Vibration Sensor Market Report

Published Date: 31 January 2026 | Report Code: vibration-sensor

Vibration Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Vibration Sensor market, covering insights on market size, growth forecasts from 2023 to 2033, key segments, regional breakdowns, and industry trends influencing the sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

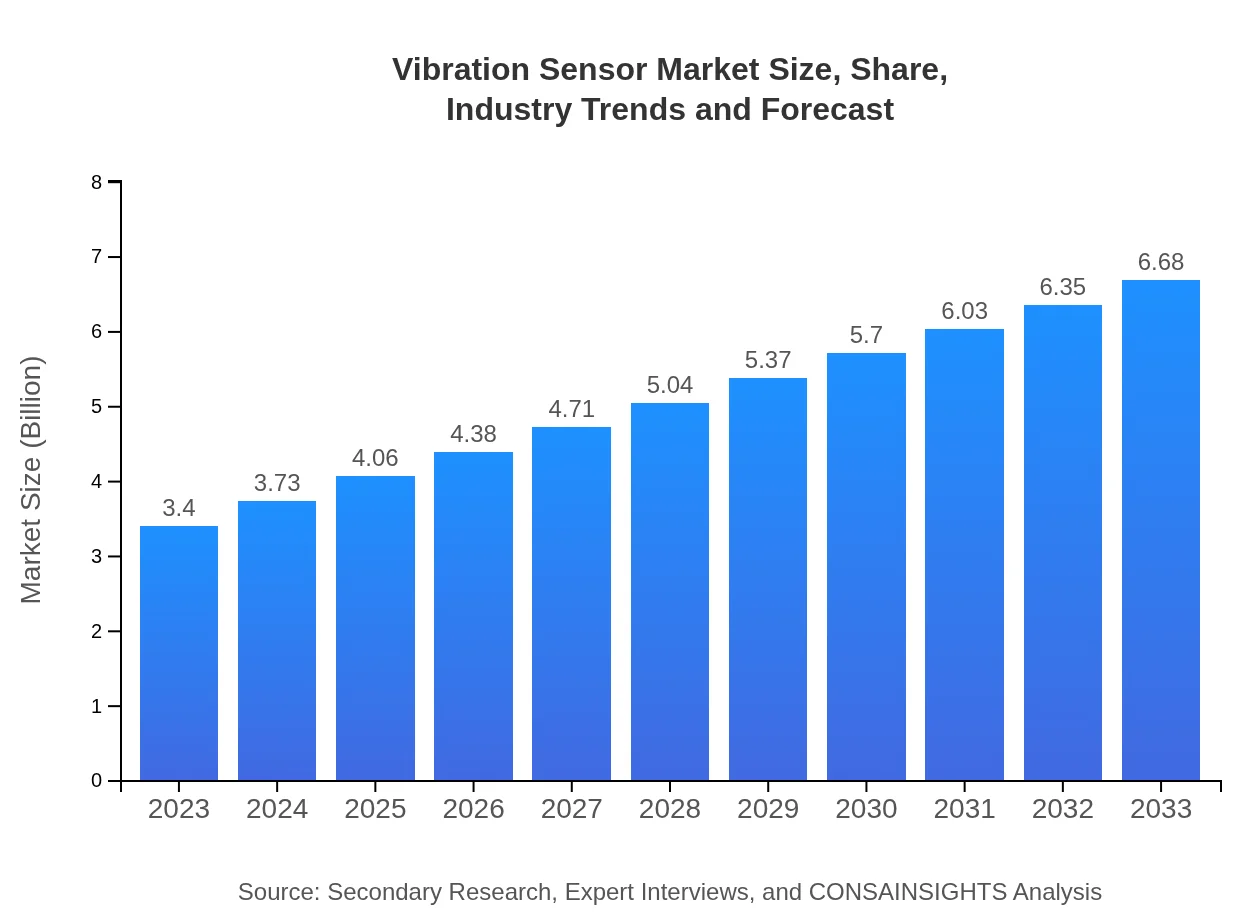

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.68 Billion |

| Top Companies | National Instruments, Honeywell International Inc., Omega Engineering, PCB Piezotronics, Siemens AG |

| Last Modified Date | 31 January 2026 |

Vibration Sensor Market Overview

Customize Vibration Sensor Market Report market research report

- ✔ Get in-depth analysis of Vibration Sensor market size, growth, and forecasts.

