Video Management Software Market Report

Published Date: 31 January 2026 | Report Code: video-management-software

Video Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Video Management Software market, including market size, segmentation, regional analysis, and future trends from 2023 to 2033. Key insights and industry data are presented to understand market dynamics and growth potential.

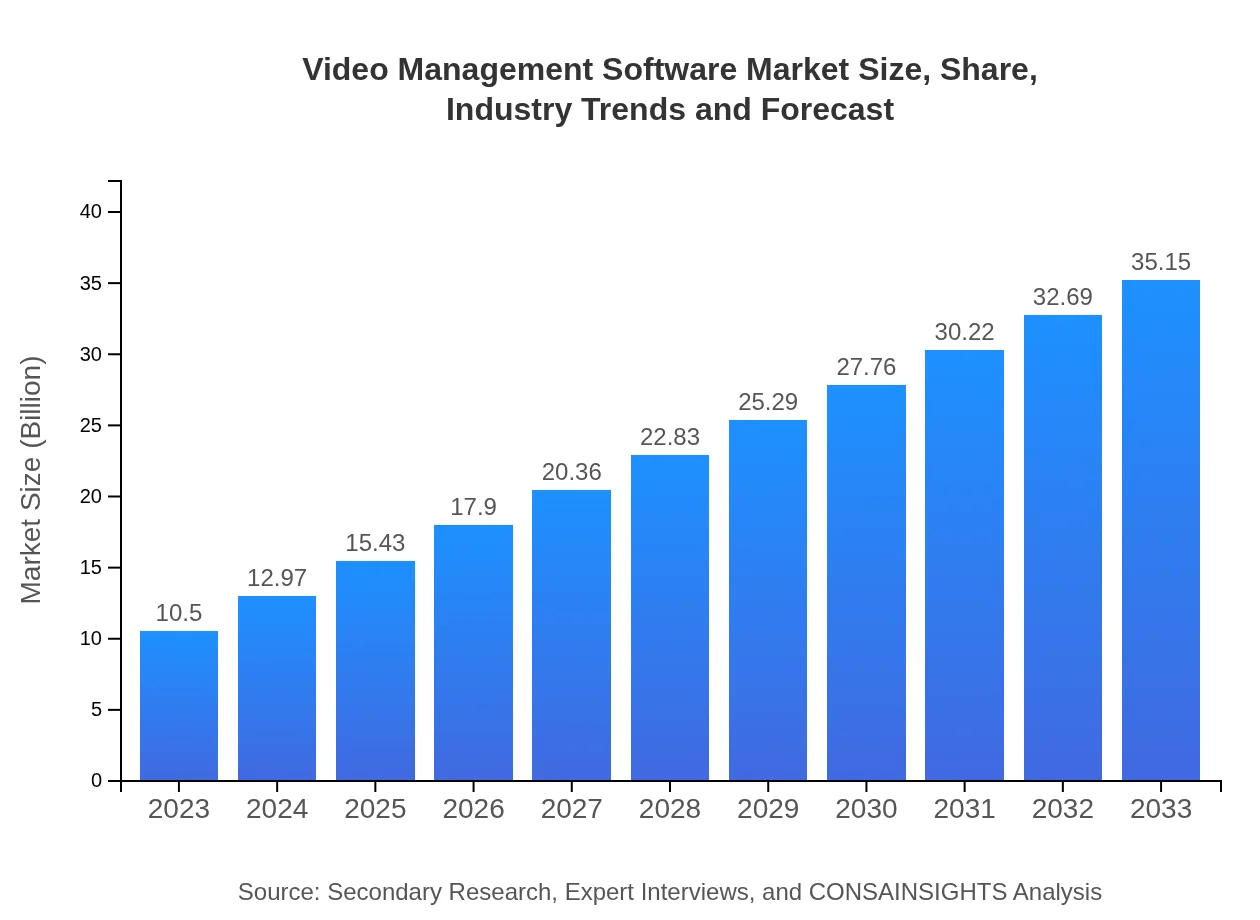

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $35.15 Billion |

| Top Companies | Milestone Systems, Genetec, Axis Communications, Hikvision, Avigilon |

| Last Modified Date | 31 January 2026 |

Video Management Software Market Overview

Customize Video Management Software Market Report market research report

- ✔ Get in-depth analysis of Video Management Software market size, growth, and forecasts.

