Vvt And Start Stop System Market Report

Published Date: 02 February 2026 | Report Code: vvt-and-start-stop-system

Vvt And Start Stop System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the VVT and Start-Stop System market, highlighting key trends, size, competition, and forecasts from 2023 to 2033. Insights into the industry's segmentation and regional performance are also included.

| Metric | Value |

|---|---|

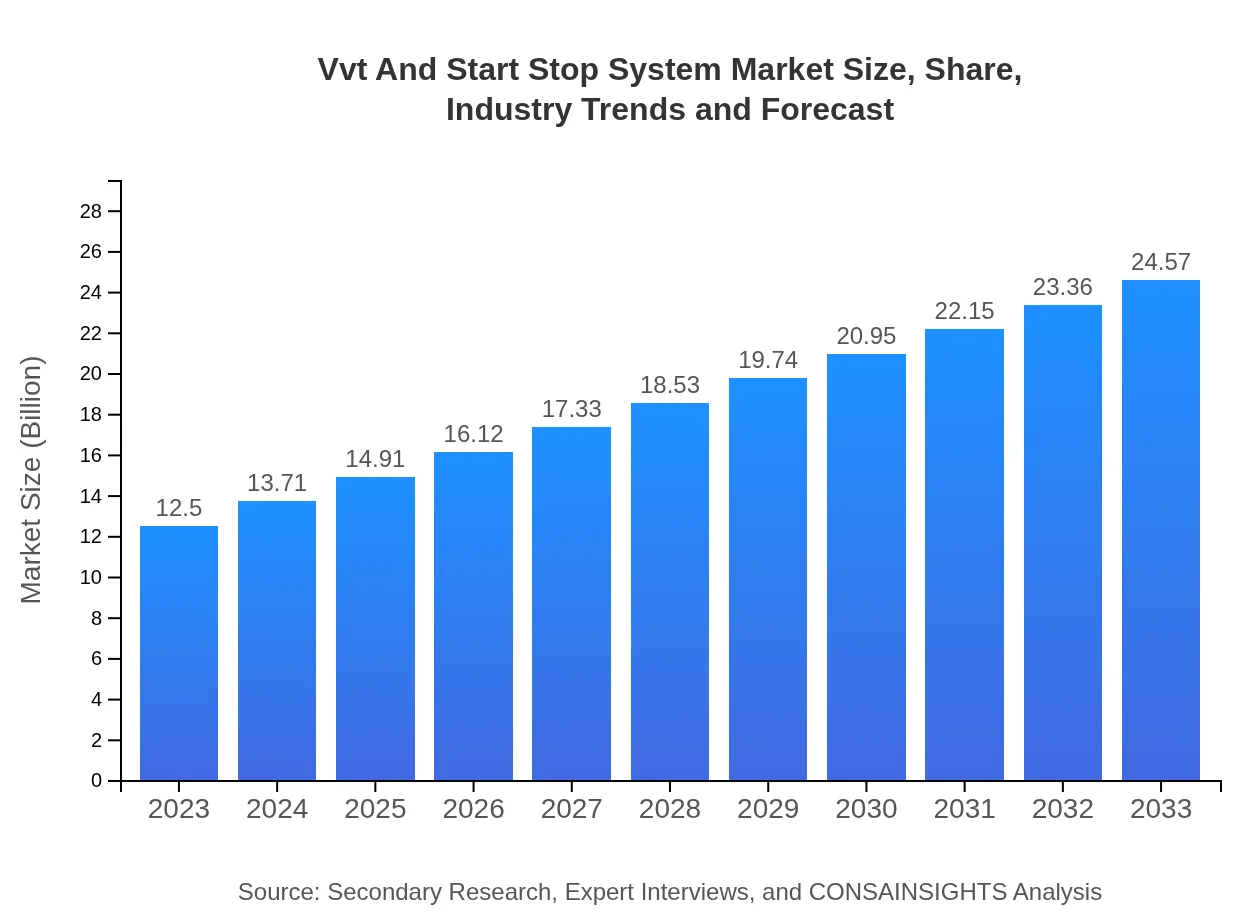

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Bosch, Continental AG, Aisin Seiki Co., Ltd., DENSO Corporation |

| Last Modified Date | 02 February 2026 |

Vvt And Start Stop System Market Overview

Customize Vvt And Start Stop System Market Report market research report

- ✔ Get in-depth analysis of Vvt And Start Stop System market size, growth, and forecasts.

