Video Surveillance System Market Report

Published Date: 31 January 2026 | Report Code: video-surveillance-system

Video Surveillance System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Video Surveillance System market, covering market trends, size, and growth projections from 2023 to 2033, alongside regional insights and key technology advancements.

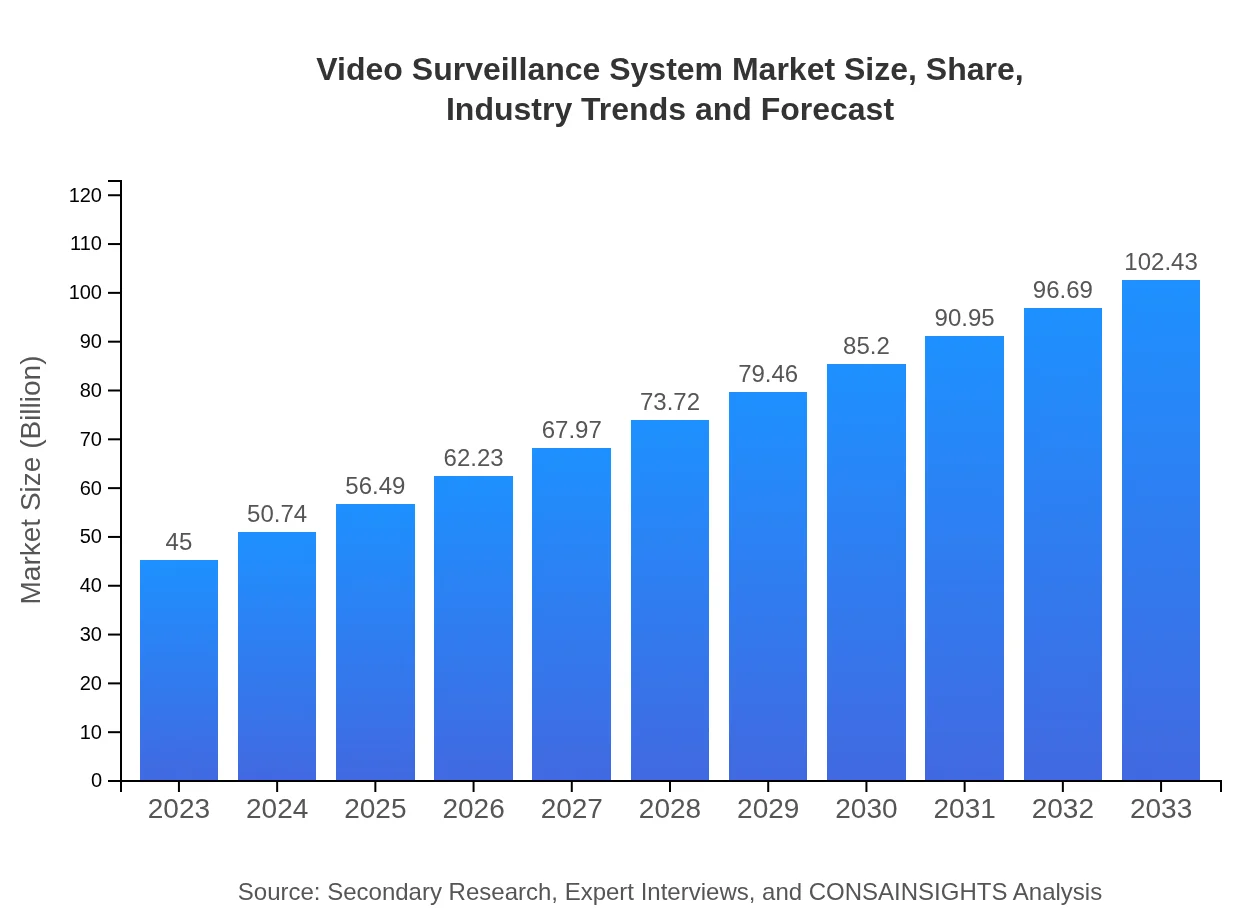

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $102.43 Billion |

| Top Companies | Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell |

| Last Modified Date | 31 January 2026 |

Video Surveillance System Market Overview

Customize Video Surveillance System Market Report market research report

- ✔ Get in-depth analysis of Video Surveillance System market size, growth, and forecasts.

