Washed Silica Sand Market Report

Published Date: 02 February 2026 | Report Code: washed-silica-sand

Washed Silica Sand Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Washed Silica Sand market from 2023 to 2033, focusing on market trends, size, segmentation, regional insights, and competitive landscape. The insights provided will help stakeholders make informed decisions and strategy optimizations.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

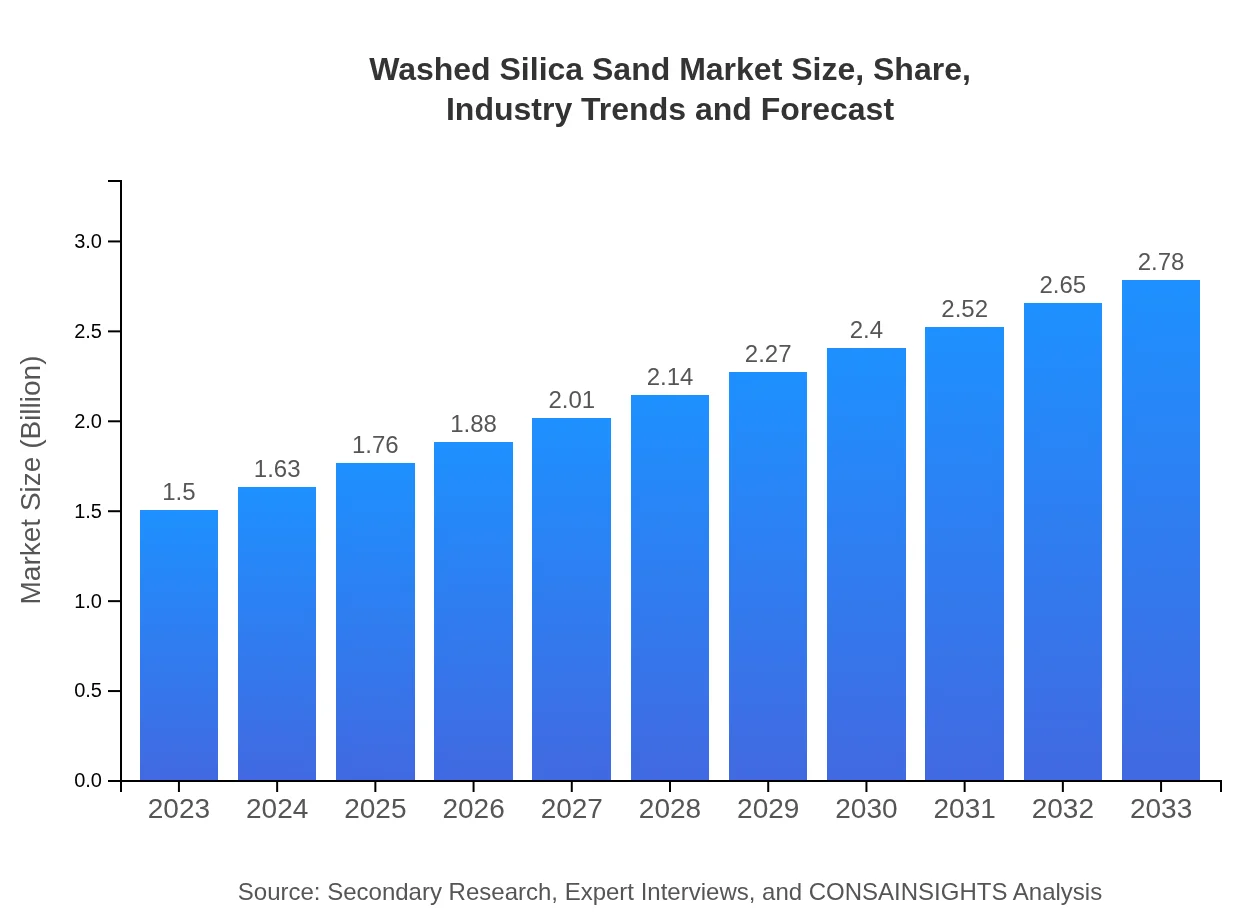

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | U.S. Silica Holdings, Inc., Badger Mining Corporation, Fairmount Santrol |

| Last Modified Date | 02 February 2026 |

Washed Silica Sand Market Overview

Customize Washed Silica Sand Market Report market research report

- ✔ Get in-depth analysis of Washed Silica Sand market size, growth, and forecasts.

