Vinyl Floor Covering Market Report

Published Date: 24 January 2026 | Report Code: vinyl-floor-covering

Vinyl Floor Covering Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vinyl Floor Covering market, covering current trends, market size from 2023 to 2033, and regional insights. It aims to equip stakeholders with valuable data and forecasts necessary for strategic planning and market positioning.

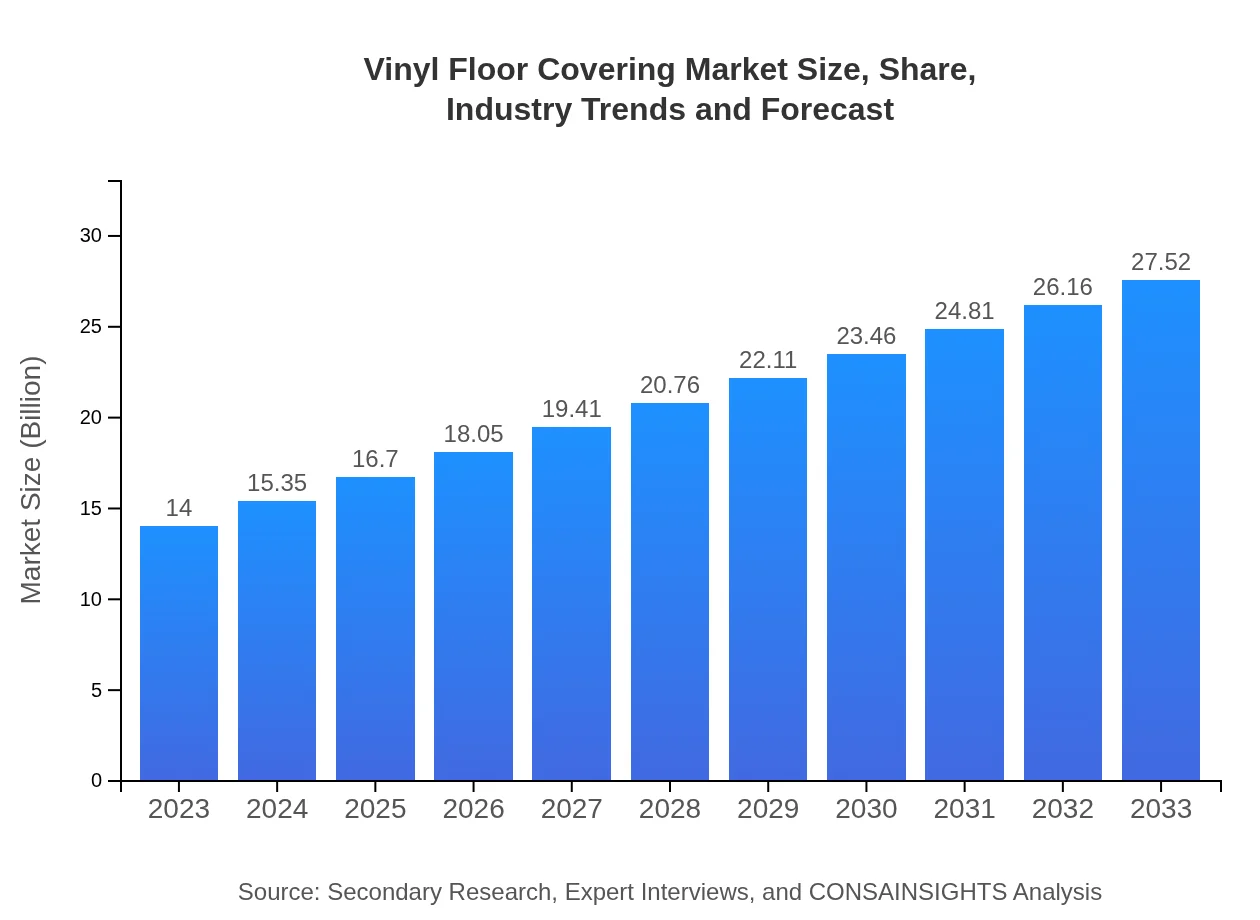

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $27.52 Billion |

| Top Companies | Mohawk Industries, Inc., Armstrong Flooring, Inc., Shaw Industries Group, Inc., Gerflor Group |

| Last Modified Date | 24 January 2026 |

Vinyl Floor Covering Market Overview

Customize Vinyl Floor Covering Market Report market research report

- ✔ Get in-depth analysis of Vinyl Floor Covering market size, growth, and forecasts.

