Warehouse Fumigants Market Report

Published Date: 02 February 2026 | Report Code: warehouse-fumigants

Warehouse Fumigants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Warehouse Fumigants market including current trends, growth forecasts, and industry insights from 2023 to 2033.

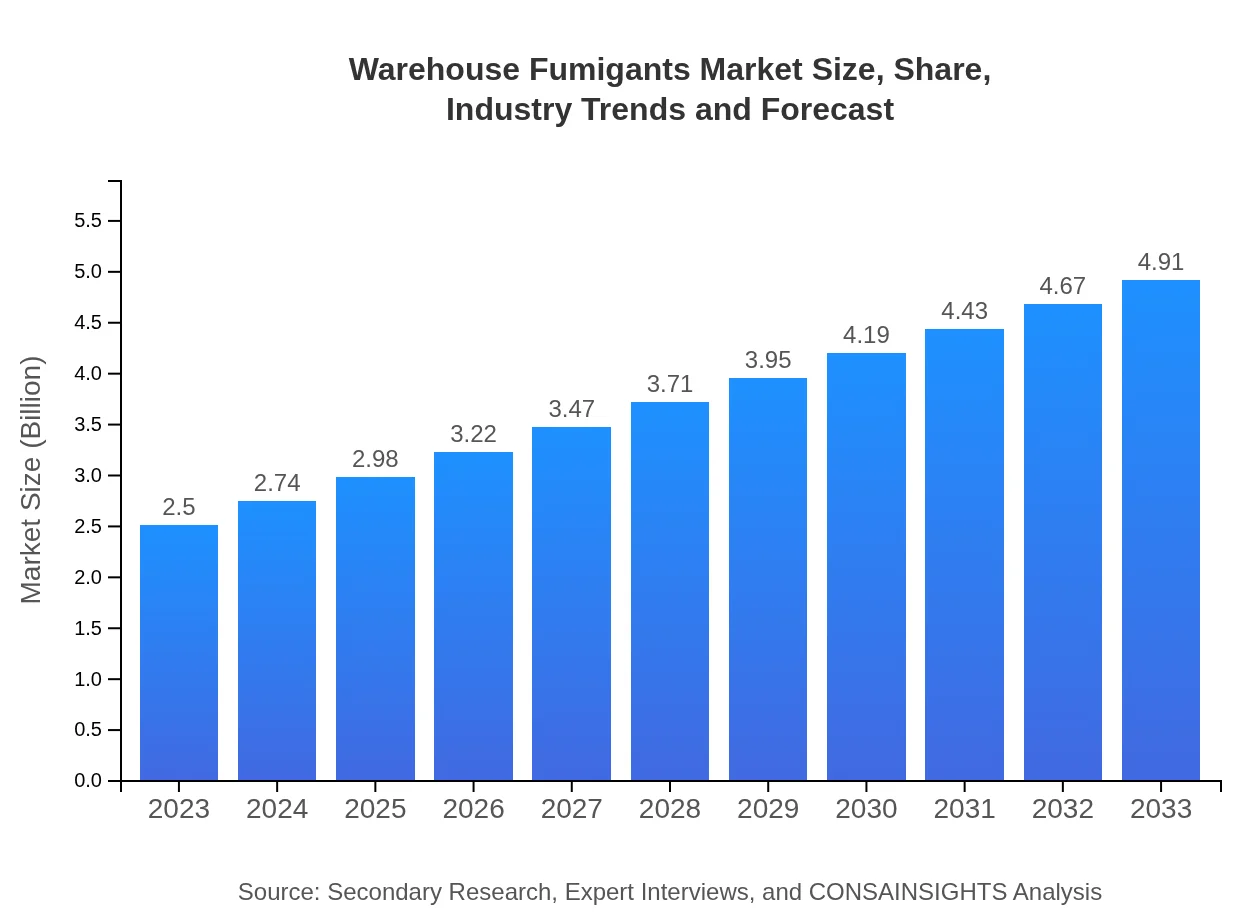

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, De Sangosse, UPL Limited |

| Last Modified Date | 02 February 2026 |

Warehouse Fumigants Market Overview

Customize Warehouse Fumigants Market Report market research report

- ✔ Get in-depth analysis of Warehouse Fumigants market size, growth, and forecasts.

