Warehouse Automation Market Report

Published Date: 22 January 2026 | Report Code: warehouse-automation

Warehouse Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Warehouse Automation market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional analysis, and key players in the industry.

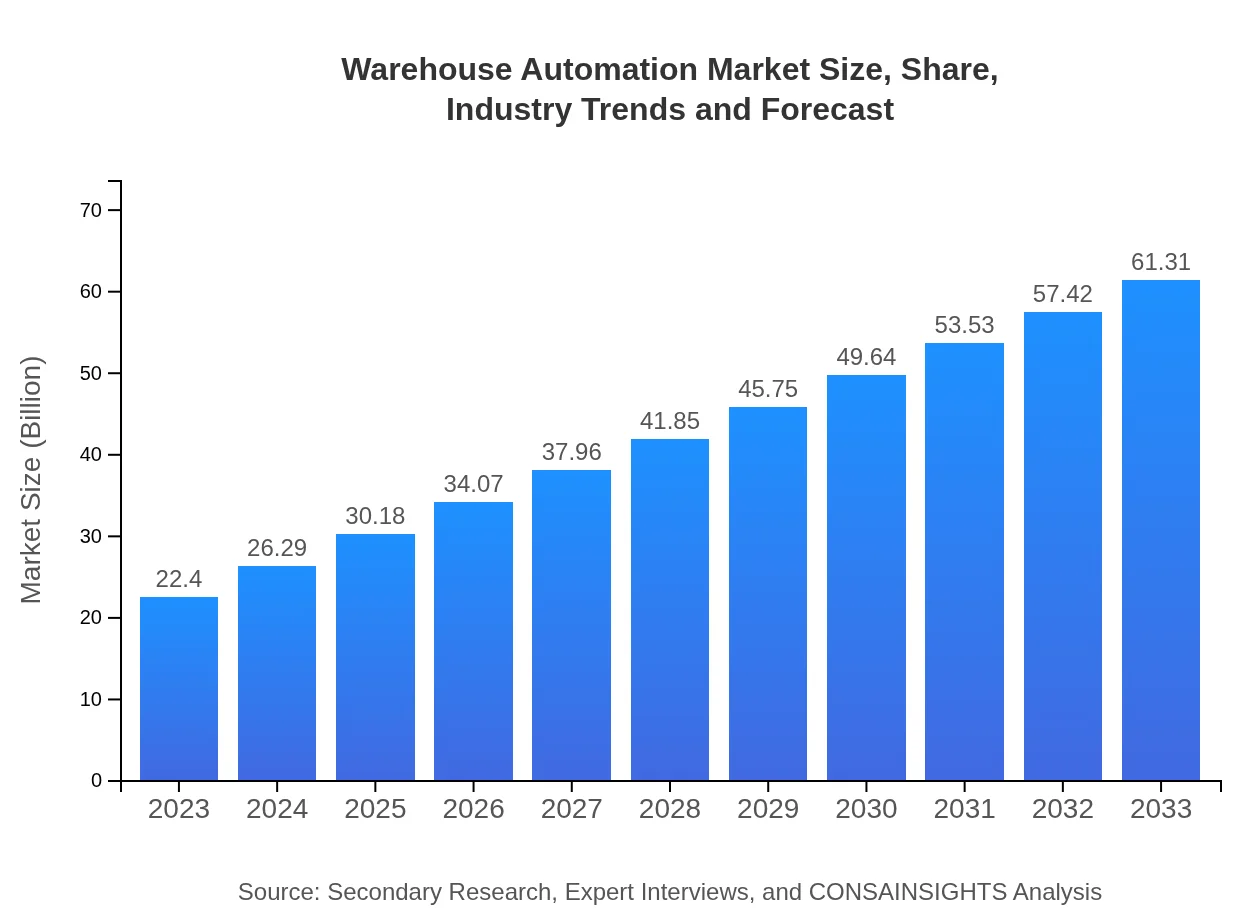

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.40 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $61.31 Billion |

| Top Companies | Kiva Systems (Amazon Robotics), Dematic, Honeywell Intelligrated, Siemens AG, Swisslog |

| Last Modified Date | 22 January 2026 |

Warehouse Automation Market Overview

Customize Warehouse Automation Market Report market research report

- ✔ Get in-depth analysis of Warehouse Automation market size, growth, and forecasts.