- ✔ Understand Vinyl Floor Covering's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vinyl Floor Covering

What is the Market Size & CAGR of Vinyl Floor Covering market in 2023?

Vinyl Floor Covering Industry Analysis

Vinyl Floor Covering Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vinyl Floor Covering Market Analysis Report by Region

Europe Vinyl Floor Covering Market Report:

In Europe, the market size is $4.11 billion in 2023, projected to reach $8.07 billion by 2033. Growing environmental concerns and the shift towards sustainable building materials drive the adoption of vinyl flooring, particularly in eco-friendly renovations.Asia Pacific Vinyl Floor Covering Market Report:

In the Asia Pacific region, the Vinyl Floor Covering market was valued at $2.57 billion in 2023 and is expected to reach $5.06 billion by 2033. The growth is driven by rapid urbanization, increasing disposable incomes, and an expanding real estate sector, particularly in China and India.North America Vinyl Floor Covering Market Report:

North America holds a significant market share, valued at $5.31 billion in 2023 and expected to grow to $10.44 billion by 2033. The strong demand for vinyl flooring in the residential renovations and commercial sectors bolsters this growth, with the U.S. being a key contributor.South America Vinyl Floor Covering Market Report:

The South American market is relatively small, with a size of $0.18 billion in 2023 that is projected to grow to $0.35 billion by 2033. The demand is mainly from the residential sector, as consumers begin to favor cost-effective flooring solutions.Middle East & Africa Vinyl Floor Covering Market Report:

The Middle East and Africa market was valued at $1.83 billion in 2023 and is anticipated to hit $3.59 billion by 2033, fueled by infrastructure development projects and a growing hospitality sector in countries like the UAE and South Africa.Tell us your focus area and get a customized research report.

