Video Analytics Market Report

Published Date: 31 January 2026 | Report Code: video-analytics

Video Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Video Analytics market, covering comprehensive insights, trends, and forecasts from 2023 to 2033. The report assesses various segments, regional performance, and key drivers shaping the industry's trajectory.

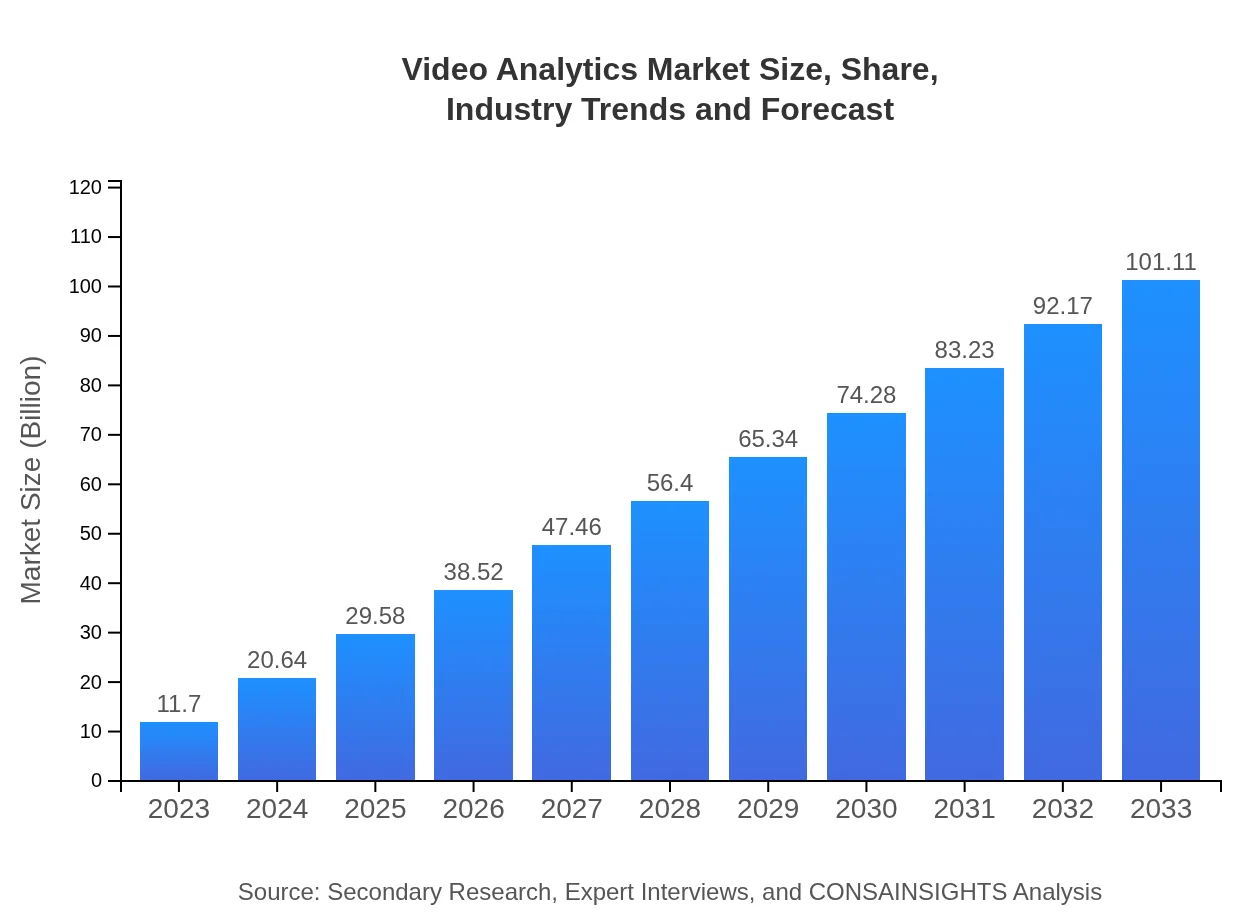

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.70 Billion |

| CAGR (2023-2033) | 22.6% |

| 2033 Market Size | $101.11 Billion |

| Top Companies | Avigilon, Genetec, Axis Communications, BriefCam |

| Last Modified Date | 31 January 2026 |

Video Analytics Market Overview

Customize Video Analytics Market Report market research report

- ✔ Get in-depth analysis of Video Analytics market size, growth, and forecasts.