- ✔ Understand Warehouse Fumigants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Warehouse Fumigants

What is the Market Size & CAGR of Warehouse Fumigants market in 2023 and 2033?

Warehouse Fumigants Industry Analysis

Warehouse Fumigants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Warehouse Fumigants Market Analysis Report by Region

Europe Warehouse Fumigants Market Report:

The European market was valued at $0.77 billion in 2023 and is expected to grow to $1.52 billion by 2033. Increasing awareness of environmental concerns and the demand for organic food products are influencing the shift towards eco-friendly fumigants.Asia Pacific Warehouse Fumigants Market Report:

The Asia Pacific region exhibited a market size of $0.47 billion in 2023, expected to grow to $0.93 billion by 2033, driven by increasing agricultural activities and evolving pest challenges.North America Warehouse Fumigants Market Report:

North America is anticipated to expand from $0.88 billion in 2023 to $1.73 billion by 2033, bolstered by innovative product formulations and stringent food safety regulations that drive the use of effective fumigation methods.South America Warehouse Fumigants Market Report:

In South America, the market size was valued at $0.15 billion in 2023, projected to reach $0.29 billion by 2033. The region is characterized by agricultural growth and a substantial demand for effective pest management solutions.Middle East & Africa Warehouse Fumigants Market Report:

The market in the Middle East and Africa, valued at $0.23 billion in 2023, is projected to witness a rise to $0.45 billion by 2033, fueled by growing agricultural practices and the demand for food storage solutions.Tell us your focus area and get a customized research report.