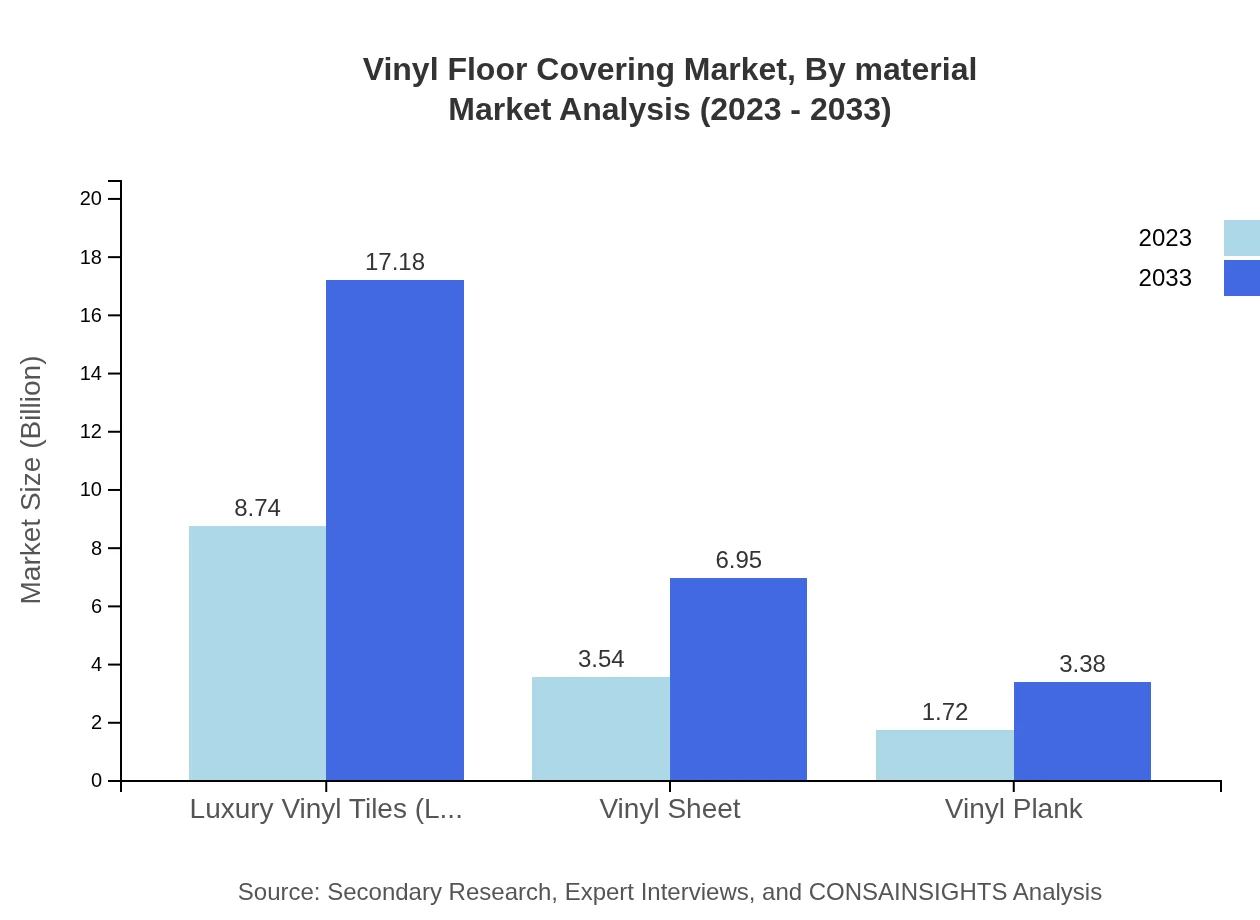

Vinyl Floor Covering Market Analysis By Material

The Vinyl Floor Covering market by material type includes Luxury Vinyl Tiles (LVT), Vinyl Sheet, and Vinyl Plank. In 2023, LVT represents the largest segment with a market size of $8.74 billion, expected to grow to $17.18 billion by 2033. Vinyl Sheet and Vinyl Plank follow, with sizes of $3.54 billion and $1.72 billion in 2023, expected to increase to $6.95 billion and $3.38 billion respectively by 2033. The significant size of the LVT segment underlines the consumer trend toward high-quality and visually appealing products.