- ✔ Understand Video Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Video Analytics

What is the Market Size & CAGR of Video Analytics market in 2023?

Video Analytics Industry Analysis

Video Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Video Analytics Market Analysis Report by Region

Europe Video Analytics Market Report:

Europe's Video Analytics market is expected to see a rise from $3.38 billion in 2023 to $29.17 billion by 2033, supported by stringent regulations around security and growing investments in infrastructure and smart technologies across member states.Asia Pacific Video Analytics Market Report:

The Asia Pacific region is set to experience substantial growth, with the market projected to expand from $2.24 billion in 2023 to $19.32 billion by 2033. This growth is fueled by increasing urbanization, rising investment in smart city projects, and heightened demand for security systems in countries like China and India.North America Video Analytics Market Report:

North America maintains a leading position in the Video Analytics market, forecasted to grow from $4.25 billion in 2023 to $36.76 billion by 2033. The presence of key market players and high adoption of advanced technologies contribute to this significant growth.South America Video Analytics Market Report:

In South America, the Video Analytics market is expected to grow from $0.51 billion in 2023 to $4.45 billion by 2033, driven by advancements in technology and growing security concerns necessitating the integration of video analytics in various sectors.Middle East & Africa Video Analytics Market Report:

The Middle East and Africa (MEA) region is anticipated to grow from $1.32 billion in 2023 to $11.40 billion by 2033. Factors such as increasing safety concerns and government initiatives to enhance public security are key drivers of this growth.Tell us your focus area and get a customized research report.