- ✔ Understand Video Surveillance System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Video Surveillance System

What is the Market Size & CAGR of Video Surveillance System market in 2023 and 2033?

Video Surveillance System Industry Analysis

Video Surveillance System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Video Surveillance System Market Analysis Report by Region

Europe Video Surveillance System Market Report:

In Europe, the market is set to grow from $12.35 billion in 2023 to $28.12 billion by 2033. Strong regulatory frameworks supporting security initiatives contribute significantly to this market expansion.Asia Pacific Video Surveillance System Market Report:

The Asia-Pacific region is anticipated to exhibit significant growth, increasing from $8.64 billion in 2023 to $19.66 billion by 2033. This growth is driven by urbanization, investments in infrastructure, and government initiatives to enhance public safety.North America Video Surveillance System Market Report:

North America remains a key player, with the market size increasing from $17.12 billion in 2023 to $38.96 billion in 2033. The adoption of advanced surveillance technologies in various sectors, including defense and retail, drives this growth.South America Video Surveillance System Market Report:

The South American market is relatively smaller but is projected to grow from $0.82 billion in 2023 to $1.87 billion by 2033. Increasing security concerns and a growing middle class are likely to drive demand.Middle East & Africa Video Surveillance System Market Report:

The Middle East and Africa market is expected to rise from $6.07 billion in 2023 to $13.82 billion by 2033, fueled by urbanization, heightened security infrastructure investments, and events that necessitate enhanced surveillance.Tell us your focus area and get a customized research report.

