Vna Pacs Market Report

Published Date: 31 January 2026 | Report Code: vna-pacs

Vna Pacs Market Size, Share, Industry Trends and Forecast to 2033

This market report provides in-depth insights into the Vna Pacs market from 2023 to 2033, analyzing current trends, market size, segmentation, and forecasts. It delivers valuable data for stakeholders to make informed decisions regarding investments and strategic planning.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

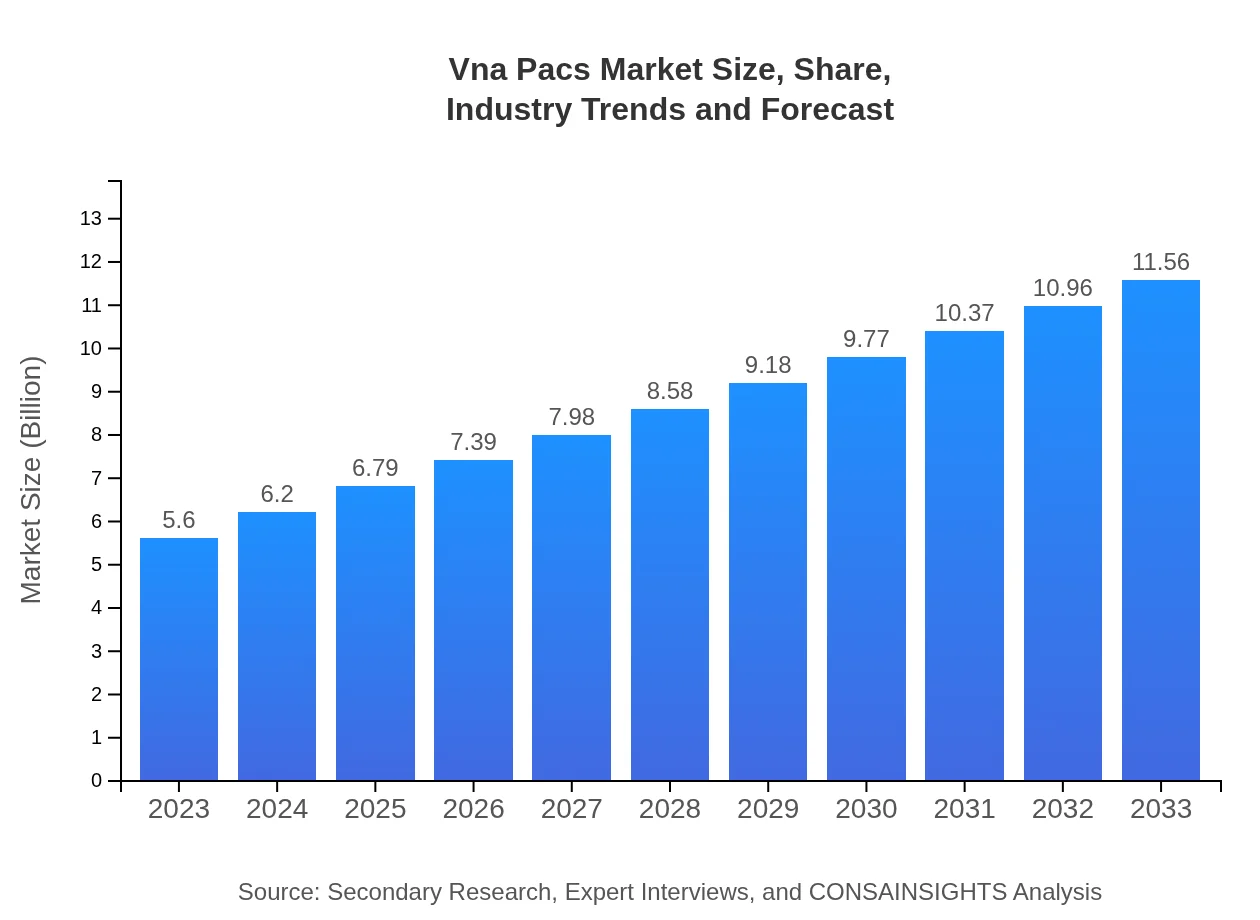

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | Philips Healthcare, GE Healthcare, Siemens Healthineers, Dell EMC |

| Last Modified Date | 31 January 2026 |

Vna Pacs Market Overview

Customize Vna Pacs Market Report market research report

- ✔ Get in-depth analysis of Vna Pacs market size, growth, and forecasts.

