Vinyl Acetate Market Report

Published Date: 02 February 2026 | Report Code: vinyl-acetate

Vinyl Acetate Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Vinyl Acetate market, covering market size, trends, and forecasts from 2023 to 2033. It highlights industry dynamics, regional insights, and competitive landscape, delivering valuable data for stakeholders in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

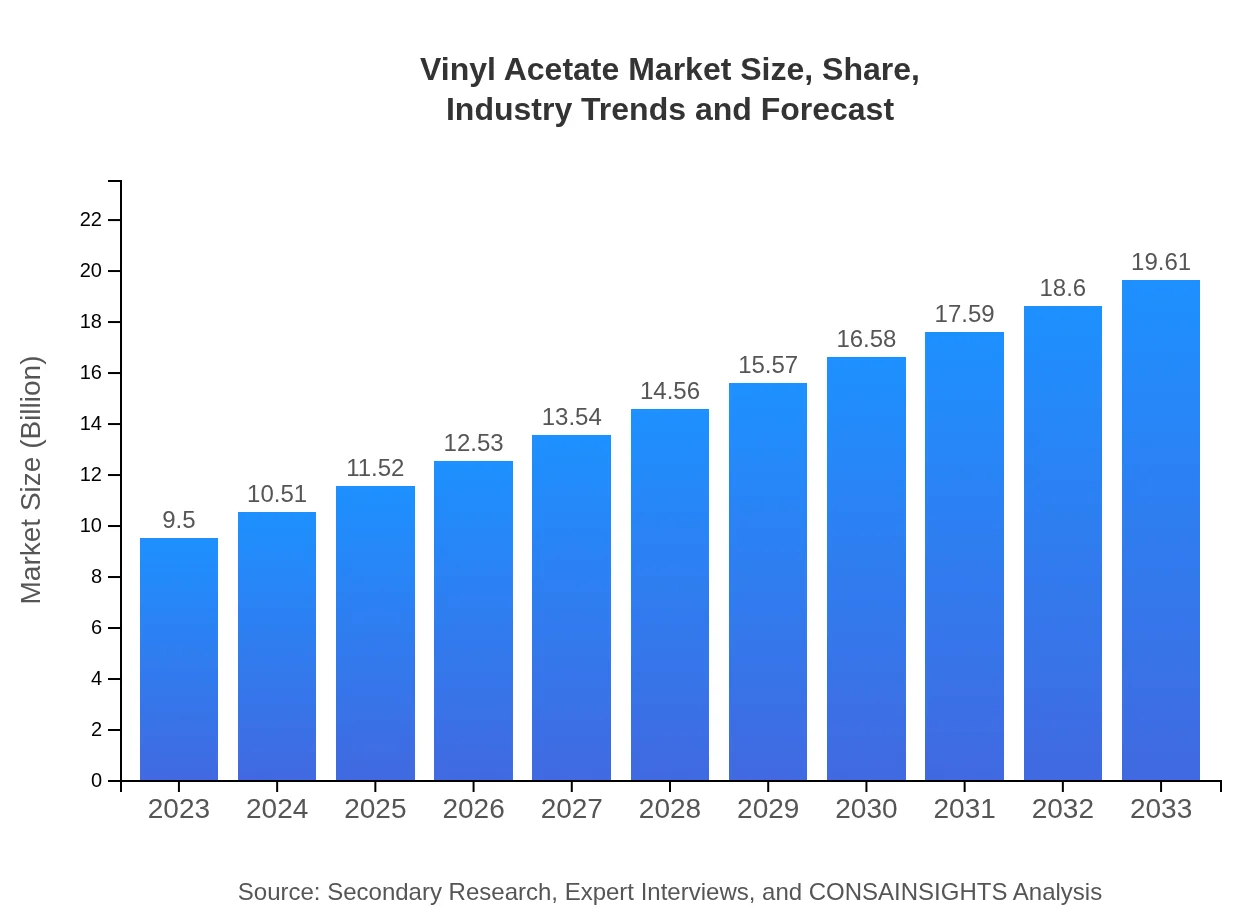

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $19.61 Billion |

| Top Companies | DuPont, BASF SE, Wacker Chemie AG, ExxonMobil |

| Last Modified Date | 02 February 2026 |

Vinyl Acetate Market Overview

Customize Vinyl Acetate Market Report market research report

- ✔ Get in-depth analysis of Vinyl Acetate market size, growth, and forecasts.