- ✔ Understand Warehouse Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Warehouse Automation

What is the Market Size & CAGR of Warehouse Automation market in 2023?

Warehouse Automation Industry Analysis

Warehouse Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Warehouse Automation Market Analysis Report by Region

Europe Warehouse Automation Market Report:

The European market for Warehouse Automation will expand from USD 6.52 billion in 2023 to USD 17.85 billion by 2033. European companies are focusing on the integration of automated systems to enhance their supply chain operations amidst regulatory challenges.Asia Pacific Warehouse Automation Market Report:

In the Asia Pacific region, the Warehouse Automation market is projected to grow from USD 4.44 billion in 2023 to USD 12.16 billion by 2033, driven by rising demand for automated solutions in countries like China and India, which are investing heavily in infrastructural advancements.North America Warehouse Automation Market Report:

North America leads the Warehouse Automation market, with a size of USD 7.23 billion in 2023, projected to grow to USD 19.80 billion by 2033. The strong presence of key players and the robust logistics network in the U.S. contribute significantly to this growth.South America Warehouse Automation Market Report:

The South American Warehouse Automation market is expected to increase from USD 1.46 billion in 2023 to USD 4.01 billion by 2033, as retailers and manufacturers begin to implement automated solutions to improve efficiency and cope with logistical challenges.Middle East & Africa Warehouse Automation Market Report:

In the Middle East and Africa, the Warehouse Automation market is anticipated to grow from USD 2.74 billion in 2023 to USD 7.50 billion by 2033, mainly driven by increased investments in infrastructure and the adoption of smart technology in logistics.Tell us your focus area and get a customized research report.