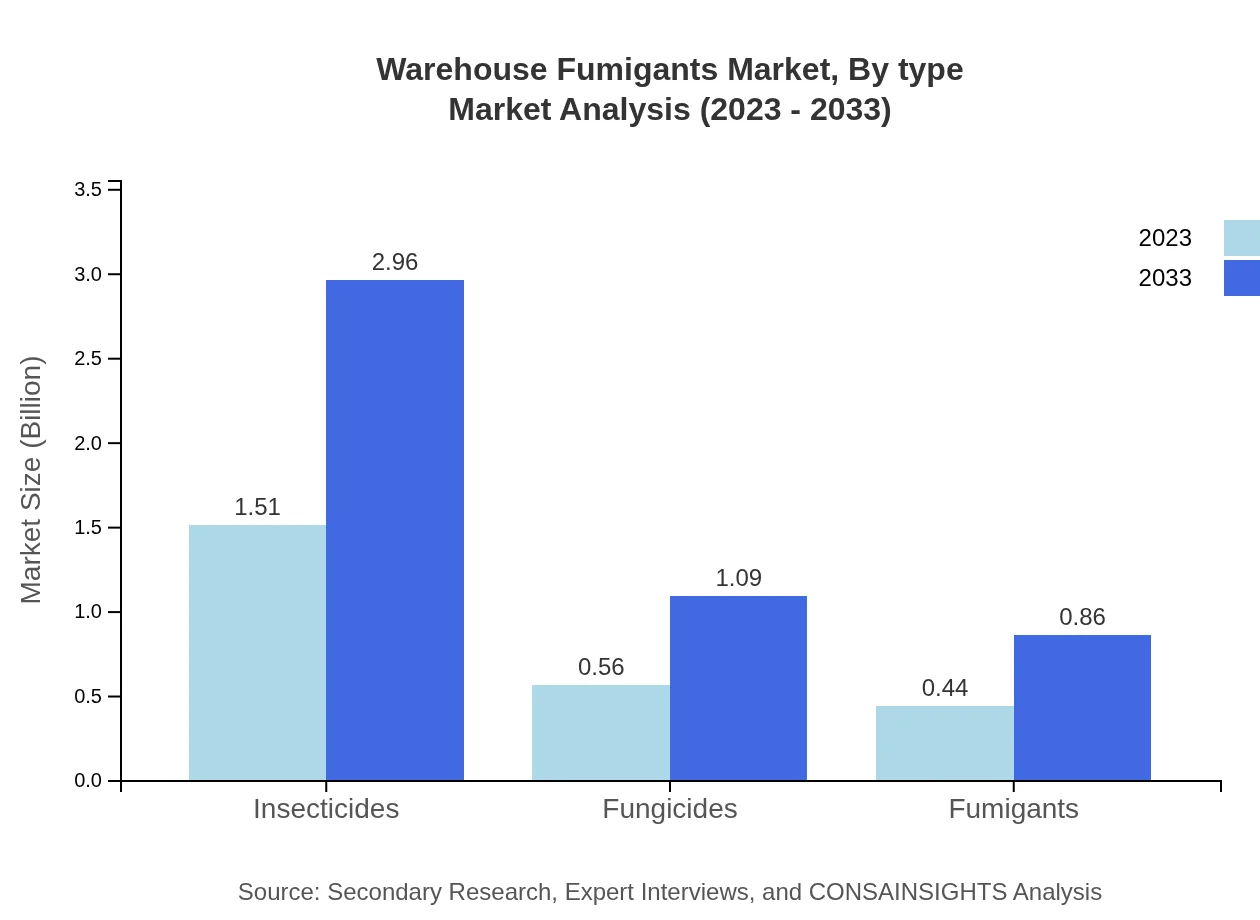

Warehouse Fumigants Market Analysis By Type

The Warehouse Fumigants market by type reveals a strong preference for insecticides, capturing a market size of $1.51 billion in 2023 with a share of 60.32%. Fungicides follow with $0.56 billion and a share of 22.2%, while fumigants account for $0.44 billion, representing 17.48% of the market. The demand for insecticides, particularly, is poised for growth as pest resistance increases.