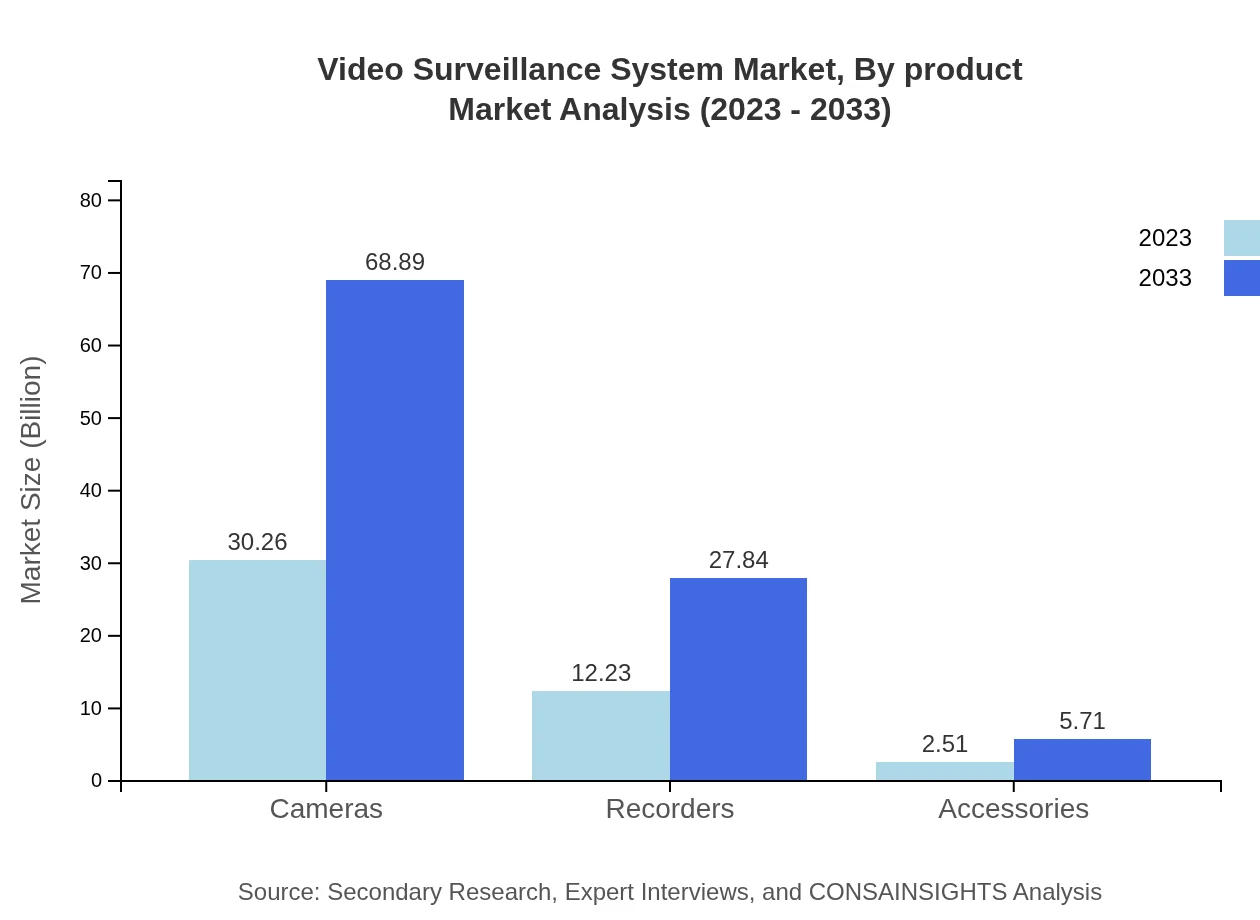

Video Surveillance System Market Analysis By Product

In 2023, the market size for cameras is $30.26 billion, showcasing a robust growth trajectory expected to reach $68.89 billion by 2033. Recorders hold a market size of $12.23 billion in 2023, projected to grow to $27.84 billion, while accessories, starting at $2.51 billion, are forecasted to expand to $5.71 billion.

