Water Automation And Instrumentation Market Report

Published Date: 22 January 2026 | Report Code: water-automation-and-instrumentation

Water Automation And Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Water Automation and Instrumentation market, including market size, growth forecasts, technological advancements, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

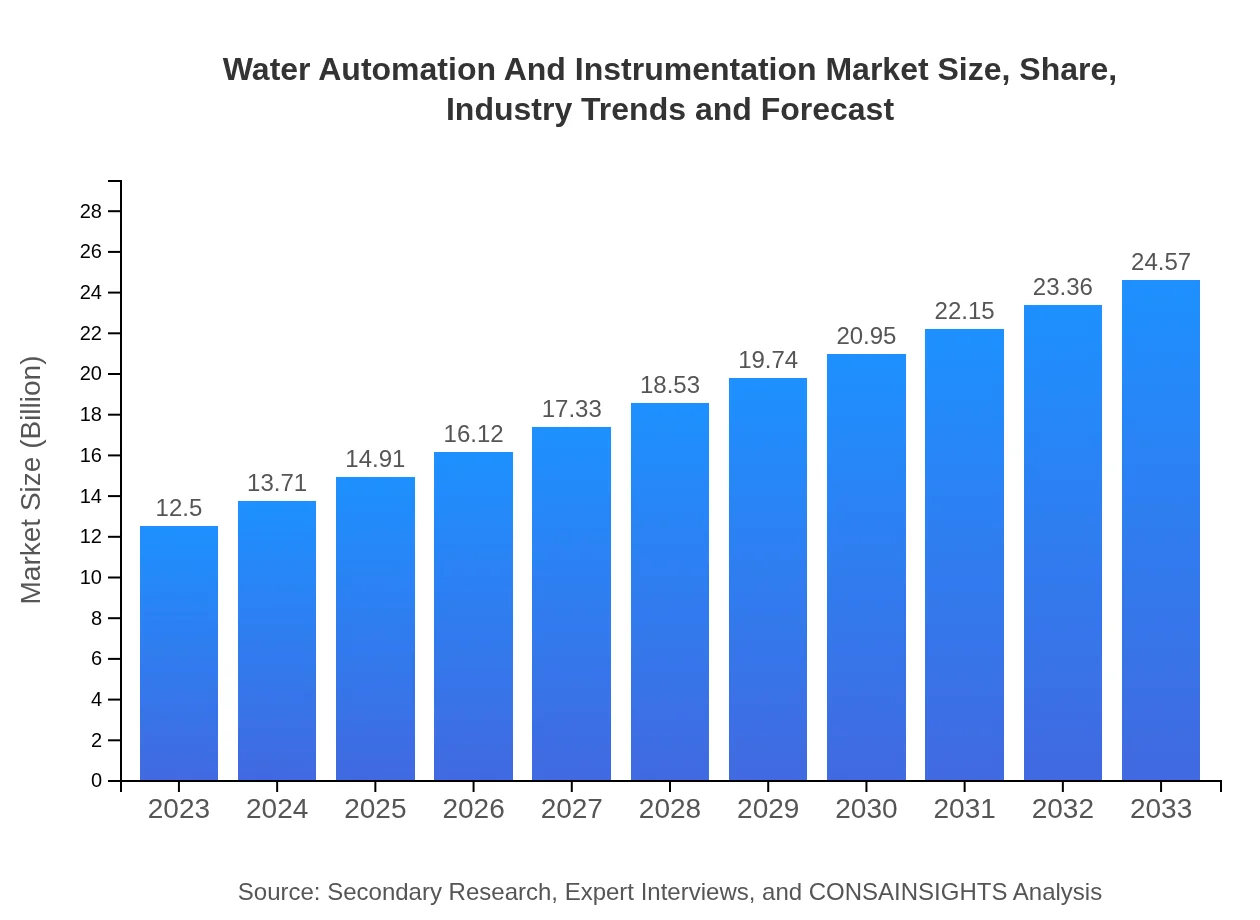

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Siemens AG, Emerson Electric Co., Honeywell International Inc., Schneider Electric, Endress+Hauser |

| Last Modified Date | 22 January 2026 |

Water Automation And Instrumentation Market Overview

Customize Water Automation And Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Water Automation And Instrumentation market size, growth, and forecasts.