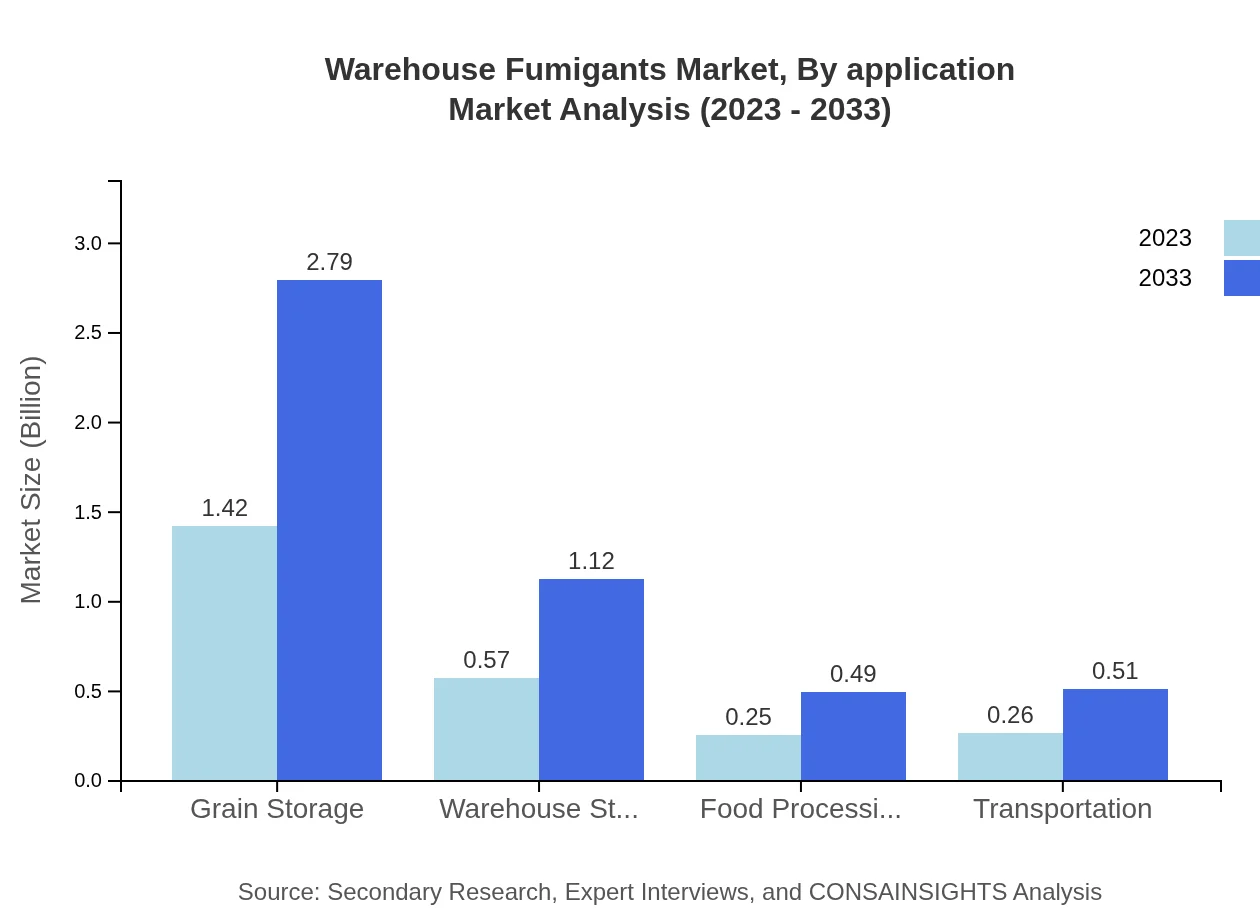

Warehouse Fumigants Market Analysis By Application

In terms of application, the agriculture sector leads with a size of $1.42 billion representing 56.83% of the market in 2023, and is expected to grow robustly. Warehouse stored products hold a substantial size of $0.57 billion (22.79%). The food manufacturing and pharmaceutical sectors also significantly contribute to the market, representing 22.79% and 10.02% shares, respectively.