- ✔ Understand Vibration Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vibration Sensor

What is the Market Size & CAGR of Vibration Sensor market in 2023?

Vibration Sensor Industry Analysis

Vibration Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vibration Sensor Market Analysis Report by Region

Europe Vibration Sensor Market Report:

Europe is estimated to have a market size of $0.94 billion in 2023, anticipated to reach $1.85 billion by 2033. The focus on reducing maintenance costs and enhancing equipment reliability through predictive maintenance solutions is a major factor fueling market growth in this region.Asia Pacific Vibration Sensor Market Report:

In the Asia Pacific region, the Vibration Sensor market is valued at approximately $0.66 billion in 2023, projected to grow to $1.29 billion by 2033. The growth is spurred by rising industrial activity, particularly in manufacturing and energy sectors, along with increasing government initiatives to promote automation.North America Vibration Sensor Market Report:

North America holds a robust position in the Vibration Sensor market with a valuation of $1.17 billion in 2023, forecasted to grow to $2.30 billion by 2033. The region is characterized by advanced manufacturing technologies and high adoption rates of IoT devices, promoting the use of vibration sensors across multiple industries.South America Vibration Sensor Market Report:

The South American Vibration Sensor market starts at $0.33 billion in 2023, expected to reach $0.66 billion by 2033. The growth is driven by investments in infrastructure and industrial projects, although challenges related to economic fluctuations may impact growth rates.Middle East & Africa Vibration Sensor Market Report:

The Vibration Sensor market in the Middle East and Africa is expected to increase from $0.30 billion in 2023 to $0.59 billion by 2033. This growth can be attributed to the increasing investment in the oil and gas sector and the push towards industrial automation.Tell us your focus area and get a customized research report.