- ✔ Understand Video Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Video Management Software

What is the Market Size & CAGR of Video Management Software market in 2023?

Video Management Software Industry Analysis

Video Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Video Management Software Market Analysis Report by Region

Europe Video Management Software Market Report:

Europe's market is anticipated to grow from USD 3.07 billion in 2023 to USD 10.29 billion by 2033. This growth reflects the increasing regulatory pressures surrounding surveillance and privacy, alongside widespread adoption of advanced technology for safety and security.Asia Pacific Video Management Software Market Report:

The Asia Pacific region, with a market size of USD 2.12 billion in 2023, is expected to grow to USD 7.10 billion by 2033. This growth is attributed to increasing urbanization and the proliferation of smart technologies, particularly in countries like China and India, where security infrastructure investments are on the rise.North America Video Management Software Market Report:

North America, the largest market, is expected to grow from USD 3.64 billion in 2023 to USD 12.19 billion in 2033, driven by extensive investments in surveillance networks and advancements in VMS technology, particularly in the United States.South America Video Management Software Market Report:

In South America, the market size is projected to increase from USD 0.81 billion in 2023 to USD 2.71 billion by 2033. The growing concerns over public safety and the increasing adoption of smart cities contribute to market growth in this region.Middle East & Africa Video Management Software Market Report:

The Middle East and Africa region is expected to experience steady growth in its VMS market, rising from USD 0.85 billion in 2023 to USD 2.85 billion in 2033. Key drivers include increasing investments in infrastructure and a growing focus on enhancing security measures across various sectors.Tell us your focus area and get a customized research report.