- ✔ Understand Water Automation And Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Automation And Instrumentation

What is the Market Size & CAGR of Water Automation And Instrumentation market in 2023?

Water Automation And Instrumentation Industry Analysis

Water Automation And Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Automation And Instrumentation Market Analysis Report by Region

Europe Water Automation And Instrumentation Market Report:

The European market for water automation and instrumentation is set to rise from $4.32 billion in 2023 to $8.48 billion by 2033, fueled by advanced water management practices and investments in smart city projects.Asia Pacific Water Automation And Instrumentation Market Report:

In the Asia-Pacific region, the market is projected to grow from $2.31 billion in 2023 to $4.55 billion by 2033, driven by rapid industrialization, government investments in smart water infrastructure, and the need for sustainable water management practices.North America Water Automation And Instrumentation Market Report:

In North America, the market is anticipated to increase from $4.19 billion in 2023 to $8.24 billion by 2033. Factors such as stringent regulations on water quality, aging infrastructure, and technology adoption are contributing to this growth.South America Water Automation And Instrumentation Market Report:

The South American market, although smaller, is expected to expand from $0.12 billion in 2023 to $0.23 billion by 2033, primarily due to increasing awareness of water conservation and environmental sustainability.Middle East & Africa Water Automation And Instrumentation Market Report:

The Middle East and Africa market is projected to grow from $1.56 billion in 2023 to $3.07 billion by 2033, as countries seek to address water scarcity through enhanced automation technologies.Tell us your focus area and get a customized research report.