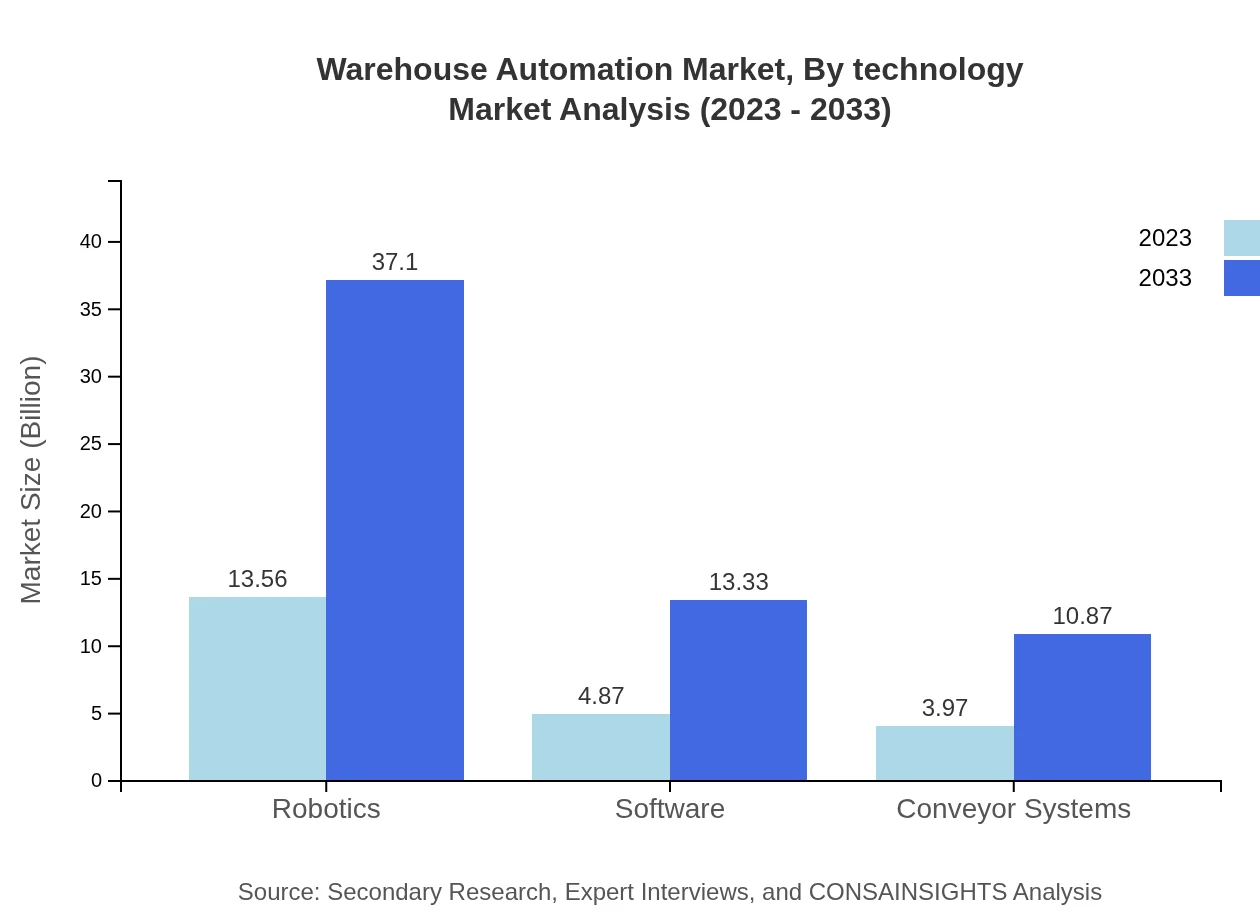

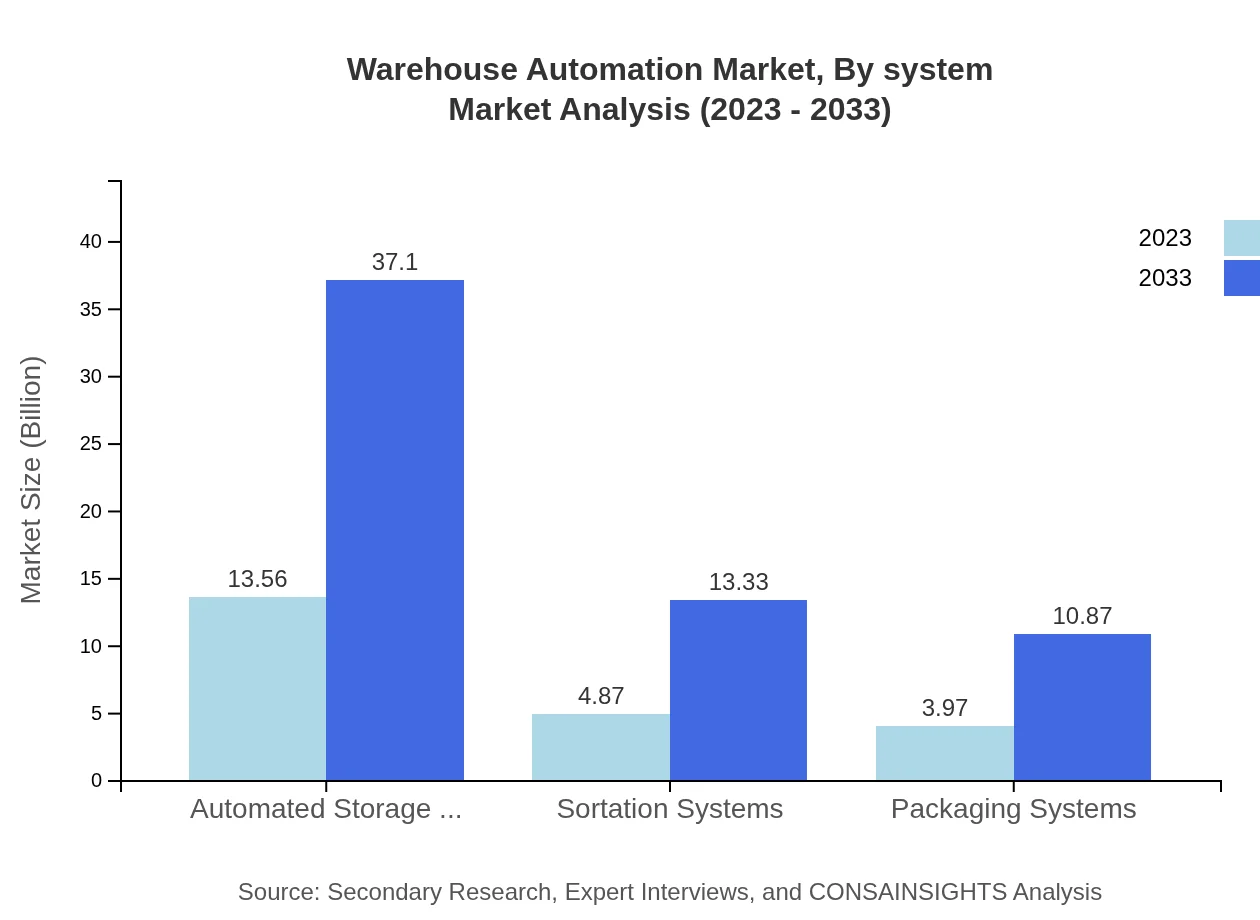

Warehouse Automation Market Analysis By Technology

The technology segment of the Warehouse Automation market is led by Automated Storage and Retrieval Systems (AS/RS), which had a market size of USD 13.56 billion in 2023, expected to reach USD 37.10 billion by 2033, holding a major market share of 60.52%. Other significant technologies include sortation systems and robotics, with increasing market shares in the automated landscape.