- ✔ Understand Vvt And Start Stop System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vvt And Start Stop System

What is the Market Size & CAGR of Vvt And Start Stop System market in 2023?

Vvt And Start Stop System Industry Analysis

Vvt And Start Stop System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vvt And Start Stop System Market Analysis Report by Region

Europe Vvt And Start Stop System Market Report:

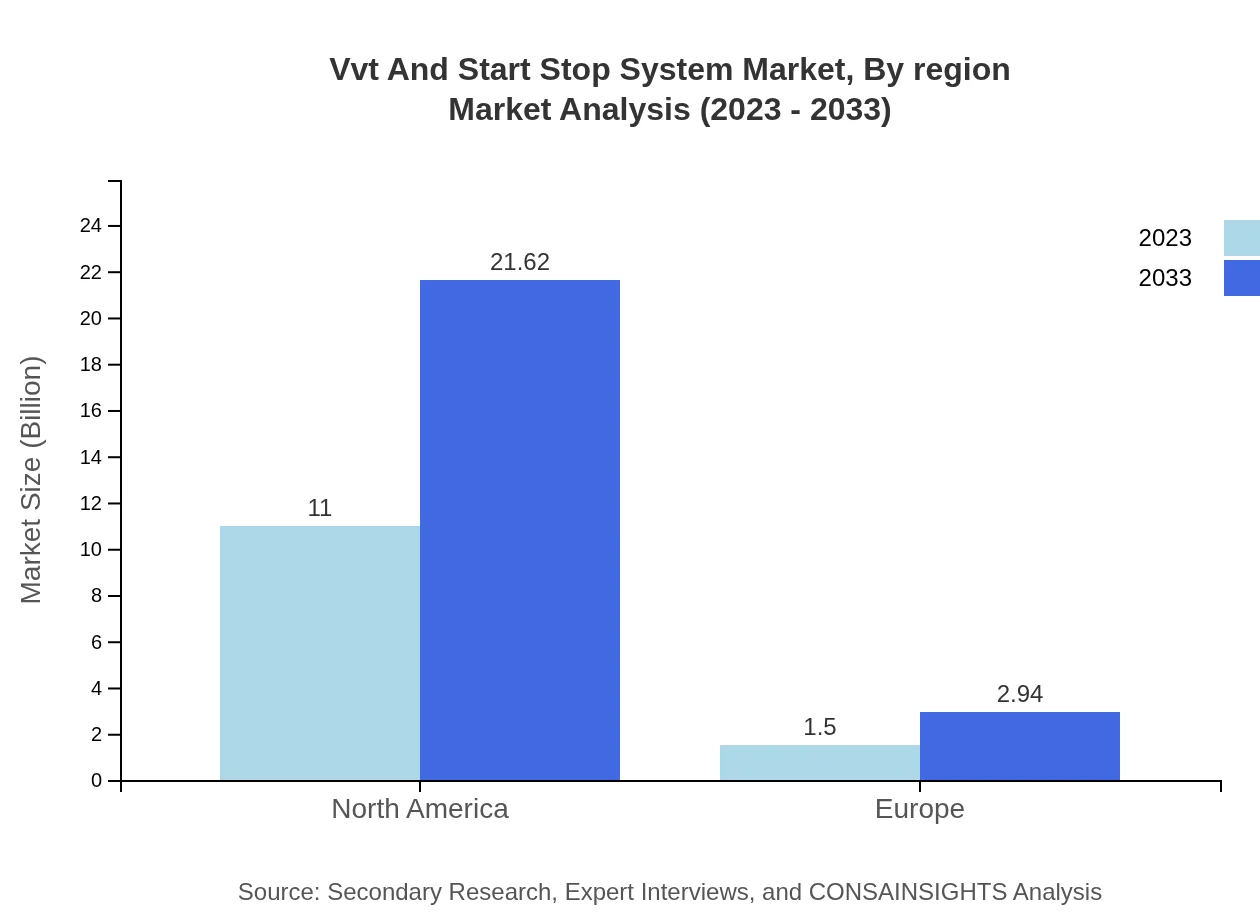

Europe is experiencing a notable upward trend, with market size expected to rise from $3.30 billion in 2023 to $6.48 billion by 2033. Rigorous emission regulations endorsed by the EU are compelling automakers to adopt advanced technologies like VVT and Start-Stop systems, aligning with the region's sustainability goals.Asia Pacific Vvt And Start Stop System Market Report:

In the Asia Pacific region, the VVT and Start-Stop System market is projected to grow from $2.67 billion in 2023 to $5.26 billion by 2033, reflecting the trend of increasing automobile production. Countries like China and India are spearheading this growth due to rapid urbanization and rising disposable incomes, fueling demand for improved vehicle technologies.North America Vvt And Start Stop System Market Report:

North America remains a significant market, with a forecasted increase from $4.34 billion in 2023 to $8.53 billion in 2033. Enhanced regulatory frameworks promoting fuel efficiency, particularly in the US, contribute significantly to the demand for VVT and Start-Stop systems in both passenger and commercial vehicle segments.South America Vvt And Start Stop System Market Report:

The South American market is relatively smaller, with a market size of $0.54 billion in 2023, expected to reach $1.05 billion by 2033. This growth is mainly supported by increasing investments in automotive technology, although economic fluctuations may affect overall growth rates.Middle East & Africa Vvt And Start Stop System Market Report:

The Middle East and Africa market is projected to grow from $1.65 billion in 2023 to $3.24 billion by 2033, driven primarily by growing automotive manufacturing capabilities and an increase in the number of automotive suppliers in the region.Tell us your focus area and get a customized research report.

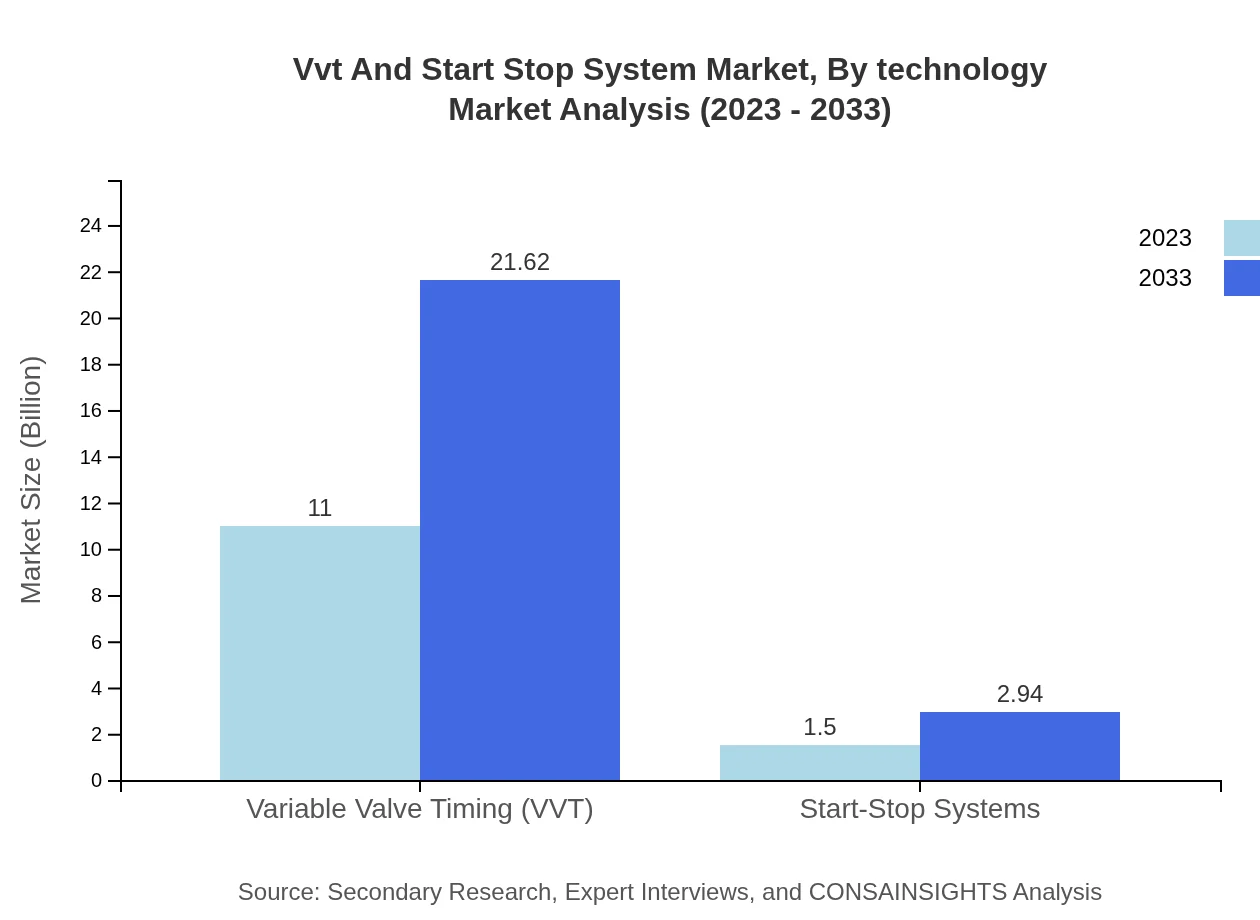

Vvt And Start Stop System Market Analysis By Technology

The VVT segment leads the market due to its extensive application in modern engines for enhancing performance and efficiency, comprising approximately 88% market share in 2023. In contrast, Start-Stop systems account for about 12% market share, yet their adoption is accelerating as consumers seek fuel-efficient solutions.