- ✔ Understand Vna Pacs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vna Pacs

What is the Market Size & CAGR of Vna Pacs market in 2023?

Vna Pacs Industry Analysis

Vna Pacs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vna Pacs Market Analysis Report by Region

Europe Vna Pacs Market Report:

Europe's Vna Pacs market is projected to grow from $1.41 billion in 2023 to $2.90 billion by 2033, driven by the rise in chronic diseases requiring medical imaging, along with government initiatives for healthcare digitization and data management.Asia Pacific Vna Pacs Market Report:

In the Asia Pacific region, the Vna Pacs market is anticipated to grow from $1.14 billion in 2023 to $2.34 billion by 2033. The increase can be attributed to rising healthcare expenditure and the growing number of diagnostic imaging centers, coupled with the push for digitization in medical records and imaging services.North America Vna Pacs Market Report:

North America, leading the Vna Pacs market, is forecasted to expand from $2.09 billion in 2023 to $4.31 billion by 2033. Factors including advanced healthcare infrastructure, high adoption rates of innovative imaging solutions, and increasing focus on interoperability are propelling this growth.South America Vna Pacs Market Report:

South America is expected to see significant growth, with the market size increasing from $0.54 billion in 2023 to $1.12 billion by 2033. The region is experiencing a shift towards digital health solutions, driven by demand for improved patient care and operational efficiency in healthcare institutions.Middle East & Africa Vna Pacs Market Report:

In the Middle East and Africa, the market will likely increase from $0.43 billion in 2023 to $0.88 billion by 2033. This growth is fueled by investments in healthcare infrastructure and the need for improved data storage solutions in the region.Tell us your focus area and get a customized research report.