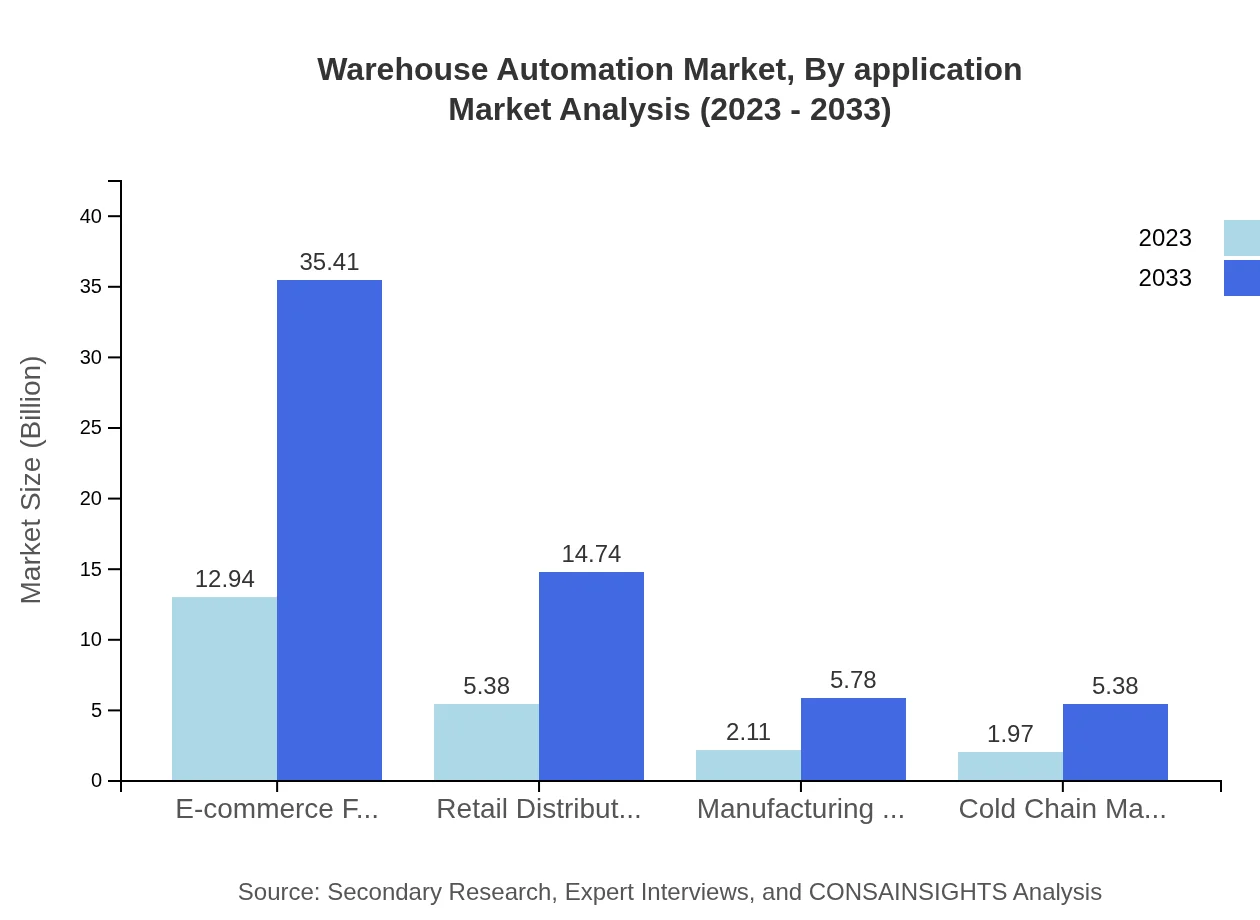

Warehouse Automation Market Analysis By Application

The Warehouse Automation market's application segment is dominated by E-commerce Fulfillment, reflecting the growing trend of online shopping. It reported a market size of USD 12.94 billion in 2023 and is projected to rise to USD 35.41 billion by 2033, holding a 57.76% market share. Other applications include manufacturing logistics and retail distribution, which are also showing promising growth rates.