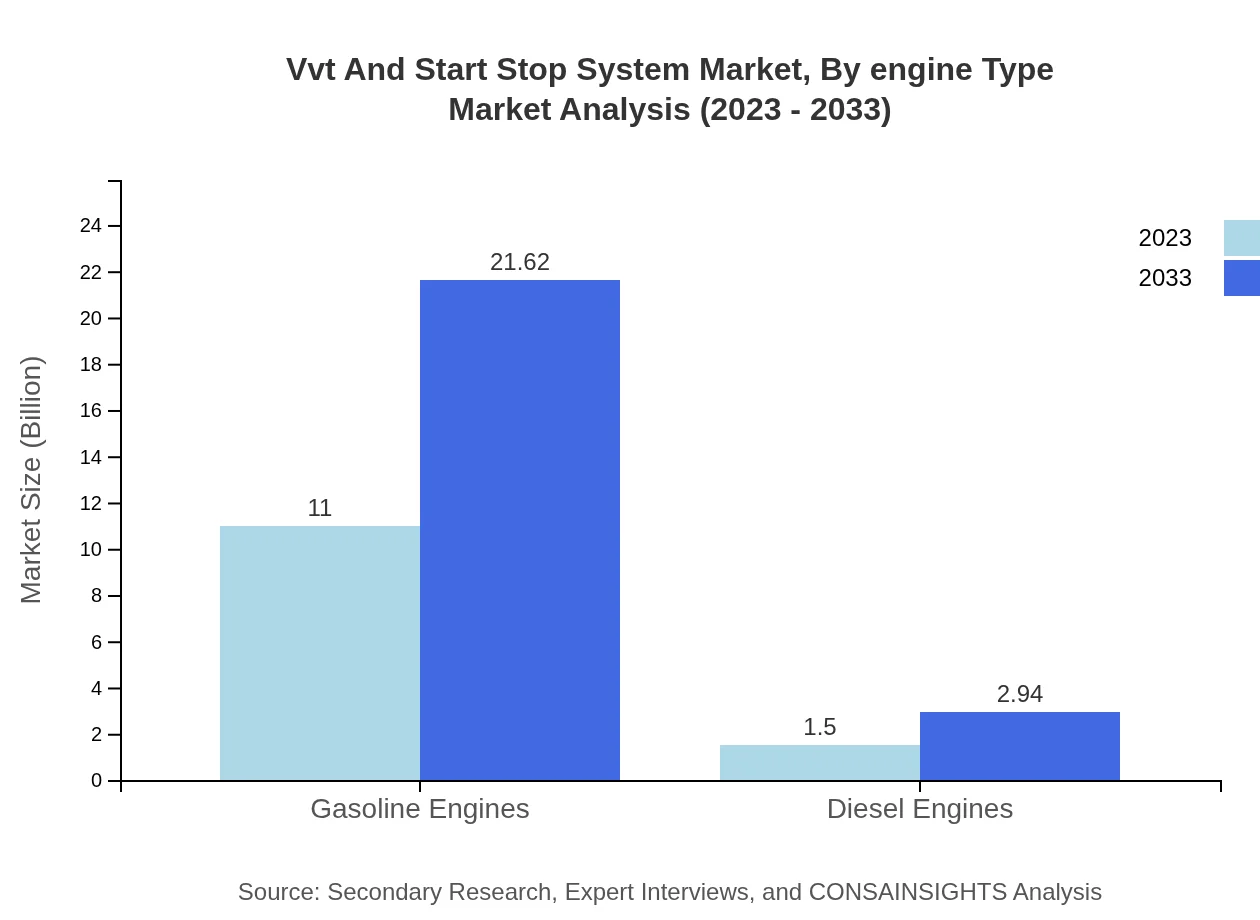

Vvt And Start Stop System Market Analysis By Engine Type

Gasoline engines dominate the VVT and Start-Stop System market, holding an 88% share in 2023. Diesel engines have gradually increased their foothold due to advancements in diesel technology and corresponding fuel-saving measures, making up about 12% of the market.

