Warm Water Aquaculture Feed Market Report

Published Date: 02 February 2026 | Report Code: warm-water-aquaculture-feed

Warm Water Aquaculture Feed Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Warm Water Aquaculture Feed industry. It encompasses market size, segmentation, regional insights, trends, and forecasts from 2023 to 2033, offering strategic insights for stakeholders.

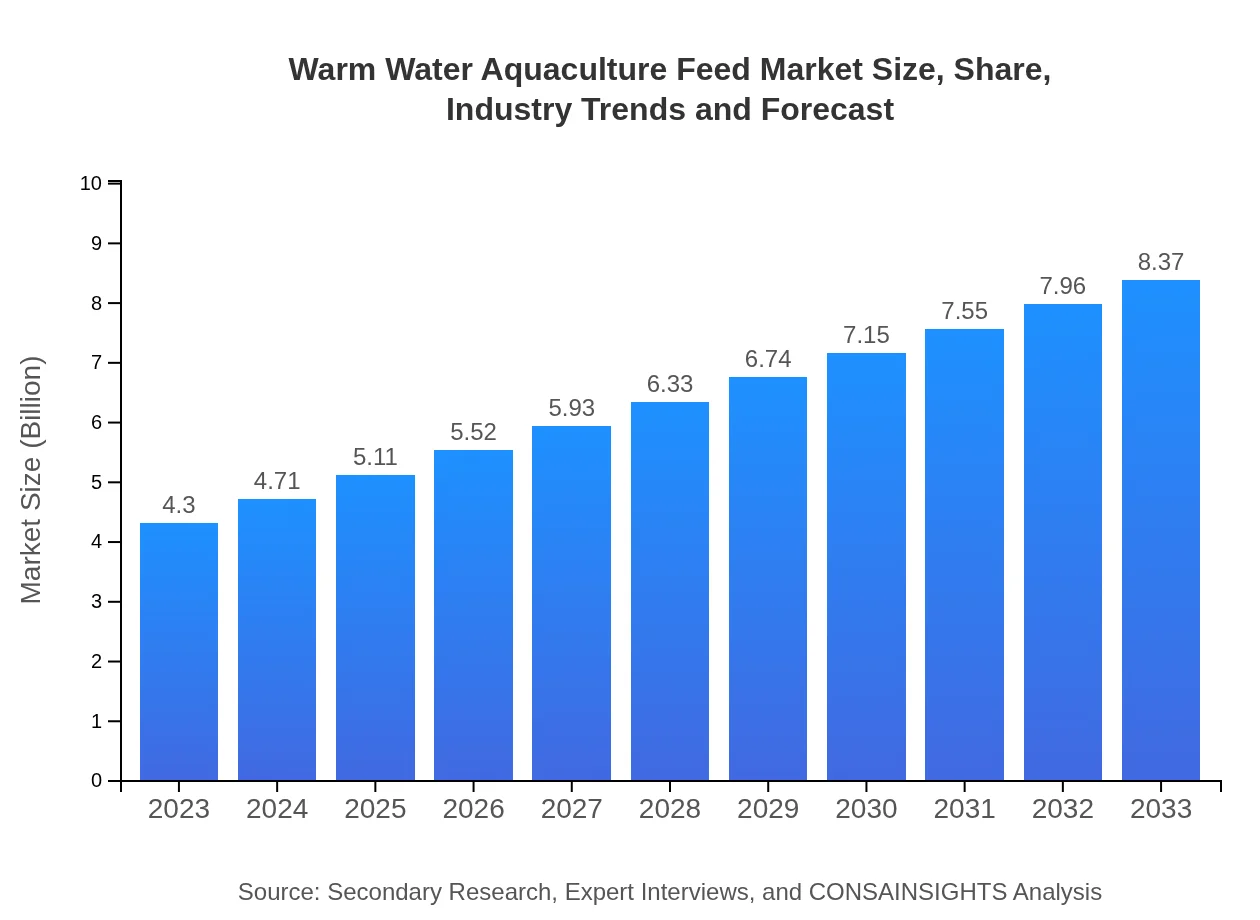

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.30 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $8.37 Billion |

| Top Companies | Cargill , Nutreco, Alltech, Skretting |

| Last Modified Date | 02 February 2026 |

Warm Water Aquaculture Feed Market Overview

Customize Warm Water Aquaculture Feed Market Report market research report

- ✔ Get in-depth analysis of Warm Water Aquaculture Feed market size, growth, and forecasts.