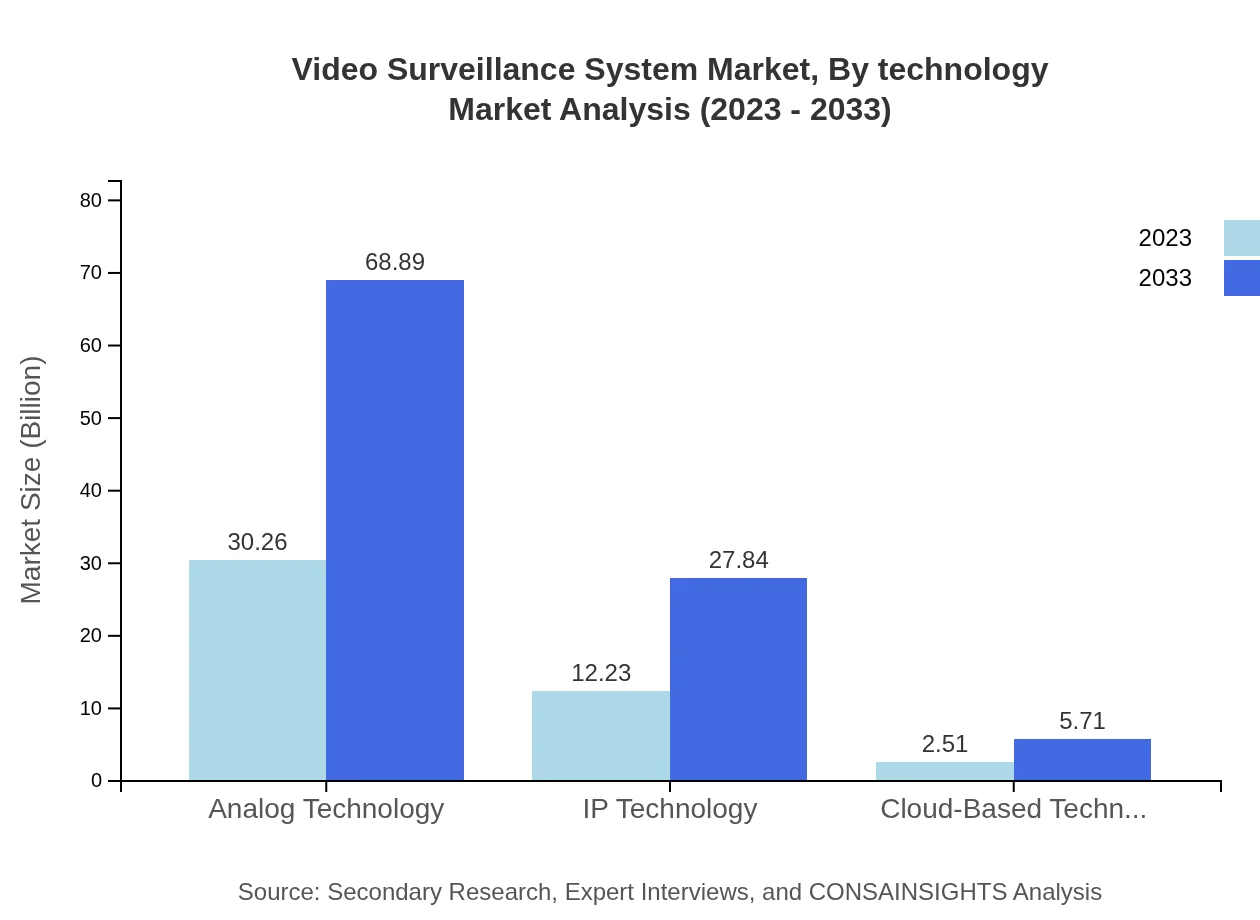

Video Surveillance System Market Analysis By Technology

The Analog Technology segment holds a substantial share, accounting for $30.26 billion in 2023 and expected to grow to $68.89 billion. In contrast, IP Technology and Cloud-Based Technology are gaining traction with market sizes of $12.23 billion and $2.51 billion, respectively, in 2023, projected to expand to $27.84 billion and $5.71 billion by 2033.