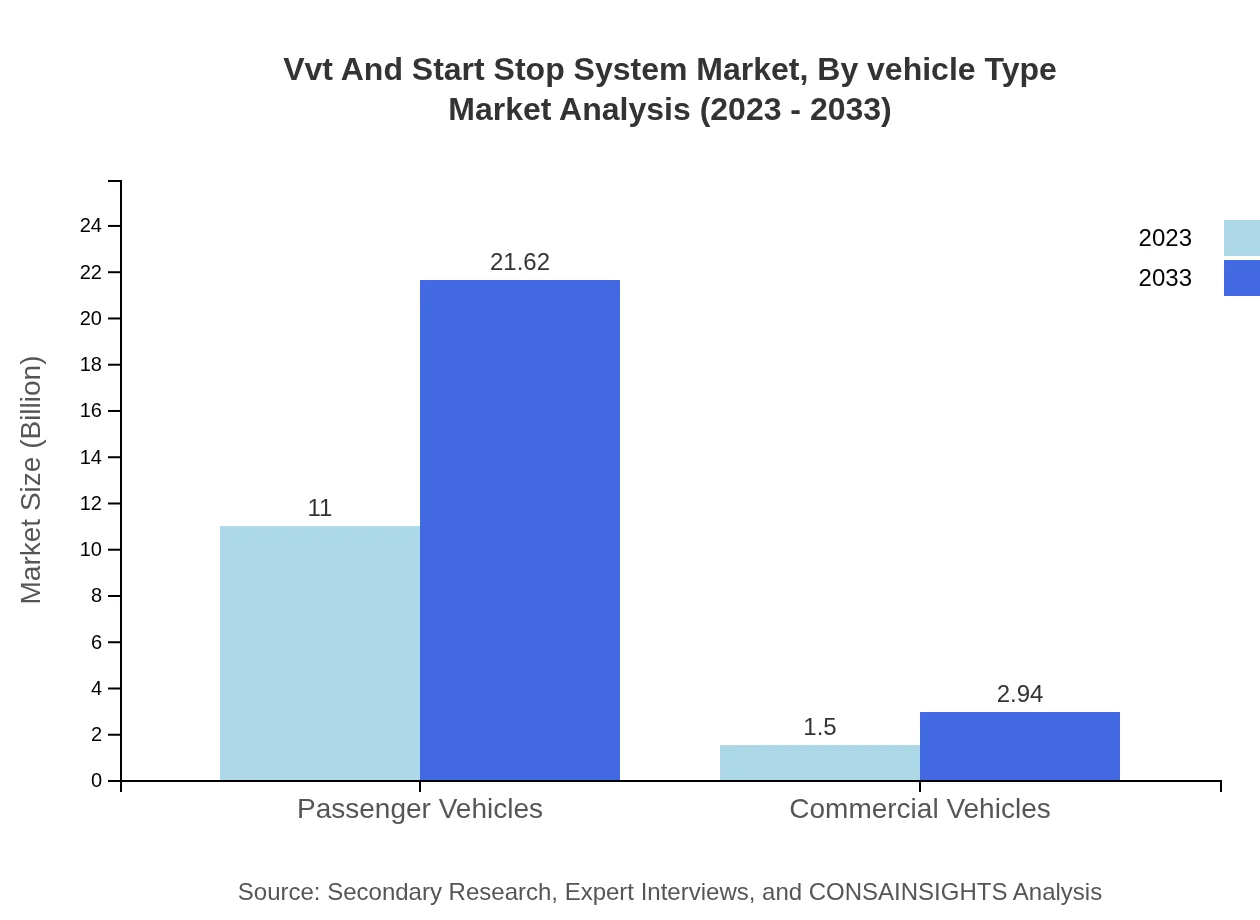

Vvt And Start Stop System Market Analysis By Vehicle Type

Passenger vehicles represent the bulk of the market at around 88% in 2023, directly reflecting consumer preference for efficiency in personal transport. Meanwhile, commercial vehicles are gradually incorporating these innovations, capturing a moderate market share of approximately 12%.