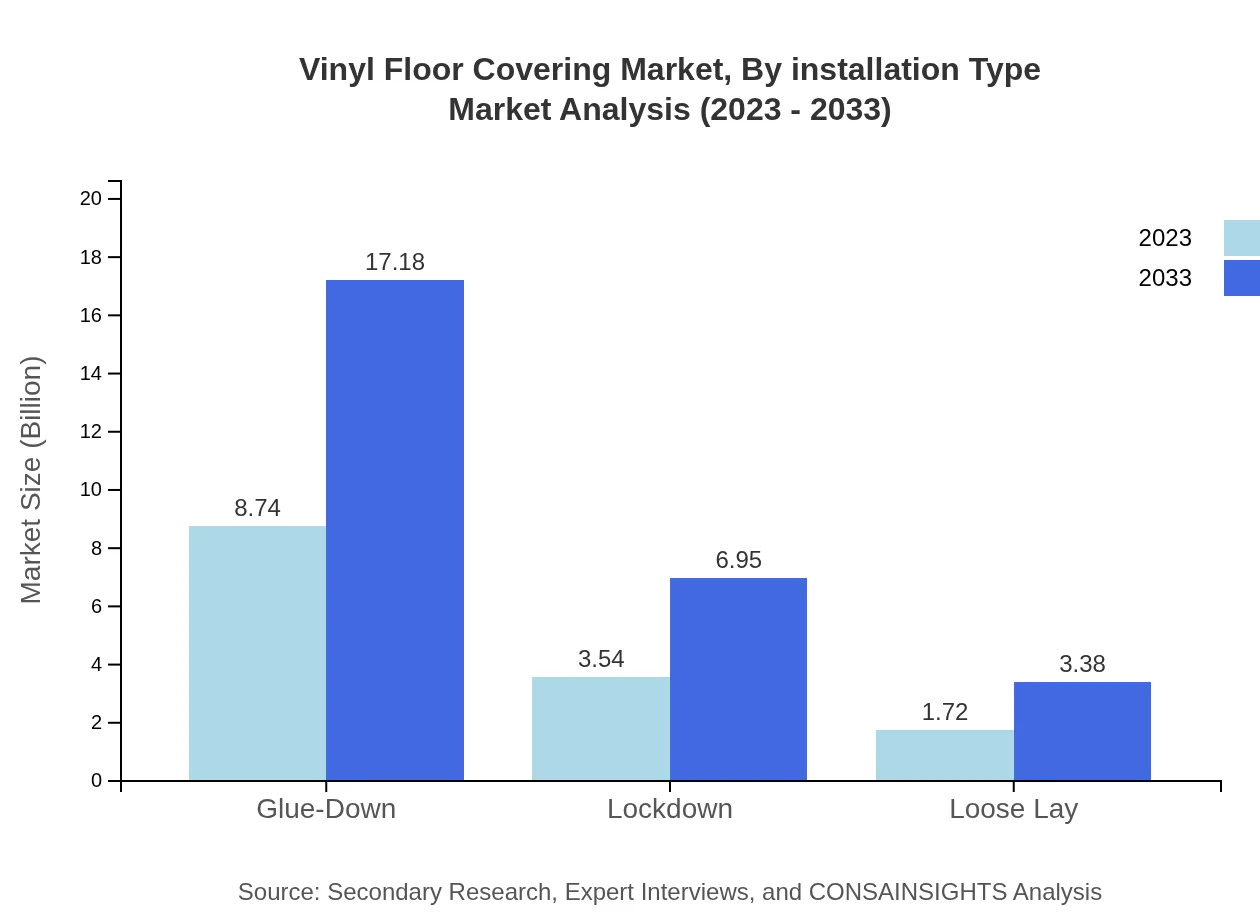

Vinyl Floor Covering Market Analysis By Installation Type

The market also segments into Glue-Down, Lockdown, and Loose Lay installation types. Glue-Down installations dominate with a size of $8.74 billion in 2023, projected to grow to $17.18 billion by 2033. Lockdown installations, valued at $3.54 billion in 2023, will reach $6.95 billion, while Loose Lay installations grow from $1.72 billion to $3.38 billion. The ease of installation and removal for the latter two segments is driving their popularity among consumers and contractors.

