Vitamin Fortified And Mineral Enriched Food And Beverage Market Report

Published Date: 31 January 2026 | Report Code: vitamin-fortified-and-mineral-enriched-food-and-beverage

Vitamin Fortified And Mineral Enriched Food And Beverage Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Vitamin Fortified and Mineral Enriched Food and Beverage market from 2023 to 2033, focusing on market size, CAGR, regional insights, industry trends, and key players.

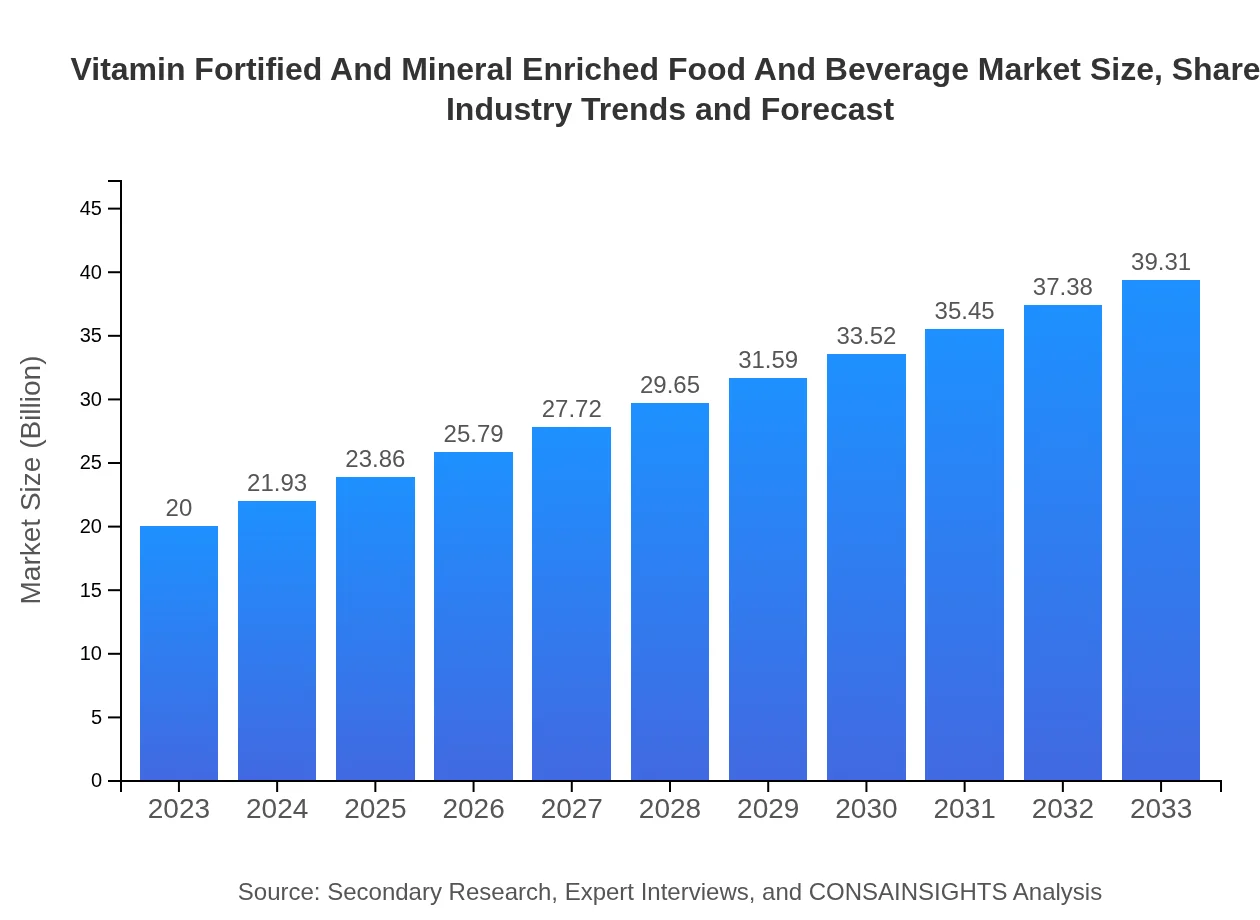

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $39.31 Billion |

| Top Companies | Nestlé, Coca-Cola , Unilever, Danone |

| Last Modified Date | 31 January 2026 |

Vitamin Fortified And Mineral Enriched Food And Beverage Market Overview

Customize Vitamin Fortified And Mineral Enriched Food And Beverage Market Report market research report

- ✔ Get in-depth analysis of Vitamin Fortified And Mineral Enriched Food And Beverage market size, growth, and forecasts.

