Water And Wastewater Treatment Technologies Market Report

Published Date: 02 February 2026 | Report Code: water-and-wastewater-treatment-technologies

Water And Wastewater Treatment Technologies Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Water and Wastewater Treatment Technologies market from 2023 to 2033, covering market size, growth trends, technological advancements, and key players in the industry.

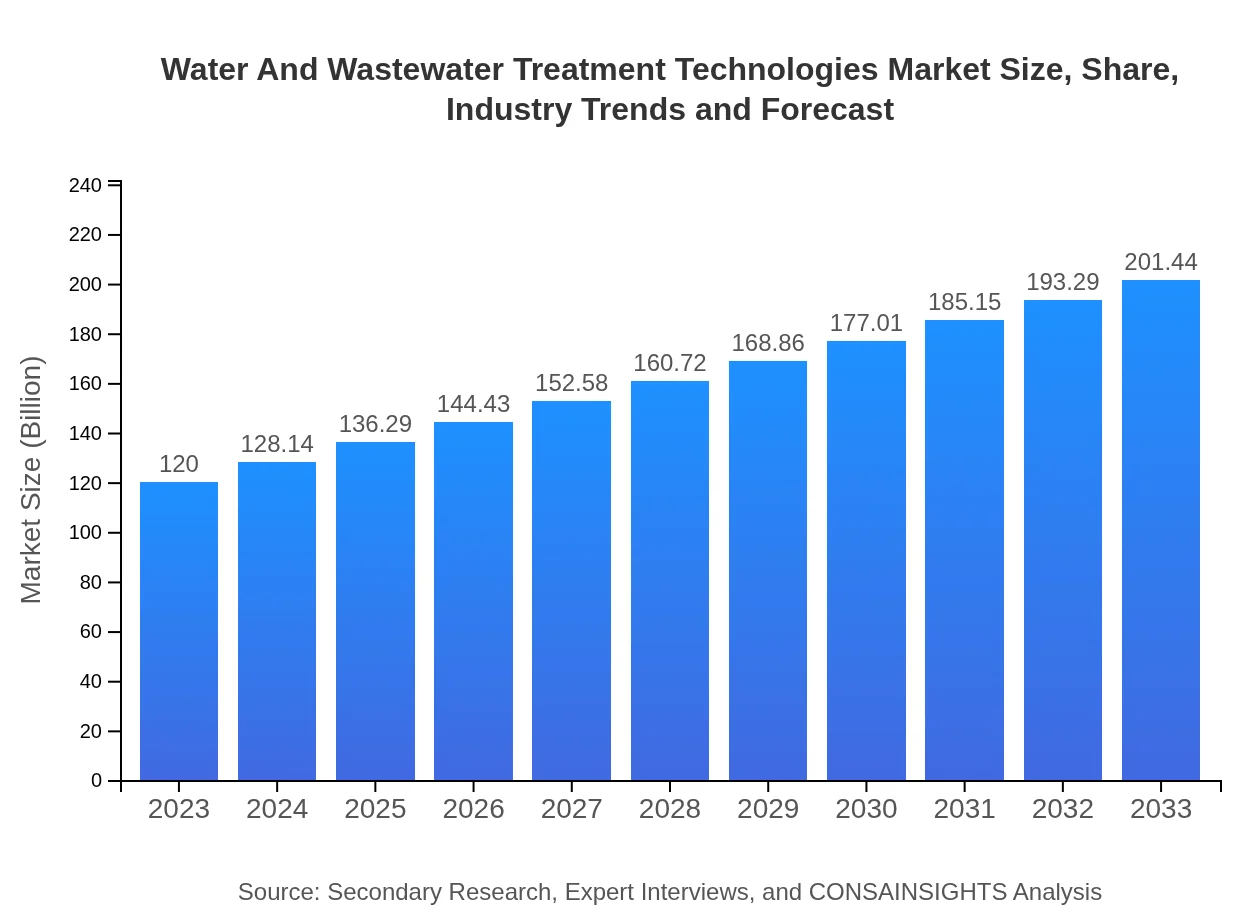

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $120.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $201.44 Billion |

| Top Companies | Veolia Environnement, Suez S.A., Xylem Inc., Danaher Corporation, Evoqua Water Technologies |

| Last Modified Date | 02 February 2026 |

Water And Wastewater Treatment Technologies Market Overview

Customize Water And Wastewater Treatment Technologies Market Report market research report

- ✔ Get in-depth analysis of Water And Wastewater Treatment Technologies market size, growth, and forecasts.