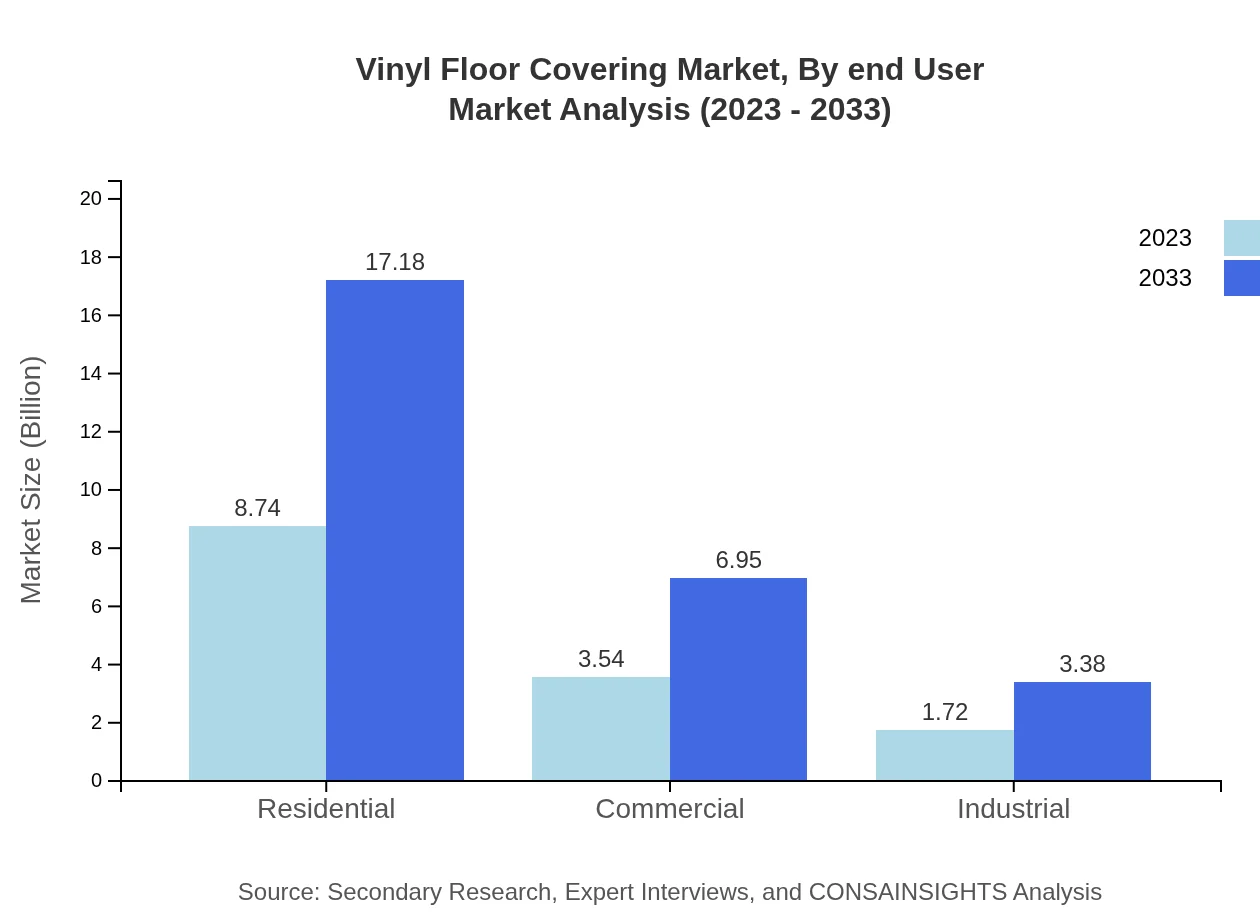

Vinyl Floor Covering Market Analysis By End User

The end-user segmentation reveals strong growth in sectors such as residential, commercial, and industrial. In 2023, the residential segment leads with a market size of $8.74 billion, reflecting a market share of 62.44%. The commercial sector is valued at $3.54 billion (25.27%), while industrial applications account for $1.72 billion (12.29%). By 2033, the residential market is expected to expand to $17.18 billion, maintaining its dominant share.