- ✔ Understand Warm Water Aquaculture Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Warm Water Aquaculture Feed

What is the Market Size & CAGR of Warm Water Aquaculture Feed market in 2033?

Warm Water Aquaculture Feed Industry Analysis

Warm Water Aquaculture Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Warm Water Aquaculture Feed Market Analysis Report by Region

Europe Warm Water Aquaculture Feed Market Report:

Europe's warm water aquaculture feed market is expected to increase from $1.37 billion in 2023 to $2.67 billion by 2033, driven by eco-friendly feed formulations and strong regulatory frameworks promoting sustainability.Asia Pacific Warm Water Aquaculture Feed Market Report:

The Asia Pacific region, accounting for a substantial market share, is expected to grow from $0.76 billion in 2023 to $1.48 billion by 2033. Increased aquaculture production driven by government initiatives and consumer demand for seafood are key drivers.North America Warm Water Aquaculture Feed Market Report:

North America’s market is anticipated to grow from $1.57 billion in 2023 to $3.05 billion by 2033, emphasizing sustainable practices and innovative feed solutions to address burgeoning seafood consumption.South America Warm Water Aquaculture Feed Market Report:

In South America, the market is projected to expand from $0.25 billion in 2023 to $0.48 billion by 2033, with Brazil leading in aquaculture operations. The region is seeing a rise in shrimp farming, which boosts feed demand.Middle East & Africa Warm Water Aquaculture Feed Market Report:

The Middle East and Africa market, starting at $0.36 billion in 2023 and reaching $0.69 billion by 2033, is showing growth due to increasing aquaculture investments and a growing appreciation for seafood.Tell us your focus area and get a customized research report.