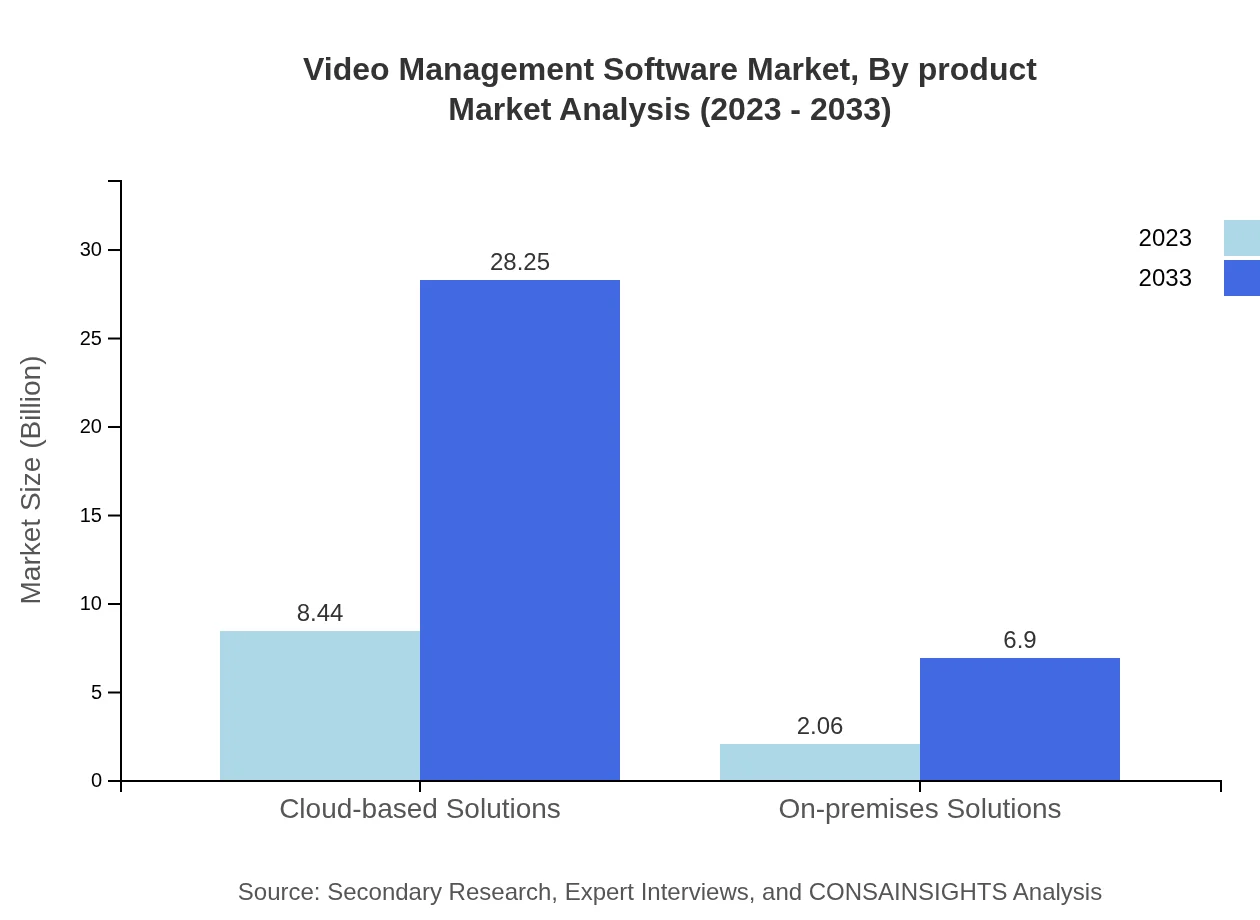

Video Management Software Market Analysis By Product

The Video Management Software market is primarily segmented into Cloud-based Solutions and On-premises Solutions. Cloud-based solutions are dominating the market with a total size of USD 8.44 billion in 2023, projected to rise to USD 28.25 billion by 2033, primarily due to their scalability and cost-effectiveness. On-premises solutions, while smaller at USD 2.06 billion in 2023, will also see growth, reaching USD 6.90 billion by 2033, as organizations with specific security concerns prefer local installations.

