Virtual Currency Market Report

Published Date: 31 January 2026 | Report Code: virtual-currency

Virtual Currency Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Virtual Currency market from 2023 to 2033, covering market trends, size, regional insights, industry analysis, technology impact, product performance, and key players shaping the industry landscape.

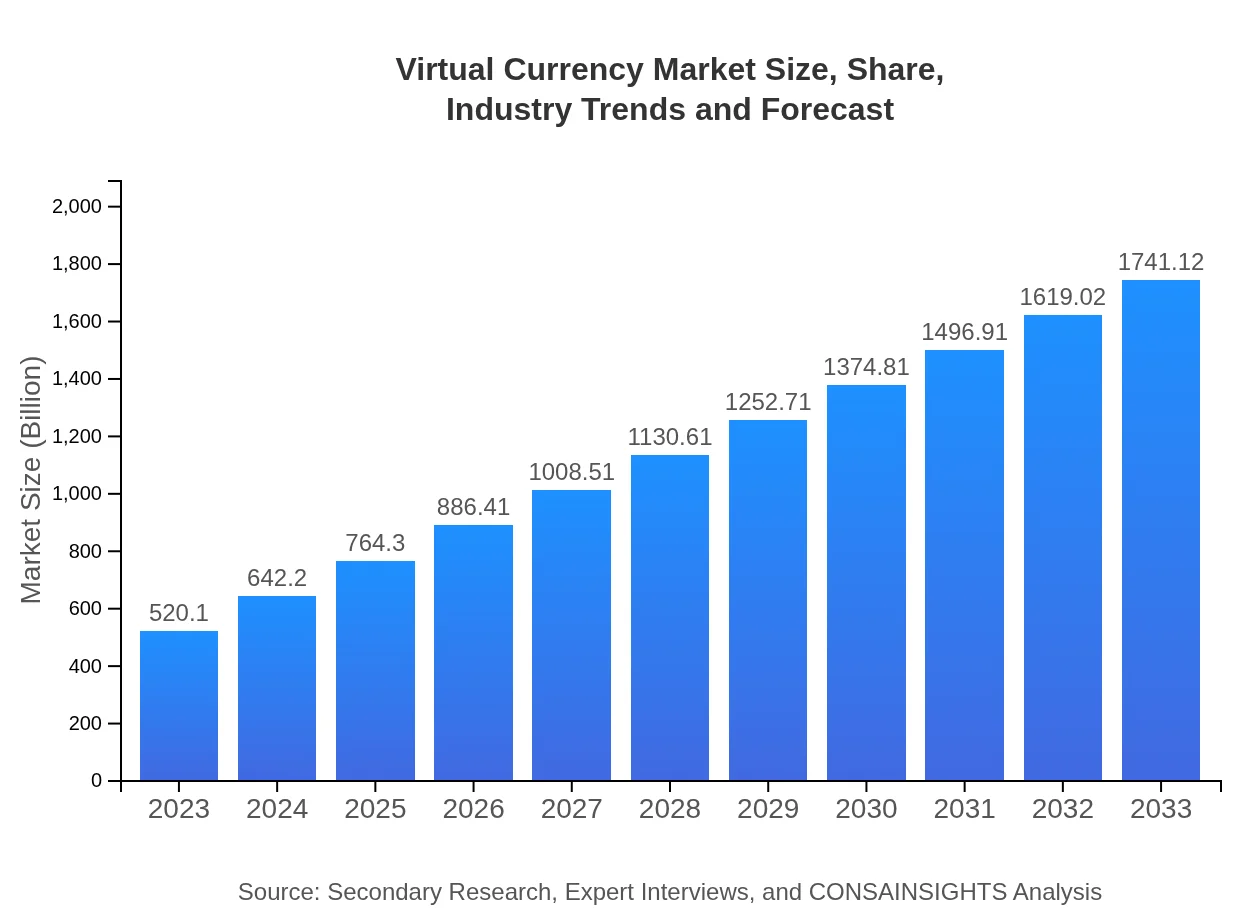

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $520.10 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $1741.12 Billion |

| Top Companies | Coinbase , Binance, Ripple, Ethereum, Bitfinex |

| Last Modified Date | 31 January 2026 |

Virtual Currency Market Overview

Customize Virtual Currency Market Report market research report

- ✔ Get in-depth analysis of Virtual Currency market size, growth, and forecasts.