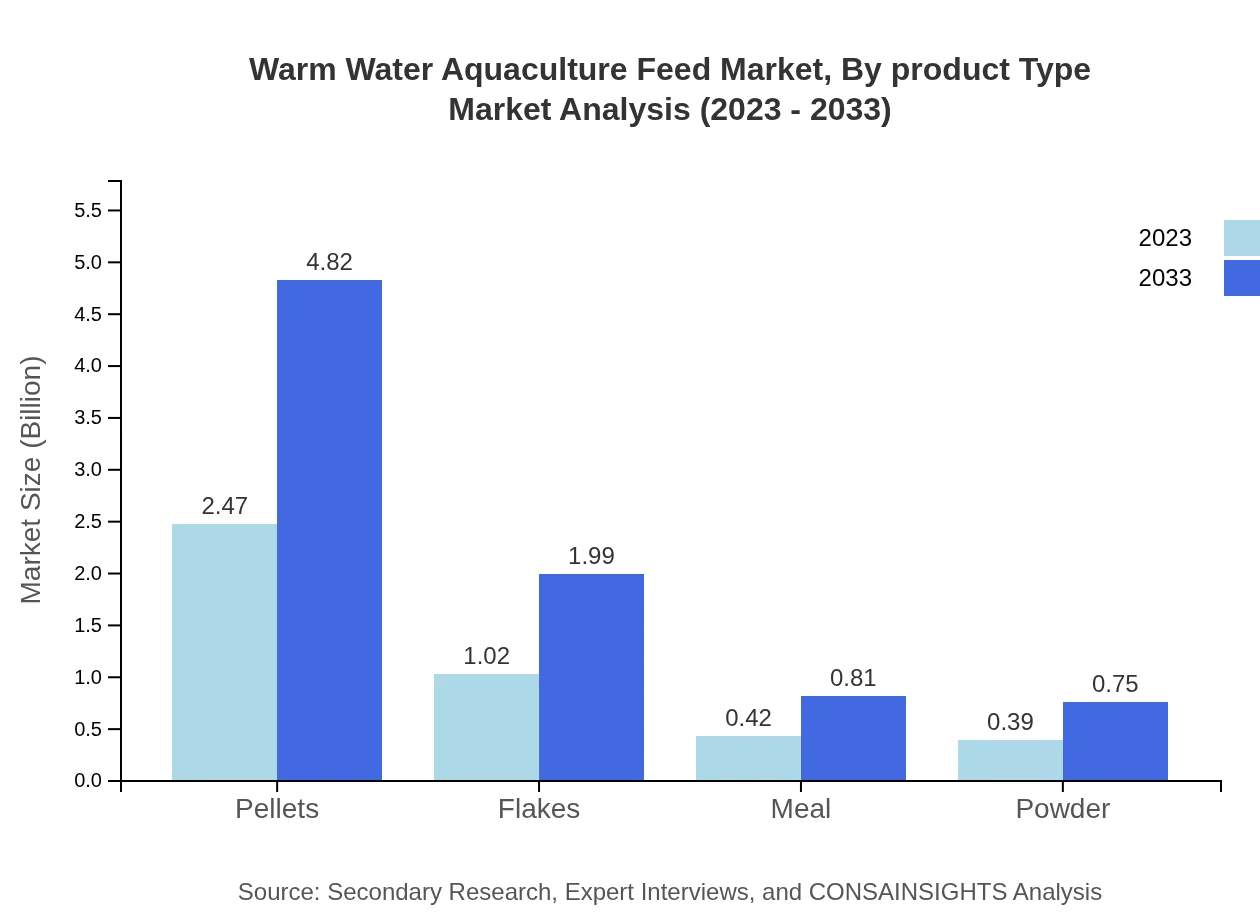

Warm Water Aquaculture Feed Market Analysis By Product Type

The product types in the Warm Water Aquaculture Feed market include pellets, flakes, meal, and powder. Pellets dominate the sector, showing a market size of $2.47 billion in 2023 and projected to reach $4.82 billion by 2033, attributed to their convenience and efficiency.