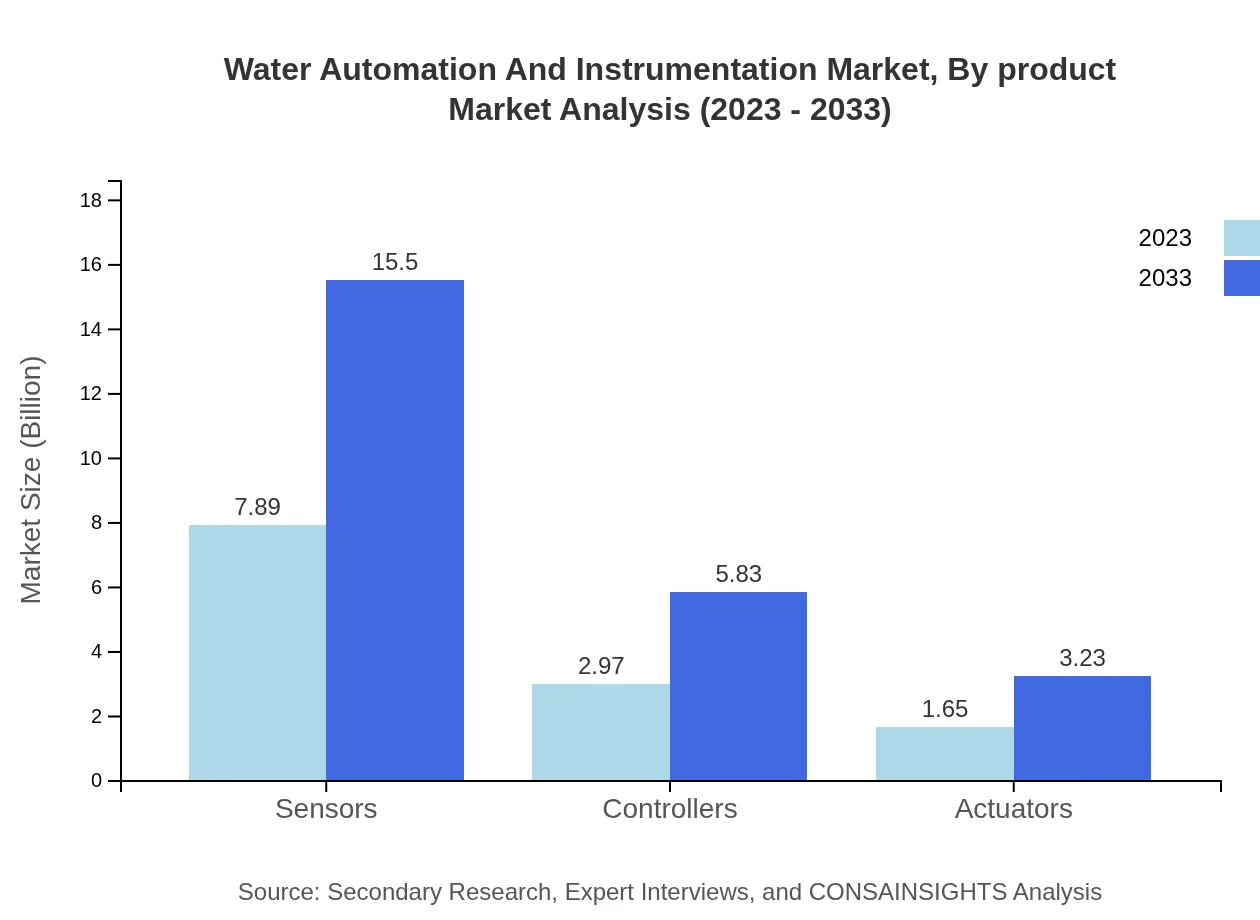

Water Automation And Instrumentation Market Analysis By Product

The market is largely driven by sensors, controllers, and actuators. In 2023, sensors alone accounted for approximately 63.09% of the total market size with a revenue of $7.89 billion, expected to grow to $15.50 billion by 2033. Controllers and actuators are also critical, with market sizes growing significantly over the same period.