- ✔ Understand Vitamin Fortified And Mineral Enriched Food And Beverage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vitamin Fortified And Mineral Enriched Food And Beverage

What is the Market Size & CAGR of Vitamin Fortified And Mineral Enriched Food And Beverage market in 2023?

Vitamin Fortified And Mineral Enriched Food And Beverage Industry Analysis

Vitamin Fortified And Mineral Enriched Food And Beverage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vitamin Fortified And Mineral Enriched Food And Beverage Market Analysis Report by Region

Europe Vitamin Fortified And Mineral Enriched Food And Beverage Market Report:

Europe's Vitamin Fortified and Mineral Enriched Food and Beverage market stands at $5.66 billion in 2023, with the forecast indicating growth to $11.13 billion by 2033. The region witnesses stringent regulations and high consumer demand for quality, which also leads to an emphasis on food safety and the effectiveness of fortification practices.Asia Pacific Vitamin Fortified And Mineral Enriched Food And Beverage Market Report:

In the Asia Pacific region, the market is projected to grow from $3.87 billion in 2023 to $7.61 billion in 2033. This surge is driven by increased urbanization, dietary changes, and a rising middle-class population seeking health-oriented products. Countries like China and India are leading this trend due to their large populations and growing health awareness.North America Vitamin Fortified And Mineral Enriched Food And Beverage Market Report:

North America is the largest market, with a value of $7.24 billion in 2023. It is anticipated to double to $14.23 billion by 2033, driven predominantly by high consumer demand for innovative and healthy food products. The U.S. leads in fortification trends, with consumers looking for functional foods tailored to specific health benefits.South America Vitamin Fortified And Mineral Enriched Food And Beverage Market Report:

The South American market, valued at $1.09 billion in 2023, is expected to reach $2.15 billion by 2033. Brazil and Argentina are key contributors to this growth, spurred by an increase in the consumption of fortified foods as consumers become more health-conscious and aware of nutritional benefits.Middle East & Africa Vitamin Fortified And Mineral Enriched Food And Beverage Market Report:

In the Middle East and Africa, the market is projected to increase from $2.13 billion in 2023 to $4.19 billion by 2033. Growing urbanization and rising health awareness around malnutrition are key drivers, with governments promoting food fortification initiatives aimed at combating micronutrient deficiencies.Tell us your focus area and get a customized research report.