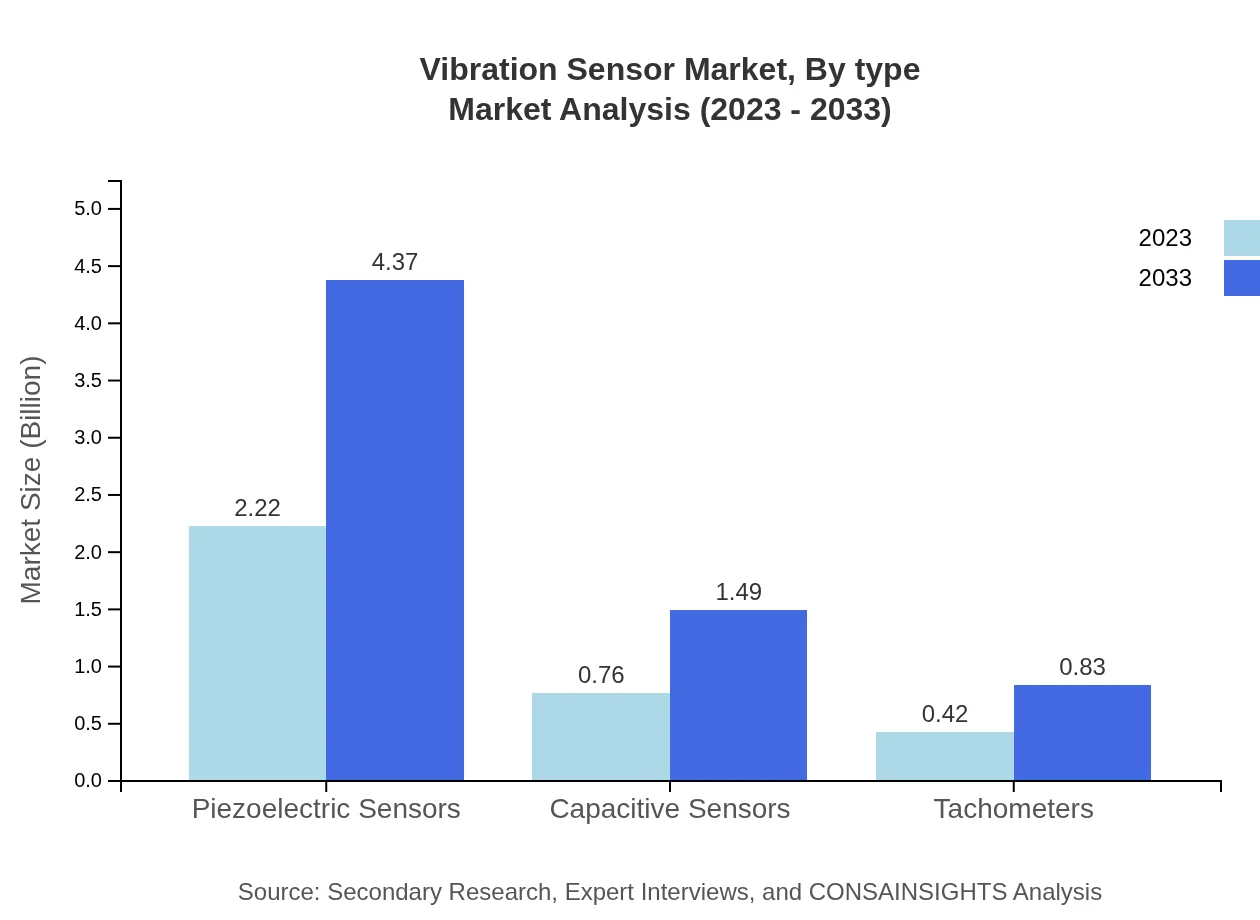

Vibration Sensor Market Analysis By Type

The market for vibration sensors by type is dominated by piezoelectric sensors, expected to grow from $2.22 billion in 2023 to $4.37 billion by 2033, maintaining a market share of 65.38%. Capacitive sensors follow with a growth from $0.76 billion to $1.49 billion during the same period at a share of 22.25%. Tachometers, while smaller, are also growing, moving from $0.42 billion to $0.83 billion, securing 12.37% of the market.