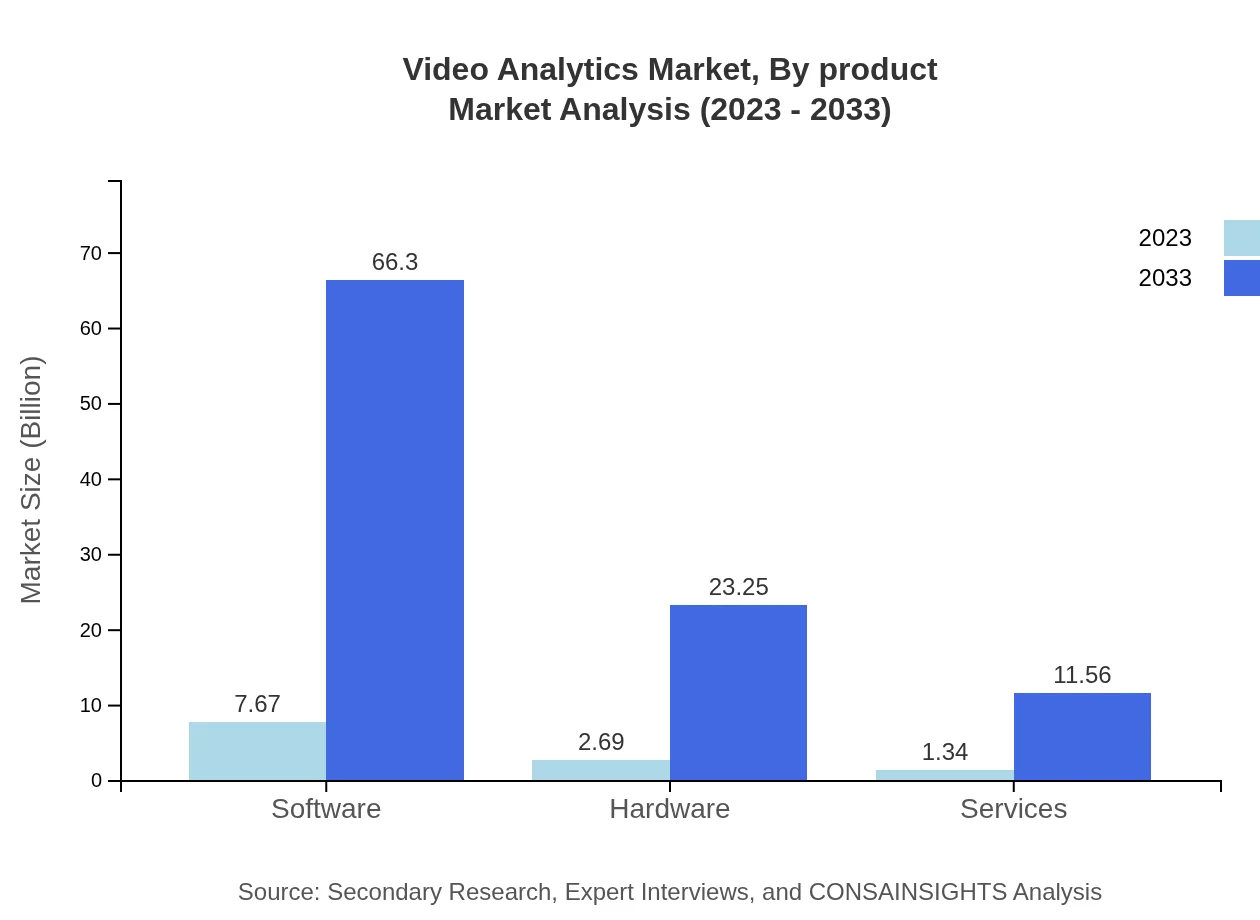

Video Analytics Market Analysis By Product

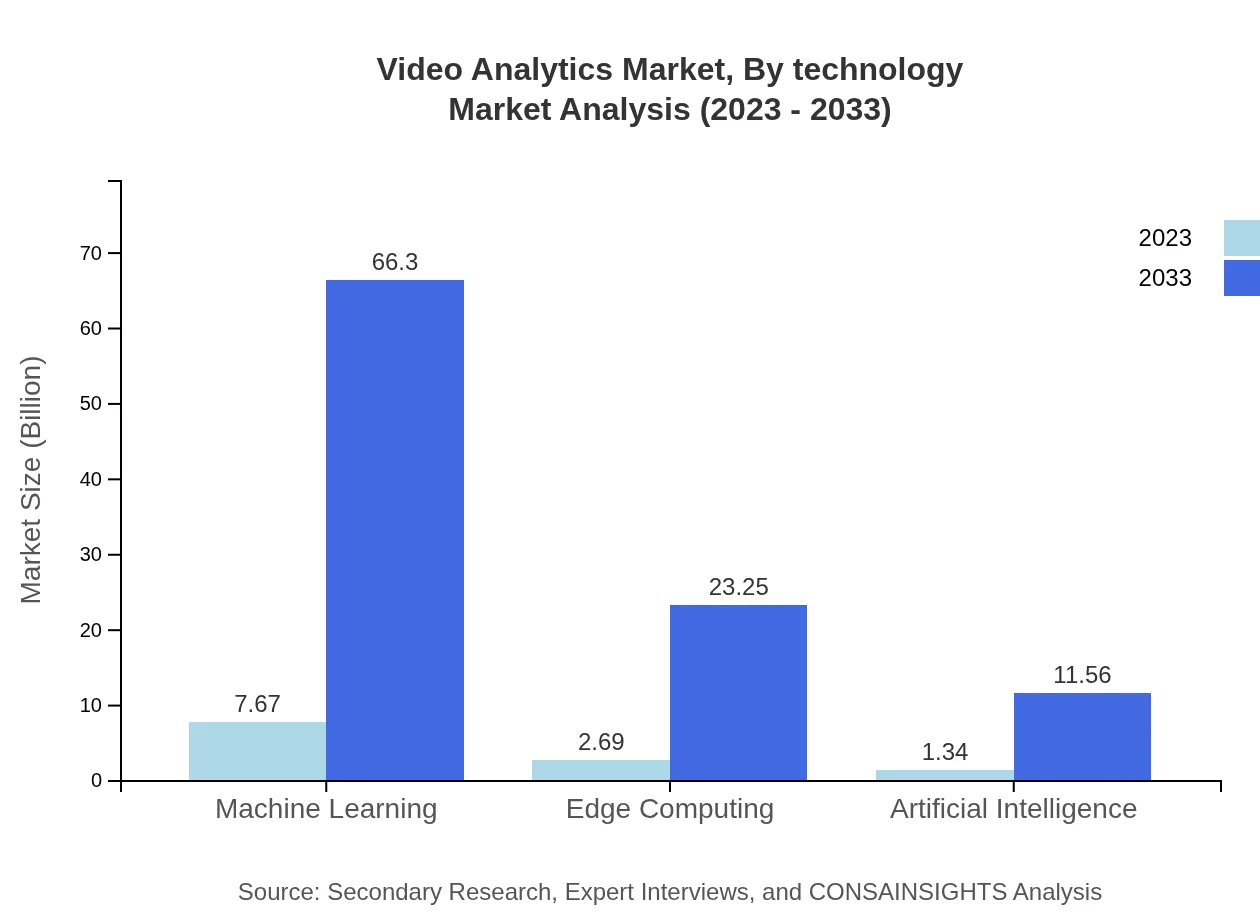

The Video Analytics Market is largely driven by the software segment, projected to grow significantly from $7.67 billion in 2023 to $66.30 billion by 2033, making up approximately 65.57% market share throughout the forecast period. Hardware components, while integral, show a slower growth path, increasing from $2.69 billion to $23.25 billion, maintaining a 23% share. Services are also witnessing growth due to rising demand for integrated solutions, climbing from $1.34 billion to $11.56 billion.