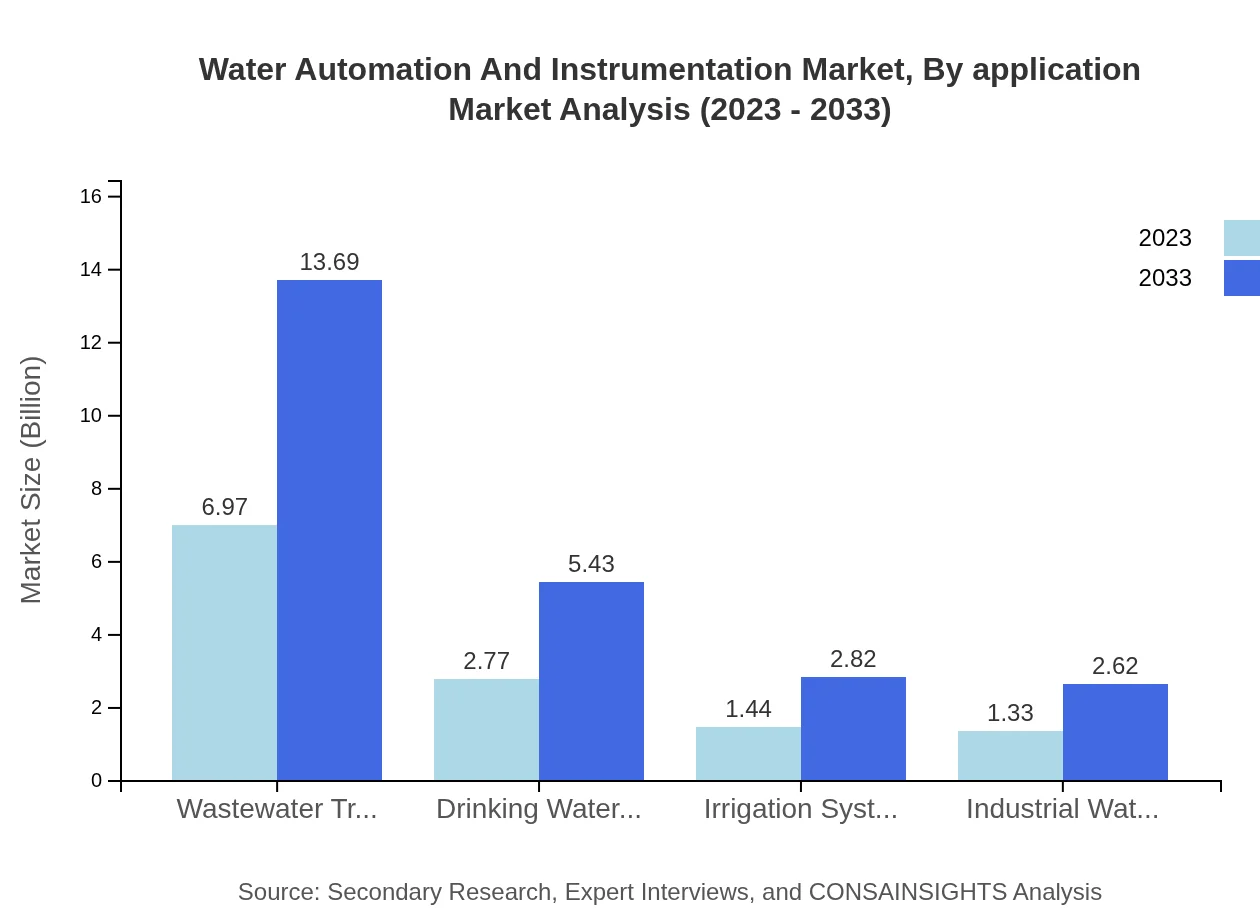

Water Automation And Instrumentation Market Analysis By Application

The municipal sector is the leading application for water automation, representing 48.5% of market share in 2023. With advancements in wastewater treatment and drinking water management, the market share is expected to remain stable while expanding into agriculture and industrial uses.

