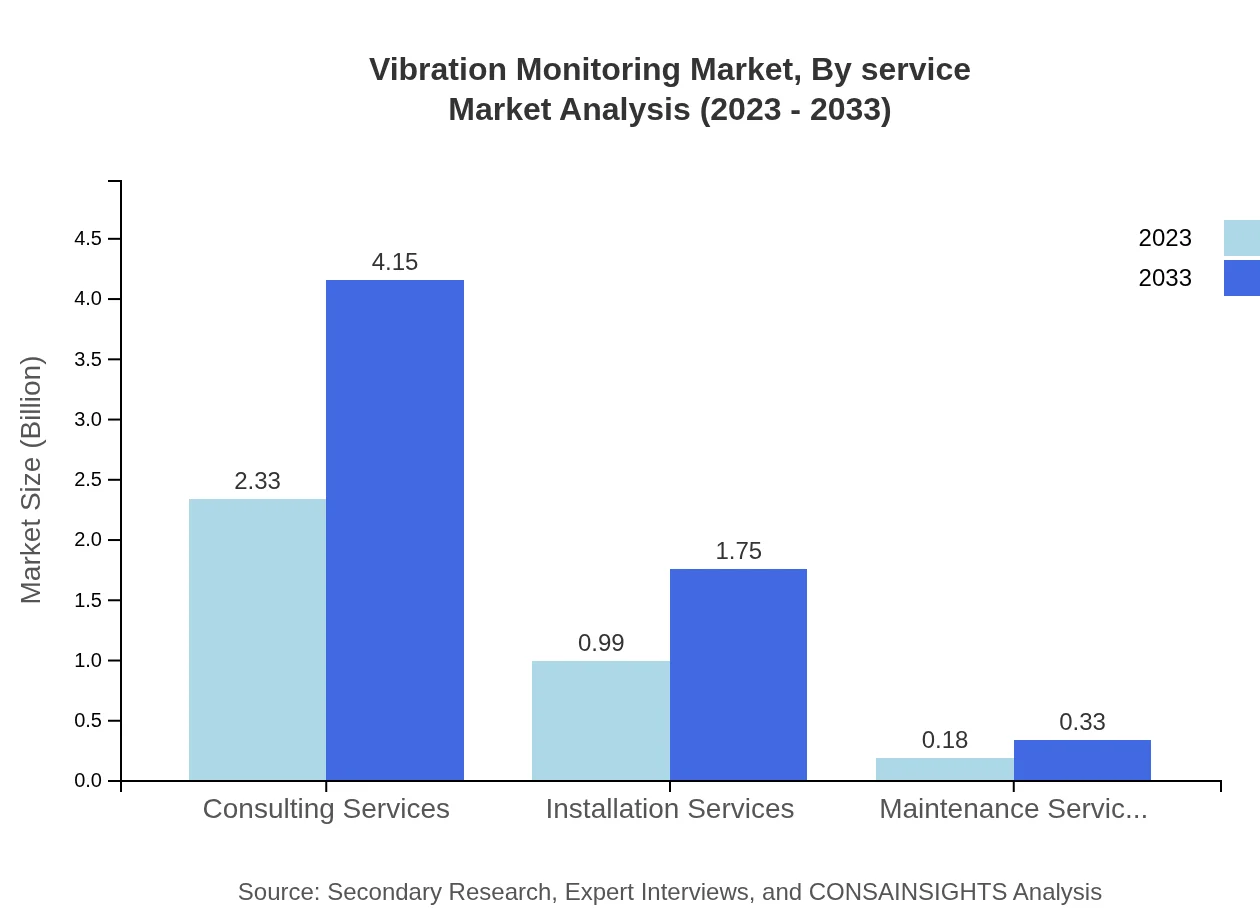

Vibration Monitoring Market Analysis By Service

The Vibration Monitoring market by service includes several vital segments. In 2023, Consulting Services lead the market with a size of $2.33 billion, projected to reach $4.15 billion by 2033, holding a share of 66.6% throughout the period. Installation Services also hold substantial value at $0.99 billion, expected to grow to $1.75 billion. Maintenance Services, while smaller at $0.18 billion in 2023, will rise to $0.33 billion, demonstrating the growing importance of ongoing support.