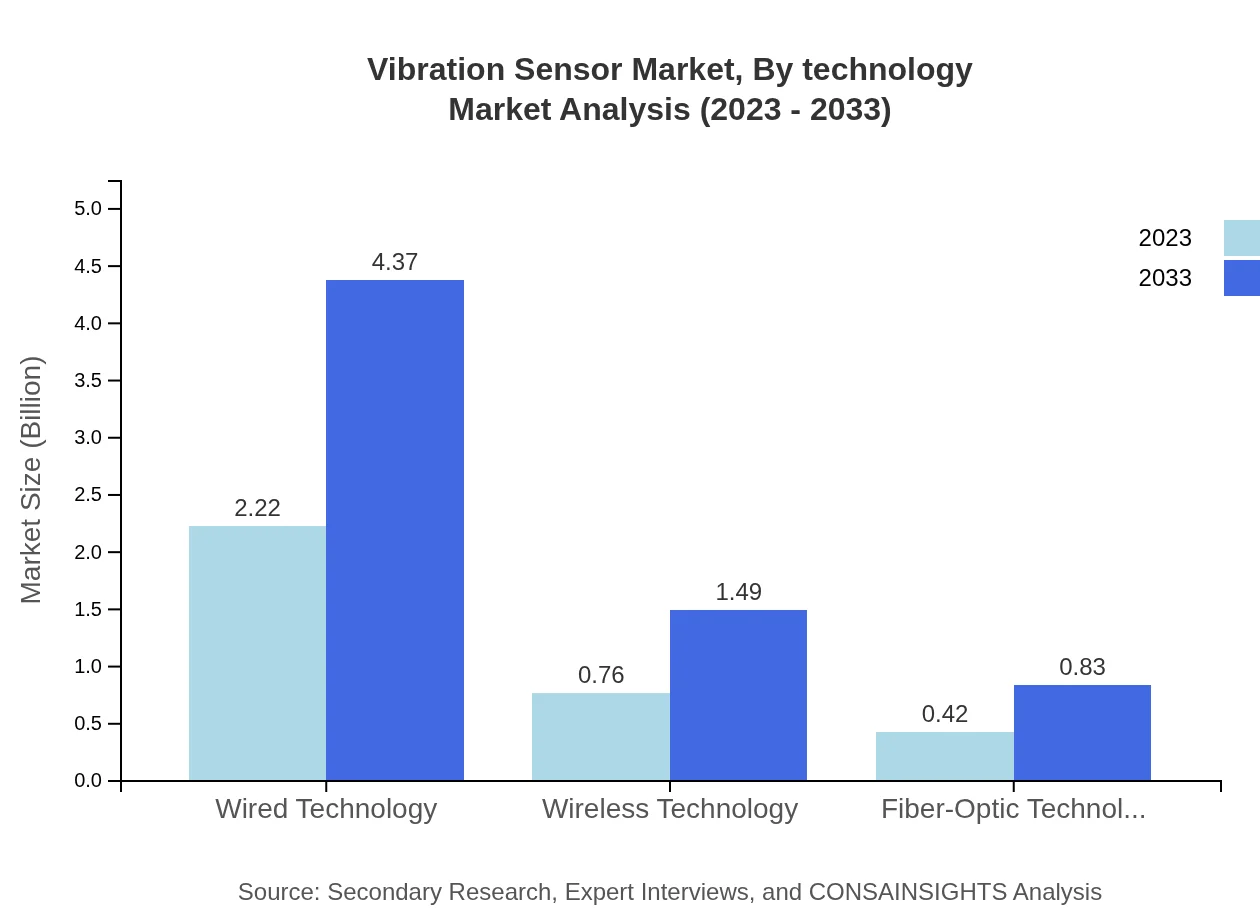

Vibration Sensor Market Analysis By Technology

Wired technology continues to dominate the segment, anticipated to reach $4.37 billion by 2033 while retaining a 65.38% share in the market. Wireless technology is also gaining traction, growing from $0.76 billion to $1.49 billion, sustaining a 22.25% market share. Fiber-optic technology, although a smaller segment, is expected to rise from $0.42 billion to $0.83 billion, maintaining a 12.37% share.