- ✔ Understand Washed Silica Sand's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Washed Silica Sand

What is the Market Size & CAGR of Washed Silica Sand market in 2023?

Washed Silica Sand Industry Analysis

Washed Silica Sand Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Washed Silica Sand Market Analysis Report by Region

Europe Washed Silica Sand Market Report:

The European market, valued at $0.47 billion in 2023, is expected to double to $0.87 billion by 2033. A shift towards sustainable construction practices and stringent regulations related to building materials promotes the use of washed silica sand.Asia Pacific Washed Silica Sand Market Report:

In Asia Pacific, the market is valued at approximately $0.29 billion in 2023 and is expected to grow to $0.53 billion by 2033. Rapid urbanization and infrastructural development in countries like China and India are primary growth drivers. The rising demand for construction materials coupled with environmental initiatives supports sustainable silica sand production.North America Washed Silica Sand Market Report:

In North America, the market is expected to expand from $0.52 billion in 2023 to $0.96 billion by 2033. The region's growth is driven by robust construction activities and the need for high-quality materials in various sectors, particularly oil and gas.South America Washed Silica Sand Market Report:

South America is poised for moderate growth, with the market size projected to increase from $0.11 billion in 2023 to $0.21 billion by 2033. Countries like Brazil are enhancing infrastructure, which increases the consumption of washed silica sand for construction purposes.Middle East & Africa Washed Silica Sand Market Report:

The market in the Middle East and Africa will grow from $0.11 billion in 2023 to $0.21 billion by 2033. Increased construction and infrastructural projects driven by economic diversification initiatives in countries like UAE and Saudi Arabia fuel the demand for washed silica sand.Tell us your focus area and get a customized research report.