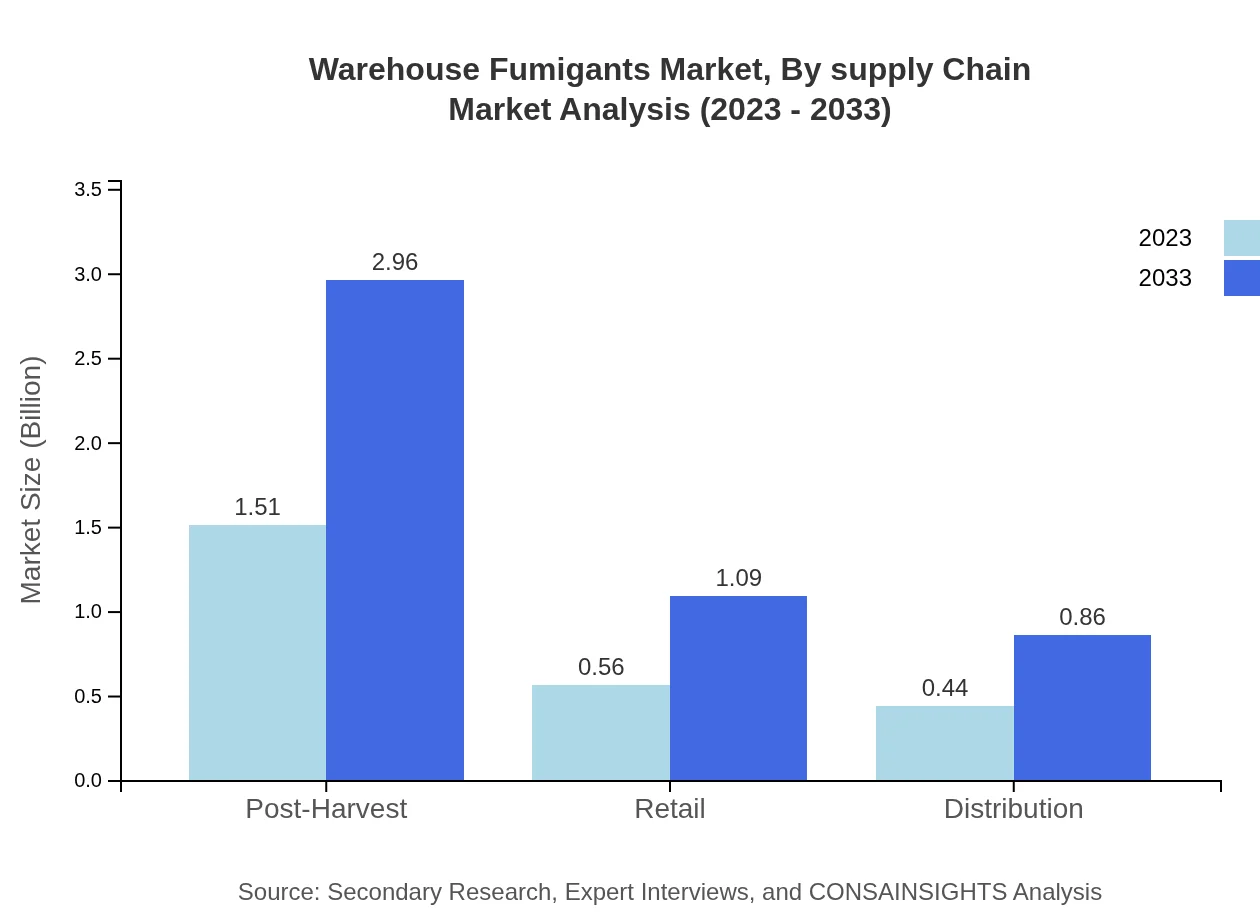

Warehouse Fumigants Market Analysis By Supply Chain

The analysis of market segmentation by supply chain stages shows that distribution is crucial, contributing $0.44 billion to the warehouse fumigants market, accounting for a 17.48% share in 2023. The food processing sector also plays a significant role, attributed to regulatory demands for pest control within food safety frameworks.