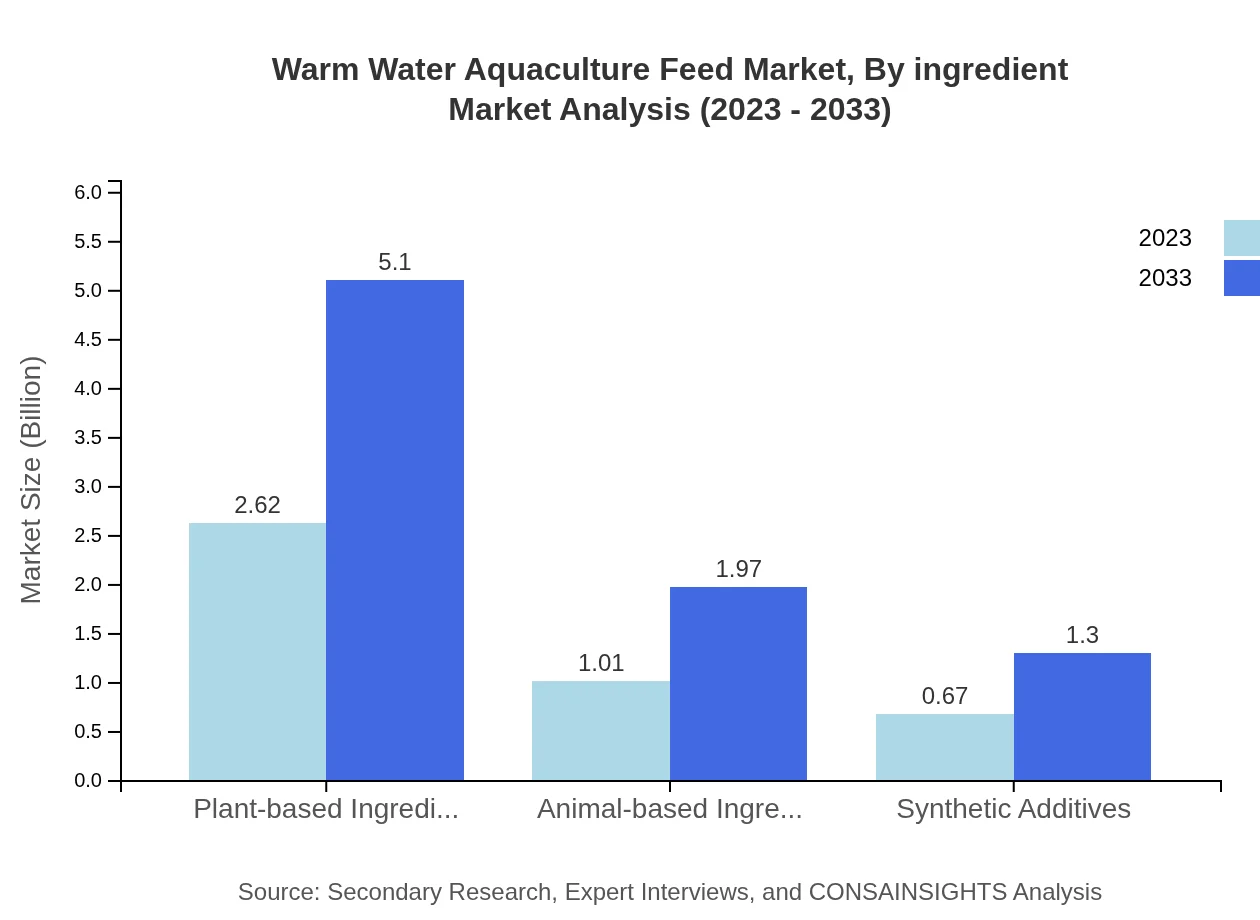

Warm Water Aquaculture Feed Market Analysis By Ingredient

The ingredient types are prominently segmented into plant-based ingredients, animal-based ingredients, and synthetic additives. Plant-based ingredients hold a large share, valued at $2.62 billion in 2023 and expected to grow to $5.10 billion by 2033, representing the industry's shift towards more sustainable options.