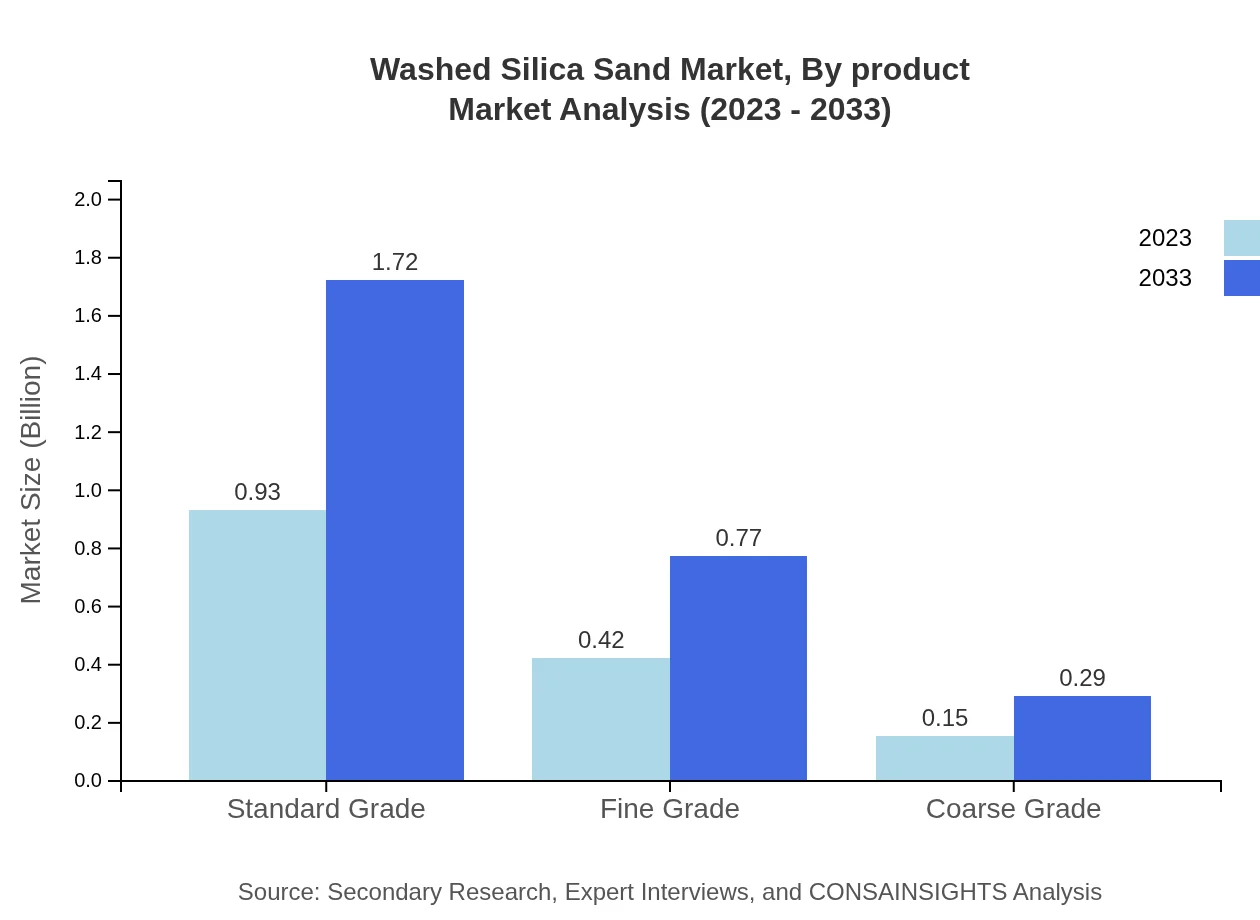

Washed Silica Sand Market Analysis By Product

The Washed Silica Sand market can be divided into three primary product types: Standard Grade, Fine Grade, and Coarse Grade. The Standard Grade dominates the market with significant growth expected from $0.93 billion in 2023 to $1.72 billion by 2033, holding a market share of 61.93%. Fine Grade and Coarse Grade products are expected to grow as demand from specific applications increases.