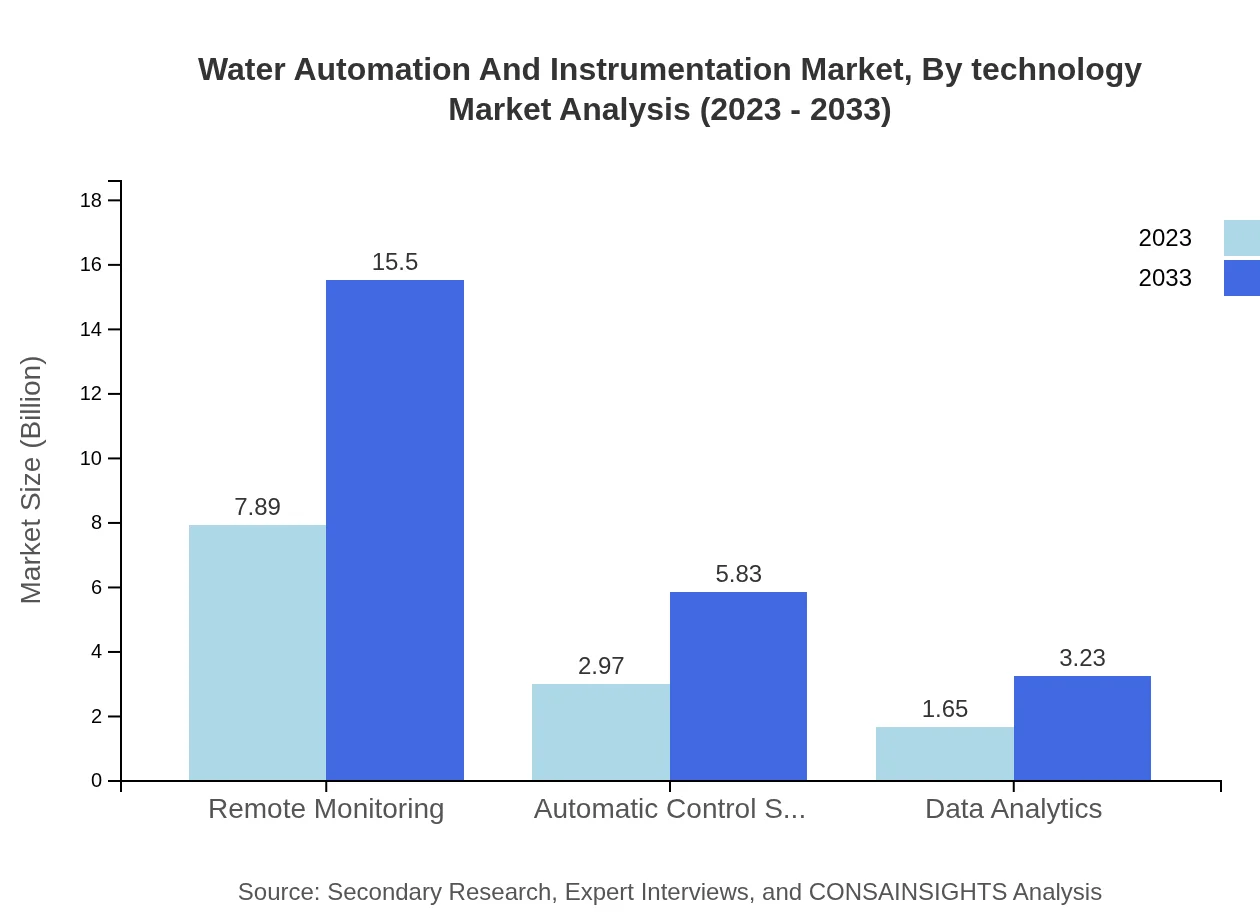

Water Automation And Instrumentation Market Analysis By Technology

Technological innovations such as IoT and advanced data analytics are critical for industry growth, expected to drive the adoption of predictive maintenance and intelligence in water management by 2033.