- ✔ Understand Virtual Currency's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Virtual Currency

What is the Market Size & CAGR of Virtual Currency market in 2023?

Virtual Currency Industry Analysis

Virtual Currency Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Virtual Currency Market Analysis Report by Region

Europe Virtual Currency Market Report:

In Europe, the Virtual Currency market is estimated to grow from $144.48 billion in 2023 to $483.68 billion by 2033. The regulatory landscape is progressively evolving, with several countries adopting supportive measures to bolster the blockchain ecosystem. Leading economies like Germany, France, and the UK are witnessing increasing consumer engagement, institutional adoption, and technological innovation, even as concerns regarding scams and volatile markets persist.Asia Pacific Virtual Currency Market Report:

In the Asia Pacific region, the Virtual Currency market is expected to grow from approximately $109.95 billion in 2023 to $368.07 billion by 2033. Countries like China, India, and Japan are at the forefront of adoption, driven by a tech-savvy population and increasing investments in blockchain technology. However, regulatory challenges in some territories may impact growth. The emergence of numerous startups and a robust investor community add vitality to this landscape.North America Virtual Currency Market Report:

The North American Virtual Currency market is projected to grow from $166.85 billion in 2023 to approximately $558.55 billion by 2033. The U.S. continues to be a leader, with significant institutional investment, technological infrastructure, and innovative startups driving market dynamics. The integration of cryptocurrencies into traditional finance through regulatory advancements supports growth, while debates on digital dollar implications loom large, affecting investor confidence and trading patterns.South America Virtual Currency Market Report:

South America's Virtual Currency market is projected to expand from $44.99 billion in 2023 to $150.61 billion by 2033. The region is witnessing a surge in cryptocurrency adoption due to factors like inflation concerns and remittance needs. Countries such as Brazil and Argentina are leading the charge, capitalizing on virtual currencies to enhance cross-border transactions. Potential regulatory frameworks will play a pivotal role in shaping the market's future trajectory.Middle East & Africa Virtual Currency Market Report:

The Middle East and Africa region's Virtual Currency market is expected to grow from $53.83 billion in 2023 to $180.21 billion by 2033. Growth is propelled by burgeoning mobile payment solutions and increased awareness of wealth preservation strategies through cryptocurrencies. However, the notable adoption varies across nations, with regions like the UAE and South Africa demonstrating significant engagement due to supportive regulatory environments and innovative financial institutions.Tell us your focus area and get a customized research report.