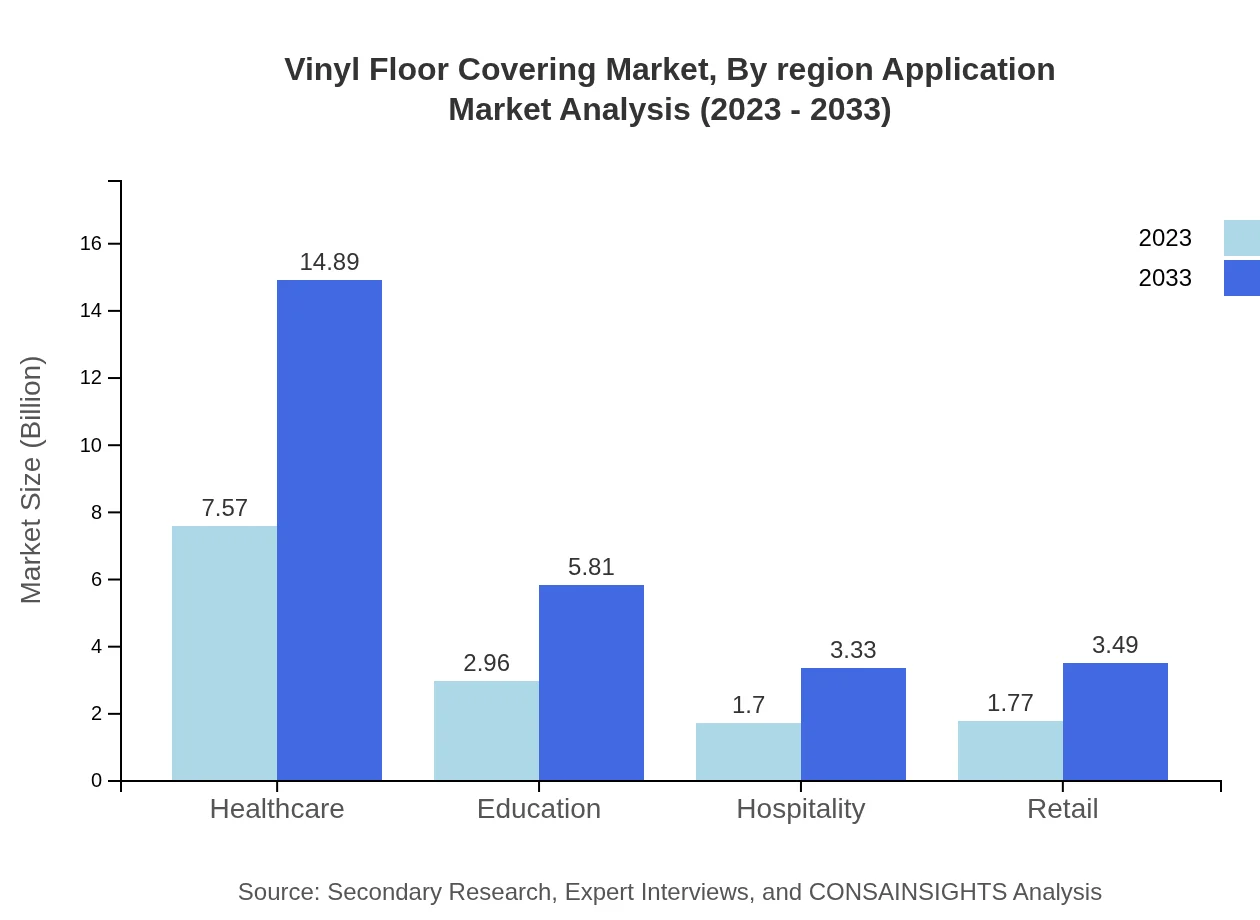

Vinyl Floor Covering Market Analysis By Region Application

Applications in healthcare, education, hospitality, and retail are integral in this market. The healthcare sector, valued at $7.57 billion in 2023, is projected to reach $14.89 billion by 2033, driven by hygiene and maintenance considerations. The education sector holds $2.96 billion, while hospitality and retail sectors exhibit steady growth from $1.70 billion and $1.77 billion, respectively. By 2033, application areas will evolve to cater more extensively to industrial needs.

Vinyl Floor Covering Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vinyl Floor Covering Industry

Mohawk Industries, Inc.:

Mohawk Industries is a leading manufacturer of flooring products, specializing in vinyl, laminate, and other flooring solutions, with a strong focus on sustainability and innovation.Armstrong Flooring, Inc.:

Armstrong Flooring is renowned for its stylish and durable flooring solutions, offering a wide range of vinyl flooring products that cater to both residential and commercial needs.Shaw Industries Group, Inc.:

Shaw Industries is a global flooring manufacturer offering extensive vinyl flooring options known for their quality and design versatility.Gerflor Group:

Gerflor is dedicated to providing innovative and sustainable flooring solutions, with a strong presence in healthcare and educational segments.We're grateful to work with incredible clients.

FAQs

What is the market size of vinyl Floor Covering?

The global vinyl floor covering market is valued at approximately $14 billion in 2023, with a projected CAGR of 6.8%. This growth signifies a robust demand and increasing adoption across various sectors over the forecast period.

What are the key market players or companies in the vinyl floor covering industry?

Key players in the vinyl floor covering market include major manufacturers such as Armstrong Flooring, Mohawk Industries, and Tarkett. These companies drive product innovation and address the growing consumer demand for sustainable flooring solutions.

What are the primary factors driving the growth in the vinyl floor covering industry?

Growth in the vinyl floor covering industry is driven by rising demand for affordable, durable, and aesthetic flooring options. Increased investment in construction and renovation projects also boosts market expansion.

Which region is the fastest Growing in the vinyl floor covering market?

The Asia Pacific region is the fastest-growing market, expanding from approximately $2.57 billion in 2023 to $5.06 billion by 2033. This growth is spurred by urbanization and rising real estate development.

Does ConsaInsights provide customized market report data for the vinyl floor covering industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the vinyl floor covering industry, enabling businesses to access specific insights relevant to their strategies.

What deliverables can I expect from this vinyl floor covering market research project?

Expect detailed reports on market dynamics, competitor analysis, segment trends, and regional insights. Additionally, projections for future growth and strategy recommendations will be included.

What are the market trends of vinyl floor covering?

Current trends in the vinyl floor covering market include an increasing preference for luxury vinyl tiles (LVT), growing focus on sustainable materials, and the adoption of innovative installation technologies.