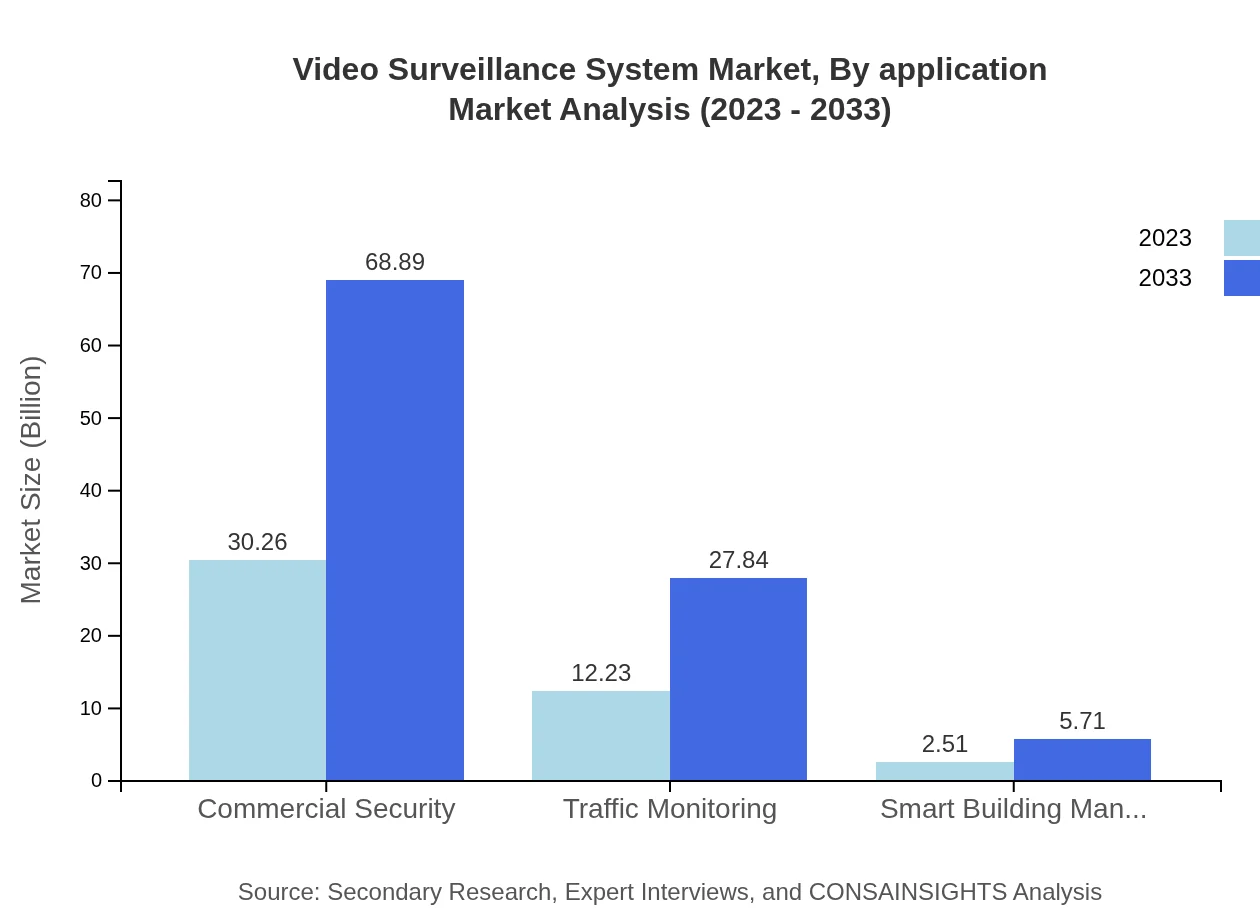

Video Surveillance System Market Analysis By Application

The Commercial Security application dominates, growing from $30.26 billion in 2023 to $68.89 billion by 2033. Traffic Monitoring applications are also significant, growing from $12.23 billion to $27.84 billion, while Smart Building Management is anticipated to reach $5.71 billion, starting from $2.51 billion.