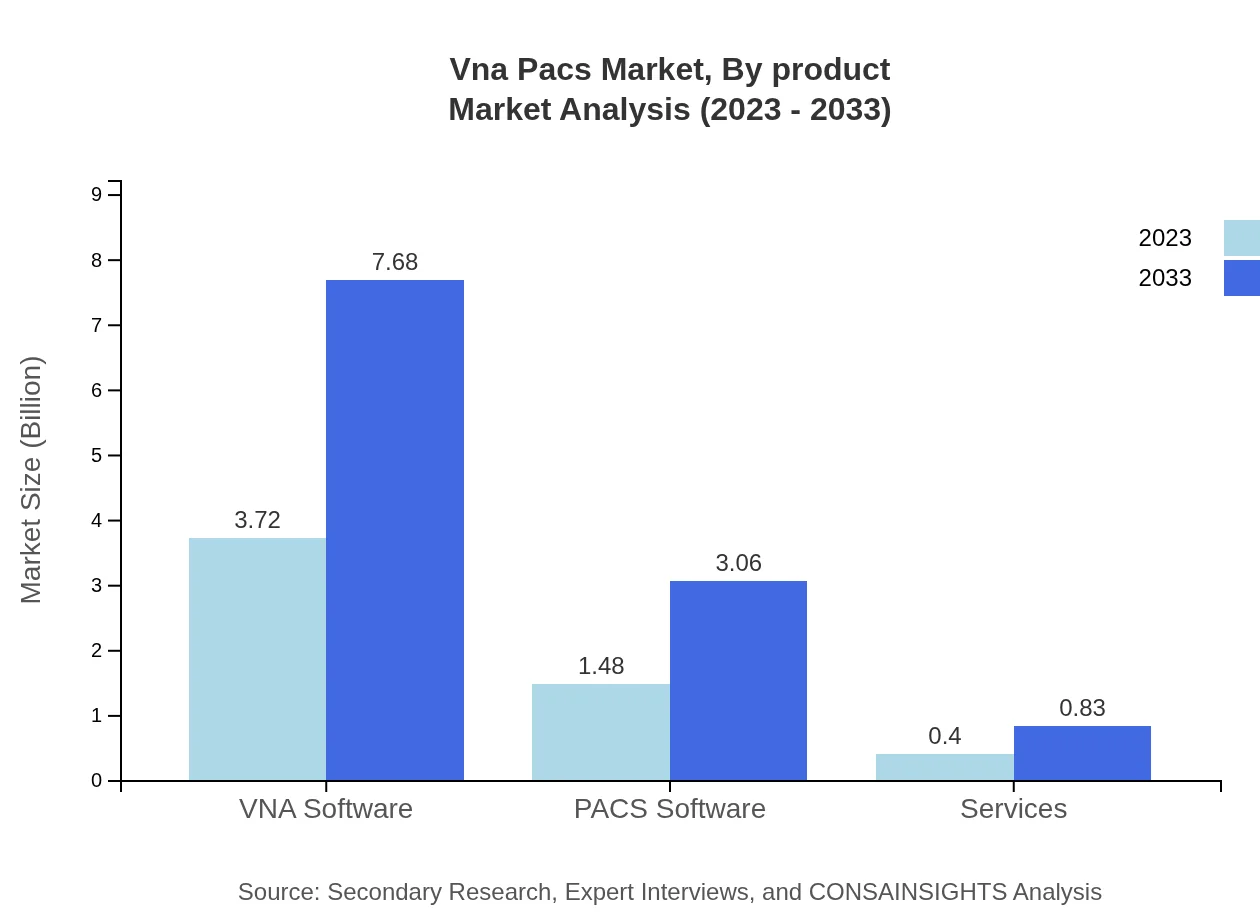

Vna Pacs Market Analysis By Product

In 2023, the VNA Software segment dominates the market with an estimated size of $3.72 billion, projected to reach $7.68 billion by 2033, holding a substantial market share of 66.4% throughout the period. The PACS Software segment is also significant, growing from $1.48 billion in 2023 to $3.06 billion by 2033, capturing a market share of 26.43%. Additionally, services related to Vna Pacs are expected to increase from $0.40 billion to $0.83 billion.