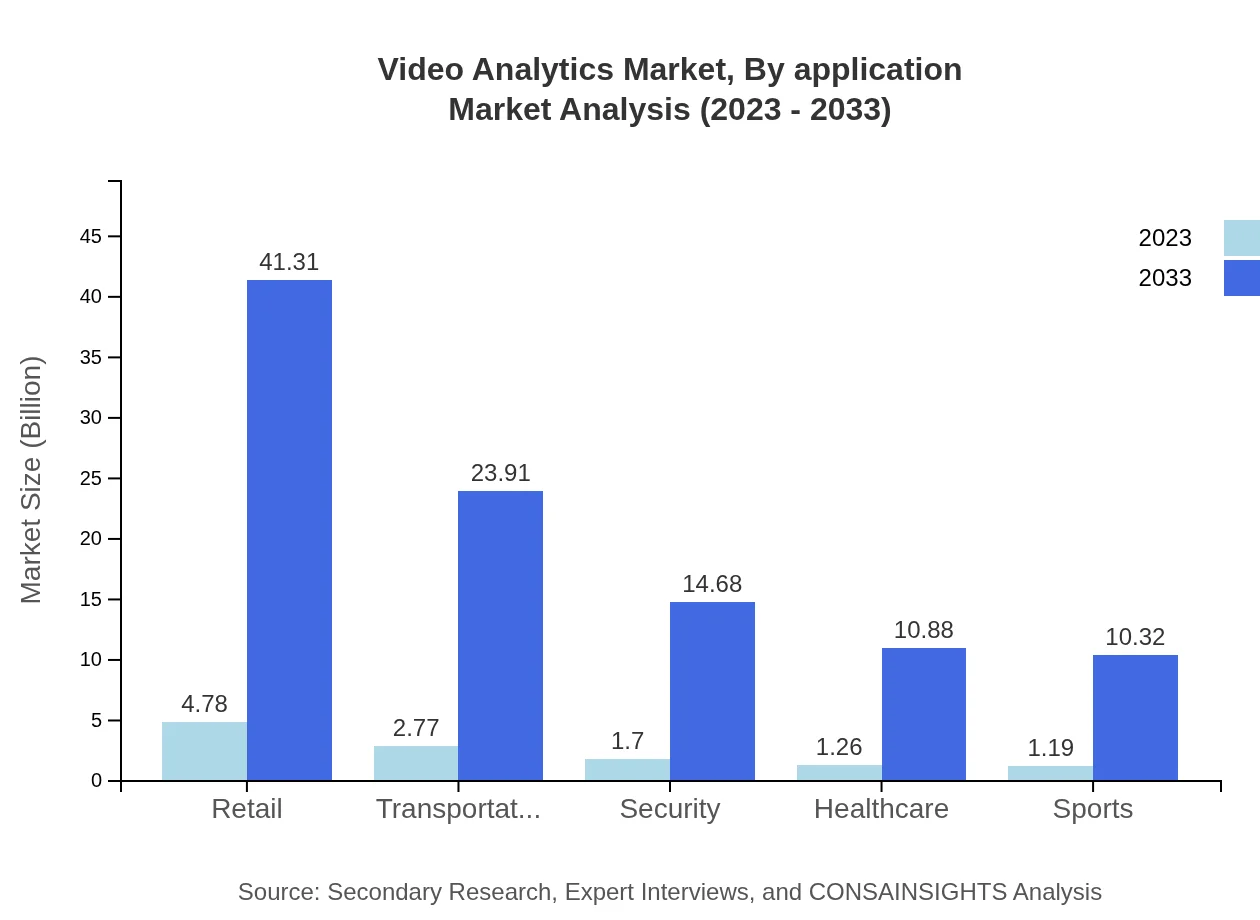

Video Analytics Market Analysis By Application

The key applications of Video Analytics include retail, transportation, security, healthcare, and more. The retail application stands out, projected to grow from $4.78 billion in 2023 to $41.31 billion by 2033, indicating a notable focus on loss prevention and customer activity analysis, maintaining a share of 40.86%. Transportation applications are also on the rise, driven by advancements in traffic management solutions, with a growth forecast from $2.77 billion to $23.91 billion.