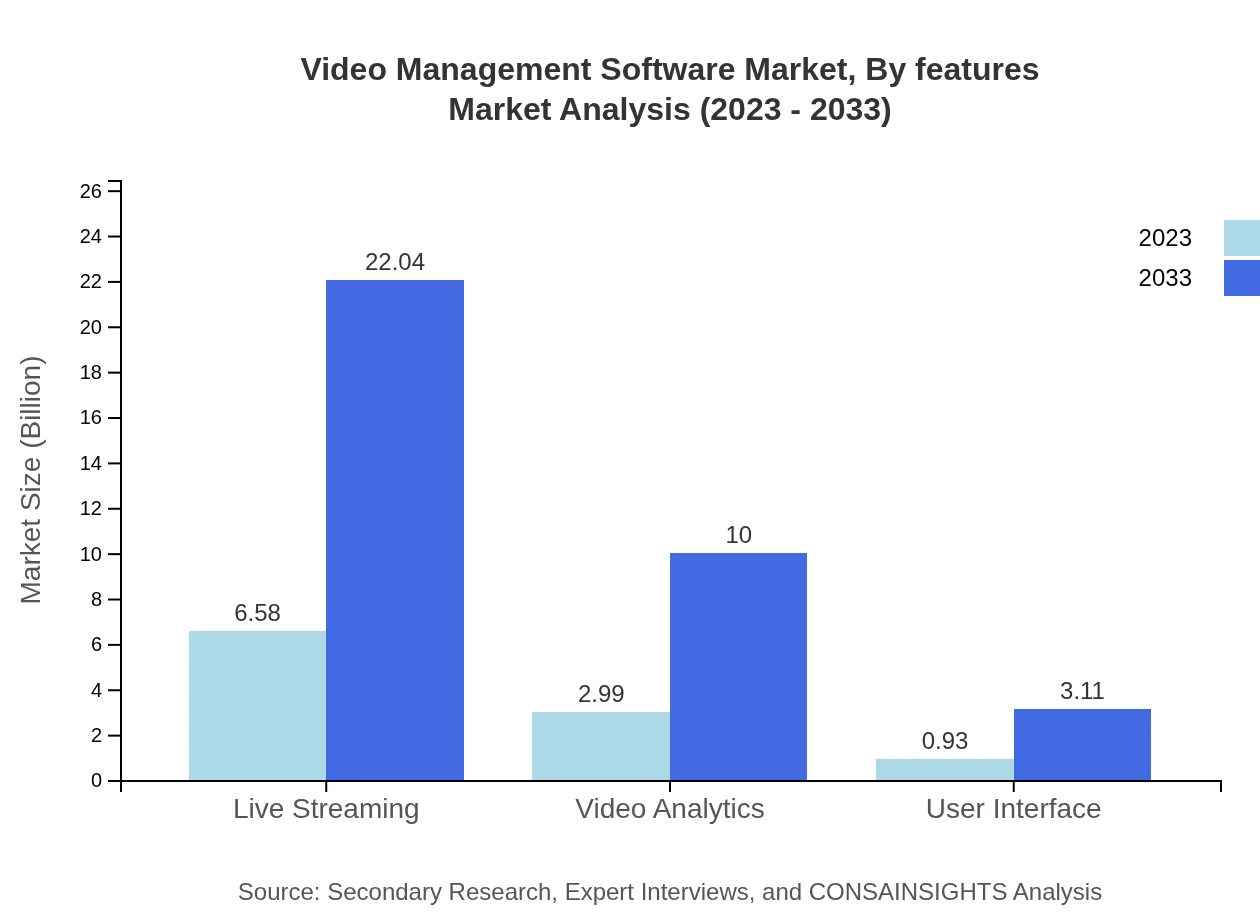

Video Management Software Market Analysis By Features

Key features driving adoption include Live Streaming, Video Analytics, User Interface, and System Integration. Live Streaming technology in VMS is expected to grow from USD 6.58 billion in 2023 to USD 22.04 billion by 2033. Video Analytics will also show significant growth, increasing from USD 2.99 billion to USD 10.00 billion in the same period, indicating the market's shift toward data-driven security solutions.