- ✔ Understand Vinyl Acetate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vinyl Acetate

What is the Market Size & CAGR of Vinyl Acetate market in 2023?

Vinyl Acetate Industry Analysis

Vinyl Acetate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vinyl Acetate Market Analysis Report by Region

Europe Vinyl Acetate Market Report:

In Europe, the market stands at $2.57 billion in 2023, expected to grow to $5.30 billion by 2033. Stringent regulations regarding environmental safety and increasing demand for sustainable products are steering the market towards innovation and growth.Asia Pacific Vinyl Acetate Market Report:

In 2023, the Asia Pacific Vinyl Acetate market is valued at approximately $1.93 billion and is projected to grow to $3.99 billion by 2033. This growth is propelled by rapid industrialization and urbanization in countries like China and India, leading to increased demand for adhesives and coatings. The region's advancements in manufacturing technologies play a pivotal role in enhancing production capacities.North America Vinyl Acetate Market Report:

North America holds a significant share of the market, valued at $3.45 billion in 2023, projected to reach $7.13 billion by 2033. The growth is largely influenced by the booming automotive and construction sectors, alongside strong demand for environmentally friendly products.South America Vinyl Acetate Market Report:

The South American Vinyl Acetate market was valued at $0.64 billion in 2023, with expectations to grow to $1.33 billion by 2033. The region is witnessing growth in consumer goods and construction, driven by economic recovery and infrastructure investments, leading to increased adoption of Vinyl Acetate applications.Middle East & Africa Vinyl Acetate Market Report:

The Middle East and Africa Vinyl Acetate market is anticipated to grow from $0.90 billion in 2023 to $1.87 billion by 2033. The growth is driven by increasing investments in construction and automotive sectors, alongside rising awareness and demand for high-performance adhesives.Tell us your focus area and get a customized research report.