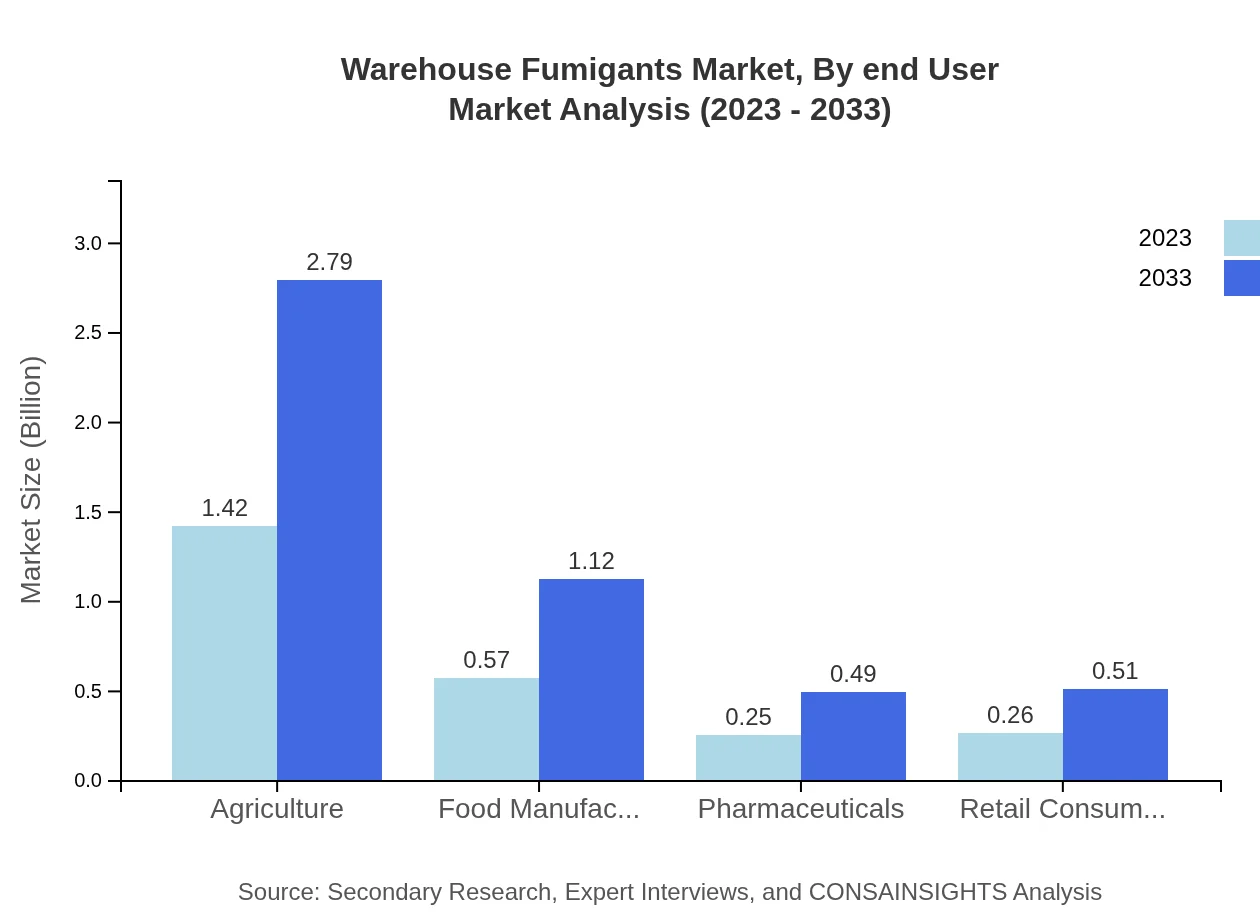

Warehouse Fumigants Market Analysis By End User

End-users of warehouse fumigants primarily include agriculture and food manufacturing sectors, which account for significant shares. Retail consumers show a sizeable participation highlighting end-user diversity. The agricultural sector alone represents a significant portion of the market, emphasizing the need for effective pest management solutions.