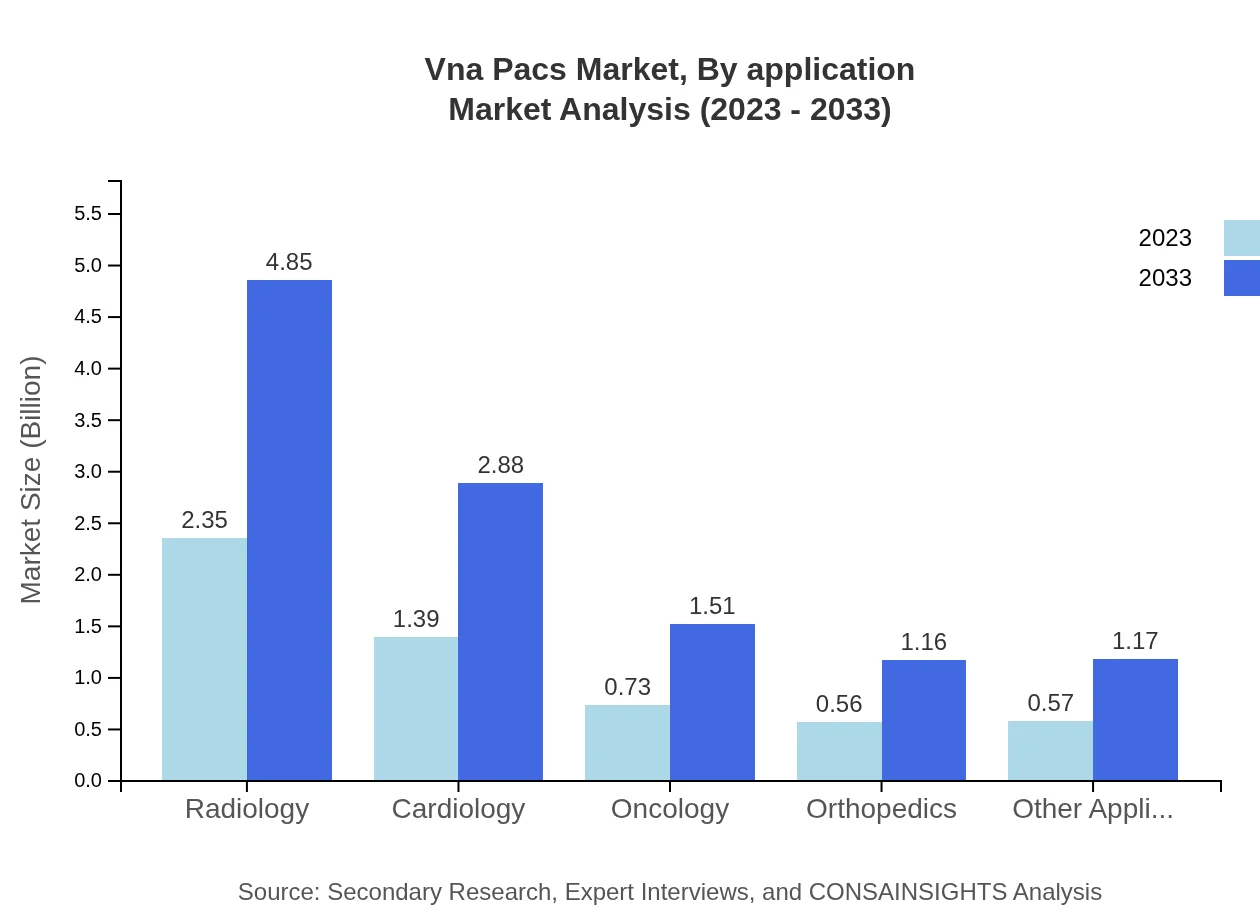

Vna Pacs Market Analysis By Application

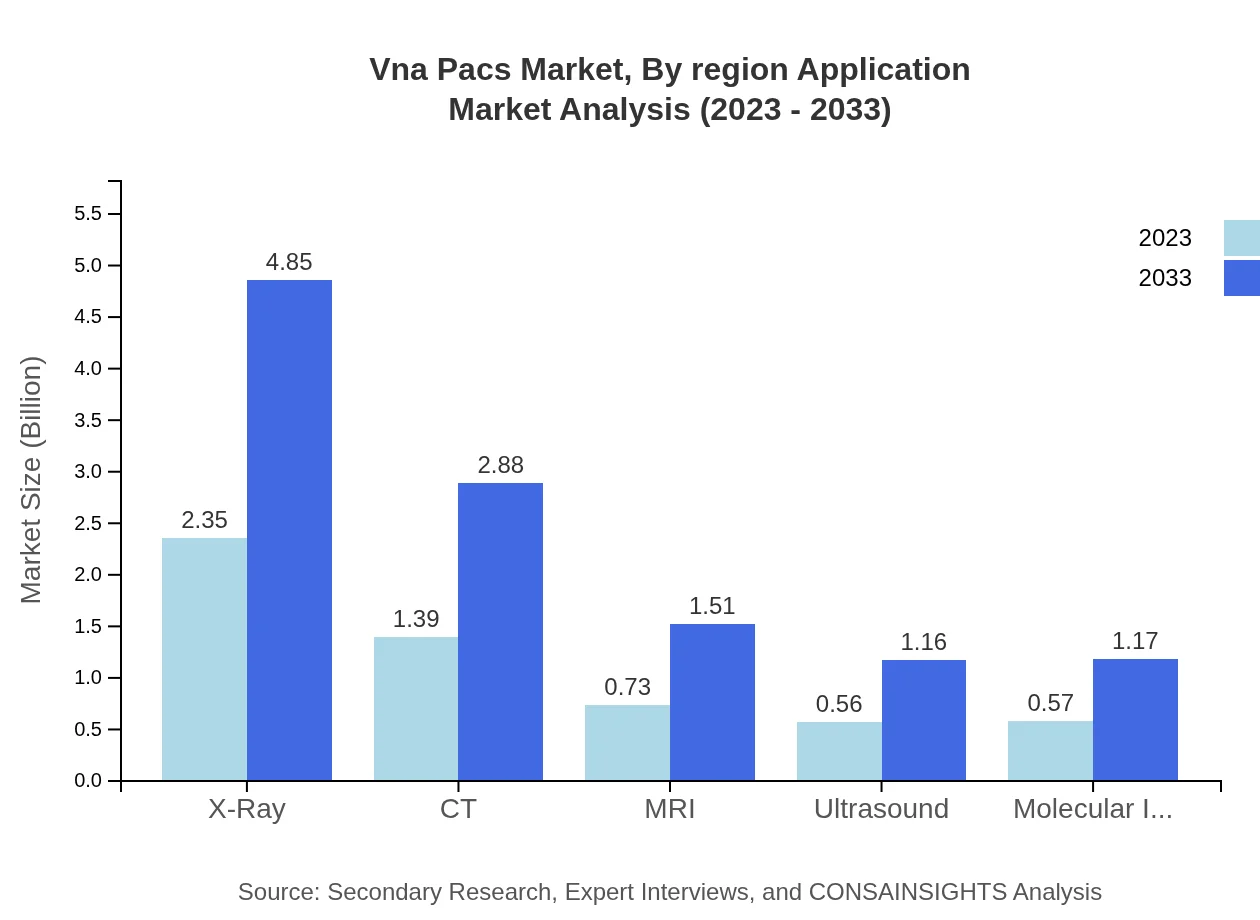

The application segment illustrates varied growth trends, with Radiology leading at $2.35 billion in 2023, projected to reach $4.85 billion by 2033, representing 41.98% market share. Other applications such as Cardiology and Oncology follow suit with market sizes of $1.39 billion and $0.73 billion respectively in 2023, expected to grow considerably as the healthcare sector develops.