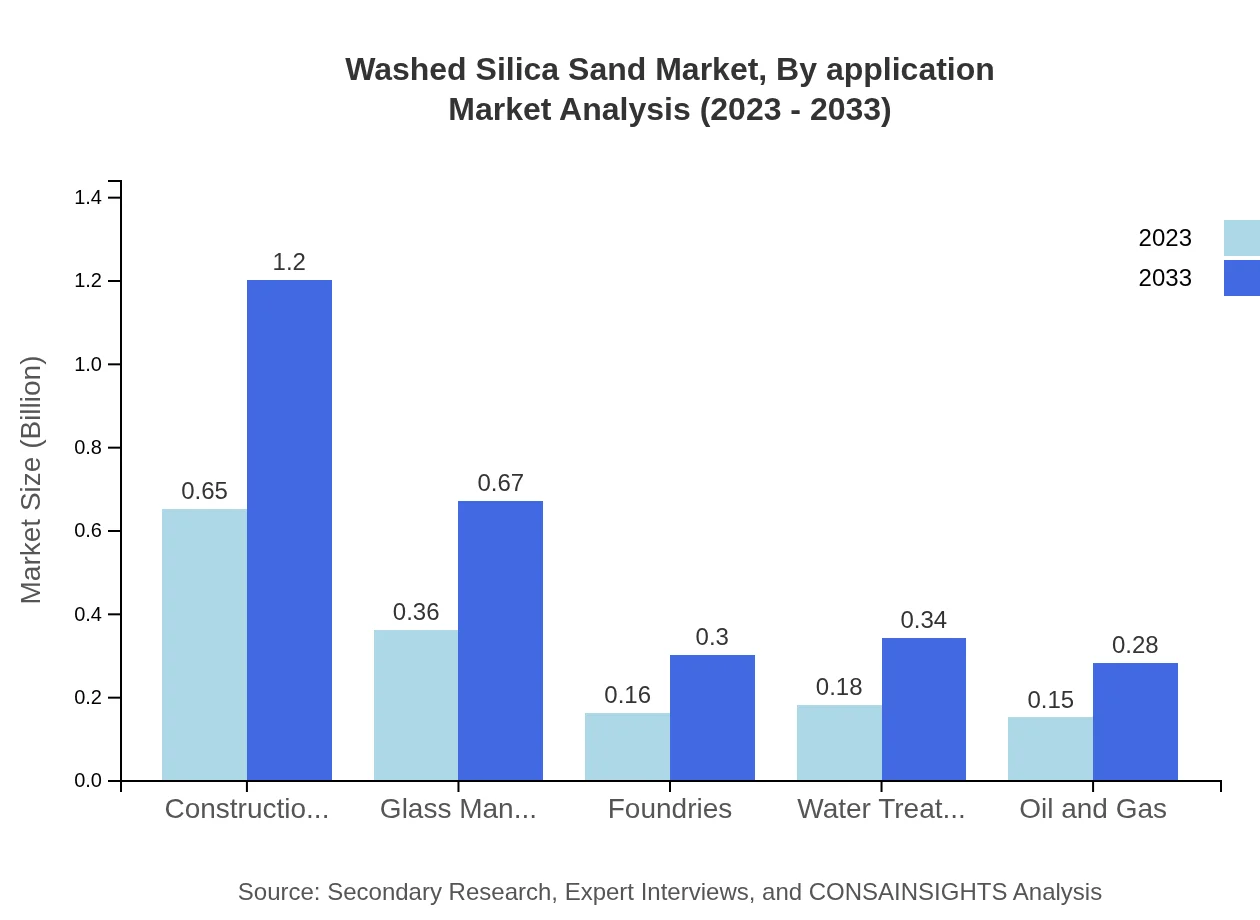

Washed Silica Sand Market Analysis By Application

The market applications for Washed Silica Sand include construction, glass manufacturing, environmental services, and oil & gas. Construction remains the largest application sector, accounting for approximately 51.38% of the market share in 2023, with significant growth expected as urban development continues.