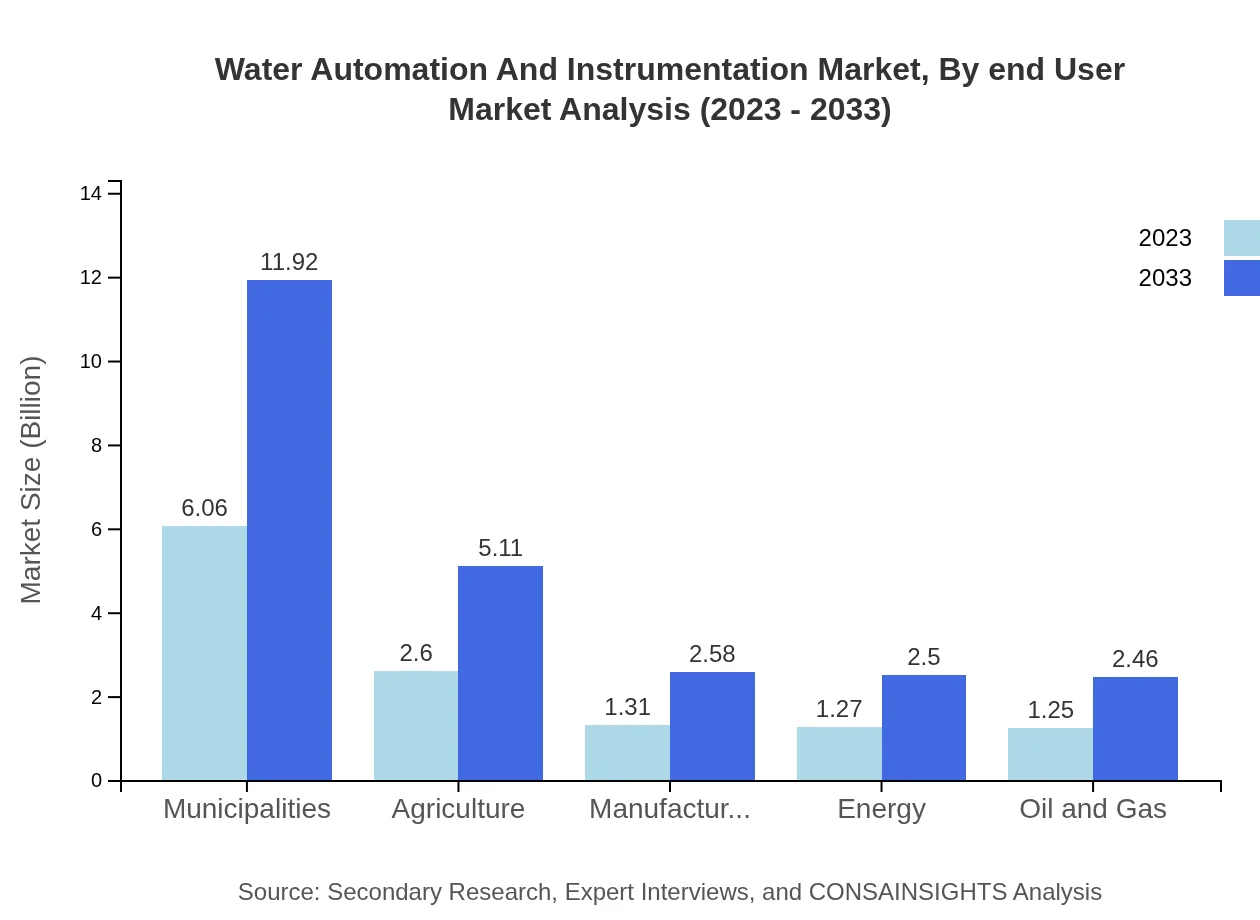

Water Automation And Instrumentation Market Analysis By End User

Key end-users include municipalities, agriculture, and industries such as oil and gas. The municipal segment commands the largest share, with agriculture also seeing notable growth due to precision irrigation technologies boosting water efficiency.

Water Automation And Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Automation And Instrumentation Industry

Siemens AG:

Siemens AG is a global technology company that specializes in automation and digitalization in various industries, including water and wastewater treatment.Emerson Electric Co.:

Emerson Electric Co. provides automation technology and solutions for a range of industries, focusing on enhancing water management systems.Honeywell International Inc.:

Honeywell offers a broad spectrum of water automation solutions, promoting energy-efficient and environmentally friendly systems.Schneider Electric:

Schneider Electric is a leader in energy management and automation, providing innovative solutions that improve water efficiency and treatment processes.Endress+Hauser:

Endress+Hauser specializes in measurement and automation solutions for water and wastewater applications, helping industries ensure compliance and optimize processes.We're grateful to work with incredible clients.

FAQs

What is the market size of water Automation And Instrumentation?

The global water automation and instrumentation market is currently valued at approximately $12.5 billion and is projected to grow at a CAGR of 6.8%. This growth indicates a strong and steady demand for advanced water management solutions.

What are the key market players or companies in this water automation and instrumentation industry?

Key players in the water automation and instrumentation industry include significant corporations such as Siemens, ABB Ltd., Honeywell, and Emerson Electric Co. These companies focus on innovation and developing solutions for efficient water resource management.

What are the primary factors driving the growth in the water automation and instrumentation industry?

The growth in the water automation and instrumentation industry is driven by increasing demand for water supply management, regulatory pressures for efficient water usage, and technological advancements in IoT and smart sensing technologies enhancing operational efficiencies and environmental sustainability.

Which region is the fastest Growing in the water automation and instrumentation?

The Asia Pacific region is the fastest-growing market for water automation and instrumentation, with projections rising from $2.31 billion in 2023 to $4.55 billion by 2033, driven by urbanization and increasing investments in water infrastructure.

Does ConsaInsights provide customized market report data for the water automation and instrumentation industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the water automation and instrumentation industry, allowing clients to access detailed insights, trends, and market forecasts that are relevant to their business objectives.

What deliverables can I expect from this water automation and instrumentation market research project?

Deliverables from the water automation and instrumentation market research project typically include comprehensive reports, data analysis, segment-wise breakdowns, regional insights, key player profiles, and actionable recommendations for informed decision-making.

What are the market trends of water automation and instrumentation?

Current trends in the water automation and instrumentation market include increased adoption of smart sensors, growth in remote monitoring applications, a shift towards automated control systems, and escalating investments in wastewater treatment and management solutions.