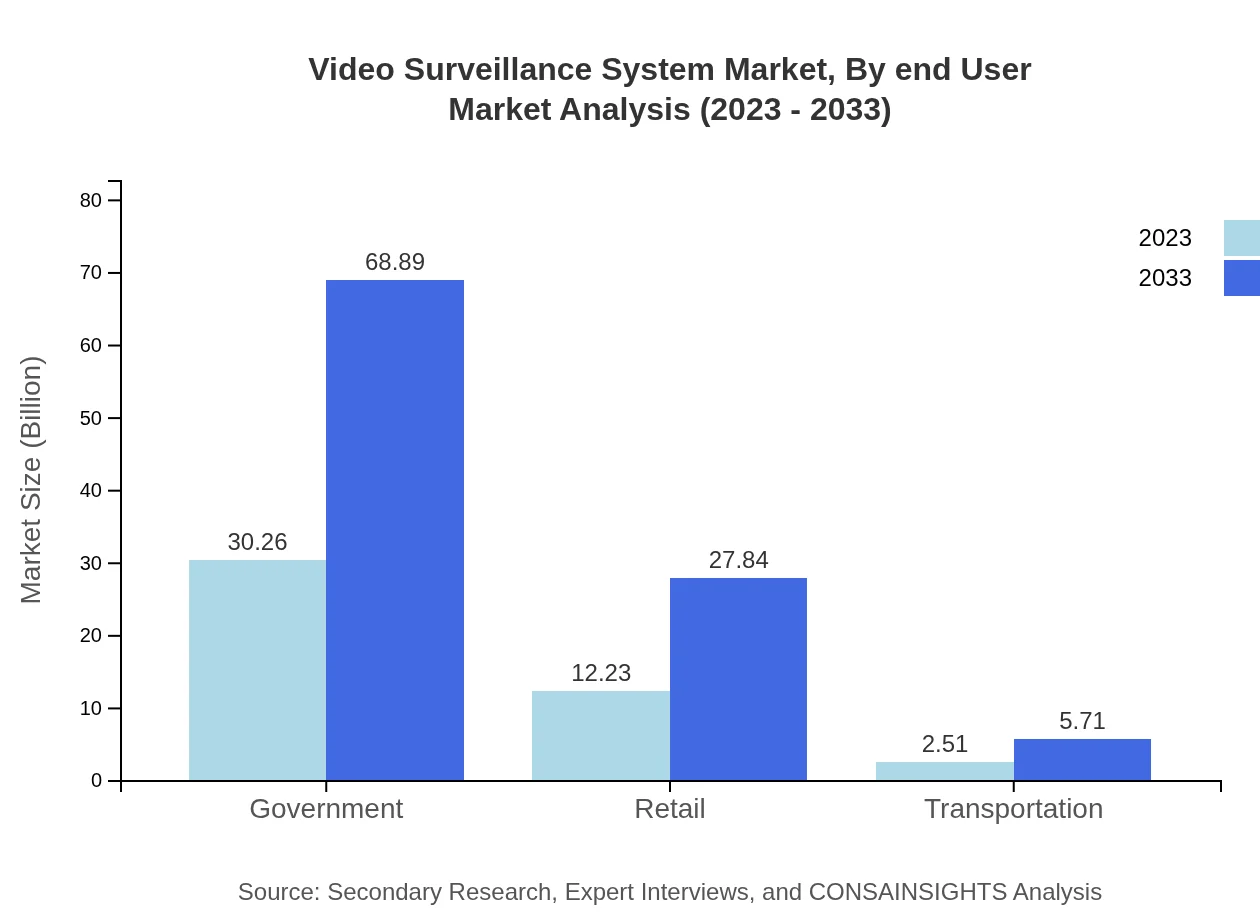

Video Surveillance System Market Analysis By End User

Government applications lead the market with a size of $30.26 billion in 2023, projected to gain ground to $68.89 billion. Retail and Transportation sectors illustrate growth as well, with expected expansions from $12.23 billion to $27.84 billion and from $2.51 billion to $5.71 billion, respectively.

Video Surveillance System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Video Surveillance System Industry

Hikvision:

A global leader providing innovative video surveillance products and solutions that enhance security and intelligence in various sectors.Dahua Technology:

Renowned for its comprehensive product line and advanced imaging technologies, Dahua is committed to being at the forefront of video surveillance and security solutions.Axis Communications:

Pioneers in the development of network cameras and video surveillance technologies, Axis leads the market in providing high-quality security solutions.Bosch Security Systems:

A trusted provider in security technology, Bosch offers a wide range of video surveillance solutions that enhance safety in various applications.Honeywell :

Honeywell delivers innovative security solutions with a strong emphasis on video surveillance products designed for commercial and residential applications.We're grateful to work with incredible clients.

FAQs

What is the market size of video Surveillance System?

The video surveillance system market is projected to reach $45 billion by 2033, growing at a CAGR of 8.3%. This growth reflects increasing security needs across various sectors, particularly given rising concerns around safety and crime.

What are the key market players or companies in this video Surveillance System industry?

Key players in the video surveillance system industry include Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, and Tyco International. These companies significantly influence the market through innovation and advancements in surveillance technology.

What are the primary factors driving the growth in the video Surveillance System industry?

Growth in the video surveillance system industry is driven by increasing urbanization, rising crime rates, technological advancements in surveillance solutions, and the growing demand for smart cities and intelligent building management systems.

Which region is the fastest Growing in the video Surveillance System?

The Asia Pacific region is the fastest-growing area in the video surveillance market, expanding from $8.64 billion in 2023 to $19.66 billion by 2033, driven by rapid urbanization and infrastructure development.

Does ConsaInsights provide customized market report data for the video Surveillance System industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the video surveillance system industry, enabling organizations to gain insights that are aligned with their unique business needs and objectives.

What deliverables can I expect from this video Surveillance System market research project?

From a video surveillance system market research project, you can expect detailed reports, market analysis, segmentation data, trend forecasting, regional analysis, and competitive landscape assessments tailored to inform strategic decision-making.

What are the market trends of video Surveillance System?

Key trends in the video surveillance system market include advancements in AI and analytics, increased demand for cloud-based solutions, integration with IoT devices, and a shift towards IP-enabled surveillance technologies for enhanced security measures.