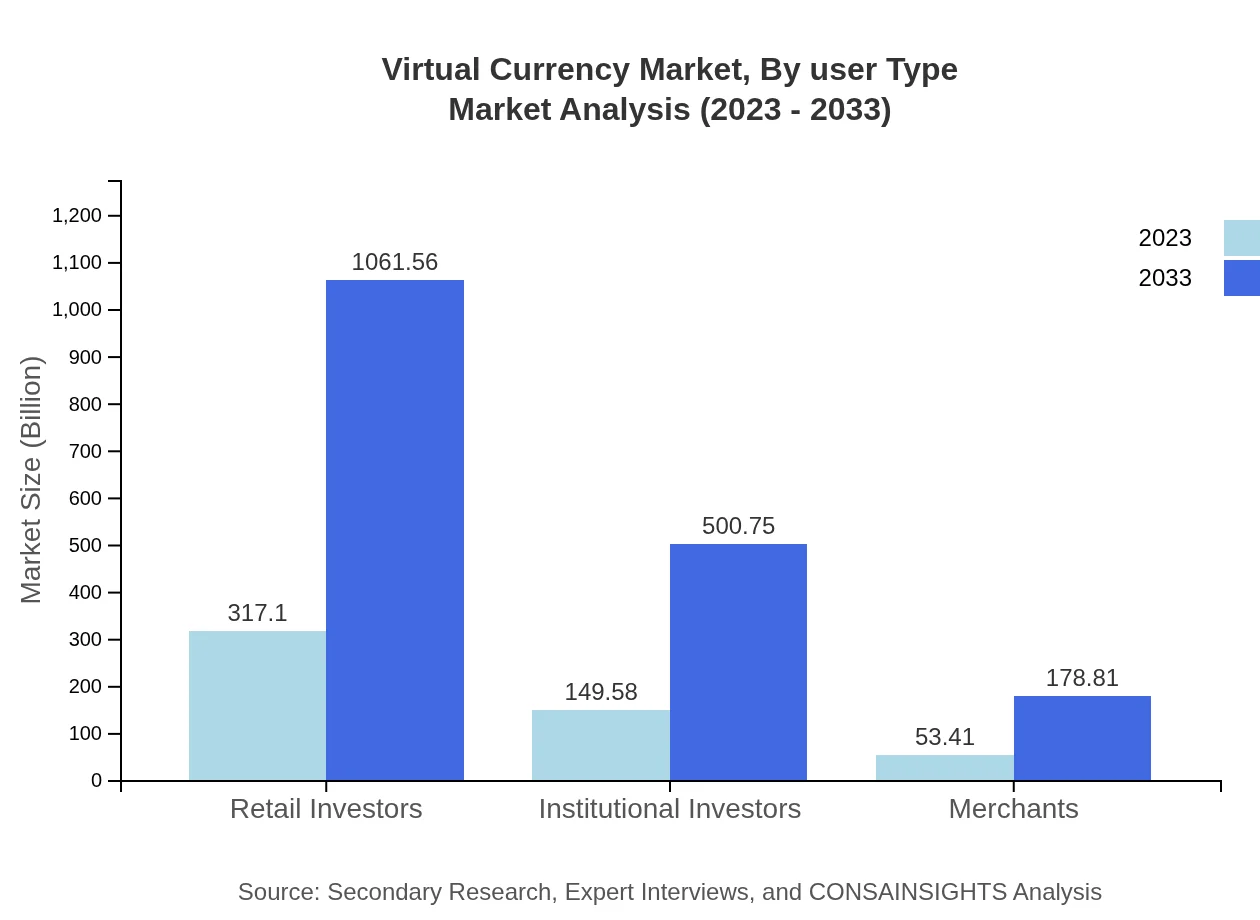

Virtual Currency Market Analysis By User Type

The segment analysis for user types in the Virtual Currency market reveals distinct patterns. Retail Investors dominate, with market size growing from $317.10 billion in 2023 to $1,061.56 billion in 2033, claiming a significant 60.97% market share. Institutional Investors are also expanding, moving from $149.58 billion to $500.75 billion, capturing an increasing share of 28.76%. Merchants, while smaller at $53.41 billion to $178.81 billion, make up 10.27% of the share. This segmentation underscores the growing trend of mainstream retail adoption while institutional investment solidifies stability within the market.