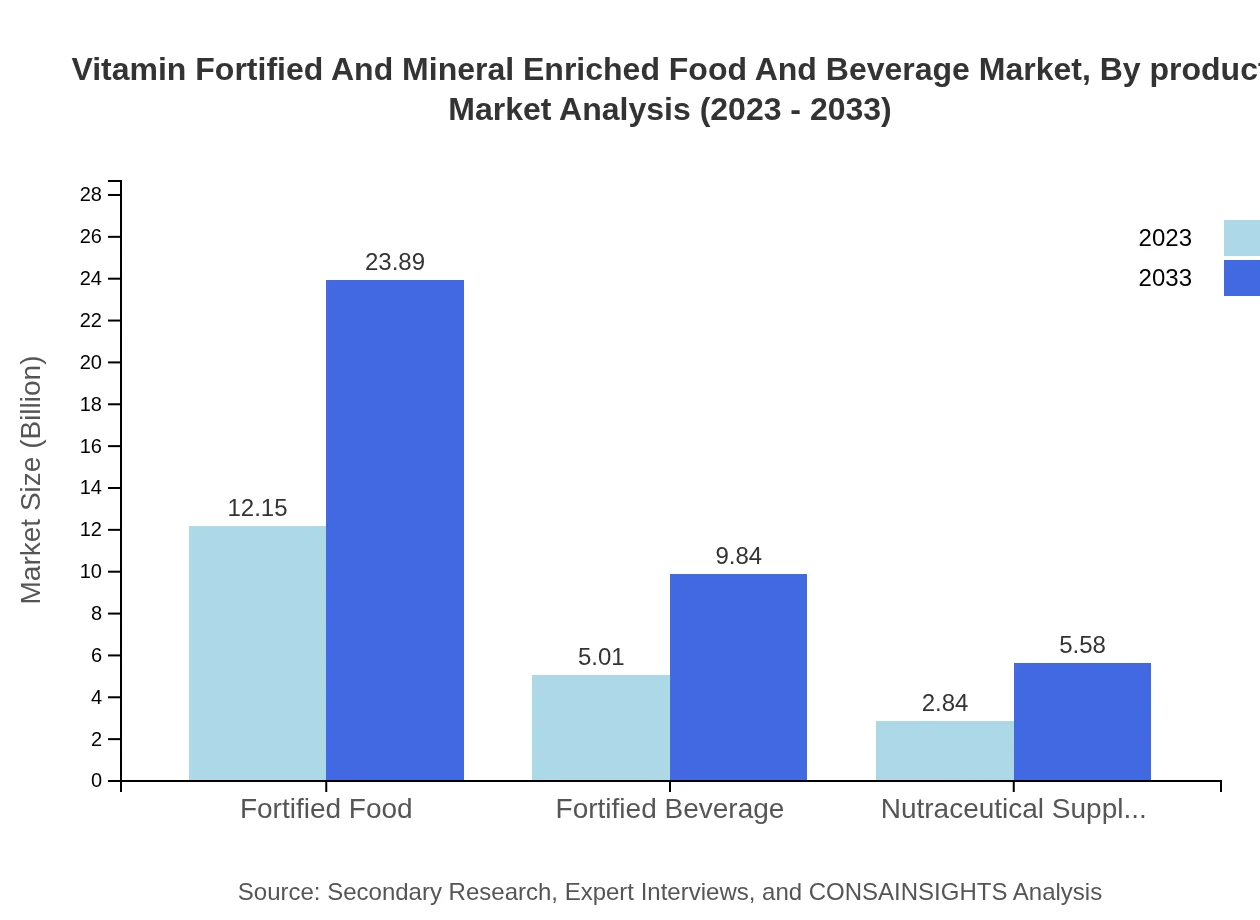

Vitamin Fortified And Mineral Enriched Food And Beverage Market Analysis By Product

The fortified food segment dominates the market, valued at $12.15 billion in 2023, expected to reach $23.89 billion by 2033. The fortified beverage segment holds a significant market share of $5.01 billion in 2023, growing to $9.84 billion by 2033. This illustrates a clear consumer preference for convenient nutritional options.