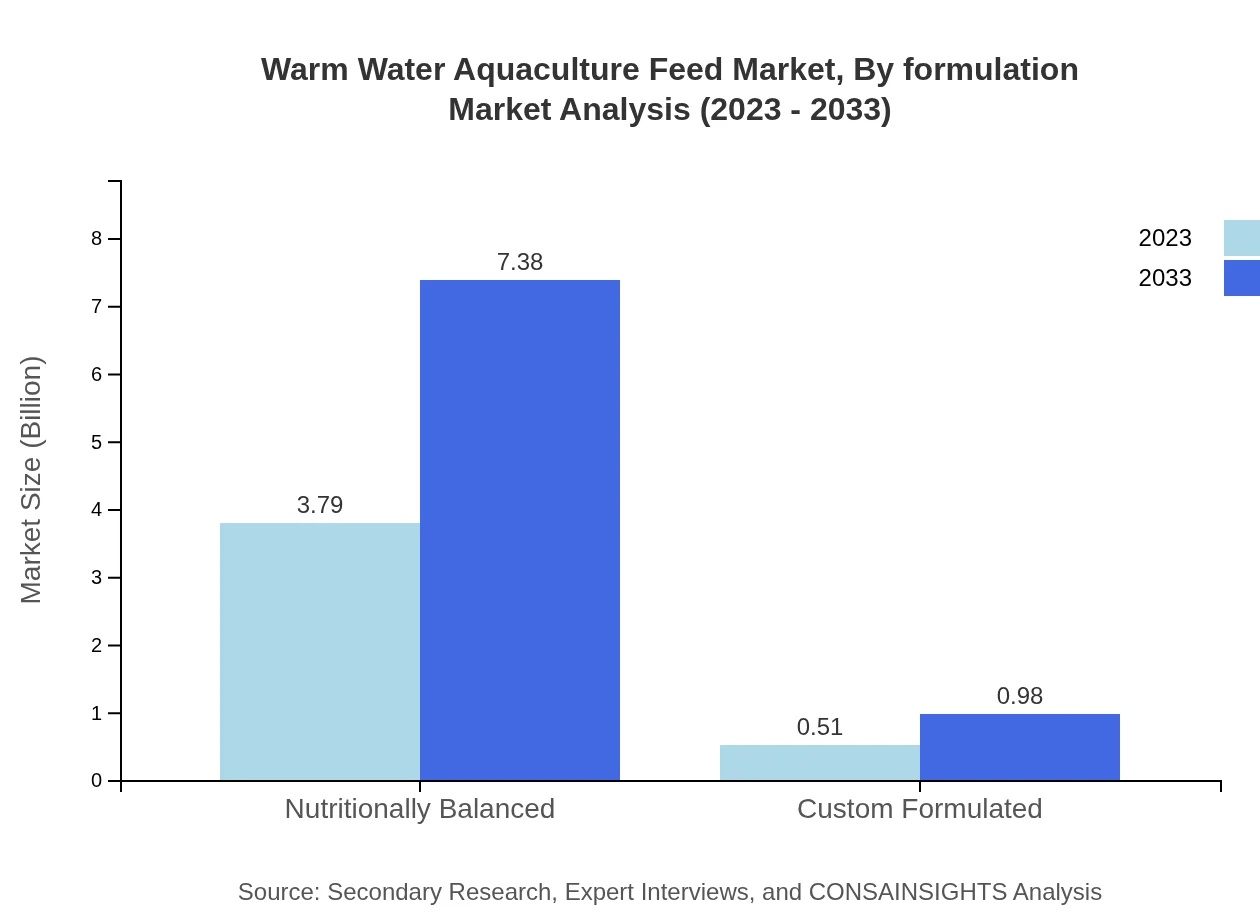

Warm Water Aquaculture Feed Market Analysis By Formulation

Formulation categories center on nutritionally balanced and custom formulated feeds. The nutritionally balanced segment is noteworthy, holding a market value of $3.79 billion in 2023 and rising to $7.38 billion by 2033 due to its critical role in enhancing aquaculture productivity.