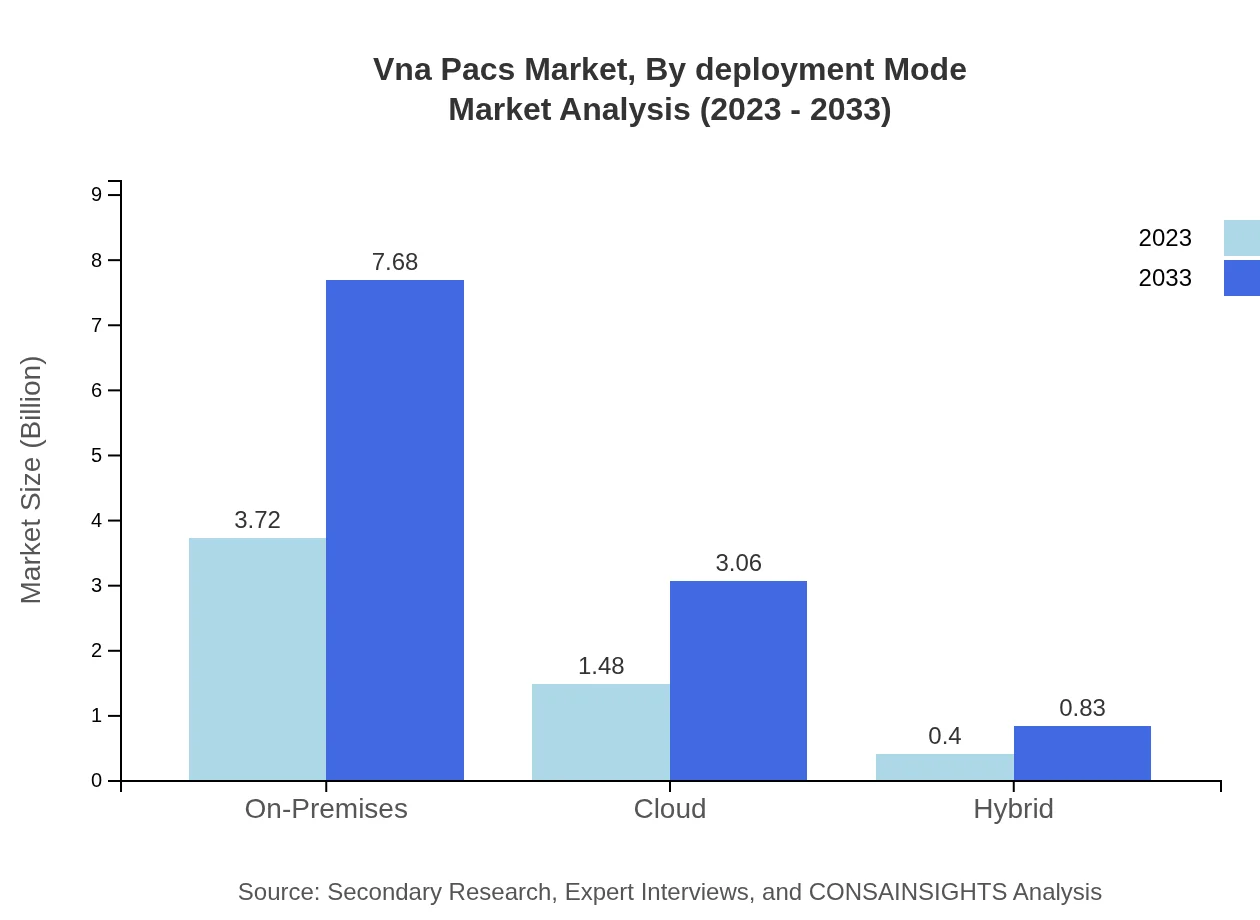

Vna Pacs Market Analysis By Deployment Mode

The deployment mode of Vna Pacs systems is categorized into On-Premises, Cloud, and Hybrid. As of 2023, On-Premises solutions lead in market size at $3.72 billion, projected to rise to $7.68 billion by 2033, maintaining a consistent share of 66.4%. Cloud solutions are also gaining popularity, with growth anticipated from $1.48 billion to $3.06 billion by 2033, as the demand for flexible, scalable solutions increases.