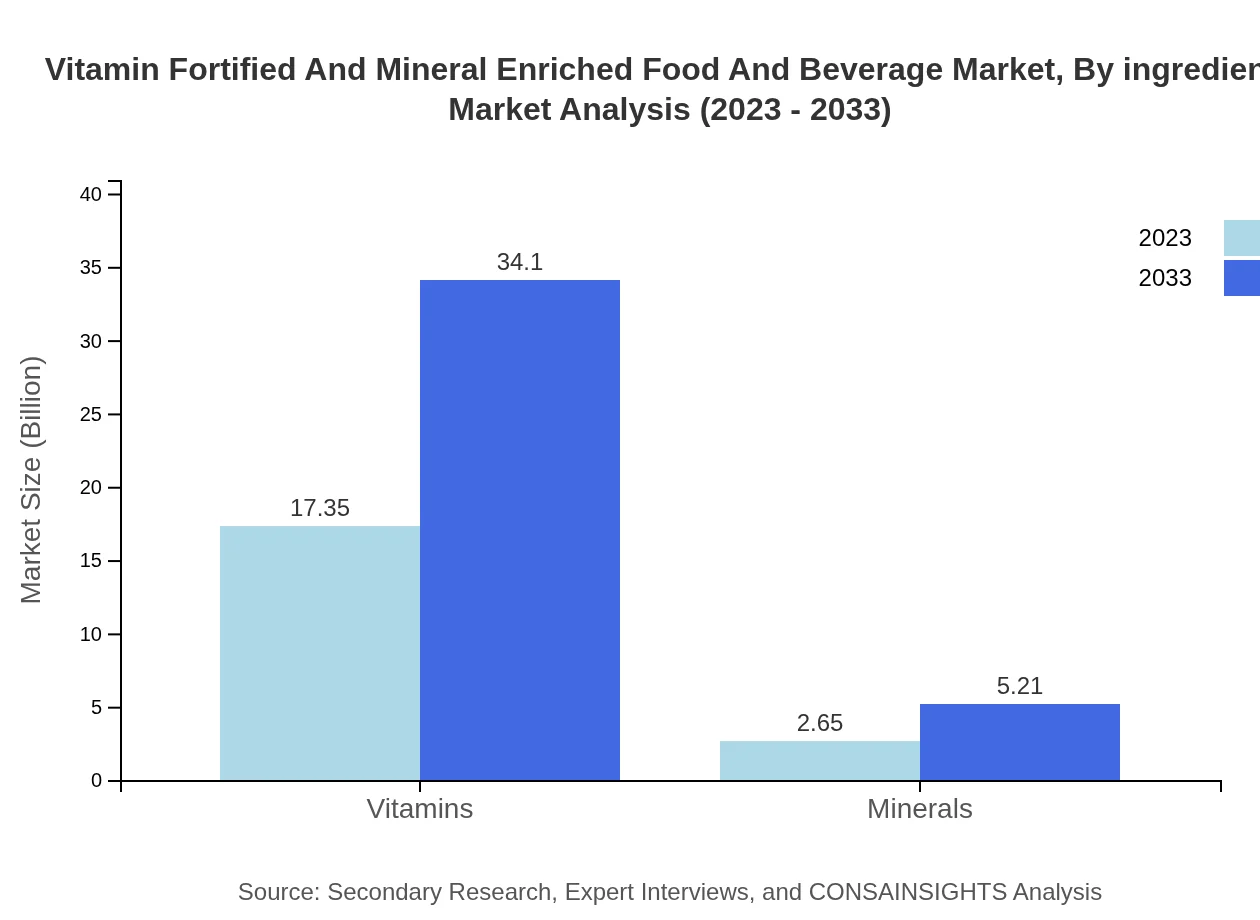

Vitamin Fortified And Mineral Enriched Food And Beverage Market Analysis By Ingredients

Vitamins lead the market with a staggering size of $17.35 billion in 2023 and projected to reach $34.10 billion by 2033. Minerals account for a smaller share, valued at $2.65 billion in 2023, anticipated to grow to $5.21 billion. This differentiation underscores the paramount importance placed on vitamins in diet supplementation.