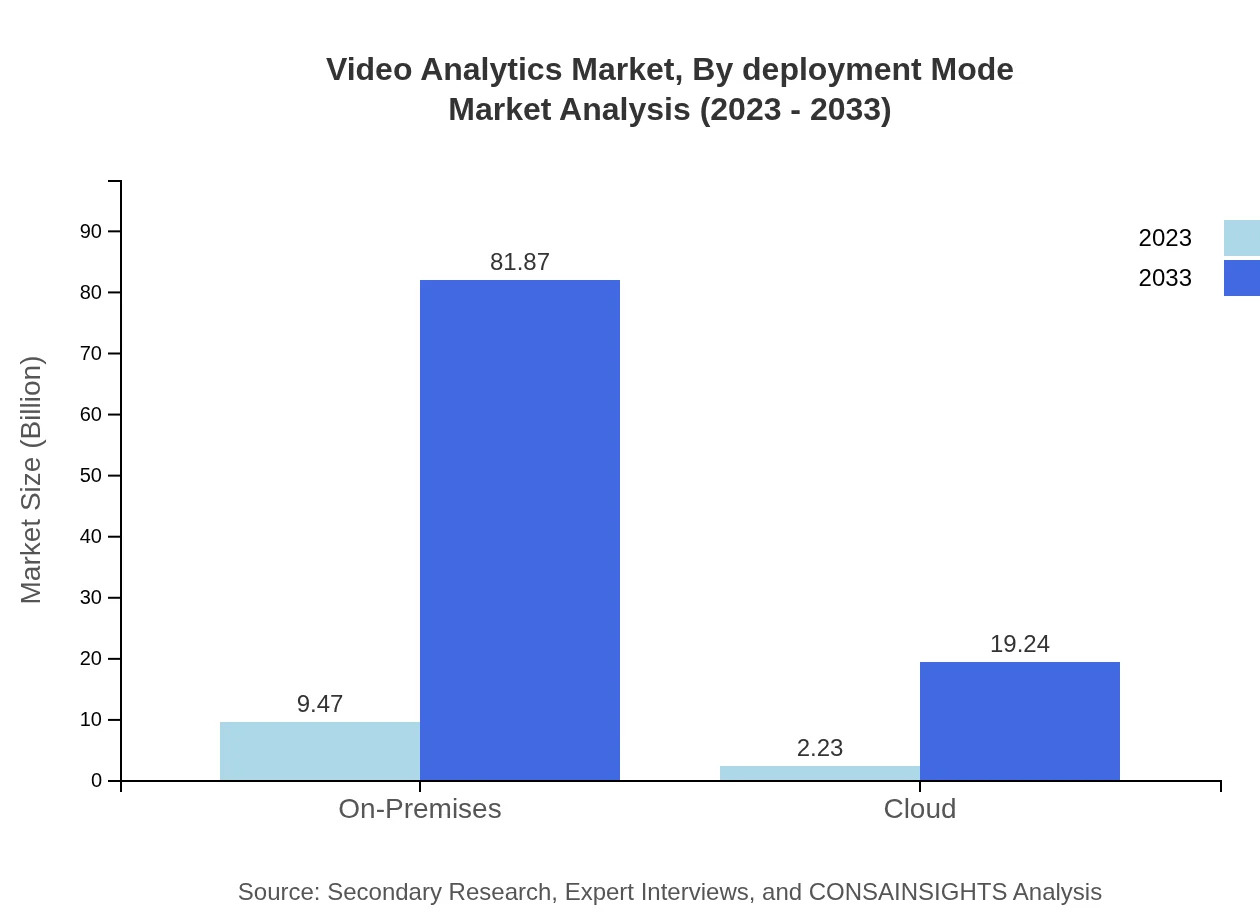

Video Analytics Market Analysis By Deployment Mode

Deployment modes in the Video Analytics Market include on-premises and cloud solutions. The on-premises deployment is currently leading the market, anticipated to escalate from $9.47 billion in 2023 to $81.87 billion by 2033, while also holding a substantial share of 80.97%. Cloud solutions, although trailing, are showing remarkable growth from $2.23 billion to $19.24 billion, reflecting the shift towards more flexible and scalable cloud-based services.