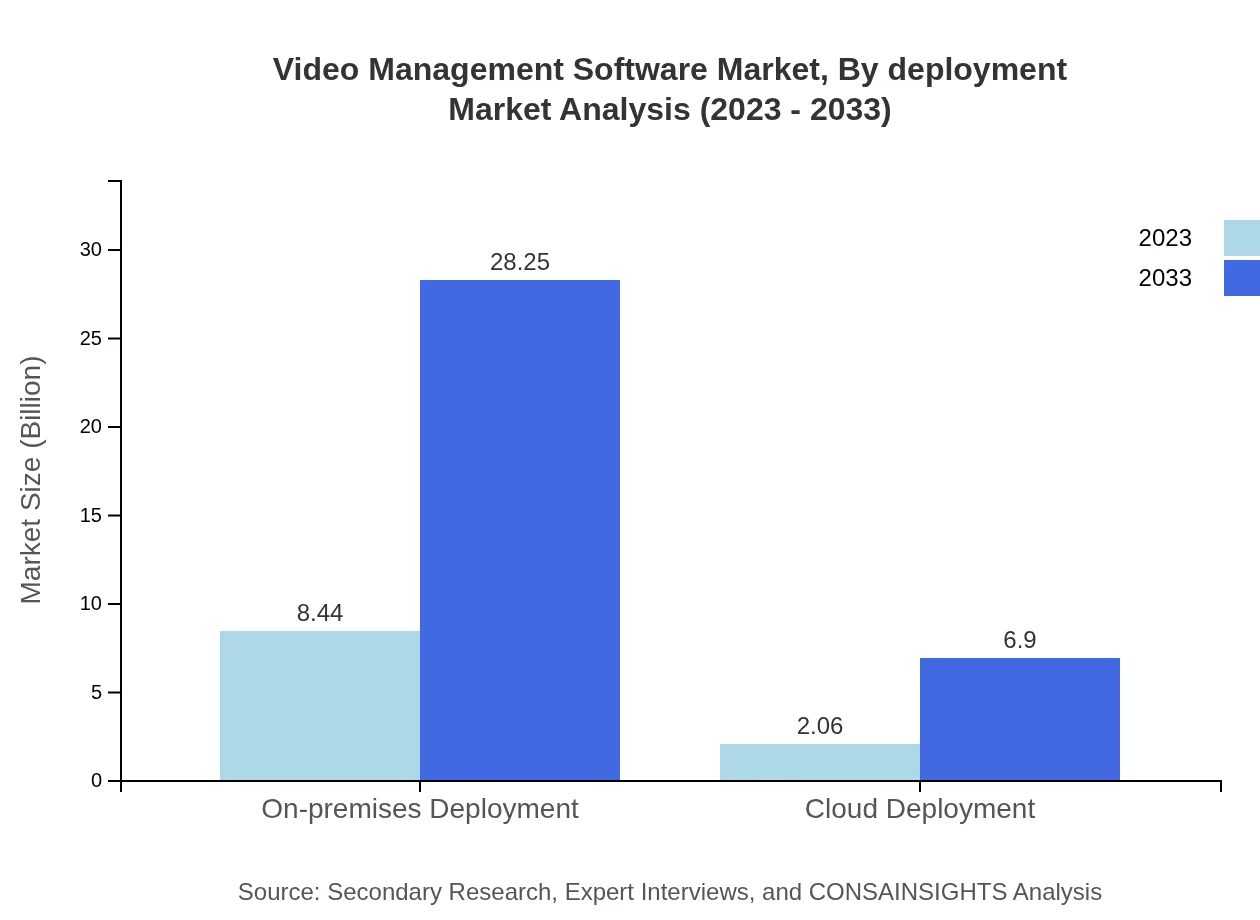

Video Management Software Market Analysis By Deployment

The VMS market is segmented by deployment into Cloud Deployment and On-premises Deployment. The Cloud Deployment segment, valued at USD 2.06 billion in 2023, is anticipated to grow to USD 6.90 billion by 2033. The On-premises Deployment, leading with USD 8.44 billion, is expected to increase at the same rate, proving essential for organizations focusing on data privacy and security.