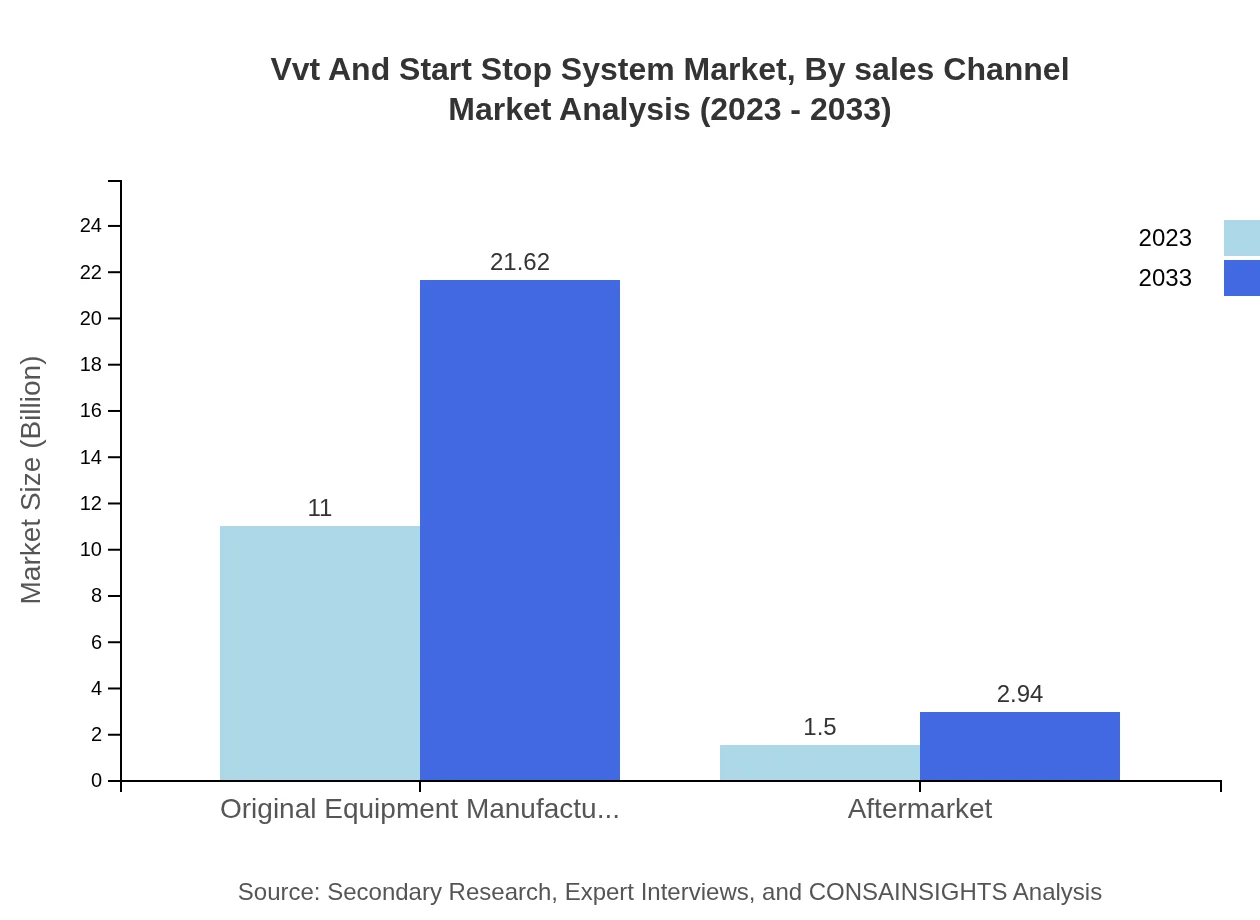

Vvt And Start Stop System Market Analysis By Sales Channel

The OEM segment forms the largest share at 88% in 2023, primarily due to the integration of these systems in new vehicle models. The aftermarket segment is also growing, catering to existing vehicle owners looking to upgrade their vehicles for efficiency.

Vvt And Start Stop System Market Analysis By Region

Regional performance varies significantly, with North America, Europe, and Asia Pacific leading the growth due to stringent regulations and consumer preferences. Emerging markets in South America and the Middle East are also expected to scale up with improved awareness and development in automotive technology.

Vvt And Start Stop System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vvt And Start Stop System Industry

Bosch:

A leading technology and service company that specializes in providing innovative automotive solutions, particularly in fuel injection technology and powertrain components.Continental AG:

Known for its diverse range of automotive products, Continental AG focuses on enhancing vehicle safety, comfort, and efficiency through cutting-edge systems and components.Aisin Seiki Co., Ltd.:

A prominent supplier of automotive parts and systems, Aisin is well recognized for its innovative approach in engine technologies, including VVT systems.DENSO Corporation:

A global manufacturer of advanced automotive technology, Denso's contributions to thermal and powertrain systems make it a key player in the growth of the VVT and Start-Stop System market.We're grateful to work with incredible clients.

FAQs

What is the market size of VVT and Start-Stop System?

The VVT and Start-Stop System market is valued at approximately $12.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8% projected through 2033, indicating significant potential for expansion and innovation in this sector.