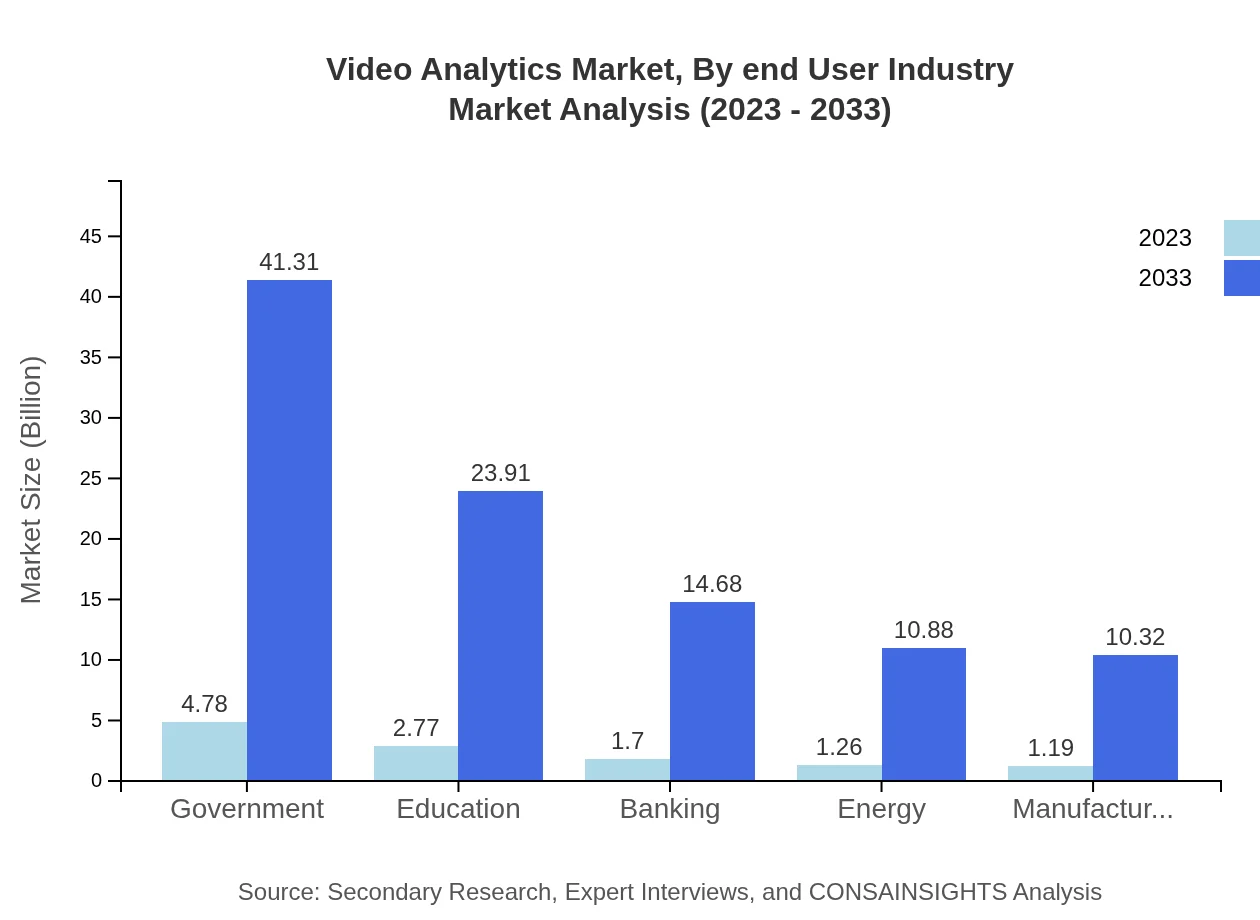

Video Analytics Market Analysis By End User Industry

Various end-user industries such as government, education, banking, energy, manufacturing, healthcare, and sports utilize video analytics for enhanced operational efficiency and security. The government sector, in particular, is projected to grow from $4.78 billion to $41.31 billion, carrying a 40.86% share. The healthcare sector is also on an upward trajectory, driven by patient monitoring and safety protocols, projected to rise from $1.26 billion to $10.88 billion.

Video Analytics Market Analysis By Technology

Emerging technologies such as Machine Learning, Edge Computing, and Artificial Intelligence are significantly influencing the Video Analytics landscape. The Machine Learning segment leads, with a forecast to grow from $7.67 billion to $66.30 billion by 2033. Edge Computing is predicted to expand, reflecting the need for real-time processing, and Artificial Intelligence will also see substantial growth, underlining the drive towards more autonomous systems.

Video Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Video Analytics Industry

Avigilon:

Avigilon, a subsidiary of Motorola Solutions, provides video analytics solutions and surveillance systems to public safety and security markets.Genetec:

Genetec offers an integrated security platform pairing video surveillance with advanced analytics and real-time data insights for various industries.Axis Communications:

Axis Communications specializes in network video solutions, offering innovative video analytics features to assist in security and operational efficiency.BriefCam:

BriefCam focuses on intelligence solutions for video content analysis, helping organizations extract key information from extensive video footage.We're grateful to work with incredible clients.

FAQs

What is the market size of video Analytics?

The video analytics market is projected to reach $11.7 billion by 2033, growing at a remarkable CAGR of 22.6% from its current value. This growth is driven by increased demand for advanced surveillance and analytical technologies across various sectors.

What are the key market players or companies in this video analytics industry?

Key players in the video analytics market include major technology companies and software providers that focus on security, data analytics, and AI. These players are instrumental in shaping market trends and driving innovation in video surveillance technology.

What are the primary factors driving the growth in the video analytics industry?

Factors driving growth include the rising need for public safety, advancements in AI and machine learning technologies, and increasing adoption of smart surveillance solutions across various sectors, including retail, healthcare, and security.

Which region is the fastest Growing in the video analytics?

The fastest-growing region in the video analytics market is North America, projected to increase from $4.25 billion in 2023 to $36.76 billion by 2033. This growth is fueled by high investments in security infrastructure and technology innovation.

Does ConsaInsights provide customized market report data for the video analytics industry?

Yes, ConsaInsights offers customized market report data for the video analytics industry, allowing clients to access tailored insights and analytic solutions that meet their unique business needs and challenges.

What deliverables can I expect from this video Analytics market research project?

Deliverables typically include comprehensive market reports, detailed regional analyses, competitive landscape insights, trend forecasts, and actionable recommendations tailored to guide strategic decision-making.

What are the market trends of video analytics?

Market trends include the rise of AI-powered video analysis tools, increasing adoption of cloud-based solutions, and a growing emphasis on privacy regulations, reshaping how organizations utilize video surveillance technology.