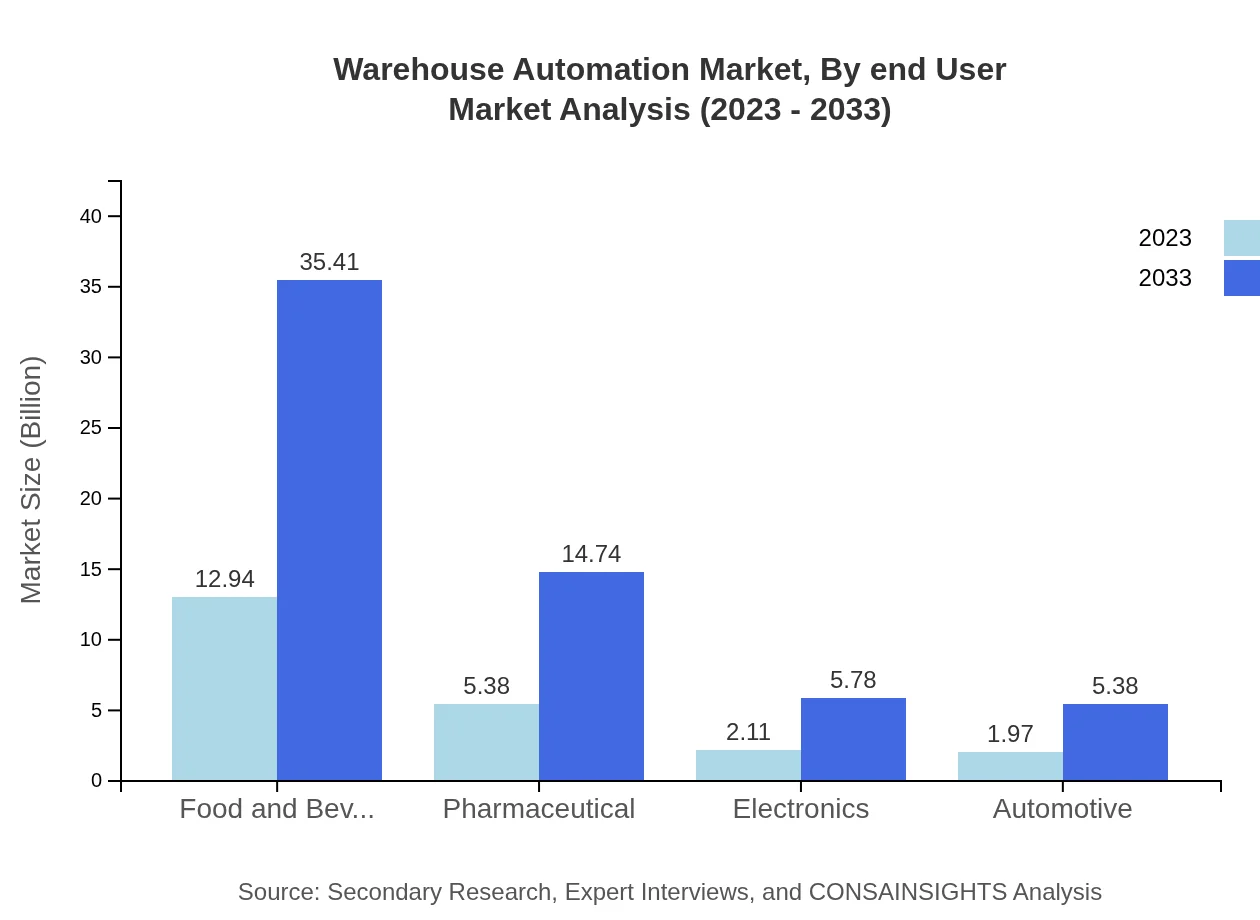

Warehouse Automation Market Analysis By End User

The end-user segment shows significant variety, with key industries being Food and Beverage, Automotive, and Pharmaceuticals. The Food and Beverage sector had a market size of USD 12.94 billion in 2023, anticipated to rise to USD 35.41 billion by 2033, representing a market share of 57.76%. Pharmaceuticals also demonstrate strong growth due to stringent regulations that necessitate automated solutions for compliance.