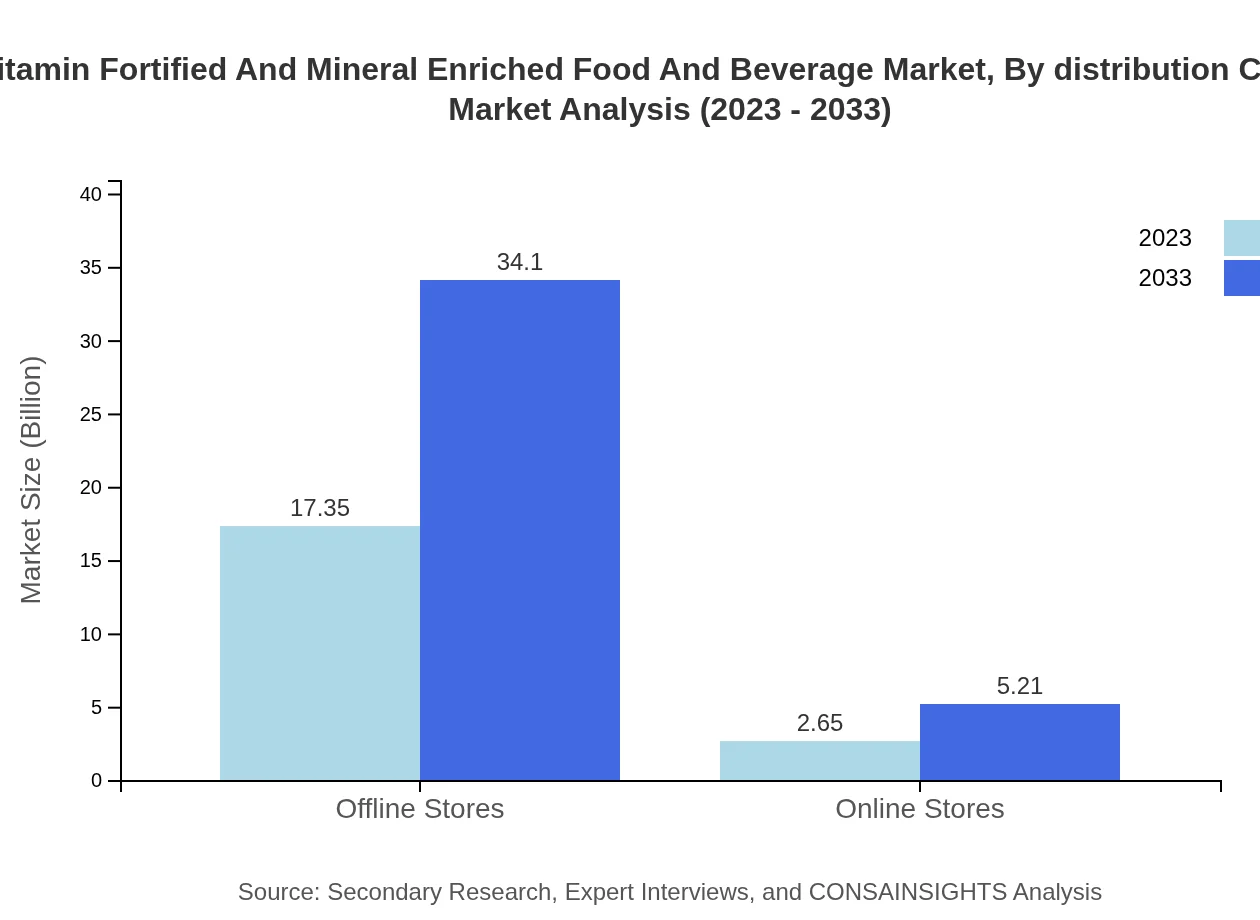

Vitamin Fortified And Mineral Enriched Food And Beverage Market Analysis By Distribution Channel

The offline stores segment dominates, with a market size of $17.35 billion in 2023, expected to maintain a steady growth to $34.10 billion by 2033. Online stores are also expanding, growing from $2.65 billion in 2023 to $5.21 billion, reflecting changing consumer purchasing patterns influenced by convenience and access.