- ✔ Understand Water And Wastewater Treatment Technologies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water And Wastewater Treatment Technologies

What is the Market Size & CAGR of Water And Wastewater Treatment Technologies market in 2023?

Water And Wastewater Treatment Technologies Industry Analysis

Water And Wastewater Treatment Technologies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water And Wastewater Treatment Technologies Market Analysis Report by Region

Europe Water And Wastewater Treatment Technologies Market Report:

Europe's market is valued at $36.04 billion in 2023, with forecasts predicting it will grow to $60.49 billion by 2033. Strong governmental regulations and a commitment to sustainable practices underpin market expansion, along with high consumer awareness regarding water conservation.Asia Pacific Water And Wastewater Treatment Technologies Market Report:

In 2023, the Asia Pacific market is valued at approximately $24.00 billion, with projections reaching $40.29 billion by 2033. The region's rapid urbanization, coupled with severe water scarcity and pollution challenges, fosters significant investment in modern treatment technologies, driving growth.North America Water And Wastewater Treatment Technologies Market Report:

In North America, the market is projected to reach $40.01 billion in 2023, escalating to $67.16 billion by 2033. The region is characterized by a robust regulatory framework and significant investments in infrastructure, especially aimed at improving water quality and addressing climate challenges.South America Water And Wastewater Treatment Technologies Market Report:

The South American market for Water and Wastewater Treatment Technologies is estimated at $11.89 billion in 2023, expected to grow to $19.96 billion by 2033. Increased industrial activities and government initiatives for sustainable water management are key factors in this growth.Middle East & Africa Water And Wastewater Treatment Technologies Market Report:

In 2023, the Middle East and Africa market stands at $8.06 billion, expanding to $13.54 billion by 2033. The increasing need for advanced water treatment technologies due to water scarcity and infrastructural development plays a pivotal role in driving market growth.Tell us your focus area and get a customized research report.