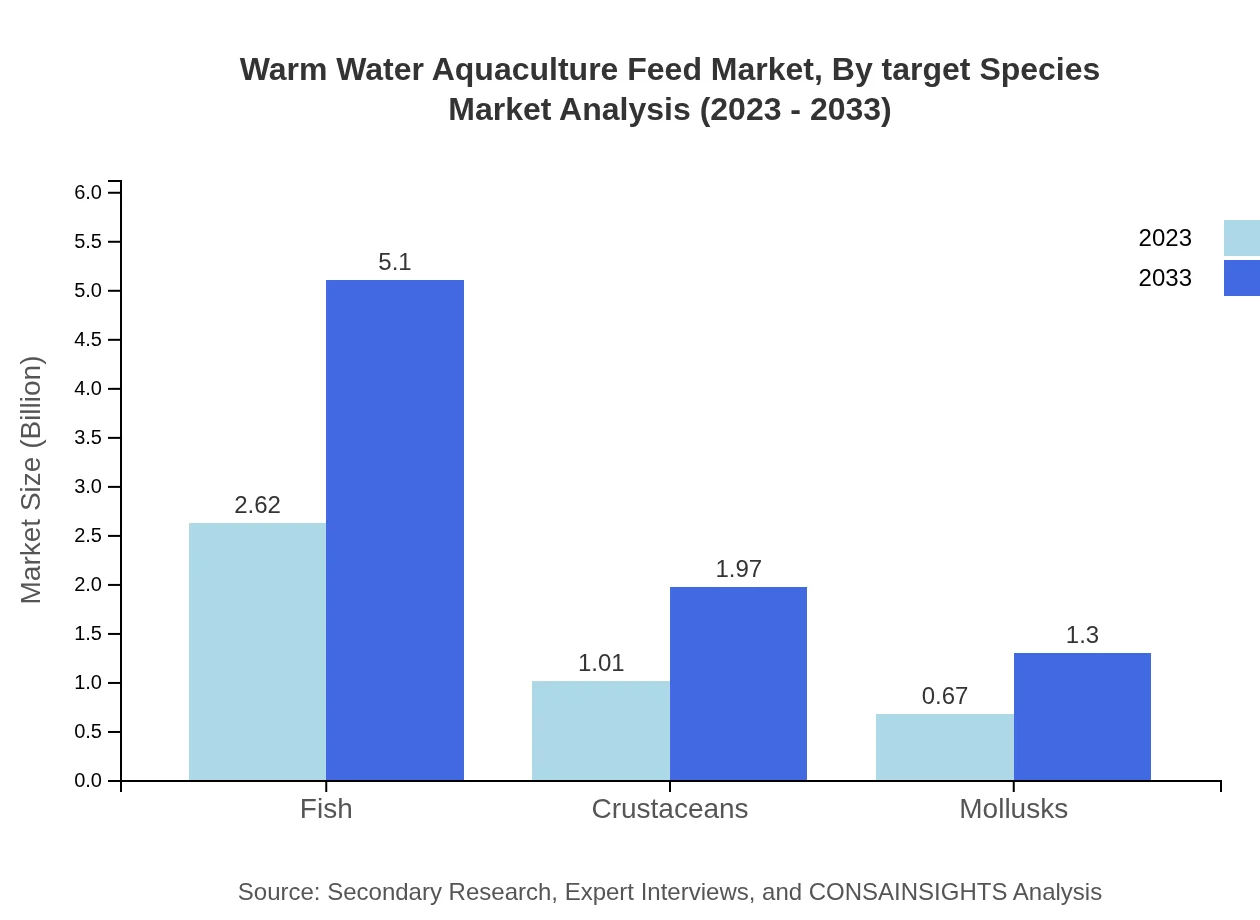

Warm Water Aquaculture Feed Market Analysis By Target Species

This market segment focuses on fish, crustaceans, and mollusks. Fish feed accounts for a major share, with a market size of $2.62 billion in 2023, set to expand to $5.10 billion by 2033, supported by the growing fish farming practices.