What are the key market players or companies in this VVT and Start-Stop System industry?

Key market players in the VVT and Start-Stop System industry include major automotive manufacturers and component suppliers such as Bosch, DENSO, and Valeo, focusing on technology innovations to enhance performance and fuel efficiency in vehicles.

What are the primary factors driving the growth in the VVT and Start-Stop System industry?

Growth in the VVT and Start-Stop System industry is primarily driven by increasing automotive production, rising demand for fuel-efficient vehicles, strict emission regulations, and advancements in engine technologies enhancing overall performance and efficiency.

Which region is the fastest Growing in the VVT and Start-Stop System?

The Asia Pacific region is the fastest-growing in the VVT and Start-Stop System market, with market growth projected to rise from $2.67 billion in 2023 to $5.26 billion by 2033, reflecting a growing automotive sector and consumer demand.

Does ConsaInsights provide customized market report data for the VVT and Start-Stop System industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the VVT and Start-Stop System industry, ensuring relevant insights and detailed analysis to inform business strategies.

What deliverables can I expect from this VVT and Start-Stop System market research project?

Deliverables from the VVT and Start-Stop System market research project include comprehensive reports, in-depth market analysis with segmented data, growth forecasts, competitive landscape overview, and customized insights to support decision-making.

What are the market trends of VVT and Start-Stop System?

Market trends in the VVT and Start-Stop System industry include a shift towards hybrid and electric vehicles, increased adoption of fuel-efficient technologies, a rise in OEM partnerships, and innovations in engine control systems which enhance overall vehicle efficiency.