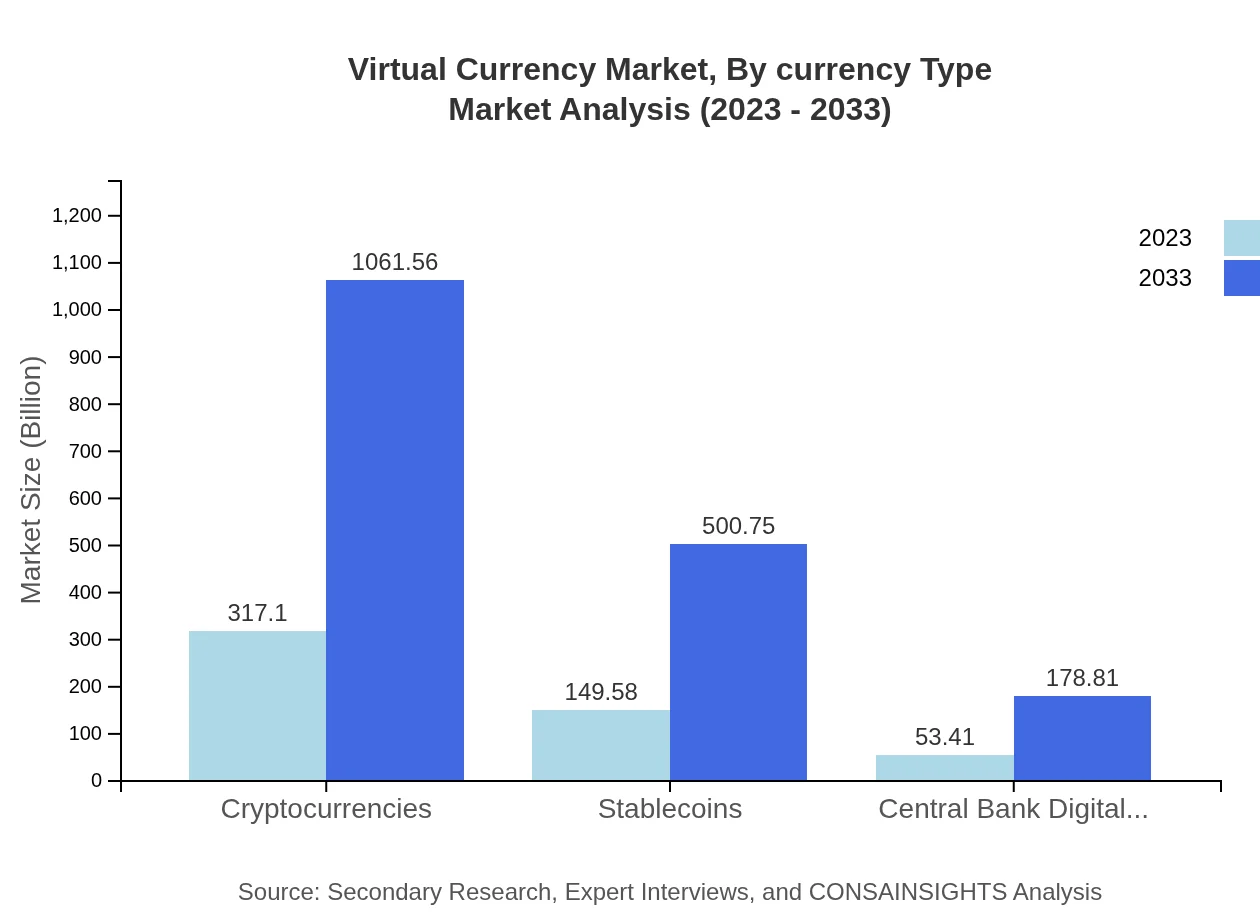

Virtual Currency Market Analysis By Currency Type

In the currency type segment, Cryptocurrencies lead with robust growth from $317.10 billion in 2023 to $1,061.56 billion in 2033, along with a consistent share of 60.97%. Stablecoins, serving crucial roles for stability and transactions, are projected to expand from $149.58 billion to $500.75 billion, holding 28.76%. The emergence of Central Bank Digital Currencies (CBDCs) is also significant, increasing from $53.41 billion to $178.81 billion, taking a 10.27% share. Each currency type exhibits tailored use cases, directing their respective growth trajectories.