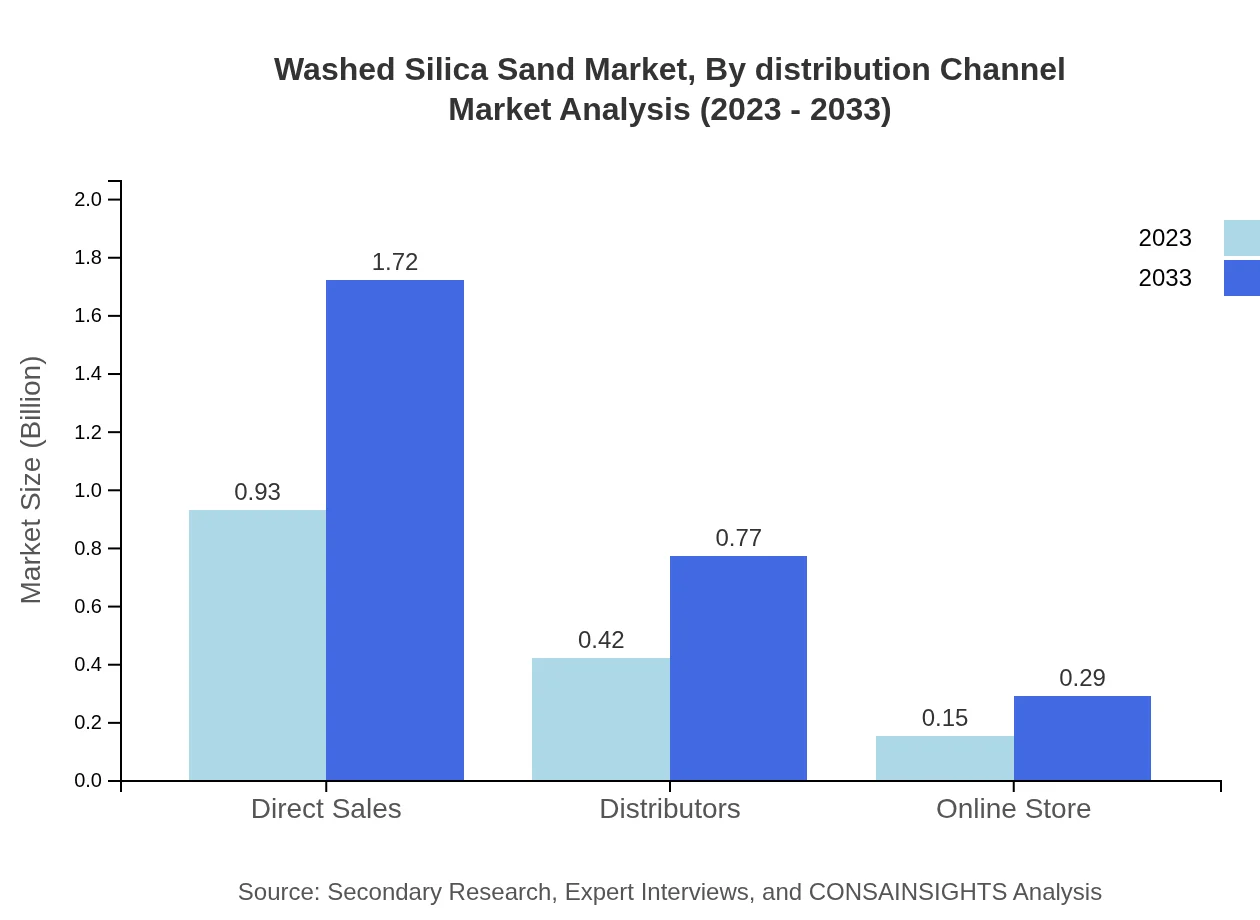

Washed Silica Sand Market Analysis By Distribution Channel

Distribution channels for Washed Silica Sand include direct sales, distributors, and online stores. Direct sales dominate the market with a share of 61.93% in 2023, reflecting a strong preference for immediate transactions and logistic conveniences among buyers.