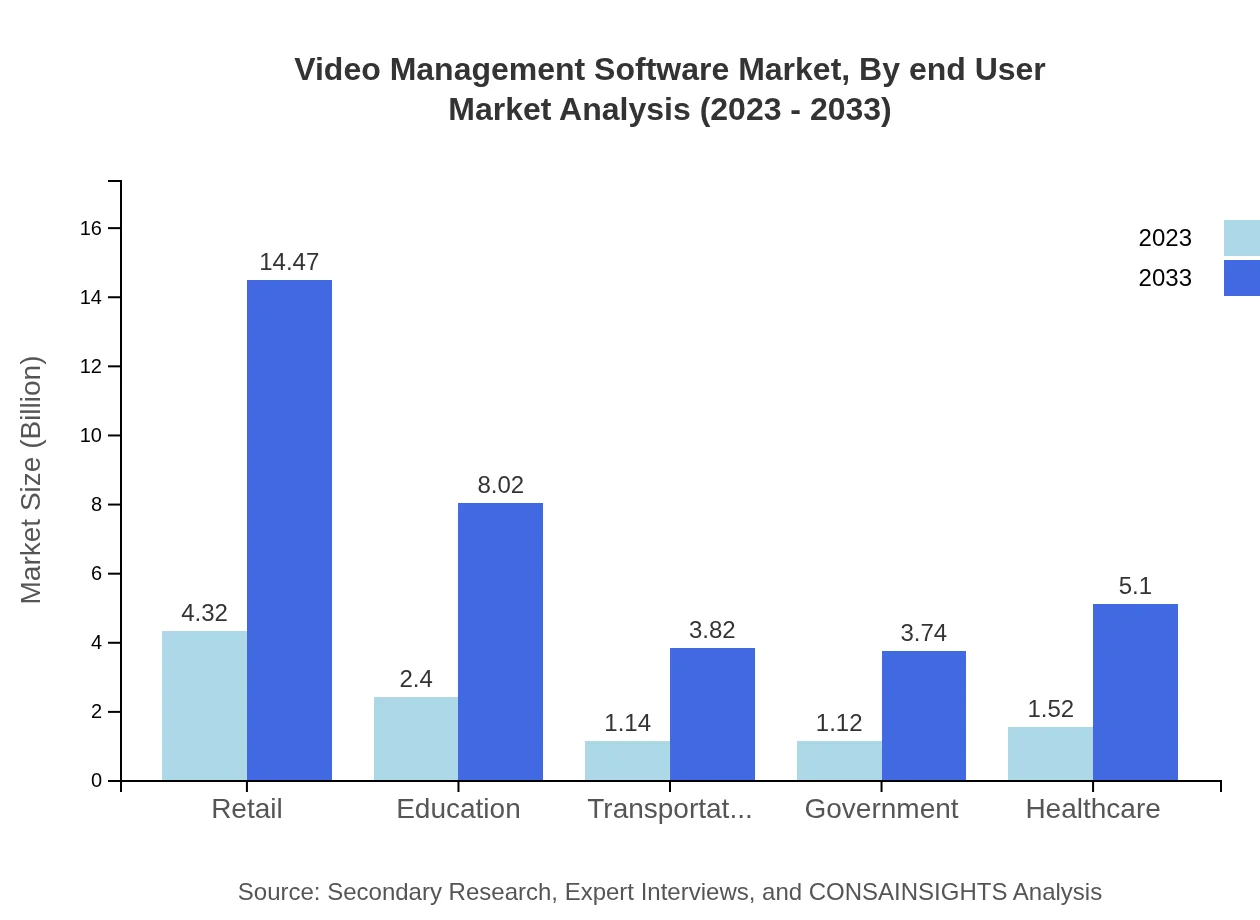

Video Management Software Market Analysis By End User

End-user industries include Retail, Government, Education, Healthcare, and Transportation. The Retail sector, representing USD 4.32 billion in 2023, will grow to USD 14.47 billion by 2033. The Education sector, although smaller at USD 2.40 billion, is expected to expand significantly due to the increasing emphasis on campus safety, reaching USD 8.02 billion.