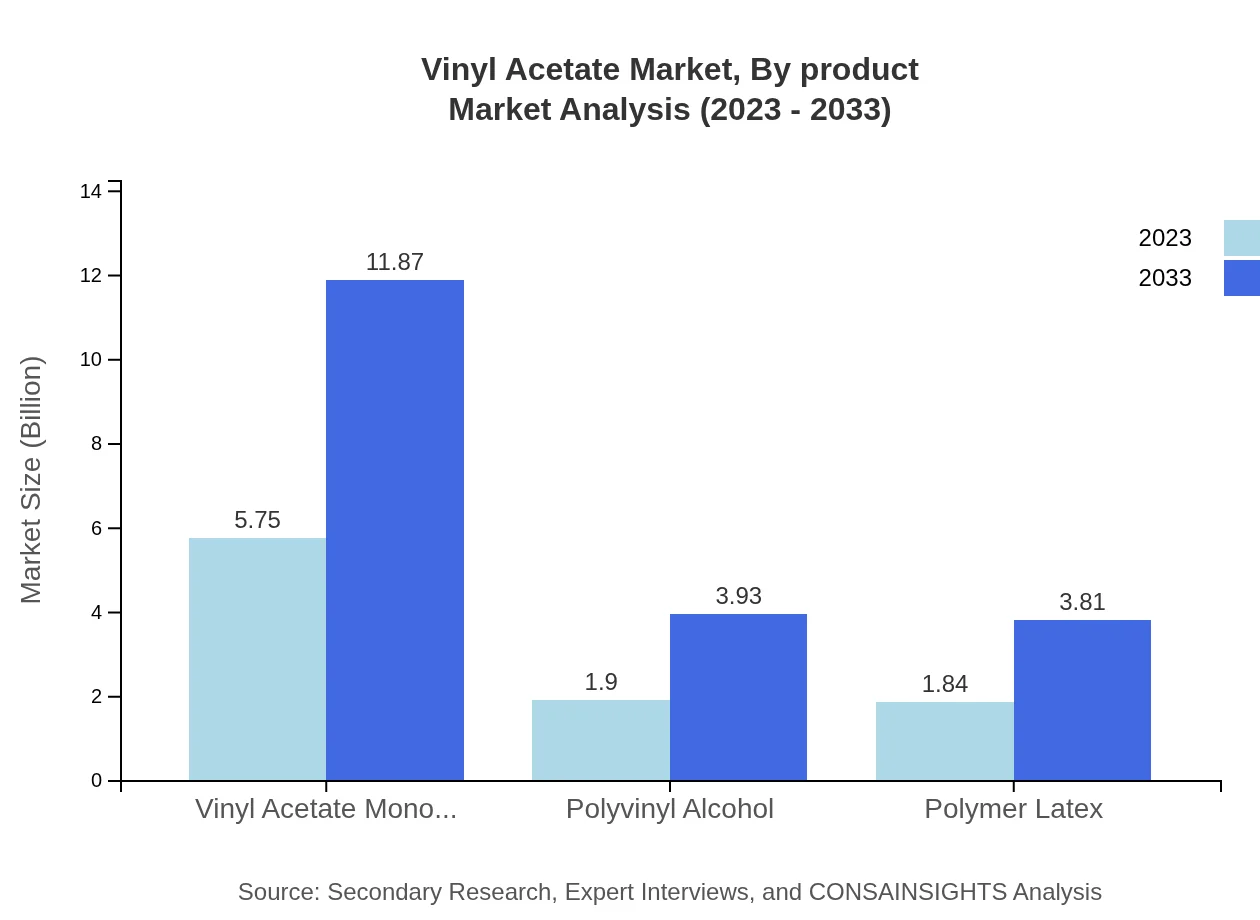

Vinyl Acetate Market Analysis By Product

The Vinyl Acetate market can be divided into several product categories, namely Vinyl Acetate Monomer, Polyvinyl Alcohol, and Polymer Latex. Vinyl Acetate Monomer dominates the market with a share of 60.55% in 2023, accounting for a market size of $5.75 billion and expected to grow to $11.87 billion by 2033. Polyvinyl Alcohol and Polymer Latex also hold significant shares, contributing to the growing demand in various applications such as adhesives and coatings.