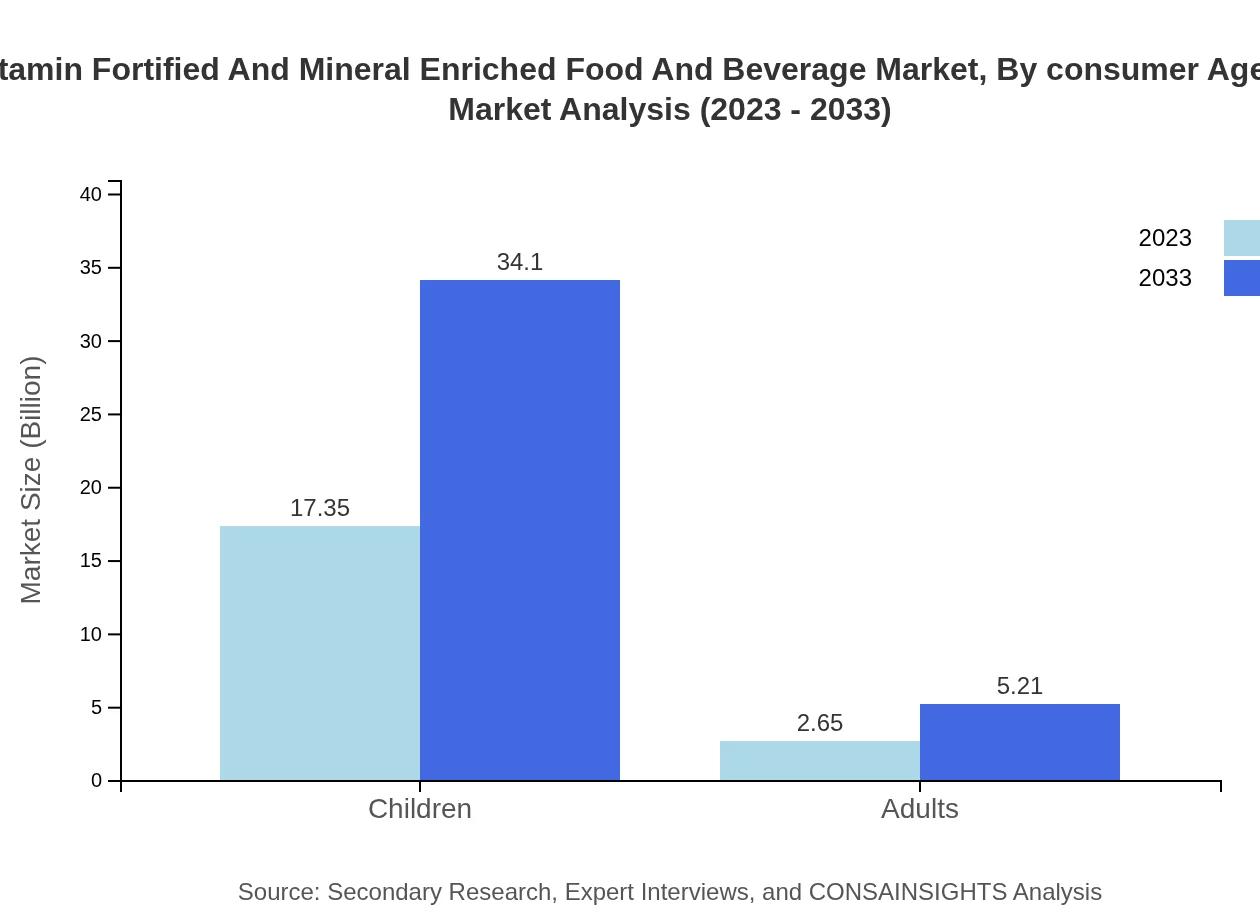

Vitamin Fortified And Mineral Enriched Food And Beverage Market Analysis By Consumer Age Group

Children's segment commands the highest share, valued at $17.35 billion in 2023 and projected to grow to $34.10 billion. Adults account for lesser value at $2.65 billion, reflecting targeted marketing of fortification towards children, who are considered more vulnerable to deficiencies.

Vitamin Fortified And Mineral Enriched Food And Beverage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vitamin Fortified And Mineral Enriched Food And Beverage Industry

Nestlé:

A leading global food and beverage company known for its diverse portfolio of fortified products targeting health and wellness, Nestlé focuses heavily on R&D for nutritious offerings.Coca-Cola :

Through its beverage segments, Coca-Cola offers a range of fortified drinks, contributing to the nutritional beverage market while maintaining consumer taste preferences.Unilever:

Unilever emphasizes nutritional enrichment in its food products and has a strong commitment to sustainability and public health, positioning itself as a key player in the fortification market.Danone:

Danone is recognized for its health-focused brand approach, offering fortified dairy products that cater to various health-conscious consumers around the globe.We're grateful to work with incredible clients.

FAQs

What is the market size of vitamin Fortified And Mineral Enriched Food And Beverage?

The vitamin-fortified and mineral-enriched food and beverage market is projected to reach $20 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing consumer awareness and demand for fortified products.

What are the key market players or companies in this vitamin Fortified And Mineral Enriched Food And Beverage industry?

Key players in the vitamin-fortified and mineral-enriched food and beverage industry include major food corporations, beverage giants, and supplement manufacturers. They innovate products to meet consumer needs for enhanced nutrition and health benefits.

What are the primary factors driving the growth in the vitamin Fortified And Mineral Enriched Food And Beverage industry?

Key growth drivers include rising health awareness, increased incidence of nutrient deficiencies, and consumer preference for convenient, healthy food options. Strategic marketing and product innovation also contribute significantly to market expansion.

Which region is the fastest Growing in the vitamin Fortified And Mineral Enriched Food And Beverage?

The fastest-growing region for vitamin-fortified and mineral-enriched food and beverage is Europe, projected to increase from $5.66 billion in 2023 to $11.13 billion by 2033, reflecting a strong emphasis on health and wellness.

Does ConsaInsights provide customized market report data for the vitamin Fortified And Mineral Enriched Food And Beverage industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the vitamin-fortified and mineral-enriched food and beverage sector, ensuring precise insights aligned with unique market strategies.

What deliverables can I expect from this vitamin Fortified And Mineral Enriched Food And Beverage market research project?

Expect comprehensive deliverables including detailed market analysis, segmentation data, trend reports, competitive landscape insights, and actionable recommendations tailored to foster strategic decision-making in the vitamin-fortified segment.

What are the market trends of vitamin Fortified And Mineral Enriched Food And Beverage?

Key market trends include the rising demand for functional foods, innovation in flavors and formats, growth of online distribution channels, and increasing focus on sustainability in sourcing and packaging within the vitamin-fortified sector.