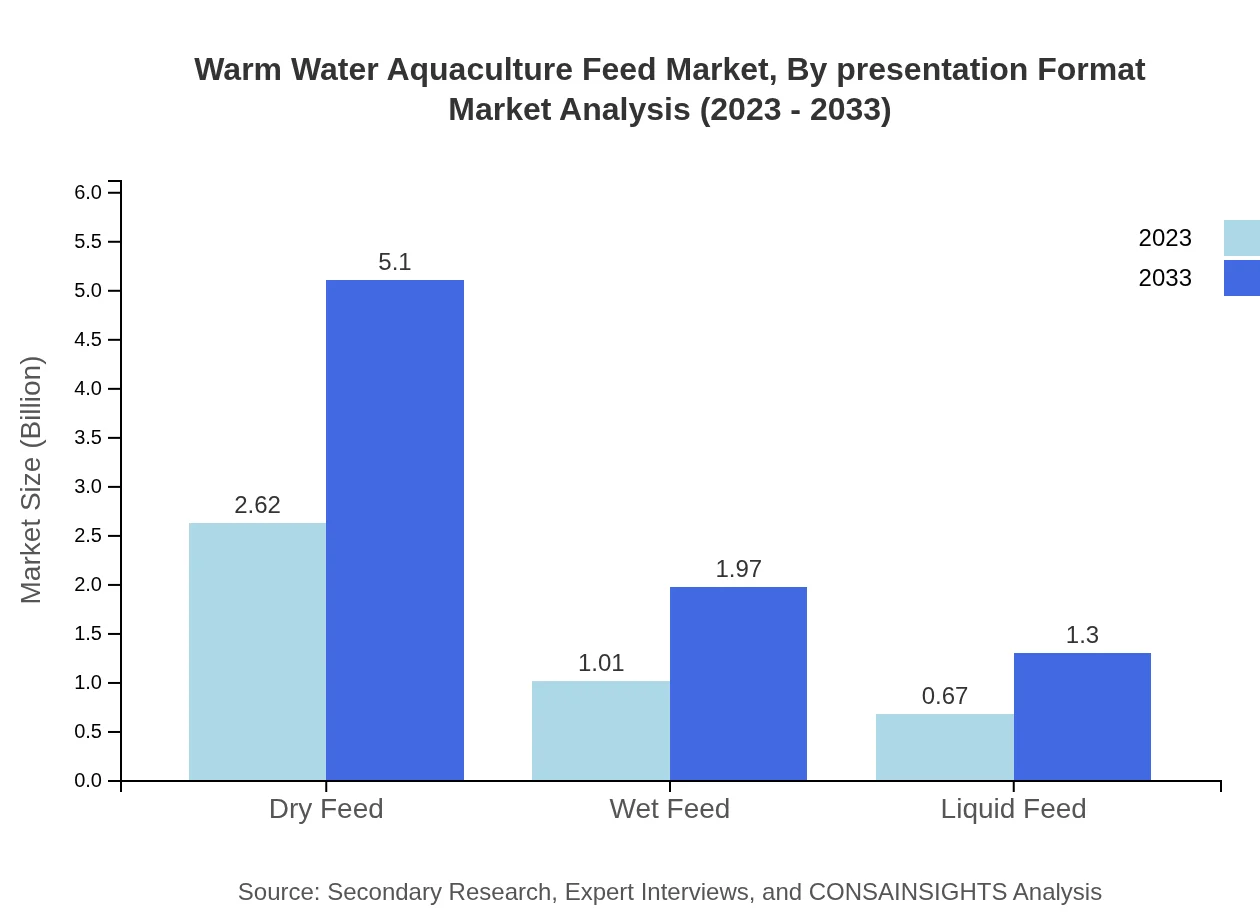

Warm Water Aquaculture Feed Market Analysis By Presentation Format

Market presentation formats include dry feed, wet feed, and liquid feed, with dry feed being the most prevalent. In 2023, dry feed captured $2.62 billion, expected to rise to $5.10 billion by 2033, reflecting its favored status in aquaculture operations.

Warm Water Aquaculture Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Warm Water Aquaculture Feed Industry

Cargill :

A leading global player in aquaculture feed, Cargill offers innovative feed solutions aimed at enhancing productivity and sustainability in aquaculture.Nutreco:

Nutreco is renowned for its cutting-edge nutritional solutions across aquaculture, focusing on sustainable practices and product quality.Alltech:

Alltech provides innovative feed products tailored for aquaculture, emphasizing health and nutrition to improve fish farming efficiency.Skretting:

A prominent aquaculture feed manufacturer known for its premium nutritional products that promote sustainable growth in fish and shrimp.We're grateful to work with incredible clients.

FAQs

What is the market size of warm Water aquaculture feed?

The warm-water aquaculture feed market is valued at approximately $4.3 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.7%, projecting significant growth in the upcoming decade.

What are the key market players or companies in the warm Water aquaculture feed industry?

Key players in the warm-water aquaculture feed industry include major global corporations such as Cargill, Nutreco, and Skretting, along with several regional players that contribute significantly to market innovation.

What are the primary factors driving the growth in the warm Water aquaculture feed industry?

Growth in the warm-water aquaculture feed industry is driven by increasing seafood demand, advancements in aquaculture technology, and rising awareness of sustainable and nutritious feeding practices among aquaculture farmers.

Which region is the fastest Growing in the warm Water aquaculture feed market?

The fastest-growing regions in the warm-water aquaculture feed market are North America, expected to grow from $1.57 billion in 2023 to $3.05 billion by 2033, and Europe, projected to rise from $1.37 billion to $2.67 billion in the same period.

Does Consainsights provide customized market report data for the warm Water aquaculture feed industry?

Yes, Consainsights offers customized market reports tailored to the specific needs of clients within the warm-water aquaculture feed industry, providing detailed insights and forecasts.

What deliverables can I expect from this warm Water aquaculture feed market research project?

Clients can expect comprehensive reports containing market analysis, key trends, competitive landscape, segment data, and regional insights to make informed decisions within the warm-water aquaculture feed market.

What are the market trends of warm Water aquaculture feed?

Current trends in the warm-water aquaculture feed market include a shift towards plant-based ingredients, the growing demand for nutritionally balanced feed, and advancements in feed formulations for enhanced sustainability.