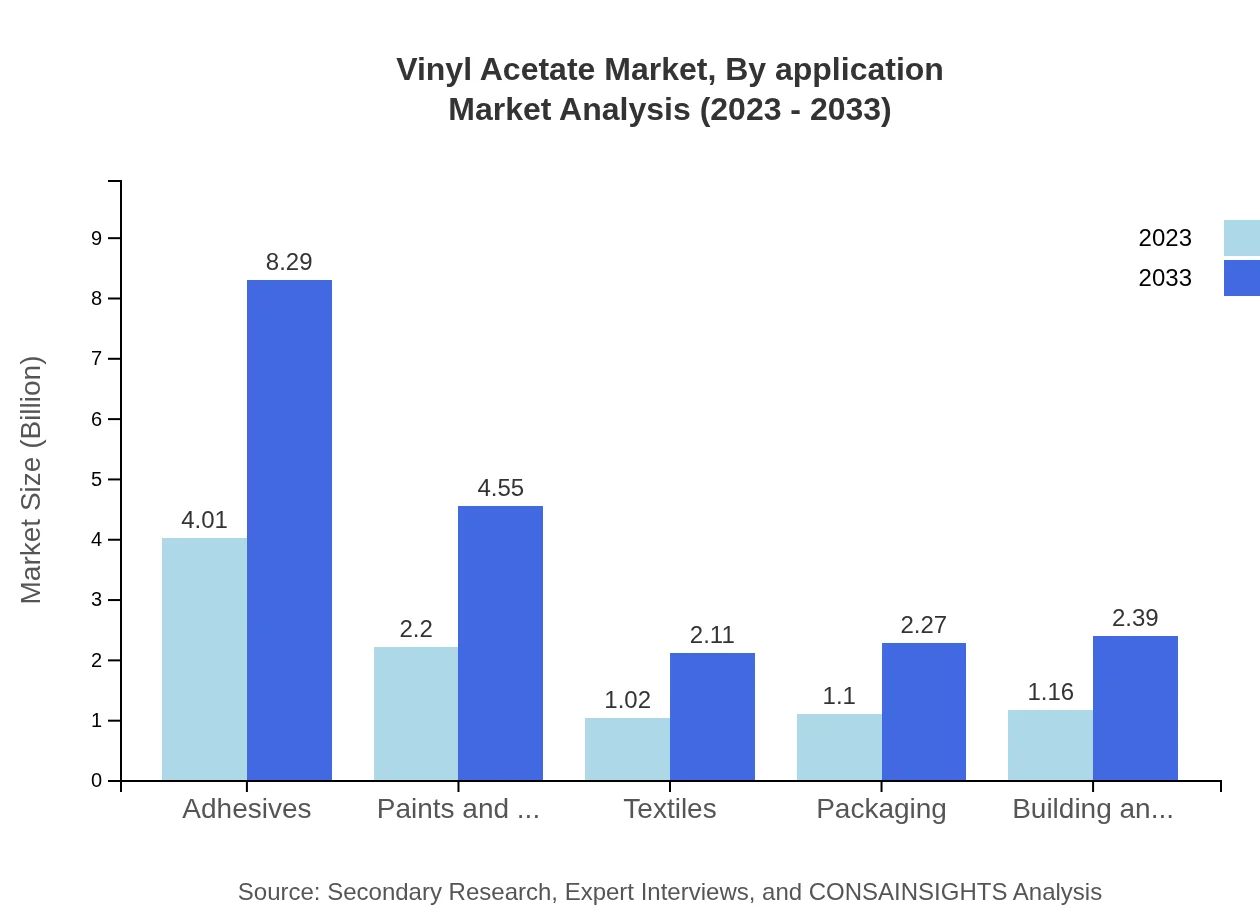

Vinyl Acetate Market Analysis By Application

The primary applications of Vinyl Acetate include Automotive, Construction, and Adhesives. The adhesive segment leads with a size of $4.01 billion in 2023 and is forecasted to rise to $8.29 billion by 2033, representing 42.26% market share. Other significant application areas include paints and coatings, consumer goods, and electronics, each contributing to the growth and diversification of the market.