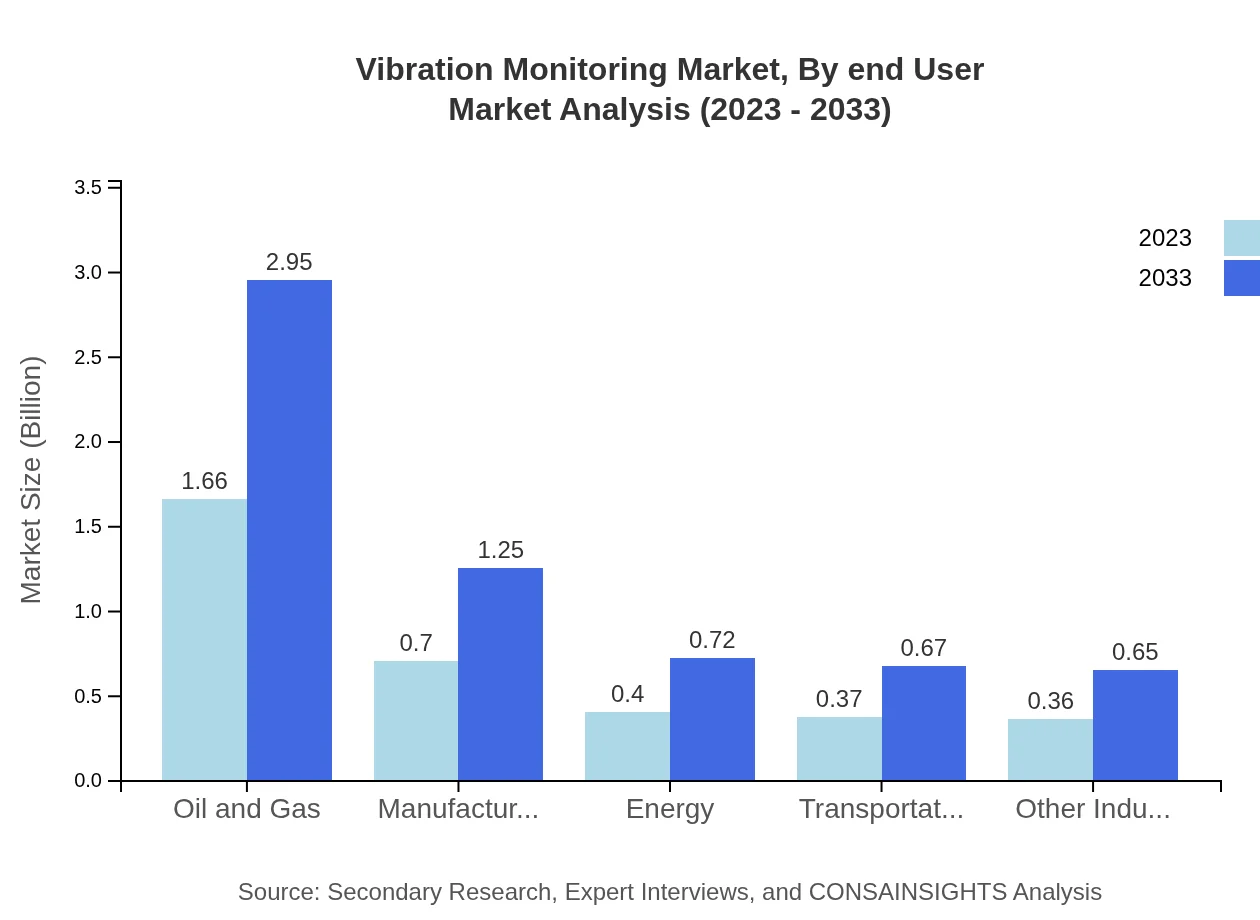

Vibration Monitoring Market Analysis By End User

The oil and gas industry significantly drives the Vibration Monitoring market, contributing $1.66 billion in 2023 and expected to reach $2.95 billion by 2033, maintaining a share of 47.35%. Manufacturing follows closely with a market size of $0.70 billion, predicted to increase to $1.25 billion, while the energy sector reflects growth from $0.40 billion to $0.72 billion, showcasing broader acceptance across industries.