Warehouse Automation Market Analysis By System

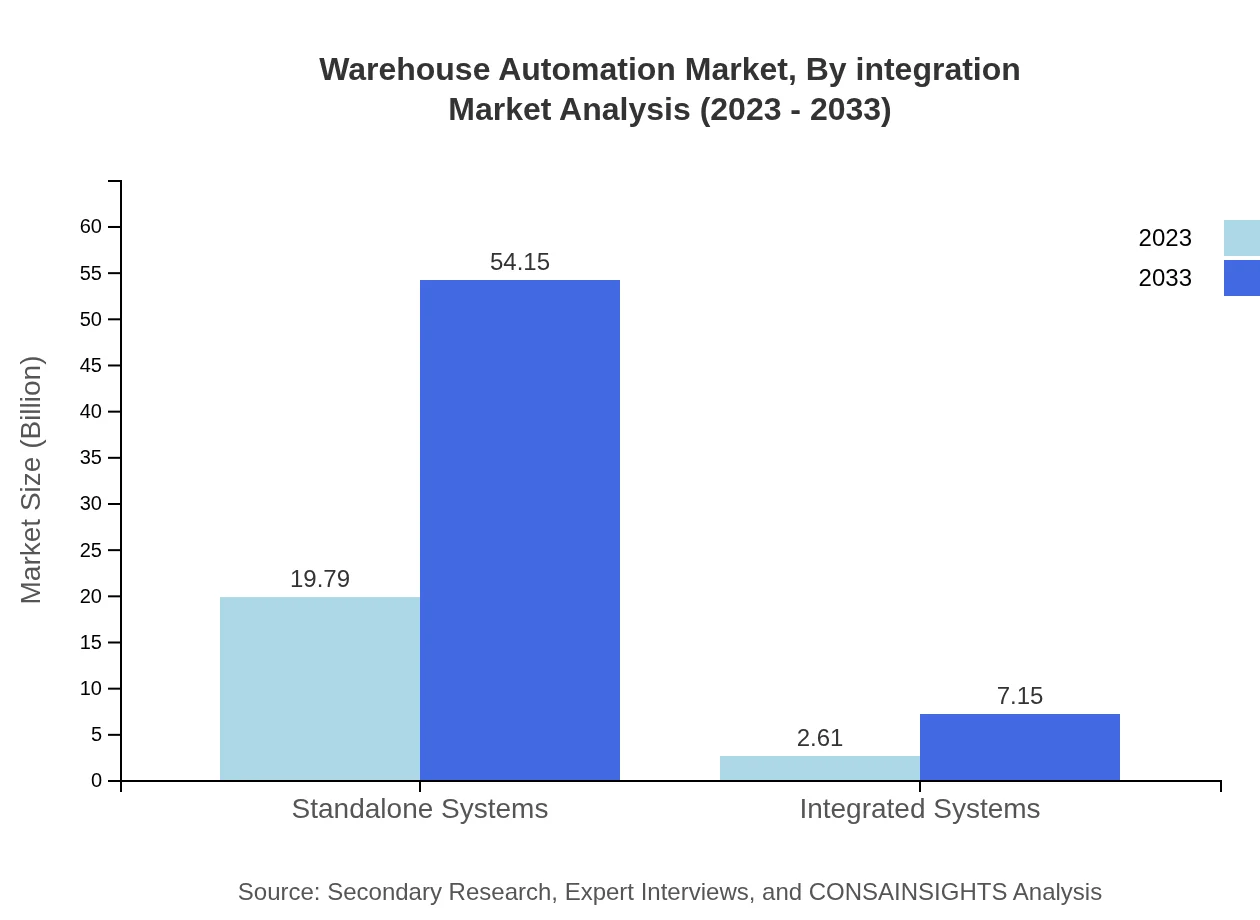

Standalone Systems dominate the Warehouse Automation systems segment, accounting for USD 19.79 billion in 2023, with projections of USD 54.15 billion by 2033. This represents an 88.33% market share, attributed to their flexibility in various applications across the industry.

Warehouse Automation Market Analysis By Integration

The integration segment showcases a growing trend toward Integrated Systems, which had a market size of USD 2.61 billion in 2023, expected to increase to USD 7.15 billion by 2033. Integrated Systems are becoming essential for operations requiring seamless connectivity between different systems and processes, improving data accessibility and efficiency.

Warehouse Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Warehouse Automation Industry

Kiva Systems (Amazon Robotics):

Amazon Robotics, formerly Kiva Systems, specializes in automated mobile robots that transport goods within warehouses, significantly improving efficiency in order fulfillment.Dematic:

Dematic is renowned for its automated and robotic solutions designed for warehouses and distribution centers, focusing on optimizing logistics and operational efficiency.Honeywell Intelligrated:

Honeywell Intelligrated offers smart warehouse automation solutions that include robotic picking and advanced fulfillment technologies, enhancing operational workflows.Siemens AG:

Siemens AG provides comprehensive automation solutions, incorporating IoT technology to enhance warehouse operations across manufacturing and logistics.Swisslog:

Swisslog delivers integrated logistics solutions with a focus on automated systems and robotics, enhancing material handling and inventory management.We're grateful to work with incredible clients.

FAQs

What is the market size of warehouse Automation?

The global warehouse automation market is valued at $22.4 billion in 2023, with a projected growth at a CAGR of 10.2%, indicating significant expansion expected over the next decade, enhancing operational efficiencies in logistics.

What are the key market players or companies in this warehouse Automation industry?

Key players in the warehouse automation market include major companies like Siemens AG, Dematic, Honeywell Intelligrated, and Kiva Systems, which innovate and provide advanced solutions, driving industry standards and customer loyalty.

What are the primary factors driving the growth in the warehouse Automation industry?

Growth in the warehouse automation industry is primarily driven by the rise of e-commerce, demand for operational efficiency, labor shortages, and advancements in technology such as robotics and AI enhancing supply chain processes.

Which region is the fastest Growing in the warehouse Automation?

The fastest-growing region in warehouse automation is North America, projected to grow from $7.23 billion in 2023 to $19.80 billion in 2033, fueled by significant investments in logistics technology and infrastructure improvements.

Does ConsaInsights provide customized market report data for the warehouse Automation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and aspects of the warehouse automation industry, ensuring that businesses receive the most relevant and actionable insights.

What deliverables can I expect from this warehouse Automation market research project?

Deliverables from the warehouse automation market research project typically include comprehensive market analysis, detailed trends and forecasts, segment analysis, and strategic recommendations to enhance business decision-making.

What are the market trends of warehouse automation?

Current market trends in warehouse automation include increasing adoption of robotics, the rise of AI-driven solutions, integration of IoT for smarter logistics, and a growing focus on sustainable operations to meet environmental standards.