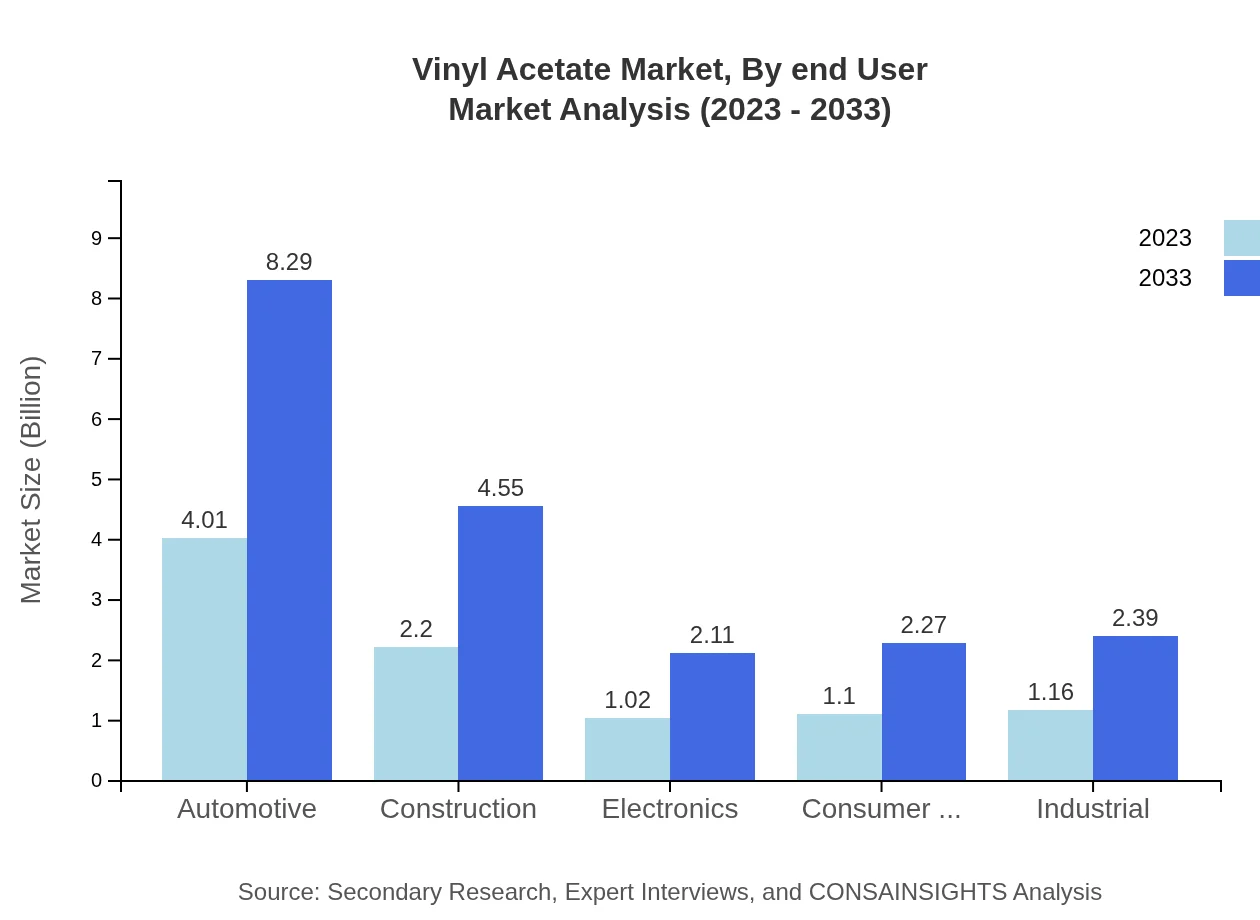

Vinyl Acetate Market Analysis By End User

End-user industries such as construction, automotive, and consumer goods represent major portions of the Vinyl Acetate market. The construction sector, which is experiencing growth due to increased infrastructure projects, accounted for a market size of $2.20 billion in 2023 and is projected to reach $4.55 billion by 2033. The automotive segment is also a key consumer of Vinyl Acetate, using it in various manufacturing processes.