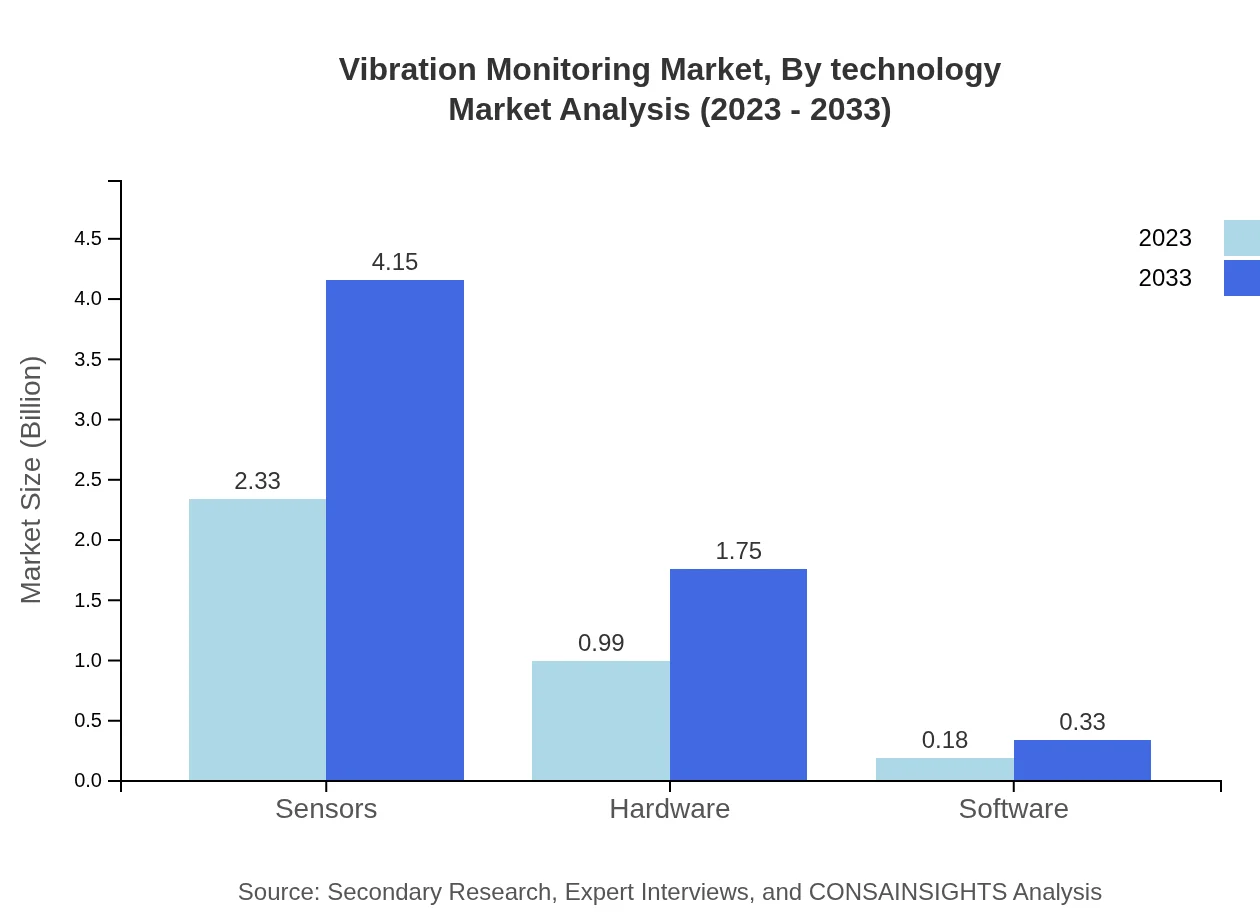

Vibration Monitoring Market Analysis By Technology

The technology segment reveals that sensors are a major component in the Vibration Monitoring market, with a current size of $2.33 billion, anticipated to rise to $4.15 billion by 2033. Hardware and software solutions are also crucial, with similar increasing trends showcasing the industry's reliance on advanced technological solutions for effective monitoring.