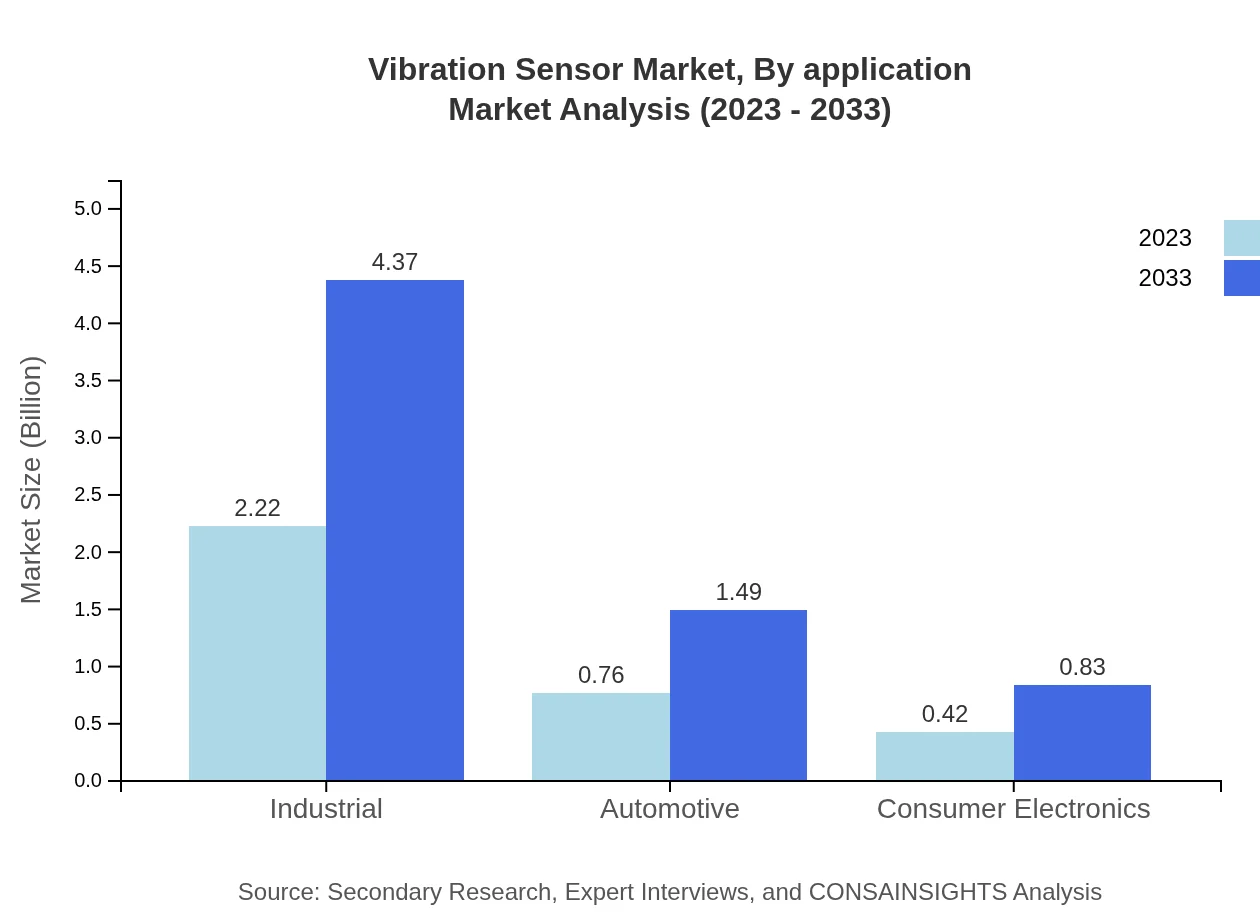

Vibration Sensor Market Analysis By Application

The industrial application segment is the largest, valued at $2.22 billion in 2023 and projected to reach $4.37 billion in 2033, holding a 65.38% market share. The oil and gas segment is also significant, growing from $0.76 billion to $1.49 billion (22.25% share), while the energy and power segment is expected to grow from $0.42 billion to $0.83 billion, with a 12.37% share.