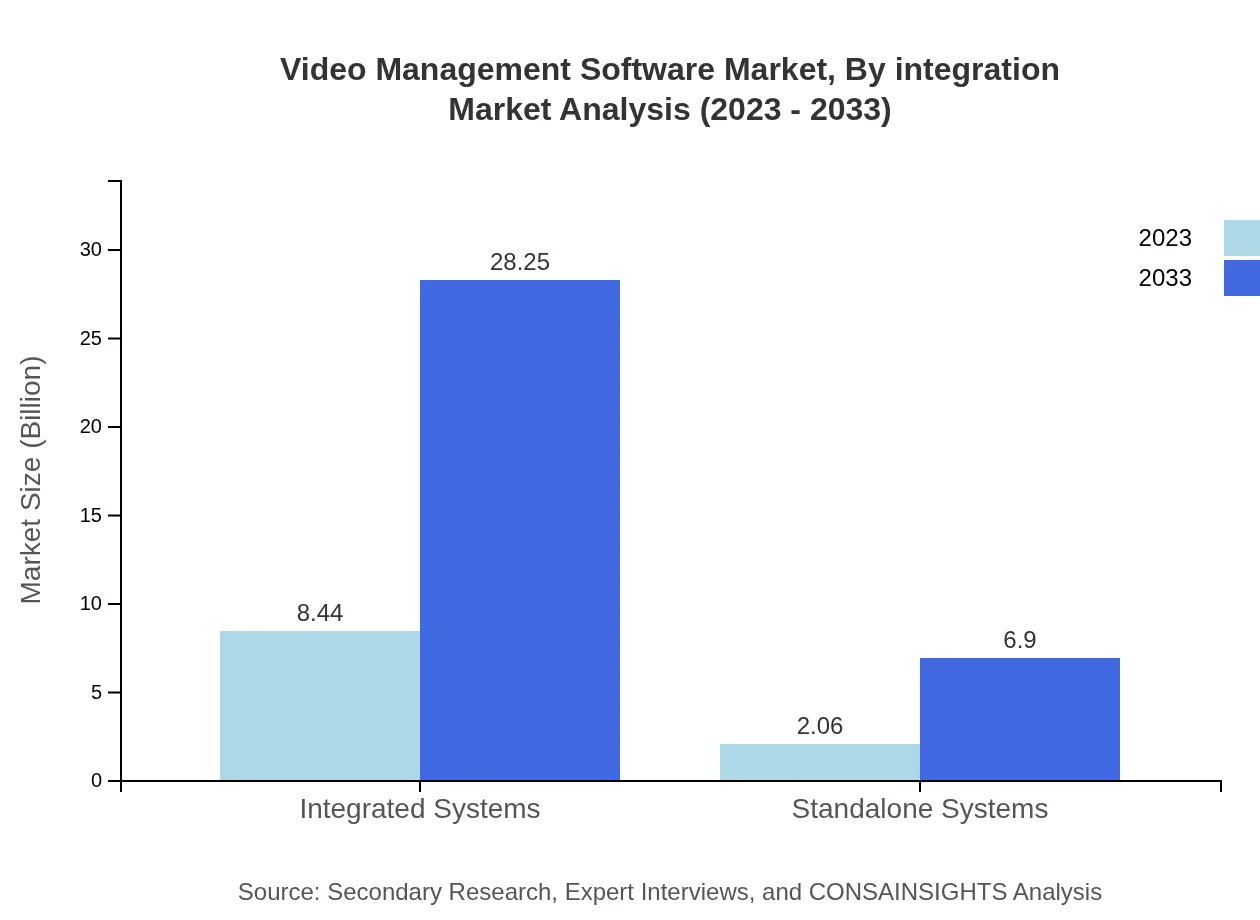

Video Management Software Market Analysis By Integration

Integration types include Integrated Systems and Standalone Systems. Integrated Systems are projected to dominate, growing from USD 8.44 billion to USD 28.25 billion by 2033, emphasizing the market's preference for comprehensive security solutions. Standalone Systems, while prevalent, will see slower growth from USD 2.06 billion to USD 6.90 billion, focusing on specific applications.

Video Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Video Management Software Industry

Milestone Systems:

A leader in the Video Management Software market, Milestone Systems offers robust solutions that cater to a range of industries, known for its scalability and open architecture that simplifies integration.Genetec:

Genetec provides unified security solutions, including advanced VMS, with a focus on cloud-based innovations and real-time data analytics, enhancing user experience and operational efficiency.Axis Communications:

Axis is a key player in the VMS market, known for its high-quality video surveillance products and innovative VMS solutions focused on enhancing security and integration capabilities.Hikvision:

As one of the world's leading suppliers of video surveillance products, Hikvision produces comprehensive VMS solutions that leverage artificial intelligence and machine learning to improve security monitoring.Avigilon:

A subsidiary of Motorola Solutions, Avigilon offers advanced VMS products that integrate AI technologies, providing intelligent alerts and comprehensive monitoring features.We're grateful to work with incredible clients.

FAQs

What is the market size of video Management Software?

The global video management software market is projected to grow from a market size of $10.5 billion in 2023, with a compound annual growth rate (CAGR) of 12.3%, reaching substantial growth by 2033.

What are the key market players or companies in video Management Software industry?

Key players in the video management software market include notable companies that drive innovation and competition, contributing significantly to market dynamics and offering various product solutions to cater to different user needs.

What are the primary factors driving the growth in the video Management Software industry?

Growth is primarily driven by increasing demand for security solutions, advancements in cloud technology, and the rising adoption of video content across industries for marketing and communication purposes.

Which region is the fastest Growing in the video Management Software?

The fastest-growing region in the video management software market is North America, expected to rise from $3.64 billion in 2023 to $12.19 billion by 2033, showcasing significant growth potential.

Does ConsaInsights provide customized market report data for the video Management Software industry?

Yes, ConsaInsights offers tailored market report data for the video management software industry, ensuring businesses receive insights specifically suited to their strategic needs and market interests.

What deliverables can I expect from this video Management Software market research project?

Deliverables include comprehensive market analysis, insights on trends and forecasts, profiles of key players, competitive landscape assessments, and strategic recommendations for effective decision-making.

What are the market trends of video Management Software?

Current trends in the video management software market include a shift towards cloud-based solutions, increased focus on AI-driven video analytics, and growing integration with IoT security systems, enhancing operational efficiency.