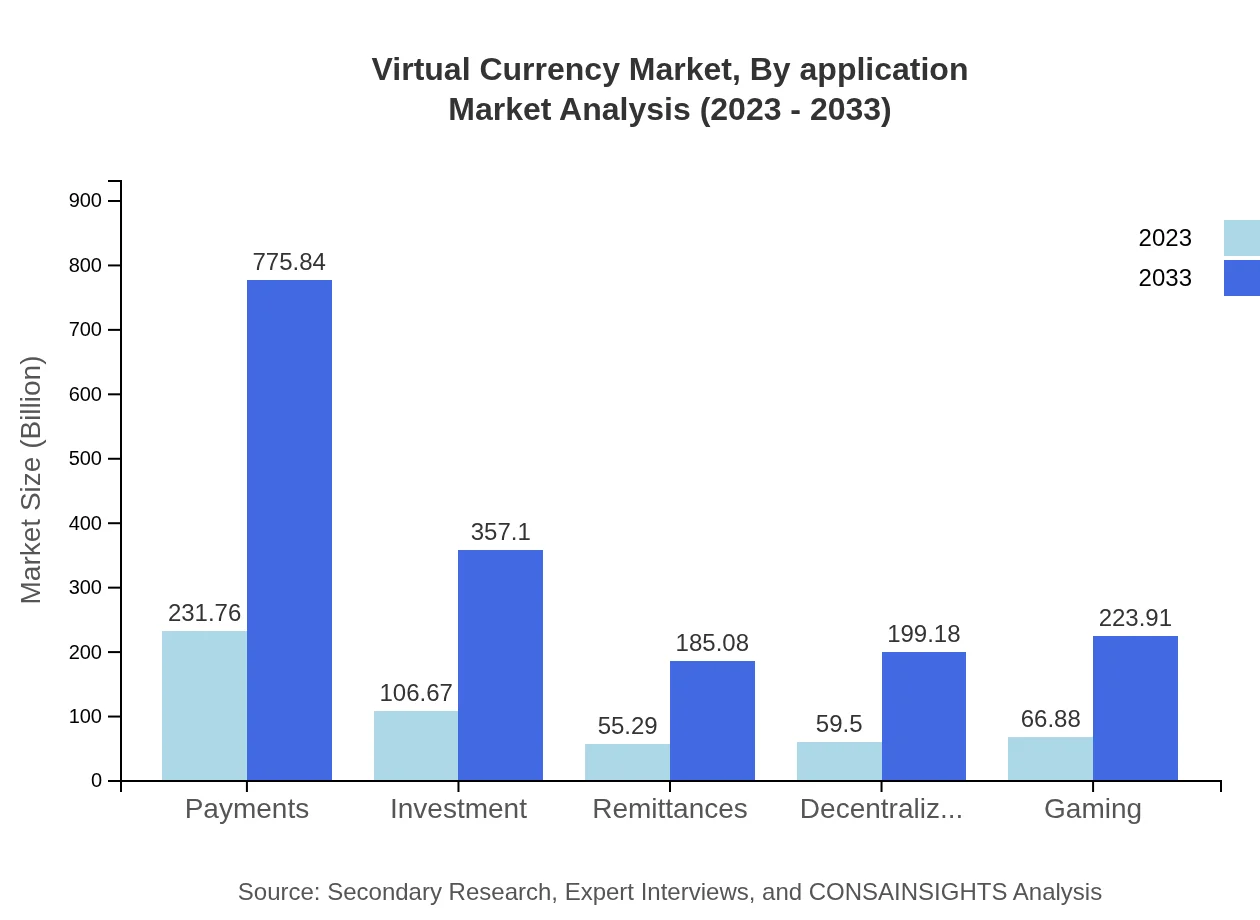

Virtual Currency Market Analysis By Application

The analysis by application segment indicates that Payments represent a substantial market share, growing from $231.76 billion in 2023 to $775.84 billion by 2033, holding a consistent share of 44.56%. Investment applications are also on the rise, projecting growth from $106.67 billion to $357.10 billion, capturing 20.51%. The Remittances segment is gaining traction, forecasted to grow from $55.29 billion to $185.08 billion, while Decentralized Finance (DeFi) applications and Gaming show promising expansion. These dynamics reflect a diversifying market with various applications driving demand.