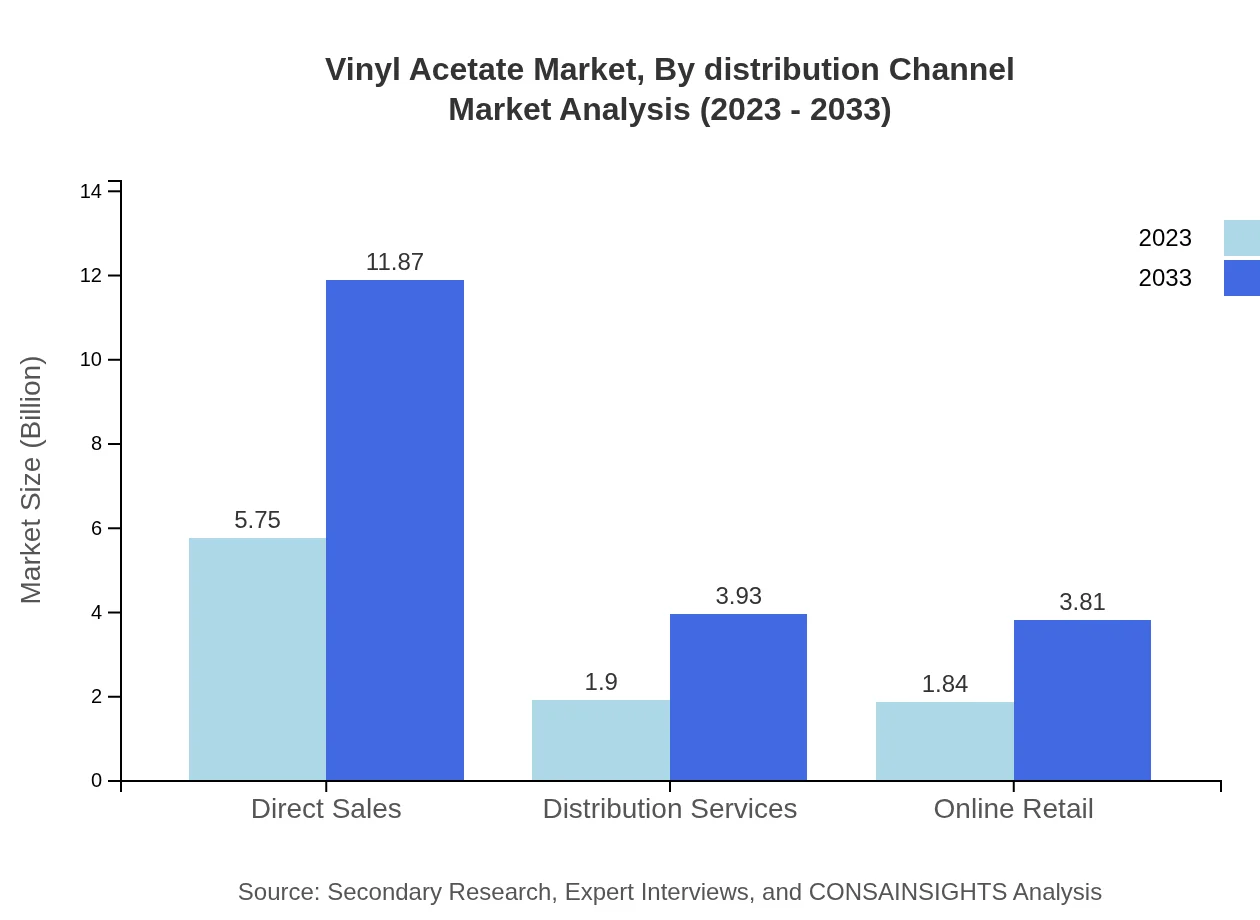

Vinyl Acetate Market Analysis By Distribution Channel

The distribution channels for Vinyl Acetate include Direct Sales, Distribution Services, and Online Retail. Direct Sales dominates the market with a share of 60.55% in 2023. Online Retail is emerging as a significant channel due to changing consumer behavior and the increasing shift towards e-commerce platforms, suggesting a future trend for market engagement.