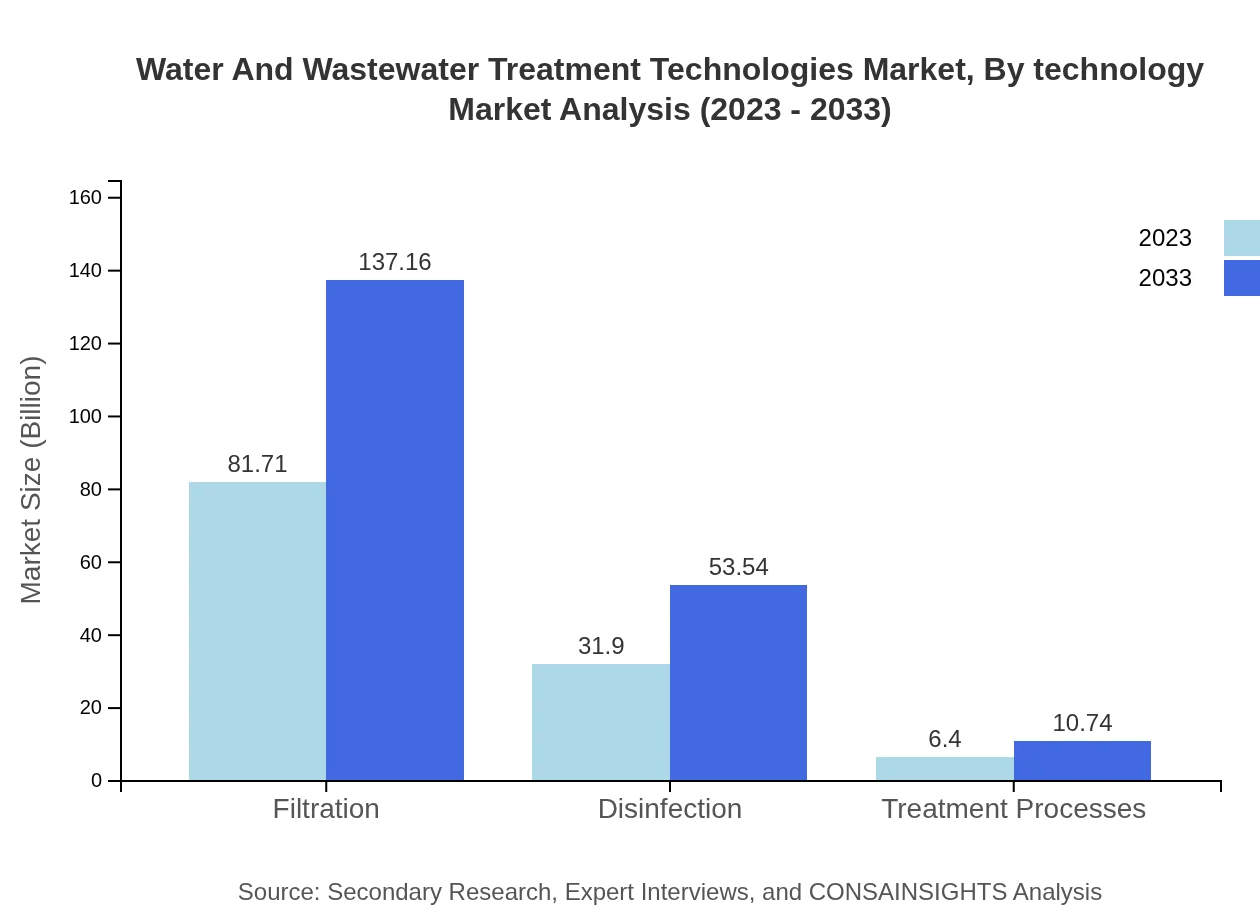

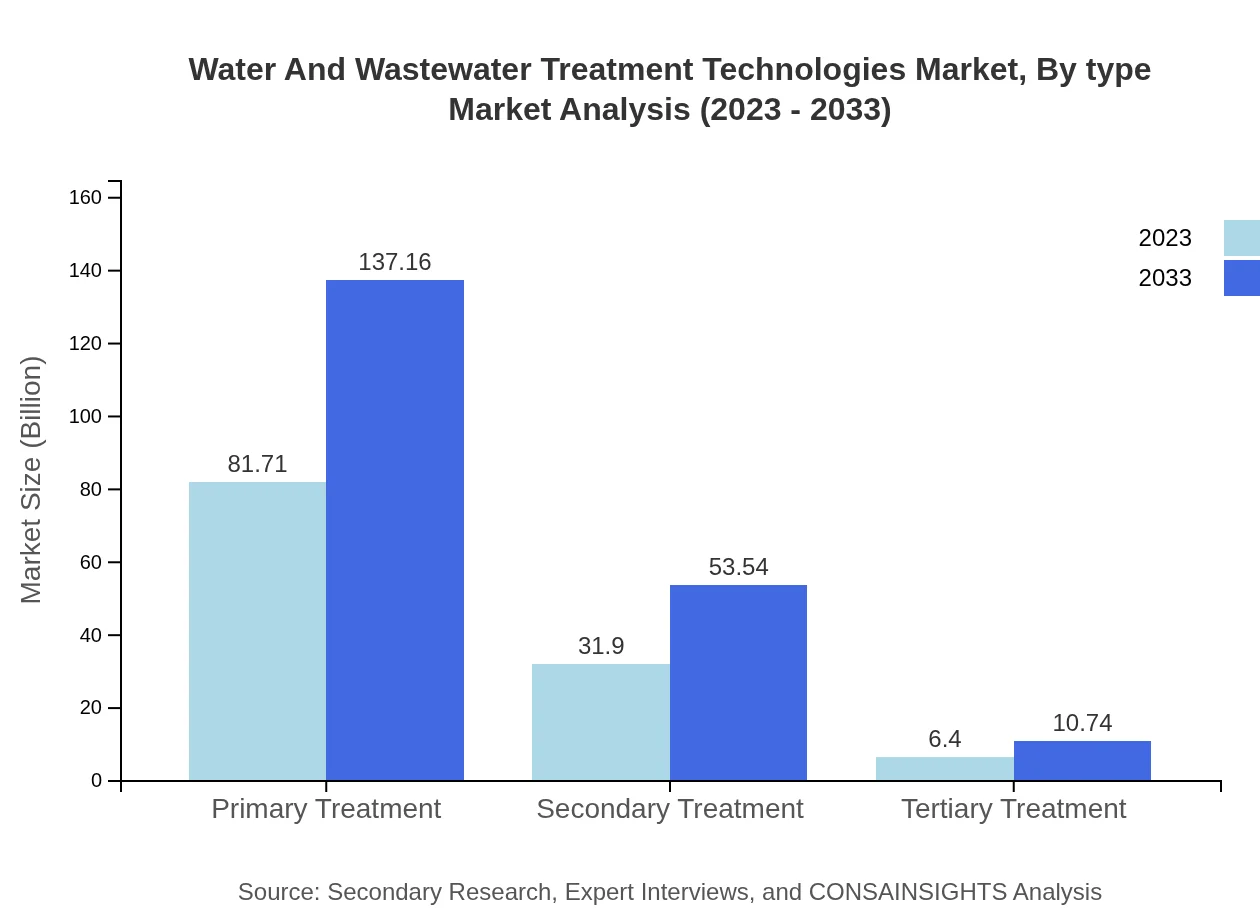

Water And Wastewater Treatment Technologies Market Analysis By Technology

The market by technology is segmented into filtration, disinfection, and treatment processes. In 2023, filtration dominates the market with a share of 68.09%, valued at $81.71 billion, and is projected to grow to $137.16 billion by 2033. Disinfection technologies hold a 26.58% share, expected to rise from $31.90 billion to $53.54 billion, while treatment processes, though smaller, are anticipated to expand significantly from $6.40 billion to $10.74 billion.