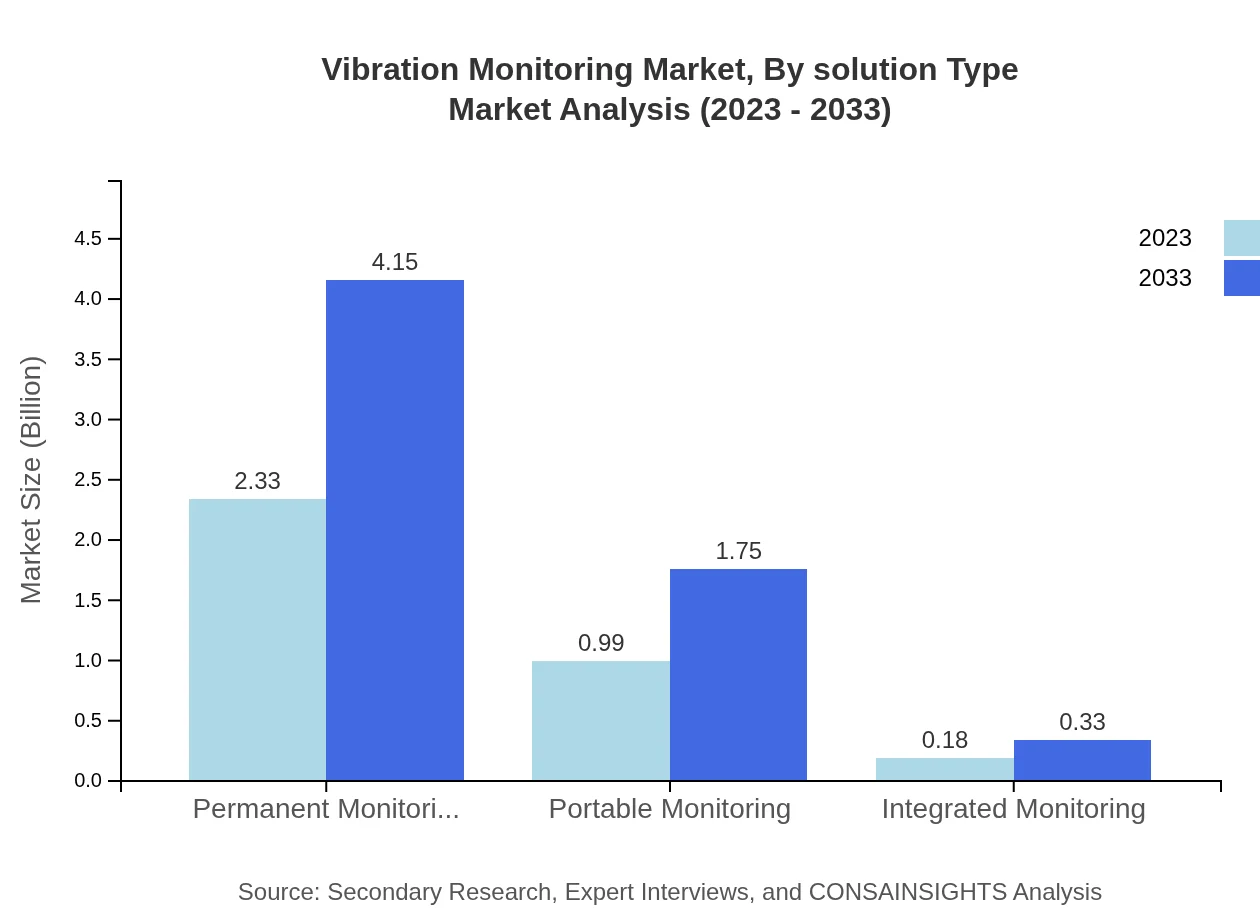

Vibration Monitoring Market Analysis By Solution Type

Within solution types, Permanent Monitoring leads with a size of $2.33 billion in 2023 and expected to reach $4.15 billion by 2033. Portable Monitoring positions itself as a growing solution type, with moves from $0.99 billion to $1.75 billion during the same period, catering to diverse operational applications and enhancing flexibility.

Vibration Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vibration Monitoring Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization, providing vibration monitoring solutions that enhance maintenance strategies and operational efficiency across various industries.Rockwell Automation:

Rockwell Automation specializes in industrial automation and information, offering advanced monitoring technologies that integrate seamlessly with existing systems for optimized asset performance.Honeywell International Inc.:

Honeywell develops technologies that improve safety, security, and energy efficiency, producing state-of-the-art vibration sensors and monitoring solutions to mitigate operational risks.Baker Hughes:

Baker Hughes is a prominent player in the oil and gas sector, providing comprehensive vibration monitoring solutions to ensure equipment reliability and performance management.Emerson Electric Co.:

Emerson Electric Co. delivers automation solutions for various industries, excelling in providing vibration monitoring technologies that ensure efficient and reliable operations.We're grateful to work with incredible clients.

FAQs

What is the market size of vibration Monitoring?

The global vibration monitoring market is currently valued at approximately $3.5 billion, with a projected compound annual growth rate (CAGR) of 5.8% from 2023 to 2033, reflecting increasing adoption across various industrial sectors.

What are the key market players or companies in this vibration Monitoring industry?

Major players in the vibration monitoring industry include SKF, Fluke Corporation, and PCB Piezotronics, among others. These companies are crucial in driving technological advancements and enhancing service offerings to meet growing market demand.

What are the primary factors driving the growth in the vibration Monitoring industry?

Growth in the vibration monitoring industry is primarily driven by increasing industrial automation, a growing focus on predictive maintenance, and stringent regulations related to equipment safety. Additionally, technological advancements in monitoring devices contribute significantly.

Which region is the fastest Growing in the vibration Monitoring?

The fastest-growing region in the vibration monitoring market is North America, which is projected to increase from $1.31 billion in 2023 to $2.34 billion by 2033, reflecting strong industrial activity and increased investment in monitoring technologies.

Does ConsaInsights provide customized market report data for the vibration Monitoring industry?

Yes, ConsaInsights provides tailored market report data for the vibration monitoring industry, allowing clients to access customized insights and forecasts that suit specific business needs and strategic goals.

What deliverables can I expect from this vibration Monitoring market research project?

Expect comprehensive insights including market size analysis, competitive landscape, growth trajectories, and regional performance metrics. Additionally, the report will provide segment-specific data and actionable recommendations for strategic planning.

What are the market trends of vibration monitoring?

Current trends in vibration monitoring include the integration of IoT technologies, a shift towards predictive maintenance strategies, and the growing use of artificial intelligence to enhance monitoring accuracy, boosting operational efficiency across sectors.