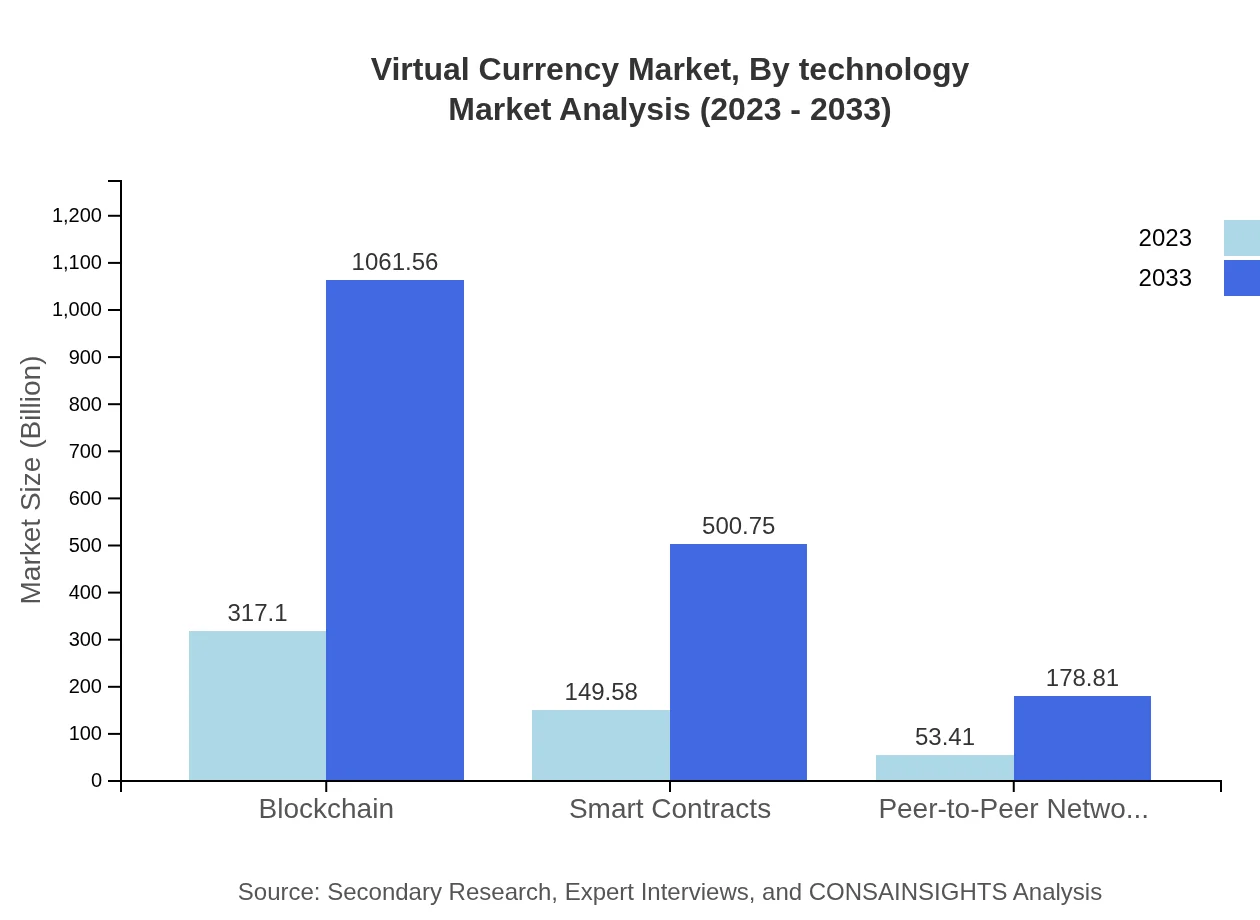

Virtual Currency Market Analysis By Technology

Technological advancements are integral to the Virtual Currency market. Blockchain technology remains a primary driver, projected to grow from $317.10 billion in 2023 to $1,061.56 billion by 2033, with a market share of 60.97%. Smart Contracts follow closely, rising from $149.58 billion to $500.75 billion, capturing 28.76%. Peer-to-Peer Networks also show significant growth, from $53.41 billion to $178.81 billion, holding a 10.27% market share. Innovations in these technological segments facilitate enhanced security and efficiency, shaping the industry's future.