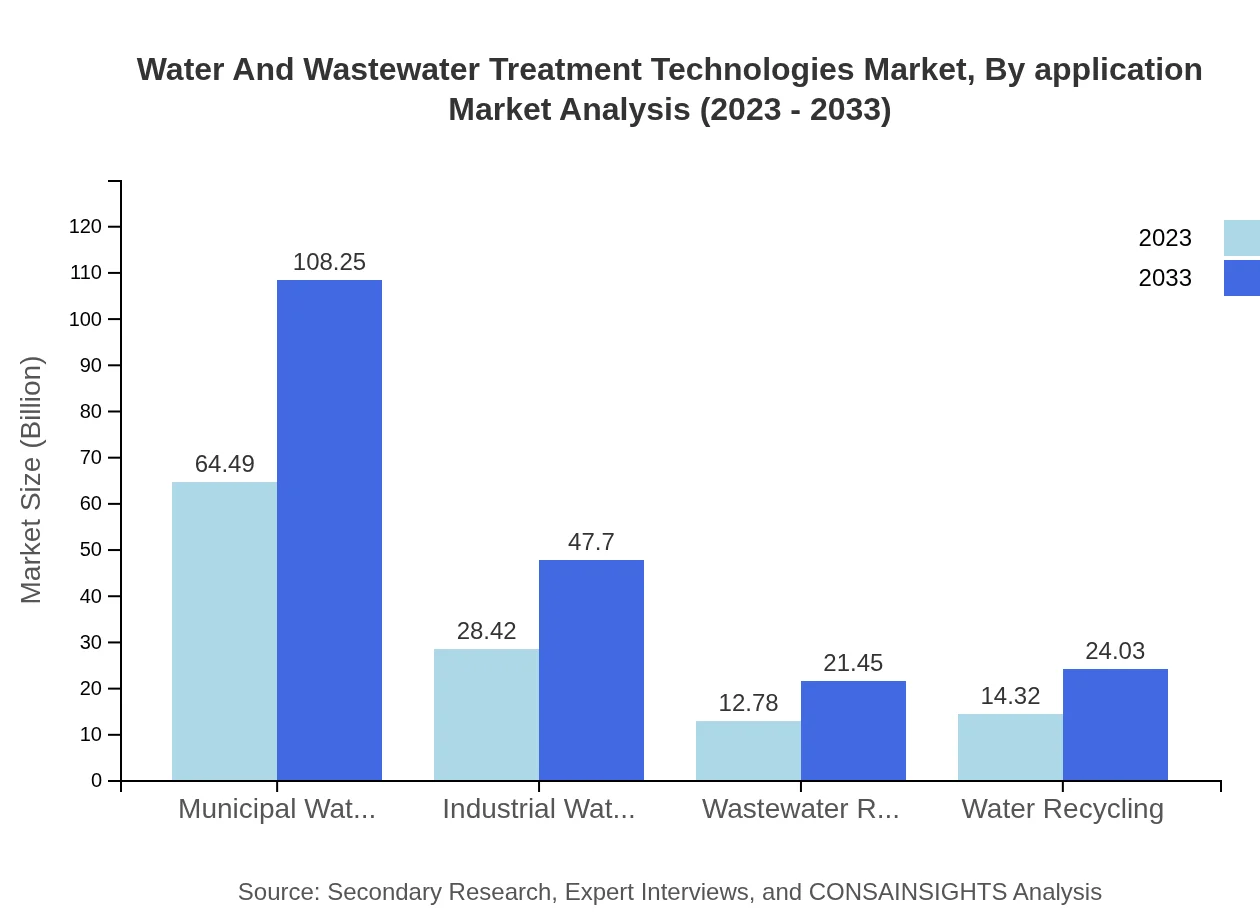

Water And Wastewater Treatment Technologies Market Analysis By Application

Applications in municipal water treatment significantly outweigh others, with a size of $64.49 billion in 2023, predicted to reach $108.25 billion by 2033, encompassing the largest market share of 53.74%. The industrial sector follows, expanding from $28.42 billion to $47.70 billion, while commercial applications cover $12.78 billion, increasing to $21.45 billion.