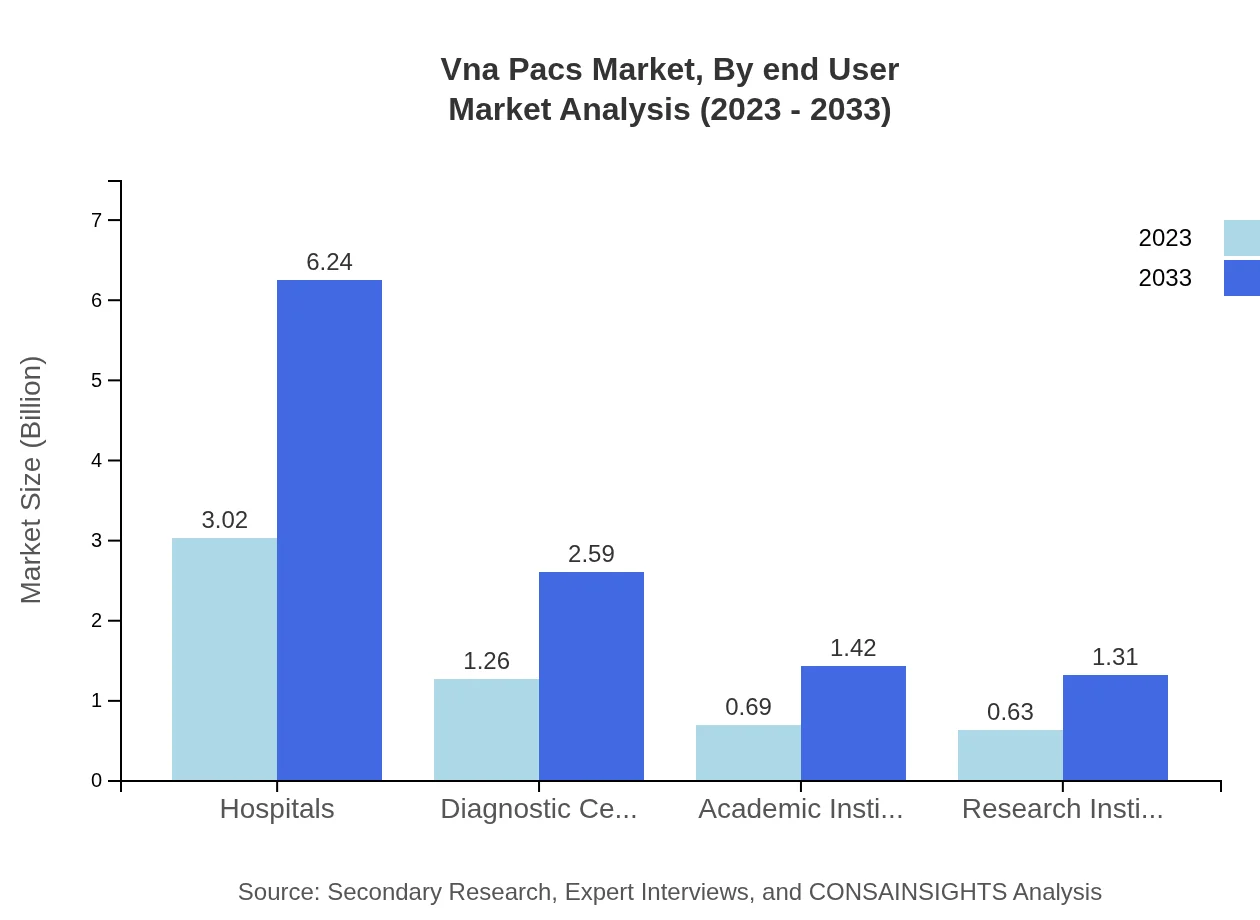

Vna Pacs Market Analysis By End User

Hospitals represent the largest end-user segment in the Vna Pacs market, with a size of $3.02 billion in 2023, expected to grow to $6.24 billion by 2033, accounting for 53.96% of the market share. Other end-users include Diagnostic Centers and Academic Institutions, showing robust growth prospects due to the increasing reliance on imaging systems.

Vna Pacs Market Analysis By Region Application

The segmentation by technology reveals how different modalities such as X-Ray, CT, MRI, and Ultrasound contribute to the market. For instance, X-Ray technology dominated with $2.35 billion in 2023, likely reaching $4.85 billion by 2033, representing substantial growth in imaging services.

Vna Pacs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vna Pacs Industry

Philips Healthcare:

Philips Healthcare offers an extensive range of innovative imaging technology and Vna Pacs solutions, enhancing operational efficiencies and improving patient outcomes.GE Healthcare:

GE Healthcare is a market leader renowned for its advanced digital archiving solutions and comprehensive range of medical imaging equipment, contributing significantly to the Vna Pacs market.Siemens Healthineers:

Siemens Healthineers specializes in integrated imaging services and Vna Pacs systems, focusing on providing healthcare providers with more intelligent and streamlined data management solutions.Dell EMC:

Dell EMC is crucial in the Vna Pacs ecosystem, facilitating data storage solutions that ensure high availability and compliance with industry regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of VNA-PACS?

The VNA-PACS market is valued at approximately $5.6 billion as of 2023, with an estimated CAGR of 7.3% projected until 2033, indicating robust growth and increasing demand for vendor-neutral archive solutions in the healthcare sector.

What are the key market players or companies in this VNA-PACS industry?

Key players in the VNA-PACS industry include major health IT companies such as GE Healthcare, Siemens Healthineers, Philips Healthcare, and IBM Watson Health, among others, that provide innovative imaging solutions and support advancements in medical diagnostics.

What are the primary factors driving the growth in the VNA-PACS industry?

Growth in the VNA-PACS industry is driven by increasing demand for integrated healthcare solutions, advancements in imaging technologies, the growing volume of medical imaging data, and a rising preference for cloud-based storage solutions among healthcare providers.

Which region is the fastest Growing in the VNA-PACS?

Asia Pacific is the fastest-growing region in the VNA-PACS market, with market size expected to grow from $1.14 billion in 2023 to $2.34 billion by 2033, highlighting significant investment in healthcare infrastructure and digitization.

Does ConsaInsights provide customized market report data for the VNA-PACS industry?

Yes, ConsaInsights offers customized market report data for the VNA-PACS industry, tailoring insights and analysis to meet specific client needs, ensuring comprehensive market coverage and relevance to individual business strategies.

What deliverables can I expect from this VNA-PACS market research project?

Deliverables from the VNA-PACS market research project may include detailed market analysis reports, segment-focused insights, competitive landscape assessments, regional market forecasts, and strategic recommendations for stakeholders.

What are the market trends of VNA-PACS?

Current trends in the VNA-PACS market include the shift towards cloud-based solutions, increasing interoperability among medical devices, enhanced focus on data security and patient privacy, and rising adoption of AI in imaging technologies.