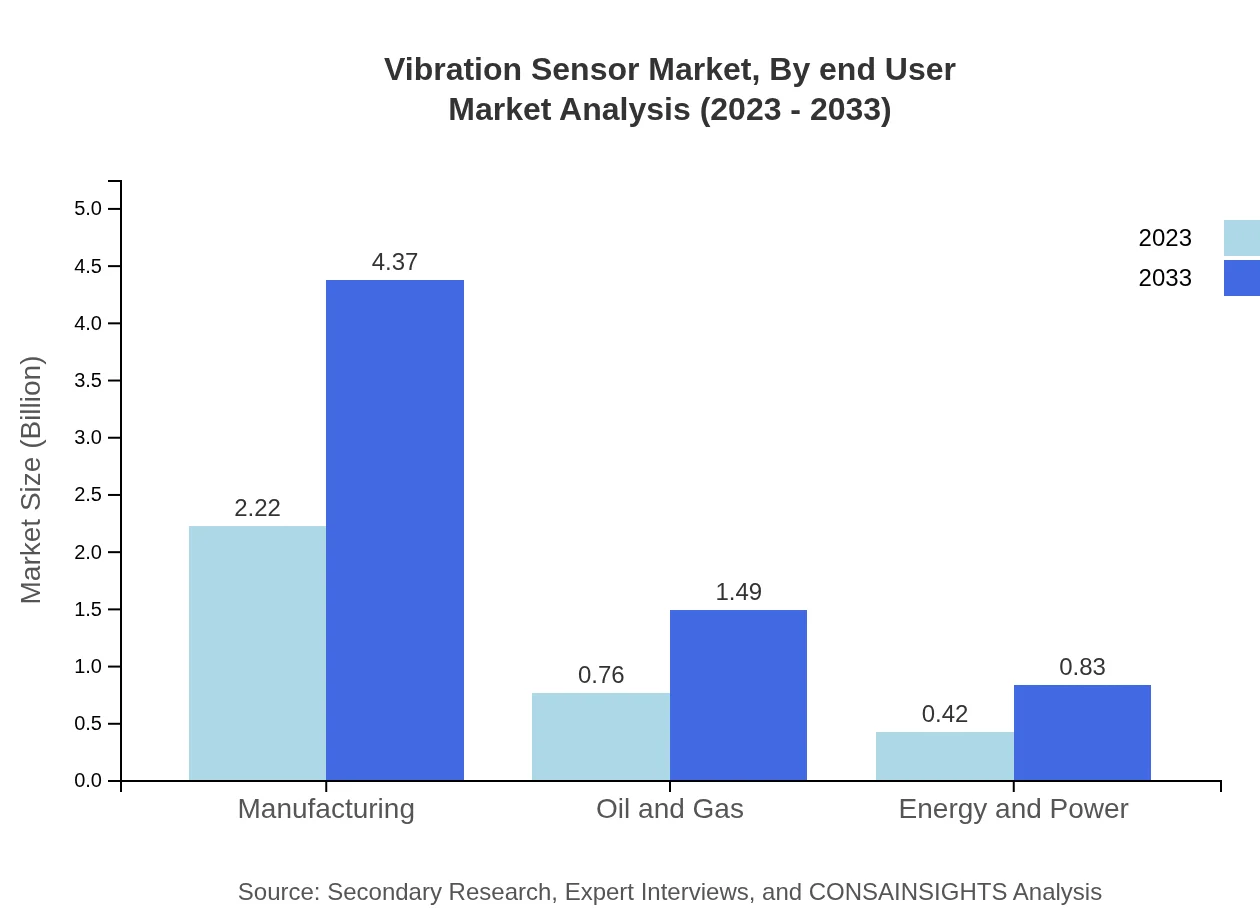

Vibration Sensor Market Analysis By End User

The manufacturing end-user sector leads the Vibration Sensor market at $2.22 billion in 2023, expected to reach $4.37 billion by 2033, maintaining 65.38% share. Meanwhile, the automotive sector is projected to grow from $0.76 billion to $1.49 billion, holding a 22.25% share, and the consumer electronics segment is set to increase from $0.42 billion to $0.83 billion, capturing 12.37% of the market.

Vibration Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vibration Sensor Industry

National Instruments:

A leader in test and measurement solutions, National Instruments provides robust vibration sensors for various industrial applications focused on enhancing productivity.Honeywell International Inc.:

Honeywell offers a range of advanced vibration sensors that enhance automation and predictive maintenance across multiple industries.Omega Engineering:

Omega specializes in manufacturing sensors and measurement instruments, including high-precision vibration sensors widely used in laboratory and industry settings.PCB Piezotronics:

Known for its piezoelectric sensors, PCB Piezotronics leads in vibration sensing technologies for critical monitoring applications in various industries.Siemens AG:

Siemens supplies a broad spectrum of industrial equipment, including advanced vibration sensors that optimize system performance.We're grateful to work with incredible clients.

FAQs

What is the market size of vibration Sensor?

The global vibration sensor market was valued at $3.4 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching an estimated $5.9 billion by 2033.

What are the key market players or companies in the vibration Sensor industry?

Key players in the vibration sensor market include Siemens, Honeywell, National Instruments, and TE Connectivity, which deliver innovative sensor solutions across various sectors, positioning themselves as industry leaders.

What are the primary factors driving the growth in the vibration Sensor industry?

The growth of the vibration sensor industry is primarily driven by the increasing demand for predictive maintenance, advancements in sensor technologies, and rising investments in industrial automation across different sectors.

Which region is the fastest Growing in the vibration Sensor market?

The Asia Pacific region is witnessing significant growth in the vibration sensor market, with a rise from $0.66 billion in 2023 to $1.29 billion by 2033, fueled by industrial expansion and technological advancements.

Does ConsaInsights provide customized market report data for the vibration Sensor industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the vibration sensor industry, allowing clients to obtain insights that cater to their unique business needs and strategic goals.

What deliverables can I expect from this vibration Sensor market research project?

Expect comprehensive market analysis, data segmentation reports, regional insights, and tailored recommendations as key deliverables from the vibration sensor market research project.

What are the market trends of vibration sensors?

Key market trends include a growing shift towards wireless technology for vibration monitoring, increased utilization of IoT solutions, and a heightened focus on predictive maintenance across key industries.