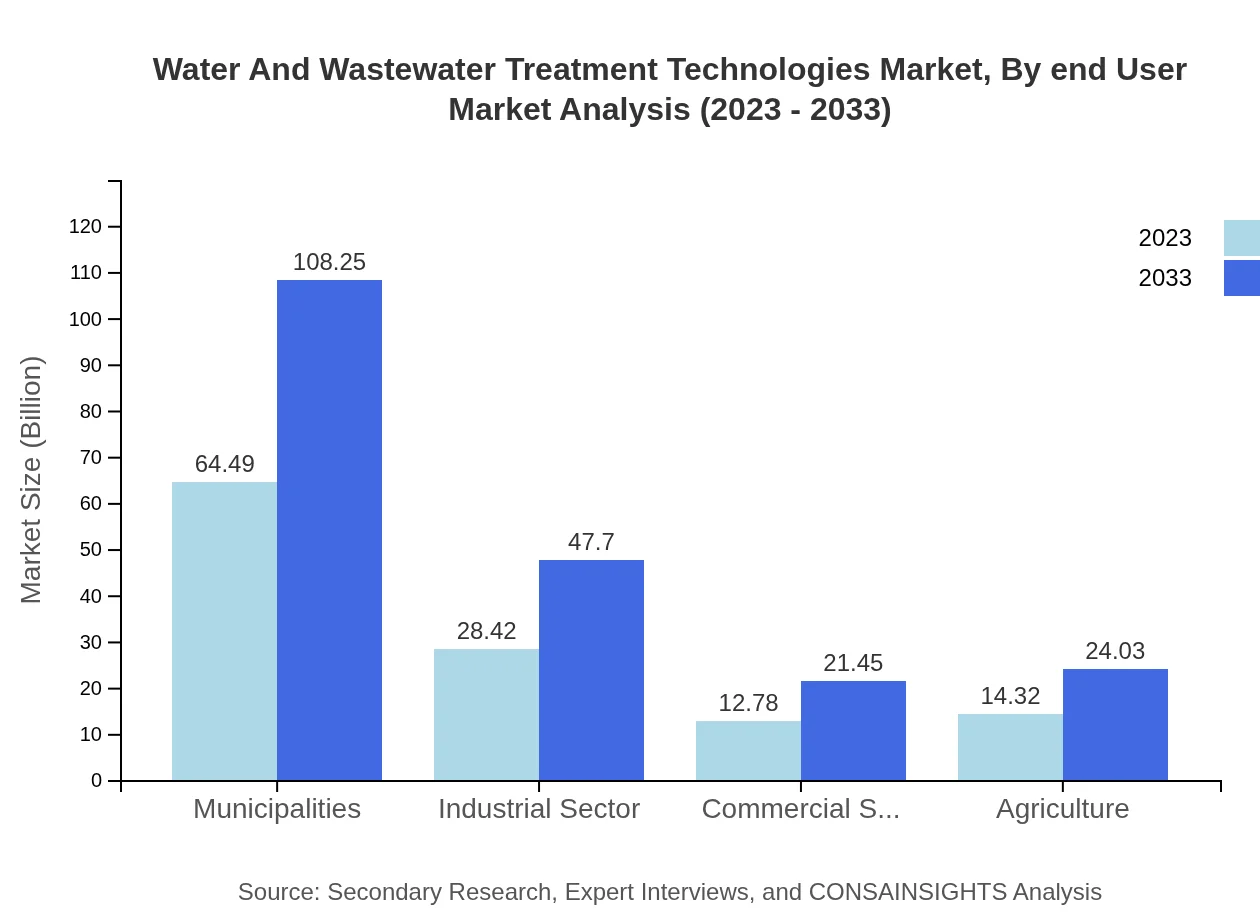

Water And Wastewater Treatment Technologies Market Analysis By End User

The market segmentation by end-user highlights municipalities as the leading sector, with a 53.74% market share in 2023. The industrial sector also notably contributes with a 23.68% share, while agriculture holds an 11.93% share, anticipating growth driven by increased awareness of efficient water use in farming.