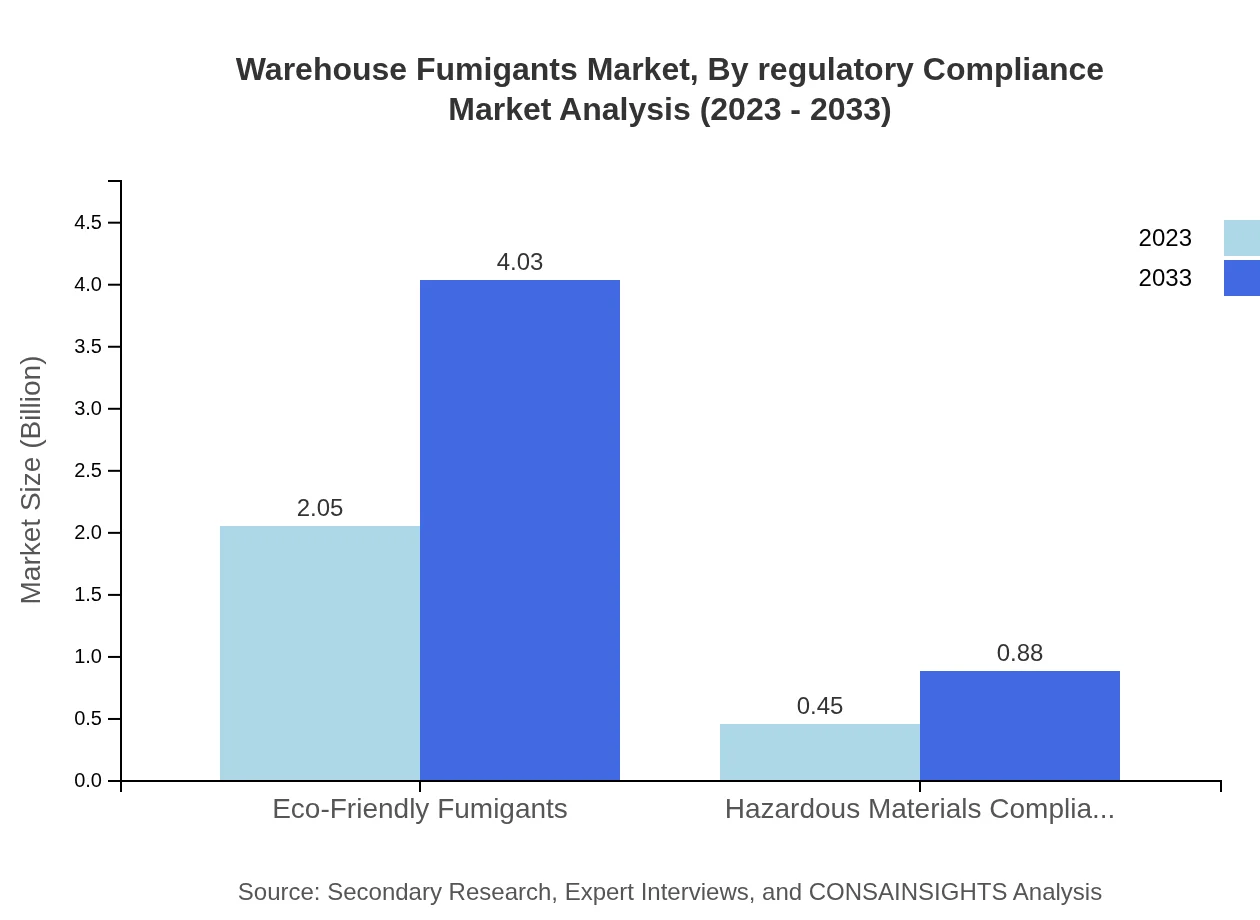

Warehouse Fumigants Market Analysis By Regulatory Compliance

Regulatory compliance in the Warehouse Fumigants market is paramount due to potential health hazards associated with fumigation substances. Products must adhere to regulations ensuring safe usage, particularly for eco-friendly fumigants, which are on the rise due to stringent regulations promoting sustainability.

Warehouse Fumigants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Warehouse Fumigants Industry

BASF SE:

A global leader in chemistry, BASF produces a wide range of fumigants and crop protection products catering to agricultural needs.Syngenta AG:

Syngenta specializes in agrochemicals, including innovative fumigants aimed at enhancing agricultural productivity and sustainability.FMC Corporation:

FMC offers a variety of agricultural solutions, including effective pest control products, ensuring farmers can maintain crop health.De Sangosse:

A key player in the agrochemical sector, focusing on integrated pest management solutions including fumigation products.UPL Limited:

UPL provides a diverse range of agrochemical products, including fumigants that foster agricultural efficiency and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of warehouse Fumigants?

The market size for warehouse fumigants is estimated at $2.5 billion in 2023, with a projected CAGR of 6.8%. This growth reflects increasing demand for safe and effective fumigation solutions in food storage and agricultural sectors.

What are the key market players or companies in the warehouse fumigants industry?

Key players in the warehouse fumigants sector include companies specializing in pest control and agricultural solutions. Leading brands focus on developing innovative fumigants that meet industry standards and have a minimal environmental impact, contributing to their competitive edge.

What are the primary factors driving the growth in the warehouse fumigants industry?

The growth in the warehouse fumigants industry is driven by factors such as increasing agricultural production, stringent regulations on pest control, and rising consumer demand for safe food storage. Additionally, advancements in eco-friendly fumigation technologies are gaining traction.

Which region is the fastest Growing in the warehouse fumigants market?

The fastest-growing region in the warehouse fumigants market is North America, projected to grow from $0.88 billion in 2023 to $1.73 billion by 2033. This growth is driven by advancements in pest management and a strong focus on food safety.

Does ConsaInsights provide customized market report data for the warehouse fumigants industry?

Yes, ConsaInsights offers customized market report data tailored to the warehouse fumigants industry. Clients can obtain insights based on specific needs and regional data to inform strategic business decisions and investments.

What deliverables can I expect from this warehouse fumigants market research project?

Deliverables from the warehouse fumigants market research project may include detailed market size reports, segment analysis, competitive landscape assessments, and regional growth trends. Executive summaries and actionable insights for strategic planning are also standard.

What are the market trends of warehouse fumigants?

Current market trends in warehouse fumigants include a shift towards eco-friendly products, increasing automation in pest control, and the integration of digital technologies. Moreover, consumer awareness around sustainable practices is influencing product development and marketing strategies.