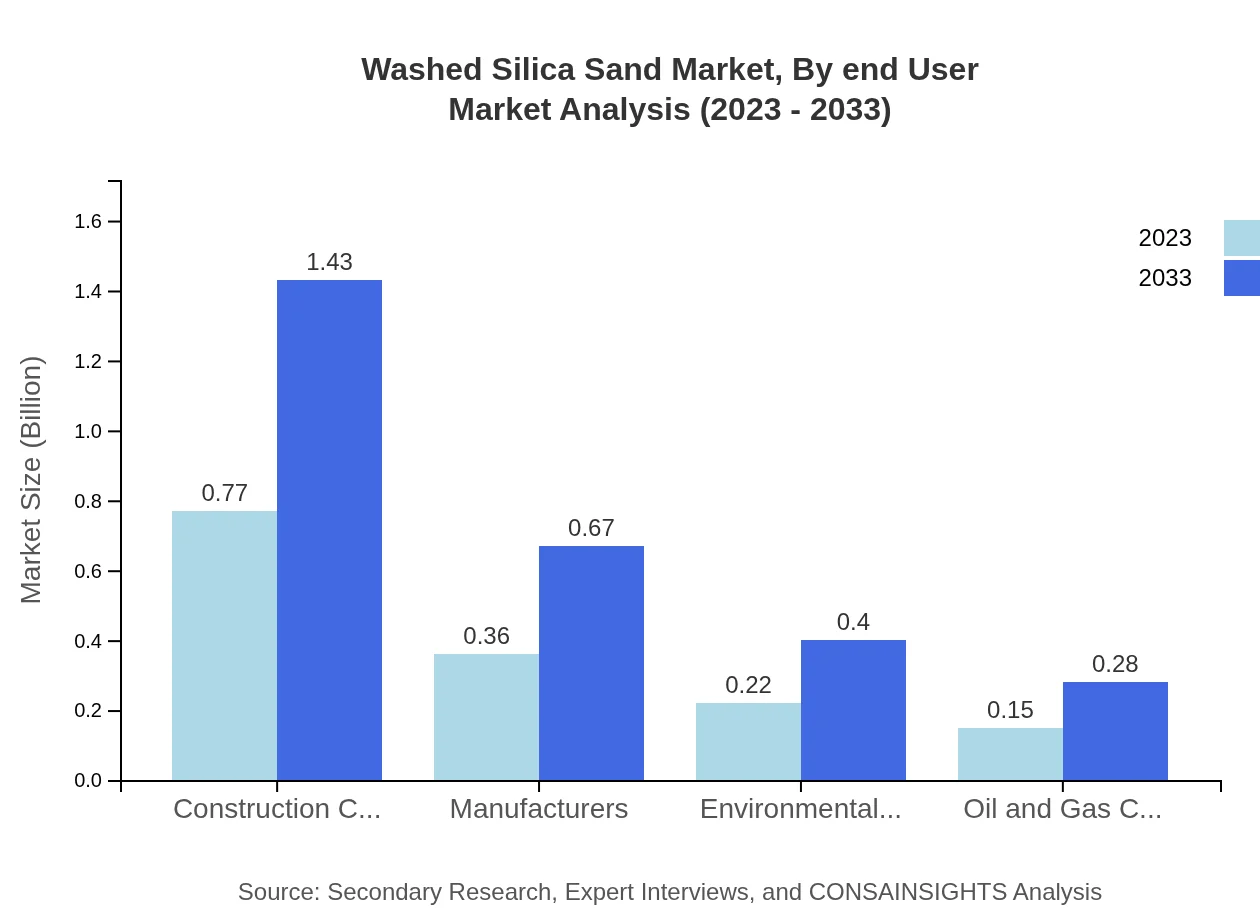

Washed Silica Sand Market Analysis By End User

End-users of Washed Silica Sand include construction companies, manufacturers, and environmental services. The construction industry remains the largest end-user, with a projected market size growth from $0.65 billion in 2023 to $1.20 billion by 2033, accounting for 43.08% of the share.

Washed Silica Sand Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Washed Silica Sand Industry

U.S. Silica Holdings, Inc.:

A leading provider of sand and minerals with a strong focus on quality and sustainability, U.S. Silica is well-known for its innovative solutions across various industrial applications.Badger Mining Corporation:

Specializes in the production of high-quality silica sand for various applications, Badger Mining has established a significant market presence and is recognized for its dedication to environmental responsibility.Fairmount Santrol:

A prominent player in the silica sand market, Fairmount Santrol provides raw materials globally and is known for its stringent quality control and customer-focused services.We're grateful to work with incredible clients.

FAQs

What is the market size of washed Silica Sand?

The global washed silica sand market is currently valued at approximately $1.5 billion and is projected to grow at a compound annual growth rate (CAGR) of 6.2%, indicating strong demand and expansion in various applications over the next decade.

What are the key market players or companies in the washed Silica Sand industry?

Key players in the washed silica sand market include major construction and manufacturing companies that utilize washed silica sand in their processes. The market is characterized by intense competition and a variety of regional players, contributing to its dynamic landscape.

What are the primary factors driving the growth in the washed silica sand industry?

Factors contributing to the growth of the washed silica sand industry include increasing demand in construction and glass manufacturing, technological advancements in extraction processes, rising awareness of environmental benefits, and growing applications in water treatment and oil and gas sectors.

Which region is the fastest Growing in the washed silica sand market?

The Asia Pacific region is anticipated to be the fastest-growing market for washed silica sand, projected to grow from approximately $0.29 billion in 2023 to $0.53 billion by 2033, reflecting strong construction and industrial activity in that area.

Does ConsaInsights provide customized market report data for the washed silica sand industry?

Yes, ConsaInsights offers customized market report data for the washed silica sand industry, allowing clients to receive tailored insights and strategies that fit their specific needs and business goals, enhancing decision-making capabilities.

What deliverables can I expect from this washed silica sand market research project?

Deliverables from the washed silica sand market research project include comprehensive reports with market analysis, forecasts, competitor assessments, segment insights, and strategic recommendations. These insights will support informed decision-making for stakeholders.

What are the market trends of washed silica sand?

Current trends in the washed silica sand market include the increasing adoption of eco-friendly practices, innovations in processing techniques, and the expanding use of washed silica sand in diverse industries like construction, environmental services, and manufacturing.