Water And Wastewater Treatment Technologies Market Analysis By Region

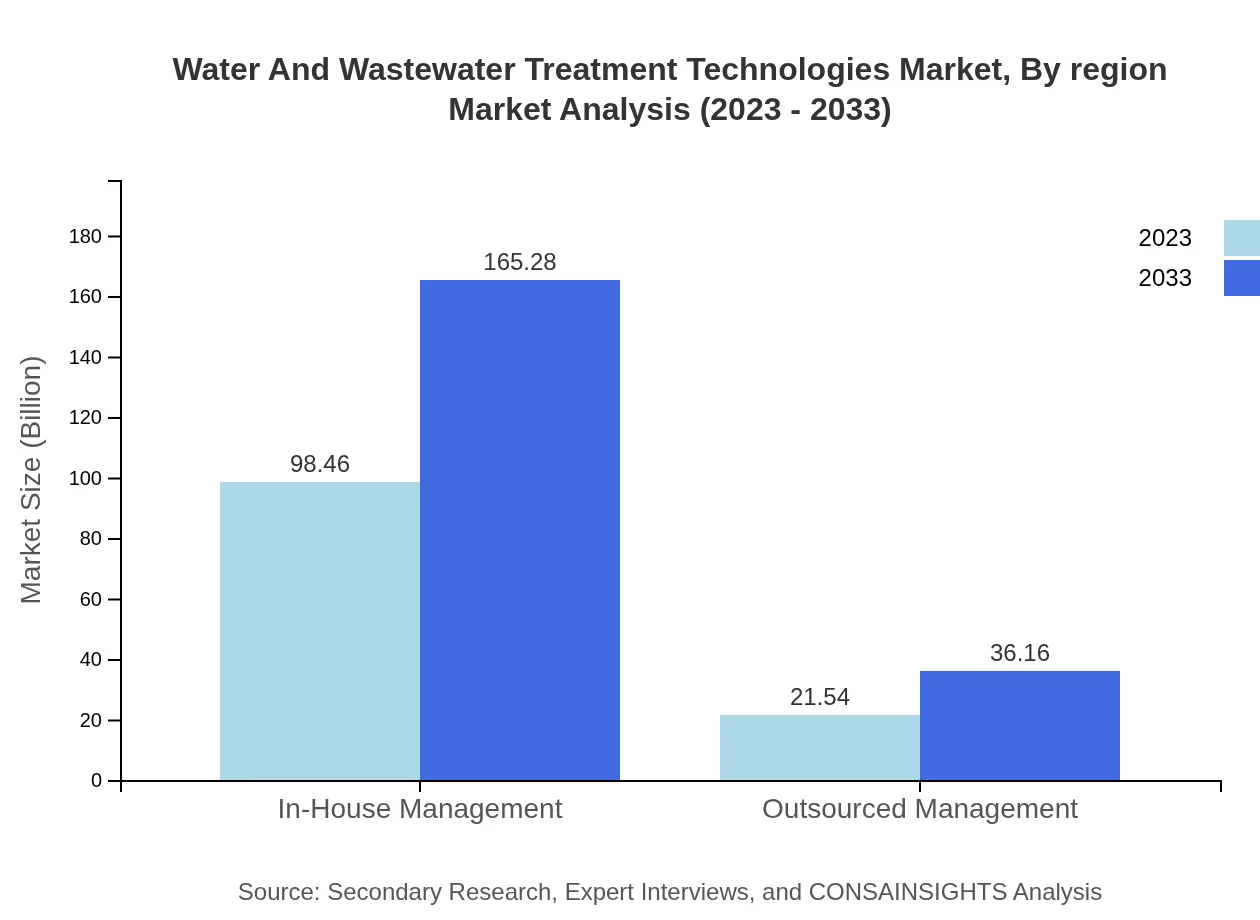

Management types are divided into in-house and outsourced management. In-house management dominates with a size of $98.46 billion in 2023, set to grow to $165.28 billion by 2033, commanding an 82.05% market share. Outsourced management, while smaller at $21.54 billion, is on pace to grow to $36.16 billion, reflecting businesses seeking cost-effective solutions.

Water And Wastewater Treatment Technologies Market Analysis By Type

This market analysis by type indicates filtration leads with a size of $81.71 billion in 2023, expected to grow to $137.16 billion by 2033. Other types include disinfection and treatment processes, contributing to overall market dynamics and reflecting ongoing advancements in treatment technologies.

Water And Wastewater Treatment Technologies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water And Wastewater Treatment Technologies Industry

Veolia Environnement:

A global leader in optimized resource management, specializing in water and wastewater treatment, offering innovative solutions that promote sustainable development.Suez S.A.:

Suez provides a wide range of services for water and wastewater management, focusing on sustainable solutions and technological advancements to meet environmental challenges.Xylem Inc.:

Xylem designs and manufactures innovative technology solutions for water and wastewater treatment, focusing on delivering safe, reliable, and efficient systems.Danaher Corporation:

Danaher is a globally diversified conglomerate with significant contributions in water quality testing and monitoring technologies, essential for effective treatment.Evoqua Water Technologies:

Evoqua is dedicated to delivering innovative solutions for water and wastewater treatment, focusing on enhancing water quality and safety for future generations.We're grateful to work with incredible clients.

FAQs

What is the market size of water And Wastewater Treatment Technologies?

The global water and wastewater treatment technologies market is currently valued at $120 billion and is projected to grow at a CAGR of 5.2% over the next decade. This growth indicates a robust demand for innovative treatment technologies and solutions.

What are the key market players or companies in this water And Wastewater Treatment Technologies industry?

Key players in the water and wastewater treatment technologies market include Veolia Environnement, SUEZ, Xylem Inc., and Danaher Corporation. These companies are recognized for their advanced technologies and extensive market presence, playing significant roles in the industry.

What are the primary factors driving the growth in the water And Wastewater Treatment Technologies industry?

Growth in the water and wastewater treatment technologies industry is driven by increasing urbanization, regulatory pressures regarding waste management, and the need for sustainable water solutions. Additionally, technological advancements contribute significantly to market growth.

Which region is the fastest Growing in the water And Wastewater Treatment Technologies?

The fastest-growing region in the water and wastewater treatment technologies market is North America. From a market size of $40.01 billion in 2023, it is expected to reach $67.16 billion by 2033, showing strong growth potential in this area.

Does ConsaInsights provide customized market report data for the water And Wastewater Treatment Technologies industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the water and wastewater treatment technologies industry. Clients can request specific insights or trends that pertain to their business requirements.

What deliverables can I expect from this water And Wastewater Treatment Technologies market research project?

Deliverables from the market research project include comprehensive reports detailing market size, growth trends, regional analysis, and competitive landscape, along with insights into key segments such as treatment types and market share.

What are the market trends of water And Wastewater Treatment Technologies?

Current trends in the water and wastewater treatment technologies market include a shift towards advanced filtration systems and increased adoption of water recycling technologies, as well as enhanced focus on efficient wastewater reuse practices across various sectors.