Virtual Currency Market Analysis By Regulatory Framework

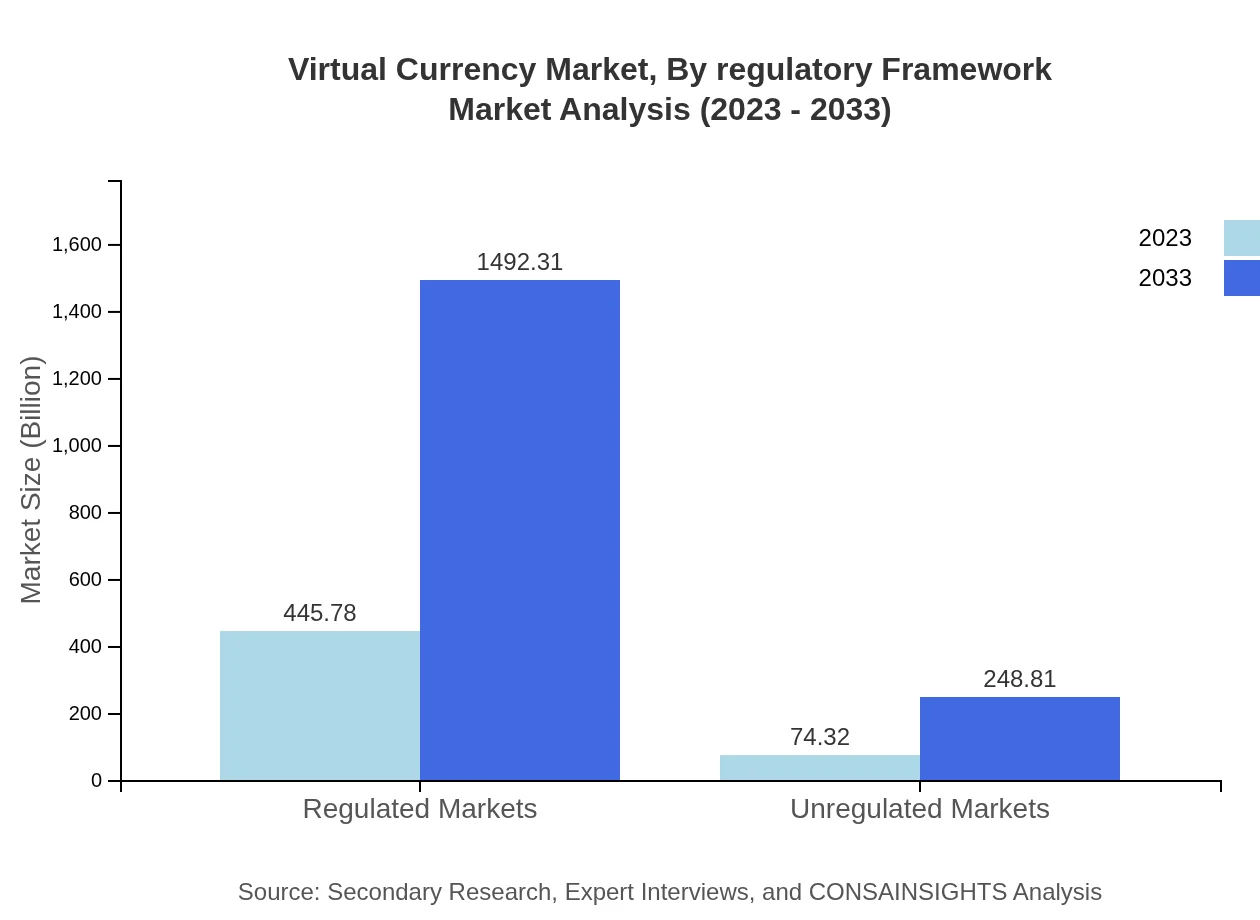

The regulatory framework segment of the Virtual Currency market reveals critical insights, with Regulated Markets anticipated to grow from $445.78 billion in 2023 to $1,492.31 billion by 2033, commanding an 85.71% share. In contrast, Unregulated Markets are projected to grow from $74.32 billion to $248.81 billion, representing 14.29%. The growing emphasis on regulatory frameworks enhances market stability and encourages mainstream adoption, indicating that clear guidelines significantly influence the market's growth outlook.

Virtual Currency Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Virtual Currency Industry

Coinbase :

One of the largest cryptocurrency exchanges in the U.S., Coinbase strives to provide a secure and user-friendly platform to facilitate buying, selling, and managing digital currencies.Binance:

Binance is a global cryptocurrency exchange known for its extensive selection of digital assets and trading options, leading to its recognition as one of the world's largest exchanges by trading volume.Ripple:

Ripple focuses on facilitating real-time cross-border payment solutions, leveraging blockchain technology to enhance transaction speed and efficiency for financial institutions.Ethereum:

Ethereum is a decentralized platform that allows developers to build and deploy smart contracts and decentralized applications (DApps), widely recognized for its pioneering role in the DeFi ecosystem.Bitfinex:

Bitfinex is a significant cryptocurrency exchange that offers advanced trading features and high liquidity, catering to both retail and institutional investors.We're grateful to work with incredible clients.

FAQs

What is the market size of virtual currency?

The global virtual currency market is valued at approximately $520.1 billion in 2023. It is projected to grow at a CAGR of 12.3%, reaching an anticipated size significantly higher by 2033, driven by advancements in technology and increasing adoption.

What are the key market players or companies in this virtual currency industry?

Key players in the virtual currency sector include major exchanges like Binance, Coinbase, and Kraken. Additional influential companies include Ripple Labs, BitPay, and Circle, which are shaping the landscape of cryptocurrency applications and blockchain technology.

What are the primary factors driving the growth in the virtual currency industry?

Growing acceptance of cryptocurrencies for transactions, advancements in blockchain technology, increased investment from institutional players, and favorable government regulations are primary drivers of growth in the virtual currency sector.

Which region is the fastest Growing in the virtual currency?

The fastest-growing region in the virtual currency market is North America, which is expected to expand from a market size of $166.85 billion in 2023 to $558.55 billion by 2033, highlighting a strong interest in digital currencies and blockchain innovations.

Does ConsaInsights provide customized market report data for the virtual currency industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the virtual currency industry, allowing stakeholders to gain insights relevant to their unique strategic interests or business objectives.

What deliverables can I expect from this virtual currency market research project?

Deliverables from this research project include detailed market analysis, growth forecasts, competitive landscape evaluation, regional insights, and segmented data in areas such as investment, payments, and emerging technologies in the virtual currency sector.

What are the market trends of virtual currency?

Current trends in the virtual currency market include the rise of decentralized finance (DeFi), increasing integration of cryptocurrencies in e-commerce, growing regulatory frameworks, and a surge in retail and institutional investment, creating a dynamic and evolving landscape.