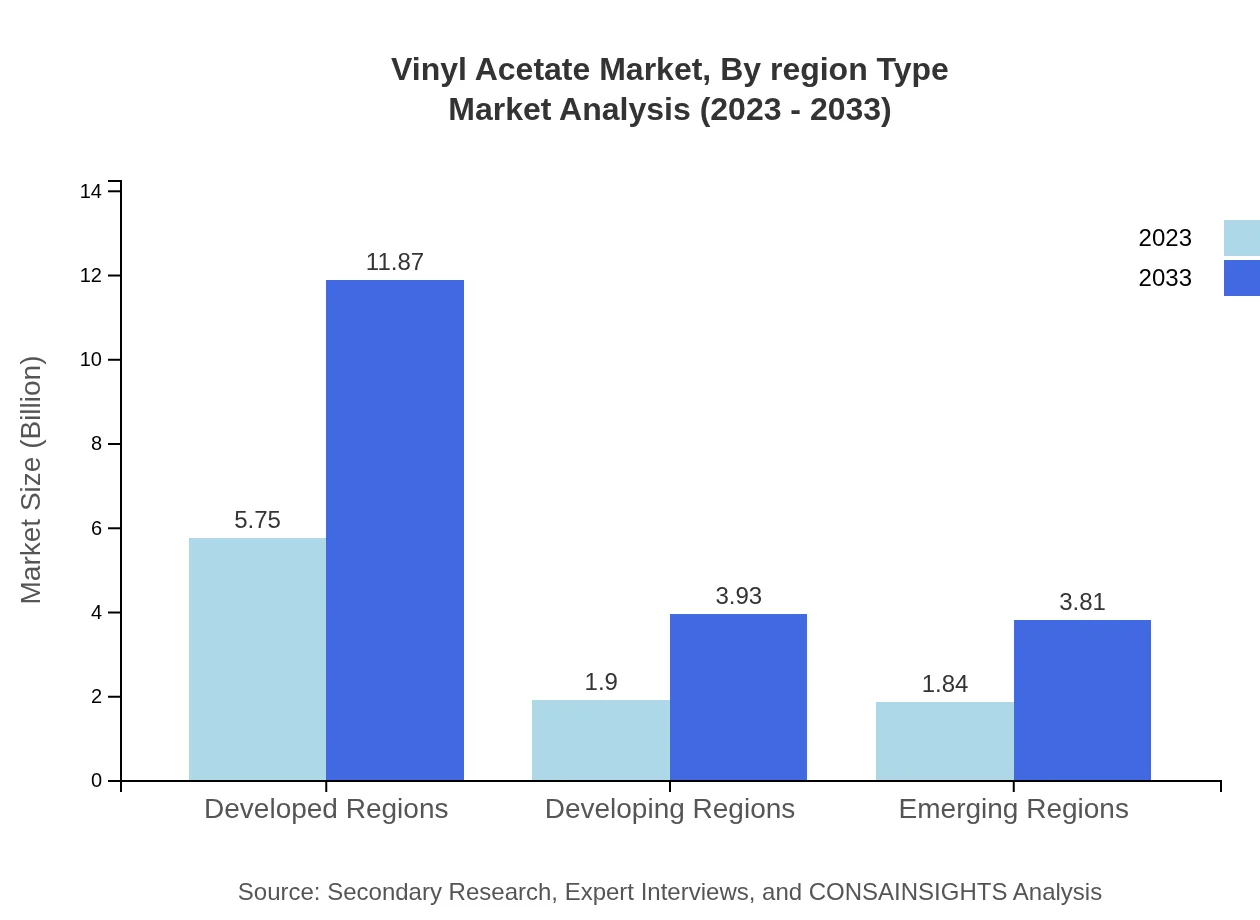

Vinyl Acetate Market Analysis By Region Type

The Vinyl Acetate market can be classified into Developed Regions and Developing Regions. Developed Regions currently account for a substantial share of the market, valued at $5.75 billion in 2023 and projected to reach $11.87 billion by 2033. Meanwhile, Developing Regions are also emerging, highlighting the importance of global market diversification as these regions continue to grow and adopt Vinyl Acetate across various applications.

Vinyl Acetate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vinyl Acetate Industry

DuPont:

DuPont, a leader in specialty materials, is known for its innovative approaches in delivering high-quality Vinyl Acetate products, enhancing its application versatility across diverse sectors.BASF SE:

BASF SE, one of the largest chemical producers, plays a significant role in the Vinyl Acetate market through its extensive portfolio and commitment to sustainability.Wacker Chemie AG:

Wacker Chemie AG focuses on high-performance chemical products and is recognized for its contributions to the Vinyl Acetate industry through continuous R&D and product development.ExxonMobil:

ExxonMobil leverages its extensive experience in chemical production to supply Vinyl Acetate to various end-user industries, driving innovations in synthesis methods.We're grateful to work with incredible clients.

FAQs

What is the market size of vinyl Acetate?

The vinyl-acetate market was valued at approximately $9.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.3% expected through 2033. This growth indicates a robust demand across various applications, reinforcing its significance in the chemical industry.

What are the key market players or companies in the vinyl Acetate industry?

Key players in the vinyl-acetate market include major chemical manufacturers and producers known for innovative applications. These include companies such as DuPont, Wacker Chemie AG, and Celanese Corporation, which are pivotal in shaping the market's landscape through their technological advancements.

What are the primary factors driving the growth in the vinyl Acetate industry?

The growth of the vinyl-acetate industry is driven by several factors, including increased demand for adhesives, paints, and coatings, the expansion of automotive production, as well as construction activities globally. These sectors significantly contribute to the rising consumption of vinyl-acetate products.

Which region is the fastest Growing in the vinyl Acetate?

The fastest-growing region in the vinyl-acetate market is projected to be North America. From a market size of $3.45 billion in 2023, it is expected to grow to $7.13 billion by 2033, reflecting a vibrant manufacturing and automotive sectors in the region.

Does ConsaInsights provide customized market report data for the vinyl Acetate industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the vinyl-acetate industry. This service provides in-depth analysis and insights tailored to individual business needs, ensuring clients receive the most relevant and actionable information.

What deliverables can I expect from this vinyl Acetate market research project?

Deliverables from the vinyl-acetate market research project typically include detailed reports on market size, growth forecasts, competitive landscape analyses, and segment breakdowns. Visual representations such as graphs and charts may also be included for clarity.

What are the market trends of vinyl Acetate?

Current trends in the vinyl-acetate market include a shift towards eco-friendly products, increased innovation in adhesive technologies, and a rising focus on sustainable manufacturing processes. This trend aligns with global sustainability efforts, impacting production and consumption patterns.